Understanding Your Rights When Insurance Companies Fight Back

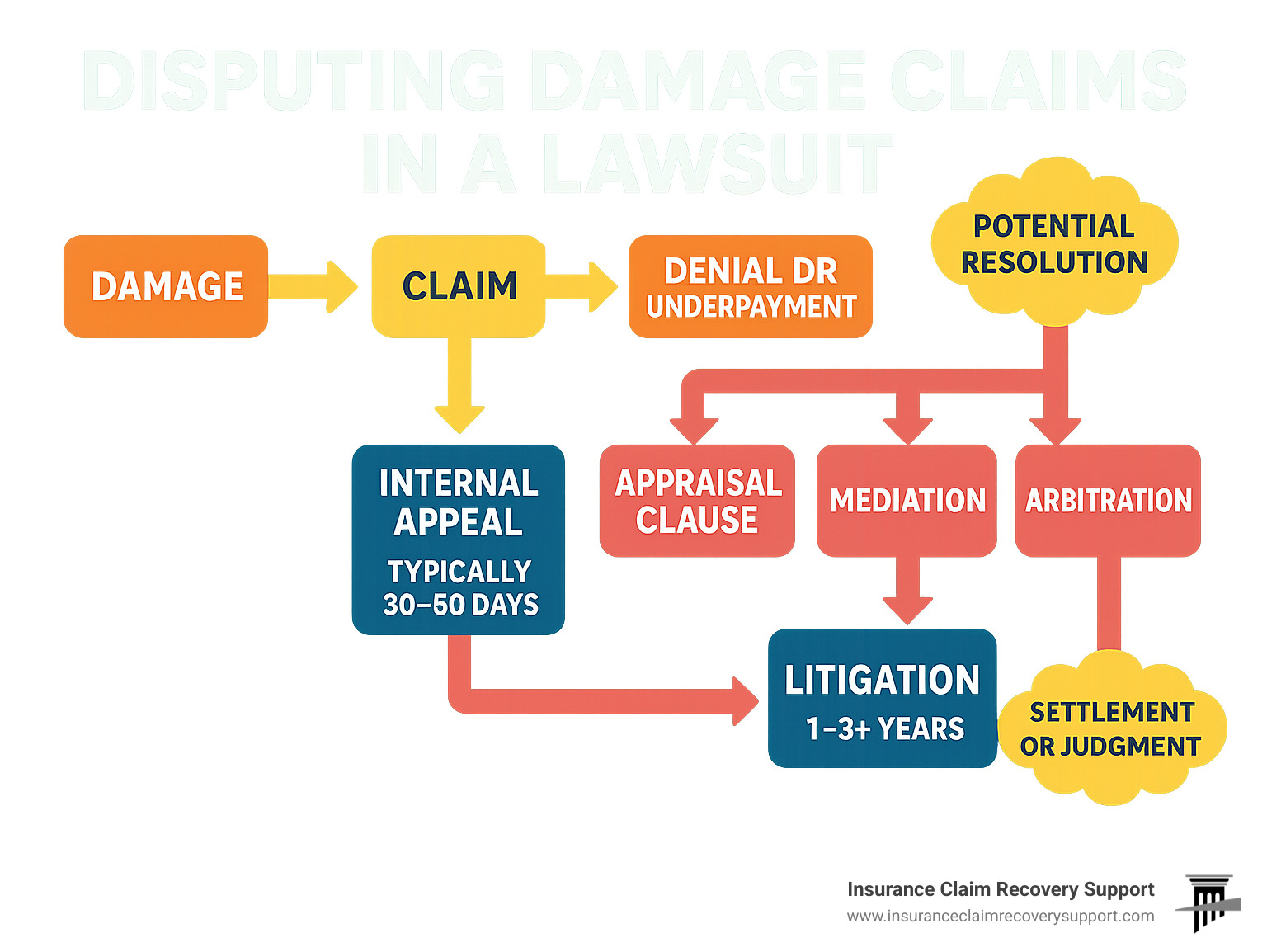

Disputing damage claims in a lawsuit becomes necessary when insurance companies deny, delay, or underpay legitimate property damage claims. Here’s what you need to know:

Key Steps for Disputing Damage Claims:

– File a formal complaint in state or federal court

– Gather expert evidence including contractor estimates and engineer reports

– Steer findy through depositions and document requests

– Present your case at trial or reach a settlement

– Consider appeals if the verdict is unfavorable

Common Dispute Triggers:

– Claim denials based on policy exclusions

– Underpayment of repair costs

– Coverage disputes over cause of damage

– Bad faith practices by insurers

– Excessive documentation demands

When your commercial property, multifamily complex, or facility suffers damage from storms, fires, or other covered perils, you expect your insurance company to honor the policy you’ve paid for. Unfortunately, customer satisfaction with homeowners insurance property claims declined to a 7-year low in 2024, with insurers covering less while demanding more from policyholders.

As one attorney noted after suing State Farm over residential roof claims more than 50 times since 2020: “There is this macro trend in insurance. They’re covering less.” This trend means more property owners find themselves forced into legal battles to recover what their policies should cover.

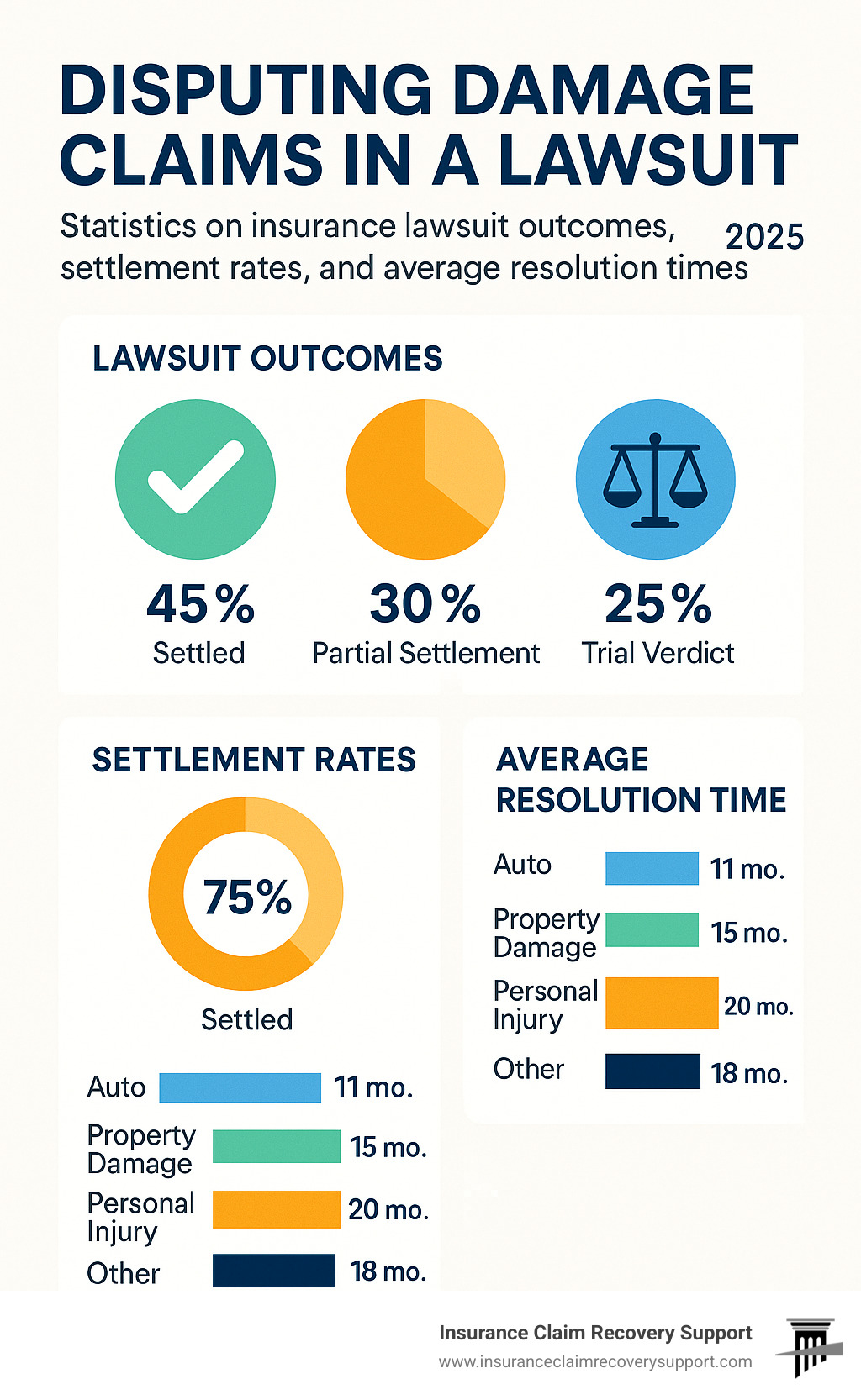

Most lawsuits over insurance claim disputes are settled before they go to trial, but knowing how to steer the legal process – or better yet, how to avoid it entirely – can save you time, money, and frustration.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled over $250 million in commercial and multifamily property damage claims. Through my experience disputing damage claims in a lawsuit and overturning wrongfully denied claims, I’ve learned that preparation and knowledge are your best weapons against unfair insurance practices.

What Triggers a Damage Claim Dispute?

Nobody wants to fight their insurance company in court, but sometimes disputing damage claims in a lawsuit becomes the only way to get what you’re rightfully owed. After handling thousands of property damage claims across Texas and beyond, I’ve seen the same patterns emerge time and again.

Outright claim denial tops our list of dispute triggers. Your roof gets damaged by a Texas storm, you file your claim, and then – surprise! – the insurance company says the damage isn’t covered. They might blame “pre-existing conditions” or claim it’s just “normal wear and tear,” even when you know that’s not true.

Underpayment battles create another major headache. Picture this: your contractor estimates $31,000 to repair storm damage, but your insurer offers $700. That’s not a typo – we’ve seen gaps this dramatic in real cases. When the numbers are this far apart, somebody’s math is seriously wrong.

Coverage disputes get messy fast, especially with partial denials. Your insurer might agree to cover your roof damage but then deny the interior water damage that happened during the same storm. It’s like they’re pretending water can’t flow downhill.

Bad faith practices cross the line from mere disputes into potential lawsuit territory. This includes intentionally delaying your claim, failing to investigate properly, or making unreasonable demands for documentation. In Texas, insurers have 30 days to pay after approving replacement costs – anything beyond that can trigger penalties.

Processing delays that drag on for months violate the insurer’s duty to handle claims promptly. We’ve watched legitimate claims sit in limbo while insurers conduct “investigations” that seem designed more to frustrate than to gather facts.

If you’re experiencing these tactics, check out our guide on 8 Sneaky Tricks Insurance Companies Use to Underpay and Delay Your Claim to see what else might be coming your way.

Red-Flag Scenarios That Lead to Court

Granular loss disputes have become a major battleground, especially here in Texas where storm damage is a fact of life. Some insurers refuse to recognize granular loss on shingles as covered damage, even when their own policy language doesn’t make these artificial distinctions.

Biased engineer reports create another path to the courthouse. When insurers order engineering inspections, those reports often lean heavily toward the insurance company’s position. The engineers know who’s paying their bills, and repeat business depends on keeping insurers happy.

Partial denial battles happen when insurers accept the obvious damage but deny everything else that flows from the same event. They’ll cover your roof damage but deny the interior water damage, mold remediation, or temporary living expenses that resulted from the same storm.

Commercial liability disputes, including slip-and-fall claims, often involve complex questions about premises liability. With over 1 million slip-and-fall accidents sending people to emergency rooms each year, these claims frequently escalate when insurers dispute either their responsibility or the extent of claimed damages.

Disputing Damage Claims in a Lawsuit – Step-By-Step Playbook

When alternative dispute resolution fails and you must pursue litigation, understanding the legal process helps you make informed decisions and work effectively with your legal team. Disputing damage claims in a lawsuit follows a predictable pattern, though each case has unique elements.

Filing the Complaint initiates your lawsuit. Your attorney will draft a formal complaint outlining your claims against the insurer, whether for breach of contract, bad faith, or both. The complaint must be filed within your state’s statute of limitations – typically 2-4 years from the date of loss or denial.

Findy Phase represents the most time-consuming part of litigation. Both sides exchange documents, take depositions, and gather evidence. This phase includes document production, depositions of key witnesses, expert reports, and written questions that must be answered under oath.

Expert Witness Preparation often determines case outcomes. Your team may need multiple experts: structural engineers to assess damage, contractors to estimate repair costs, and insurance experts to interpret policy language and industry standards.

Settlement Negotiations typically intensify as trial approaches. Most insurance disputes settle before trial, often during court-ordered mediation or through direct negotiations between attorneys.

Trial Preparation and Presentation requires extensive preparation if settlement isn’t reached. Trials can last days or weeks, depending on case complexity.

For guidance on choosing the right professional help, review our comparison of Public Adjuster or Plaintiff Insurance Attorney?.

Key Evidence When Disputing Damage Claims in a Lawsuit

Success in disputing damage claims in a lawsuit depends heavily on the quality and comprehensiveness of your evidence.

Photographic and Video Documentation provides the foundation for most successful disputes. Take comprehensive photos of all damage from multiple angles, including wide shots showing context and close-ups revealing details.

Professional Contractor Estimates carry significant weight when disputing underpayment claims. Obtain detailed estimates from licensed, reputable contractors who itemize materials, labor, and compliance costs.

Weather Data and Documentation proves crucial for storm-related claims. Official weather service reports, radar data, and local weather station readings can establish the timing, intensity, and path of damaging weather events.

Independent Engineering Reports can counter biased insurer-hired engineers. While expensive, independent structural assessments provide credible expert opinions about damage causation and repair requirements.

Policy Language Analysis requires careful examination of your insurance policy’s specific terms, conditions, and exclusions. Insurance policies are contracts of adhesion, meaning ambiguous language should be interpreted in favor of the policyholder.

Communications Records document the entire claim handling process. Save all emails, letters, phone logs, and text messages with your insurer. These records often reveal bad faith practices, unreasonable delays, or inconsistent positions.

According to scientific research on insurance claim satisfaction, proper documentation and professional representation significantly improve claim outcomes and customer satisfaction.

Legal Standards When Disputing Damage Claims in a Lawsuit

Burden of Proof in insurance disputes typically follows the “preponderance of evidence” standard – meaning you must prove your case is more likely true than not.

Bad Faith Statutes vary by state but generally require insurers to handle claims fairly and in good faith. Texas Insurance Code Chapter 541 defines unfair claim settlement practices and provides remedies for violations.

Prompt Payment Rules establish timeframes for claim processing and payment. In Texas, insurers must acknowledge claims within 15 days and begin investigation promptly.

Statute of Limitations creates deadlines for filing lawsuits. Most states allow 2-4 years from the date of loss or denial to file suit. However, some policies contain shorter suit limitation clauses.

Alternative Resolution Paths Before Court

Nobody wants to spend years in court fighting their insurance company. The good news? Disputing damage claims in a lawsuit isn’t your only option. Smart property owners explore several alternative paths that can resolve disputes faster, cheaper, and with less stress than full-blown litigation.

Direct negotiation with your insurer should always be your starting point after a denial or lowball offer. Don’t just accept their first “no” – ask for a detailed written explanation and respond with your own evidence: photos, contractor estimates, weather reports, whatever supports your position.

Internal appeals through your insurance company’s complaint process cost you nothing but time. Most insurers have formal procedures that route disputes to senior adjusters or special review departments.

State insurance department complaints add external pressure that insurers take seriously. Filing a complaint with the Texas Department of Insurance (or your state’s regulator) creates an official record and may prompt your insurer to reconsider.

Appraisal clauses in most property policies provide a streamlined way to resolve disputes about repair costs or damage scope. When you and your insurer can’t agree on numbers, either party can trigger this process to get an independent determination.

Mediation has become the gold standard for resolving insurance disputes. A neutral mediator helps both sides find common ground in a confidential setting. The beauty of mediation is that both parties maintain control.

Arbitration offers a more formal alternative where an arbitrator makes a binding decision. Some policies require arbitration instead of allowing lawsuits.

For detailed information about these processes, check out our guide on Insurance Claim Damage Appraisal, Breach of Contract and Bad Faith: Is There a Connection?.

| Resolution Method | Cost | Timeline | Binding | Success Rate | Best For |

|---|---|---|---|---|---|

| Negotiation | Low | 1-3 months | No | Moderate | Simple disputes |

| Internal Appeal | Low | 1-2 months | No | Low | Policy violations |

| Appraisal | Medium | 2-4 months | Yes* | High | Valuation disputes |

| Mediation | Medium | 3-6 months | No | High | Complex disputes |

| Arbitration | High | 6-12 months | Yes | Moderate | Contractual requirement |

| Litigation | Very High | 1-3 years | Yes | Variable | Bad faith/coverage |

*Appraisal is binding on valuation but not coverage issues

Invoking the Policy’s Appraisal Clause

Most property insurance policies include appraisal clauses that work like a specialized court system for damage disputes. Appraisal only resolves disputes about the dollar amount of covered damage. It cannot determine what damage is covered under your policy in the first place.

Triggering the appraisal process requires written notice to your insurer stating your intent to invoke appraisal. Most policies give you 20 days from this notice to hire your appraiser and submit your choice for umpire.

Choosing your appraiser significantly impacts your outcome. Look for someone with relevant experience in your type of property and damage. Public adjusters often serve as appraisers because we understand both the technical aspects of damage assessment and how insurance claims actually work.

Umpire selection requires agreement between both appraisers. The umpire serves as the tiebreaker when appraisers disagree about values.

Mediation & Arbitration Tips

Mediation preparation should focus on understanding your bottom line and anticipating your insurer’s concerns. Prepare a concise presentation of your case with key evidence readily available.

The confidentiality protections in mediation create a safe space for honest discussion. Statements made during mediation cannot be used against you in later litigation.

Settlement documentation requires careful attention to detail. Ensure any agreement specifies exactly what damage is covered, payment terms, deadlines, and any ongoing obligations.

Arbitration considerations deserve extra caution because arbitration awards are typically final and binding. Unlike mediation where you can walk away if things go poorly, arbitration commits you to accepting the arbitrator’s decision.

Weighing Risks, Costs & Potential Outcomes

Disputing damage claims in a lawsuit involves significant financial and time commitments that must be carefully evaluated against potential recovery. Understanding these factors helps you make informed decisions about whether to pursue litigation or accept settlement offers.

Attorney Fees represent the largest litigation expense for most policyholders. Contingency fee arrangements typically range from 25-40% of any recovery, while hourly rates for experienced insurance attorneys can exceed $500 per hour.

Expert Witness Costs can quickly escalate into tens of thousands of dollars. Structural engineers charge $200-400 per hour for analysis and testimony. Budget $10,000-50,000 for expert costs in complex cases.

Time to Verdict averages 18-36 months from filing to trial, though complex cases can take longer. Mediation might resolve disputes in 3-6 months, while arbitration typically takes 6-12 months.

Settlement Statistics show that most insurance disputes settle before trial. Industry data suggests 80-90% of cases resolve through settlement, often during court-ordered mediation or in the weeks before trial.

Small Claims Court Limitations cap recovery amounts but offer faster, less expensive resolution for smaller disputes. Texas small claims courts handle cases up to $20,000, while other states have lower limits.

Punitive Damages availability varies by state and claim type. Texas allows exemplary damages for insurance bad faith, potentially multiplying your recovery. However, punitive damages require clear and convincing evidence of malicious or fraudulent conduct.

Budgeting for Battle

Contingency Fee Arrangements align attorney interests with yours by tying compensation to successful outcomes. Typical contingency fees range from 25% for simple cases to 40% for complex litigation.

Hourly Fee Structures provide more predictable costs but require upfront payment. Experienced insurance attorneys typically charge $300-600 per hour.

Court Cost Estimates should include filing fees, service costs, deposition expenses, expert witness fees, and trial costs. Budget $5,000-15,000 for basic court costs in straightforward cases.

Possible Endings

Full Settlement Recovery represents the best possible outcome, where you recover all claimed damages plus attorney fees and costs. This outcome is more likely when you have strong evidence of bad faith or clear policy violations.

Partial Settlement occurs when you recover some but not all claimed damages. Evaluate partial settlements carefully, considering litigation costs and the uncertainty of trial outcomes.

Defense Verdicts mean you recover nothing and may be responsible for your own attorney fees and costs. While disappointing, defense verdicts are relatively rare in cases with strong evidence and experienced counsel.

Appeal Processes can extend litigation for years after initial verdicts. Both sides can appeal adverse rulings, potentially reaching state supreme courts in significant cases.

Proactive Strategies to Avoid Future Disputes & FAQ

Prevention remains the best strategy for avoiding costly claim disputes. Implementing proper documentation and maintenance practices significantly reduces the likelihood of disputes while strengthening your position if conflicts arise.

Documentation Habits should become routine for all property owners. Maintain detailed records of property conditions, improvements, and maintenance activities. Annual property inspections with photographs create baseline documentation that proves pre-loss conditions.

Annual Policy Reviews help identify coverage gaps and ensure adequate limits. Review your policy annually with your agent or broker, particularly after property improvements or changes in occupancy.

Maintenance Logs demonstrate proper property care and can counter insurer arguments about pre-existing conditions or deferred maintenance. Document all repairs, inspections, and preventive maintenance activities.

Professional Relationships with qualified contractors, public adjusters, and attorneys provide resources when disasters strike. Establish these relationships before you need them, as the best professionals are often busy during major catastrophes.

For comprehensive definitions of insurance terms, consult our Glossary of Property Insurance Claim Terms.

FAQ #1 – How long do I have to sue over a denied property claim?

Statute of Limitations periods vary by state and policy type, but most property insurance disputes must be filed within 2-4 years of the loss or denial. However, many insurance policies contain “suit limitation” clauses that shorten this period to two years from the date of loss.

Written Denial Requirements often trigger the limitations period. Some courts hold that the limitations period doesn’t begin until you receive a clear, written denial of your claim.

Policy Language may contain specific notice and suit requirements that must be followed precisely. Failure to comply with policy requirements can bar your claim regardless of the general statute of limitations.

FAQ #2 – Should I hire a public adjuster or go straight to an attorney?

Claim Complexity often determines the best approach. Simple underpayment disputes may be resolved effectively by public adjusters, while complex coverage disputes or clear bad faith situations may require immediate legal representation.

Cost Comparison favors public adjusters for many property damage claims. Public adjusters typically charge 10-15% of the settlement, while attorneys may charge 25-40% contingency fees plus costs.

Expertise Differences matter significantly. Public adjusters specialize in property damage assessment and claim negotiation, while attorneys focus on legal strategy and courtroom advocacy.

FAQ #3 – What if the insurer demands more paperwork after I sue?

Findy Rules govern document requests and other information gathering during litigation. Once you file suit, formal findy procedures replace informal claim investigation processes.

Protective Orders can limit excessive or irrelevant findy requests. If your insurer demands unreasonable documentation, your attorney can seek court protection from abusive findy practices.

Relevance Standards limit findy to information reasonably related to the claims and defenses in your case. Fishing expeditions for irrelevant information are not permitted.

Conclusion

When your insurance company refuses to honor their policy obligations, disputing damage claims in a lawsuit becomes more than just a legal option – it’s your path to fair treatment and the coverage you’ve paid for. Whether you’re dealing with storm damage in Round Rock, fire loss in Georgetown, or freeze damage in Lakeway, the journey from initial claim to potential litigation follows predictable patterns.

The reality across Texas – from Houston’s hurricane-prone coast to Dallas-Fort Worth’s tornado alley, from Austin’s freeze-susceptible areas to San Antonio’s diverse weather challenges – is that property owners increasingly face insurance companies that deny more, pay less, and demand more documentation than ever before.

Most disputes don’t require litigation. Through proper preparation, thorough documentation, and experienced professional representation, the majority of claim disputes can be resolved through negotiation, appraisal, or mediation. These alternatives save time, money, and stress while often achieving better outcomes than courtroom battles.

However, when insurers act in bad faith, make unreasonable denials, or refuse fair settlements, the legal system provides powerful remedies. Bad faith penalties, attorney fees, and exemplary damages can turn the tables on insurers who think they can simply outlast or outspend property owners.

The key to success lies in preparation and professional help. Whether you start with a public adjuster to maximize your claim value or need an attorney to fight bad faith practices, having experienced advocates makes the difference between successful and unsuccessful outcomes.

Don’t accept unfair treatment. Your insurance policy represents a contract that should provide security when disaster strikes. When insurers fail to honor their obligations, you have options ranging from internal appeals through full litigation.

Time limits matter. Whether it’s invoking your appraisal rights, filing regulatory complaints, or pursuing litigation, most dispute resolution methods have strict deadlines. Acting promptly protects your rights and preserves all available options.

As a public adjuster firm based in Texas with nationwide reach, Insurance Claim Recovery Support LLC has helped thousands of property owners steer these complex disputes across Austin, Dallas-Fort Worth, San Antonio, Houston, and beyond. Our experience has taught us that every claim dispute is winnable with the right approach, evidence, and advocacy.

If you’re facing a property damage claim dispute, you don’t have to accept your insurer’s first answer. Professional help can often resolve disputes efficiently while protecting your legal rights for future action if necessary.

For immediate assistance with your property damage claim, visit our Claim Help page to connect with our experienced team of public adjusters who exclusively represent policyholders in their fight for fair treatment and maximum settlements.