Why Hail Property Damage Insurance Claims Get Denied or Underpaid

What are common reasons why insurers deny or underpay hail and wind roof and other property damage insurance claims? There are several common reasons why insurers may deny or underpay hail and wind insurance claims: Damage not meeting the deductible: Many insurance policies have a deductible that must be met before the insurance company will […]

Commercial Large Loss Panel Moderator – National Conference

Scott Friedson CEO of Insurance Claim Recovery Support Public Insurance Adjusters moderated the Commercial Large Loss panel at Win The Storm Conference. The distinguished nationwide group of contractors, public adjusters, engineers, attorneys, hygienists, and consultants covered important insurance claim topics, dispelled misconceptions, and covered essential issues every policyholder and insurance professional who works or aspires […]

Video: What Is A Good Public Adjuster?

Searching for “Public adjuster near me”? Try searching for “What is a GOOD public adjuster?” A public adjuster is a private, independent, licensed, bonded, and professional claims adjuster who settles property damage insurance claims exclusively on behalf of the insured that the policyholder may hire to help settle an insurance claim on their behalf. Public […]

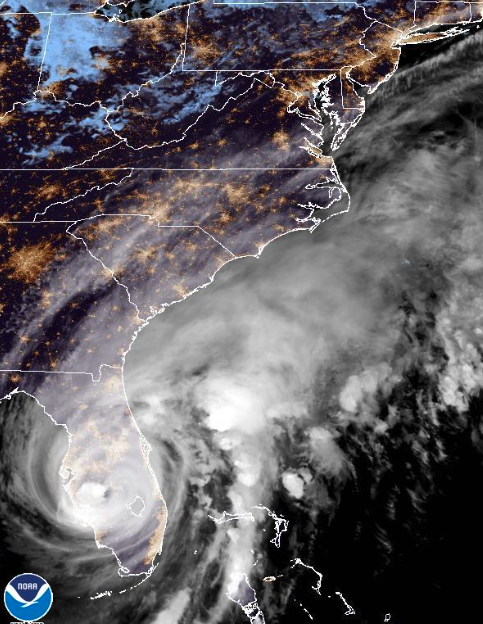

Hurricane Ian Property Damage Insurance Claims

Hurricane Ian could potentially generate more than $30 billion in insured property losses, which would make it one of the largest natural catastrophe events in US history. #hurricaneian #publicadjuster #propertyinsurance #propertydamage https://www.claimsjournal.com/news/national/2022/09/29/312944.htm

How Some Insurance Companies Intentionally Delay, Deny and Underpay Claims

Not all, but many bad faith Insurance companies intentionally delay, deny and underpay claims. Of course, these tactics are improper, unethical, and immoral but in a pathetic attempt to gin up business for their defense law firm, a recent blog post targeting bad faith insurance companies outlines the benefits of purposely delaying insurance claims as an […]

What makes ICRS public insurance adjusters (P.I.A.’s) different?

What makes ICRS public insurance adjusters (P.I.A.’s) different? ICRS Public Adjusters are the best in business for settling large loss property damage insurance claims in Texas and many other states. We exclusively represent policyholders help recover from fire, storms, and other disaster property damages covered under property insurance policies and its related coverage. Get the […]

Insurance Policies and Texas Freeze: What Policyholders Need To Know To Survive “Largest Insurance Claim Event In History”

Insurance Policies, Pipe Burst, Collapse, Snow & Ice The U.S. experienced unprecedented severe winter weather, including snow, ice, and freezing temperatures causing significant water damage to multifamily and commercial properties. The insured losses caused by winter storms, 2021 will likely exceed $50B. Read below to see what you need to know about insurance policies. The […]

Avoid an Underpaid or Delayed Insurance Claim Settlement

Don’t let your insurer underpay or delay your Insurance Claim Business owners trust the licensed public adjusting firm Insurance Claim Recovery Support, LLC (ICRS). We are one of the country’s oldest and leading Commercial and Multifamily insurance claim specialists with over $100M in claims settled fairly and promptly. We exclusively represent the interests of and […]