Why Finding the Right Fire Claim Adjuster Is Critical for Your Recovery

Why You Need an Advocate: Understanding the Types of Adjusters

When fire strikes your home, you’re suddenly thrust into an insurance world with different players who have very different motivations. Understanding who’s really working for you can mean the difference between a fair settlement and getting shortchanged when you need help most.

Company adjusters are the insurance company’s employees. They show up at your door with clipboards and sympathetic expressions, but here’s the reality: their paychecks come from the same company you’re filing a claim against. Their job is to investigate your claim and determine how little they can pay while still meeting their legal obligations.

Independent adjusters might seem like a middle ground, but they’re actually contractors hired by your insurance company. Think of them as temporary employees brought in during busy periods – like after major disasters hit Texas cities. While they’re not on the insurance company’s payroll permanently, they depend on maintaining good relationships with insurers to keep getting work. That means they’re still motivated to keep your settlement low.

Public Insurance Adjusters operate completely differently. We work exclusively for you, the policyholder. Our success depends entirely on maximizing your settlement, not minimizing it. This creates a fundamental conflict of interest between company adjusters and public adjusters – they want to pay you less, while we fight to get you everything you deserve.

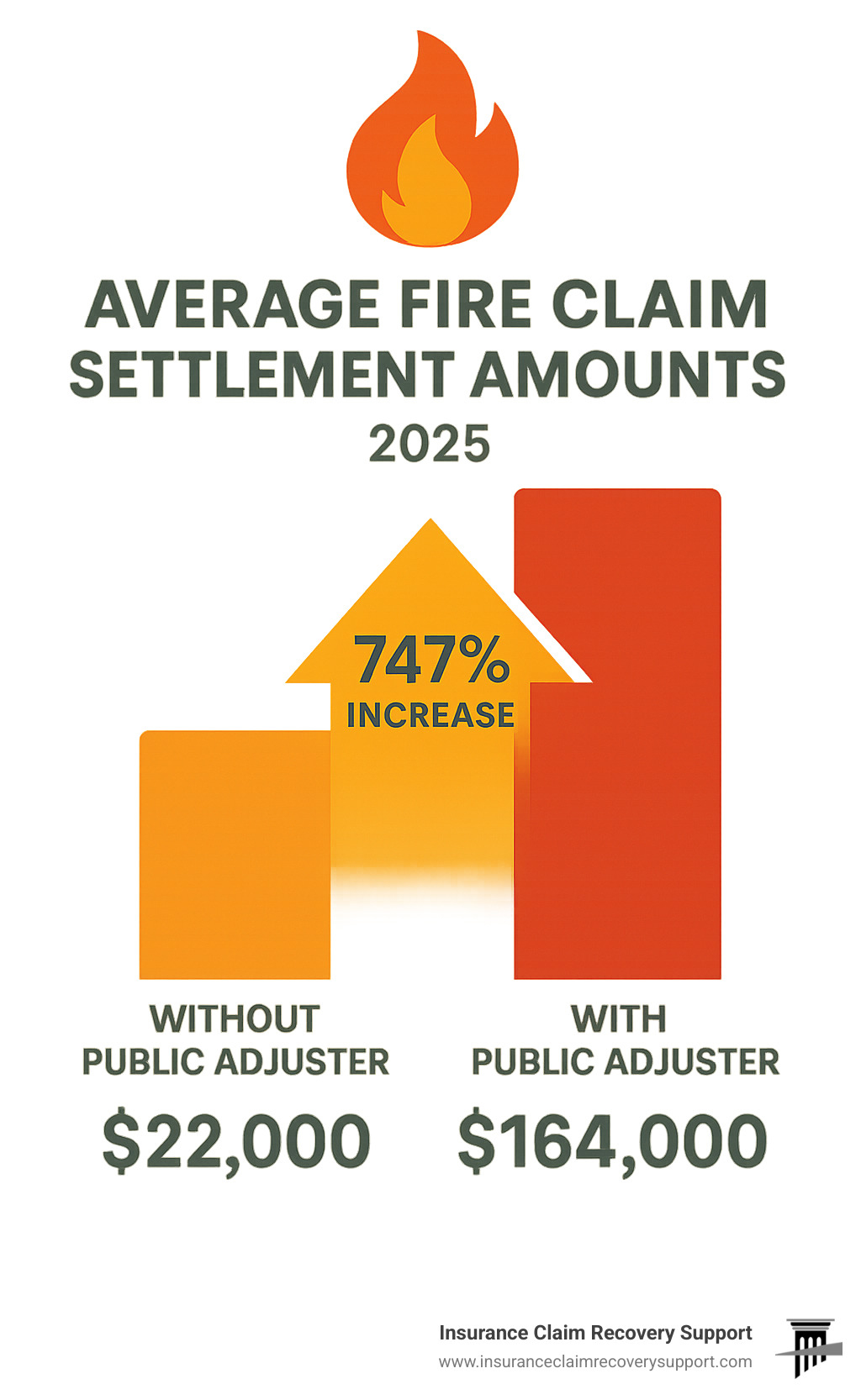

The difference in outcomes is dramatic. Fire claim adjuster representation by a public adjuster leads to settlements that are 747% higher on average. This isn’t magic – it’s simply the result of having someone who truly understands fire damage and knows how to properly present your claim.

| Aspect | Company Adjuster | Public Adjuster |

|---|---|---|

| Works For | Insurance Company | You (Policyholder) |

| Primary Goal | Minimize Payout | Maximize Your Settlement |

| Who Pays Them | Insurance Company | You (from settlement) |

The Role of the Insurance Company’s Adjuster

Company adjusters face an impossible situation when handling your fire claim. Their employer expects them to keep costs down, but they’re supposed to treat you fairly. Guess which priority usually wins?

These adjusters are often salaried employees whose performance reviews and career advancement depend on keeping claim costs low. They rely heavily on standardized software to generate repair estimates, which frequently don’t reflect the actual costs of rebuilding in Texas markets like Austin, Houston, Dallas, or San Antonio.

During their inspections, company adjusters typically focus on obvious damage while potentially missing critical issues. They might overlook smoke contamination in your HVAC system, structural integrity problems, or code upgrade requirements that could add thousands to your rebuild costs. Their training emphasizes finding reasons to limit coverage rather than identifying all the ways your policy can help you recover.

In Texas, where we’ve seen everything from devastating wildfires to kitchen fires, company adjusters may not fully grasp regional building costs or local contractor availability. Their estimates often fall short of what you’ll actually need for proper restoration, leaving you to cover the difference from your own pocket.

For a deeper understanding of how the claims process works, check out our guide on What You Need to Know About Insurance Claims.

The Power of a Public Fire Claim Adjuster

A public fire claim adjuster changes everything. We’re your exclusive advocate throughout the entire claims process, bringing specialized expertise that puts you on equal footing with the insurance company.

Policy interpretation is where we shine. Fire insurance policies are filled with complex language, exclusions, and coverage triggers that can confuse even experienced homeowners. We analyze your specific policy to uncover all available coverages – not just the obvious ones like dwelling protection and contents coverage, but also additional living expenses, debris removal, and often-overlooked benefits like code upgrade coverage.

Comprehensive damage assessment sets us apart from company adjusters. Fire damage goes far beyond what you can see. We identify structural damage, smoke and soot contamination throughout your home, water damage from firefighting efforts, and potential mold issues that could develop later. Our thorough documentation ensures nothing gets missed that could affect your recovery.

Negotiation expertise is perhaps our most valuable skill. We understand insurance company tactics because we deal with them every day. We know how to counter their strategies and present your claim in a way that maximizes your settlement. While company adjusters try to minimize your payout, we fight to secure every dollar you’re entitled to under your policy terms.

Stress reduction might be the benefit you appreciate most. Dealing with a fire claim while managing displacement, family needs, and emotional trauma is overwhelming. We handle all communications with your insurer, manage the paperwork, and guide you through each step of the process. This lets you focus on what matters most – taking care of your family and planning your recovery.

Learn more about our comprehensive approach through our Public Adjusters page.

How a Public Adjuster\u0019s Fee Makes Them Budget-Friendly

Fire losses create immediate cash-flow pressure, so it\u0019s natural to worry about “one more bill.” The good news is that a public fire claim adjuster doesn\u0019t add to your out-of-pocket costs. We work on a contingency basis:

- 0 $ up-front. You keep your funds for housing, food, and replacing essentials.

- 10–15 % of the final settlement. We\u0019re paid only after the insurer issues your check, and only from that check.

- Aligned incentives. The larger your recovery, the more we earn – which is why settlements with public adjusters average 747 % higher than those negotiated by policyholders alone.

Think of it as hiring a real-estate agent: you\u0019d rather pay a small commission on a $300,000 sale than keep every dollar of a $100,000 sale. The exact same math applies to your claim.

Real-World Results (Texas Cases)

| Initial Offer | Final Settlement | Net Gain After 15 % Fee |

|---|---|---|

| $620,000 | $1,200,000 | +$400,000 |

| $247,000 | $637,500 | +$294,875 |

| $576,000 | $842,000 | +$139,700 |

Across Austin, Dallas-Fort Worth, Houston, San Antonio, and Lubbock, these numbers repeat again and again because a qualified advocate documents hidden smoke, water, and code-upgrade costs the carrier overlooked.

For full details on fee structures, visit How Do Public Adjusters Get Paid.

Step-by-Step: How to Choose the Right Public Adjuster

Hiring a fire claim adjuster is like choosing a surgeon: credentials and results matter more than slick marketing. Follow these three fast checks – they take minutes and can save you hundreds of thousands of dollars.

1. Confirm License & Fire Experience

- Verify the adjuster\u0019s license on the Texas Department of Insurance website.

- Ask how many fire claims – not just “property” claims – they handled last year.

- Make sure they\u0019ve settled losses similar in size to yours in Austin, Dallas, Houston, or San Antonio.

According to the National Fire Protection Association, structure fires cause billions in direct damage annually – so you want someone who lives in this niche every day, not a generalist.

2. Check Reputation & Local Knowledge

- Read recent Google reviews and ask for two Texas homeowner references you can call.

- Quiz them on local building-code upgrades in Round Rock, Georgetown, or Lakeway – answers should come easily.

- Confirm they\u0019ve worked multi-peril events common here (wildfire + wind, fire + freeze).

Explore examples on our Licensed Public Adjuster Near Me Houston TX page.

3. Review the Contract – Slowly

- Legitimate adjusters give you time to read; no door-knocking pressure.

- Fee percentage and services (policy review, damage scope, negotiation, appraisal) must be in writing.

- Clarify how often you\u0019ll get updates and what happens if the insurer denies the claim.

For additional tips, see Tips for Filing Claims and our guide on How to Negotiate a Settlement with an Insurance Claims Adjuster.

Follow these steps and you\u0019ll quickly separate seasoned advocates from opportunistic rookies.

The Fire Claim Process and How Your Adjuster Helps

Navigating a fire insurance claim involves multiple complex steps, each presenting opportunities for underpayment if not handled properly. A skilled fire claim adjuster guides you through this process while avoiding common pitfalls that can devastate your recovery.

Common Claim Pitfalls Include:

- Accepting quick settlements that undervalue damages

- Missing hidden damage like smoke contamination

- Inadequate documentation of personal property losses

- Failure to identify all applicable policy coverages

- Poor negotiation resulting in underpayment

- Delays that extend displacement and increase costs

The fire claim process typically spans several months and requires expertise in damage assessment, policy interpretation, and negotiation tactics. Without professional representation, policyholders often accept settlements far below their policy entitlements.

For comprehensive information about fire claims, visit our Fire Insurance Claim resource page.

Initial Assessment and Policy Review

Immediate Post-Fire Steps: After ensuring everyone’s safety, immediate priorities include securing the property to prevent further damage, contacting your insurance company to report the loss, and beginning documentation efforts.

Your public adjuster can guide these initial steps, ensuring you don’t inadvertently compromise your claim. We help coordinate emergency services while protecting your claim interests.

Comprehensive Policy Analysis: Fire insurance policies contain numerous coverage sections that company adjusters may not fully explain. We analyze your policy to identify all applicable coverages including:

- Dwelling coverage for structural damage

- Personal property coverage for contents

- Additional Living Expenses (ALE) for displacement costs

- Debris removal coverage

- Building code upgrade coverage

- Business interruption coverage for commercial properties

Damage Scope Identification: Fire damage extends far beyond obvious destruction. We identify all covered damages including structural issues, smoke and soot contamination, water damage from firefighting efforts, and potential mold growth.

Learn more about fire-specific damages on our Fire Property Damage page.

Comprehensive Damage Documentation

Structural Damage Assessment: Fire affects building materials in complex ways. Steel beams may weaken, electrical systems require replacement, and seemingly undamaged areas may have hidden structural issues. We coordinate with engineers and contractors to identify all structural damage.

Smoke and Soot Contamination: Smoke damage often exceeds fire damage in scope and cost. Soot contamination affects HVAC systems, electronics, fabrics, and building materials throughout the structure. Proper assessment requires specialized knowledge and testing.

Water Damage from Firefighting: Fire suppression efforts can cause extensive water damage requiring immediate attention to prevent mold growth. This secondary damage is covered under most policies but often overlooked by company adjusters.

Hidden Hazards: Fire can expose or create hazardous materials including Asbestos After a Fire and create conditions for Fire Mold growth. These issues require specialized remediation and affect claim values.

Personal Property Inventory: Creating a comprehensive inventory of damaged personal property is time-consuming but crucial. We help document everything from major appliances to clothing, ensuring proper valuation and replacement cost calculations.

Expert Coordination: Complex fire claims often require input from engineers, contractors, environmental specialists, and other experts. We coordinate these professionals to build a comprehensive claim package.

Negotiation and Final Settlement with Your Fire Claim Adjuster

Claim Package Preparation: We compile all documentation, expert reports, estimates, and policy analysis into a comprehensive claim package that demonstrates the full scope of your covered losses.

Proof of Loss Submission: The proof of loss is a formal document detailing your claimed damages. This critical document requires precision and completeness to avoid claim delays or denials.

Strategic Negotiation: Insurance companies often make initial offers well below policy entitlements. We understand their tactics and negotiate strategically to secure maximum settlements. Our experience with thousands of claims provides insight into effective negotiation approaches.

Communication Management: We handle all communications with your insurance company, ensuring nothing is said that could compromise your claim. This relieves stress while protecting your interests.

Appraisal Process: If negotiations reach an impasse, many policies include an appraisal clause that provides binding dispute resolution. We can guide you through this process when necessary.

For additional settlement strategies, review our guide on How to Settle Property Damage Insurance Claims.

Frequently Asked Questions about Fire Claims

When your home or business suffers fire damage, you’re suddenly thrust into an unfamiliar world of insurance terminology, coverage types, and claim processes. These are the questions we hear most often from families and business owners dealing with fire losses across Texas.

What types of damage are covered in a fire insurance claim?

Fire insurance policies are designed to restore your life and property after a devastating loss. Understanding what’s covered helps you maximize your recovery and avoid leaving money on the table.

Dwelling and structure coverage forms the foundation of your fire policy. This pays to repair or rebuild your home’s structure – everything from the foundation to the roof, including walls, flooring, built-in appliances, and attached structures like garages or decks. If your home is a total loss, this coverage rebuilds it according to your policy limits.

Personal property coverage protects your belongings inside the home. This includes furniture, clothing, electronics, jewelry, and thousands of other items that make your house a home. Depending on your policy, you’ll receive either replacement cost (what it costs to buy new) or actual cash value (replacement cost minus depreciation).

Additional Living Expenses (ALE) becomes crucial when fire damage makes your home uninhabitable. This coverage pays for temporary housing, restaurant meals, laundry services, and other expenses necessary to maintain your normal standard of living during repairs. Many families underestimate these costs, which can easily reach thousands of dollars per month.

Debris removal coverage handles the massive cleanup required after a fire. Removing charred materials, damaged belongings, and structural debris can cost tens of thousands of dollars – money that would otherwise come from your dwelling coverage limits.

Building code upgrades protect you when repairs must meet current building codes that differ from your home’s original construction. This coverage pays the difference between repairing to original specifications and upgrading to current code requirements.

For commercial properties, business interruption coverage replaces lost income and covers ongoing expenses when your business must close during repairs. This coverage can be the difference between surviving a fire loss and closing permanently.

You can explore all covered damage types on our Loss Types page.

How long does a fire claim take to settle?

The timeline for settling a fire claim varies dramatically based on several key factors. Simple fire damage affecting one room might settle within weeks, while complex total losses can take months or even years to resolve completely.

Claim complexity drives much of the timeline. A kitchen fire with limited damage settles faster than a total loss requiring extensive investigation. When fire damage involves structural issues, smoke contamination throughout the home, or questions about the fire’s cause, expect longer processing times.

Insurance company responsiveness varies significantly between insurers and even between different adjusters within the same company. Some insurers pride themselves on quick claim resolution, while others seem to drag their feet at every opportunity. During busy periods like wildfire season, company adjusters become overwhelmed, creating delays beyond anyone’s control.

Documentation quality dramatically affects processing speed. Professional, thorough documentation from a fire claim adjuster expedites the process because everything the insurance company needs is provided upfront. Poor documentation creates back-and-forth requests that extend timelines unnecessarily.

Negotiation requirements add time but typically result in significantly higher settlements. If your insurance company’s first offer is inadequate (which it usually is), negotiating for proper compensation extends the timeline but puts substantially more money in your pocket.

Having a public adjuster often accelerates the overall process. We provide complete, accurate documentation from the start and handle all communications efficiently. While individual steps might take the same amount of time, the overall process runs smoother with fewer delays and complications.

Learn specific strategies for faster claim resolution in our guide How to Expedite Property Damage Insurance Claim Settlement.

Should I just accept the insurance company’s first offer?

Never accept the first offer without thorough analysis. This might be the most expensive mistake you can make during your fire claim recovery.

Insurance companies routinely make initial offers well below what policyholders are entitled to receive. This isn’t necessarily malicious – it’s simply good business from their perspective. They’re hoping you’ll accept a quick settlement due to financial pressure, lack of knowledge about true claim values, or simple relief at receiving any money at all.

First offers typically undervalue claims because company adjusters conduct quick inspections focusing on obvious damage while missing hidden issues. They might not identify smoke contamination in your HVAC system, structural damage that isn’t immediately visible, or the full scope of personal property losses. Their estimates often use generic pricing that doesn’t reflect actual local contractor costs in Austin, Dallas, Houston, or San Antonio.

The pressure to settle quickly is real when you’re displaced from your home and facing immediate expenses. Insurance companies understand this pressure and may emphasize your urgent needs or suggest that delays will occur if you don’t accept their offer immediately. Don’t fall for this tactic.

You have legal rights under your policy terms, including the right to negotiate and seek proper compensation. Accepting an inadequate settlement often means signing a release that prevents you from seeking additional compensation later, even if you find the settlement was insufficient.

Professional evaluation reveals true claim values. Before accepting any offer, have a qualified public adjuster review the settlement against your policy coverage and actual damages. This analysis frequently reveals significant underpayment – sometimes hundreds of thousands of dollars in larger losses.

Insurance companies make their first offers expecting negotiation. They’re rarely offended when you counter-offer or seek professional representation. In fact, they often respect policyholders who advocate for themselves properly.

For guidance on making this important decision, visit our Should I Hire a Public Adjuster page.

Conclusion

When your home burns and your world turns upside down, a fire claim adjuster working for you isn’t just helpful – it’s absolutely essential. Think of it this way: you wouldn’t go to court without a lawyer, so why face an insurance company without your own advocate?

The beauty of hiring a public adjuster lies in the contingency fee structure. You don’t need to worry about upfront costs when you’re already dealing with hotel bills, replacing clothes, and figuring out where your family will live. We only get paid when you do – and that payment comes from a settlement that’s typically hundreds of thousands of dollars higher than what you’d receive alone.

Those 747% higher settlements aren’t just statistics – they represent real families getting the money they need to truly rebuild. When a settlement jumps from $620,000 to $1.2 million, that’s not just numbers on paper. That’s the difference between cutting corners on your rebuild and creating a home that’s better than before.

The right fire claim adjuster brings three things you simply can’t get elsewhere: deep expertise in fire damage assessment, fluency in insurance policy language, and battle-tested negotiation skills. While you’re dealing with the emotional trauma of losing precious belongings and family memories, we’re handling the complex claims process that can make or break your financial recovery.

Here at Insurance Claim Recovery Support, we’ve spent decades in the trenches with fire damage victims across Texas and beyond. Whether you’re dealing with a kitchen fire in Austin, a wildfire in San Antonio, or storm-related electrical fires in Houston, we understand the unique challenges each situation presents.

Don’t let insurance companies take advantage during your most vulnerable time. They’re counting on your urgency, your emotional state, and your lack of knowledge about the claims process. With the right advocate, you can level that playing field completely.

We’re proud to serve policyholders nationwide from our offices throughout Texas – from Austin to Dallas-Fort Worth, San Antonio to Houston, and everywhere in between. Our Who We Help Policyholder Advocates page shows exactly how we fight for families and businesses just like yours.

Your first step toward fair recovery is just a phone call away. Contact a public insurance adjuster for a free consultation and find what your fire claim is really worth. No obligations, no pressure – just honest answers about your options.

Your recovery is too important to leave in the hands of an insurance company that profits from paying you less. Let us fight for every dollar you deserve under your policy terms. After all, it’s not just about the money – it’s about getting your life back.