We settle large-loss Hurricane damage insurance claims

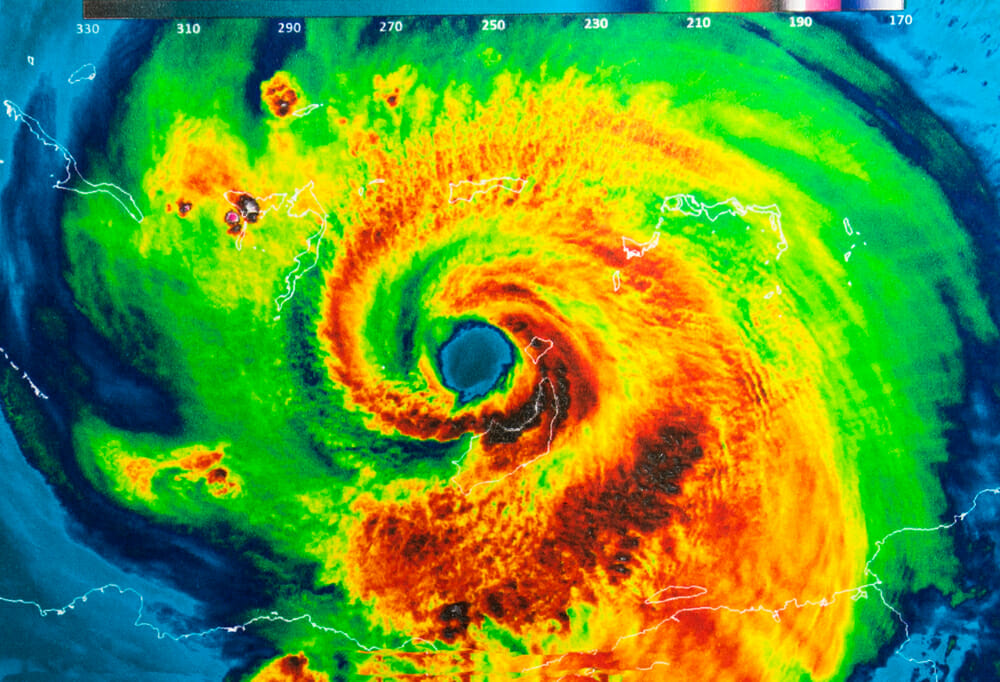

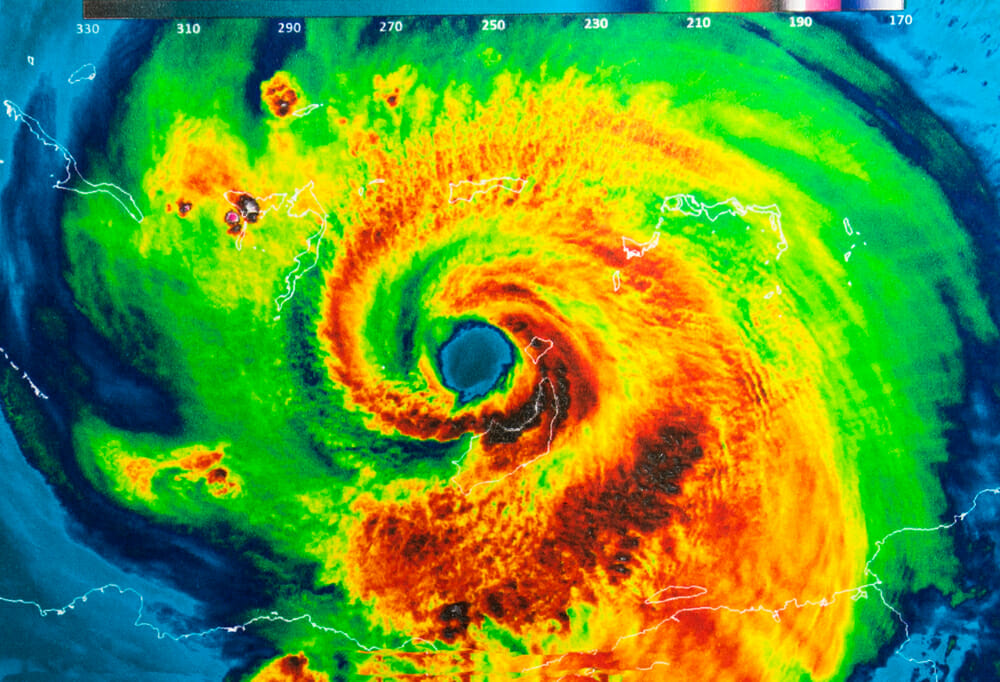

HURRICANE LOSS

Trust ICRS public adjusters to settle your hurricane damage insurance claim

When a hurricane has devastated your property, engaging ICRS public adjusters to handle your hurricane claim can help you get settled fairly and promptly.

- Commercial Property Hurricane Claims

- Multi-Family Property Hurricane Claims

- High-Value Homes & Real Estate Hurricane Claims

Public Adjuster for Hurricane damage claims

Get the Hurricane Property Damage Insurance Claim You Deserve

Don’t let hurricane property damage destroy your home, HOA, or business.

Are you 100% fed up dealing with a delayed or underpaid large loss Hurricane property damage insurance claim in Texas, Florida, Georgia, North or South Carolina? Engaging the professionals at Insurance Claim Recovery Support public adjusters can make a big difference in your settlement outcome. We have over a decade of experience settling large and complex Hurricane claims settled fairly and promptly without unnecessary litigation.

Hurricane property damage insurance claims can be large and complex which require a professional public adjuster. Hurricane damage is among the most devastating, and hardest to repair. These storms are capable of causing billions in wind, water, business interruption, equipment, and flood property damages.

If your commercial building, apartment complex, high-value home or business has been impacted by a hurricane or is struggling to resolve an underpaid or delayed hurricane insurance claim, put ICRS’ experienced public insurance adjusters to work for you today for easy-to-understand answers and experienced help with your hurricane insurance claim.

Time is of the essence. Delays, underpayments, and loss of revenue are common in hurricane damage insurance claims. Knowing your business owner’s or homeowner’s insurance policy, statutory insurance codes, policyholder rights, and department of insurance bulletins, and properly filing a claim against your insurance company to be indemnified fairly for full policy benefits while understanding the deductibles, exclusions, and terms, conditions, and facts of your policy can be a daunting task for even the most vigilant policyholder.

Get the professional help you need today with Insurance Claim Recovery Support licensed public insurance adjusters representing your interests.

When you hire ICRS public insurance adjusters to represent your claim, we perform these services exclusively for you:

- Analyze your insurance policy to ensure maximum claim coverage.

- Inspect the property damage and estimate all losses.

- Notify the insurance company of your loss and submit documentation supporting your loss.

- Coordinate appointments with insurance company staff and provide them with preliminary estimates for building and contents damage and loss of business accounting figures.

- Negotiate with your insurance company for a fair and equitable settlement.

- Prepare all documents in order to obtain final payment.

- No Recovery, No Fee

After A Hurricane

- Inspect your property for any potential wind or water damage.

- Damage to roof, windows, siding, and interior moisture.

- Take pictures and video of all damage.

- Water Damage Mitigation – Involves the removal of wet porous material, cleaning, disinfecting, extracting water, and drying out the structure with equipment to prevent mold growth.

- Policyholders have a duty to reasonably mitigate to prevent further damage.

- Water mitigation and water damage restoration can be complex and costly.

- When performing an internet search for water damage restoration near me, be sure to work with a professional who is familiar with the IICRC standards.

- IICRC stands for the Institute of Inspection, Cleaning and Restoration Certification. The Institute is a non-profit organization dedicated to assisting and improving the cleaning and restoration industry and is known across the world as the standard-bearer for professional cleaning and restoration service.

- Water Damage Restoration Technician (WRT) certification demonstrates knowledge to perform remediation work and an understanding of water damage, its effects, and techniques for drying structures.

- Water Damage Restoration – Is focused on repairing and restoring the water damage caused to a home or building after the water mitigation process.

- Replacing damaged walls and flooring.

- Eliminating mold.

- Repairing roof damage.

- Conducting humidity and moisture testing to ensure all issues have been resolved.

- Handling Water Mitigation and Restoration on your own after a flood may be too difficult or dangerous for you to do alone according to the Centers for Disease Control and Prevention (CDC). Putting yourself and others in jeopardy of health issues resulting from mold exposure is not worth the risk. A professional restoration company can use advanced meters and sensors to measure the level of moisture that’s present and effectively reduce your risk of mold growth.

- Locate an IICRC professional

- Locate a member of the Society of Cleaning & Restoration Technicians

Years Experience

Claims Settled

Hours Worked

Average Claim Amount

Risk-Free Loss Recovery Offer

Get a complimentary consultation on your hurricane damage insurance claim. We are hurricane claim adjusters who work for policyholders, not the insurance company. If you choose to hire us, we work on contingency. No recovery, no fee. Our hurricane insurance claim process is proven and streamlined. We also value your privacy. We do not sell, trade, or rent your personal information to others.

Need immediate hurricane damage insurance claim help?

TESTIMONIALS

What Client Says About ICRS

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

Florida: Hurricane Insurance Claims

How long does a Florida Public Adjuster have to perform services for a policyholder?

Florida Public adjusters must provide the claimant or insured a written estimate of the loss to assist them in the submission of a proof of loss or any other claim for payment of insurance proceeds within 60 days after the date of the contract.

How long does an insurance company have to pay a claim in Florida?

A claim must be paid or denied within 90 days after receipt of the claim. Failure to pay or deny a claim within 120 days after receipt of the claim creates an uncontestable obligation to pay the claim.

Texas Hurricane Insurance Claims

How long does a Texas Public Adjuster have to perform services for a policyholder?

In Texas, there isn’t a specific time limit mandated for how long a public adjuster must perform services for a policyholder. However, the duration of their services typically depends on the complexity of the insurance claim, the extent of the damages, and the negotiation process with the insurance company. Public adjusters usually work with clients throughout the entire claims process until a settlement is reached or the claim is resolved. It’s essential for policyholders to discuss the scope and duration of services with their chosen public adjuster to ensure clarity and alignment of expectations.

What is Texas Wind Insurance Association?

https://www.twia.org/

What are Texas insurance statutes that explain an Insurer’s duty to policyholders?

https://statutes.capitol.texas.gov/Docs/IN/htm/IN.542.htm

How long does an insurance company have to pay a claim in Texas?

Per Texas Insurance Code Sec. 542.057. PAYMENT OF CLAIM. (a) Except as otherwise provided by this section, if an insurer notifies a claimant under Section 542.056 that the insurer will pay a claim or part of a claim, the insurer shall pay the claim not later than the fifth business day after the date notice is made.

(b) If payment of the claim or part of the claim is conditioned on the performance of an act by the claimant, the insurer shall pay the claim not later than the fifth business day after the date the act is performed.

(c) If the insurer is an eligible surplus lines insurer, the insurer shall pay the claim not later than the 20th business day after the notice or the date the act is performed, as applicable.