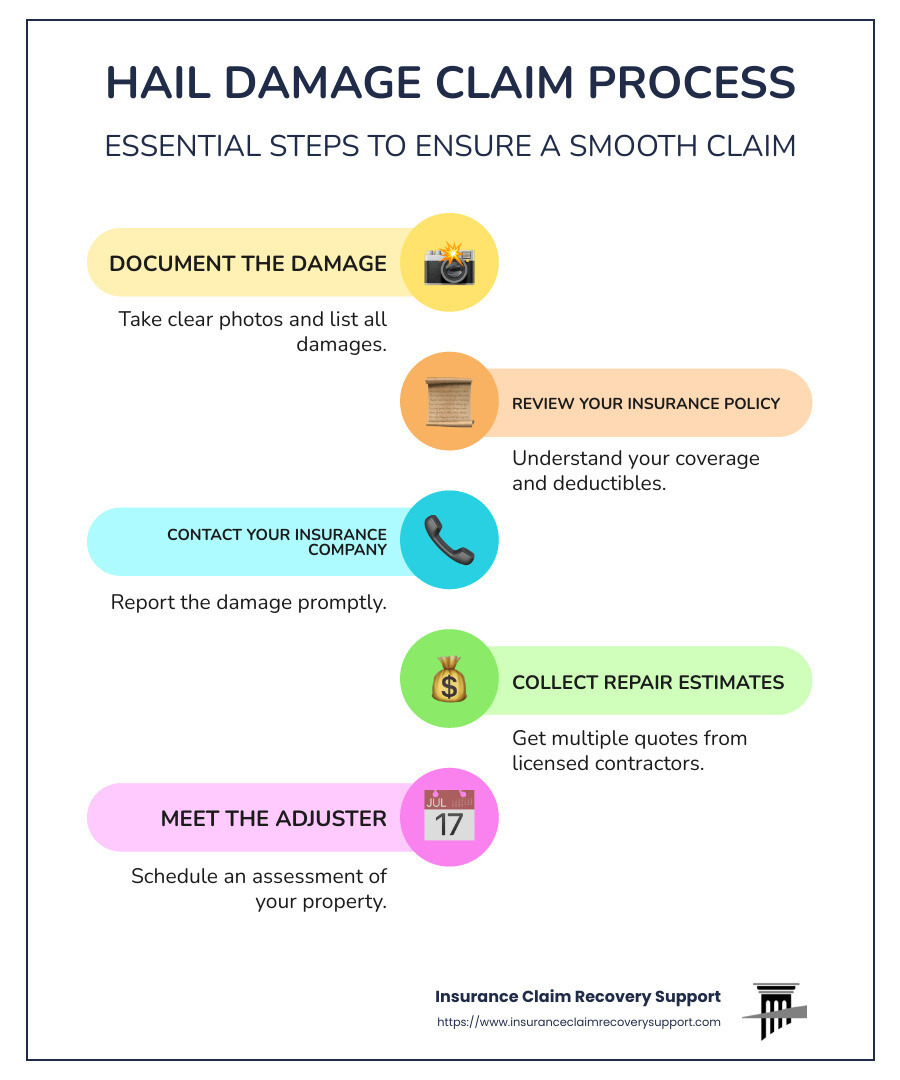

Hail damage claim process can be daunting, especially if you’re a commercial property owner dealing with significant damage. Here’s a quick summary to help you get started:

- Document the Damage: Take clear photos and list all damages.

- Review Your Insurance Policy: Understand your coverage and deductibles.

- Contact Your Insurance Company: Report the damage promptly.

- Collect Repair Estimates: Get multiple quotes from licensed contractors.

- Meet the Adjuster: Schedule an assessment of your property.

- Finalize the Claim: Review the settlement offer and finalize the claim.

Hailstorms can wreak havoc on properties, causing extensive damage that can strain your finances. Whether you’re managing a commercial building, multifamily complex, or other large properties, filing an insurance claim is crucial for financial recovery. At Insurance Claim Recovery Support, we help policyholders steer the complexities of the hail damage claim process to ensure a fair and quick settlement.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. With over 500 large loss claims settled and more than $250,000,000 recovered for policyholders, my team and I can guide you through the hail damage claim process. Let’s move forward to understand the ins and outs of your insurance policy.

Understanding Your Homeowners Insurance Policy

Actual Cash Value (ACV)

Understanding Actual Cash Value (ACV) is key when dealing with a hail damage claim. ACV represents the current value of your roof, factoring in depreciation. This means that the older your roof, the less money you’ll receive upfront.

For example, if your roof was installed 10 years ago and has an expected lifespan of 30 years, the insurance company will calculate its depreciated value. This initial payment is known as the ACV. It’s designed to help you start repairs but won’t cover the total cost.

Replacement Cash Value (RCV)

Replacement Cash Value (RCV), on the other hand, is the total cost to fully repair or replace your damaged roof with new materials. Unlike ACV, RCV doesn’t account for depreciation, meaning you get the full amount needed for repairs.

However, to receive the RCV, you must first complete the repairs and submit invoices to your insurance company. Initially, you’ll get the ACV payment, and once the repairs are done and verified, the insurance company will release the remaining amount (the depreciation payment).

Depreciation

Depreciation is the reduction in value of your roof due to age, wear, and tear. This is why the ACV is often lower than the RCV. The older or more worn out your roof, the higher the depreciation, and the lower the initial ACV payment.

Deductible

Your deductible is the amount you must pay out of pocket before your insurance kicks in. For instance, if your deductible is $1,000 and your repair costs are $10,000, your insurance will cover $9,000.

The Two-Part Payment Process

- Initial Payment (ACV): After the adjuster’s assessment, you’ll receive the ACV to start repairs.

- Depreciation Payment (RCV): Once repairs are complete, submit your invoices to get the remaining amount, covering the full repair cost.

Understanding these terms and the payment process can make navigating your hail damage claim process much smoother. Next, we’ll dive into how to document the damage effectively.

Documenting the Damage

When it comes to filing a hail damage claim, documenting the damage is crucial. Proper documentation ensures that your claim is processed smoothly and that you receive the settlement you deserve. Here’s how to do it right.

Take Photos and Videos

Start by taking clear photos and videos of all the damage. This visual evidence will be your primary proof when filing your claim.

Tips for effective documentation:

- Multiple angles: Capture the damage from different perspectives to provide a comprehensive view.

- Close-ups and wide shots: Take close-up shots for detail and wide shots for context.

- Timestamps: Use a camera or phone that timestamps the photos and videos to establish when the damage occurred.

- Include a scale: Place a common object, like a coin or ruler, in the photos to show the size of the damage.

Hire a Professional Inspector

While your photos and videos are essential, having a professional inspection can add credibility and detail to your claim.

Steps to consider:

- Contact a local roofing contractor: Schedule an inspection as soon as possible.

- Detailed inspection: Ensure the roofer checks all aspects of your roof and related home areas for collateral damage.

- Get a written report: Request a comprehensive report detailing the findings, including photos and measurements.

A professional inspector can identify issues that might not be immediately apparent, providing a thorough assessment that strengthens your claim.

Detailed Notes

In addition to photos and videos, keep detailed notes of the damage. Write down everything you observe, no matter how small it may seem. Include descriptions of:

- Visible damage: Shingles, gutters, windows, and any other affected areas.

- Collateral damage: Items like outdoor furniture or vehicles.

- Weather conditions: Note the date and time of the hailstorm, including the size of the hailstones if possible.

Initial Record

Creating an initial record of the damage is your first step in the hail damage claim process. This record will serve as a foundational document throughout your claim.

Components of an initial record:

- Damage description: A detailed account of all observed damage.

- Photos and videos: Attach all visual evidence.

- Inspector’s report: Include the professional roofer’s findings.

- Receipts and estimates: Keep any receipts for temporary repairs and initial repair estimates.

Having a well-documented initial record ensures you don’t miss any critical details and provides a solid basis for your claim.

By following these steps, you can effectively document the damage and set the stage for a successful hail damage claim. Next, we’ll look at how to file the hail damage claim process with your insurance provider.

Filing the Hail Damage Claim Process

Once you’ve documented the hail damage thoroughly, you’re ready to file the hail damage claim process with your insurance provider. This step is crucial to ensure you get the settlement you deserve.

Contact Your Insurance Provider

First, initiate your claim by contacting your insurance company. This can often be done online or via a phone call.

Steps to contact your insurer:

- Find the right contact info: Look on your insurance card or the company’s website to get the correct phone number or online portal.

- Report the claim: Provide a brief description of the damage and the date of the storm.

- Follow their process: You might need to fill out a claim form. Be as detailed as possible.

Pro Tip: Using the insurer’s website or mobile app can speed up the process.

Submit Detailed Documentation

After initiating the claim, you’ll need to submit detailed documentation. This helps the insurance company assess the damage accurately.

What to include in your documentation:

- Photos and videos: Attach the clear, timestamped images and videos you took.

- Repair estimates: Get quotes from local contractors to show the potential cost of repairs.

- Inspector’s report: Include the detailed inspection report from a professional roofer.

- Receipts for temporary repairs: If you made any immediate fixes to prevent further damage, include these receipts.

Important: Review your insurance policy to understand what is covered and any relevant deductibles.

Adjuster Assessment

Once your claim is submitted, the insurance company will send an adjuster to assess the damage.

Preparing for the adjuster’s visit:

- Be present: Make sure you’re there to guide the adjuster and provide any additional information.

- Show all damage: Walk the adjuster through all the damage you documented.

- Have your contractor present: If possible, have a trusted contractor there to ensure a thorough assessment.

The adjuster’s report will be crucial in determining the payout for your claim. Make sure they see everything.

By following these steps, you’ll ensure that your hail damage claim is processed smoothly and accurately. Next, we’ll discuss working with contractors and adjusters to get fair repair estimates.

Working with Contractors and Adjusters

Collect Multiple Repair Estimates

Once you’ve filed your hail damage claim, the next step is collecting repair estimates. This helps ensure you get a fair assessment and avoid overcharges.

Steps to collect repair estimates:

- Contact Local Contractors: Reach out to several local contractors who specialize in hail damage repairs. This gives you a range of potential costs.

- Get Independent Estimates: Independent estimates help you understand the scope and cost of repairs. This is crucial for comparing quotes.

- Compare Costs: Look at the details in each estimate. Ensure the costs are in line with what is reasonable and customary in your area.

Pro Tip: Choose contractors with good reviews and verified licenses. This ensures quality work and compliance with local building codes.

Meet with the Insurance Adjuster

Once you’ve gathered your estimates, the insurance company will send an adjuster to assess the damage. This is a critical step in the hail damage claim process.

How to prepare for the adjuster’s visit:

- Schedule the Appointment: Coordinate a time that works for you and, if possible, your preferred contractor. Having a contractor present can help ensure a thorough assessment.

- Be Present: Make sure you’re there during the inspection. This allows you to guide the adjuster and point out all the damage you documented.

- Show All Damage: Walk the adjuster through the damage, using your photos, videos, and repair estimates as reference points.

Important: The adjuster’s report will determine the repair costs covered by your insurance. Make sure they see everything to avoid any overlooked damage.

By following these steps, you ensure a fair and accurate assessment of your hail damage claim. Next, we’ll steer the payment process to get your repairs funded.

Navigating the Payment Process

Initial Payment (ACV)

After the insurance adjuster assesses the damage, your insurance company will offer an initial payment based on the Actual Cash Value (ACV) of your roof. This amount considers the roof’s age, wear, and current condition, minus depreciation.

Key Points to Understand:

- Repair Initiation: Use this initial payment to start the repair process. It’s crucial to engage a reputable contractor to ensure quality work.

- Partial Coverage: The ACV payment might not cover all repair costs immediately. It’s a partial payment meant to get the process started.

- Deductible: The amount you receive will be reduced by your deductible. For instance, if your roof’s ACV is $5,000 and your deductible is $1,000, you’ll receive $4,000 initially.

Pro Tip: Keep all receipts and invoices from the repair work. These documents are essential for the next step.

Depreciation Payment (RCV)

Once the repairs are complete, it’s time to claim the Replacement Cost Value (RCV). This is where you recover the depreciation amount withheld in the initial ACV payment.

Steps to Follow:

- Invoice Submission: Submit all repair invoices to your insurance company. This proves that the repairs were completed and allows you to claim the remaining amount.

- Final Payment: The insurance company will review your invoices and release the depreciation payment. This final payment bridges the gap between the ACV and the RCV, covering the total repair costs.

Complete Coverage:

- Final Settlement: Ensure you receive the full RCV for your roof. The total should include both the initial ACV payment and the subsequent depreciation payment.

- Check for Discrepancies: If there are any discrepancies in the final payment, discuss them promptly with your insurance provider to resolve any issues.

Important: Always retain all associated paperwork, including repair invoices, adjuster’s reports, and communications with the insurance company. This documentation is vital for any potential future claims or references.

By understanding and following these steps, you can steer the payment process smoothly, ensuring that your repairs are fully funded and your home is restored efficiently.

Next, we’ll address some frequently asked questions about the hail damage claim process.

Frequently Asked Questions about the Hail Damage Claim Process

How do you negotiate a hail damage claim?

Negotiating a hail damage claim can be challenging. Here are some key steps to help you:

- Gather Evidence: Collect as much evidence as possible. Take clear photos and videos of the damage from multiple angles. Use timestamps and include common objects for scale.

- Be Proactive: Contact your insurance company promptly. Delays can complicate the process.

- Hire Legal Counsel: If negotiations stall, consider hiring a public adjuster or an attorney. They specialize in insurance claims and can advocate on your behalf.

Pro Tip: Compare the insurance adjuster’s report with your documentation. If there are discrepancies, discuss them with your adjuster or legal counsel.

How long do you have to file a hail claim in Texas?

In Texas, the statute of limitations for filing a hail damage claim is typically two years from the date of the hailstorm.

Key Points:

- Act Quickly: File your claim as soon as possible after the storm. Delaying can hinder your ability to receive your settlement.

- Check Policy Stipulations: Review your insurance policy for any specific time limits or requirements. Some policies may have shorter deadlines.

Important: Always confirm the exact time frame with your insurance provider to avoid missing the deadline.

How does hail insurance work?

Understanding how hail insurance works is crucial for a smooth claims process.

Steps to Follow:

- Claim Filing: Report the hail damage to your insurance company. Provide the date of the storm and your policy number.

- Deductible: Be aware of your deductible. This is the amount you pay out-of-pocket before the insurance coverage kicks in.

- Insurer Payment: After assessing the damage, your insurer will provide an initial payment based on the Actual Cash Value (ACV) of the damaged property. Once repairs are completed, you can claim the Replacement Cost Value (RCV) to cover the remaining costs.

Pro Tip: Keep all repair receipts and documentation. These are essential for claiming the full RCV.

By understanding these aspects, you can steer the hail damage claim process more effectively, ensuring you receive fair settlement for your repairs.

Conclusion

Hail storms can cause substantial damage, leaving homeowners feeling overwhelmed. At Insurance Claim Recovery Support, we are here to help you steer the complex world of hail damage claims and ensure you receive the maximum settlement you deserve.

Policyholder Advocacy

Our primary mission is to advocate for policyholders. We understand that insurance companies often use tactics to minimize claim payouts. Our team is dedicated to counteracting these tactics and ensuring your claim is thoroughly documented and accurately assessed. We stand with you every step of the way, from the initial damage assessment to the final settlement negotiation.

Maximizing Settlements

We specialize in carefully documenting your hail damage claim. Our goal is to ensure that no detail is overlooked. By leveraging our deep understanding of hail storm insurance policies, we can negotiate effectively with insurance companies. This approach has consistently resulted in increased settlements for our clients, providing the financial support needed to restore their properties.

Local Expertise

Being based in Texas, we have extensive experience dealing with hail damage claims in areas such as Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway. Our familiarity with local building codes and insurance practices is an invaluable asset in navigating the claims process efficiently.

Peace of Mind

Navigating a hail damage claim can be daunting, but you don’t have to do it alone. With Insurance Claim Recovery Support by your side, you gain access to a wealth of knowledge and a robust support system. We handle the complexities of the claims process, allowing you to focus on what matters most: rebuilding and moving forward.

Get the Support You Need

If you’re facing a hail damage claim, let us be your advocate and partner in recovery. Visit our service page to learn more about how we can assist you.

Together, we can turn a stressful situation into a manageable one, ensuring you receive the settlement you need to restore your property and peace of mind.