Why Texas Property Owners Need Public Adjuster Services

Public adjuster services Texas are professional advocacy services that represent policyholders—not insurance companies—during the insurance claims process. If you’ve experienced property damage and are considering hiring help, here’s what you need to know:

- Definition: Licensed professionals who work exclusively for policyholders to prepare, file, and negotiate insurance claims

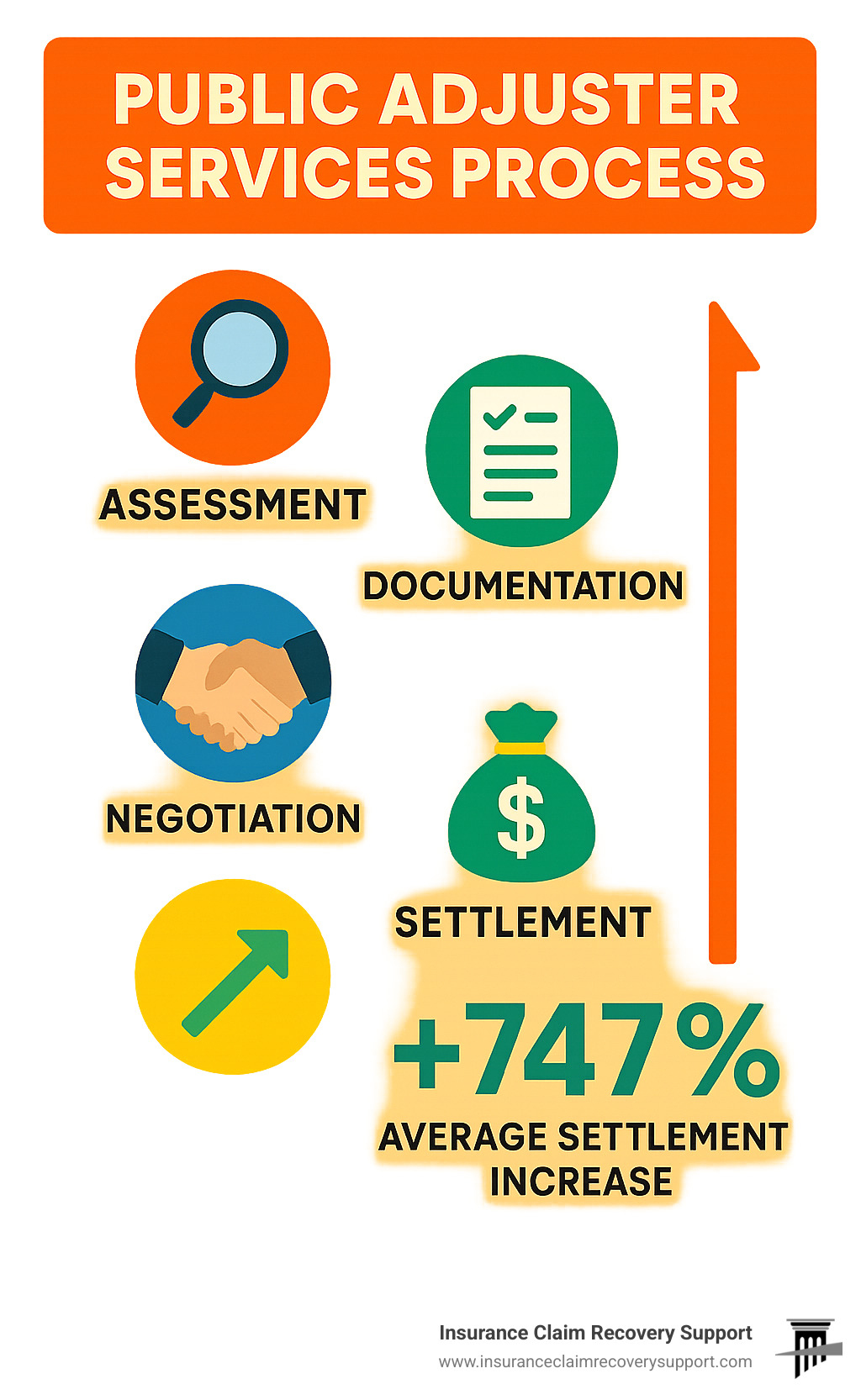

- Key Services: Property damage assessment, policy interpretation, documentation, negotiation, and settlement maximization

- When to Hire: Large or complex claims, denied claims, underpaid settlements, or when you lack time/expertise

- Cost: Texas law caps fees at 10% of the total claim settlement

- Benefits: Studies show public adjusters increase settlements by 50-747% on average

When disaster strikes your property in Texas, the last thing you need is to battle with your insurance company. Insurance carriers employ teams of adjusters whose primary goal is to minimize the company’s payout. Meanwhile, you’re left trying to rebuild your life or business while navigating complex policy language and documentation requirements.

Public adjusters level the playing field. They bring specialized expertise in policy interpretation, damage valuation, and negotiation tactics that most property owners simply don’t have. In Texas, where severe weather events like hurricanes, hailstorms, and tornadoes are common, having a professional advocate can make the difference between a fair settlement and financial hardship.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support LLC headquartered in Austin, TX, specializing in public adjuster services Texas for over two decades and having settled hundreds of millions in commercial and residential property damage claims throughout the state.

Easy Public adjuster services Texas word list:

– Insurance claim lawyer Dallas

– property damage lawyer

Understanding Public Insurance Adjusters in Texas

When disaster strikes your Texas property, understanding who’s truly on your side makes all the difference. Public insurance adjusters are licensed professionals who work exclusively for you, the policyholder. Unlike other adjusters in the claims process, public adjuster services Texas professionals operate with a fiduciary duty to protect your interests and maximize your settlement.

The Texas Department of Insurance (TDI) doesn’t take this profession lightly. To ensure you’re working with qualified experts, Texas requires public adjusters to clear several important problems. They must pass a challenging licensing exam, submit to fingerprint background checks, maintain a $10,000 surety bond, follow a strict professional code of ethics, and complete 24 hours of continuing education to keep their license active.

These requirements aren’t just bureaucratic hoops—they’re your protection. When you hire public adjuster services Texas, these standards ensure you’re getting a professional who understands both the technical aspects of property damage and the fine print in your insurance policy.

| Type of Adjuster | Who They Work For | Primary Goal | Payment Structure |

|---|---|---|---|

| Public Adjuster | Policyholder | Maximize your settlement | Contingency fee (max 10% in TX) |

| Company/Staff Adjuster | Insurance carrier | Minimize carrier payout | Salary from insurer |

| Independent Adjuster | Contracted by insurer | Process claims per insurer guidelines | Fee from insurer |

What a Public Insurance Adjuster Does

Think of public adjuster services Texas professionals as your personal claims experts. They handle the complex tasks most property owners simply aren’t equipped to manage:

First, they conduct thorough damage valuations using specialized equipment like thermal imaging cameras and moisture meters. This helps identify all damage—including hidden problems that might not be visible to the untrained eye.

Second, they interpret your policy language. Let’s be honest—insurance policies are confusing documents filled with exclusions, endorsements, and conditions that can be nearly impossible for the average person to fully understand. Public adjusters are experts at deciphering this language to identify every coverage you’re entitled to receive.

Perhaps most importantly, they negotiate directly with your insurance company. They leverage their knowledge of building codes, construction costs, and industry standards to counter lowball offers. This expertise explains why a Florida Legislature study found claims handled by public adjusters resulted in settlements 750% greater than those handled by policyholders alone.

How They Differ From Other Adjusters

The most important distinction comes down to loyalty—who does the adjuster actually work for?

Staff adjusters work directly for insurance companies. While they might seem helpful and friendly, their primary responsibility is to their employer—not you. Their job performance is often measured by how efficiently they process claims and how little they pay out.

Independent adjusters might sound independent, but they’re actually contractors hired by insurance companies. Though not direct employees, they still represent the insurer’s interests and are paid by them.

Public adjusters represent only policyholders—period. This fundamental difference eliminates the inherent conflict of interest present with other adjuster types. As one Texas school superintendent noted after Hurricane Harvey: “They pointed out damage the carrier’s team missed during their walkthrough.” This real-world observation shows how public adjuster services Texas professionals can identify overlooked damage that company adjusters might miss—whether accidentally or intentionally.

Legal & Licensing Standards

Texas maintains strict standards for public adjusters to protect consumers like you:

All public adjusters must pass a comprehensive exam administered by Pearson VUE and submit to a fingerprint background check. They’re required to maintain a $10,000 surety bond, ensuring they have financial accountability for their actions.

For your protection, Texas law caps public adjuster fees at 10% of the total claim settlement. You’re also granted a 72-hour rescission window after signing a contract, giving you time to reconsider your decision without penalty.

Ethical standards prohibit public adjusters from acting as contractors, practicing law, or soliciting door-to-door after 9 p.m. during disasters. These boundaries ensure they stay focused on their primary role—advocating for your fair settlement.

For the most current information on regulations governing public adjusters, you can visit the Texas Department of Insurance website.

Hiring Public Adjuster Services Texas: When Does It Make Sense?

Not every insurance claim requires professional help, but there are times when having an expert in your corner makes all the difference. Think of it like this: you wouldn’t represent yourself in court if the stakes were high enough—the same logic applies to significant property damage claims.

Top Claim Scenarios for Public Adjuster Services Texas

When disaster strikes your Texas property, certain situations practically scream for professional help. Here’s where we see public adjuster services Texas making the biggest difference:

1. Large Commercial Roof Claims

Commercial roofing is complicated and expensive—period. When storms tear through these systems, insurance companies often undervalue the damage. Just recently, we helped a Dallas business owner turn a lowball offer into a settlement three times higher than what the insurance company initially proposed. The difference funded proper repairs rather than just patches.

2. Hurricane Wind Damage

After hurricanes sweep through Texas, insurance companies face thousands of claims at once. In their rush, they miss things—sometimes big things. Following Hurricane Harvey, we worked with a Texas City school district whose three damaged campuses had been hastily assessed. Our thorough inspection revealed extensive damage that had been completely overlooked, securing the funds needed for proper restoration.

3. Freeze-Related Pipe Damage

Brutal 2021 Texas freeze? It left countless properties with burst pipes and water damage. Many folks received flat denials based on confusing policy exclusions. Our team successfully reversed many of these denials by correctly interpreting the actual policy language—turning “no” into “yes” for desperate property owners.

4. Tornado Destruction

When a tornado tears through your property, the damage goes beyond what’s visible. Structural integrity issues, hidden damage, and code compliance requirements create a complex claim scenario. In these cases, we regularly see six-figure differences between initial offers and fair settlements.

5. Fire and Smoke Damage

Fire claims are never simple. Beyond the obvious burn damage, there’s smoke infiltration (which can affect everything from electronics to textiles), water damage from firefighting efforts, and often mandatory code upgrades during rebuilding. These layers of complexity require experienced navigation.

For more specific information about weather-related claims, visit our Hail Damage Claims resource page.

Benefits vs. DIY or Carrier Adjuster

Why bring in a professional when the insurance company sends their own adjuster “for free”? The benefits are substantial and measurable:

Dramatically Higher Settlements

This isn’t just marketing talk—it’s backed by government research. Studies show that using a public adjuster increases claim payouts by an average of 747%. Why such a dramatic difference? Because public adjuster services Texas professionals know exactly what to look for, understand the fine print that most policyholders miss, stay current on building codes and costs, and can effectively counter insurance company tactics designed to minimize payouts.

Precious Time Saved

Managing a complex insurance claim can easily become a part-time job. Our clients regularly tell us how relieved they are to focus on running their businesses or caring for their families while we handle the mountains of paperwork, endless phone calls, and sometimes tense negotiations.

Professional Documentation That Carries Weight

Insurance companies use sophisticated software like Xactimate to calculate repair costs. We use the exact same industry-standard tools, speaking their language while representing your interests. This professional documentation makes a compelling case that’s harder for insurers to dismiss.

Perfect Alignment of Interests

Since public adjusters work on contingency (typically capped at 10% in Texas), their success is directly tied to yours. They get paid when you get paid, and they earn more when you receive more. This creates a refreshingly straightforward relationship where everyone’s incentives point in the same direction—maximizing your recovery.

When disaster strikes your Texas property, having a professional advocate can mean the difference between struggling to rebuild and having the resources to restore your property properly. For complex or significant claims, public adjuster services Texas often pay for themselves many times over.

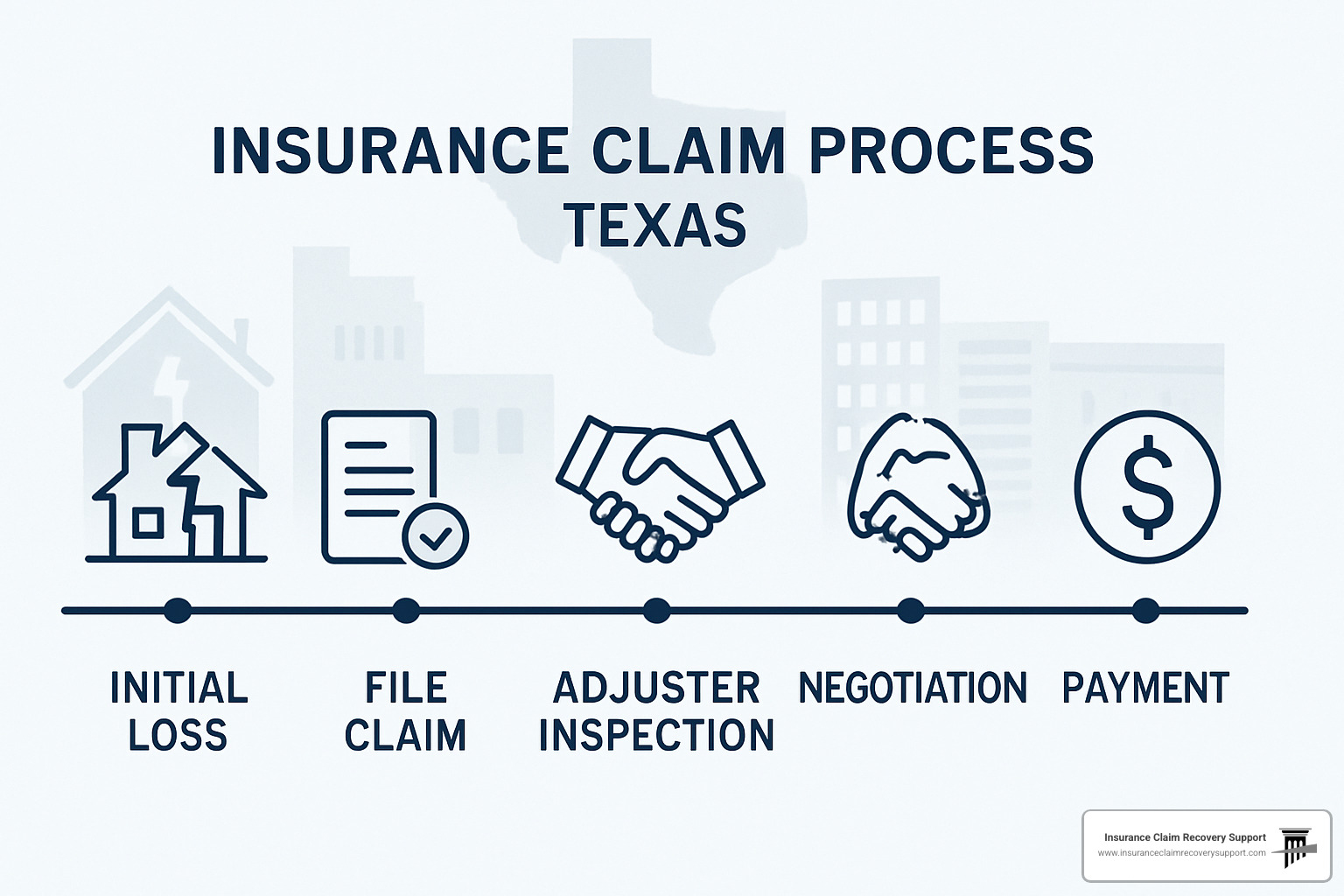

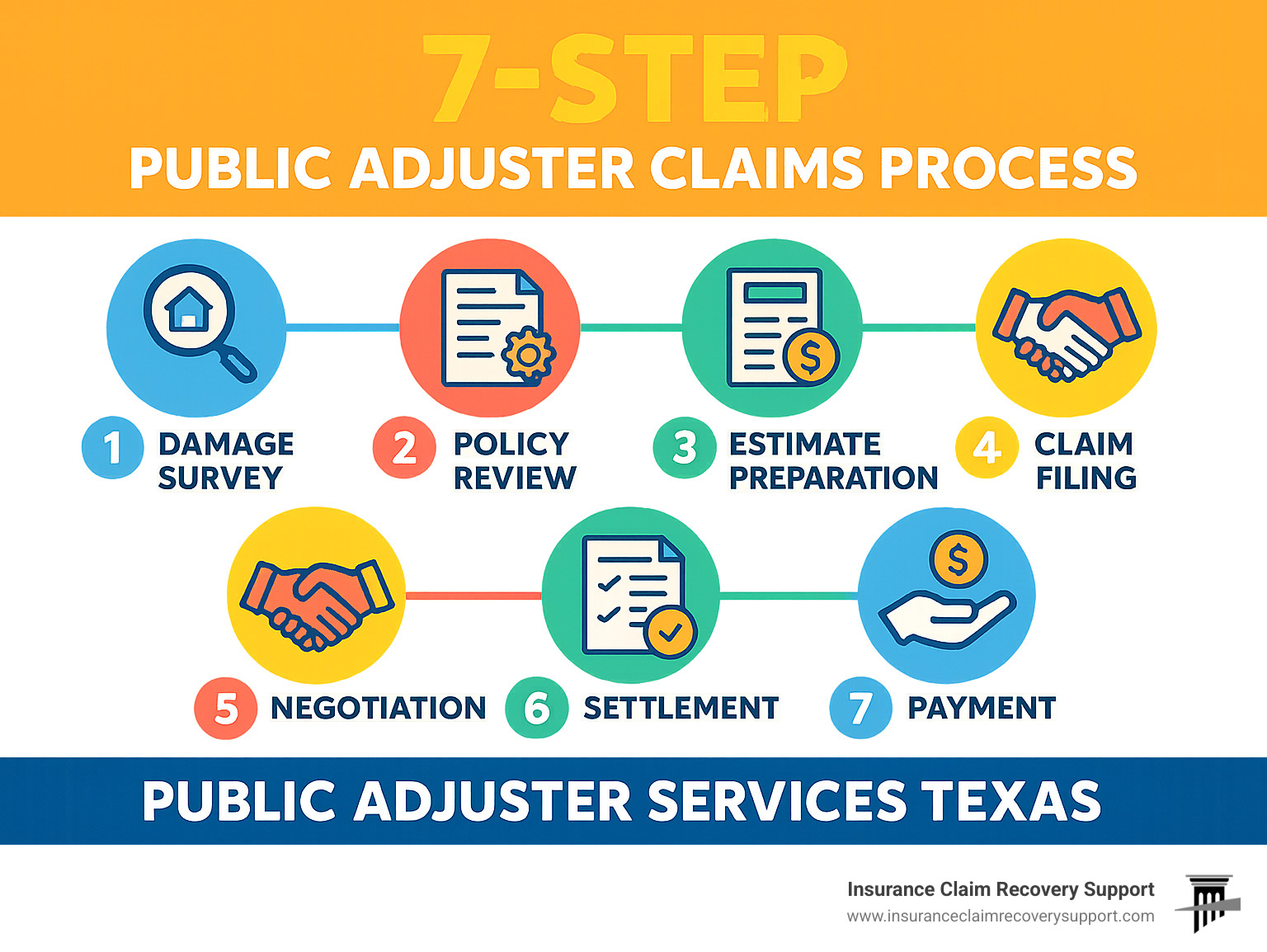

Texas Public Adjuster Claims Process: From Notice to Settlement

When you bring in public adjuster services Texas professionals, you’re not just hiring an advocate – you’re setting in motion a carefully designed process that aims to get you every dollar you deserve. Let’s walk through what happens after you sign on the dotted line:

Timeline & Key Milestones

The journey from damage to settlement follows a predictable path, though timing can vary based on your unique situation.

Within just 1-3 days of hiring us, we’ll conduct a comprehensive property inspection. This isn’t a quick walk-around – we use specialized equipment to document everything from obvious damage to hidden issues that might worsen over time.

While we’re examining your property, we’re also diving into your insurance policy. Those dense pages of insurance-speak actually contain valuable coverages many people overlook, like additional living expenses while you’re displaced, code upgrade requirements that could add thousands to your claim, business interruption compensation, and extra expense provisions.

The next 1-2 weeks involve detailed estimate preparation using the same industry-standard software insurance companies use. We account for current material costs (which fluctuate constantly), appropriate labor rates for your area, code requirements that might affect repairs, and the full scope of what’s needed to make you whole again.

By weeks 2-3, we’re ready for proof of loss submission – the formal documentation package we present to your insurance company. This includes carefully prepared scope-of-loss documents, supporting photographs that tell the visual story of your damage, engineering reports when structural issues are involved, and comprehensive cost estimates that leave no room for shortchanging.

Then comes the negotiation phase, where our expertise truly shines. Insurance adjusters often start with lowball offers, scope disagreements, or missing items. We counter these tactics with facts, documentation, and persistent advocacy. This phase varies in length but is absolutely critical to your outcome.

Most claims reach settlement within 30-90+ days, though complex cases can take longer. If negotiations stall, we can guide you through alternatives like the appraisal process (a form of binding arbitration), mediation, or preparation for litigation by working alongside attorneys.

For more detailed strategies on handling complex claims, our resource on How to Steer Commercial Property Claims in 5 Easy Steps offers valuable insights.

Limitations & What Adjusters Cannot Do

While public adjuster services Texas bring tremendous value to the claims process, it’s important to understand what we can and cannot do for you.

Public adjusters are not attorneys and cannot provide legal advice, though we often work alongside lawyers when claims have legal dimensions. We also cannot perform contracting or repair work – in fact, Texas law specifically prohibits this to prevent conflicts of interest.

During disaster periods, we cannot solicit business door-to-door after 9 p.m. – a consumer protection measure. Our expertise is also limited to property insurance, so we cannot handle health, auto, mobile home, or renter insurance claims.

Additionally, we cannot accept referral fees from contractors – another important protection that ensures our recommendations are based solely on quality, not kickbacks.

Understanding these boundaries helps set appropriate expectations and ensures you bring in the right professionals at the right time. For instance, while we can’t provide legal advice, we can tell you when it’s time to consult an attorney and help prepare documentation they’ll need.

The claims process can feel overwhelming, but with professional guidance, it becomes manageable. We handle the paperwork, meetings, and negotiations while you focus on getting your life or business back on track.

Fees, Regulations, and Your Rights as a Texas Policyholder

When you partner with public adjuster services Texas, it’s important to understand exactly what you’re signing up for – including how much it costs and what protections you have. Let’s break down the dollars and sense of working with a public adjuster in Texas.

Understanding Fee Structures

Good news for Texas property owners: state law has your back. Texas caps public adjuster fees at 10% of your total claim settlement. This consumer-friendly regulation ensures you’ll never face excessive charges while still allowing adjusters to earn a fair living.

Most public adjusters structure their fees in one of two ways:

Percentage of Total Settlement: The most straightforward approach – your adjuster receives up to 10% of whatever amount you ultimately receive from the insurance company. For example, if your final settlement is $200,000, the maximum fee would be $20,000.

“New Money” Basis: Some adjusters only charge based on additional money they secure above what the insurance company initially offered. While these percentages might be higher (often 25%), they’re still capped so they never exceed 10% of your total settlement.

Here’s a real-world example: Imagine your insurer initially offers $100,000 for your damaged property. You hire a public adjuster who identifies additional damage and negotiates a final settlement of $150,000. Under the “new money” approach, they might charge 25% of the additional $50,000 they secured ($12,500), which is still less than 10% of your total settlement.

You’ll still need to pay your policy deductible, and these fees are only paid after you receive your settlement. Many adjusters are also open to negotiating their fee structure – particularly for larger claims where a flat dollar amount might make more sense than a percentage.

Rights & Protections

Texas law provides several important safeguards when working with public adjuster services Texas:

72-Hour Cooling-Off Period: Had second thoughts after signing? No problem. Texas gives you a full 72 hours to cancel your contract with a public adjuster without any penalty. This gives you breathing room to reconsider or to shop around for other options.

Clear Fee Disclosure: Before you sign anything, public adjusters must provide a written explanation of their fee structure. No surprises allowed.

License Verification: Peace of mind is just a click away. You can easily verify that your adjuster is properly licensed through the Texas Department of Insurance website or by calling their consumer helpline at 800-252-3439.

Formal Complaint Process: If things go sideways with your public adjuster, the Texas Department of Insurance provides a structured complaint process to address your concerns.

Legal Rights Preserved: Working with a public adjuster never limits your right to seek legal counsel. You’re free to consult with an attorney at any point during the claims process.

Research consistently shows that professional representation substantially increases insurance settlements. A landmark study from the Office of Program Policy Analysis and Government Accountability found claims handled by public adjusters resulted in payments up to 747% higher than those without representation. These aren’t just numbers – they represent real families and businesses who received fair compensation instead of settling for less.

For more detailed information about navigating the claims process and understanding your rights as a policyholder, visit our comprehensive Claim Help resource page, where we walk you through every step of getting the settlement you deserve.

Choosing a Reputable Public Adjuster in Texas

Selecting the right public adjuster services Texas is like finding a trusted advisor during one of life’s most stressful moments. You want someone who’ll stand by your side and fight for what you deserve—not just anyone with a business card.

Step 1: Gather Recommendations

The search for a quality public adjuster often begins with conversations. Talk with neighbors, friends, or family members who’ve been through the claims process. Their experiences—both good and bad—provide invaluable insights you won’t find in advertisements.

Online reviews can tell you a lot about how an adjuster treats clients when the going gets tough. Take some time to browse Google reviews, Facebook testimonials, and Better Business Bureau ratings. Look beyond the star ratings to read about specific experiences. Did the adjuster remain responsive throughout the process? Were they transparent about challenges? These details reveal character and professionalism.

If you already have an attorney, they might know reputable adjusters who’ve delivered results for other clients. Legal professionals often have networks of trusted insurance specialists they can recommend.

Step 2: Verify Credentials

A legitimate Texas public adjuster must hold a current license from the Texas Department of Insurance—this isn’t optional, it’s the law. Before your first meeting, verify their license status through the TDI website. This simple step protects you from potential scammers who appear after disasters.

Professional association membership signals a commitment to ethical standards and ongoing education. Membership in TAPIA (Texas Association of Public Insurance Adjusters) indicates the adjuster takes their professional responsibilities seriously and stays current with industry developments.

Don’t be shy about asking direct questions about their experience with your specific type of claim. A good adjuster will be straightforward about their expertise and limitations, perhaps even referring you elsewhere if your claim requires specialized knowledge they don’t possess.

Step 3: Evaluate Experience and Expertise

Experience matters tremendously in public adjusting. An adjuster who’s been working Texas claims for years has likely seen variations of your situation before and knows how different insurance companies typically respond. They’ll recognize red flags and opportunities that newcomers might miss.

Ask potential adjusters to share stories (without breaching confidentiality) about similar claims they’ve handled. How did they overcome challenges? What strategies proved effective? These conversations reveal their problem-solving approach and depth of knowledge.

Specialized expertise can be particularly valuable. Commercial property claims differ significantly from residential ones. Similarly, fire damage requires different documentation approaches than water damage. Public adjuster services Texas professionals who understand your specific situation will steer the process more efficiently.

Step 4: Confirm Geographic Coverage

Insurance regulations and building codes vary by location, making local knowledge invaluable. At Insurance Claim Recovery Support, we’ve developed deep expertise across Texas communities, including:

Austin and the surrounding communities of Round Rock, Georgetown, and Lakeway have unique building codes and weather patterns we understand intimately. The Dallas-Fort Worth metroplex presents its own challenges with diverse property types and municipal regulations. We’re equally comfortable handling claims in San Antonio, Houston, Lubbock, San Angelo, and Waco—each with their distinct insurance claim landscapes.

This geographic knowledge helps us anticipate issues before they arise and speak the language of local contractors and building officials.

Checklist Before Signing a Contract for Public Adjuster Services Texas

Before shaking hands and signing papers, take a moment to review the contract carefully. A transparent public adjuster has nothing to hide and will encourage your careful review.

Your contract should clearly spell out the fee structure—whether it’s a percentage of the total settlement or calculated another way. You deserve to know exactly what you’ll pay and when payment is due. No surprises.

Look for specific commitments about the work they’ll perform. Will they personally inspect your property? Will they prepare detailed estimates using industry-standard software? Will they attend all meetings with insurance representatives? These details matter tremendously.

Timeline expectations help manage the process. While no adjuster can guarantee exact dates for insurance company responses, they should outline their own commitment to prompt action and regular updates.

The 72-hour rescission clause is your legal right in Texas. Make sure it’s clearly stated in the contract, giving you time to reconsider without penalty if needed.

Finally, understand how you’ll receive updates. Will there be weekly calls? Email summaries? A client portal? Clear communication prevents frustration during what can be a lengthy process.

For more comprehensive information about working with public adjusters throughout the state, visit our Public Adjusters in Texas resource page.

Frequently Asked Questions about Public Adjuster Services in Texas

Do I owe fees if my claim is not increased?

Absolutely not. When you work with reputable public adjuster services Texas, you can rest easy knowing they operate on a true contingency basis. This means if they don’t increase your settlement amount, you won’t owe them a dime.

This arrangement creates a perfect alignment between your interests and your adjuster’s goals. Since they only get paid when you receive additional money, they’re genuinely motivated to maximize your recovery.

At Insurance Claim Recovery Support, we’re so confident in our ability to increase your settlement that we stake our compensation on it. No increased settlement? No fee. It’s that simple.

How do I cancel a contract within 72 hours?

Texas law protects consumers by providing a 72-hour cooling-off period for public adjuster contracts. If you change your mind, here’s how to exercise this important right:

Put your cancellation in writing – an email works, but certified mail gives you proof of delivery. Clearly state that you’re canceling the contract, keep a copy for your records, and request written confirmation that they’ve received your cancellation.

Your 72-hour window starts ticking when you sign the contract, not when work begins. If you’re having second thoughts, don’t delay taking action.

Can a public adjuster handle business interruption calculations?

Yes, though there’s some nuance here. Business interruption claims involve complex financial calculations that go beyond typical property damage assessment. While public adjuster services Texas can manage the documentation and presentation of these claims, the most complex cases often benefit from specialized financial expertise.

At Insurance Claim Recovery Support, we take a collaborative approach. We’ve built relationships with certified public accountants who specialize in business interruption claims. This teamwork ensures both the physical property damage and the financial impact on your business operations are thoroughly documented and presented to your insurer.

What types of claims do Texas public adjusters typically handle?

Public adjuster services Texas professionals focus primarily on property damage claims. These include:

Fire and smoke damage that can devastate homes and businesses, water damage from plumbing failures that often hide behind walls, storm damage from wind and lightning, catastrophic hurricane and tornado losses, and commercial building damage of all types. Many adjusters also handle business interruption claims that occur when property damage forces a temporary shutdown.

What they don’t handle: auto insurance, health insurance, mobile home claims, or renter’s insurance claims. These specialized areas typically fall outside a property adjuster’s scope of practice.

How long does the typical insurance claim process take with a public adjuster?

The honest answer is: it depends on your specific situation. Simple residential claims might resolve in 30-60 days, while complex residential claims typically take 60-120 days. Commercial claims often require 90-180+ days, and truly catastrophic losses can take 6-12+ months to settle properly.

While these timeframes might seem lengthy, rushing the process often leads to underpaid claims. Think of it this way: would you rather have a quick $50,000 settlement or wait a few extra weeks for a $150,000 settlement? Our experience shows that patience often pays significant dividends.

The public adjuster services Texas professionals at Insurance Claim Recovery Support focus on thoroughness over speed. We’d rather take the time to document every aspect of your loss properly than leave money on the table by rushing the process.

Conclusion

When disaster strikes your Texas property, the path to recovery shouldn’t be paved with insurance company obstacles and underpaid claims. Public adjuster services Texas provide the expertise, advocacy, and support needed to steer the complex claims process and secure the settlement you deserve.

The statistics speak for themselves—policyholders who work with public adjusters receive settlements that are, on average, 50% to 747% higher than those who handle claims on their own. This dramatic difference exists because insurance policies are complex, damage assessment requires specialized knowledge, and negotiation is an art form that most property owners haven’t mastered.

At Insurance Claim Recovery Support, we’ve spent decades fighting for Texas property owners in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, and Waco. Our team understands not just the technical aspects of property damage, but also the emotional toll that disasters take on families and business owners.

Remember these key points:

– Texas public adjusters must be licensed by the TDI

– Fees are capped at 10% of your total settlement

– You have a 72-hour window to cancel a contract

– The right adjuster can dramatically increase your recovery

When you’re facing property damage, you deserve an advocate who works exclusively for you—not the insurance company. That’s exactly what we provide.

For additional resources or to connect with experienced property damage attorneys who can complement our services, visit our property damage lawyer page.

The path to claim victory in Texas begins with the right team on your side. Let us help you steer the journey from disaster to recovery.