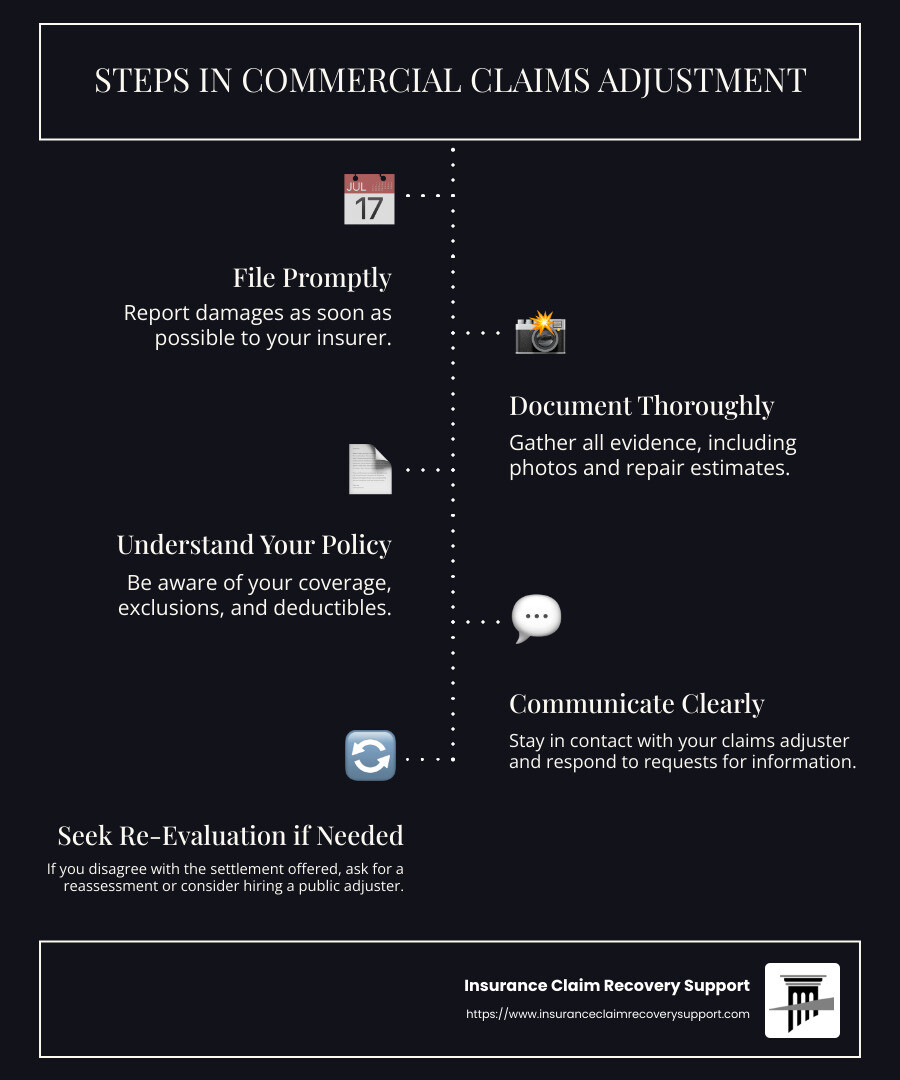

Understanding commercial claims adjustment is crucial for any commercial property owner faced with property damage. This involves navigating a series of steps with your insurance provider, from filing the initial claim to finalizing a settlement. A clear understanding of this process helps ensure you receive the rightful amount for damages covered by your policy. Here’s a quick rundown:

- File Promptly: Report damages as soon as possible to your insurer.

- Document Thoroughly: Gather all evidence, including photos and repair estimates.

- Understand Your Policy: Be aware of your coverage, exclusions, and deductibles.

- Communicate Clearly: Stay in contact with your claims adjuster and respond to any requests for information.

- Seek Re-Evaluation if Needed: If you disagree with the settlement offered, don’t hesitate to ask for a reassessment or consider hiring a public adjuster.

Handling an insurance claim is daunting, especially amidst the stress of property damage from events like natural disasters. However, having a firm grip on each step can significantly ease the strain and lead to a fairer outcome.

My name is Scott Friedson, and I have over two decades of experience in commercial claims adjustment. I have helped policyholders settle hundreds of millions in claims and overcome obstacles such as wrongful denials, ensuring they receive the maximum reimbursement for damages.

Commercial claims adjustment word list:

– how to become a commercial claims adjuster

– what does a commercial claims adjuster do

– what is the average salary for a commercial claims adjuster

The Role of a Commercial Claims Adjuster

A commercial claims adjuster plays a vital role in helping businesses recover from losses. Their main job is to investigate insurance claims and determine how much the insurance company should pay the policyholder. Let’s break down their key responsibilities:

Investigating Insurance Claims

When a claim is made, the adjuster starts by gathering all the necessary information. This means:

-

Inspecting the Damage: Adjusters often visit the site to see the damage firsthand. They take photos and gather evidence to build a complete picture of the loss.

-

Reviewing Reports: They look at police reports, fire department records, and any other documents related to the incident. This helps confirm the details of what happened.

-

Interviewing Witnesses: Talking to people who saw the event can provide valuable insights. Witnesses might remember details that documents don’t show.

Mark Snyder, a claims expert, highlights the importance of this step: “Adjusters are initially charged with investigating the cause of the loss that generated the insurance claim, and documenting and quantifying the resulting damages.”

Evaluating Liability

Once the investigation is complete, the adjuster moves on to evaluate liability. This involves:

-

Reviewing the Insurance Policy: The adjuster checks the policy to understand what is covered and what isn’t. They need to make sure the claim fits within the policy terms.

-

Determining Fault: Sometimes, figuring out who is responsible for the damage isn’t straightforward. The adjuster assesses all the evidence to decide this.

Decision-Making

After evaluating the claim, the adjuster makes decisions about the payout:

-

Calculating Settlements: The adjuster estimates the cost to repair or replace the damaged property. They may consult with repair professionals or use software to help with this.

-

Negotiating Settlements: Adjusters often negotiate with the policyholder to reach a fair settlement. Strong communication skills are essential here.

Kenny Taylor, a public adjuster, notes, “Both independent and staff adjusters are responsible for making sure that every penny paid out is earned under the terms of the insurance policy.”

Overall, a commercial claims adjuster helps ensure that claims are processed fairly and accurately. They balance the needs of the policyholder with the interests of the insurance company, striving to reach a resolution that satisfies both parties.

Steps in the Commercial Claims Adjustment Process

The commercial claims adjustment process can seem complex, but breaking it down into clear steps makes it easier to understand. Here’s what happens from start to finish:

Claim Investigation

The first step is a thorough claim investigation. This is where the adjuster dives deep into the details of the claim.

-

Site Inspection: The adjuster visits the site to inspect the damage. They take photos, gather evidence, and note everything about the loss.

-

Report Review: They examine police reports, fire department logs, and other relevant documents. This helps them confirm the facts.

-

Witness Interviews: Speaking with witnesses can reveal important details. These conversations help the adjuster understand what happened.

Mark Snyder, a claims expert, emphasizes the importance of this phase: “Adjusters are initially charged with investigating the cause of the loss that generated the insurance claim, and documenting and quantifying the resulting damages.”

Loss Assessment

Once the investigation is complete, the adjuster moves on to loss assessment. This involves evaluating the extent of the damage and its impact.

-

Reviewing Insurance Policy: The adjuster checks the policy to determine what is covered. They ensure the claim fits within the policy terms.

-

Cost Estimation: Using tools like Xactimate, adjusters estimate the cost to repair or replace the damaged property. They may consult with repair professionals for accurate figures.

Payout Decisions

The final step is making payout decisions. This is where the adjuster decides how much the insurance company will pay.

-

Settlement Calculation: The adjuster calculates a fair settlement based on their findings. This involves balancing the policyholder’s needs with the insurance company’s guidelines.

-

Negotiation: Sometimes, adjusters negotiate with policyholders to reach an agreement. Good communication is key to ensuring both parties are satisfied.

Kenny Taylor, a public adjuster, explains, “Both independent and staff adjusters are responsible for making sure that every penny paid out is earned under the terms of the insurance policy.”

Understanding these steps helps explain the commercial claims adjustment process. It ensures that claims are handled fairly and efficiently, benefiting both the policyholder and the insurance company.

Next, we’ll explore the key challenges faced in the commercial claims adjustment process.

Key Challenges in Commercial Claims Adjustment

Commercial claims adjustment can be tricky. Let’s explore the main challenges that adjusters face:

Complex Policies

Commercial insurance policies are not simple. They often include many details and specific terms. Understanding these policies requires a keen eye and expertise. Adjusters must interpret these documents correctly to ensure that claims are processed fairly.

-

Multiple Coverages: Commercial policies often cover various risks. This can include property damage, liability, and business interruption. Adjusters need to know what each policy covers to make accurate decisions.

-

Detailed Terms: Policies have terms that explain what is covered and what isn’t. Adjusters must be able to read these terms and apply them to real-world situations.

Coverage Areas

Understanding the coverage area is crucial for adjusters. This means knowing what is protected under the policy and what isn’t. For instance, certain types of damage, like flood damage, might not be included unless specified.

-

Geographic Risks: In places like Texas, where storms and fires are common, adjusters must be aware of local risks. This knowledge helps them prepare for and respond to claims effectively.

-

Policy Limits: Each policy has limits on how much it will pay out. Adjusters need to ensure that the claims stay within these limits.

Loss Adjustment Expense

Loss adjustment expenses (LAE) are the costs insurance companies face when handling claims. These can include the costs of hiring adjusters, investigators, and legal experts.

-

Allocated vs. Unallocated Costs: Allocated costs are specific to a claim, like fees for an expert to assess damage. Unallocated costs are general overheads, like salaries for staff adjusters.

-

Controlling Costs: Insurance companies aim to keep these expenses low to maintain profitability. Adjusters play a key role in managing these costs while ensuring claims are handled correctly.

Handling these challenges requires skill and experience. Adjusters must balance the needs of the policyholder with the company’s guidelines. This ensures that claims are processed fairly and efficiently.

Next, we’ll explore the benefits of professional commercial claims adjustment and how it can make a difference.

Benefits of Professional Commercial Claims Adjustment

Professional commercial claims adjustment offers many benefits, especially when dealing with complex claims. Let’s explore how expert resources, complex claims handling, and loss control oversight can help ensure a smooth process.

Expert Resources

Professional adjusters bring a wealth of knowledge and experience. They understand the intricate details of commercial policies and can interpret them accurately. This expertise ensures that claims are handled fairly and efficiently.

-

Qualified Adjusters: Having skilled adjusters means that claims are evaluated by professionals who know what to look for. This reduces errors and speeds up the claim process.

-

Specialized Knowledge: Adjusters often specialize in specific areas like property or liability claims. Their deep understanding of these areas helps in assessing claims accurately.

Complex Claims Handling

Commercial claims can be complicated due to multiple coverages and detailed policy terms. Professional adjusters are trained to handle these complexities.

-

Thorough Investigations: Adjusters conduct detailed investigations to understand the full scope of the claim. This includes evaluating damages and determining liability.

-

Efficient Processing: By managing complex claims effectively, professional adjusters ensure that the process is smooth and timely, benefiting both the insurance company and the policyholder.

Loss Control Oversight

Loss control is about minimizing the impact of claims on both the insurer and the insured. Professional adjusters play a crucial role in this area.

-

Cost Management: Adjusters help control costs by identifying potential savings and avoiding unnecessary expenses. This includes managing loss adjustment expenses, which can be significant in commercial claims.

-

Risk Mitigation: They provide insights into potential risks and help implement strategies to reduce future claims. This proactive approach is beneficial for businesses looking to minimize their insurance costs.

In summary, professional commercial claims adjustment provides the necessary expertise, efficient handling of complex claims, and effective loss control. This ensures that claims are processed accurately, fairly, and in a timely manner, benefiting all parties involved.

Next, we’ll address some common questions people have about commercial claims adjustment.

Frequently Asked Questions about Commercial Claims Adjustment

What is a Commercial Claims Adjuster?

A commercial claims adjuster is a professional who investigates insurance claims related to commercial properties. Their main job is to evaluate the damage and determine the insurance company’s liability. This involves:

- Inspecting Damage: They visit the site to see the damage firsthand.

- Gathering Information: Collecting reports, photos, and statements to get a full picture.

- Calculating Settlements: Estimating repair costs to ensure fair compensation.

Think of them as detectives for insurance claims. They piece together the story of what happened and decide how much the insurance company should pay.

How are Commercial Claims Different from Personal Claims?

Commercial claims differ from personal claims in several key ways:

-

Complexity: Commercial claims often involve multiple types of coverage and policy details. For example, a claim for a retail center might include property damage and loss of income.

-

Scale: Commercial properties are usually larger and more complex than personal properties. This means the potential damages and payouts can be much higher.

-

Stakeholders: There are often more people involved, such as business partners or tenants. This adds layers to the claims process.

In short, commercial claims are more intricate due to the nature of the properties and the businesses involved.

What is the Importance of Loss Adjustment Expenses?

Loss adjustment expenses (LAE) are costs incurred while processing a claim. These are important because they affect both the insurer and the policyholder:

-

Allocated Loss Adjustment Expenses (ALAE): Directly tied to a specific claim, like hiring an expert to assess damage.

-

Unallocated Loss Adjustment Expenses (ULAE): General costs, such as salaries of claims adjusters, not linked to a specific claim.

Managing these expenses is crucial. High LAE can lead to increased insurance costs for policyholders. Professional adjusters help keep these costs in check by efficiently managing the claims process and finding ways to reduce unnecessary expenses.

Next, we’ll dive deeper into the conclusion, focusing on how Insurance Claim Recovery Support advocates for policyholders to maximize settlements.

Conclusion

Navigating the commercial claims adjustment process can be daunting, but you don’t have to go it alone. At Insurance Claim Recovery Support, we are dedicated to standing by policyholders every step of the way. Our mission is to ensure that you receive the maximum settlement you’re entitled to, allowing you to focus on rebuilding and moving forward.

Policyholder Advocacy

We take pride in being fierce advocates for policyholders. Unlike insurance companies, which may prioritize their bottom line, we prioritize you. Our team carefully documents every detail of your claim, ensuring nothing is overlooked. By leveraging our expertise and understanding of complex policies, we help you steer the intricate world of commercial claims with confidence.

Maximizing Settlements

Our commitment to maximizing settlements is unwavering. We know the tactics that can lead to lower payouts and work diligently to counter them. From assessing the extent of damage to negotiating with insurance companies, our approach is thorough and strategic. This dedication has consistently resulted in higher settlements for our clients, turning potentially overwhelming situations into manageable ones.

Local Expertise, Nationwide Reach

Based in Texas, with locations in Austin, Dallas-Fort Worth, San Antonio, Houston, and beyond, we understand the unique challenges faced by businesses in these areas, especially when it comes to storm-related damages. Our local expertise is complemented by a nationwide reach, allowing us to serve clients across the country with the same level of dedication and care.

In conclusion, the path to a fair settlement doesn’t have to be a solo journey. With Insurance Claim Recovery Support by your side, you have a partner who is committed to fighting for your rights and ensuring you receive the compensation you deserve. Let us be your guide and advocate in the commercial claims adjustment process, so you can focus on what truly matters—your business and your future.