Not the Insurance Company

Policyholder-focused.

We settle large-loss property damage insurance claims for Policyholders.

Commercial Property

Industrial Facilities, Office Buildings, Medical, Hospitals, Retail Properties, Hotels & Hospitality, Religious Institutions, Educational Buildings, Storage, and Historical Buildings.

Multifamily Property

Apartment Complexes, High Rise Apartments, Townhome Communities, Condominium Associations, Student Housing, Senior Living, Mixed-Use, and Affordable Housing.

High-Value Homes

Luxury Estates, Custom Built Mansions, Historic Homes, Waterfront Homes, Mountain Retreats & Ranch Estates, Gated Community Homes, and Celebrity or Notable-Owner Residences.

COMMERCIAL AND MULTIFAMILY

LARGE-LOSS PROPERTY DAMAGE INSURANCE CLAIMS SPECIALISTS.

Our team specializes in navigating, documenting, negotiating, and resolving extensive large-loss property damage insurance claims resulting from fire, hail, storms, hurricanes, tornadoes, lightning, floods, water damage, freezing, business interruption, and wind-related incidents. It’s important to note that we do not represent insurance companies. We exclusively represent policyholders.

- No Recovery, No Fee Pro-Policyholder Representation.

- We Exclusively Represent Insured Policyholders.

- $ 250M+ Settled Property Damage Insurance Claims.

- 500+ Large-loss property damage claim settlements.

- 15 Years of Experience.

- Public Adjusters nationwide.

- Non-Litigious Solution.

- Verifiable experience and client references.

- Avoid conflicts of interest with a licensed, successful, & ethical public adjuster working on your behalf.

- 20%, 91%, 163%, 181%, 281%, 301%, 1,310%, 3,324%, and 3,830%+ increased results over initial insurer offers.

- Reversed wrongful denials.

- Routinely re-open claims for supplementation.

- Avoid unnecessary litigation, underpayments, delays, & denials.

- Get the settlement you deserve!

- No one provides peace of mind like ICRS public adjusters.

Insurance Claim Recovery Support

Policyholders Trust

ICRS Public Adjusters to Settle

Large-Loss Property Damage Insurance Claims.

Insurance Claim Recovery Support (ICRS) Public Adjusters, headquartered in Austin, TX, specializes in large loss property damage insurance claims, offering comprehensive documentation, negotiation, and settlement services exclusively for policyholders across Texas and numerous other states. With over 15 years in business, 20 years of experience, and a proven track record on more than 500 claims, ICRS has successfully secured hundreds of millions of dollars in settlements for damages caused by events such as fire, hail, storms, hurricanes, tornadoes, lightning, floods, water damage, freezes, business interruptions, and wind.

We serve building owners and property management companies of apartments, storage facilities, offices, retail spaces, multifamily, syndications, homeowner associations, property management companies, and high-value homes.

Representation services are offered on a contingency basis

—No Recovery, No Fee.

If your property has suffered insured damages of $250,000 or more, we can help you navigate the property insurance claim process to get the settlement you deserve fairly and promptly.

- Apartment & Multi-Family Complexes

- Commercial Buildings

- Townhome, Condo, and HOAs

- Industrial and Manufacturing Facilities

- High-Value Homes

- Church & Religious Organizations

- Historic Buildings

- Schools and Universities

- Large-Loss Complex Claim Experts

Insurance Companies Have Experts Working For Them,

You Should Too! ™

LET US ADVOCATE FOR YOU

Your Search To Find and Hire the "Best Public Insurance Adjuster Near Me" is Over!

It’s no secret that navigating the property insurance claims process can be tricky. Don’t take chances with your home or business. Make no mistake about it, your insurance company has experts working on their behalf.

Most Policyholders find hail, fire, and other storm damage insurance claims to be a complex and unfamiliar process. Disputes involving an underpaid or delayed settlement don’t necessarily need lawyers or attorneys to resolve differences between the policyholder and insurer. That’s why smart Policyholders dealing with large and complex property damage insurance claims trust the experienced public adjusters at Insurance Claim Recovery Support (ICRS) to deliver the settlement results they deserve without unnecessary litigation.

Our goal is to assist policyholders in securing the rightful settlement they deserve, safeguarding their rights, compelling insurers to fulfill their obligations, and ensure your insurance claims are resolved fairly and promptly.

We’ve had the privilege of settling claims totaling hundreds’ of millions of dollars for companies who manage up to $3 billion in assets.

Discover why Policyholders choose ICRS as the right public adjuster to settle large property damage insurance claims.

Multifamily Claims

ICRS licensed public insurance adjusters settle fire, hail, flood, wind, water, freeze, hurricane damage, and other storm-related property damage insurance claims for residential, multifamily, and apartment complex policyholders.

We’re proud of our long-standing track record for successfully settling large and complex claims, serving as zealous advocates on behalf of apartment owners, real estate syndicates, investors, assisted living facilities, homeowner associations, condominium associations, townhomes, student housing, and multifamily property management companies.

Many insurance policies contain ambiguous language regarding exclusions, building code upgrades, ADA and OSHA laws. insurance code statutes, department of insurance bulletins as well as Overhead and Profit are included where applicable in your Pro-Policyholder claim package submissions from our licensed public adjusters.

Protect your assets, retain tenants, and get the fair and prompt settlement you deserve with the help of the best public insurance adjusters in the industry.

Commercial Claims

Commercial property building damage insured for fire, hail, hurricane, tornado, flood or other perils to offices, hotels, schools, municipalities, retail centers, manufacturing and storage facilities, typically contain subjective insurance policy language that can negatively affect your business if your insurance claim is not handled promptly and adequately.

We help policyholders manage risk by helping you understand policyholder requirements and policy benefits but also assert your rights and submit Pro-Policyholder supporting evidence to substantiate your claim to your insurance company.

Set your claim up for success at the beginning of a loss or if your insurance claim has been improperly handled, we routinely overcome unreasonable delays and underpayments to get you the settlement you deserve! Don’t get stressed and waste valuable time playing claim games with your insurer.

Insurance Claim Recovery Support LLC licensed Public Insurance Adjusters exclusively represent policyholders’ interests, not insurers. We are licensed in Texas as well as several other states. As your policyholder advocates, we document, negotiate, and settle your insurance claim with your insurance company fairly and promptly. Get the maximum settlement, in minimum time!

Business Interruption Claims

Insurance policy language for business interruption claims can be subjective. So save time and stress playing claim games! If a loss of business income insurance claim isn’t adjusted promptly and adequately, it can drastically affect your company. Market rents, leases, concessions, expenses, special provisions and reasonable restoration periods are important loss of business income factors to capture in your analysis of what is reasonably owed and payable under your policy.

ICRS Public Adjusters work exclusively on your behalf to get the settlement you deserve from your insurance company. Let us help you get back in business!

LISTEN TO OUR PODCAST

What Is a Public Insurance Adjuster?

What Is a Good Public Adjuster?

Want more tips on how to navigate the insurance claim process and how ICRS public adjusters negotiate large loss property damage settlements pro-policyholders?

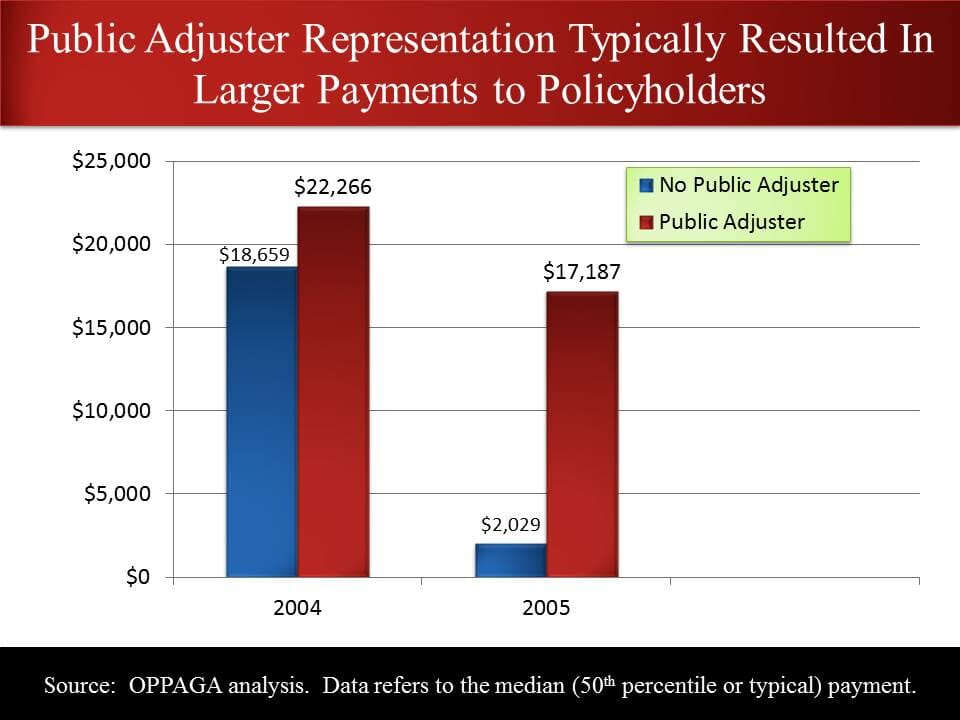

“547% higher payments with a public adjuster for claims.”

We Settle Big Property Damage Insurance Claims

It Pays To Know ICRS

We Exclusively Represent Policyholders

Insurance Claim Recovery Support (ICRS) is a premier public adjustment firm that exclusively represents policyholders in their quest to achieve fair settlements for their insurance claims. With an unwavering commitment to the interests of policyholders, ICRS ensures that clients receive the maximum compensation they deserve. This unique focus on policyholders sets the company apart from other public adjusters, who often serve both the policyholders and insurance companies, creating potential conflicts of interest. ICRS stands out by prioritizing the needs of their clients above all else, making certain that their rights are protected throughout the claims process.

ICRS brings to the table an extensive understanding of the insurance industry, allowing them to effectively advocate for their clients. Their team of highly skilled public adjusters specializes in evaluating, documenting, and negotiating complex insurance claims on behalf of policyholders. By leveraging their deep knowledge of policy language and claims procedures, ICRS enables their clients to navigate the often confusing and time-consuming claims process with ease. The company’s primary goal is to ensure that their clients receive the compensation they are entitled to, which can be invaluable in helping them rebuild their lives and businesses after a loss.

- Commercial Property Insurance Claims

- Multi-Family Property Insurance Claims

- High-Value Homes & Real Estate Insurance Claims

Businesses We Serve

OUR TEAM

Who Is Looking Out For Your Interests?

The Single Best Way to Settle Commercial and Multifamily Property Damage Insurance Claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document and negotiate your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time.

Scott Friedson

CEO | Public Insurance Adjuster

- Texas #1632488

- Florida #W797805

- Ohio #1289475

- Colorado #411678

- Georgia #2874635

- Indiana #3891955

- Kansas #15827727

- Kentucky #1014264

- Maryland #2106190

- North Carolina #15827727

- Nebraska #15827727

- Nevada #3508775

- Oklahoma #100118599

- Pennsylvania #1043874

- South Carolina #893766

- Utah #915234

- NPN #15827727

- Haag Certified Commercial Roof Inspector #201408103

Misty Friedson

VP | Public Insurance Adjuster

- Texas #2647568

- Florida #W798577

- Kentucky #1267289

- North Carolina #19846653

- Nebraska #19846653

- Oklahoma #3001820951

- Ohio #1416569

- Pennsylvania #1054792

- South Carolina #19846653

- Utah #915489

- Haag Certified Commercial Roof Inspector #202111207

Insurance Claim Recovery Support

Get the Maximum Insurance Claim Settlement You Deserve in Minimum Time™ No Recovery, No Fee

ICRS Public Adjusters are the best in the business for settling large loss property damage insurance claims in Texas and many other states. We exclusively represent policyholders to help recover from fire insurance claims, storm damage, and other disasters covered under property insurance policies.

Business and property owners, insurance brokers, contractors, real estate syndicators, and property management companies trust ICRS public insurance adjusters to settle new, underpaid, delayed, or wrongfully denied hail, wind, fire, water, or other storm damage insurance claims fairly and promptly.

- Our public insurance adjusters have over a decade of experience

- Haag Engineering Certified Commercial Roof Inspectors

- IICRC Water Restoration Technician Certifications

- State-Licensed and Bonded

ICRS is on YOUR side

With ICRS on your side, we represent you, not the insurance company. When you hire a public adjuster from ICRS, we present your insurance claim submissions Pro-Policyholder filled with facts and valuable documentation to support your claim for coverage under your policy submitted to your insurer on your behalf, representing your interests, not your insurance company. Our policyholder claims are placed on equal footing with your insurance company’s adjuster, engineer, and building consultants, who represent their interests, not yours. Our track record for successfully negotiating a fair and prompt settlement for insured policyholders is unmatched. If your insurer chooses to ignore evidence that supports your Pro-Policyholder claim and force you to sue, we have a network of insurance attorneys to whom we refer victims of bad faith insurance claim handling practices that typically work on a contingency basis. We prefer to reasonably settle all our insurance claims without litigation but unfortunately, not all insurers are reasonable, some act in bad-faith.

Tools and Resources to Help You

Here at ICRS, we help policyholders understand their rights. Discover the different types of insurance, the insurance claim process, and settlement tips from the National Association of Insurance Commissioners.

LOSS TYPES

We represent policyholders with large loss property damage

Years Experience

Large-Loss Claims Settled

Hours Worked

Average Claim Amount

No Recovery, No Fee

Receive a complimentary and insightful consultation regarding your large-loss property damage insurance claim. Experience our pressure-free, sales-pitch-free approach aimed at assisting you in making well-informed decisions about the best course of action for your claim. Our licensed public adjusters, who exclusively work with policyholders, boast years of invaluable experience. Opting to engage our services means operating on a contingency basis—no recovery, no fee. Rest assured, our proven and efficient insurance claim process gets results.

We also value your privacy, uphold strict standards and do not sell, trade, or rent your personal information to third parties.

TESTIMONIALS

What Client Says About ICRS

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

I cannot say enough good things about Insurance Claim Recovery Support — they truly feel like earth angels. Misty and Scott helped me through one of the most overwhelming and helpless times of my life. As a single woman dealing with major home renovations after a severe water leak, I was unfortunately taken advantage of by a dishonest contractor. From breaking my TV and not saying a word, to lying about repairs, damaging my sprinkler, inflating estimates with bogus charges, and even threatening legal action — I was completely overwhelmed.

That’s when Misty and Scott stepped in. Their knowledge of the laws and the insurance claims process is unmatched, and their compassion and support were exactly what I needed. They knew exactly how to handle the situation, empowered me with the facts, and guided me every step of the way. They genuinely listened, made me feel heard and understood, and stood by my side when I needed it most. I am beyond grateful for their integrity, expertise, and kindness. If you’re facing a tough insurance claim situation, do not hesitate to reach out to them — they are absolute professionals and true advocates and helped me feel safe in my own home again.

Scott and Misty are absolute professionals. Their knowledge of the insurance claim process is unmatched, and they navigated our case with skill, integrity, and relentless attention to detail. On top of that, they’re HAAG certified roof inspectors, which made all the difference in proving the true extent of our damages.

Looking back, we wish we had hired ICRS from the very beginning. It would have saved us so much stress, time, and lost money. If you’re dealing with an insurance claim - especially a commercial one - don’t wait. Call ICRS.

We’re beyond grateful for everything they did for us.

Scott and Misty from ICRS have been the most honest, supportive, and knowledgeable people I’ve encountered throughout this ordeal. They made me feel heard and understood, which was a welcome relief after so many interactions with professionals who seemed more interested in their bottom line than in helping me.

Scott guided me through this incredibly complex and stressful process with expert advice, giving me the clarity and confidence I desperately needed. His and Misty’s commitment to doing what’s right for their clients is unmatched. They genuinely care and provide guidance and support that feels personalized and sincere.

Thanks to Scott and Misty, I’m back on track and no longer feel overwhelmed. ICRS has saved me countless hours of stress and struggle, and I wholeheartedly recommend them to anyone dealing with a large-loss claim after a storm. Trust me—making them your first call can save you immeasurable frustration and help you navigate this difficult path with sound advice and unwavering support.

Thank you, Scott and Misty, for everything you’ve done!

-Jason Cheshire

Our Insurer mislead us and withheld information. It took weeks for them to provide a copy of our policy, and when they did, they excluded information that benefited us. ICRS pressured them to provide a full copy of our policy which included the benefits they had initially excluded.

Our Insurer provided a scope that was not aligned with the actual cost of rebuilding our home. ICRS countered with a realistic scope and advised us to secure independent quotes on our own. ICRS then leveraged its scope and the independent quotes to force our insurer to provide more realistic amount for the rebuild. The scoping process took months, and ICRS drove the communications the entire time.

The first adjuster that our insurer assigned to our claim arrived at the site visit and interview with a combative attitude, where he used inappropriate language, and attempted to force the negotiations their favor by manipulating the facts. ICRS swiftly called out the adjuster and guided the negations back on track.

Our Insurer cycled through four adjusters during our claim. The pass-down of information between these adjusters was insufficient, with each new adjuster attempting to avoid payout using the same methods that failed with the last. We were astonished that a company could act in this manner without serious recourse. ICRS was able to leverage emails, photos, inspection reports, and additional documentation to bring the adjusters up to speed after each transition. ICRS’ efforts kept the claim moving every time our insurer attempted to stall.

When our Insurer misrepresented the policy and refused to pay out for damages that were covered, ICRS drove the communications process and provided documentation, which included case-law excerpts from similar claims that had gone to trial. This approach provided breakthroughs on vital areas of the negotiations. ICRS provided a paper trail and documentation that our Insurer couldn’t ignore, and ultimately they were forced to pay out due to the exposure that ICRS had made apparent.

ICRS increased the overall claim by more than 20% during the planning and rebuild process through supplements. Through negotiations with our Insurance company, ICRS increased the claim by 104% over what was released up-front in our initial settlement. Additionally, the payout ICRS secured for us was 31% higher than our policy limit.

Before that fire, we had heard insurance companies pull out every trick in the book to avoid paying out on a policy. Having gone through this experience, we can say that the behavior on our insurers part was far worse than we had ever imagined possible. We advise with 100% conviction that anyone dealing with a large loss such as ours, hire a public adjuster to navigate and advocate on their behalf in order to get the needed results. Our family could not have rebuilt our home with the funds our insurance company provided, and we only have a home to return to because of ICRS’ efforts to hold our insurer accountable for the policy we had paid for. Throughout the claim, which lasted over a year, ICRS navigated the entire claim process with professionalism and care. Our family offers a sincere thank you to Scott, Misty, and the entire ICRS team.

Very knowledgeable. Thank you for helping!!