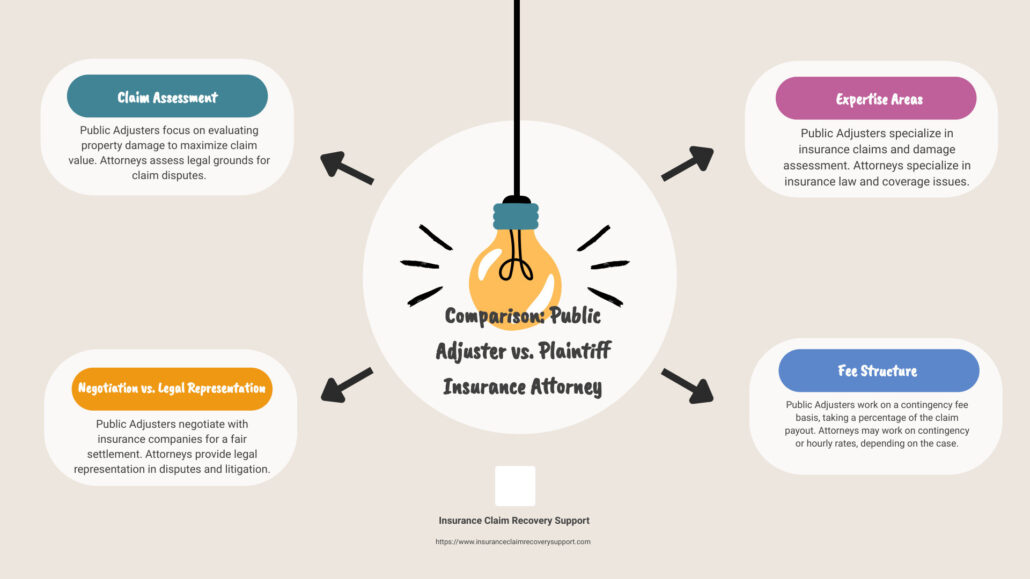

The Ultimate Guide to Choosing a Public Adjuster or Plaintiff Insurance Attorney

Discover how to choose the right Public Adjuster or Plaintiff Insurance Attorney for your insurance claim in Texas with our ultimate guide, covering all key aspects.

Navigating the Unfair Game: Analogy of Insurance Claims and Sports Referees

In the intricate world of insurance, policyholders often find themselves entangled in a process that bears an uncanny resemblance to the dynamics of a sports match governed by an unfair and biased referee. Just as a referee’s decisions can profoundly impact the outcome of a game, the insurance claims process can shape the financial fate […]

The Complete Guide to Roof Storm Damage Insurance Claims

Discover essential tips for navigating roof storm damage insurance claims with our comprehensive guide to secure your home and peace of mind.

Why Hail Property Damage Insurance Claims Get Denied or Underpaid

What are common reasons why insurers deny or underpay hail and wind roof and other property damage insurance claims? There are several common reasons why insurers may deny or underpay hail and wind insurance claims: Damage not meeting the deductible: Many insurance policies have a deductible that must be met before the insurance company will […]

Commercial Large Loss Panel Moderator – National Conference

Scott Friedson CEO of Insurance Claim Recovery Support Public Insurance Adjusters moderated the Commercial Large Loss panel at Win The Storm Conference. The distinguished nationwide group of contractors, public adjusters, engineers, attorneys, hygienists, and consultants covered important insurance claim topics, dispelled misconceptions, and covered essential issues every policyholder and insurance professional who works or aspires […]

Video: What Is A Good Public Adjuster?

Searching for “Public adjuster near me”? Try searching for “What is a GOOD public adjuster?” A public adjuster is a private, independent, licensed, bonded, and professional claims adjuster who settles property damage insurance claims exclusively on behalf of the insured that the policyholder may hire to help settle an insurance claim on their behalf. Public […]

Video: What is a good public adjuster?

How does a Policyholder qualify a good public insurance adjuster from a bad one? A public insurance adjuster is an independent licensed advocate that a policyholder may hire to help settle an insurance claim on their behalf. Among the voluminous amount of information online about the insurance claim process, getting professional help from a trustworthy […]

How Some Insurance Companies Intentionally Delay, Deny and Underpay Claims

Not all, but many bad faith Insurance companies intentionally delay, deny and underpay claims. Of course, these tactics are improper, unethical, and immoral but in a pathetic attempt to gin up business for their defense law firm, a recent blog post targeting bad faith insurance companies outlines the benefits of purposely delaying insurance claims as an […]

Damaging Storms Reach Denver, Colorado

Tuesday Night’s Storm Caused 1 Tornado & Tennis Ball Sized Hail Colorado was hit with a storm so intense it caused high winds, large hail, and even a tornado in Lincoln County. The storm began to unfold just before midnight on Tuesday evening when the National Weather Service issued its first warning that storms were […]

Damage from Georgetown, TX May 2020 Hail Storm

Georgetown Texas Residents – Don’t Wait! Now’s The Time to Submit Your Hail Damage Claim! Early Thursday morning the residents of Georgetown Texas woke up and began to assess the damage from what will likely be one of the most costly hail storms in Georgetown’s history. Hail from egg-sized to the size of tennis balls […]