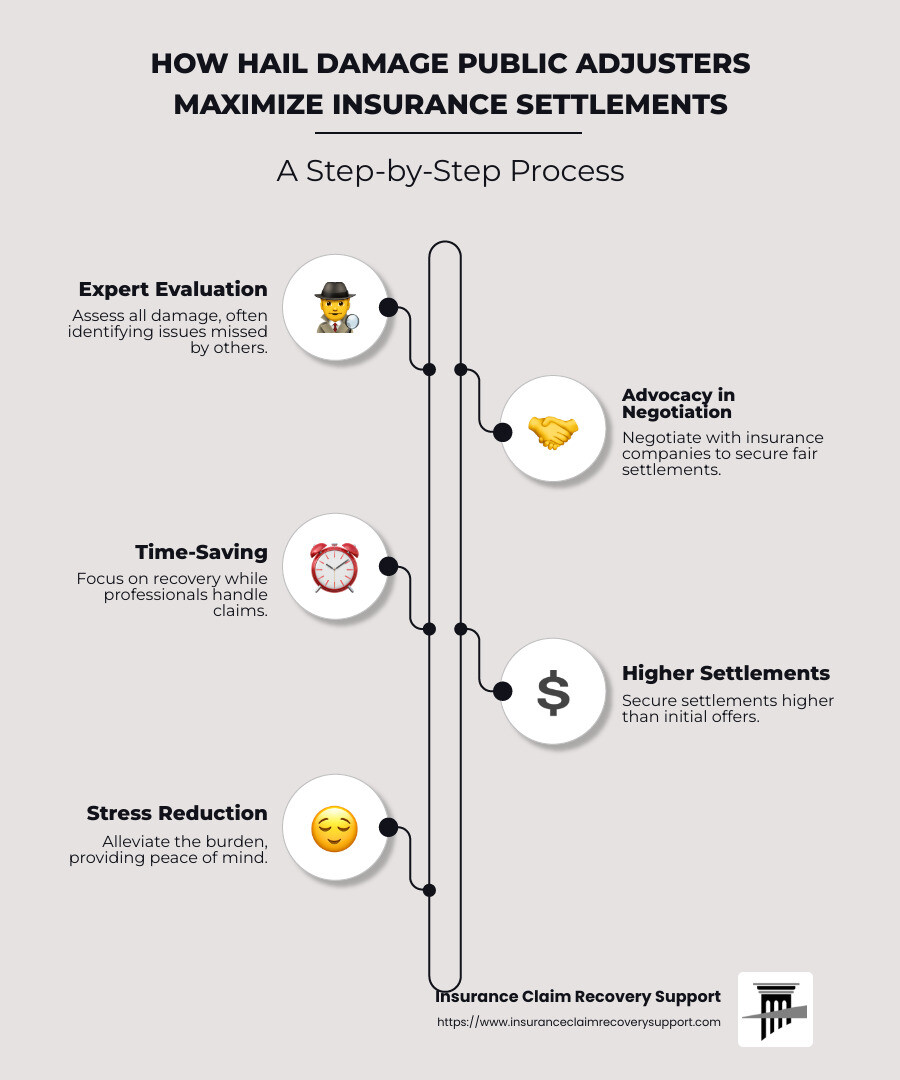

When you’re struggling with the aftermath of storm damage, navigating the insurance claims process can be daunting. A hail damage public adjuster could be your strongest ally in securing a fair settlement. Here’s why:

- Expert Evaluation: They assess all damage, often identifying issues missed by others.

- Advocacy: They negotiate with insurance companies, ensuring you’re not shortchanged.

- Time-Saving: With professionals handling the claim, you focus on recovery.

- Higher Settlements: Adjusters often secure settlements higher than initial offers.

- Stress Reduction: Professionals alleviate the burden, providing peace of mind.

Hail damage public adjusters offer a smart solution for property owners overwhelmed by storm damage claims. My name is Scott Friedson, and I’ve spent years as a hail damage public adjuster, successfully settling claims and advocating for policyholders across the country.

Glossary for hail damage public adjuster:

– hail damage adjuster

– hail damage insurance claim process

– roof hail damage

Understanding Hail Damage and Insurance Claims

Hailstorms can cause a surprising amount of damage to your property, and often, it isn’t immediately visible. The impact of hailstones, sometimes falling at speeds over 100 miles per hour, can severely damage roofs, windows, and vehicles. This damage might not be obvious from the ground, but it can lead to leaks and other costly issues.

Why is this important for insurance claims?

Insurance companies typically require clear evidence of damage before approving claims. This is where understanding hail damage becomes crucial. If you miss documenting any damage, you might not get the compensation you deserve.

The Insurance Process

-

Document Everything: Start by taking photos and videos of all visible damage. This includes dents in cars, broken windows, and any roof damage you can safely capture. Keep all related receipts and invoices.

-

Review Your Policy: Know what your insurance covers. Many policies include hail damage, but there might be deductibles or specific reporting timelines.

-

File Your Claim Promptly: Contact your insurance company as soon as possible to report the damage. Delays can complicate the process and might impact your claim.

-

Get Estimates: Obtain repair estimates from licensed contractors. This helps establish a fair cost for repairs and can support your claim.

-

Meet with the Adjuster: Be prepared when the insurance adjuster arrives. Have your documentation ready and be clear about the damage and costs involved.

By understanding these steps, you can steer the insurance process more effectively. Having a hail damage public adjuster can also be incredibly beneficial. They specialize in identifying and documenting damage, ensuring nothing is overlooked, and advocating for you throughout the claims process.

The Role of a Hail Damage Public Adjuster

When hailstorms strike, the aftermath can be overwhelming. This is where a hail damage public adjuster steps in as your advocate, guiding you through the complex claims process.

Public Adjusters: Your Advocate in the Claims Process

Public adjusters are not employed by insurance companies. They work exclusively for you, the policyholder. Their main job is to ensure you get the compensation you deserve. Unlike insurance adjusters who might aim to minimize payouts, public adjusters are on your side.

Claim Negotiation: Ensuring Fair Compensation

Negotiating with insurance companies can be intimidating. Public adjusters bring their expertise to the table, ensuring that every detail of your claim is considered. They carefully document the damage and present a strong case to the insurance company. This can significantly increase your chances of receiving a fair settlement.

One case study highlights how a public adjuster helped a homeowner in Florida. The initial offer from the insurance company was far below what was needed to cover the repairs. The public adjuster intervened, and through detailed negotiation, the homeowner received a settlement that adequately covered all the damages.

The Settlement Process: From Start to Finish

The settlement process can be lengthy and confusing. A public adjuster handles everything from start to finish. They assess the damage, gather evidence, and submit a detailed claim to the insurance company. They also negotiate on your behalf, ensuring the settlement reflects the true cost of repairs.

A hail damage public adjuster serves as both a shield and a sword in the claims process. They protect your interests and fight to maximize your claim, ensuring you are not left shortchanged after a devastating hailstorm.

Next, we will dig into the specific benefits of hiring a public adjuster and how they can make a significant difference in your claim outcome.

Benefits of Hiring a Public Adjuster

When dealing with the aftermath of a hailstorm, hiring a hail damage public adjuster can make a world of difference. Here’s why:

Fair Settlement: Getting What You Deserve

Public adjusters are experts in ensuring you receive a fair settlement. They carefully review your policy and document every detail of the damage. This thorough approach often leads to higher compensation than what you’d achieve on your own. A public adjuster’s goal is to maximize your claim, ensuring you have the funds needed to restore your property fully.

One example shows how a public adjuster secured a significantly higher settlement for a homeowner than what was initially offered by the insurance company. Their expertise in claim assessment and negotiation was pivotal in achieving this outcome.

Policyholder Advocacy: Your Personal Champion

Public adjusters act as your personal champion throughout the claims process. Unlike insurance adjusters, who represent the insurance company’s interests, public adjusters work exclusively for you. They advocate on your behalf, ensuring that your claim receives the attention and consideration it deserves. This advocacy is crucial, especially when insurance companies try to undervalue your claim.

Claim Management: Navigating the Complex Process

The claims process can be daunting, filled with paperwork, inspections, and negotiations. Public adjusters manage the entire process for you. They handle everything from gathering evidence to negotiating with the insurance company. This not only saves you time and stress but also ensures that the claim is handled professionally and efficiently.

By hiring a public adjuster, you can focus on recovering from the storm while they work tirelessly to secure the compensation you need to rebuild.

In the next section, we’ll explore how to choose the right public adjuster, ensuring you have the best possible representation for your hail damage claim.

How to Choose the Right Public Adjuster

Choosing the right hail damage public adjuster is crucial to ensure you get the best representation for your claim. Here’s what to consider:

Experience Matters

Look for a public adjuster with a solid track record in handling hail damage claims. Experience means they know the ins and outs of the claims process and can anticipate potential challenges. An experienced adjuster will have a keen eye for detail, ensuring every aspect of your damage is documented and presented effectively to the insurance company.

For instance, adjusters like Greg Roover, who transitioned from working with insurance companies to advocating for policyholders, bring valuable insider knowledge to the table. This expertise can be pivotal in securing a favorable settlement.

Seek Referrals

Referrals can be a great way to find a reliable public adjuster. Ask friends, family, or neighbors who have experienced similar situations for recommendations. You can also check online reviews and testimonials to gauge the adjuster’s reputation and client satisfaction. Positive reviews and successful case stories are good indicators of an adjuster’s capability and reliability.

Hail Damage Expertise

Not all adjusters are created equal. Some specialize in specific types of claims, like fire or flood damage. Ensure the adjuster you choose has specific expertise in hail damage. This specialization means they understand the unique challenges and nuances of hail damage claims and are better equipped to handle them.

For example, adjusters who have dealt with numerous hail damage cases will know exactly what evidence to gather and how to present it to maximize your settlement. They will also be familiar with common pitfalls and how to avoid them.

In the following section, we’ll address some frequently asked questions about public adjusters, providing further clarity on their role and benefits.

Frequently Asked Questions about Public Adjusters

What are the disadvantages of using a public adjuster?

While hiring a hail damage public adjuster can be beneficial, there are some potential downsides to consider.

Settlement Percentage: Public adjusters typically work on a commission basis, charging a percentage of the settlement amount. In Texas, this fee often hovers around 10%. While this incentivizes them to maximize your claim, it also means you’ll receive less of the final payout.

Claim Duration: The process might take longer. Public adjusters are thorough, ensuring all evidence is gathered and documented. This attention to detail can extend the timeline, which may be frustrating if you’re eager for a quick resolution.

How do you negotiate a hail damage claim?

Negotiating a hail damage claim involves several key steps:

Evidence Gathering: Collecting solid evidence is crucial. Take clear photos and videos of the damage. Document everything carefully, including hail marks and any immediate repairs needed to prevent further damage.

Proactive Measures: Protect your property from further harm. Cover broken windows or roof holes with tarps. These actions show the insurance company you’re responsible and can prevent future disputes over additional damage.

Negotiation Skills: Understand your policy and the true cost of repairs. Don’t accept the first offer from the insurance adjuster. Instead, use the evidence and estimates to negotiate a fair settlement.

How much can a public adjuster charge in Texas?

In Texas, public adjusters charge a standard fee based on a percentage of the claim settlement. This commission typically ranges around 10%, though it can vary. Texas regulations ensure these fees remain fair and reasonable, protecting policyholders from excessive charges. Understanding this fee structure helps you make informed decisions about hiring a public adjuster.

In the next section, we’ll wrap up our guide with a conclusion that aims to empower you with knowledge and confidence as you seek the best possible outcome for your insurance claim.

Conclusion

Navigating the aftermath of hail damage can be overwhelming, but you don’t have to face it alone. Insurance Claim Recovery Support is dedicated to representing policyholders like you, ensuring that you receive the maximum settlement you deserve.

Our commitment to policyholder advocacy sets us apart. We work exclusively for you, not the insurance company. This means our sole focus is on maximizing your claim and ensuring a fair settlement. Our team understands the complexities of hail damage claims and is equipped to handle every detail, from evidence gathering to negotiating with insurance companies.

With our expertise, you can rest assured that your claim is in capable hands. We have a proven track record of helping clients across Texas, from Austin to Houston, and beyond. Our experience in dealing with property damage claims means we know how to steer the insurance process efficiently and effectively.

If you’re dealing with hail damage, consider partnering with us. We offer a free case review, so you can understand your options without any pressure. Our goal is to empower you with the knowledge and support necessary to secure the compensation you deserve.

For more information about how we can assist with your hail damage claim, visit our Property Damage Claims in Texas page.

Let us help you turn a daunting situation into a manageable one, ensuring you get the fair and prompt settlement that’s rightfully yours.