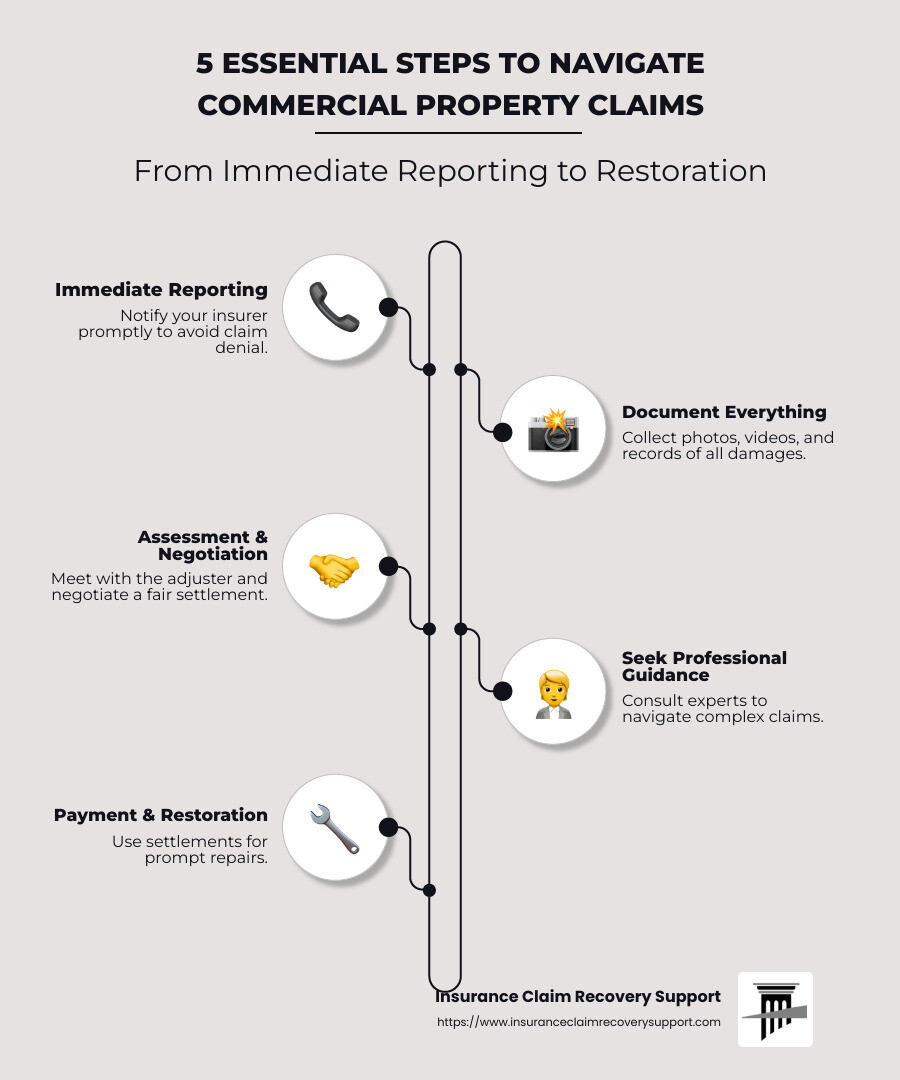

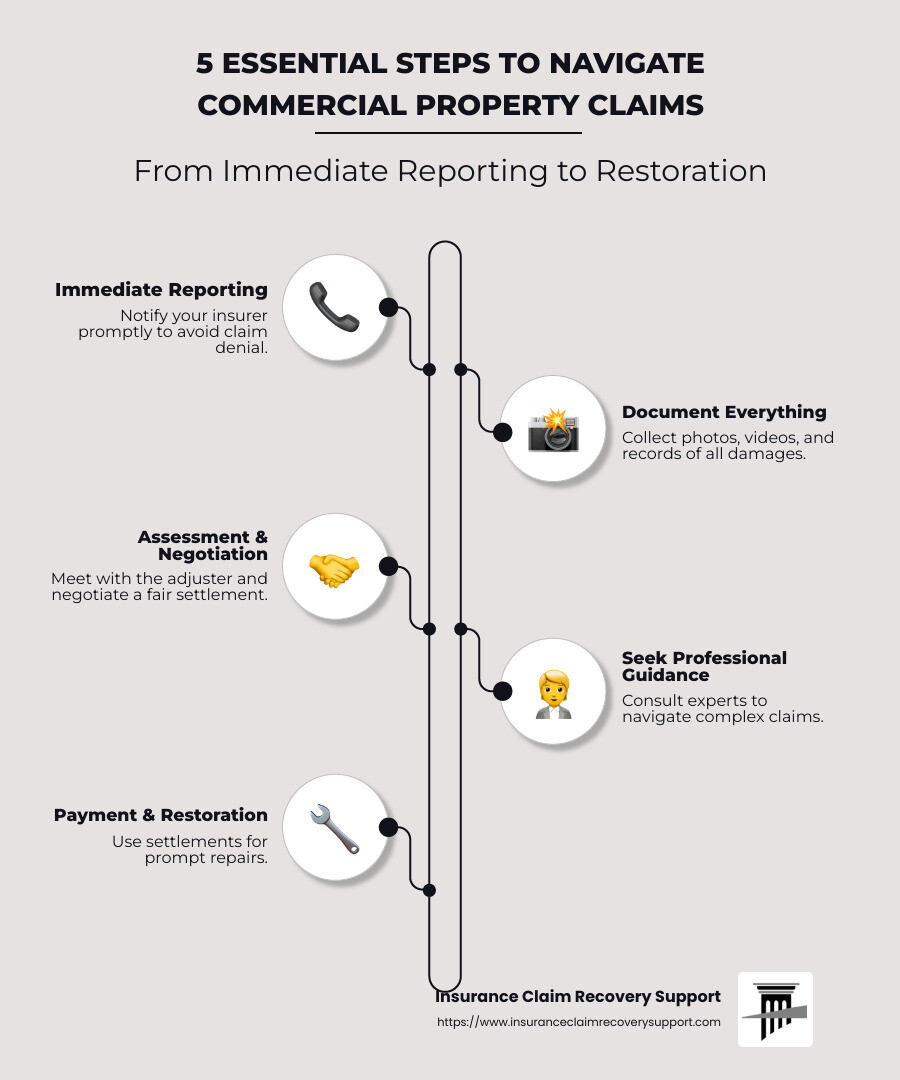

Commercial property claims can feel overwhelming for anyone running a business. However, understanding the claim process and your policyholder rights can simplify this daunting task. Here’s what you need to know in a nutshell:

- Immediate Reporting: Notify your insurer promptly to avoid claim denial.

- Detailed Documentation: Collect photos, videos, and records of all damages.

- Assessment & Negotiation: Meet with the adjuster and negotiate a fair settlement.

- Professional Guidance: Seek expert help to steer complex claims.

- Payment & Restoration: Use settlements for prompt repairs.

Understanding Commercial Property Claims

Commercial property claims are a crucial part of protecting your business after unexpected events like fires, storms, or theft. These claims help you recover financially from property damage and get back to business as usual. Let’s break down the key aspects:What Are Commercial Property Claims?

A commercial property claim is your request for settlement from your insurance company after your business property is damaged. This could be due to various incidents such as fires, vandalism, or natural disasters. The goal is to restore your property to its pre-loss condition.Types of Property Damage Covered

Your commercial property insurance policy typically covers:- Fire Damage: Repairs or rebuilding after a fire.

- Storm Damage: Wind, hail, and lightning-related repairs.

- Theft and Vandalism: Replacement of stolen or damaged items.

- Burst Pipes: Water damage from plumbing incidents.

The Role of Insurance Coverage

Your insurance coverage is designed to protect your business’s physical assets. This includes the building, equipment, inventory, and sometimes even landscaping. It’s essential to know what your policy covers and what it doesn’t. For example, business interruption insurance is often separate but crucial if your operations are halted due to a covered event.Why Understanding Your Policy Matters

Knowing your policy inside out is key. Policy language can be tricky, and terms like “deductibles” or “coverage limits” can impact your claim. Misunderstanding these can lead to underinsurance or claim denial. Always review your policy’s specifics and ask your insurer for clarification if needed. By understanding these elements, you ensure that your business is well-protected and prepared to handle any damage. This knowledge empowers you to steer commercial property claims confidently. Next, let’s dive into our first quick tip: how to document everything effectively for a smoother claims process.Quick Tip 1: Document Everything

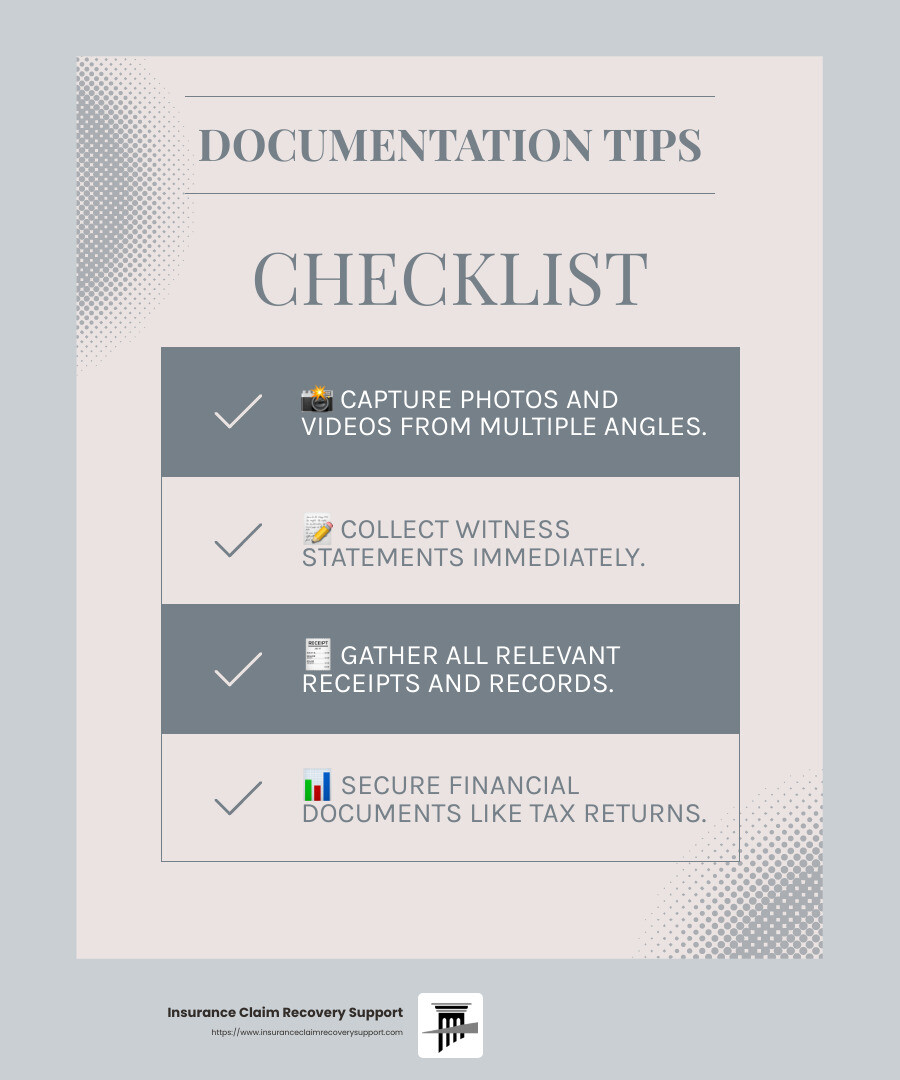

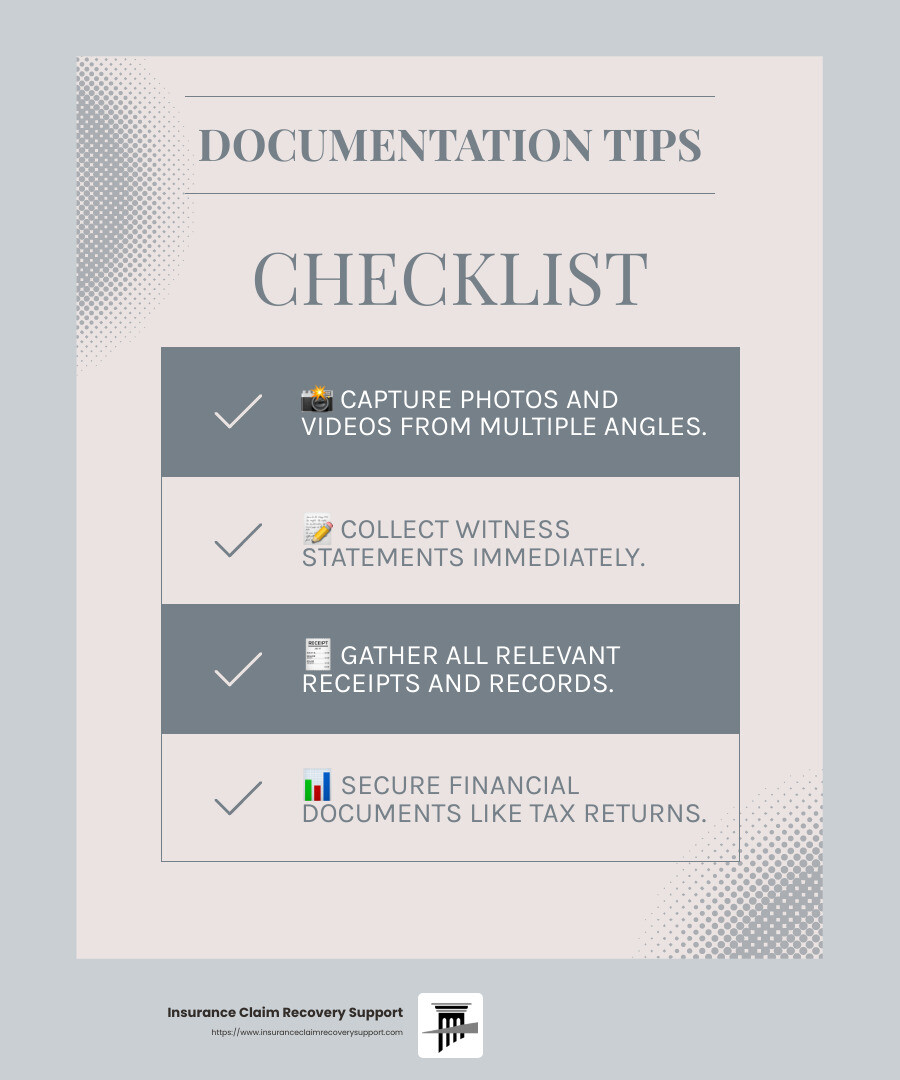

Proper documentation is the backbone of a successful commercial property claim. It provides the evidence needed to support your claim and helps ensure a fair settlement. Here’s how you can document effectively:Gather Evidence Immediately

As soon as an incident occurs, start collecting evidence. This includes:- Photos and Videos: Capture the damage from multiple angles. For example, after a fire, photograph all affected areas, including structural damage and ruined inventory. Videos can provide a comprehensive view that static images might miss.

- Witness Statements: If someone saw the incident, get their account. A witness statement can add credibility to your claim.

- Receipts and Records: Gather all relevant documents like purchase receipts, maintenance records, and any appraisals. These help prove the value of the damaged items.

Secure Important Documents

Having the right documents ready can make the claim process smoother:- Financial Records: Collect profit and loss statements, tax returns, and balance sheets. These demonstrate the financial impact of the loss.

- Inventory Records: Keep up-to-date inventory lists with descriptions, quantities, and values of all items. This helps in assessing the extent of your loss.

- Appraisals: If you’ve had items appraised, include these documents. They provide proof of value, which is crucial for your claim.

Create an Equipment Inventory

A detailed inventory of your equipment can significantly streamline the claims process:- Equipment Details: For each piece of equipment, note the model, serial number, purchase date, and value. This helps the adjuster understand what needs to be replaced or repaired.

- Photographs: Take clear photos of all equipment. Capture different angles to show condition and any identifying marks or serial numbers.

- Annual Updates: Update your equipment inventory annually. This keeps your records current and accurate, making it easier to file a claim if needed.

Quick Tip 2: Know Your Policy

Understanding your insurance policy is crucial when dealing with commercial property claims. It can prevent surprises and help ensure you’re adequately covered. Here’s what you need to focus on:Decode Policy Language

Insurance policies are often filled with complex language. It’s important to break down these terms to understand what is covered. Look for key terms like “all-risk” or “named perils” to know what incidents are included. For example, if your policy is “all-risk,” it covers most types of damage unless specifically excluded. On the other hand, “named perils” policies only cover incidents listed in the document. Pro Tip: Ask your insurance agent to explain any confusing terms. Don’t hesitate to seek clarification on anything you don’t understand.Identify Coverage Limits

Every policy has limits on how much it will pay out. Knowing these limits helps set realistic expectations for your claim.- Policy Limits: These are the maximum amounts your insurer will pay for a claim. Think of it as a cap on your coverage.

- Sublimits: These are smaller caps within your main policy limit for specific types of claims. For instance, there might be a sublimit for theft that is lower than your overall coverage.

Understand Exclusions

Exclusions are specific situations or types of damage not covered by your policy. Common exclusions include:- Flood Damage: Often requires a separate policy.

- Earthquake Damage: Typically not covered under standard policies.

- Equipment Breakdown: May need additional coverage.

Quick Tip 3: Communicate Effectively with Your Insurer

Effective communication with your insurer is key when handling commercial property claims. It can make the difference between a smooth process and a frustrating ordeal.Be Clear and Concise

When speaking with your insurer, clarity is crucial. Provide clear details about the incident and your claim. Use simple language and stick to the facts.- Incident Overview: Briefly explain what happened, when it occurred, and the extent of the damage.

- Documentation: Mention any photos, videos, or receipts you have collected as evidence.

Regularly Follow Up

Don’t wait for your insurer to reach out. Be proactive and check in regularly to stay updated on your claim’s progress.- Scheduled Calls: Set a schedule for follow-up calls or emails.

- Tracking: Keep a record of all interactions, including dates and summaries of conversations.

Engage in Claim Negotiation

Negotiation is often part of the claims process. Be prepared to discuss your claim and ensure you receive a fair settlement.- Know Your Facts: Have all relevant documentation ready to support your claim.

- Stay Professional: Keep the conversation respectful and focused on facts.

Consider Professional Help

If communication becomes challenging, or if you’re facing a complex claim, consider hiring a public adjuster. They can handle negotiations and ensure your interests are represented. Pro Tip: A public adjuster can be particularly helpful in large or complex claims, as they bring expertise and experience to the table. By communicating effectively with your insurer, you can help ensure a smoother claims process and a fair outcome. Next, we’ll explore the benefits of seeking professional help when needed.Quick Tip 4: Consider Professional Help

When dealing with commercial property claims, sometimes it’s best to bring in the experts. Handling these claims can be complex and overwhelming, especially if you’re navigating it alone. Here’s why you might want to consider professional help:Public Adjusters: Your Advocate

A public adjuster is a professional who works for you, not the insurance company. They are experts at assessing damage, documenting losses, and negotiating with insurers to maximize your claim settlement.- Maximize Settlement: Public adjusters are skilled at identifying all possible damages, which might increase your payout. They know what to look for and how to present it effectively to your insurer.

- Save Time: Let them handle the paperwork and negotiations while you focus on running your business. Their expertise can streamline the process and reduce stress.

Insurance Claim Recovery Support: Expert Negotiators

If you want someone to manage the entire claims process, consider partnering with Insurance Claim Recovery Support. They specialize in handling commercial property claims and can take over negotiations with your insurer.- Comprehensive Service: They manage everything from gathering evidence to negotiating settlements, ensuring you get a fair deal.

- Focus on Recovery: With professionals handling your claim, you can concentrate on getting your business back to normal.

Legal Support: When Things Get Tough

Sometimes, even with a public adjuster, disputes arise. If your claim is denied or you believe the settlement offer is unfair, legal support might be necessary.- Legal Expertise: An attorney can interpret policy language and advocate for your rights. They can help you understand complex terms and conditions that might affect your claim.

- Appeal and Dispute Resolution: If your claim is denied, an attorney can guide you through the appeal process and fight for a fair resolution.

Quick Tip 5: Be Prepared for Denials

Even with the best preparation, commercial property claims can sometimes be denied. Don’t panic. Understanding the reasons behind a denial and knowing how to respond is key.Common Reasons for Denial

- Policy Exclusions: Your claim might be denied if the damage falls under a category not covered by your policy. Always review your policy to understand these exclusions.

- Insufficient Documentation: Lack of proper evidence can lead to a denial. Ensure you have comprehensive documentation, including photos, receipts, and inventory lists.

- Late Filing: Filing your claim too late can result in a denial. Always report incidents to your insurer promptly.

The Appeal Process

If your claim is denied, you have the right to appeal. Here’s how to approach it:- Review the Denial Letter: Understand why your claim was denied. This letter should outline the reasons and provide a basis for your appeal.

- Gather More Evidence: Strengthen your case by collecting additional documentation. This can include expert opinions or further assessments.

- Write a Response Letter: Clearly explain why you believe the denial was incorrect. Include all new evidence and reference specific policy language that supports your claim.

Legal Options

If the appeal process doesn’t resolve the issue, consider your legal options:- Consult an Attorney: An attorney specializing in insurance claims can help you steer the legal landscape. They can interpret complex policy language and represent your interests.

- Consider Small Claims Court: For smaller disputes, small claims court can be a cost-effective option. However, be aware that hiring a lawyer will be at your expense.

- State Insurance Regulators: Involve state insurance regulators if you suspect unfair practices. They can provide guidance and help mediate disputes.

Frequently Asked Questions about Commercial Property Claims

What is a commercial property claim?

A commercial property claim is a request made by a business to its insurance company for settlement due to damage or loss covered under a commercial property insurance policy. This can include damages from events like fire, theft, vandalism, or certain types of storms. Understanding what is covered by your policy is crucial, as not all types of damage, such as flood damage, are included without additional coverage.How do I file a commercial property claim?

Filing a commercial property claim involves several key steps:- Notify Your Insurer: As soon as damage occurs, contact your insurance company. Quick reporting is essential to ensure your claim is considered.

- Document the Damage: Take photos and videos of the damage and gather any relevant documents like receipts and inventory lists. This evidence supports your claim and can speed up the process.

- Complete Claim Forms: Fill out any required claim forms provided by your insurer. Be thorough and accurate to avoid delays.

- Meet with the Adjuster: Your insurance company will likely send an adjuster to assess the damage. Be present to provide additional information and answer questions.

- Review the Settlement Offer: Once your claim is processed, review the offer carefully. If it seems insufficient, you may need to negotiate or provide further evidence.

What if my commercial property claim is denied?

If your commercial property claim is denied, don’t lose hope. You have several options:- Understand the Denial: Carefully read the denial letter to understand the reasons. Common reasons include policy exclusions or insufficient documentation.

- File an Appeal: Gather additional evidence and submit an appeal to your insurer, explaining why the denial should be reconsidered.

- Seek Professional Assistance: If the appeal is unsuccessful, consider consulting an attorney or a public adjuster. They can help interpret policy language and advocate on your behalf.

- Contact State Regulators: If you believe the denial was unjust, you can reach out to your state’s insurance regulator for assistance.

Conclusion

Navigating commercial property claims can be challenging, but you don’t have to do it alone. At Insurance Claim Recovery Support, we are committed to advocating for policyholders like you, ensuring that you receive the maximum settlement you deserve. Our team specializes in handling property damage claims resulting from events such as fire, hail, hurricanes, and other significant weather events. We operate nationwide, with a strong presence in Texas cities like Austin, Dallas, Fort Worth, San Antonio, Houston, and more. Our focus is exclusively on representing policyholders, not insurance companies, which means our priorities align with yours. Why Choose Us?- Expert Advocacy: We understand the tactics insurers use to minimize payouts, and we fight to ensure fair settlement for your losses.

- Comprehensive Support: From filing the initial claim to negotiating settlements, we provide ongoing support throughout the entire process.

- Contingency-Based Service: Our services are on a contingency basis—meaning we only get paid when you do. This ensures our interests are aligned with yours.

- Proven Success: With a track record of settling large loss claims over $200M, our expertise and dedication speak for themselves.