Why Understanding the Insurance Claim Process Steps Is Critical for Property Owners

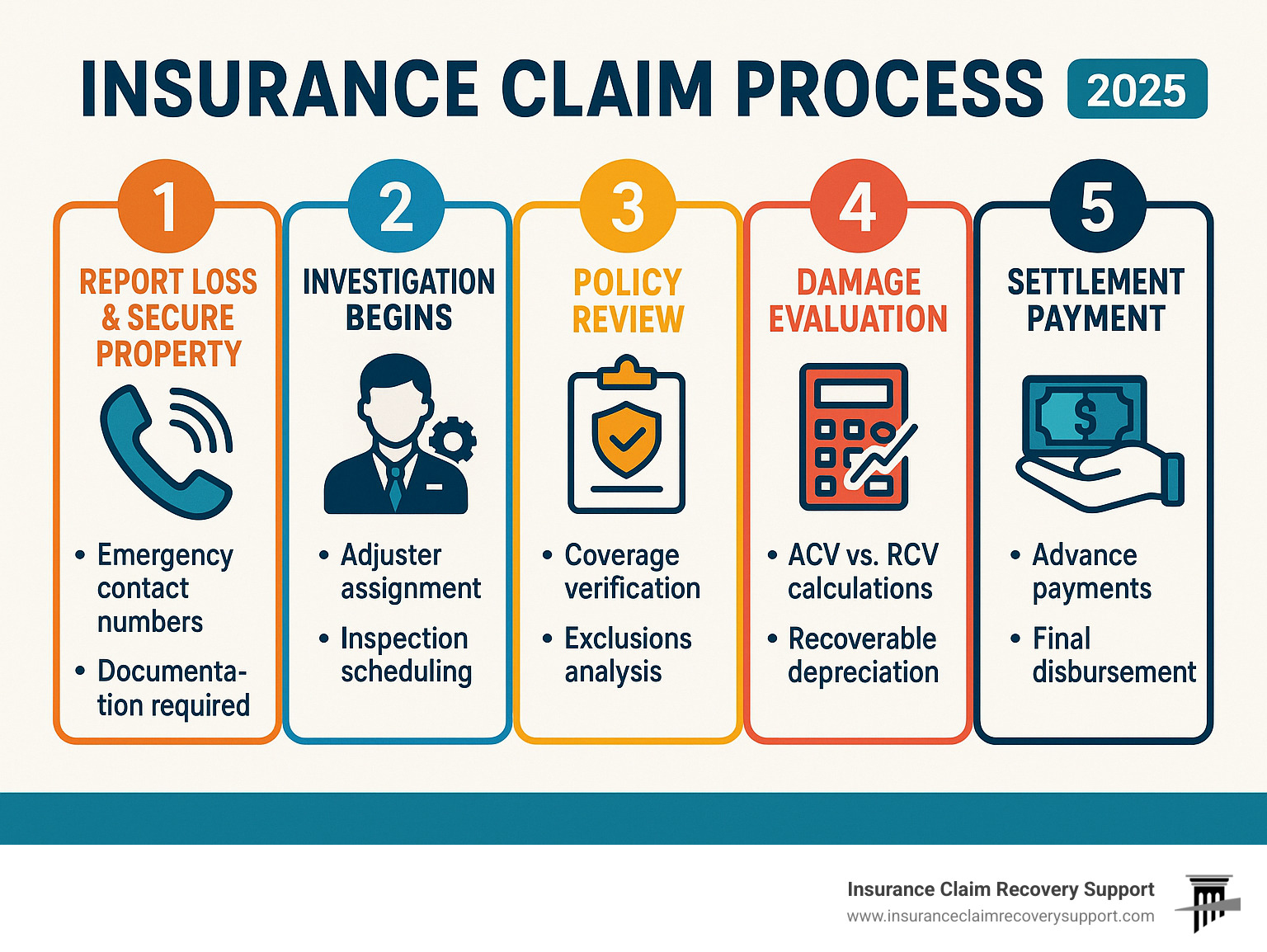

Insurance claim process steps can feel overwhelming when dealing with damage to your commercial building, multifamily complex, or other managed properties. The process involves five main stages: reporting the loss, investigation, policy review, damage evaluation, and settlement.

Here are the essential insurance claim process steps:

- Report the claim immediately – Contact your insurer within policy deadlines (typically 90 days to 12 months)

- Document everything – Take photos, videos, and create detailed damage lists

- Secure your property – Make temporary repairs to prevent further damage

- Work with the adjuster – Cooperate during the investigation and damage evaluation

- Review the settlement – Negotiate if the offer doesn’t cover your actual losses

An insurance claim is a formal request for financial compensation for covered losses. For commercial property owners, HOA managers, and multifamily investors, understanding this process is essential when dealing with fire, hail, hurricane, tornado, freeze, lightning, or flood damage.

The stakes are high. Most insurers have strict claim submission deadlines, and missing them can result in denial. Additionally, repair fraud is common after disasters, with contractors taking advantage of property owners who don’t understand the process.

The decision to file a claim should consider your deductible. If repair costs only slightly exceed it, you might face premium increases that cost more than the payout. For commercial properties, this calculation is more complex when considering business interruption coverage and additional living expenses.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of ICRS LLC. I’ve settled over 500 large loss claims valued at more than $250 million. Through my experience, I’ve helped property owners overturn wrongfully denied claims, increase settlements from 30% to 3,800% or more, and avoid unnecessary litigation.

Insurance claim process steps terms explained:

Step 1: Immediate Actions and Damage Mitigation

Picture this: a sudden storm rips through your commercial building, or a pipe bursts in your apartment complex. The first few hours after property damage are critical. Once everyone is safe, the smart moves you make next can make or break your insurance claim process steps.

Safety First and Securing the Property

First, ensure everyone—your tenants, staff, and visitors—is safe. If there’s any doubt about injuries or major structural issues, call 911 immediately. Once the danger has passed, your next crucial step is to secure your property to prevent it from getting worse. This is a huge part of the insurance claim process steps!

For instance, if a Texas storm rips a hole in the roof of your Dallas apartment complex, act fast. Use tarps or boards for temporary repairs to stop more water from getting in. This protects your property and shows your insurer you’re doing your part to prevent further damage. Pro tip: save every single receipt for those temporary repairs! These costs are usually covered if the damage is included in your policy.

Documenting Everything

Now, let’s talk about your secret weapon: documentation. It’s your best friend throughout the claims journey. From the moment you spot damage, take extensive photos and videos. Get every angle, every broken window, every water stain. Having too much proof is always better than not enough. These visual records provide undeniable evidence of the damage’s extent.

Beyond pictures, start a detailed list of everything that’s been damaged or destroyed. For your commercial property, that means inventory, equipment, furniture, and structural parts. A comprehensive pre-loss inventory of your property—with approximate values and purchase dates—can be a lifesaver. Keep it updated and store copies safely, perhaps in the cloud.

Notifying Your Insurance Agent or Broker

Once things are safe and you have initial documentation, your next call should be to your insurance agent or broker. They are your first point of contact and can walk you through the initial reporting steps. Promptly contacting them is vital because most insurers have strict filing deadlines—usually from 90 days to 12 months from when the damage occurred. Missing this deadline could put your entire claim at risk.

What to Do After Specific Events in Texas

Operating properties in Texas means facing unexpected challenges, from heat to freezes and powerful storms. Knowing specific actions for different types of damage is key to navigating the insurance claim process steps effectively.

- Fire Damage Safety (Austin, Houston, Fort Worth): After a fire, structural integrity may be compromised and utilities hazardous. Do not turn on any electrical switches until a professional has checked your electrical system. If you smell gas fumes, call the gas company immediately and evacuate. Your safety always comes first!

- Water Damage Mitigation (San Antonio, Lubbock): Whether from a burst pipe in a San Angelo apartment during a freeze or a sudden downpour, water damage needs immediate attention. If safe, turn off your main water shut-off valve. Move undamaged items away from wet areas. Mold can start growing in less than 48 hours, so quick action is paramount!

- Wind Damage Documentation (Waco, Round Rock): For wind damage documentation (common in places like Waco or Round Rock), noting the exact date and time is vital. If you can, capture the weather conditions. Start a detailed list of all damage to your building and its contents. (Note: this tip applies to wind damage; we covered hail damage in our introduction!).

- Hurricane Preparedness and Aftermath (Houston, Coastal Texas): Houston’s hurricane season requires proactive measures. Before a storm, secure all glass openings, bring in outdoor furniture, and seek refuge in an interior room away from windows. After the storm, be extremely cautious of downed power lines and gas leaks. Stay away from heavily damaged areas and listen to local authorities for instructions.

- Tornado Aftermath (Dallas-Fort Worth, Throughout Texas): Tornadoes can cause catastrophic damage. If your commercial property or religious institution is hit, ensure everyone’s safety first. Then, document the scene thoroughly before any cleanup begins. If your property faces a total loss, a public adjuster can be instrumental in ensuring you receive the full policy value.

- Freeze Damage Precautions (Across Texas): As Texans know, winter freezes can lead to significant pipe bursts and water damage. Insulating your pipes and maintaining proper heating can help prevent these issues. If damage occurs, follow water mitigation steps immediately to minimize further loss.

- San Antonio Flood Risks: San Antonio faces unique flood risks. If your property floods, your priorities should be safety, thorough documentation of the damage, and making temporary repairs to prevent further issues.

- Houston Hurricane Season: Being prepared for hurricane season in Houston means having a clear emergency plan, securing your property in advance, and knowing the immediate steps to take after a storm to protect your valuable commercial assets.

Step 2: Initiating the Claim and Comprehensive Documentation

Once you’ve secured your property and taken initial photos, it’s time to officially start the insurance claim process steps with your insurer. This is where the formal process begins, and having your documentation in order will make all the difference.

Contacting the Insurer and Policy Review

Claim submission deadlines are critical. Most insurance companies give you 90 days to 12 months to report a loss, but some policies require immediate notification. Miss that deadline, and you could be looking at a denied claim before you even get started.

When you call your insurer, they’ll assign a claim number and begin the policy review. Your insurance company will examine every detail of your policy and how it applies to your specific loss. Your policy is a contract, and the insurer will review policy exclusions, coverage limits, and whether your damage is covered under its terms.

Understanding Your Coverage: Covered vs. Non-Covered Losses and Exclusions

Understanding what’s actually covered can be tricky. Your commercial property policy might cover fire damage but exclude damage from flooding—unless you’ve purchased separate flood insurance. These policy exclusions are stated in the policy, though the language can be complex.

Deductibles are another piece of the puzzle. If your Austin office building suffers $25,000 in storm damage and you have a $10,000 deductible, you’re responsible for that first $10,000. For smaller losses, consider whether filing a claim makes financial sense, as frequent claims can impact future premiums.

For multifamily properties, Additional Living Expenses (ALE) coverage is crucial when tenants need temporary housing. Meanwhile, business interruption coverage is your financial lifeline when commercial operations halt due to property damage. This coverage helps with lost income and continuing expenses like payroll while your business recovers.

Key Documentation for Your Insurance Claim Process Steps

Thorough documentation separates successful claims from headaches. Think of it as building your case.

The proof of loss form is your formal statement to the insurer about your claim. Your insurer provides this form, and accuracy is critical. Discrepancies can cause delays or disputes.

If your Houston warehouse was vandalized or your Dallas retail space was burglarized, police reports are essential. They provide third-party verification and establish a timeline.

Repair estimates from licensed contractors add credibility and help establish the scope of damage. I recommend getting multiple estimates to show the insurer you’re being thorough.

Pre-loss property condition photos are invaluable. They show your property’s condition before the damage, making it easier to demonstrate the extent of the loss.

Maintenance records are also important. They show you’ve properly maintained your property and that the damage wasn’t due to neglect.

Keep receipts for temporary repairs you made right after the damage. These expenses are typically covered, but only if you can prove what you spent.

Finally, keep detailed contact information for all parties involved: your insurance agent, the assigned adjuster, contractors, and anyone else in the process. Staying organized will save you time and frustration.

The more organized and comprehensive your documentation, the smoother your claim process will be. Insurers appreciate prepared policyholders, which often leads to faster, fairer resolutions.

The 5 Essential Insurance Claim Process Steps for Property Damage

Once you’ve reported your claim and gathered initial documentation, the heart of the insurance claim process steps begins. This is where your insurance company assigns a claims adjuster to investigate your loss and determine what they’ll pay.

Claim Assigned to an Adjuster

After you report your claim, your insurer assigns a claims adjuster to your case. This person is your primary contact, but they work for the insurance company, not for you. Their job is to investigate your claim, assess the damage, and determine coverage from their employer’s perspective.

The adjuster will contact you to schedule an inspection. This timeline can vary; after major storms in Houston or Dallas, for example, adjusters may be backlogged for weeks.

The Role of the Company Adjuster

The company adjuster is the insurer’s representative. They’ll examine your damaged commercial building, apartment complex, or religious institution, taking photos and measurements. They review your policy to determine what’s covered, apply your deductible, and calculate potential payouts. They may request additional documents like police reports or repair receipts and will verify the damage was from a covered peril, not neglect.

What to Expect During the Inspection

When the adjuster visits, be prepared. Have your documentation ready: your damage list, photos, videos, and contractor estimates. Walk them through the affected area, pointing out all damage.

Cooperate fully, but remember the adjuster represents the insurer’s interests. They are trained to identify covered damage while also looking for reasons to limit the payout. Be present during the inspection if possible. Answer questions honestly, but don’t speculate. If you’re unsure, it’s better to say “I don’t know” than to guess.

Damage Evaluation: Verifying Lost Item Values, ACV vs. RCV, and Recoverable Depreciation

The adjuster’s primary task is evaluating your damage’s monetary value. This involves several key concepts that significantly impact your settlement.

Actual Cash Value (ACV) versus Replacement Cost Value (RCV) makes a huge difference. ACV compensates you for the value of items minus depreciation. RCV pays the cost to replace damaged items with new, similar ones.

Even with an RCV policy, most insurers initially pay the ACV, holding back the depreciation. To receive the full replacement cost, you must complete the repairs and provide proof of payment to your insurer.

Recoverable depreciation is often money left on the table. Many policyholders don’t realize they must submit receipts to recover this held-back amount. For a $50,000 roof replacement on your Austin apartment complex, you might initially get $35,000 (ACV), but you’re entitled to the remaining $15,000 once you complete repairs and submit receipts.

The Role of a Public Adjuster as Your Advocate

This is where having a public adjuster changes everything. Unlike the company adjuster who works for the insurer, a public adjuster works exclusively for you, the policyholder.

We maximize your settlement by understanding policy nuances and knowing how to properly present claims. At Insurance Claim Recovery Support, we’ve seen settlements increase dramatically with professional advocacy—sometimes from 30% to 3,800% or more.

Interpreting complex policy language is a key strength. Insurance policies have technical jargon that can work against you. We ensure you understand your rights and what you’re owed.

Managing the entire claim process frees you to focus on your business. We handle everything from documentation and communication to final negotiation.

Handling all communication with the insurer means you have an expert liaison who speaks their language. This often leads to faster, better outcomes.

Crucially, having a public adjuster can help you avoid unnecessary litigation. Our expertise in claim presentation and negotiation often resolves disputes without the time, expense, and uncertainty of a lawsuit. We know when to push back on lowball offers and when a settlement is fair, helping you make informed decisions.

For more information on how we can assist with your property damage claim, visit our HOA services page.

Step 4: Navigating the Settlement, Disputes, and Denial

After the adjuster’s evaluation, the insurance company presents a settlement offer. This is a pivotal moment in the insurance claim process steps, and how you handle it can significantly impact your recovery.

Settlement Offer: Reviewing the Offer

When the settlement offer arrives, review it carefully. Don’t feel pressured to accept the first offer, especially if it doesn’t align with your repair estimates or the true extent of your property’s damage.

You might receive an advance payment to start critical repairs. Additional payments often follow, particularly if your policy includes recoverable depreciation. The insurer initially holds back this portion, releasing it once you prove repairs are complete. Understand the difference between this advance and the final payment that settles your claim. The adjuster’s initial offer may not reflect all benefits available under your policy.

What if My Claim Is Denied? Reasons for Denial

What if your claim is denied, or the settlement is too low? It’s frustrating, but it’s not always the final word.

Insurers deny claims for several reasons: lack of coverage (e.g., flood damage without a flood policy), missed deadlines for reporting or documentation, insufficient documentation to prove the loss, specific policy exclusions, or claims that damage was due to pre-existing conditions or poor maintenance.

Navigating Disputes in the Insurance Claim Process Steps

If you disagree with your insurer’s decision, you have options. Professional advocacy can make a difference, often helping you avoid unnecessary litigation and recover faster.

Let’s compare two paths you might consider:

| Feature | Public Adjuster | Insurance Lawsuit |

|---|---|---|

| Role | Works exclusively for you, the policyholder, as your expert advocate. | Legal representation via an attorney in an adversarial process. |

| Focus | Maximizing your settlement, interpreting policy language, and managing the claim. | Proving the insurer breached its contract; seeking damages legally. |

| Cost | A contingency fee, a percentage of the increased settlement achieved for you. | Involves hourly legal fees, court costs, and expert witness fees that add up. |

| Timeframe | Aims to expedite the claim for a faster, fairer resolution out of court. | A lengthy process, often taking months or years due to court schedules, findy, and appeals. |

| Complexity | Handles all details and communication, reducing your burden. | A complex legal process requiring significant time, effort, and involvement. |

| Relationship | Collaborative with you; an expert liaison with the insurer. | Adversarial with the insurer, leading to formal legal proceedings. |

| Outcome | Strives for a fair settlement via negotiation and proper documentation, often avoiding litigation. | Seeks a court judgment, but the outcome is unpredictable and may not justify the cost. |

| Stress Level | Reduces your stress, freeing you to focus on your business or property management. | High stress, demanding significant emotional and time commitment. |

Beyond engaging a public adjuster, other dispute resolution options include:

- Negotiation: Directly negotiating with your insurer using your documentation and estimates.

- Appraisal Process: If your policy has an appraisal clause, independent appraisers and an umpire resolve disputes over the loss amount.

- Mediation: A neutral third party helps you and the insurer reach an agreement.

If you believe your insurer acted in bad faith, consider filing a complaint with the Texas Department of Insurance. They oversee insurance practices in the state. The National Association of Insurance Commissioners (NAIC) also provides helpful consumer information: Guidance from the National Association of Insurance Commissioners (NAIC).

You don’t have to steer these complex insurance claim process steps alone. An expert on your side can make all the difference in securing the fair settlement your commercial property deserves.