Understanding Public Adjusters: Your Advocate in Insurance Claims

A public adjuster definition is an independent insurance professional licensed by the state to represent policyholders in preparing, filing, and negotiating first-party property insurance claims. Unlike insurance company adjusters who work for the insurer, public adjusters exclusively represent you—the policyholder.

What is a Public Adjuster? (Quick Definition)

| Term | Definition |

|---|---|

| Public Adjuster | A licensed insurance professional who works exclusively for policyholders (not insurance companies) to help document, file, and negotiate insurance claims for maximum settlement. |

| Key Duties | – Evaluates property damage – Documents and estimates repair costs – Interprets policy language – Negotiates with insurance companies – Advocates for fair settlements |

| How They’re Paid | Typically 5-20% of the final settlement amount (often capped by state law) |

| When to Hire | After significant property damage, when facing a complex claim, or when an insurer’s offer seems too low |

Filing a homeowners insurance claim after a disaster can be overwhelming. Between documenting damage, understanding policy language, and negotiating with insurance companies, many property owners feel unprepared and outmatched. That’s where a public adjuster comes in.

Public adjusters are not free—they typically charge between 5% and 20% of your final settlement, with some states capping fees (like Texas at 10%). However, data suggests they often help secure significantly higher payouts. According to studies, homeowners who hired public adjusters received an average settlement of $22,266, compared to $18,659 for those handling claims themselves.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support LLC who has settled hundreds of millions in property damage claims while consistently increasing settlement amounts and helping policyholders understand the importance of proper public adjuster definition and representation during the claims process.

Basic public adjuster definition glossary:

– fire claims public adjuster

– homeowners insurance claims adjuster

– National Association of Public Insurance Adjusters

Public Adjuster Definition: What It Really Means

When disaster strikes your home or business, the last thing you need is to steer the insurance claim process alone. This is where a public adjuster enters the picture – your personal advocate in what can feel like an uphill battle with insurance companies.

A public adjuster is a licensed professional who works exclusively for you, the policyholder. Unlike adjusters hired by insurance companies, public adjusters have one loyalty: helping you receive the maximum settlement possible under your policy.

Think of a public adjuster as your insurance translator and negotiator. They speak the complex language of insurance policies fluently and understand exactly what you’re entitled to receive. The best part? They only get paid when you do – working on a contingency fee basis means their success is directly tied to yours.

What makes public adjusters different is their fiduciary duty to act in your best interest. They’re legally bound to represent you fairly and honestly, a responsibility they don’t take lightly. Statistics consistently show that policyholders who hire public adjusters typically receive larger settlements – though they can’t get you more than what your policy allows.

Formal Public Adjuster Definition

The official public adjuster definition varies slightly from state to state, but the core meaning remains consistent. For example, Kentucky Revised Statute (KRS 304.9-020) defines a public adjuster as:

“Any person who, for compensation, acts on behalf of an insured in negotiating for or effecting the settlement of a claim or claims for loss or damage under any policy of insurance covering real or personal property.”

This formal definition highlights the professional nature of the role. Public adjusters aren’t casual consultants – they’re highly regulated professionals who must:

- Pass a rigorous licensing exam

- Complete ongoing education requirements

- Maintain a bond (typically $20,000) to protect consumers

- Carry errors and omissions insurance

- Follow a strict professional code of ethics

Plain-English Public Adjuster Definition

Let’s break down the public adjuster definition into everyday language. Simply put, a public adjuster is your personal insurance claim helper and settlement maximizer.

When your Texas home suffers damage from a tornado, fire, or hurricane, a public adjuster becomes your paperwork navigator and advocate. They roll up their sleeves and:

Become your eyes and ears by thoroughly inspecting property damage, often finding issues that might be overlooked.

Speak insurance language by interpreting your policy’s complicated terms and conditions.

Handle the heavy lifting by preparing and filing all necessary documentation.

Stand up for your rights by negotiating directly with insurance representatives.

Fight for every dollar you deserve under your policy limits.

The public adjuster definition might seem technical, but their purpose is beautifully simple: to level the playing field between everyday property owners and insurance giants. When you’re feeling overwhelmed after a disaster in Austin, Dallas, Houston, or anywhere in Texas, having someone exclusively in your corner can make all the difference in your recovery journey.

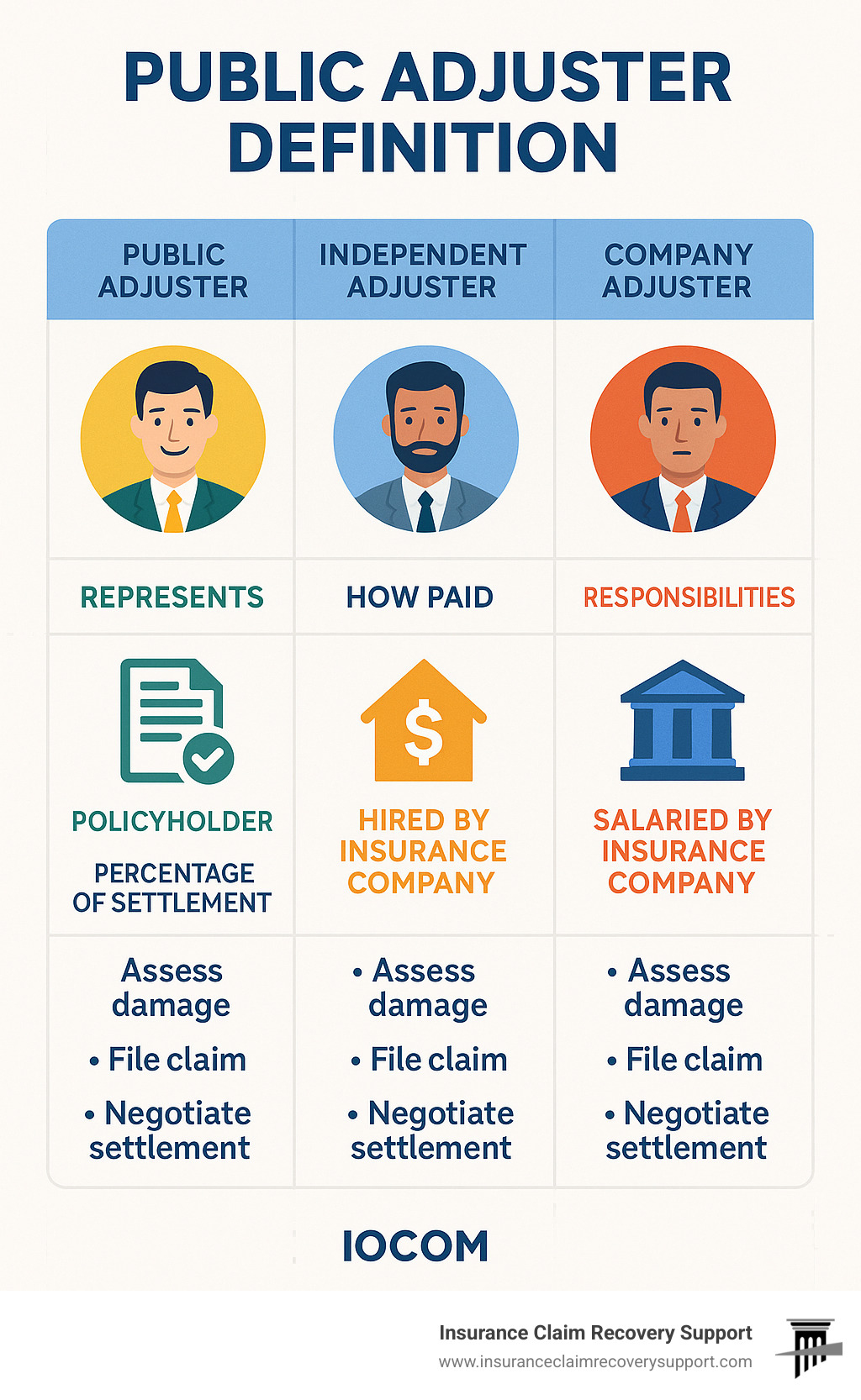

Types of Insurance Adjusters & Who They Represent

When filing an insurance claim, you’ll encounter different types of adjusters, each representing different interests. Understanding these differences is crucial to navigating the claims process effectively.

| Type of Adjuster | Who They Work For | Who Pays Them | Primary Goal | Negotiation Authority |

|---|---|---|---|---|

| Staff/Company Adjuster | Insurance Company | Insurance Company | Minimize Company Payout | Limited by Company Guidelines |

| Independent Adjuster | Insurance Company | Insurance Company | Process Claims for Insurer | Limited by Company Guidelines |

| Public Adjuster | Policyholder | Policyholder | Maximize Policyholder Recovery | Full Authority to Represent Policyholder |

Staff/Company Adjusters are direct employees of the insurance company. While they may be professional and courteous, their primary loyalty is to their employer. Their job performance is often measured by how well they control costs for the insurance company.

Independent Adjusters are contractors hired by insurance companies. They’re not employees, but they still represent the insurer’s interests. Insurance companies often use independent adjusters during disaster situations when their staff adjusters are overwhelmed.

Public Adjusters work exclusively for policyholders. They have a fiduciary duty to represent your interests only. By law, they cannot represent both the insurer and the insured in the same claim—this would create a conflict of interest. The ban on dual representation is designed to protect consumers.

As we often tell our clients in Austin, Dallas, Houston, and throughout Texas: “When you hire a public adjuster, you’re leveling the playing field. The insurance company has professionals working for them—shouldn’t you?”

When & Why to Hire a Public Adjuster

Life throws curveballs sometimes – especially in Texas, where Mother Nature seems to have a personal vendetta against our homes. When disaster strikes and you’re facing a mountain of insurance paperwork while still processing the emotional impact of property damage, a public adjuster can be your greatest ally.

Large or Complex Losses

Not every fender-bender needs a lawyer, and similarly, not every insurance claim needs a public adjuster. But when you’re dealing with significant damage, the stakes get much higher:

Fire damage can be particularly devastating, with complex smoke and water damage that’s easy to miss. Hurricane or tornado damage often affects multiple parts of your property in ways that aren’t immediately visible. Lightning strikes can cause electrical system damage throughout your home, while freeze damage might not show itself until pipes thaw and begin leaking inside walls. Flood damage (which requires separate coverage from standard homeowners policies) presents its own unique challenges with mold and structural concerns.

Business interruption claims are another area where public adjusters shine – they understand how to document not just physical damage but lost income and ongoing expenses during recovery.

Challenging Claim Situations

Here in Texas, from Austin’s surprise hailstorms to San Angelo’s wildfire threats, we’ve seen countless homeowners struggle with insurance claims. You might benefit from professional help if:

Your insurer’s offer seems significantly underestimated compared to the actual damage. The settlement gap we typically see is substantial – policyholders with public adjusters receive an average of $22,266 versus just $18,659 for those handling claims themselves.

You’re simply too busy to manage the complex claims process yourself. Between work, family, and trying to keep your life on track after property damage, the hours required for proper documentation can be overwhelming.

The stress of dealing with insurance adjusters is affecting your wellbeing. Having someone in your corner who speaks the language of insurance can provide immense relief.

You need expert interpretation of your policy’s fine print. Those 30+ pages of insurance jargon contain important details about what’s covered – and what’s not.

Pros of Hiring

Higher Settlement Potential is the most obvious benefit. Public adjusters know what to look for and how to document it properly. They understand fair market repair costs and won’t let insurance companies undervalue the work needed.

Expert Documentation makes all the difference. Your public adjuster brings professional tools and methods to capture evidence of all damage – including hidden problems that might not surface until months later.

Policy Interpretation expertise helps you understand what you’re actually entitled to receive. Most homeowners read their policies only once (if ever), while public adjusters work with these contracts daily.

Bad-Faith Leverage can be crucial if your insurance company unreasonably denies or delays your claim. Having a professional documenting everything provides valuable evidence should legal action become necessary.

Cons & Cost Considerations

Let’s be transparent about the costs: Public adjusters typically charge between 5% and 20% of your final settlement amount. Here in Texas, state law caps these fees at 10%, which helps protect consumers.

For smaller claims under $10,000, the math might not work in your favor. If a public adjuster increases your $8,000 claim to $10,000 but charges a 10% fee, you’ll actually net less than handling it yourself.

Your deductible still applies regardless of whether you hire help. The adjuster’s fee comes from the settlement after your deductible is subtracted.

For more detailed information about what these services might cost in your specific situation, visit our page about Public Adjuster Fees for Property Damage Claims.

When storms roll through Dallas, Houston, or San Antonio, having a professional public adjuster by your side can make the difference between a fair recovery and years of financial struggle. They’re not just claim processors – they’re advocates who understand both the technical aspects of property damage and the human impact of disaster recovery.

How Public Adjusters Work: Process, Contracts & Compliance

When you hire a public adjuster, you’re engaging a professional who follows a structured process to maximize your claim recovery:

-

Initial Inspection: The adjuster conducts a thorough examination of all damage to your property.

-

Damage Scope Development: They create a detailed inventory of all damaged items and necessary repairs.

-

Estimate Preparation: Using industry-standard software and pricing, they prepare a comprehensive repair estimate.

-

Claim Filing: They compile and submit all necessary documentation to your insurance company.

-

Negotiation: They advocate on your behalf with the insurance company’s adjusters.

-

Settlement: They work to secure the maximum settlement allowed under your policy.

In Texas, public adjusters must comply with specific regulations outlined by the Texas Department of Insurance. For official guidelines, visit the Texas Department of Insurance page on public adjusters.

Compensation & Fee Caps Explained

Most public adjusters work on a contingency basis, meaning they only get paid if you receive a settlement. Fees typically range from 5% to 20% of the final settlement amount, with variations based on:

- Claim complexity

- Damage severity

- Geographic location

- State regulations

In Texas, public adjuster fees are capped at 10% of the insurance settlement. This cap helps protect consumers while still allowing adjusters to provide valuable services.

Negotiation Tip: For very large claims, you may be able to negotiate a lower percentage fee. Some adjusters are willing to work on a sliding scale, with the percentage decreasing as the claim amount increases.

Finding & Vetting a Reputable Public Adjuster

When selecting a public adjuster, due diligence is essential:

-

Verify Licensing: Check with your state’s insurance department to confirm the adjuster is properly licensed. In Texas, you can verify licenses through the Texas Department of Insurance website.

-

Check Professional Associations: Membership in organizations like the National Association of Public Insurance Adjusters (NAPIA) or the Texas Association of Public Insurance Adjusters (TAPIA) indicates a commitment to professional standards.

-

Request References: Ask for and contact past clients, particularly those with similar claims to yours.

-

Read Online Reviews: While not definitive, online reviews can provide insight into others’ experiences.

-

Interview Multiple Adjusters: Don’t settle for the first adjuster you meet, especially after a disaster.

For more guidance on selecting the right public adjuster, see our article on What is a Good Public Adjuster?

Red Flags & Scam Avoidance

Unfortunately, disasters often attract unscrupulous individuals. Watch for these warning signs:

-

Door-to-Door Solicitation: Be wary of adjusters who go door-to-door after a disaster. In Texas, this practice is prohibited.

-

Pressure Tactics: Legitimate adjusters will give you time to review contracts and make decisions.

-

Upfront Fees: Most reputable public adjusters work on contingency and don’t require payment upfront.

-

Dual Contractor Roles: In many states, including Texas, it’s illegal for someone to act as both your contractor and your public adjuster for the same claim.

-

Too-Good-To-Be-True Promises: Be skeptical of anyone guaranteeing specific settlement amounts or promising to get your claim paid regardless of coverage.

Public Adjuster vs. Attorney & Other Claim Advocates

When you’re struggling with an insurance claim, knowing who to turn to can make all the difference. Let’s explore your options for professional help.

Public Adjusters are the specialists of the insurance claim world. They excel at documenting property damage, preparing thorough claims, and negotiating settlements with insurance companies. If your home in Austin was damaged by a storm or your San Antonio business suffered fire damage, a public adjuster is typically your best first advocate—especially when you believe you’re covered but the settlement offer seems too low.

Attorneys enter the picture when legal complications arise. While public adjusters handle the nuts and bolts of claim valuation, attorneys become necessary when:

- Your insurer has denied coverage that appears legitimate

- You suspect bad-faith practices (like unreasonable delays or dishonest claim handling)

- Negotiations have completely stalled despite clear evidence

- You need representation in court proceedings

The differences between these professionals are significant. Attorneys typically charge higher fees—often 33-40% of your recovery plus expenses, compared to the 10% cap for public adjuster fees in Texas. Only attorneys can represent you in court, but they may not have the specialized knowledge of building materials, construction costs, and insurance policy interpretation that experienced public adjusters possess.

Collaboration Scenarios

In complex cases, especially after major disasters in places like Houston or Lubbock, we sometimes see public adjusters and attorneys working as a team. The public adjuster handles the detailed damage documentation and valuation aspects, while the attorney addresses potential legal violations or bad-faith issues.

This partnership can be particularly effective for large commercial claims or when insurance companies are overwhelmed following widespread disasters like the Texas freeze events or Gulf Coast hurricanes.

When to Escalate

As a Texas property owner, you should consider consulting an attorney if:

Your claim has been denied despite your public adjuster’s assessment that it should be covered

You’ve received communications suggesting bad-faith practices

The statute of limitations on your claim is approaching (typically two years from the date of loss in Texas)

You’ve received a final denial letter after multiple attempts at resolution

As a policyholder, you have rights throughout the claims process. These include the right to choose your own representation, the right to appeal claim decisions, and the right to fair treatment from your insurance company.

Many property owners in Waco, Round Rock, and throughout Texas start with a public adjuster and only escalate to legal representation if absolutely necessary. This approach often provides the best balance of expertise and cost-effectiveness.

For more information about the various insurance adjustment services available to you, visit our Insurance Adjustment Services page.

Frequently Asked Questions about Public Adjusters

Can a public adjuster guarantee a higher settlement?

No ethical public adjuster can guarantee a specific settlement amount or promise they’ll get you more money than you could on your own. That would be like a doctor promising to cure you before examining you!

What a good public adjuster definition includes is someone who offers their expertise in:

- Thoroughly identifying all covered damages (even the hidden ones)

- Properly documenting your loss with professional tools and methods

- Understanding complicated policy language that most homeowners find confusing

- Negotiating effectively with insurance companies who handle thousands of claims yearly

While statistics consistently show public adjusters often help secure higher settlements, every claim is unique. Think of it this way: insurance companies have professionals working to minimize their payout – having your own professional advocate simply levels the playing field.

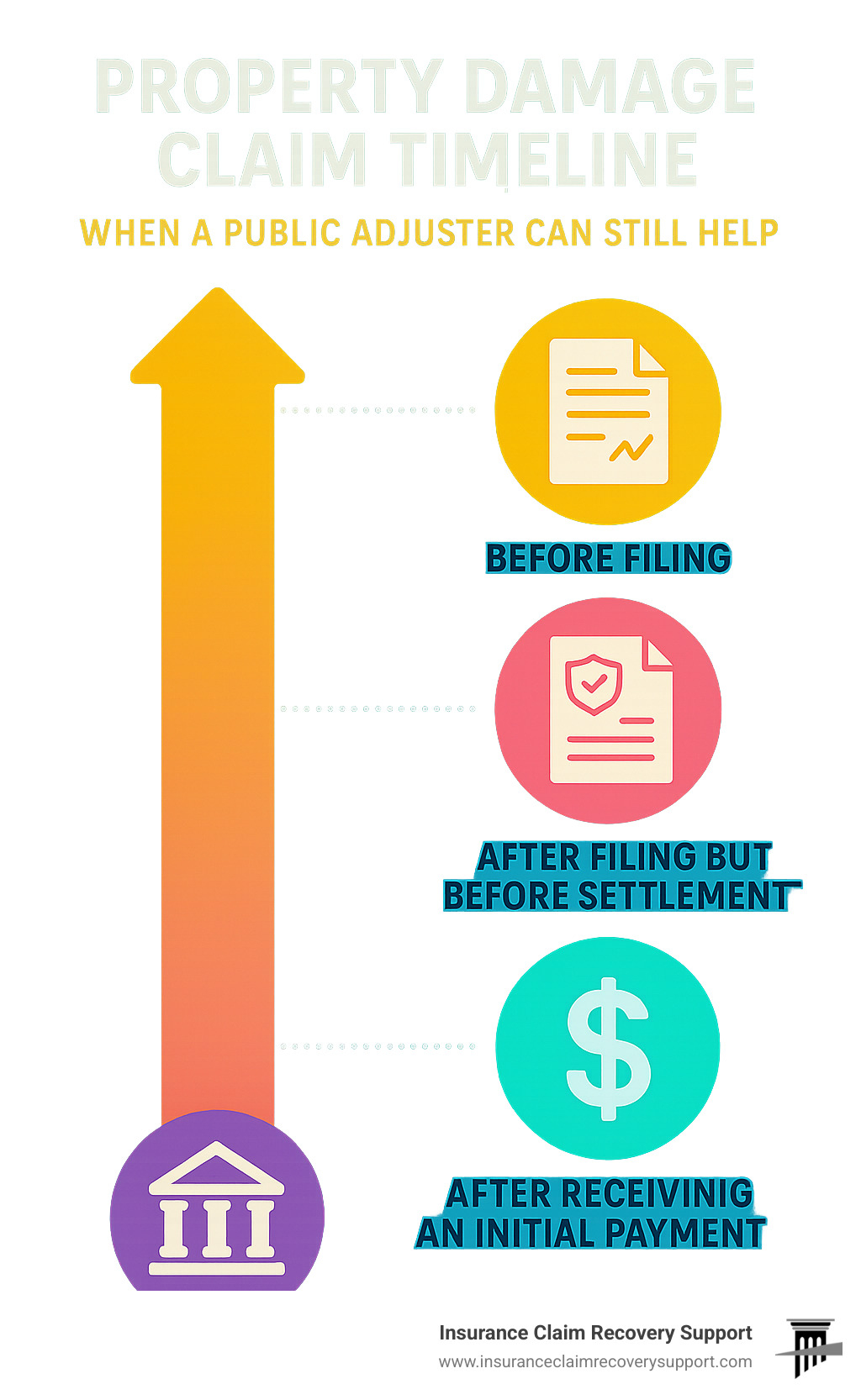

Is it too late to hire one after I’ve filed or been paid?

It’s rarely too late to bring in a professional! Public adjusters can jump in at almost any stage of your claim:

Before filing is ideal timing, as they can help from day one, but that’s not always possible when you’re dealing with sudden disasters.

After filing but before settlement is still very effective – they can review what’s been submitted and strengthen your position.

After receiving an initial payment is common – many Texas homeowners call us after realizing their insurance company’s first offer won’t cover all repairs.

After accepting a final settlement might still work – in Texas and many states, property insurance claims can typically be reopened within two years of the loss date, provided you haven’t signed a release or waiver.

I’ve personally helped many Austin and Houston homeowners who initially tried handling claims themselves but became overwhelmed by the process. It’s never too late to ask for help!

What should be in a public adjuster contract?

A proper public adjuster contract should be clear and straightforward – if it reads like confusing legal jargon, that’s a red flag! Here’s what you should expect to see:

Clear Fee Structure – The percentage or flat fee should be plainly stated. In Texas, this is capped at 10% of your settlement.

Scope of Services – What exactly will the adjuster do for you? This should cover inspections, documentation, filing, and negotiation.

Cancellation Rights – Texas law gives you a 72-hour cooling-off period to change your mind after signing.

Term of Agreement – How long will the contract remain in effect? Most run until your claim is settled.

Signatures and Dates – Both you and the adjuster must sign and date the agreement.

License Information – The adjuster’s license number should appear on the contract – this lets you verify they’re legitimate.

Disclosure of Rights – Texas requires specific disclosures about your rights as a consumer.

Before signing anything, read it carefully over a cup of coffee – not in the stressful moments after a disaster. Don’t hesitate to ask questions, and if something isn’t clear, request clarification in writing. A reputable public adjuster will be happy to explain everything in plain English.

This is a business relationship that could impact thousands of dollars in your recovery. Take the time to understand exactly what you’re agreeing to before moving forward.

Conclusion

When disaster strikes your home or business, understanding the public adjuster definition isn’t just academic—it’s practical knowledge that can make a real difference in your recovery. We’ve walked through what these professionals do, how they work, and when they might be worth their fee.

Think of public adjusters as your personal guides through the insurance maze. They’re the experts who level the playing field between you—a policyholder who might file one major claim in a decade—and insurance companies that handle thousands of claims every day.

The value of a public adjuster often shows up in the details: the hidden water damage they find behind walls, the proper valuation of your heirloom furniture, or their ability to interpret those confusing policy exclusions written in what sometimes feels like another language. Their expertise can transform an overwhelming process into a manageable one, giving you space to focus on rebuilding your life rather than fighting for what your policy promises.

While not every claim needs professional help, knowing when to bring in an advocate can save you significant time, stress, and often money. Whether you’re dealing with fire damage in Austin, tornado recovery in Dallas, hurricane aftermath in Houston, or freeze damage in San Antonio, having someone exclusively in your corner makes a difference.

At Insurance Claim Recovery Support LLC, we’ve helped property owners across Texas and nationwide steer the claims process and secure fair settlements. Our team understands that behind every claim is a family or business owner trying to put the pieces back together after a disaster.

As a policyholder, you have rights—including the right to professional representation during your claim. You’ve faithfully paid your premiums, and when disaster strikes, you deserve the full benefit of the coverage you purchased.

For more information about how professional public adjusters can help with your specific situation, visit our public insurance adjuster services page.

When it comes to recovering from property damage, you don’t have to go it alone. Professional help is available to ensure you receive every dollar you’re entitled to under your policy—no more, no less.