Insurance claim assistance for roofs in texas can be tricky, given the unpredictable weather conditions. Whether you’re dealing with hail, strong winds, or a hurricane, ensuring your roof is secure is a top priority. However, when damage occurs, navigating the insurance claim process becomes crucial. Here’s what you need to know:

- Understand your policy: Familiarize yourself with what your insurance covers and exclusions.

- Document the damage: Take clear photos and videos of any roof damage immediately after a storm.

- Timely reporting: Contact your insurance company right away to report the damage and initiate a claim.

I’m Scott Friedson, a multi-state licensed public adjuster with experience in providing insurance claim assistance for roofs in Texas. Over the years, I’ve guided countless clients through the complexities of property damage claims, ensuring they receive the settlements they deserve.

Understanding Your Home Insurance Policy

When it comes to insurance claim assistance for roofs in Texas, knowing the ins and outs of your home insurance policy is key. Here’s a breakdown of what you need to understand:

Covered Damage

Your policy typically covers specific types of damage. The most common include:

-

Wind Damage: High winds can cause shingles to blow off or even lead to structural issues. This is generally covered by your policy.

-

Fire Damage: If your roof is damaged by fire, your insurance should cover the repair or replacement costs.

Policy Exclusions

Not everything is covered under your insurance policy. Here are some common exclusions:

-

Wear and Tear: Regular aging and deterioration of your roof aren’t covered. Insurance is for sudden events, not gradual wear.

-

Neglect: If the damage is due to a lack of maintenance, you might find yourself footing the bill. Insurers expect homeowners to take care of their property.

-

Specific Events: Some events, like earthquakes or floods, might not be covered unless you have specific additional policies. Always check your policy for these exclusions.

Deductible

Understanding your deductible is crucial:

-

Definition: A deductible is the amount you pay out of pocket before your insurance kicks in. It’s your share of the repair costs.

-

Amount: Deductibles can be a set dollar amount or a percentage of your home’s value. For example, a $1,000 deductible means you pay the first $1,000 of any claim.

-

Choosing a Deductible: A higher deductible usually results in lower premiums, but you’ll pay more if you have a claim. Balance your deductible with what you can afford in an emergency.

By understanding these aspects of your policy, you’ll be better equipped to handle any roof damage claim that comes your way.

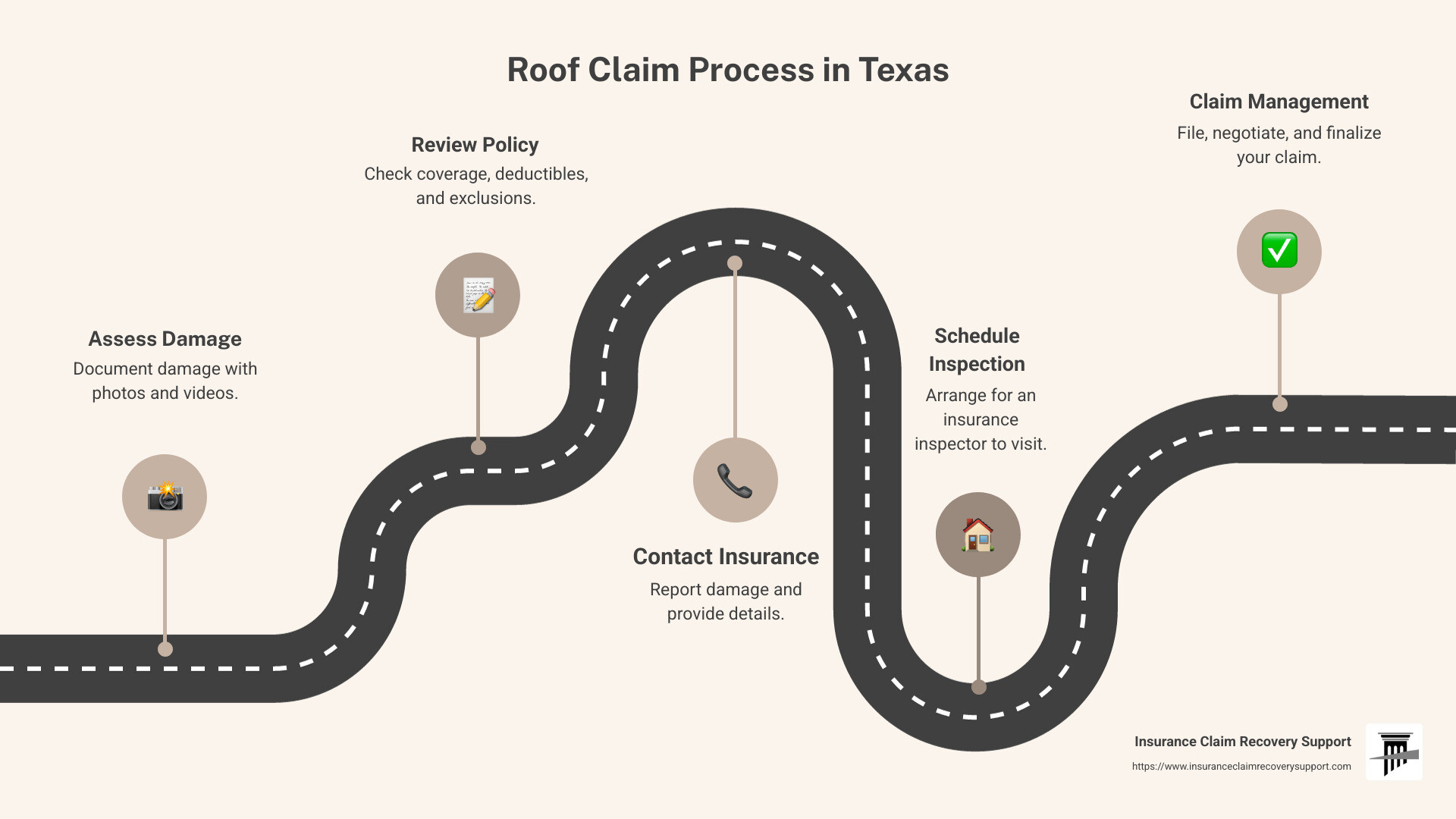

Steps in the Roof Claim Process in Texas

Navigating the roof claim process can be daunting, but breaking it down into manageable steps makes it easier. Here’s a simple guide to help you through the process:

Assess the Damage

Start by evaluating the damage to your roof. This step is crucial because it sets the stage for your insurance claim.

-

Document Everything: Take clear photos and videos of the damage. Capture different angles and include close-ups of specific issues like missing shingles or cracks.

-

Be Thorough: Don’t just focus on the obvious. Check for less visible damage, like leaks or structural issues, that could worsen over time.

Having a comprehensive record will strengthen your claim and help ensure you get the compensation you deserve.

Review Insurance Policy

Before contacting your insurance company, review your policy. This helps you understand what to expect and prepares you for discussions with your insurer.

-

Coverage: Know what types of damage are covered. For instance, wind and fire damage are typically included, but always double-check.

-

Deductibles: Be aware of your deductible amount. This is the portion you’ll pay out of pocket before your insurance covers the rest.

-

Exclusions: Familiarize yourself with any exclusions, such as wear and tear or neglect. This knowledge helps you avoid surprises during the claim process.

Contact Your Insurance Company

Once you’ve assessed the damage and reviewed your policy, it’s time to reach out to your insurer.

-

Report the Damage Promptly: Notify your insurance company as soon as possible. Provide them with details about the damage, including when and how it occurred.

-

Provide Documentation: Share the photos and videos you’ve collected. This evidence supports your claim and helps your insurer understand the extent of the damage.

-

Schedule an Inspection: Your insurance company will likely send an adjuster to inspect the damage. Be present during the inspection to point out areas of concern and ensure a thorough assessment.

By following these steps, you’ll be well-prepared to handle the roof claim process in Texas. Proper documentation and understanding your policy are key to a successful claim.

Next, we’ll explore how professional guidance can assist you in filing and negotiating your roof insurance claim in Texas.

Insurance Claim Assistance for Roofs in Texas

When dealing with roof damage in Texas, Insurance Claim Recovery Support offers expert guidance to steer the complex process of filing and negotiating insurance claims. They provide professional claim management to ensure you receive the compensation you deserve.

Filing a Claim

Documentation is Key: Start by gathering all necessary documentation. This includes detailed photos and videos of the damage, estimates from reputable roofing contractors, and any correspondence with your insurance company. Having a well-organized file will make the process smoother and more efficient.

Get Multiple Estimates: Collect quotes from at least three licensed contractors. This not only helps you understand the repair costs but also provides leverage when negotiating with your insurer.

Submit Your Claim: Once your documentation is in order, submit your claim to your insurance company. Be sure to include all relevant evidence and estimates to support your case.

Review the Settlement Offer: After submitting your claim, the insurance company will provide a settlement offer based on their assessment. Review this offer carefully to ensure it covers all necessary repairs.

Negotiating and Finalizing

Negotiate the Offer: If the initial settlement offer is insufficient, don’t hesitate to negotiate. Use the estimates and documentation you gathered to argue for a fairer amount. The first offer is often just a starting point.

Agree on Repairs: Once a satisfactory settlement is reached, select a reputable contractor to carry out the repairs. Ensure the contractor is licensed and insured to avoid any further complications.

Finalize the Claim: After the repairs are completed, submit all final invoices and documentation to your insurance company. This step is crucial for closing the claim and receiving any remaining payments.

Professional Guidance: Consider enlisting the help of Insurance Claim Recovery Support. Their expertise in claim management can be invaluable, especially if you encounter challenges during the process. They can help you steer negotiations and ensure a smooth finalization of your claim.

By following these steps and utilizing professional assistance, you can effectively manage your roof insurance claim in Texas and maximize your settlement.

Next, we’ll address some frequently asked questions about roof insurance claims to further assist you in understanding the process.

Frequently Asked Questions about Roof Insurance Claims

Is it worth claiming roof damage on insurance?

Claiming roof damage on your insurance can be worthwhile, especially if the damage is significant and costly to repair. However, weigh the potential benefits against factors like your deductible and possible premium increases. Texas law, under HB 2102, requires homeowners to pay their deductible. This law aims to protect consumers from fraudulent contractors who might offer to waive deductibles, often leading to subpar work. Before filing a claim, assess the damage and compare repair costs to your deductible. If the costs exceed the deductible and the damage is covered by your policy, filing a claim is likely beneficial.

How does a roof claim work in Texas?

The roof claim process in Texas involves several key steps:

-

Assess the Damage: Document the damage with photos and videos. This evidence is crucial for your claim.

-

Review Your Insurance Policy: Understand what your policy covers, including any exclusions or specific events that might affect your claim.

-

Contact Your Insurance Company: Report the damage promptly. Provide details about the event that caused the damage and schedule an inspection with an adjuster.

-

Negotiate and Finalize: Once you receive a settlement offer, evaluate it against the repair estimates you’ve gathered. If necessary, negotiate for a fair settlement that covers all repair costs.

Throughout this process, avoid admitting fault or negligence, as this can affect liability and potentially reduce your compensation.

What not to say to a roof insurance adjuster?

When speaking with a roof insurance adjuster, be cautious about your statements. Avoid making any admissions of fault, such as suggesting the damage was due to neglect or poor maintenance. Instead, focus on the facts and evidence of the damage.

Key tips:

- Stick to the Facts: Provide clear, concise information about the damage and the event that caused it.

- Avoid Speculation: Do not guess or assume the cause of the damage. Leave the assessment to the professionals.

- Present Documentation: Use your photos, videos, and contractor estimates to support your claim.

By following these guidelines, you can help ensure a smoother claim process and increase your chances of receiving a fair settlement.

Conclusion

Navigating the complexities of insurance claim assistance for roofs in Texas can be daunting, but you don’t have to go through it alone. At Insurance Claim Recovery Support, we understand the challenges that Texas homeowners face when dealing with roof damage from severe weather events such as hurricanes, tornadoes, and hailstorms. Our team of experienced public adjusters is dedicated to advocating for you, ensuring that you receive the maximum settlement you deserve.

Maximizing Settlement

When it comes to maximizing your insurance settlement, documentation is key. Our experts will assist you in gathering all necessary evidence, including photographs, videos, and professional estimates. We are committed to carefully documenting and arguing for the fullest possible compensation for your losses. Our deep understanding of insurance policies means no detail is overlooked, giving you the best chance at a fair settlement.

Texas Property Damage

Texas is particularly vulnerable to severe weather, and dealing with property damage can be stressful. Whether you’re in Austin, Dallas, Fort Worth, San Antonio, or any other city across Texas, we are here to help. Our expertise in Texas’ unique weather patterns and insurance claim processes ensures that you are in good hands. From initial damage assessment to finalizing your claim, we stand by you every step of the way.

Trust Insurance Claim Recovery Support to handle your roof insurance claims with professionalism and care. Let us help you steer the path to recovery, ensuring that your home is restored, and your rights as a policyholder are protected.

For more information on how we can assist with your insurance claims, visit our Public Adjuster Services page. We’re here to help you get the settlement you deserve.