When searching for “adjusters near me,” it’s crucial to understand that not all adjusters work in your best interest.

For anyone in need of a licensed public adjuster:

– Public adjusters are licensed professionals who represent policyholders during the insurance claim process.

– They have specialized knowledge about insurance policies, endorsements, and the complex steps involved in a claim.

– Hiring a public adjuster can help maximize your settlement, ensuring you receive a fair amount for property damage.

If you’re dealing with property damage due to fire, hurricane, tornado, or other disasters, navigating the insurance claim process can be daunting. That’s where licensed public adjusters come in. They advocate for you, the policyholder, to get the maximum settlement under your policy terms. Whether you’re a business owner, a member of a homeowner association, or managing a multifamily complex, hiring a public adjuster can significantly impact the outcome of your claim.

As a 15 year experienced expert handling large loss claims, I can attest to the transformative role a skilled public adjuster plays. With a track record of settling hundreds of millions in property damage claims, my expertise ensures your interests are well-protected.

What is a Public Adjuster?

A public adjuster is an independent professional hired by policyholders to help them steer the insurance claim process. They act as your advocate, working to ensure that you receive the maximum settlement for your property damage claim.

Types of Adjusters

Understanding the different types of adjusters can help you make an informed decision when handling your insurance claim. Here are the main types:

Public Adjuster

A public adjuster works exclusively for the policyholder, not the insurance company. They assist in preparing, presenting, and negotiating claims to ensure you get a fair settlement. Public adjusters are licensed by the state and are experts in policy language and claim processes.

Independent Adjuster

An independent adjuster (IA) is typically a 1099 contractor hired by an independent adjusting firm. These firms are engaged by insurance companies to handle claims on their behalf. While they technically work for the insurance company, their loyalty is primarily to the firm that employs them. They often follow strict guidelines aimed at minimizing claim costs, which may not always align with your best interests.

Example: An independent adjuster might follow an insurance company’s guideline that disallows coverage for floor damage extending past a doorway, even if the flooring is continuous. This could result in a lower payout for you.

Company or Staff Adjuster

A company or staff adjuster is an employee of the insurance company. Their main responsibility is to protect the company’s financial interests. They follow internal guidelines and policies designed to minimize the insurer’s payouts. They do not work for you, the policyholder.

Desk Adjuster

Desk adjusters handle the administrative side of claims, often working from an office or remotely. They review documentation, coverage details, and estimates submitted by field adjusters. Desk adjusters can be either staff adjusters or independent adjusters.

Field Adjuster

Field adjusters are the ones who visit the site of the damage to inspect and document the extent of the loss. They report their findings to a desk adjuster, who then processes the claim. Field adjusters can be either staff adjusters or independent adjusters.

Understanding these roles can help you decide who to engage for your claim, ensuring that your interests are well-represented and that you receive a fair settlement. Whether dealing with a simple claim or a complex one, knowing the types of adjusters can make a significant difference in the outcome.

Now that you understand the different types of adjusters, let’s explore the benefits of hiring a public adjuster for your insurance claim.

Benefits of Hiring a Public Adjuster

Increased Settlements

One of the main reasons to hire a public adjuster is to maximize your settlement. Public adjusters have specialized knowledge in evaluating claims and know how to document every aspect of your loss. This expertise can lead to significantly higher settlements.

Statistics back this up: According to the Florida Legislature’s Office of Program Policy Analysis & Government Accountability (OPPAGA), policyholders who hired public adjusters for non-catastrophic claims received 574% more money than those who did not. For hurricane claims, the increase was even more dramatic at 747%.

No Recovery, No Fee

Another major benefit is the contingency fee structure. Public adjusters work on a “no recovery, no fee” basis, meaning they only get paid if you do. This eliminates any upfront costs and aligns their interests with yours—they are motivated to get you the highest settlement possible.

Typically, public adjusters charge a percentage of the final settlement amount. While this can vary, it’s usually around 10%. So, if your claim is settled for $100,000, the adjuster would receive $10,000. This fee structure ensures they are fully committed to maximizing your payout.

Policyholder Rights and Claim Management

Public adjusters act as your personal advocates. They manage the entire claims process, from initial consultation to final settlement. This involves:

- Documenting damages

- Estimating repair costs

- Submitting claims to the insurance company

- Negotiating settlements

Their goal is to ensure you are treated fairly and receive the compensation you deserve. This can be particularly helpful if your insurer is dragging their feet or making unreasonable demands.

Negotiation Expertise

Public adjusters are skilled negotiators. Unlike insurance company adjusters, who aim to minimize payouts, public adjusters strive to maximize them. They know the ins and outs of policy language and can effectively argue on your behalf.

For example, after a hurricane, determining what damage falls under which policy can be daunting. A public adjuster can steer this maze for you, ensuring all coverages are claimed.

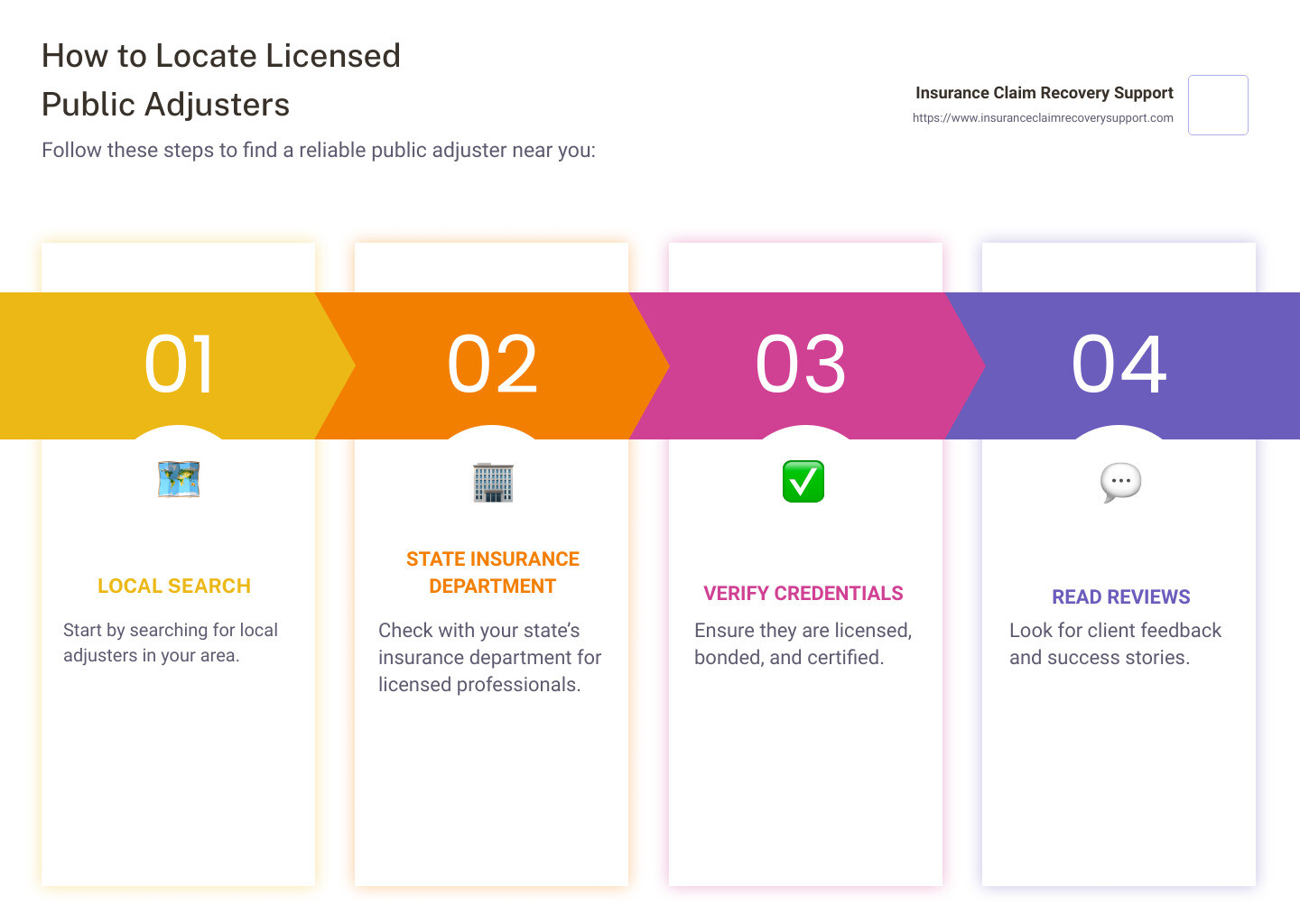

How to Find Licensed Public Adjusters Near Me

Verify Credentials

When searching for adjusters near me, verifying their credentials is crucial. A licensed public adjuster must meet state-specific requirements, which can include passing exams and ongoing education. This ensures they have the necessary knowledge and skills to handle your claim effectively.

Here’s a quick checklist to verify their credentials:

- Licensed: Check their license through your state’s Department of Insurance. For instance, in Texas, you can verify licenses online via the Texas Department of Insurance.

- Bonded: Ensure the adjuster is bonded, which offers you financial protection if they fail to fulfill their obligations.

- Certified: Look for additional certifications that demonstrate their expertise and commitment to high standards.

Read Reviews and Testimonials

Client feedback is a goldmine of information. Reading reviews and testimonials can help you gauge the reliability and service quality of public adjusters.

Here’s how to get started:

- Client Feedback: Look for reviews on platforms like Google, Facebook, and the Better Business Bureau (BBB). These reviews often provide insights into the adjuster’s performance and client satisfaction.

- Success Stories: Seek out case studies or success stories. These can provide real-world examples of how public adjusters have successfully negotiated higher payouts for various claims.

- Online Reviews: Websites like Insurance Claim Recovery Support offer directories and reviews of public adjusters. These resources can help you find reputable professionals in your area.

By verifying credentials and reading reviews, you can confidently find a licensed public adjuster who will advocate for your best interests.

Steps to Hire a Public Adjuster

Initial Consultation

The first step in hiring a public adjuster is the initial consultation. This is typically a free consultation where you discuss your insurance claim and coverage with a licensed public adjuster.

During this meeting, the adjuster will:

- Inspect the damage: They will visit your property to conduct a thorough damage inspection.

- Review your policy: They’ll go over your insurance policy to understand your coverage and identify any provisions that can maximize your claim.

This initial meeting sets the stage for a custom strategy to handle your claim.

Damage Assessment

After the initial consultation, the next step is a comprehensive damage assessment.

Here’s what happens:

- Document damages: The adjuster will document all damages carefully. This includes taking photographs and videos.

- Estimate repair costs: Using sophisticated estimating software like Xactimate®, the adjuster will estimate the cost to repair or replace damaged property.

- Assess business interruption losses: If you own a business, they’ll calculate losses due to interrupted operations.

This detailed documentation is crucial for building a strong claim.

Claim Preparation and Negotiation

Once the damage assessment is complete, the adjuster will move on to claim preparation and negotiation.

This involves:

- Claim documentation: The adjuster will prepare all necessary claim documents, ensuring they are thorough and accurate.

- Insurance company communication: They will handle all communications with your insurance company, keeping things moving smoothly.

- Settlement negotiation: The adjuster will negotiate with the insurance company to secure a fair settlement. Their goal is to maximize your payout and ensure you are treated fairly.

Case Study: One Florida homeowner praised their public adjuster for being “compassionate and understanding during this emotional and stressful time,” highlighting the importance of having a dedicated advocate during the claims process.

By following these steps, you can ensure that your claim is well-documented, accurately assessed, and fairly negotiated. This process not only maximizes your settlement but also alleviates much of the stress associated with filing an insurance claim.

Frequently Asked Questions about Public Adjusters

What is the difference between a claims adjuster and an insurance adjuster?

A claims adjuster and an insurance adjuster are often terms used interchangeably, but they serve different roles.

Claims adjusters can be public adjusters, independent adjusters, or company adjusters. Their primary role is to investigate insurance claims, determine the extent of the insurance company’s liability, and ensure that claims are processed fairly and accurately.

Insurance adjusters, on the other hand, typically work directly for the insurance company. Their main responsibility is to protect the insurance company’s financial interests. They assess the damage, determine coverage, and calculate the payout.

Public adjusters, like those at Insurance Claim Recovery Support, represent policyholders and aim to maximize your payout, unlike insurance adjusters who prioritize the insurance company’s bottom line.

Is being an adjuster stressful?

Yes, being an adjuster can be quite stressful. Here are a few reasons why:

- Multiple Cases: Adjusters often juggle numerous claims simultaneously, especially after major events like hurricanes.

- Quick Decisions: They need to make swift and accurate decisions to process claims efficiently.

- Long Hours: The job often requires long and unpredictable hours, particularly during peak times.

- Emergency Situations: Natural disasters and other emergencies can lead to a sudden influx of claims, increasing the workload and stress levels.

High stress comes from dealing directly with individuals who have experienced loss or damage. These conversations can be emotionally charged. Adjusters must steer these interactions with empathy and professionalism, all while managing their own stress levels.

What is the adjuster fee in Texas?

In Texas, public adjuster fees are regulated to protect policyholders. The maximum fee a public adjuster can charge is 10% of the claim payout after the contract is signed. However, this fee is can be higher for supplements as long as the fee does not exceed 10% of the settlement.

This regulation ensures that policyholders receive a fair portion of their settlement without excessive fees. Public adjusters like those at Insurance Claim Recovery Support work on a contingency basis, meaning they only get paid if you receive a settlement, ensuring their interests are aligned with yours.

Conclusion

At Insurance Claim Recovery Support, we are dedicated to advocating for policyholders. Our mission is to ensure you receive the maximum settlement you deserve. With our team of expert public adjusters, we are here to help you steer the complexities of your insurance claim, from initial consultation to final settlement.

Policyholder Advocacy

We understand that dealing with property damage and insurance claims can be overwhelming. Our public adjusters are licensed professionals who work solely for you, the policyholder. We handle all aspects of your claim, ensuring that every detail is carefully documented and presented to your insurance company. Our goal is to protect your rights and secure a fair settlement.

Maximum Settlement

Statistics show that hiring a public adjuster can significantly increase your insurance payout. According to a study by the Florida Legislature’s Office of Program Policy Analysis & Government Accountability (OPPAGA), policyholders who hired public adjusters received 747% more for catastrophe claims and 574% more for non-catastrophe claims. This demonstrates the value of having an experienced advocate on your side.

Texas and Nationwide Service

While we are based in Texas, our services are available nationwide. Whether you are dealing with fire damage, flood damage, or any other type of property loss, we are ready to assist you. Our expertise extends across various types of claims and regions, ensuring that you have the support you need, no matter where you are located.

We work on a contingency basis, which means we only get paid when you do. This aligns our success with yours and ensures that we are fully committed to achieving the best possible outcome for your claim.

For more information on how we can assist you with your insurance claim, visit our Public Adjuster Near Me page.

Let us be your guide and advocate in securing the settlement you need to move forward.