The Real Cost of Expertise: What You’ll Pay for Public Adjuster Services

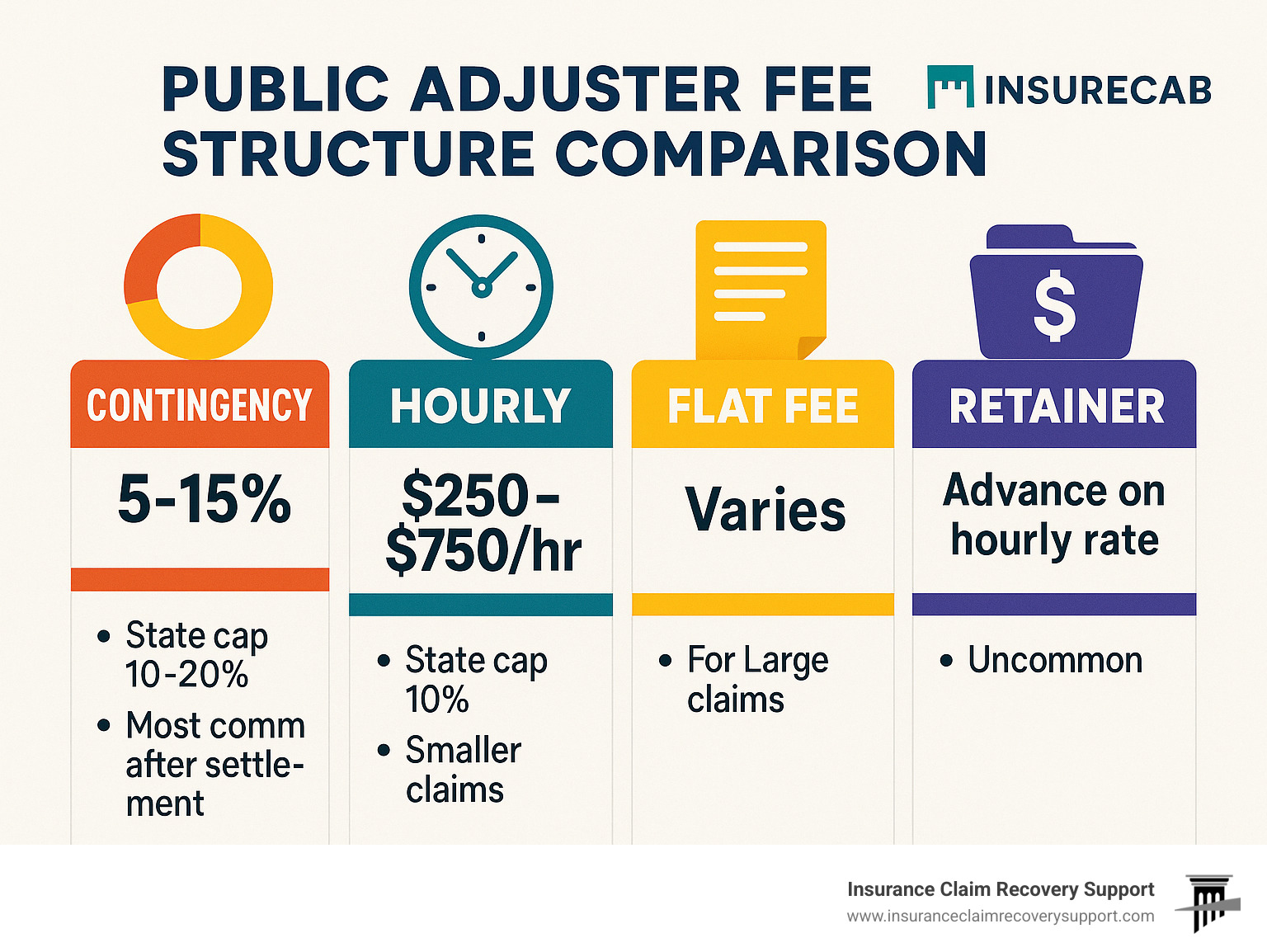

Public adjuster rates typically range from 5-15% of your final insurance settlement, with most states capping fees between 10-20%. Here’s what you can expect to pay:

| Fee Structure | Typical Range | When It’s Used |

|---|---|---|

| Contingency Fee | 5-15% | Most common; paid only after settlement |

| Hourly Rate | $250-$750/hour | Rare; used for smaller claims |

| Flat Fee | Varies by project | For straightforward large claims |

| Retainer | Advance on hourly rate | Held in trust account; uncommon |

When disaster strikes your property, navigating the complex maze of insurance claims can feel overwhelming. Whether you’re dealing with fire damage to your commercial building, hail damage to your apartment complex, or hurricane destruction to your retail center, the process of documenting losses and negotiating with insurance companies often requires specialized expertise.

Public adjusters represent you – not the insurance company – and work to maximize your settlement. But this expertise comes at a price.

Most public adjusters work on a contingency basis, meaning they only get paid when you do. Their fees are regulated in most states, with important variations you should understand before signing any agreement.

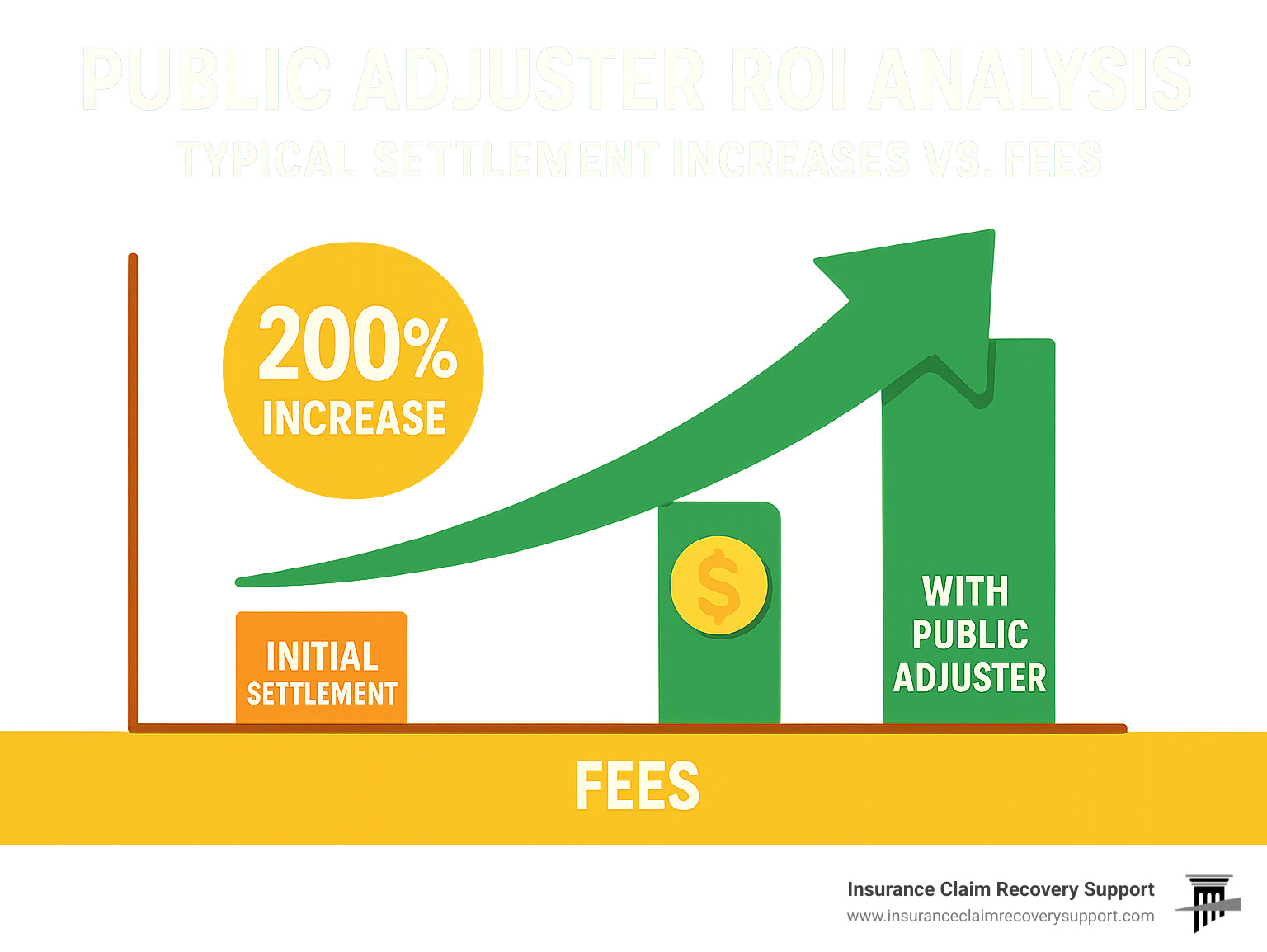

The good news? Studies show that policyholders who use public adjusters often receive settlements 2-3 times higher than those who don’t, even after accounting for the adjuster’s fee.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled hundreds of millions in commercial and multifamily property damage claims with public adjuster rates that have consistently delivered net positive outcomes for my clients while avoiding unnecessary litigation.

What Does a Public Adjuster Do?

Picture this: Your property has been damaged, you’ve filed a claim, and now you’re facing an insurance company with teams of professionals whose job is to minimize payouts. Who’s in your corner? That’s where a public adjuster comes in.

Public adjusters are the advocates you didn’t know you needed until disaster strikes. Unlike the adjuster sent by your insurance company, a public adjuster works exclusively for you, the policyholder. They’re your personal guide through the insurance claim maze.

When your Houston high-rise suffers water damage or your Dallas warehouse faces fire recovery, a public adjuster becomes your property damage detective, policy interpreter, and negotiation specialist all rolled into one.

Their core responsibilities include conducting thorough damage assessments that catch both obvious and hidden damage your insurer might miss. They’ll dive deep into your policy’s fine print, identifying coverages you might not even know exist. Then they’ll carefully document every loss, prepare comprehensive claims, and negotiate with insurance representatives who negotiate claims for a living.

In places like San Antonio, Austin, and other Texas cities where hailstorms, floods, and hurricanes are unfortunate realities, public adjuster rates are often a worthwhile investment when facing catastrophic damage. They bring specialized expertise to complex losses that most property owners simply don’t have.

When Should You Hire One?

Not every fender-bender needs a lawyer, and not every insurance claim needs a public adjuster. Here’s when bringing in this professional makes financial sense:

When you’re dealing with disputes over $10,000 or more, the math starts working in your favor. For smaller claims, the adjuster’s fee might eat too much of your settlement to be worthwhile.

If you’ve received a denial letter or an offer that seems suspiciously low, a public adjuster can often spot the discrepancies and fight for fair compensation. As one client in Round Rock told us: “The insurance company offered $85,000 for my commercial building damage. My public adjuster found another $120,000 in legitimate damages they missed. Even after the 10% fee, I came out $93,000 ahead.“

After disaster declarations, when adjusters from insurance companies are handling hundreds of claims simultaneously, having your own dedicated advocate ensures your file doesn’t get lost in the shuffle.

Commercial property claims often justify professional help more than residential ones, as business interruption calculations and complex building systems require specialized knowledge to properly assess.

Pros & Cons to Weigh

Before signing with a public adjuster, consider both sides of the equation:

On the plus side, statistics consistently show higher payouts with professional representation. Most work on contingency, meaning no upfront fees come out of your pocket. They also save you countless hours of paperwork, research, and frustrating phone calls.

The drawbacks? Their fee will come from your settlement, reducing your net recovery. Once you sign a contract, you’re typically committed for a specified period. Adding another party to the process can sometimes create an additional communication layer with your insurer.

The quality of public adjusters varies significantly, which is why firms like Insurance Claim Recovery Support focus on proven results and transparent public adjuster rates.

Think of it this way: When facing a serious legal matter, most people wouldn’t represent themselves in court. Similarly, when facing a significant property claim, having professional representation often makes the difference between an adequate settlement and one that truly makes you whole.

How Public Adjuster Fee Structures Work

Understanding how public adjusters charge for their services is essential before signing any agreement. While contingency fees are most common, several other fee structures exist, each with its own advantages and appropriate applications.

Contingency Percentages Explained

Contingency fees are the most prevalent payment structure in the public adjusting industry. Under this arrangement, the adjuster receives a percentage of the final settlement amount, typically ranging from 5% to 20%.

The core principle is simple: no recovery, no fee. This aligns the adjuster’s financial interests with yours—they only get paid when you do, and the more they recover for you, the more they earn.

Key aspects of contingency arrangements include:

- Standard percentages: Most commonly 10-15% for standard claims

- Sliding scales: Some adjusters use regressive scales where the percentage decreases as the settlement amount increases (e.g., 20% on the first $100,000, 15% on the next $100,000, and 10% thereafter)

- “New money only” arrangements: Some adjusters charge only on the additional amount they secure beyond what the insurance company initially offered

As one Dallas commercial property owner explained: “After a major fire, my insurer offered $250,000. My public adjuster secured $450,000 and charged 10% of the total. While $45,000 seemed substantial, the $155,000 net increase made it worthwhile.”

Hourly, Flat & Retainer Options

While less common than contingency arrangements, these alternative fee structures serve specific purposes:

Hourly Rates:

– Range from $250-$325 in rural areas to $325-$750+ in major metropolitan areas like Houston or Dallas

– Typically include a minimum fee (often around $2,500)

– Best for smaller, straightforward claims where the outcome is predictable

– May include a cap to ensure fees don’t exceed a reasonable percentage of recovery

Flat Fees:

– One-time charge for handling the entire claim

– Most appropriate for large, straightforward claims with clear outcomes

– Should clearly specify what services are included and what might cost extra

– Provides budget certainty but doesn’t scale with unexpected claim developments

Retainer Fees:

– Advance payment held in a trust account

– Deducted as hourly work accrues

– Usually non-refundable if you discharge the adjuster without cause

– Less common in residential claims, more prevalent in complex commercial situations

When considering these options, always ensure:

1. The fee structure is documented in writing

2. You understand what expenses might be charged separately

3. The agreement includes provisions for periodic, itemized billing

Typical Public Adjuster Rates Across the U.S.

When it comes to public adjuster rates, there’s quite a range across America. Think of it like coffee prices—they vary depending on where you are, what you’re getting, and the local market conditions.

Most public adjusters nationwide charge between 5% and 15% of what they help you recover. It’s like their way of saying, “We’re confident we can get you more money, and we’ll only take a slice of what we help you win.”

The actual percentage you’ll pay depends on several factors. For larger claims over $100,000, you’ll typically see fees between 10-20%. Smaller claims might actually cost a higher percentage (25-40%) since there’s a minimum amount of work required regardless of claim size—kind of like how a short Uber ride still has a minimum fare.

Location matters too. Urban areas like Houston or Dallas typically command higher rates than rural Texas communities, simply because of the higher cost of doing business in metropolitan areas.

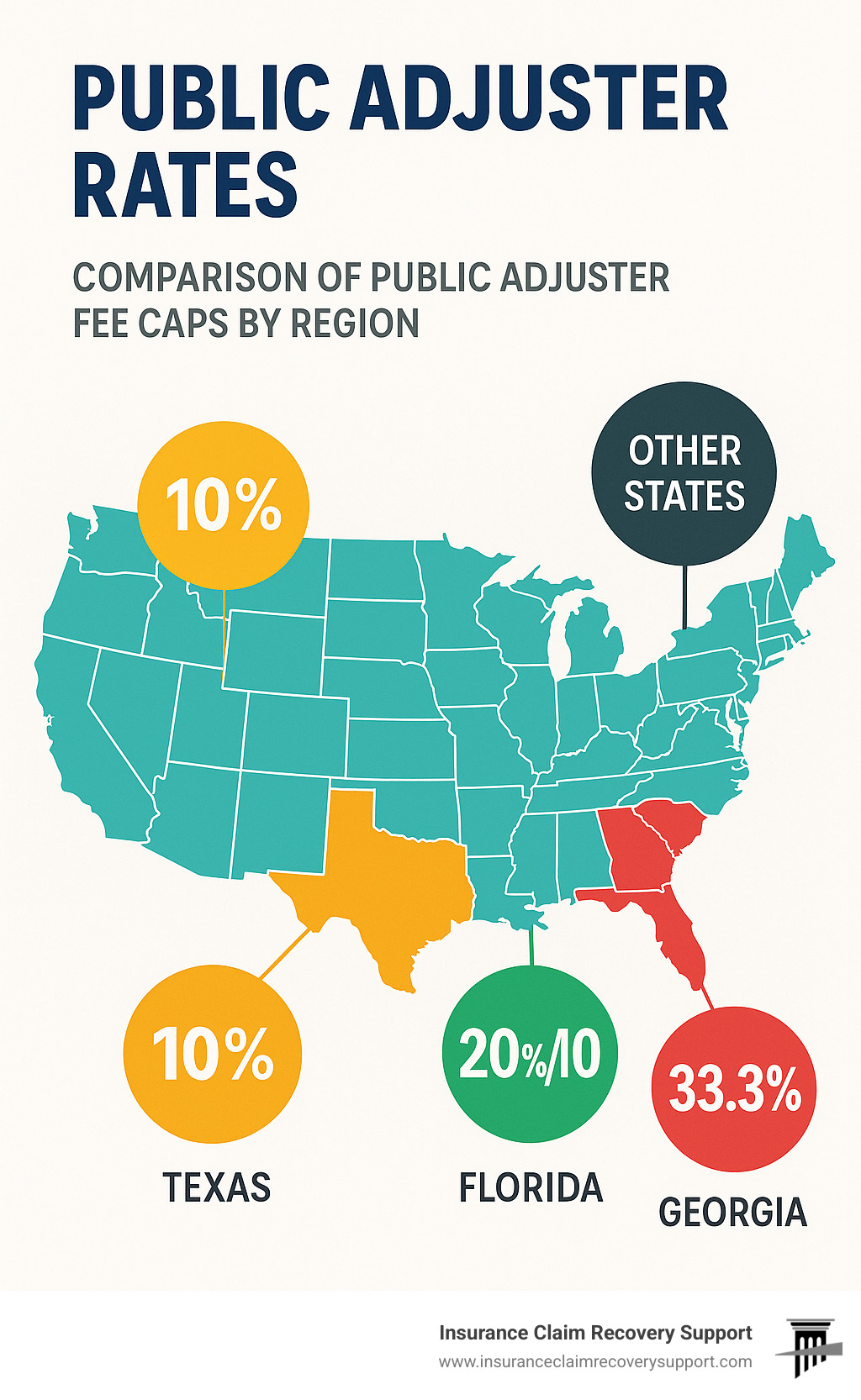

State-by-State Fee Caps

Many states have put limits on what public adjusters can charge to protect consumers from potential price gouging:

Here in Texas, the maximum allowed is 10% of your settlement—straightforward with no exceptions, even after disasters like the hurricanes that occasionally hammer our Gulf Coast.

Florida has an interesting approach—up to 20% normally, but this drops to 10% during the first year after a declared emergency. Smart thinking to protect folks when they’re most vulnerable.

Georgia allows one of the highest caps in the nation at 33.3% of the settlement amount, while neighboring states like Illinois and Michigan cap fees at a more modest 10%.

Some states get creative with their regulations. Delaware uses a tiered approach: 2.5% for the first $25,000 and 12% for amounts above that. New York varies by region—12.5% in the NYC area and 10% elsewhere.

Louisiana stands alone in requiring hourly rates rather than percentage fees, making it the odd duck in the public adjusting pond.

Several states don’t specify caps but require fees to be “reasonable”—a wonderfully vague term that leaves room for interpretation and negotiation.

Special Rules After Disasters

When disaster strikes—and in Texas, we’re no strangers to hurricanes, tornadoes, and wildfires—many states implement special protections for policyholders.

Florida’s system is perhaps the most policyholder-friendly, cutting the maximum fee in half during the first year after a declared emergency. This helps ensure that folks rebuilding their lives keep more of their insurance settlements when they need it most.

After Hurricane Harvey swamped Houston in 2017, many public adjusters voluntarily reduced their rates to help affected communities recover. This kind of community-minded response has become increasingly common throughout Texas and the Gulf Coast region following major disasters, even when not legally required.

Kentucky, Maryland, and Mississippi also have special provisions that kick in after disasters. Here in Texas, while the 10% cap remains unchanged, enforcement tends to become more vigilant during disaster recovery periods.

Where Public Adjusters Aren’t Allowed

Believe it or not, some states don’t recognize public adjusters at all. If you’re in Alabama, you’re out of luck—they don’t license or recognize public adjusters whatsoever.

Arkansas has a curious split approach—public adjusters can help with commercial claims but are prohibited from handling homeowners insurance claims. South Dakota and Wisconsin simply don’t have licensing programs for public adjusters.

In these states, policyholders typically turn to attorneys, insurance consultants, or contractors for help with claims. These alternatives operate under different rules and usually have different fee structures—often hourly rates for attorneys or consultation fees for contractors.

For Texans, we’re fortunate to have access to licensed public adjusters who can help steer the often murky waters of insurance claims, especially after the severe storms that frequently visit our state.

More info about Public Insurance Adjuster

State Regulations & Consumer Protections

When you’re dealing with a property damage claim, knowing the rules that protect you is just as important as understanding public adjuster rates. States have created a safety net of regulations to ensure you’re treated fairly when working with public adjusters.

Think of these protections as your insurance policy for the insurance claim process. Most states require public adjusters to pass rigorous licensing exams, undergo thorough background checks, and stay current with continuing education. This means the person helping with your claim should be qualified and knowledgeable.

Ever had a salesperson knock on your door at an inconvenient time? Many states prevent this by restricting when public adjusters can approach you after a disaster—typically not between 6 PM and 8 AM, and often not during the first 24-48 hours after a loss. This gives you breathing room when you’re most vulnerable.

Your agreement with a public adjuster isn’t just a handshake deal. States require detailed written contracts that clearly spell out services and fees. And if you sign but have second thoughts? Good news—most states provide a 3-5 day “cooling-off period” where you can cancel without penalty.

Financial protections are built into the system too. Client funds must be kept in separate trust accounts, and adjusters typically need to maintain surety bonds of $10,000-$50,000. Think of these bonds as security deposits that protect you if something goes wrong.

Verifying License & Reputation

Before handing over your claim to anyone, take a few minutes to check their credentials. It’s like reading reviews before trying a new restaurant—but with much higher stakes!

Start by confirming they’re properly licensed. In Texas, the Department of Insurance makes this easy with their license lookup tool. A quick search can save you from potential headaches down the road.

Professional memberships matter too. If your adjuster belongs to the National Association of Public Insurance Adjusters (NAPIA), that’s a good sign they’re committed to ethical standards and ongoing professional development.

Don’t be shy about asking for references or checking online reviews. As one San Antonio business owner told us: “The hour I spent checking credentials and talking to past clients was the best time investment I made. It gave me confidence I was working with a true professional.”

Make sure your adjuster has handled claims similar to yours. Someone who specializes in hurricane damage might not be your best choice for a fire claim. Experience with your specific type of property—whether it’s a small home or a large commercial building—is equally important.

What Must Be in the Contract

A solid public adjuster contract is your roadmap for the entire claims process. Here’s what should be clearly spelled out:

The fee percentage or rate should be front and center—no surprises about what you’ll pay. The contract should detail exactly what services are included, when and how the adjuster will be paid, and how either party can end the relationship if needed.

Pay special attention to any “new money” provisions that clarify whether fees apply to the entire settlement or only to amounts above what the insurance company initially offered. The contract should also outline your responsibilities for providing documentation and how out-of-pocket expenses will be handled.

In Texas and many other states, these contracts aren’t just suggestions—they must include specific language required by law. This standardization helps ensure you understand exactly what you’re agreeing to.

Are Fees Negotiable?

Yes! Public adjuster rates are often open to discussion, particularly for larger claims. Don’t be afraid to negotiate—it’s expected and respected in the industry.

If you’re facing a substantial loss over $250,000, you have considerable leverage to ask for lower percentages. You might suggest a sliding scale where the percentage decreases as the recovery amount increases, or propose a maximum dollar amount regardless of the final settlement.

For commercial properties with multiple buildings, ask about volume discounts. And consider requesting a “new money only” arrangement where you pay only on amounts above the insurer’s initial offer.

A Houston business owner shared this success story: “After flood damage to my warehouse, I negotiated the adjuster’s fee from 15% down to 10% with a $50,000 cap. On my $800,000 settlement, that saved me over $30,000.”

Remember though—the cheapest option isn’t always the best value. An experienced adjuster charging 12% might secure a significantly higher settlement than someone charging 8% but lacking the expertise to identify all your covered damages.

At Insurance Claim Recovery Support, we’re always transparent about our public adjuster rates and happy to discuss fee structures that make sense for your specific situation in Austin, Dallas, Houston, or anywhere across Texas.

Hiring Process & Money-Saving Tips

Finding the right public adjuster at a fair rate shouldn’t feel like another disaster. After helping hundreds of Texas property owners through this process, I’ve seen how a methodical approach can save you thousands while securing a much better settlement.

Start by interviewing at least three different adjusters. This gives you a feel for different personalities, approaches, and fee structures. During my years serving Austin and Houston clients, I’ve noticed that chemistry matters—you’ll be working closely with this person during a stressful time.

Match your adjuster’s expertise to your specific situation. Someone who specializes in commercial fire claims might not be your best choice for hurricane damage to your apartment complex. Similarly, an adjuster familiar with building codes in Dallas-Fort Worth will likely outperform someone from out of state when dealing with local insurers.

References tell the real story. Don’t just ask for them—call them. Ask specific questions about how the adjuster handled challenges, communicated throughout the process, and whether the final settlement exceeded expectations. A good adjuster will happily connect you with satisfied clients who had similar claims.

When it comes to payment, avoid upfront deposits. Most reputable adjusters work purely on contingency without requiring advance payment. If someone insists on money upfront, that’s often a red flag. Always get a written fee estimate that clearly projects both the percentage and estimated dollar amount before signing anything.

Step-by-Step to Engage an Adjuster

The journey with your public adjuster typically begins with a free consultation. This initial meeting allows the adjuster to inspect your property and evaluate your claim without any obligation on your part. It’s also your opportunity to gauge their professionalism and expertise.

After reviewing your policy and visible damage, they’ll provide a preliminary assessment of your claim’s potential. This isn’t a guaranteed number but should give you a realistic sense of what might be possible.

If you decide to move forward, you’ll receive a Letter of Representation (LOR) or service agreement outlining all fees and services. Read this carefully—it’s a binding contract that specifies exactly what you’ll pay and what you’ll receive in return.

Once engaged, your adjuster will thoroughly document all damage using photos, videos, and detailed notes. This comprehensive approach often reveals hidden damage that insurance company adjusters miss or undervalue.

“When my San Antonio apartment complex was hit by a tornado last year,” one client told me, “the insurance company offered $420,000. My public adjuster documented everything so thoroughly that we ultimately settled for over $900,000—more than double the initial offer. Even after the 10% fee, we came out way ahead.”

The negotiation phase is where professional adjusters truly earn their keep. They’ll present your claim to the insurance company with supporting documentation and advocate firmly on your behalf. This process typically takes 60-90 days for complex claims, though simpler cases may resolve faster.

Maximizing Net Settlement After Fees

Smart property owners look beyond the public adjuster rates to focus on net results. Before signing, ask prospective adjusters for a rough estimate of how much additional recovery they believe is possible. While they can’t guarantee specific amounts, experienced adjusters should be able to provide a reasonable range based on similar claims they’ve handled.

For business properties, consult your tax advisor about potential deductibility of adjuster fees. In many cases, these can be treated as business expenses, effectively reducing their actual cost.

Throughout the claim process, maintain detailed records of all related expenses, including temporary repairs, mitigation efforts, and replacement costs. These often-overlooked items can significantly increase your total settlement.

Clarify payment timing upfront. Will the adjuster’s fee come directly from the settlement check, or will you pay them separately? Understanding this process prevents surprises when the funds arrive.

Before accepting any settlement, review the full breakdown of covered items with your adjuster. This final check ensures everything has been included and properly valued. Don’t hesitate to ask questions—a good adjuster welcomes this level of engagement.

Are Public Adjuster Rates Worth It? Cost-Benefit Analysis

The most important question for any property owner is whether public adjuster rates deliver positive ROI. While fees typically range from 5-15% of your settlement, the key metric is how much additional recovery the adjuster secures compared to what you’d receive on your own.

Industry data suggests that professionally represented claims often result in settlements 2-3 times higher than self-handled claims. A study from the Office of Program Policy Analysis and Government Accountability found that policyholders who used public adjusters received settlements 747% higher for hurricane claims than those who didn’t.

Let’s break down the cost-benefit analysis:

Real-World Scenario Breakdown

Consider this actual case from a commercial property in Dallas:

Initial insurance offer: $100,000 for roof and water damage

Public adjuster’s assessment: $180,000 in covered damage

Final negotiated settlement: $170,000

Adjuster’s fee (10%): $17,000

Net increase to policyholder: $53,000 ($170,000 – $100,000 – $17,000)

Return on investment: 311% ($53,000 gain on $17,000 fee)

Even with the 10% fee, the property owner received 53% more than the initial offer. This pattern is consistent across many claims, particularly those involving:

- Complex damage assessment (water intrusion, smoke damage)

- Business interruption calculations

- Code upgrade requirements

- Multiple buildings or structures

As one Lubbock business owner explained: “After a severe hailstorm, my insurer offered $230,000. My public adjuster documented additional damage and secured $410,000. Their 10% fee was $41,000, but I still netted an extra $139,000. The return on investment was clear.”

The value proposition typically improves with claim size, as the adjuster’s ability to identify overlooked damage and negotiate effectively becomes more significant with complex losses.

Frequently Asked Questions about Public Adjuster Rates

Do public adjuster fees come out of the total or only “new money”?

One of the most common questions we hear from property owners relates to exactly how the fee calculation works. The answer depends entirely on your contract terms.

Standard contingency agreements apply the percentage to the entire settlement amount you receive. However, some adjusters (including our team at Insurance Claim Recovery Support) offer “new money only” arrangements where we charge only on the additional amount secured beyond what the insurance company initially offered.

Let me break this down with a real-world example:

If your insurer initially offered $100,000 for your commercial property damage, and your public adjuster successfully negotiated a final settlement of $150,000:

- Under a standard 10% contingency: You’d pay $15,000 (10% of the total $150,000)

- Under a “new money only” 10% contingency: You’d pay just $5,000 (10% of only the $50,000 increase)

This difference can significantly impact your bottom line. Always clarify this point during your initial consultation, and make sure it’s clearly documented in your service agreement before signing.

Can I hire a public adjuster mid-claim?

Absolutely yes! You can engage a public adjuster at virtually any stage of the claims process.

Many Texas property owners initially try handling claims themselves—which is completely understandable—and then bring in professional help when they encounter resistance, delays, or receive what they believe is an inadequate offer.

There’s no penalty for waiting, though in my experience, adjusters can often provide the most value when involved from the beginning. In Texas and most other states, you can hire an adjuster even after:

– Receiving an initial settlement offer

– Accepting a partial payment

– During supplemental claim negotiations

– When finding previously unidentified damage

A property manager in Austin shared this experience with us: “Six months after settling my claim, I finded additional water damage the insurance company had missed. I hired a public adjuster who reopened the claim and secured an additional $85,000 for repairs that would have otherwise come out of my pocket.”

Will using a public adjuster slow my settlement?

This is perhaps the biggest misconception about working with public adjusters—and one that some insurance companies unfortunately perpetuate.

The reality? Public adjusters typically expedite claims rather than delay them.

While our documentation process is admittedly more thorough (which can take additional time upfront), this comprehensive approach leads to faster approval and fewer disputes later in the process. Claims with professional representation are far less likely to face those frustrating repeated requests for information or documentation that commonly delay the settlement process.

After Hurricane Harvey devastated Houston, many of our clients at Insurance Claim Recovery Support received settlements weeks or months before neighbors who handled claims themselves. Why? Because our documentation met all requirements the first time, eliminating the back-and-forth that often drags out the process.

The bottom line: while it might take a bit longer to build a proper claim initially, the overall timeline to receiving your full settlement is typically shorter with professional help—and the settlement amount is almost always substantially higher.

Conclusion

When you’re facing significant property damage, understanding public adjuster rates isn’t just about numbers—it’s about making a smart decision during a stressful time. While the typical 5-15% fee might initially seem substantial, the potential for dramatically increased settlements often makes this investment one of the wisest choices you’ll make during your recovery.

Here’s what you need to remember as you consider your options:

Most public adjusters work on a contingency basis, meaning they only get paid when you do. This alignment of interests ensures they’re motivated to maximize your settlement. State regulations provide important consumer protections, with fee caps ranging from 10% here in Texas to as high as 33.3% in Georgia.

After major disasters like hurricanes or widespread flooding, many states enforce special rules that reduce maximum allowable fees—a protection designed to help communities recover more quickly. And remember, these fees aren’t set in stone. For larger claims especially, there’s often room to negotiate better terms or sliding scale arrangements.

While alternative payment structures exist—hourly rates, flat fees, or retainers—these are less common for residential claims and typically make more sense in very specific commercial scenarios.

At Insurance Claim Recovery Support LLC, we’ve walked alongside property owners throughout Texas—from the busy streets of Austin and Dallas to the coastal communities of Houston, the historic neighborhoods of San Antonio, and everywhere in between. Our team specializes in commercial and multi-family property claims, bringing decades of combined experience to every case we handle.

Whether you’re dealing with fire damage that’s devastated your Fort Worth business, tornado destruction in Waco that’s left your property unrecognizable, or severe wind damage to your Round Rock investment property, we understand the unique challenges of Texas insurance claims. More importantly, we understand what it takes to secure the fair compensation you need for proper restoration.

The decision to hire a public adjuster should always be personal—based on your specific situation, the complexity of your claim, and your comfort level with insurance negotiations. While our fees represent an investment in your claim, the return—both financially and in reduced stress and frustration—makes professional representation invaluable for significant property damage claims.

For a friendly, no-pressure conversation about your specific claim and to understand how our fee structure would apply to your situation, reach out today. We’re here to help you make the best decision for your recovery, whether that includes our services or not.