Weather damage insurance claims are a crucial part of safeguarding your property against the unpredictable forces of nature. These claims cover various disasters, including damage from storms, strong winds, and hail. Here’s what you should know immediately:

- Types of damage usually covered: Wind damage, hail-induced destruction, and lightning strikes.

- Important steps: Document all damage, contact your insurance company promptly, and keep track of your claims process.

- Exclusions: Typically, flood and earthquake damage require separate coverage.

Insurance claims play a vital role for policyholders seeking compensation to repair storm-induced damage to their properties. Whether you are a commercial building owner or a multifamily complex manager, understanding how to efficiently steer storm insurance claims can lead to quicker and fairer settlements.

I am Scott Friedson, a seasoned public adjuster with significant experience in Weather damage insurance claims, having overseen the settlement of numerous substantial loss claims. With expertise in advocating for policyholders, my commitment is to help you understand and manage your insurance claims effectively, ensuring you receive the comprehensive coverage you deserve.

Types of Weather Damage Covered by Insurance

When it comes to weather damage insurance claims, it’s important to know what types of damage are typically covered by your policy. Here’s a breakdown of the main types of weather-related damage that insurance often covers:

Wind Damage

Wind damage is one of the most common types of weather-related claims. High winds, including those from tornadoes and hurricanes, can wreak havoc on your home. Standard home insurance policies usually cover damage to your home’s structure and personal belongings caused by wind. However, it’s crucial to read your policy carefully, as some insurers might exclude or limit wind damage coverage, especially in high-risk areas.

Hail Damage

Hailstorms can cause serious damage to roofs, siding, and windows. In fact, hail damage is among the most frequent claims made by homeowners. Insurance policies typically cover hail damage, but you will need to pay your deductible first. It’s worth noting that some policies might not cover cosmetic damage, so be sure to check the specifics of your coverage.

Lightning

Damage from lightning strikes is generally covered under standard home insurance policies. This can include damage to your home’s electrical systems, electronic devices, and even structural damage from a direct hit. Lightning can also cause fires, which are typically covered by insurance.

Wildfires

Most standard home insurance policies include coverage for damage resulting from wildfires. However, if you live in an area prone to wildfires, finding an insurer that covers this peril might be challenging. In such cases, a state-run FAIR plan might be an option for obtaining necessary coverage.

Understanding what your insurance policy covers is crucial for navigating the claims process effectively. Make sure to review your policy details to ensure you have the right coverage for your needs.

Weather Damage Insurance Claims Process

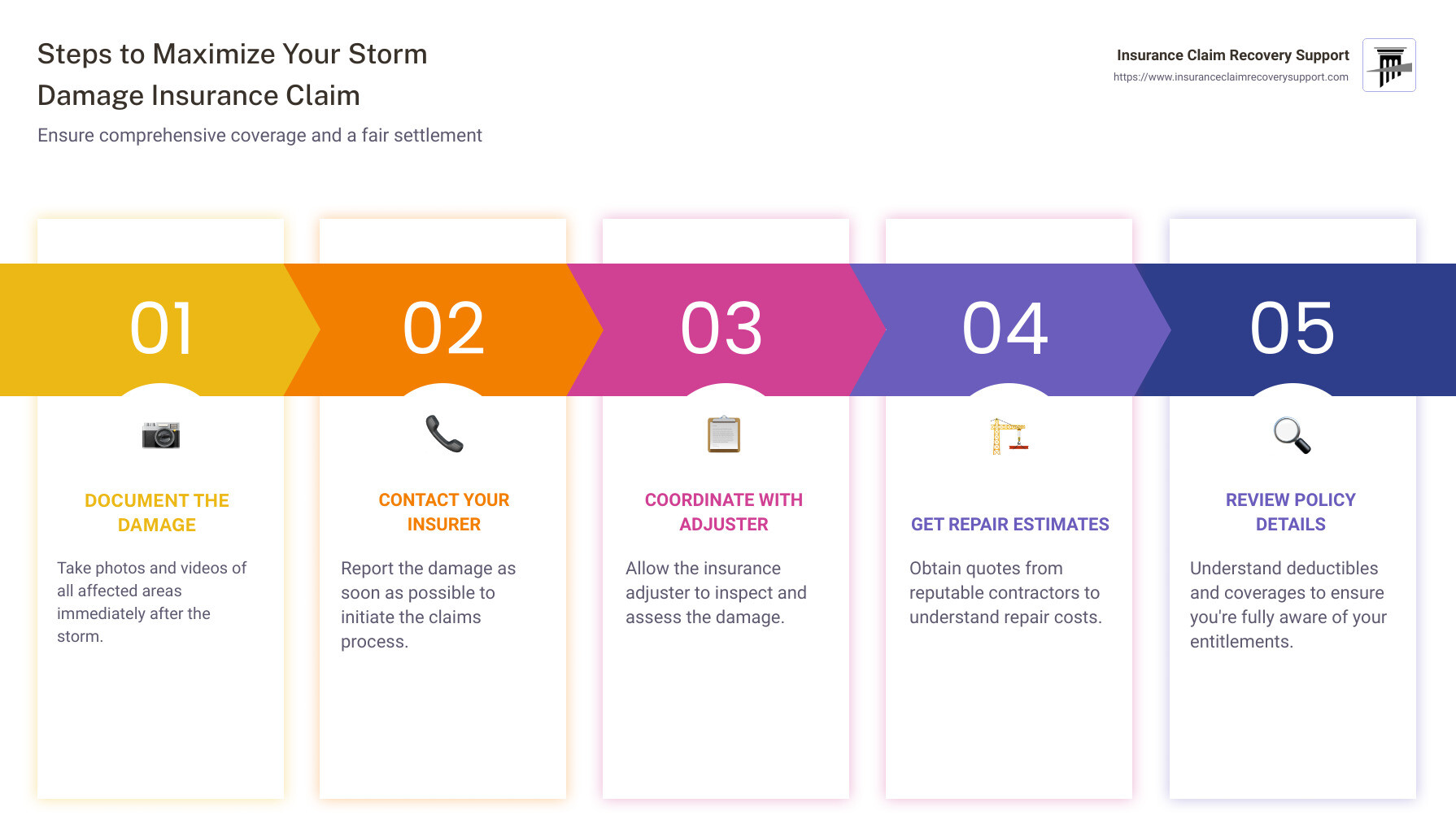

Navigating the weather damage insurance claims process can feel overwhelming, especially when you’re dealing with the aftermath of a storm. But breaking it down into simple steps can make it more manageable.

Reporting Damage

First things first—report the damage to your home as soon as possible. This quick action is crucial. Not only does it help speed up your claim, but it also aids local and state emergency managers in coordinating response efforts. Even if you decide not to file a claim, reporting the damage can still be beneficial.

Contacting Your Insurer

Once you’ve assessed the damage, reach out to your insurance company. Use the contact information provided on your insurance card or the company’s website to ensure you connect with the right department. This step is more than just a phone call; you may need to fill out a claim form, detailing the damage extensively.

Pro tip: If your insurer offers an online portal or mobile app, use these tools to streamline the process.

Adjuster Inspection

After filing your claim, your insurer will assign an adjuster to assess the damage. This inspection can be done in person or virtually using smartphone tools like FaceTime or Google Meet.

Be prepared: Gather all documentation, including photos, videos, and receipts for any emergency repairs. These details will help the adjuster understand the extent of the damage.

If you’re uncomfortable with a virtual inspection or if the damage is significant, request an in-person visit. Always verify the adjuster’s identity before allowing them into your home.

Filing a Claim

Filing a claim involves more than just reporting damage. It requires detailed documentation and an understanding of your policy’s coverage. Make sure to:

- Document everything: Photos, videos, and a list of damaged items are essential. Include timestamps if possible.

- Understand your policy: Know what your insurance covers, including any deductibles or exclusions.

- Meet deadlines: Promptly report damage to avoid delays or affect your claim’s validity.

By following these steps, you’ll be better equipped to handle the claims process efficiently. Keep all records organized and maintain clear communication with your insurer. This proactive approach will help you steer the process and move closer to resolving your claim.

Common Exclusions in Weather Damage Insurance

When it comes to weather damage insurance claims, understanding what isn’t covered is just as important as knowing what is. Many homeowners assume their policy covers all types of weather-related damage, but that’s not always the case. Here are some common exclusions you should be aware of:

Floods

Flood damage is one of the most misunderstood exclusions in standard home insurance policies. Despite being a significant risk, most policies do not cover flood damage. If you live in an area prone to flooding, it’s crucial to purchase separate flood insurance through the National Flood Insurance Program (NFIP) or a private insurer.

Why the exclusion? Flooding is considered a high-risk event, affecting large numbers of properties at once, which makes it financially unfeasible for standard policies to cover.

Earthquakes

Like floods, earthquakes are typically not covered under standard homeowners insurance. However, you can often add earthquake coverage as a separate policy or endorsement if you live in a quake-prone area.

California residents, take note: The California Earthquake Authority (CEA) offers specific coverage options for those living in the Golden State.

Policy Exclusions

Beyond natural disasters, there are other exclusions that might surprise you. Insurance companies often exclude damage that results from negligence or lack of maintenance. This means issues like mold, termite damage, or rot aren’t covered if they’re deemed preventable through regular upkeep.

Important tip: Regular maintenance and inspections can help prevent these issues and ensure your home remains insurable.

Understanding Your Policy

To avoid surprises, thoroughly review your insurance policy. Look for sections detailing exclusions and limitations. If you find the language confusing or unclear, don’t hesitate to reach out to your insurance agent for clarification.

Keeping these exclusions in mind will help you better prepare for potential risks and consider additional coverage where necessary. Understanding the limits of your policy can save you from unexpected expenses and ensure you’re adequately protected against the elements.

Tips for Maximizing Your Insurance Claim

When dealing with weather damage insurance claims, preparation is key. Here are some tips to help you maximize your claim and ensure a smooth process.

Documenting Damage

The first step after any storm is to assess and document the damage. Take clear, detailed photos and videos of all affected areas. Capture different angles to provide a comprehensive view of the damage. Keep a written record of everything damaged, including descriptions and estimated values.

Pro Tip: Don’t just focus on visible damage. Check areas like the roof, attic, and basement for hidden issues.

Getting Estimates

Before filing your claim, get written estimates from at least two reputable contractors. These estimates should be detailed and on official letterhead. This documentation will help you and the insurance adjuster understand the repair costs.

Why multiple estimates? They provide a benchmark for what repairs should cost and can prevent lowball offers from insurers.

Understanding Deductibles

Deductibles are a crucial part of your insurance claim. They represent the amount you’ll pay out-of-pocket before your insurance kicks in. There are typically two types of deductibles: percentage deductibles and flat deductibles.

- Percentage Deductibles: These are based on a percentage of your home’s insured value. They can be costly, especially for high-value properties.

- Flat Deductibles: These are fixed amounts, which can be easier to budget for.

Budgeting Tip: Ensure your deductible is affordable. If you have a percentage deductible, calculate potential costs based on your home’s value to avoid surprises.

Act Quickly

Time is of the essence when filing a claim. Contact your insurer promptly to report the damage and start the claims process. Delays can complicate your claim and may make it harder to prove the damage was storm-related.

By following these steps, you’ll be better prepared to handle your weather damage insurance claim, ensuring you get the compensation you deserve.

Frequently Asked Questions about Weather Damage Insurance Claims

What types of storm damage are typically covered?

Wind, hail, and lightning are common types of storm damage covered by standard homeowners insurance. Wind damage, including harm caused by tornadoes and hurricanes, is typically covered. This includes damage to your roof, siding, and windows. Hail damage is another common claim and usually includes repairs to your roof and siding. Lightning strikes can cause fires or power surges, and these are also generally covered by your policy.

Fact: According to the Insurance Information Institute, wind and hail damage were leading causes of insurance claims between 2014 and 2018.

How do deductibles work for weather damage claims?

Deductibles are the amount you pay out-of-pocket before your insurance kicks in. There are two main types: percentage deductibles and flat deductibles.

-

Percentage Deductibles: Calculated as a percentage of your home’s insured value. For example, if your home is insured for $200,000 and your deductible is 2%, you would pay $4,000 before insurance covers the rest.

-

Flat Deductibles: A fixed dollar amount you pay, regardless of your home’s value. These are often easier to budget for but may vary based on your policy.

Tip: Always check your policy to understand which type of deductible applies to you and how it affects your claim.

What should I do immediately after a storm?

First, ensure your safety and the safety of your family. Then, report damage to your insurance company as soon as possible. This helps to start the claims process and ensures that the damage is documented promptly.

Steps to Take:

-

Document the Damage: Take photos and videos of all damage before making any temporary repairs.

-

Contact Your Insurer: Reach out to your insurance provider to report the damage and start the claims process. Provide them with all the documentation you’ve gathered.

-

Temporary Repairs: If necessary, make temporary repairs to prevent further damage, but keep receipts for any expenses incurred.

By acting quickly and keeping detailed records, you can streamline your weather damage insurance claim process and improve your chances of a successful settlement.

Conclusion

At Insurance Claim Recovery Support, we are more than just a service—we are your ally in navigating weather damage insurance claims. Our mission is simple: to ensure you receive the maximum settlement possible. We understand the stress and confusion that can come with filing a claim after a storm, and we’re here to guide you every step of the way.

Maximizing Settlements

We know how insurance companies operate and are skilled in negotiating on your behalf. Our expertise lies in carefully documenting your claim, ensuring every detail is accounted for. This approach consistently results in higher settlements for our clients, turning a potentially daunting process into a manageable one.

Policyholder Advocacy

We stand firmly on the side of the policyholder. You are not just a number to us. You are a person, a family, a business facing a challenging time. Our advocacy extends beyond just filing claims. We educate you on your rights, guide you through the claims process, and provide the support you need to rebuild and recover.

In Texas, from Austin to Dallas, Fort Worth to Houston, we are known for our relentless advocacy and unwavering support. Our team is equipped with the knowledge, experience, and dedication needed to steer the complexities of hail and wind damage claims.

Don’t face the storm alone. Let us be your advocate, your guide, and your partner in recovery. Together, we can weather any storm.

Learn more about how we can help with your hail and wind damage insurance claims.