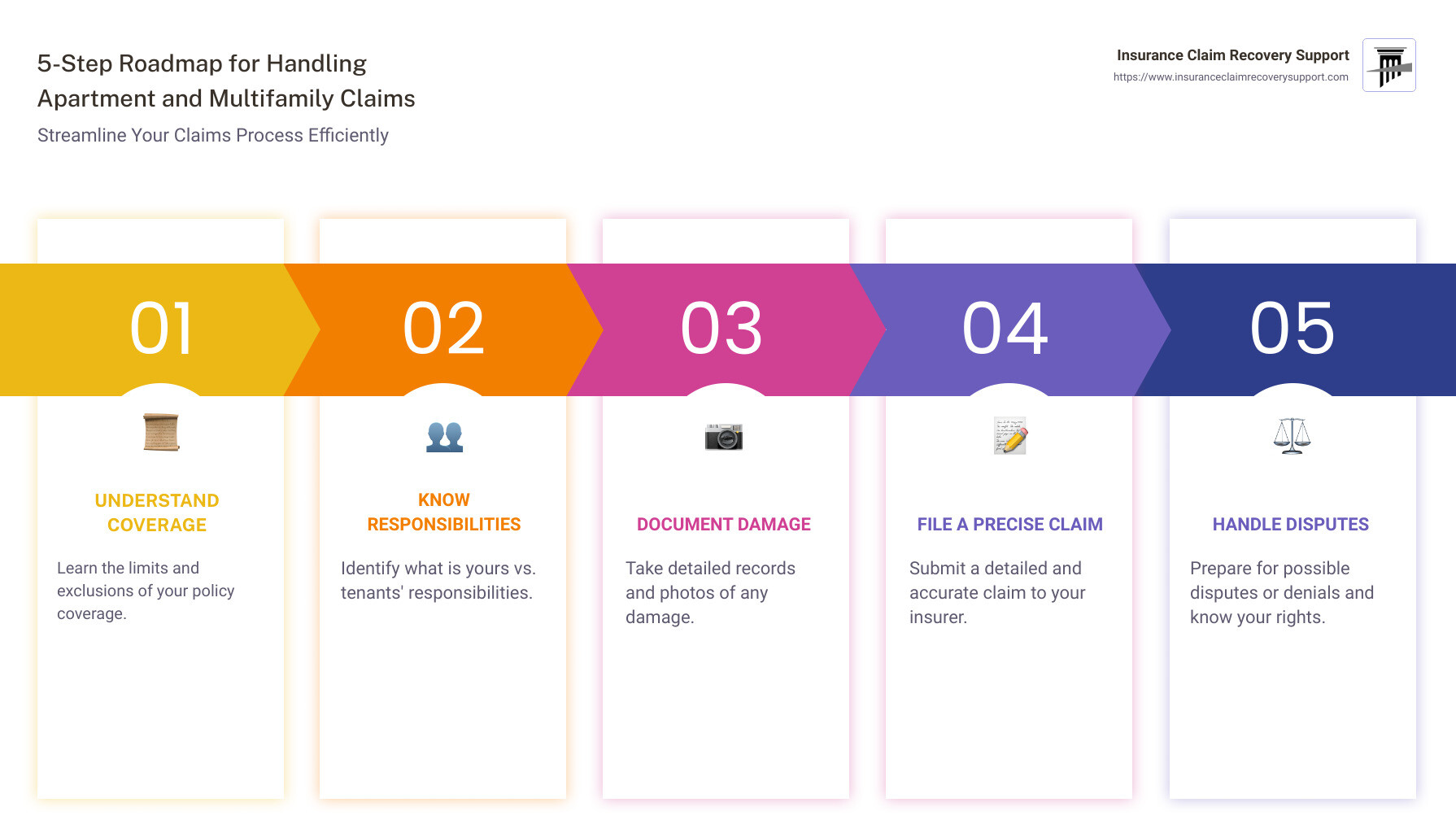

When it comes to Apartment and Multifamily Claims, understanding the process is key to minimizing costs and stress. This kind of property insurance involves navigating complex claims due to weather incidents, fires, and other emergencies. Here’s a quick roadmap to guide you:

- Understand your insurance coverage limits.

- Know your responsibilities versus your tenants’.

- Document all property damage thoroughly.

- File your claim with precise details.

- Be ready to handle disputes or denials.

These steps can help smooth out the process when dealing with multifamily claims, which can often feel like navigating a maze of responsibilities and stakeholders.

I’m Scott Friedson, a seasoned expert in the field of Apartment and Multifamily Claims. My experience in settling over 500 large-loss claims allows me to guide you through the intricacies of the claims process and ensure you receive the fair settlement you deserve.

Understanding Apartment and Multifamily Claims

When dealing with Apartment and Multifamily Claims, it’s crucial to understand the common types of claims that property owners face. Two of the most prevalent issues are water damage and fire damage, each with its own set of challenges and prevention strategies.

Water Damage

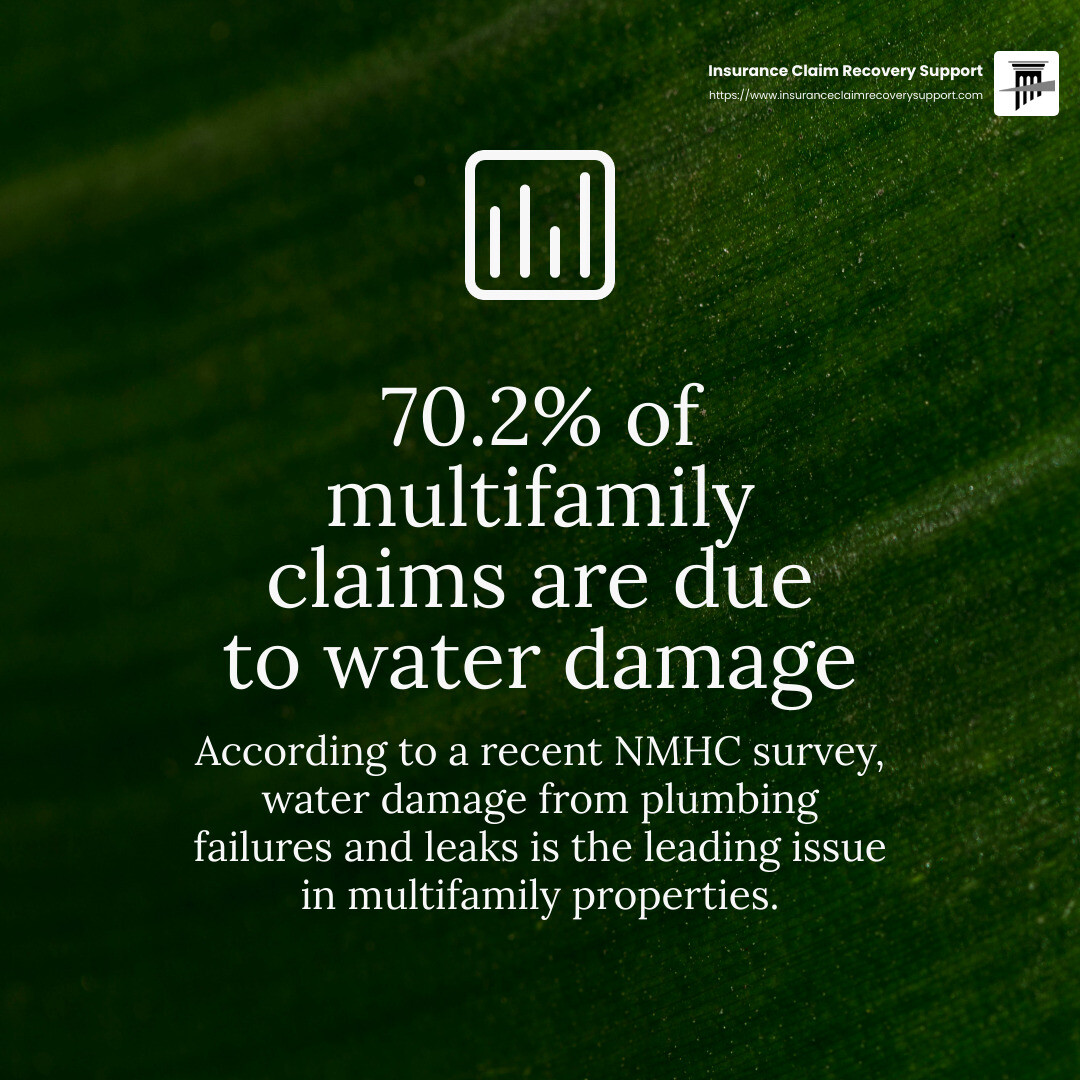

Water damage is the leading cause of claims in the multifamily sector. In a recent NMHC survey, a staggering 70.2% of respondents cited water damage as their top issue.

Causes: Water damage often results from plumbing failures, leaks, or natural disasters like flooding and heavy rainfall. Standard property insurance usually doesn’t cover flood damage, so separate flood insurance might be necessary.

Prevention: Regular inspection and maintenance of plumbing systems can help mitigate risks. Installing water detection devices and ensuring proper drainage systems are also effective strategies.

Fire Damage

Fire damage ranks third among the top claims, affecting 52.3% of respondents in the same survey. Fires can be devastating, not only due to flames but also from smoke and water used in firefighting efforts.

Causes: The most common causes of fires in apartments include kitchen accidents, faulty wiring, and unattended open flames. Interestingly, nearly half of residential fires are linked to cooking mishaps.

Prevention: Educating tenants on safe cooking practices and the importance of smoke alarms can significantly reduce fire risks. Regular electrical inspections and maintenance of fire safety equipment, like extinguishers and sprinkler systems, are also essential.

Understanding these common claims and their causes can help property owners take proactive measures to prevent them. By investing in regular maintenance and tenant education, you can protect your property and reduce the likelihood of costly claims.

Next, we’ll explore the top reasons for multifamily property claims, focusing on natural disasters and weather-related issues.

Top Reasons for Multifamily Property Claims

When it comes to Apartment and Multifamily Claims, natural disasters and weather-related issues are significant contributors. These events can cause extensive damage, leading to increased insurance claims and costs for property owners.

Natural Disasters and Weather-Related Issues

Hurricanes, Tornadoes, and Flooding

Natural disasters like hurricanes, tornadoes, and floods are major causes of damage to multifamily properties. These events can lead to severe water and structural damage. For instance, the deep freeze in Texas caused widespread plumbing failures, resulting in numerous claims.

Water Damage: As highlighted in a recent survey, 70.2% of multifamily operators reported water damage as their top claim. Flooding from storms or burst pipes can cause extensive damage to buildings and require costly repairs.

Wind and Structural Damage: High winds from hurricanes or tornadoes can tear off roofs, break windows, and cause other structural issues. About 28.5% of respondents cited wind-driven damage as a significant concern.

Fire Damage

While often overlooked in the context of natural disasters, fires can be triggered by lightning strikes during storms. Fire damage was reported by 52.3% of multifamily operators, underscoring its importance.

Insurance Reform

Rising Insurance Costs

The frequency and severity of natural disasters have driven up insurance costs. A recent survey found that property insurance costs increased by an average of 26% in the past year, with some owners seeing hikes as high as 120%.

Policy Changes

To manage these rising costs, insurers are adjusting policies. This includes increasing deductibles, limiting coverage, and adding new restrictions. Policyholders are advised to review their coverage thoroughly and consider risk management strategies to mitigate these expenses.

Government and Industry Actions

Efforts are underway to address these challenges. For example, recent legislative reforms in states like Florida aim to reduce litigation and encourage insurers to remain in the market. These changes could lead to more competitive pricing and better coverage options over time.

Understanding these factors can help property owners better steer the insurance landscape. Next, we’ll dive into the insurance claims process, offering insights on policy review, damage documentation, and claim filing.

Navigating the Insurance Claims Process

When disaster strikes, understanding the insurance claims process can make a big difference. Here’s a simple guide to help you through the steps of policy review, damage documentation, and claim filing.

Policy Review

Before anything else, grab your insurance policy and review it thoroughly. This might sound boring, but it’s crucial. You need to know what’s covered and what’s not.

Here’s what to look for:

- Replacement Cost vs. Cash Value: Know whether your policy covers the full replacement cost or just the cash value of damaged items.

- Coverage Limits: Check the dollar limits for each type of coverage. Ensure they are enough to cover current values.

- Sublimits and Additional Coverages: Look for any sublimits and extra coverages like business interruption or loss of rental value.

A quick review now can save you a lot of headaches later. If you’re unsure, don’t hesitate to ask your insurance agent or broker for help.

Damage Documentation

Once you’ve reviewed your policy, the next step is documenting the damage. This is where you gather evidence to support your claim.

Steps for Effective Documentation:

- Take Photos and Videos: Capture clear images from multiple angles of all damaged areas. This visual evidence is crucial.

- Write Detailed Notes: Describe the damage in detail. Include dates, times, and any actions you took to prevent further damage.

- Keep Receipts: Save all receipts for any temporary repairs or protective measures you had to take.

Good documentation strengthens your claim and helps avoid disputes with the insurer.

Claim Filing

After documenting the damage, it’s time to file your claim. Here’s a simple way to do it:

- Notify Your Insurer: Contact your insurance company as soon as possible. Delays can complicate the process.

- Submit Required Documents: Follow your insurer’s specific procedures. This usually involves filling out forms and providing documentation.

- Communicate Clearly: Decide who will handle communication with the insurer. This could be you, a property manager, or an attorney.

Keep a record of all communications with your insurer. This includes emails, letters, and phone calls. If there are delays or issues, having a record can be very helpful.

By following these steps, you can steer the claims process with more confidence. Next, we’ll look at tips for choosing the right multifamily insurer, focusing on financial stability and customer service.

Tips for Choosing the Right Multifamily Insurer

Choosing the right insurer for your multifamily property isn’t just about picking a name you recognize. It’s about finding a partner that fits your specific needs. Here are the key factors to consider:

Financial Stability

First and foremost, financial stability is crucial. You want an insurer who can pay claims even during tough times. Look for insurers with strong ratings from agencies like A.M. Best, Standard & Poor’s, or Moody’s.

- A.M. Best: Aim for A- or higher.

- Standard & Poor’s: Look for AA- or above.

- Moody’s: Aa3 or higher is ideal.

These ratings reflect an insurer’s ability to meet its financial commitments. Consistent high scores across different agencies can give you peace of mind.

Specialization in Multifamily Properties

Not all insurers understand the unique challenges of multifamily properties. Look for those specializing in this area. They should offer custom policies that address specific multifamily risks, such as fire damage or liability issues.

Ask potential insurers about their experience with properties similar to yours. Do they have claims adjusters who know the multifamily sector? This expertise can be invaluable when filing a claim.

Customer Service

When disaster strikes, you’ll want an insurer with excellent customer service. A smooth claims process can make all the difference. Here’s what to look for:

- 24/7 Claims Reporting: Ensure they offer round-the-clock options for filing claims. Whether it’s by phone, online, or app, you should be able to report issues immediately.

- Dedicated Claims Adjusters: Good insurers have adjusters who specialize in multifamily properties. They should communicate clearly and respond quickly, ideally within 24 to 48 hours.

- Reputation: Check reviews on platforms like Trustpilot or the Better Business Bureau. Also, look at complaint ratios on the NAIC website.

Avoid insurers with a history of delays or disputes. These could leave you high and dry when you need them most.

By considering these factors, you can choose an insurer that not only meets your needs but also provides the support you need in challenging times. Next, we’ll dive into frequently asked questions about Apartment and Multifamily Claims to clarify common concerns.

Frequently Asked Questions about Apartment and Multifamily Claims

What are the common types of claims?

When it comes to Apartment and Multifamily Claims, certain issues pop up more often than others. Here’s a quick look:

-

Water Damage: This is the most common claim. Think burst pipes, leaky roofs, or flooding from storms. In fact, 70% of apartment owners reported dealing with water damage last year.

-

Fire Damage: Fires can start from kitchen mishaps, faulty wiring, or even arson. Over half of multifamily properties have faced fire damage claims.

-

Liability Claims: These arise when someone gets hurt on your property. It could be a slip and fall, or an injury caused by faulty equipment.

Understanding these common claims can help you prepare and protect your property better.

How can I reduce insurance costs?

Insurance costs are rising, but you can take steps to manage them:

-

Risk Management: Regular maintenance and safety checks can prevent costly claims. For example, inspecting electrical systems can reduce fire risks.

-

Self-Insurance: Some owners set aside funds to cover minor damages themselves, reducing reliance on insurance for small claims.

-

Broker Assistance: A good broker can help you find better deals. They know the market and can negotiate on your behalf to secure lower premiums.

By taking these proactive steps, you can keep your insurance costs in check.

What should I do after a storm?

After a storm hits, quick action is crucial for a successful claim:

-

Notify Your Insurer: Contact them as soon as possible to report any damage. This starts the claims process and ensures you meet any deadlines.

-

Document the Damage: Take clear photos and videos of all affected areas. Note the time and date, and keep records of any repairs or expenses.

-

Mitigation Work: Take steps to prevent further damage. This might mean covering broken windows or tarping a damaged roof. Keep receipts for any temporary repairs.

Following these steps can help streamline your claim and get repairs underway faster.

Next, we’ll explore how Insurance Claim Recovery Support can assist you in securing a fair settlement and advocating for your rights as a policyholder.

Conclusion

Navigating Apartment and Multifamily Claims can be daunting. That’s where we come in. At Insurance Claim Recovery Support, our mission is simple: to advocate for you, the policyholder, and ensure you receive the fair settlement you deserve.

When disaster strikes, whether it’s a fire in Houston or a storm in Dallas, having a trusted ally to guide you through the complex claims process is crucial. We focus on maximizing your settlement, so you can focus on what matters most—restoring your property and getting back to business.

Our team of experts understands the intricacies of multifamily insurance claims. We’re here to help you document damages accurately, negotiate with insurers, and push for the best possible outcome. With a track record of settling claims for millions of dollars, we pride ourselves on being zealous advocates for our clients.

We believe in transparency and clear communication. From the moment you contact us, you’ll know what to expect every step of the way. Our commitment to policyholder advocacy means we don’t get paid unless you do—our services are offered on a contingency basis.

When insurance companies have their own experts, you need someone on your side. Trust Insurance Claim Recovery Support to be your partner in securing a fair and prompt settlement.

Protect your investment, support your tenants, and let us handle the complexities of your insurance claim. Reach out to us today and take the first step towards peace of mind.