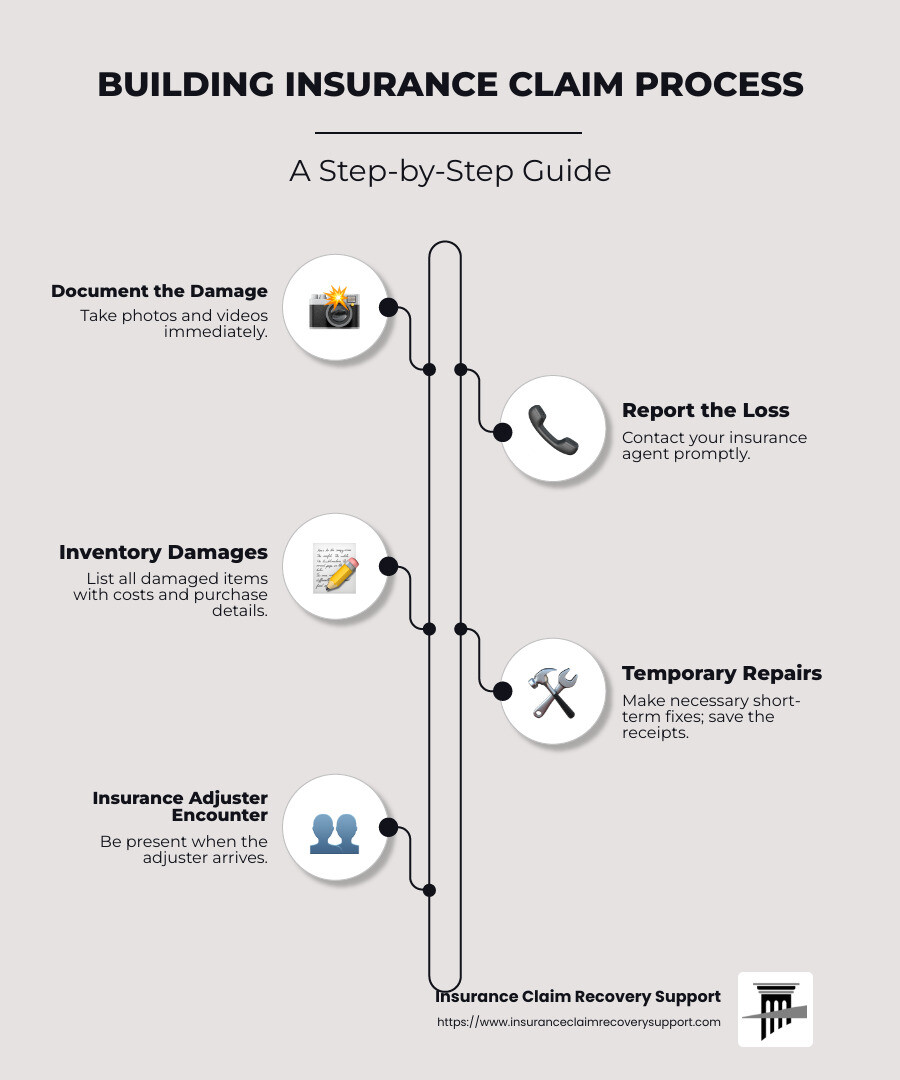

Building insurance claim process can often feel overwhelming, especially when you’re dealing with property damage. Here’s a quick rundown to help you get started:

- Document the Damage: Take photos and videos immediately.

- Report the Loss: Contact your insurance agent promptly.

- Inventory Damages: List all damaged items with costs and purchase details.

- Temporary Repairs: Make necessary short-term fixes; save the receipts.

- Insurance Adjuster Encounter: Be present when the insurance adjuster arrives.

- Settlement: Wait for your claim to be processed and paid out.

Property damage can leave any policyholder frustrated, whether it’s from a fire, hurricane, or other disasters. Insurance should be a source of relief, not stress. However, navigating the complexities of an insurance claim can be challenging, and many policyholders don’t receive the fair settlement they deserve.

As Scott Friedson, I’ve settled hundreds of millions in claims, helping countless individuals through the building insurance claim process and achieving fair and just settlements. Follow along as we dig into the process to ensure a smoother path to recovery.

Understanding the Building Insurance Claim Process

Navigating the building insurance claim process can seem like a daunting task. But breaking it down into manageable steps can make it much easier. Here’s how you can get through it smoothly.

Key Steps in Filing a Claim

-

File the Claim Promptly: Time is of the essence. As soon as you notice damage, contact your insurance company. This is crucial because most policies require you to file a claim as quickly as possible after a loss.

-

Adjuster Inspection: Once you’ve filed your claim, an insurance adjuster will inspect the damage. Think of them as detectives for your claim. Their job is to assess the damage and determine how much the insurance company should pay.

-

Settlement Discussion: After the adjuster’s inspection, you’ll discuss the settlement amount. The adjuster’s initial offer might not cover all your needs. You have the right to question and negotiate this estimate.

-

Documentation: Keep all your records organized. Photos, videos, and lists of damaged items are crucial. This documentation supports your claim and helps ensure you receive the settlement you deserve.

-

Temporary Repairs: While waiting for the settlement, you might need to make temporary repairs to prevent further damage. Save all receipts, as these costs may be reimbursable.

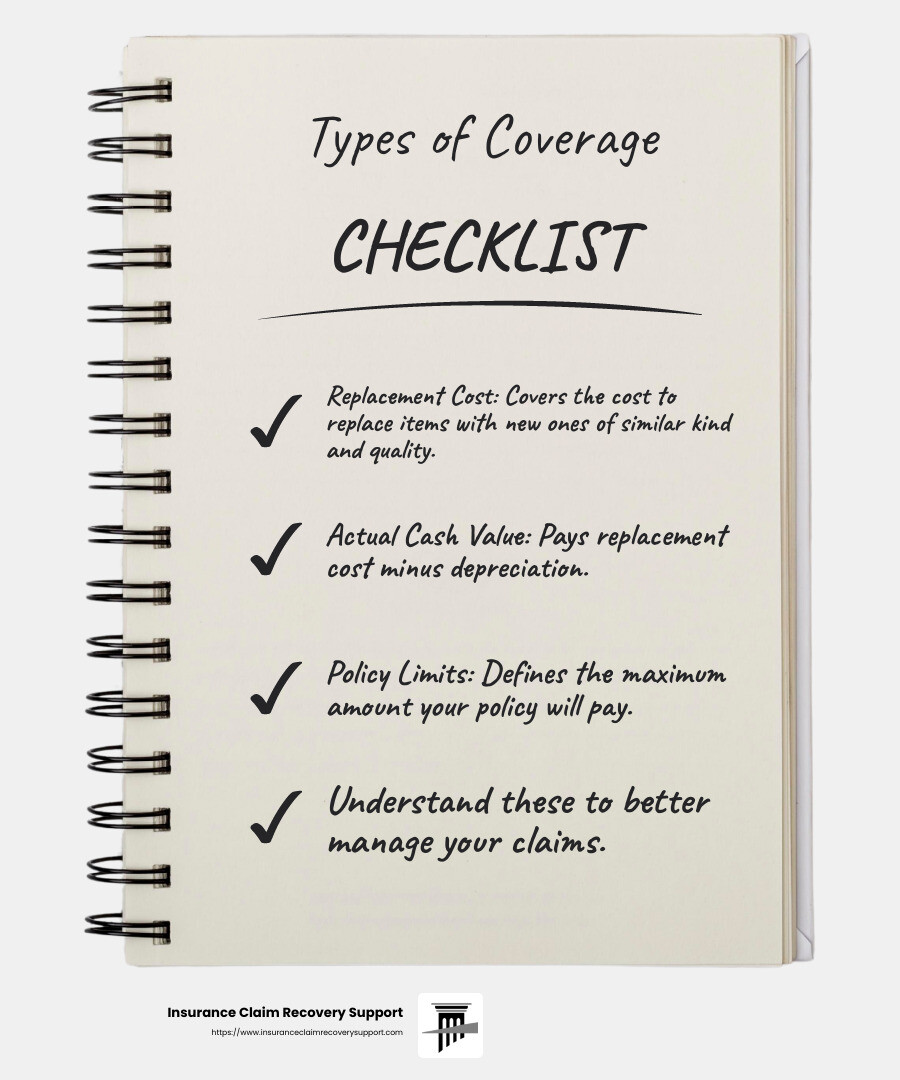

Types of Coverage

Understanding your coverage is key to getting the most out of your insurance policy. Here are the main types:

-

Replacement Cost: This coverage pays to replace damaged items with new ones of similar kind and quality, without deducting for depreciation.

-

Actual Cash Value: This coverage pays the replacement cost minus depreciation. You receive the value of the item at the time it was damaged, not the cost to replace it new.

-

Policy Limits: Every policy has limits on how much it will pay out. Knowing your policy limits helps you understand the maximum amount you can expect from your claim.

It’s important to familiarize yourself with these terms to ensure you’re fully covered. Knowing the difference between replacement cost and actual cash value can greatly affect your settlement amount.

By understanding these key steps and types of coverage, you’ll be better equipped to handle the building insurance claim process. This knowledge can make a significant difference in achieving a fair settlement.

Next up, we’ll dive into how to steer the claims process specifically in Texas, including state laws and disaster recovery.

Navigating the Claims Process in Texas

Navigating the building insurance claim process in Texas comes with its own unique set of challenges and rules. Texas is no stranger to natural disasters, from hurricanes to tornadoes, which makes understanding the claims process even more crucial for homeowners.

Working with a Public Adjuster

A public adjuster can be a valuable ally in your claim process. Unlike insurance company adjusters, public adjusters work for you, the policyholder. They are experts in maximizing your settlement and can help you steer the complex landscape of insurance claims.

Insurance Claim Recovery Support is one such entity that provides advocacy for policyholders. They help ensure that you get the settlement you deserve, especially in the aftermath of a disaster. Hiring a public adjuster means you have someone negotiating on your behalf, potentially increasing your settlement significantly.

Common Challenges and Solutions

State Laws and Regulations: Texas has specific laws that can impact your claim. For example, the state has deadlines for filing claims and regulations on how disputes with insurance companies should be handled. Being aware of these can prevent delays and denials.

Claim Denial: Sometimes, insurers may deny claims. This can be due to policy exclusions, missed deadlines, or insufficient documentation. A public adjuster can help you challenge a denial by providing the necessary documentation and negotiating with the insurer.

Additional Living Expenses: If your home is uninhabitable due to damage, your policy may cover additional living expenses, such as hotel stays and meals. It’s crucial to keep all receipts to ensure full reimbursement. These expenses are separate from the repair costs.

Mortgage Lender Involvement: If you have a mortgage, your lender will likely be involved in the claims process. Insurance checks for repairs are often made out to both you and your lender. This means you’ll need your lender’s endorsement to access the funds. Lenders typically place the money in an escrow account, releasing it as repairs are completed.

By understanding these challenges and leveraging the expertise of a public adjuster, you can steer the Texas insurance claim process more effectively. This knowledge can save you time, money, and stress during an already challenging time.

Next, we’ll explore frequently asked questions about building insurance claims, covering topics like the stages of an insurance claim and timelines for receiving payments.

Frequently Asked Questions about Building Insurance Claims

What are the stages of an insurance claim?

Filing a building insurance claim can feel like a maze, but breaking it down into stages makes it easier to handle. Here’s a quick look at the key stages:

-

File the Claim: Start by contacting your insurance company as soon as possible. You can usually do this online, through an app, or by calling them. The sooner you file, the faster you can get the process moving.

-

Adjuster Questions and Inspection: An adjuster from the insurance company will be assigned to your case. They will inspect the damage to your property and ask questions to understand the extent of the loss. It’s essential to provide them with all necessary documentation, such as photos and receipts, to support your claim.

-

Contractor Selection: Once the damage is assessed, you’ll need to choose a contractor for repairs. It’s crucial to select a reputable contractor who is licensed and insured. Getting multiple estimates and checking references can help you make an informed decision.

-

Settlement Discussion and Payment: After the inspection and contractor selection, you will discuss the settlement amount with your insurer. You might receive multiple payments, including an initial advance and subsequent payments as repairs progress.

How long should a property insurance claim take?

The timeline for a property insurance claim can vary based on several factors, including state regulations and the complexity of the claim. In Texas, insurance companies are generally required to acknowledge a claim within 15 days and must accept or deny it within 15 business days after receiving all necessary information. However, this timeline can extend in the case of natural disasters due to the sheer volume of claims.

Keeping detailed records and responding promptly to any requests from your insurer can help speed up the process.

How does a contractor get paid from an insurance claim?

Contractor payment can happen in a couple of ways:

-

Direct Payment: Some insurance policies allow for direct payment to the contractor. This usually involves signing a “direction to pay” form, which authorizes the insurer to pay the contractor directly once the work is completed to your satisfaction.

-

Reimbursement: Alternatively, you might pay the contractor yourself and then seek reimbursement from your insurance company. Make sure to keep all receipts and documentation to ensure you get reimbursed for the full amount.

When selecting a contractor, ensure they understand the terms of your insurance policy and the payment process. This clarity can prevent misunderstandings and ensure a smoother repair process.

By understanding these stages and timelines, you can better steer the building insurance claim process and manage your expectations effectively. Next, we’ll dig into more specific questions about building insurance claims.

Conclusion

Navigating the building insurance claim process can be daunting, but with the right support, it becomes manageable. At Insurance Claim Recovery Support, we specialize in advocating for policyholders, ensuring they receive the maximum settlement they deserve. Our team of experienced public adjusters is dedicated to guiding you through every step of the claim process, from initial assessment to final settlement.

Maximizing Settlements: We are committed to helping you secure the compensation you are entitled to. Our expertise in dealing with insurance companies enables us to negotiate effectively, challenging any underpayments or denials. We understand the nuances of insurance policies and leverage this knowledge to ensure you get the best possible outcome.

Policyholder Support: Our goal is to make the claim process as smooth as possible for you. We provide clear communication and transparency at every stage, so you know what to expect and what is required. Whether you’re dealing with fire, hurricane, or any other type of property damage, our team is here to support you.

Local Expertise: With locations in Austin, Dallas-Fort Worth, San Antonio, Houston, and other Texas cities, we understand the unique challenges that come with filing claims in this region. Our familiarity with Texas insurance laws and disaster recovery processes ensures that you are in capable hands.

For more information on how Insurance Claim Recovery Support can assist you, especially if you’re dealing with government or nonprofit building claims, visit our dedicated service page. Let us help you turn a challenging situation into a successful recovery.