Why Commercial Property Owners in Austin Turn to Public Adjusters

Navigating a commercial property damage insurance claim in Austin, Texas, can be an uphill battle. An Austin public adjuster is your most powerful ally, representing your best interests when it matters most.

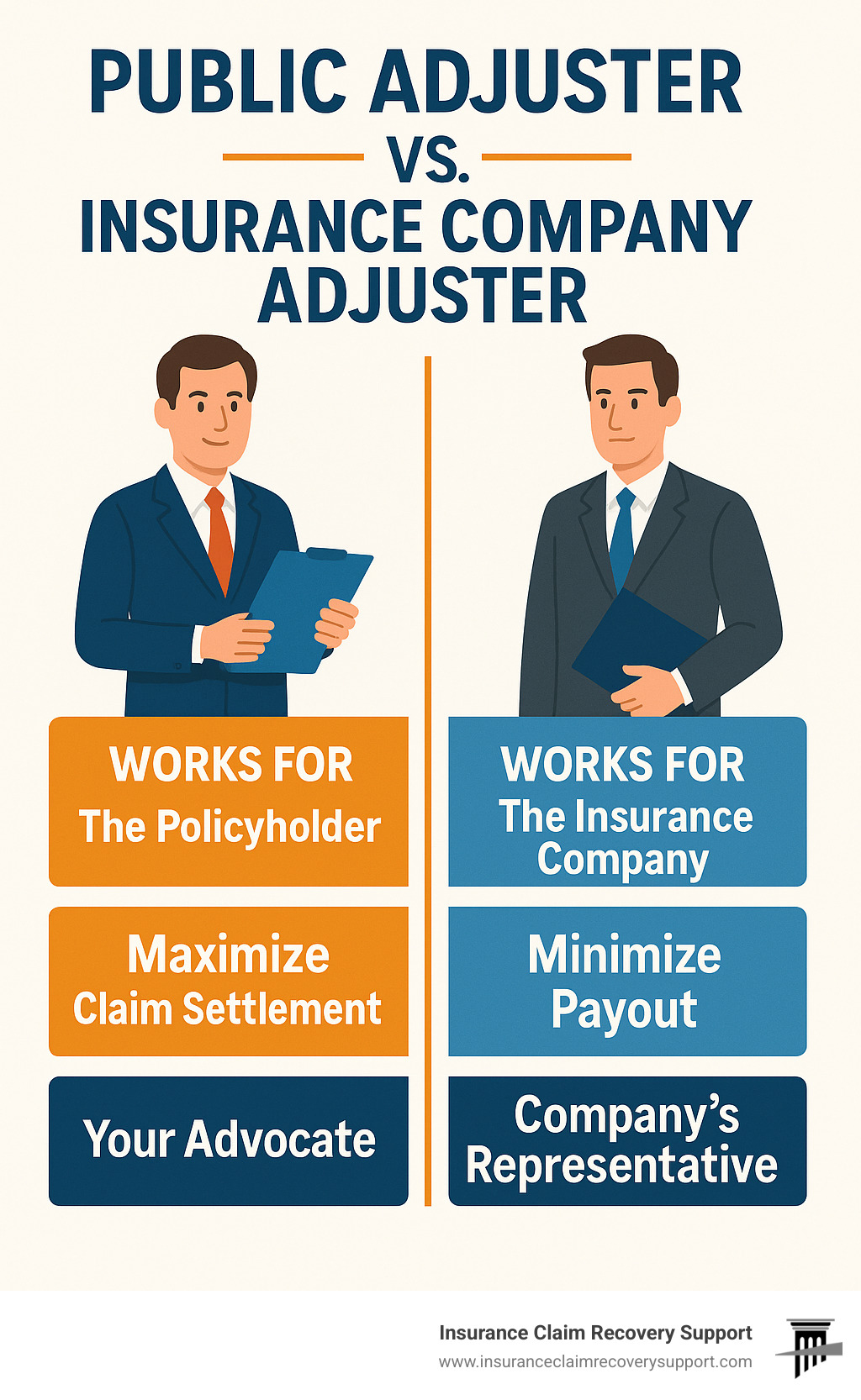

Here’s how a Public Adjuster differs from the insurance company’s adjuster:

| Feature | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Who They Work For | The Policyholder (YOU) | The Insurance Company |

| Primary Goal | Maximize Your Claim Settlement | Minimize the Company’s Payout |

| Compensation | Percentage of Settlement (No Recovery, No Fee) | Salary or Fee from Insurance Company |

| Allegiance | Your Advocate | Company’s Representative |

As a commercial property owner in Austin, you know unexpected damage from storms or fire can halt your operations. The insurance claim process is often frustrating, as insurers protect their bottom line, leaving you feeling overwhelmed and underpaid. This is where an Austin public adjuster steps in.

We are your dedicated advocate, ensuring your property damage claim is handled fairly. Studies show that using a public adjuster can lead to significantly higher payouts—some reports indicate policyholders receive 547% to 747% more for their claims.

Hiring a public adjuster lets you focus on your business, not on fighting insurers. They manage the entire claim, from documentation to negotiation, securing a maximum settlement efficiently while helping you avoid costly legal disputes.

As a multi-state licensed public adjuster and CEO of ICRS LLC, I’ve settled hundreds of millions in commercial and multifamily property damage claims. My focus is always on securing the maximum recovery for policyholders and overturning wrongfully denied claims.

Must-know Austin public adjuster terms:

What is a Public Adjuster and How Are They Different?

When your commercial or multifamily property suffers damage, understanding the difference between a public adjuster and the insurance company’s adjuster is crucial for protecting your interests.

A public adjuster is a licensed insurance professional who works exclusively for you, the policyholder. Their goal is to advocate for your interests and maximize your claim settlement, ensuring you receive what you’re owed under your policy. We level the playing field against the insurance company’s team of experts.

In contrast, an insurance company’s adjuster works for the insurer. Their goal is to protect the company’s financial interests by minimizing your claim’s payout. This inherent conflict of interest often leads to underpaid or denied claims.

Our role is to eliminate this conflict. We understand insurance companies are businesses focused on profit. Our firm operates on a ‘No Recovery = No Fee’ contingency, so our interests are directly aligned with yours. We only get paid if we successfully recover a settlement for you, ensuring our dedication to achieving the maximum possible outcome.

The Role of a Licensed Public Adjuster

As licensed public adjusters, we bring extensive knowledge to every case. Our comprehensive approach includes:

- Policy Review: We carefully review your policy to find all applicable coverages, ensuring no recovery options are missed.

- Damage Documentation: We use advanced tools like thermal imaging and drones to thoroughly document all damage, which is critical for large commercial losses.

- Claim Preparation: We create a detailed claim package with industry-standard software, presenting a clear picture of your damages and repair costs.

- Negotiation Expert: We handle all negotiations, countering low offers and challenging denials to achieve a fair settlement without litigation.

- Your Exclusive Advocate: We are your advocate throughout the process, providing clarity and guidance at every step.

We are proud to be Licensed Public Adjusters who uphold the highest standards of professionalism.

The Insurance Company’s Adjuster

The insurance company’s adjuster, whether a staff or independent adjuster, serves their employer. Their perspective is fundamentally different from a public adjuster’s.

- Works for the Insurer: Their performance is often judged on closing claims efficiently and controlling costs for the insurance company.

- Goal is to Minimize Payout: Their inherent bias is towards minimizing the insurer’s financial exposure, which can lead to undervalued estimates and overlooked damages.

- Salaried Employee: Their compensation is not tied to the size of your settlement.

- Not Your Advocate: They represent the insurance company’s interests, creating a significant disadvantage for policyholders.

Maximize Your Commercial Property Claim with an Austin Public Adjuster

For owners of commercial or multifamily properties in Austin, property damage is a serious challenge. The scale of these buildings and Texas’s unpredictable weather can lead to massive costs. That’s why an Austin public adjuster is often a necessity, not just a good idea.

The numbers speak for themselves. Studies show policyholders with a public adjuster receive significantly higher payouts—often 547% to 747% more. Our own clients have seen settlements increase by over 3,000% from the initial offer. This is the result of expert advocacy.

Austin and the rest of Texas face severe weather risks, and commercial insurance policies are notoriously complex. This combination leaves property owners vulnerable to underpaid or denied claims. We understand the unique challenges posed by Texas Storm Damage. If you’re facing a Claims Dispute, we can help.

Maximize Your Financial Recovery

Our primary goal is to secure every dollar you are entitled to under your policy. We achieve this through:

- Proven Settlement Increases: Our track record includes recovering hundreds of millions for clients, consistently securing much larger payouts than initial offers.

- In-Depth Policy Knowledge: We carefully analyze your policy to uncover all applicable coverages and endorsements, ensuring nothing is overlooked.

- Detailed Damage Valuation: We use a team of experts, including engineers and construction specialists, to produce a precise valuation of all damages, including hidden issues critical in Large Loss Claims.

- Business Interruption Claims: We are experts in preparing and negotiating business interruption claims to recover your lost income and extra expenses.

Save Time and Eliminate Stress

Managing a large property damage claim is like a second job. We handle the burden so you can focus on your business.

- Handles All Communication: We manage all interactions with your insurance company, ensuring clear, professional communication that protects your claim.

- Manages Deadlines: We track all strict insurance claim deadlines, ensuring every document is submitted correctly and on time.

- Compiles All Documentation: We gather, organize, and present the overwhelming amount of paperwork required for a large commercial claim in a compelling manner.

- Allows You to Focus on Your Business: By entrusting your claim to an Austin public adjuster, you can return to managing your property and running your business with peace of mind.

For more on navigating claim discussions, see our insights on How to Negotiate with Insurance Adjuster for Property Damage.

The Public Adjuster Process: A Better Path Than Litigation

When facing a denied or underpaid commercial property claim, litigation might seem like the only option. However, hiring an Austin public adjuster is a more efficient, less stressful, and often more effective path to a fair settlement. Our process is designed to maximize your recovery and help you avoid costly, time-consuming legal battles through skilled negotiation, sidestepping unnecessary litigation or appraisal.

Our methodical approach ensures a thorough and accurate claim, which is key to avoiding appraisal clauses and lawsuits.

Step-by-Step Claim Support

We guide commercial and multifamily property owners through every step of the process. This same dedication applies to other complex claims, like a Public Adjuster Home Insurance Claim.

- Free Consultation & Policy Review: We start with a no-obligation discussion about your property’s damage and a careful review of your insurance policy to understand your coverage.

- Thorough Damage Investigation & Documentation: We conduct a detailed on-site inspection, gathering evidence through estimates, inventories, photos, videos, and expert reports to build an undeniable case.

- Strategic Claim Submission: We prepare and submit a comprehensive claim package that clearly outlines all damages and justifies the settlement amount we are seeking.

- Aggressive Negotiation with the Insurer: We handle all communications, countering low offers and challenging incorrect policy interpretations to ensure your claim gets the attention it deserves.

- Finalizing Your Maximum Settlement: We guide you through the final stages, ensuring all paperwork is correct and you receive the funds needed to fully recover.

Public Adjuster vs. Lawsuit for a Property Damage Claim

For most property damage claims, engaging an Austin public adjuster is a more sensible path than immediate litigation.

- Faster Resolution: Lawsuits can take years. We expedite the process through expert negotiation, often achieving settlements much faster.

- Lower Cost: Litigation is expensive. We work on a contingency fee—a small percentage of the recovered amount—with no upfront costs or retainers. Our “No Recovery = No Fee” model aligns our success with yours.

- Collaborative, Not Adversarial: We start by working within the claims framework, using policy language and facts to negotiate. This is often more effective than an immediate legal battle.

- Policy Expertise, Not Legal Fights: Our expertise is in insurance policies and damage valuation. We resolve disputes based on your policy’s terms, avoiding the uncertainty of court.

- Avoiding Unnecessary Litigation: A lawsuit is a last resort. Our process of careful claim preparation and skilled negotiation is designed to secure a fair settlement without going to court.

Crucially, it is against the law for contractors to negotiate claims in Texas. A public adjuster is the licensed professional authorized to negotiate your commercial property claim, ensuring you get expert advocacy while staying on the right side of the law.

What Types of Claims Do Austin Public Adjusters Handle?

When your commercial property is damaged, the claims process can be daunting. An expert Austin public adjuster can help. Our team specializes in a wide range of commercial and multifamily property claims, ensuring your case is handled by seasoned professionals.

We represent various commercial property types, including large commercial buildings (offices, retail, industrial), multifamily HOAs, apartment complexes, and religious institutions. We help them all recover from unexpected damages.

While based in Austin, we serve clients throughout Texas—including Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway—and nationwide. We are one of the leading Public Adjusting Firms Texas USA and beyond.

Common Commercial Property Damage Claims

Commercial properties face diverse damage types, each with unique claim challenges. Our team has extensive experience with them all.

- Fire and smoke damage: Beyond the flames, fire causes widespread smoke and soot damage. We document all structural issues, ruined contents, and air quality problems to ensure a full recovery for Fire Damage.

- Wind and storm damage: Severe Texas weather, including hurricane and tornado damage, can tear apart roofs and exteriors. We are experts at identifying the full scope of storm damage, including hidden issues.

- Water damage and freeze damage: Burst pipes from events like the Texas freeze, leaks, or storms can cause major water intrusion, leading to mold and structural problems. We accurately assess all water-related damages.

- Flood damage: Often covered by a separate policy, flood damage is a critical concern. We assist property owners in navigating these specific claims.

- Vandalism: When malicious acts cause damage, we step in to document and value the losses to ensure they are fully covered by your policy.

Our deep understanding ensures every part of your Commercial Property Insurance Claims is handled with expert care.

Frequently Asked Questions about Austin Public Adjusters

Dealing with commercial property damage and insurance claims is stressful. If hiring an Austin public adjuster is a new concept, you likely have questions. We’re here to provide clear answers so you can feel confident and informed.

How is an Austin public adjuster compensated?

We work on a contingency fee basis, which is simple and aligns our goals with yours.

- No Recovery, No Fee: If we don’t recover a settlement for your claim, you owe us nothing for our services.

- Percentage of the Settlement: Our fee is a pre-agreed percentage of the total settlement we secure for you, so there are no surprises.

- Texas 10% Fee Cap: Texas law protects policyholders by capping public adjuster fees at 10% of the claim settlement.

- No Upfront Costs: You have no out-of-pocket expenses for our services. Our fee is paid from the settlement you receive from the insurance company.

When is the best time to hire a public adjuster?

The short answer is: the sooner, the better.

- Immediately After Damage Occurs: The best time is right after the damage happens. Involving us from day one ensures proper documentation, helps you avoid common mistakes, and starts your claim on the strongest footing.

- Before Accepting a Settlement: If you’ve received an offer that feels too low, it’s not too late to call us. We can review the offer, assess the true damages, and negotiate for a fair settlement on your behalf.

- If Your Claim is Underpaid or Denied: We have extensive experience overturning wrongfully denied or underpaid claims. We specialize in challenging denials and reopening claims to secure the compensation you deserve.

We can represent you effectively at any stage of the claim process.

Do I need a public adjuster if I have a good insurance agent?

This is a valid question. While your insurance agent is a valuable resource, their role is fundamentally different from a Public Insurance Adjuster.

- Different Roles: Your agent’s expertise is in selling you the right policy. A public adjuster’s expertise is in managing the complex claim process to ensure that policy pays out fully.

- Specialized Claim Expertise: Public adjusters have specialized knowledge of policy fine print, construction costs, and insurance company tactics. We are skilled negotiators who know how to challenge unfair assessments.

- Your Agent Isn’t Your Advocate in a Claim Dispute: Your agent works for or as an intermediary with the insurer. They cannot formally represent you in a dispute. A public adjuster’s sole allegiance is to you, the policyholder. We sit on your side of the table, fighting for your best interests.

Conclusion: Take Control of Your Insurance Claim

A commercial property damage claim in Austin can be a heavy burden. Complex policies, endless paperwork, and facing an insurer focused on its own interests can leave you stressed and worried about a fair outcome.

It doesn’t have to be that way.

Partnering with an Austin public adjuster from our firm gives you a powerful advocate dedicated to protecting your interests. We use our deep policy knowledge and expert negotiation skills to secure the maximum settlement you deserve. This allows you to repair your property and resume operations without financial stress or lengthy battles.

We are staunch advocates for policyholders and have helped countless owners of commercial buildings, multifamily HOAs, apartment complexes, and religious institutions recover from devastating losses. We manage the entire claim process, and because we work on a “No Recovery = No Fee” basis, our success is directly tied to yours.

You’ve worked hard for your property. Don’t settle for less than you’re entitled to. If your commercial or multifamily property in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, Lakeway, or anywhere else nationwide has been damaged, we are here to help.

It’s time to take control of your insurance claim. Let us fight for your rightful recovery.