The Ultimate Guide to Hurricane Property Damage in Texas

Discover essential tips on handling hurricane Texas property damage, from navigating insurance claims to maximizing settlements with a public adjuster.

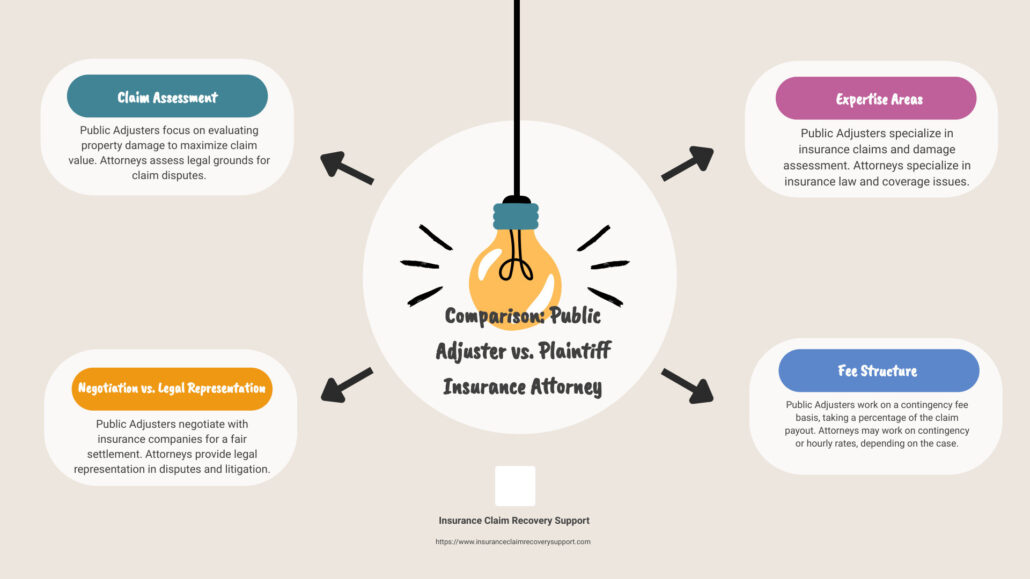

The Ultimate Guide to Choosing a Public Adjuster or Plaintiff Insurance Attorney

Discover how to choose the right Public Adjuster or Plaintiff Insurance Attorney for your insurance claim in Texas with our ultimate guide, covering all key aspects.

Commercial Large Loss Panel Moderator – National Conference

Scott Friedson CEO of Insurance Claim Recovery Support Public Insurance Adjusters moderated the Commercial Large Loss panel at Win The Storm Conference. The distinguished nationwide group of contractors, public adjusters, engineers, attorneys, hygienists, and consultants covered important insurance claim topics, dispelled misconceptions, and covered essential issues every policyholder and insurance professional who works or aspires […]

Video: What Is A Good Public Adjuster?

Searching for “Public adjuster near me”? Try searching for “What is a GOOD public adjuster?” A public adjuster is a private, independent, licensed, bonded, and professional claims adjuster who settles property damage insurance claims exclusively on behalf of the insured that the policyholder may hire to help settle an insurance claim on their behalf. Public […]

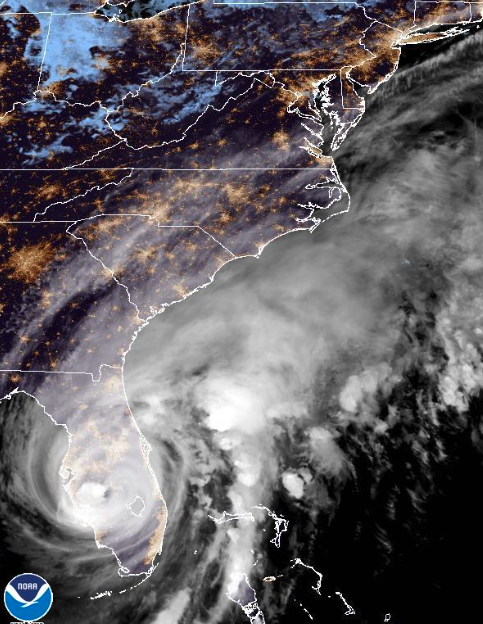

Cape Coral, Florida policyholders dealing with wind claims and deductibles.

Home and business policyholders dealing with wind damage insurance claims may find themselves battling their insurer on whether a named storm deductible applies due to Hurricane Ian or just a wind deductible applied due to a tornado that occurred before the hurricane. If wind damage existed before the September 28, 2023 Hurricane occurrence, be sure […]

Hurricane Ian Property Damage Insurance Claims

Hurricane Ian could potentially generate more than $30 billion in insured property losses, which would make it one of the largest natural catastrophe events in US history. #hurricaneian #publicadjuster #propertyinsurance #propertydamage https://www.claimsjournal.com/news/national/2022/09/29/312944.htm

How Some Insurance Companies Intentionally Delay, Deny and Underpay Claims

Not all, but many bad faith Insurance companies intentionally delay, deny and underpay claims. Of course, these tactics are improper, unethical, and immoral but in a pathetic attempt to gin up business for their defense law firm, a recent blog post targeting bad faith insurance companies outlines the benefits of purposely delaying insurance claims as an […]

What You Need to Know about Food Plant Fire Insurance Claims

Since January of 2022, there have been numerous fires at food manufacturing plants across the country. Can We Talk About the Plant Fires? caught our attention. The recovery process for these food processors to get back to business concerns us considering the number of policyholders we assist in overcoming delays and underpayments. Decades of experience […]

Flood Insurance Claim Fraudsters Engineer & Law Firms

Why does FEMA continue to use these entities who “get paid for NOT paying claims, not for paying them…it’s unconscionable?” ICRS public adjusters won’t let bad faith insurers abuse policyholders.

What makes ICRS public insurance adjusters (P.I.A.’s) different?

What makes ICRS public insurance adjusters (P.I.A.’s) different? ICRS Public Adjusters are the best in business for settling large loss property damage insurance claims in Texas and many other states. We exclusively represent policyholders help recover from fire, storms, and other disaster property damages covered under property insurance policies and its related coverage. Get the […]