The Critical First 48 Hours After a Large Loss

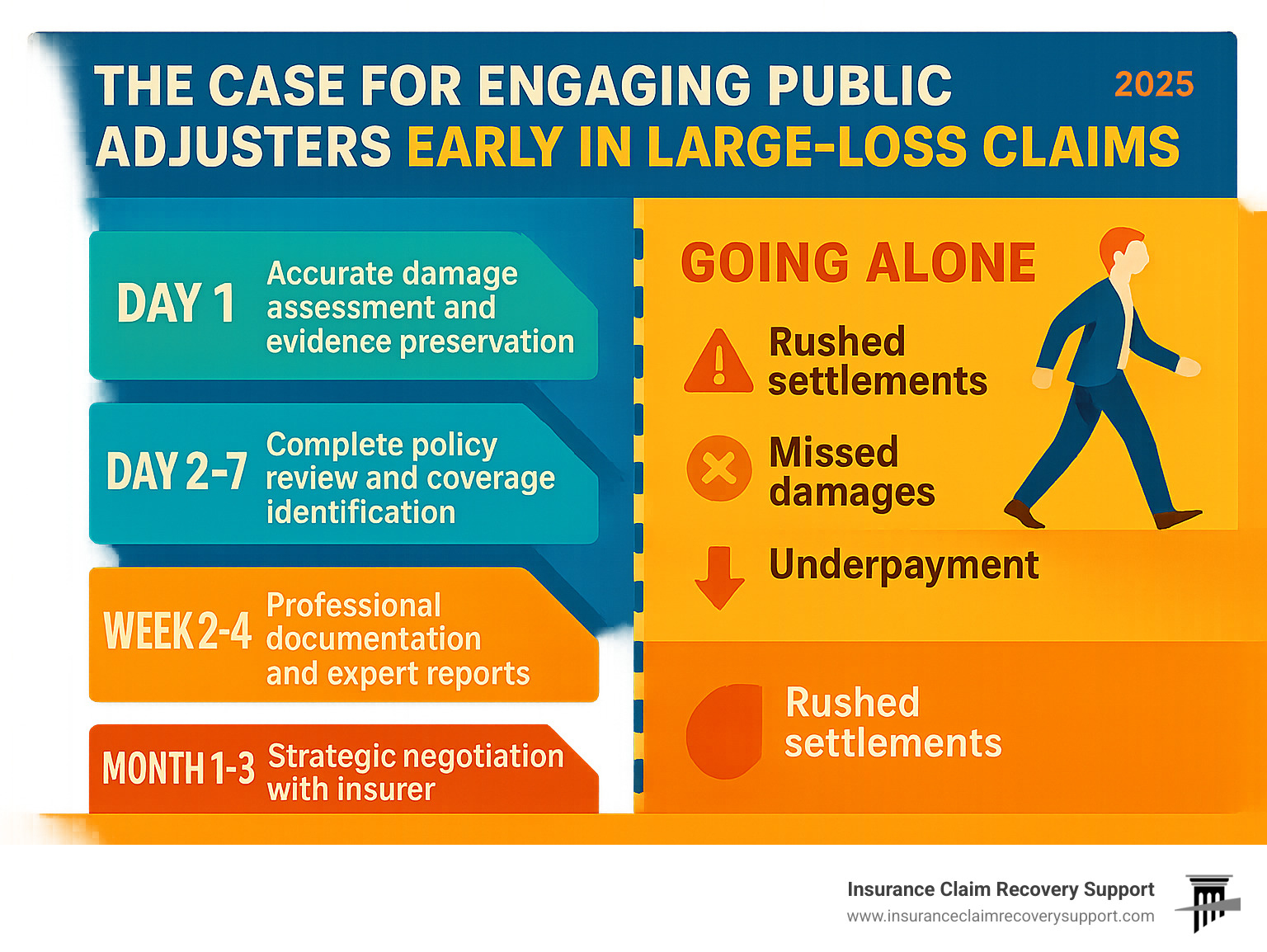

The Case for Engaging Public Adjusters Early in Large-Loss Claims is about more than maximizing your settlement—it’s about protecting your business from costly mistakes that can derail your recovery.

The case for early public adjuster engagement offers three critical advantages:

- Accurate damage assessment before evidence is lost

- Higher settlements averaging 19-700%+ more than initial offers

- Avoiding unnecessary litigation through professional representation from day one

When disaster strikes your commercial or multifamily property, the first 48 hours are critical. They determine whether you’ll receive fair compensation or fight an uphill battle against your insurer. As one business owner found: “The insurance company hires experts to prepare the claim for them… Without your involvement, we would have had to negotiate with these experts on our own. The result would have been disastrous.”

Large, complex losses require immediate professional intervention. Whether you’re dealing with fire at your apartment building, hail to the roof of your manufacturing facility or hurricane destruction at your hotel, company adjusters work for the insurer, not you. Many are incentivized to minimize payouts and often lack the specialized skills for complex commercial claims. Policyholders often find themselves quickly frustrated with the time, energy, financial risk, and expertise required to effectively settle a property damage insurance claim fairly and promptly. Handling disputes on your own, without unbiased licensed representation, often leads to low settlement offers, delays, and frustration. Having the right advocate from the start can make the difference between a drawn-out process and securing a fair, timely settlement.

Studies show policyholders who hire public adjusters receive significantly higher settlements—often more than enough to cover the adjuster’s fee and fund proper repairs.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled over 500 large-loss claims valued at more than $250 million. My experience overturning denied claims and increasing settlements by 30% to 3,800%+ proves that early public adjuster engagement can mean the difference between business survival and financial disaster.

The Proactive Advantage: How Early Public Adjuster Engagement Secures Your Claim from Day One

Picture this: your warehouse in Houston floods, or a tornado tears through your Dallas apartment complex. In those first chaotic hours, the insurance company’s adjusters are already forming opinions about your claim.

The Case for Engaging Public Adjusters Early in Large-Loss Claims isn’t about paranoia—it’s about being smart. When we step in during those critical first 48 hours, we prevent mistakes before they happen and ensure your story is told accurately from day one.

Early public adjuster engagement is like calling a lawyer before you say something that could hurt your case. We preserve evidence, document everything properly, and prevent missteps that could be used against you.

When we get involved early, we set the tone for your entire claim. Instead of the insurer controlling the narrative, we establish a professional, thorough approach that shows we mean business. This proactive stance often prevents lengthy disputes or litigation.

Property owners who wait often find themselves playing defense, trying to prove damages that weren’t properly documented. When we’re there from the beginning, we’re playing offense—building an unshakeable foundation for your claim.

Establishing an Accurate Scope of Loss Before the Insurer Takes Control

The insurance company’s adjuster has one goal: determine how much they have to pay and if it can be repaired or an exclusion applies in their policy. Our goal is different: document every single thing that needs to be fixed or replaced per the premium for a Replacement Cost Policy that a policyholder paid for, and where coverage applies.

This difference is crucial. Company adjusters often miss hidden damages that cost thousands later. Water from a burst pipe can seep into walls, causing mold and electrical issues. Smoke contamination from a fire penetrates HVAC systems and requires specialized cleaning throughout your entire building.

For Texas properties, we know what to look for. Freeze damage from events like Winter Storm Uri can cause hidden pipe breaks. Hurricane damage often includes wind-driven rain in unexpected places. Hail and wind damaged roofs that warrant full replacement, but the insurer thinks it’s reasonable to just make repairs. We’ve seen initial assessments miss these and other issues, leaving property owners scrambling for coverage.

Business interruption costs are another area where early involvement pays off. When your San Antonio restaurant can’t serve customers, every day counts. We immediately bring in forensic accountants to track these losses and use engineering reports to establish realistic repair timelines.

We use the same Xactimate software as insurance companies, but we use it to build a complete, not conservative, picture. Our job is to ensure nothing is missed before the insurer decides what your claim is worth.

Navigating Complex Policy Language and Identifying All Applicable Coverages

Insurance policies are complex, with policy loopholes, confusing endorsements, subjective exclusions, and tricky conditions like co-insurance penalties that can slash your payout.

Our fiduciary duty to you makes all the difference. We work exclusively for you, digging through your policy to find all applicable coverages you’re entitled to—not just the obvious ones.

Many commercial policies have segregated limits for different types of damage, such as building coverage, contents coverage, and extra expense coverage. Missing any of these categories leaves money on the table.

Our thorough policy review often uncovers additional coverage hidden in endorsements that can add tens or even hundreds of thousands to your settlement.

Early engagement lets us identify these coverage issues before the insurance company limits the scope of your claim. It’s much harder to expand the claim after their initial determination has been made.

For more detailed information about how we handle commercial property claims, visit our page on commercial claim services. The sooner we get involved, the better we can protect your interests.

The Case for Engaging Public Adjusters Early in Large-Loss Claims vs. Delaying or Going It Alone

Imagine your Dallas commercial building suffers major storm damage. You’re juggling repairs, tenants, and business interruption, and now you have to steer a complex insurance claim.

Many property owners think they can handle the claim themselves or trust their insurer’s adjuster. This approach often leads to underpayment risk, claim denial risk, and a prolonged timeline that adds unnecessary stress.

The reality is that company adjuster incentives are aligned with their employer, the insurance company. Their job is to settle claims as cost-effectively as possible for their employer, not to maximize your payout.

The Case for Engaging Public Adjusters Early in Large-Loss Claims becomes clear when you realize that waiting until problems arise is often too late. Early engagement provides a proactive advantage that is critical for your financial recovery.

The Pitfalls of Waiting:

Why the Insurer’s First Offer is Rarely Their Best

Insurance companies set loss reserves early in the claims process, which is the amount they expect to pay. Once that number is established, adjusters rarely deviate from it, even when additional damage is found later.

If you wait to hire professional help until after receiving a low offer, you’re trying to change a decision that’s already been made.

Initial settlement offers are notoriously low. Company adjusters are often overwhelmed, especially after major Texas weather events, and may lack the time or expertise to evaluate complex commercial properties thoroughly.

The settlement statistics are compelling. Studies show policyholders who engage public adjusters receive settlements that are 19% to 700% higher than those who go it alone (OPPAGA exhibit 6). For more insights, you can explore research on claim settlement data from organizations like the National Association of Insurance Commissioners (NAIC).

Another business owner shared their experience: “The insurance company hires experts to prepare the claim for them… Without your involvement we would have had to negotiate with these experts on our own. The result would have been disastrous.”

This isn’t about gaming the system; it’s about receiving what you’re entitled to under your policy. Early engagement means we can influence that crucial initial loss reserve, setting your claim on the right trajectory from day one.

The Documentation Dilemma:

Building an Unshakeable Claim

from the Ground Up

Without proper documentation, even legitimate damages can go uncompensated. Many property owners don’t know what’s needed or how to present it.

Meticulous documentation for large losses requires a systematic approach to capture the full financial impact. We handle this burden so you can focus on your business.

Our approach includes detailed inventories that go beyond the surface. For example, after Winter Storm Uri hit Texas, many property owners found hidden pipe damage inside walls weeks later. We know to look for these issues and document them properly.

Comprehensive photo and video evidence forms the visual foundation of your claim. We document not just the damage, but its context, showing how the loss progressed and affected less obvious areas.

Expert reports from engineers, forensic accountants, and estimators provide a technical backbone that insurers can’t easily dispute. These professionals provide detailed reports that support our damage assessments and ensure nothing is undervalued.

The result is a comprehensive Schedule of Lossa detailed breakdown of every damaged item and its replacement cost. This document becomes the foundation for negotiations.

Protecting policyholder rights means ensuring you have equal footing with the insurer’s team of experts. When we build this robust documentation from the start, we create an unshakeable foundation that makes The Case for Engaging Public Adjusters Early in Large-Loss Claims clear to everyone involved.

Public Adjuster vs. Lawsuit: A Smarter Path to Resolving Large-Loss Disputes

When your insurance company delivers a low settlement offer or denies your claim, your first instinct might be to call an attorney. The frustration is understandable.

But based on my experience with over 500 large-loss claims, litigation should be your last resort, not your first response. For most commercial property claims, engaging a public adjuster offers a smarter, faster, and more profitable path to resolution.

An insurance lawsuit involves months or years of discovery, depositions, and court battles. Legal fees can range between 30%-40% more or less. Meanwhile, your property remains damaged and your business disrupted. How a Good Public Adjuster Can Help You Avoid Unnecessary Litigation explains your legal rights when insurance companies act in bad faith.

I’ve seen owners spend years in court only to net the same or less after legal fees than we typically negotiate in a few months. The Case for Engaging Public Adjusters Early in Large-Loss Claims is about getting you back to business faster while maximizing your recovery.

We resolve disputes within the insurance framework, presenting compelling documentation and expert analysis that gives the insurance company little choice but to increase their offer.

The Public Adjuster’s Role in Pre-Litigation and Dispute Resolution

When an insurer’s offer is too low, we don’t threaten litigation. We challenge their position with data-backed evidence.

We bring in our own independent experts to counter the insurer’s assessments. If they claim your fire damage is worth $100,000, our team will demonstrate why it’s actually $350,000. This isn’t about inflating numbers; it’s about presenting the complete, accurate picture.

Another tool is the appraisal clause found in most commercial policies. This process allows both sides to appoint independent appraisers to resolve valuation disputes, with an impartial umpire making the final decision if needed. It’s like arbitration but designed for insurance claims and is a non-litigious process. However, the costs are not recoverable or payable on contingency. Another limitation is that there are few to no rules of the road to the appraisal process, they can take as long or longer than a lawsuit that can apply statutory penalties for bad faith including, but not limited to attorney fees. Learn more about appraisal ins and outs: Insurance Claim Appraisals: Where’s the Limit for Policyholders?

Professional communication backed by comprehensive documentation often shifts an insurer’s position. This approach levels the playing field without the adversarial atmosphere of litigation.

Understanding the Public Adjuster Fee Structure

and Net Settlement Impact

We work on a contingency fee basis, which means we only get paid when you get paid. This “no recovery, no fee” structure aligns our interests with yours.

In Texas, public adjuster fees are regulated, typically ranging from 10% less deductible when policyholders engage us early in the claim to 25% of supplemental settlements. While this is a percentage of your settlement, the higher settlements typically offset our fees and leave you with significantly more money than you would have received alone.

Consider this example:

| Scenario | Initial Offer | Final Settlement | PA Fee (10%) | Net to You | Your Gain |

|---|---|---|---|---|---|

| Going Alone | $75,000 | $75,000 | $0 | $75,000 | – |

| With Public Adjuster | $75,000 | $240,000 | $24,000 | $216,000 | +$141,000 |

Even after our fee, you walk away with $141,000 more than the original offer. A Dallas commercial property owner said: “I was skeptical about paying a percentage to the public adjuster, but when they turned my $85,000 offer into a $310,000 settlement, I realized I would have been foolish not to hire them. Even after their fee, I had over $180,000 more to rebuild my business.”

The Case for Engaging Public Adjusters Early in Large-Loss Claims is clear when you run the numbers. We are an investment that pays for itself while helping you avoid the stress and massive costs and time of litigation.

Frequently Asked Questions about Engaging a Public Adjuster

Property owners facing large losses often have questions about working with a public adjuster. Here are answers to the most common questions we hear from commercial property owners, apartment complex managers, and religious institution leaders.

What are the key signs I need a public adjuster for my commercial property claim?

While early engagement is almost always best, certain red flags demand professional help. Significant damage value (over $10,000 or a total loss) is the first sign you need an advocate.

Complex damage types are another reason. Company adjusters often miss critical elements in claims involving combined wind and flood damage, hidden freeze damage, or tricky fire damage claims with smoke contamination and business interruption.

Business interruption losses require forensic accounting expertise to calculate accurately, which is crucial for your financial recovery. If your Austin apartment complex loses rental income or your San Antonio facility shuts down, these costs must be properly documented.

Denied or underpaid claims are the clearest sign you need help. A low offer or rejection means the insurer isn’t taking your claim seriously yet.

We specialize in apartment complexes, HOAs, and religious institutions, understanding their unique policies. We also help owners who simply lack the time or expertise for the demanding claims process.

How do I choose the right public adjuster?

Choosing the right public adjuster is critical. Start by verifying their license with your state’s Department of Insurance… this is non-negotiable. You can use the National Association of Insurance Commissioners to locate your state department to confirm credentials. Our public adjusters maintain current licenses and adhere to strict ethical standards.

Experience with large losses in commercial properties, multifamily complexes, or religious institutions is vital. An adjuster who only handles residential claims may miss the complexities of your policy.

Check references. Ask for and call recent clients with similar claims. This is often more revealing than online reviews alone.

Review the contract carefully. Understand the contingency fee, which is typically 5-20% in Texas. State regulations provide a cancellation window, but choosing wisely upfront saves time and stress.

| Feature | Initial Contract | Supplemental Contract |

|---|---|---|

| When It’s Used | Signed at the beginning of the claims process. Covers the full scope of the insurance claim. | Signed later if additional payments (“supplements”) are pursued after the initial settlement. |

| What It Covers | All recoveries from the insurance claim, across all coverages under the policy. | Only new or additional payments discovered after the original settlement (e.g., hidden damage, underestimated repair costs). |

| Fee Structure | Fixed percentage of the gross recovery (e.g.,10%). Applies to the total settlement amount after deductible. | The lesser of:• 10% of gross recovery, OR• The standard percentage (e.g., 20%) but only applied to the supplemental portion. |

| Cap on Fees | Cannot exceed the agreed percentage of the overall claim recovery. | Cannot exceed 10% of the supplemental recovery. |

| No Recovery, No Fee | ✔ If no payment is made, no fee is due. | ✔ If no supplemental payment is made, no fee is due. |

| Payment Timing | Due when ICRS receives the insurance settlement. | Due when ICRS receives the supplemental payment. |

Example with Calculations

Suppose your initial settlement is $500,000 after deductible. Later, ICRS secures an additional supplemental payment of $100,000.

Option 1:

10% of Gross Recovery (Less Deductible)

10% of $600,000 (initial $500,000 + supplemental $100,000) = $60,000 fee.

Option 2:

25% of Supplemental Portion (New Money)

25% of $100,000 = $25,000 fee.

Which Applies?

The supplemental contract ensures you pay the lesser fee. In this case, instead of paying $60,000, you pay only $25,000. This cap protects policyholders and ensures fairness. Need further explanation of how public adjuster fees work, watch this video.

How Public Adjusters Get Paid

Typically, when represented by a public adjuster, depreciation is applied in the fee calculations for ACV payments. We also negotiate excessive depreciation applied by some insurers for a higher initial payment for the policyholder. Whenever the insurer sends us a check, we send an invoice for our fee.

It is important to note that most claims where a policyholder engages Insurance Claim Recovery Support LLC Public Adjusters at the beginning of the claim get settled much faster and the claims that are supplements to a previously rendered coverage determination from your insurer prolong the process and often get in disputes. Learn more by watching our video, When Should a Policyholder Hire a Public Insurance Adjuster?

A good communication process is key. Ask potential adjusters these questions: What’s your experience with claims like mine? How will you handle my specific situation step-by-step? What’s your fee structure and timeline? Can you provide references from commercial clients? How do you document hidden damages and business interruption? How do you stay current on construction costs?

Will hiring a public adjuster make my insurance company angry or slow down my claim?

This is a common concern. While some insurers prefer unrepresented policyholders, hiring a public adjuster is not only your legal right, but a good public adjuster can expedite the process while making sure the policyholder gets the fair and prompt settlement deserved.

Rather than slowing things down, we typically streamline the process. We submit complete, accurate documentation upfront, anticipate insurer questions, and manage communications professionally, avoiding common delays.

Furthermore, most policyholders are simply unaware that you bear the burden of proof while the insurance company only has a duty to perform a proper investigation, which can be very subjective. Learn more about how Public Adjusters Assist Business Policyholders with Insurance Claims.

Your insurance company has a legal obligation to negotiate in good faith with your representative and cannot retaliate against you. In fact, professional representation often leads to faster resolutions because we speak their language and present claims in formats they understand.

We don’t make insurers angry; we make them accountable. The Case for Engaging Public Adjusters Early in Large-Loss Claims is about ensuring fair treatment and maximum recovery while you focus on getting back to business.

Conclusion:

Secure Your Recovery by Making the First Move Your Best Move

When disaster strikes your commercial property, multifamily HOA, or apartment complex, you’re not just facing physical damage; you’re entering a battle for fair compensation. The Case for Engaging Public Adjusters Early in Large-Loss Claims is a strategic business decision that can mean the difference between financial devastation and full recovery.

Your insurance company has a team of experts working to minimize your payout. Why face them alone while also managing a disaster?

We level the playing field to maximize your settlement through specialized expertise, meticulous documentation, and skilled negotiation, often achieving settlements 40% to 700% higher than initial offers. We reduce your stress, save you time, and help you avoid costly litigation by resolving disputes effectively within the claims process.

Whether you’re dealing with fire damage in Austin, hurricane destruction in Houston, freeze damage in Dallas-Fort Worth, or storm damage anywhere from San Antonio to Lubbock, San Angelo, or Waco, you don’t have to face your insurance company alone. The aftermath of a fire, hurricane, or flood is overwhelming enough without fighting for fair compensation.

At Insurance Claim Recovery Support, your recovery is our mission. We work exclusively for policyholders, never for insurance companies. Our expertise in commercial buildings, multifamily properties, and religious institutions means we understand the unique challenges your claim presents.

Make your first move the best one. Don’t wait for a lowball offer or denial. The sooner we begin documenting your loss and advocating for your rights, the stronger your position becomes.

Contact us for a claim consultation, and let our expertise guide you to the maximum settlement you truly deserve. Your property may be damaged, but your financial recovery doesn’t have to be compromised.