When Fire Insurance Claims Go Up in Smoke

A denied fire insurance claim can feel like getting burned twice – first by the flames, then by your insurance company. When your home or business suffers fire damage, you expect your insurance policy to provide the financial support you need to rebuild and recover.

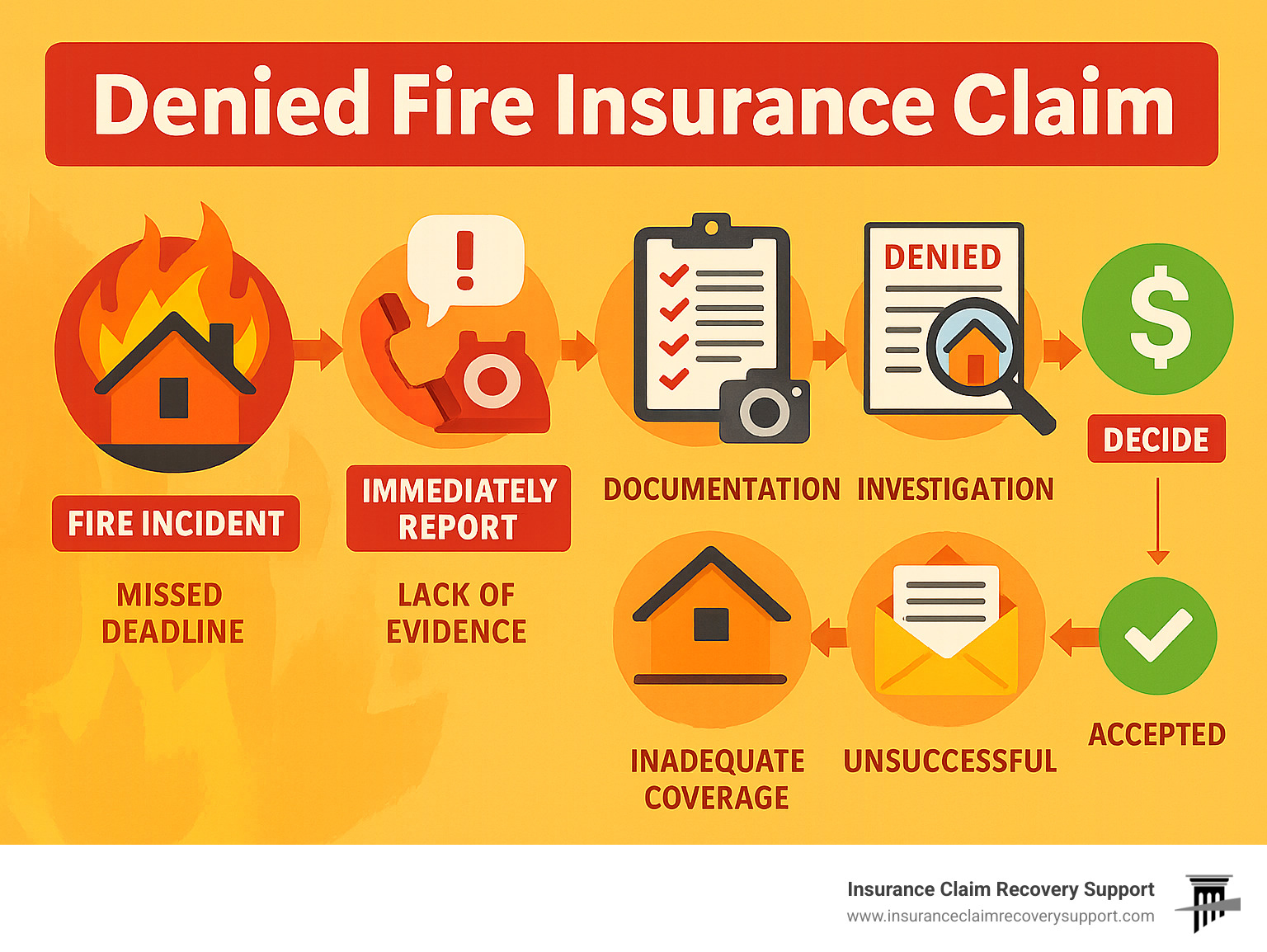

Top reasons fire insurance claims get denied:

- Suspicion of arson – Insurers investigate fire origin and may deny claims if they suspect intentional ignition

- Policy exclusions – Wildfire, negligence, or certain fire types may not be covered

- Insufficient coverage – Property values may exceed policy limits due to inflation or renovations

- Late reporting – Missing notification deadlines can void your claim

- Inadequate documentation – Lack of proof of ownership or damage evidence

- Unpaid premiums – Lapsed policies provide no coverage

- Poor maintenance – Faulty wiring or neglected fire safety systems

- Valuation disputes – Disagreements over replacement costs

- Pre-existing damage – Insurers may blame prior issues rather than the fire

- Misrepresentation – Inaccurate information on applications can void coverage

The harsh reality is that insurance companies deny or underpay hundreds of fire damage claims daily across the United States. Even legitimate claims face scrutiny as insurers look for any reason to minimize payouts.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled over 500 large loss claims valued at more than $250 million, including many initially denied fire insurance claim cases. Throughout my career, I’ve overturned wrongfully denied claims and increased settlements from 30% to 3,800% or more for policyholders who thought their cases were hopeless.

Denied fire insurance claim basics:

– fire property damage attorney

– property damage lawyer

Denied Fire Insurance Claim: 10 Common Pitfalls

When your home goes up in flames, the last thing you expect is for your insurance company to deny your claim. Yet fire claims are among the most frequently disputed by insurers, leaving families and business owners scrambling when they need help most.

Denied Fire Insurance Claim Reason #1: Suspicion of Arson

Nothing will stop a fire claim faster than the dreaded “A” word. When insurers smell something fishy about your fire’s origin, they’ll often deny claims outright – even without concrete proof of wrongdoing.

Fire origin experts examine burn patterns to determine where and how the fire started. They’ll test for accelerants, interview witnesses, and dig into your financial records. If you’ve had multiple claims recently or are facing money troubles, red flags start waving.

The good news? The burden of proof is on your insurer, not you. They must prove arson occurred – you don’t have to prove it didn’t. According to the National Fire Protection Association (NFPA), cooking fires are actually the leading cause of home fires, followed by electrical issues and heating equipment problems.

If your insurer starts throwing around arson accusations, don’t panic. A qualified Fire Claims Adjuster can arrange independent investigations and work with fire experts to establish your fire’s accidental nature.

Denied Fire Insurance Claim Reason #2: Policy Exclusions & Limitations

Reading insurance policies is boring, but those exclusions can kill your claim faster than a fire extinguisher. Many homeowners find coverage gaps only after disaster strikes.

Wildfire exclusions have become particularly problematic in Texas. Many policies won’t cover fires that start outside your property boundaries, even if they spread to your covered structures. This leaves Austin, Dallas, and Houston area homeowners vulnerable during dry seasons.

Negligence clauses are another gotcha. If insurers decide you didn’t maintain your property properly, they might void your coverage entirely. Faulty electrical systems, disabled smoke detectors, or improper storage of flammable materials can all trigger these exclusions.

The tricky part is that insurers sometimes misapply exclusions to deny valid claims. Our Public Adjusting Services team carefully reviews policy language to catch these wrongful denials.

Denied Fire Insurance Claim Reason #3: Insufficient Coverage & Underinsurance

Here’s a sobering reality: many homeowners are significantly underinsured and don’t realize it until fire strikes. Construction costs have skyrocketed, making yesterday’s adequate coverage today’s financial disaster.

Rising material costs and labor shortages have pushed replacement costs through the roof. According to Scientific research on rising construction costs, construction expenses have increased dramatically in recent years. In booming Texas markets like Austin and Houston, property values often outpace coverage adjustments.

Coinsurance penalties can slash your payout when you’re underinsured. Most policies require you to insure your property for at least 80% of its replacement cost. Fall short, and your insurer reduces claim payments proportionally.

Denied Fire Insurance Claim Reason #4: Documentation & Proof of Loss Gaps

“Where are your receipts?” might be the most dreaded question after a fire. Insurers require proof of ownership and value for damaged items, and missing documentation can torpedo even legitimate claims.

The cruel irony? Fire often destroys the very documents you need to prove your losses. That’s why smart homeowners create detailed home inventories with photos, store receipts digitally, and keep copies in fireproof safes or cloud storage.

Essential documentation includes purchase receipts for valuable items, appraisals for jewelry and art, maintenance records for major systems, and building permits for renovations. Cloud-based storage solutions ensure you’ll have access to critical information even if your home and computer are destroyed.

Denied Fire Insurance Claim Reason #5: Late Reporting & Missed Deadlines

Time is not on your side after a fire. Insurance policies contain strict deadlines for reporting incidents and filing claims, and missing these deadlines can void your coverage entirely.

Critical deadlines typically include immediate notification within 24-48 hours, formal claim filing within 30-60 days, and proof of loss submission within 60 days. Some policies also require you to attend sworn examinations when requested.

Evidence deterioration is another concern with late reporting. The longer you wait, the harder it becomes to establish fire origin and document losses. Weather, vandalism, and cleanup efforts can all compromise crucial evidence.

Our Public Insurance Claims Adjuster for Fire Damage team helps steer reporting requirements and can potentially overcome deadline issues through proper documentation and appeals.

Fine-Print Fiascos—Understanding Policy Exclusions & Limits

The devil is in the details when it comes to fire insurance policies. What looks like comprehensive coverage on the surface can quickly become a denied fire insurance claim when you find the fine print exclusions and limitations buried in your policy documents.

Common exclusions that catch policyholders off guard include acts of war and terrorism, normal wear and tear, and defective workmanship or materials. Fire-specific complications add another layer of complexity. Your policy might distinguish between smoke damage and flame damage, potentially limiting coverage for one but not the other.

Additional living expenses (ALE) caps can leave you scrambling for housing costs after the initial coverage period expires. Many policies also have ordinance and law coverage gaps that don’t account for the additional costs of bringing your rebuilt property up to current building codes.

| Covered Fire Losses | Excluded Fire Losses |

|---|---|

| Accidental kitchen fires | Arson by policyholder |

| Electrical system fires | Fires from illegal activities |

| Lightning strikes | War-related fires |

| Heating system malfunctions | Intentional negligence |

| Wildfire spreading to property | Fires from code violations |

The challenge is that these distinctions aren’t always clear-cut. What one adjuster considers accidental, another might classify as negligent. This subjective interpretation creates opportunities for wrongful claim denials.

How Coverage Limits Affect a Denied Fire Insurance Claim

Even when your fire cause is clearly covered, coverage limits can effectively deny portions of your claim. It’s like having a safety net with holes in it – you’re protected until you fall through one of the gaps.

Dwelling coverage limits set the maximum amount available for structure repair or replacement. If construction costs have risen since you purchased your policy, this limit might fall short of actual rebuilding expenses. Sub-limits are particularly sneaky because they’re buried deep in policy documents. Your policy might provide $100,000 in personal property coverage but limit jewelry to $2,500 or electronics to $5,000.

Coinsurance clauses penalize underinsurance by reducing claim payments proportionally. If you don’t maintain coverage at 80% of your property’s replacement cost, the insurance company will reduce your payout even for partial losses.

Endorsements That Close Coverage Gaps

Smart policyholders use endorsements to plug the holes in their standard coverage. These policy additions cost extra but can prevent the heartbreak of finding coverage gaps after a fire.

Inflation guard endorsements automatically increase your coverage limits annually to keep pace with rising construction costs. Extended replacement cost coverage provides a safety buffer above your policy limits, typically 125% to 150% of the dwelling limit.

Wildfire endorsements have become increasingly important in Texas, where dry conditions and rapid development create heightened fire risks. In Texas markets like Austin, Dallas, Houston, and San Antonio, where construction costs are rising rapidly and wildfire risks are increasing, these endorsements provide crucial protection against coverage gaps.

Stop Denials Before They Start—Pre-Fire Preparation & Maintenance

Prevention is always better than fighting a denied fire insurance claim after the fact. Proper preparation and maintenance can prevent fires and strengthen your position if a fire does occur.

Essential fire prevention measures:

– Install and maintain smoke detectors on every level

– Keep fire extinguishers in key locations (kitchen, garage, workshop)

– Schedule annual electrical system inspections

– Maintain heating and cooling systems properly

– Clear vegetation around structures in wildfire-prone areas

According to Scientific research on home fire prevention, working smoke alarms cut the risk of dying in a home fire by half. The U.S. Fire Administration emphasizes that three of every five home fire deaths result from fires in properties without working smoke alarms.

Maintenance documentation should include smoke detector battery replacement dates, fire extinguisher inspection records, electrical system upgrade documentation, HVAC maintenance logs, and chimney cleaning certificates.

Mitigation duty requires policyholders to take reasonable steps to prevent further damage after a fire, including securing the property against weather and theft, removing undamaged belongings, and making temporary repairs.

Building a Paper Trail to Bullet-Proof Your Claim

Creating comprehensive documentation before a fire occurs makes it much harder for insurers to deny legitimate claims. This paper trail serves as your primary defense against wrongful denials.

Photo documentation strategy should include annual photos of every room from multiple angles, valuable items with close-up photos showing serial numbers, and exterior property photos stored in cloud-based systems accessible from anywhere.

Cloud backup systems ensure your documentation survives even if your property is completely destroyed. Services like Google Drive, Dropbox, or iCloud provide secure, accessible storage for critical documents.

Annual Policy Check-Up

Regular policy reviews help identify coverage gaps before they become problems. Market changes in Austin, Houston, Dallas, and other Texas cities can quickly make your coverage inadequate.

Annual review checklist should compare current property values to coverage limits, review recent home improvements and their impact on replacement costs, assess deductible levels, and evaluate additional coverage needs.

Texas real estate markets have experienced significant appreciation, particularly in Austin and Houston. Construction costs have also risen substantially, making regular coverage adjustments essential. Our What is a Public Insurance Adjuster & Why Hire One? resource explains how we help optimize coverage before losses occur.

Your Next Move After a Claim Denial

Getting that denied fire insurance claim letter in the mail feels like a punch to the gut. You’re already dealing with the trauma of losing your home or business to fire, and now your insurance company is telling you they won’t pay. Take a deep breath – this isn’t the end of the road.

I’ve helped hundreds of Texas homeowners overturn wrongful denials, and many claims that seem hopeless actually have strong grounds for appeal. The key is understanding your rights and taking the right steps quickly.

Start by carefully reviewing that denial letter. Study every word and understand exactly why they’re saying no. Is it a coverage issue? A documentation problem? Suspicion of fraud? The specific reason determines your best strategy for fighting back.

Request written explanations for anything that isn’t crystal clear. If they say your claim is denied due to “policy exclusions,” demand they specify exactly which exclusions and how they apply to your situation.

Gathering additional evidence often makes the difference between a successful appeal and a permanent denial. Maybe you’ve found receipts you thought were lost, or a neighbor has photos of your property before the fire.

Your policy includes an internal appeal process – use it. This is your first formal chance to present your case and challenge the denial. Many insurers will reconsider claims when presented with compelling evidence and proper legal arguments.

Document everything throughout this process. Keep copies of all letters, emails, and phone conversations. Note the date, time, and content of every interaction with your insurance company.

Sometimes insurance companies cross the line from legitimate claim handling into bad faith territory. Unreasonable delays, lowball offers without justification, or shifting explanations for denials can all indicate bad faith practices. Our Texas Bad Faith expertise helps identify when insurance companies violate their duty to handle claims fairly.

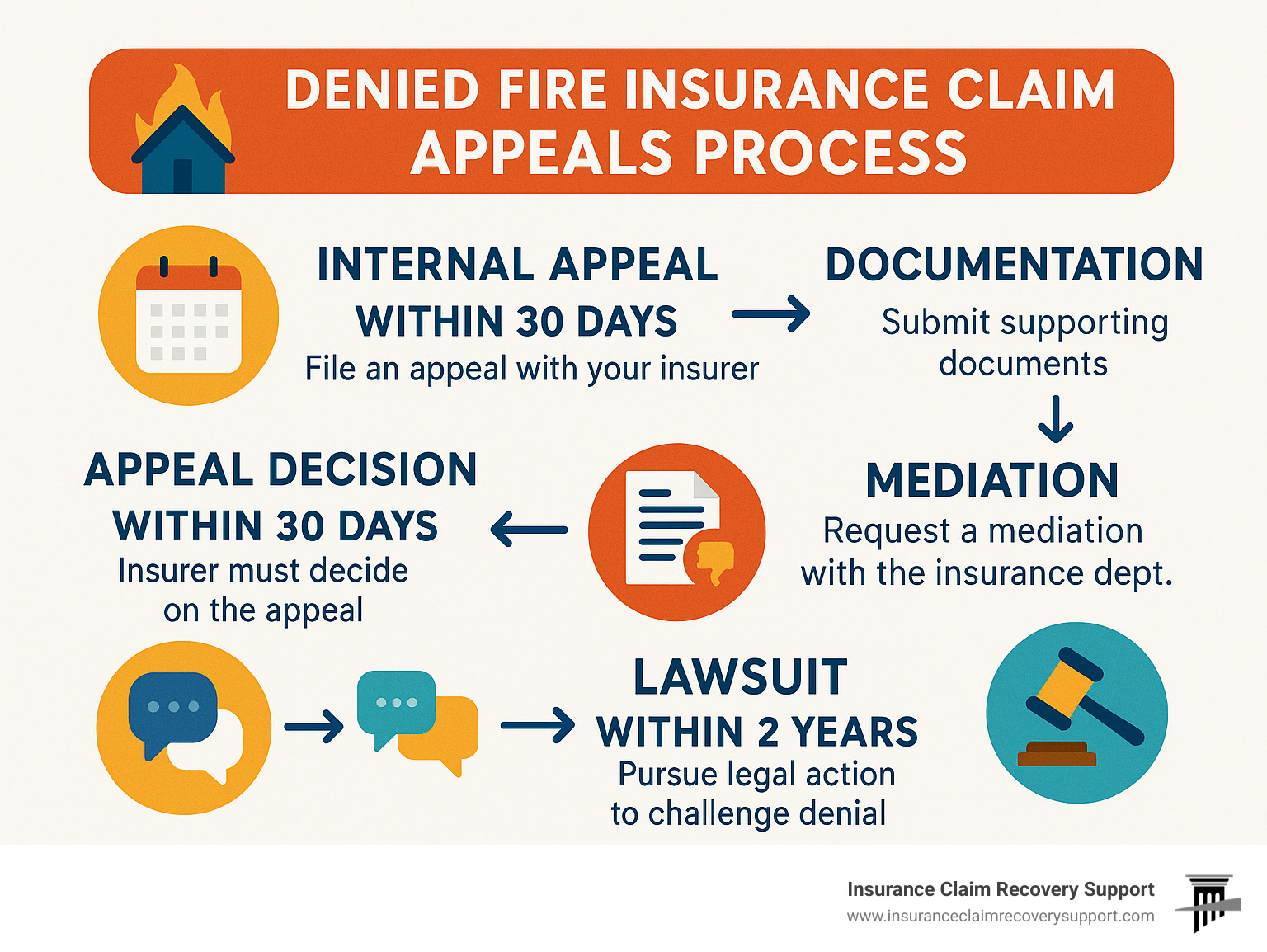

Timeline to Appeal a Denied Fire Insurance Claim

Time is not your friend when appealing a denied fire insurance claim. Miss a deadline, and you could lose your right to challenge the denial forever.

Your policy likely gives you between 60 and 180 days to file an internal appeal after receiving the denial notice. Some policies are even stricter, requiring appeals within just 30 days. Check your policy documents immediately.

Texas Department of Insurance complaints generally must be filed within two years of the denial, but don’t wait that long. The sooner you act, the better your chances of success. Evidence deteriorates, memories fade, and witnesses become harder to locate as time passes.

Evidence preservation needs to happen immediately. Fire scenes change rapidly due to weather, cleanup efforts, and simple deterioration. Physical evidence that could prove your case may be lost forever if not properly documented right away.

Signs Your Insurer May Be Acting in Bad Faith

Not all claim denials are created equal. Sometimes insurance companies cross the line from legitimate claim handling into bad faith territory.

Unreasonable delays are a classic bad faith red flag. Complex fire claims take time to investigate properly. But when your insurer takes months to respond to simple requests or keeps “losing” documents you’ve already provided multiple times, they may be stalling hoping you’ll give up.

Lowball settlement offers without proper justification are another warning sign. If your insurer offers to settle your total loss house fire for 30% of your coverage limit but won’t explain how they calculated that number, something’s wrong.

Shifting explanations for denials often indicate bad faith. First they say your claim is denied because of late reporting. When you prove you reported on time, suddenly it’s denied for inadequate documentation. This shell game approach suggests they’re looking for any excuse to avoid payment.

The good news is that bad faith violations can entitle you to damages beyond your original claim amount. In Texas, successful bad faith claims can result in additional compensation for your troubles, plus attorney fees in some cases.

Frequently Asked Questions about Denied Fire Insurance Claim

When your denied fire insurance claim leaves you confused and frustrated, you’re not alone. These are the questions I hear most often from Texas homeowners dealing with claim denials across Austin, Dallas, Houston, San Antonio, and beyond.

Why was my fire insurance claim denied even though the fire was accidental?

This might be the most heartbreaking question I encounter. Unfortunately, proving the fire wasn’t intentional is just one piece of a much larger puzzle.

The harsh reality is that accidental fires get denied every day for reasons that have nothing to do with how the fire started. Your insurer might deny your claim because your coverage limits fell short of today’s construction costs, especially with the dramatic price increases we’ve seen across Texas markets. Maybe you missed a reporting deadline while dealing with the trauma of losing your home, or perhaps critical documentation burned up in the very fire you’re claiming for.

Policy exclusions can be particularly sneaky. I’ve seen cases where an accidental campfire spread and became classified as a “wildfire,” triggering exclusions that the homeowner never knew existed. Even when the fire’s origin is clearly accidental, these other factors can still result in a denied fire insurance claim.

Can I reopen a denied fire insurance claim after finding new evidence?

Yes, and I’ve helped many clients do exactly that. New evidence can breathe life back into a denied fire insurance claim, but timing and the quality of that evidence are absolutely critical.

The key word here is “new” – this evidence needs to be information that wasn’t available during your original claim investigation. Maybe an independent fire expert finds something your insurer’s investigator missed. Perhaps you find receipts or photos that were stored elsewhere and prove the value of items your insurer questioned.

I’ve successfully reopened claims using various types of new evidence: independent fire origin reports that contradicted insurer findings, additional documentation of property values that was initially overlooked, expert testimony that challenged the insurer’s damage assessment, and even findings of investigation errors that the insurance company made.

The crucial factor is acting fast once you find this new information. Insurance policies and Texas law impose strict deadlines, and waiting too long can slam the door shut permanently.

When should I hire a public adjuster or attorney after a denial?

Here’s my honest advice: the moment you receive that denial letter, you should seriously consider professional help. I know it’s another expense when you’re already dealing with fire damage, but the earlier you bring in experts, the better your chances become.

Insurance companies have teams of adjusters, investigators, and attorneys working to minimize what they pay you. Why would you go up against that machine alone?

A public adjuster makes sense when you’re dealing with complex technical issues around fire cause or damage assessment, you need help gathering and organizing evidence that supports your claim, the denial involves policy interpretation that requires expertise, or when the potential recovery justifies the professional cost.

An attorney becomes necessary when you suspect the insurance company is acting in bad faith, they’re violating clear policy terms or legal requirements, your claim involves substantial damages that warrant legal action, or you need remedies that go beyond just getting your original claim paid.

Many of our most successful cases involve both public adjusters and attorneys working together. We handle the technical aspects of rebuilding and presenting your claim, while attorneys address any legal violations or bad faith practices.

Conclusion

Getting hit with a denied fire insurance claim can feel like your world is crashing down around you – but it’s not the end of your story. Throughout this guide, we’ve walked through the most common reasons insurers deny fire claims and what you can do about it.

The truth is, insurance companies deny legitimate claims every single day across Texas and nationwide. They’re counting on you to feel overwhelmed and simply accept their decision. But here’s what they don’t want you to know: most denials can be successfully challenged when you know what you’re doing.

Your roadmap to recovery starts with understanding these key points:

Document everything religiously – both before a fire happens and immediately after. Those photos stored in the cloud and maintenance records in your files become your strongest weapons against wrongful denials.

Know your policy inside and out – especially those sneaky exclusions and limitations that insurers love to spring on unsuspecting policyholders.

Time is always working against you – from the moment flames are extinguished, deadlines start ticking. Missing even one can hand insurers an easy excuse to deny your claim permanently.

Prevention beats cure every time – working smoke alarms, proper maintenance, and adequate coverage limits stop denials before they start.

Professional help levels the playing field – insurance companies have teams of adjusters, investigators, and lawyers working to minimize your payout. You deserve someone fighting just as hard for your interests.

At Insurance Claim Recovery Support, we’ve seen it all. Homeowners in Austin watching their dreams go up in smoke, Dallas business owners facing bankruptcy after wrongful denials, Houston families living in hotels while insurers drag their feet. We’ve turned around hundreds of these situations, often recovering settlements that are 30% to 3,800% higher than initial offers.

The most important thing to remember is this: you don’t have to accept a denial as the final word. Every denial letter we review tells a story, and many of those stories have happy endings when the right expertise gets involved.

We work exclusively for policyholders – never insurance companies. When we take your case, we’re betting our own time and resources that we can get you a better outcome. You pay nothing unless we recover money for your claim.

Don’t let a denied fire insurance claim become a permanent disaster. The insurance company had their chance to do right by you. Now it’s time to fight back with professionals who know how to win these battles.

Ready to turn your denial into a recovery? Contact Insurance Claim Recovery Support today for your free consultation. Let’s review that denial letter together and explore your options. Visit our Public Adjusting Services page to learn more about how we can help you get the settlement you deserve.

Remember: they’re counting on you to give up. We’re here to make sure you don’t.