Discover key services, fees, and success rates of loss adjusting services. Ensure the best choice for your claims with our guide.

Read MoreHarris, Dallas, Tarrant, Bexar, Travis, Collin, Denton, Hidalgo, El Paso, Fort Bend, Montgomery, Williamson, Cameron, Brazoria, Bell, Nueces, Lubbock, Webb, McLennan, Jefferson, Hays, Smith, Brazos, Ellis, Comal, Kauman, Midland, Bastrop, Orange, Wise, Kerr, Burnet, Atascosa, Val Verde, Hill, Hale, Jasper, Austin, Uvalde, Houston, Lampasas, Llano, Gaines, Hockley, Lee, Blanco, Franklin, and more.

It’s no secret that navigating the property insurance claim process can be tricky. Don’t take chances with your home or business. Your insurance company has experts working on their behalf.

Most Policyholders find hail, fire, and other storm damage insurance claims to be a complex and unfamiliar process. Disputes involving an underpaid or delayed settlement don’t necessarily need lawyers or attorneys to resolve differences between the policyholder and insurer. Public adjusters are essentially licensed, independent, and private insurance adjusters who exclusively represent the interests of policyholders in settling first party insurance claims.

Starting with a search like, “public adjuster near me” is a good start but just because they’re near you, doesnt’ mean they are the best qualified for your claim. That’s why smart Policyholders dealing with large and complex property damage insurance claims trust the experienced public adjusters at Insurance Claim Recovery Support to deliver the settlement results they deserve without unnecessary litigation.

Discover why Policyholders choose ICRS as the right public adjuster to settle large property damage claims.

ICRS licensed public insurance adjusters specialize in settling fire, hail, flood, wind, water, freeze, hurricane damage, and other storm-related property damage insurance claims for residential multifamily and apartment complex policyholders. We’re proud of our long-standing track record for successfully settling large and complex claims serving as zealous advocates on behalf of apartment owners, real estate syndicates, investors, assisted living facilities, homeowner associations, condominium associations, townhomes, student housing and multifamily property management companies. Many insurance policies contain ambiguous language regarding exclusions, building code upgrades, ADA and OSHA laws, insurance code statutes, department of insurance bulletins as well as Overhead and Profit are included where applicable in your Pro-Policyholder claim package submissions from our licensed multifamily public adjusters.

Protect your assets, retain tenants, and get the settled fair and prompt settlement you deserve with the help of the best public insurance adjusters for apartment buildings and multifamily properties in the industry. Request a FREE claim evaluation!

Commercial property insurance policy language covering building damage due to fire, hail, hurricane, tornado, flood or other perils to offices, hotels, schools, municipalities, retail centers, manufacturing and storage facilities, typically contain subjective insurance policy language that can negatively affect your company if your insurance claim is not handled promptly and adequately. An ICRS commercial public adjuster helps policyholders manage risk by assisting you in understanding your policyholder requirements, policy benefits, your rights, and we proudly submit Pro-Policyholder supporting evidence to substantiate your claim to your insurance company.

Don’t take unnecessary risks. Set your claim up for success at the beginning of a loss. And, if your insurance claim is already open but has been improperly handled, we routinely overcome unreasonable delays and underpayments to get you the settlement you deserve! Don’t get stressed and waste valuable time playing claim games with your insurer.

Insurance Claim Recovery Support LLC licensed Public Insurance Adjusters exclusively represent policyholder’s interests, not insurers. We are licensed in Texas as well as several other states. As your policyholder advocates, we document, negotiate, and settle your insurance claim with your insurance company fairly and promptly. Get the maximum settlement, in minimum time! Tell us about your Commercial Property Damage Insurance Claim Now.

Insurance policy language for business interruption claims can be subjective. So save time and stress playing claim games! If a loss of business income insurance claim isn’t adjusted promptly and adequately, it can drastically affect your company. Market rents, leases, concessions, expenses, special provisions and reasonable restoration periods are important loss of business income factors to capture in your analysis of what is reasonably owed and payable under your policy.

ICRS Public Adjusters work exclusively on your behalf to get the settlement you deserve from your insurance company. Let us help you get back in business! Start your business interruption claim now.

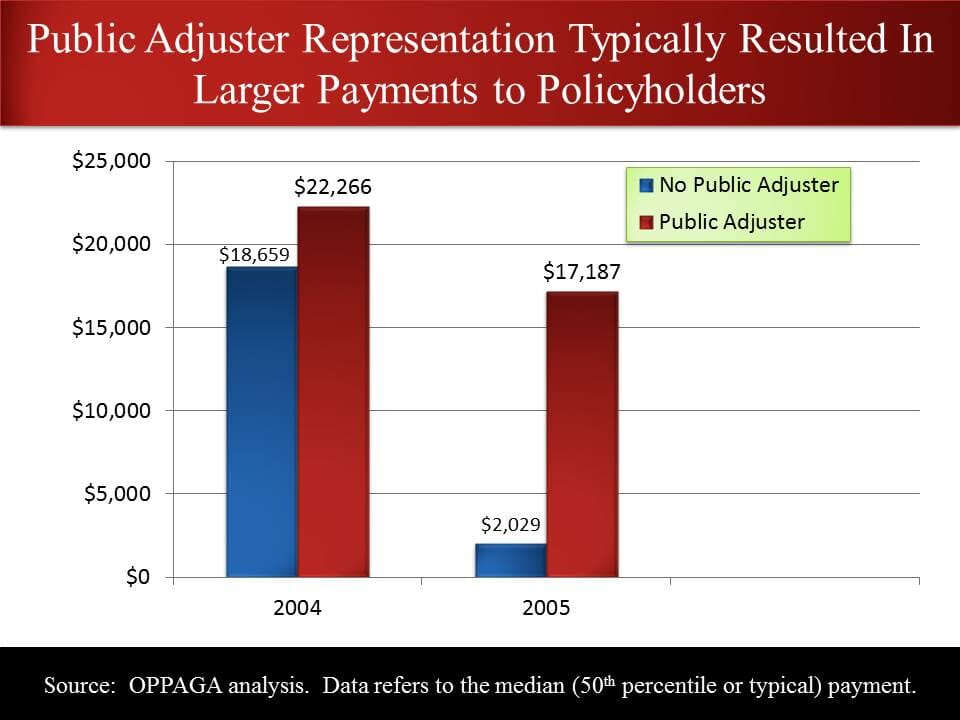

“547% higher payments with a public adjuster for claims.”

We Settle Big Property Damage Insurance Claims

Insurance Claim Recovery Support (ICRS) is a premier public adjustment firm that exclusively represents policyholders in their quest to achieve fair settlements for their insurance claims. With an unwavering commitment to the interests of policyholders, ICRS ensures that clients receive the maximum compensation they deserve. This unique focus on policyholders sets the company apart from other public adjusters, who often serve both the policyholders and insurance companies, creating potential conflicts of interest. ICRS stands out by prioritizing the needs of their clients above all else, making certain that their rights are protected throughout the claims process.

ICRS brings to the table an extensive understanding of the insurance industry, allowing them to effectively advocate for their clients. Their team of highly skilled public adjusters specializes in evaluating, documenting, and negotiating complex insurance claims on behalf of policyholders. By leveraging their deep knowledge of policy language and claims procedures, ICRS enables their clients to navigate the often confusing and time-consuming claims process with ease. The company’s primary goal is to ensure that their clients receive the compensation they are entitled to, which can be invaluable in helping them rebuild their lives and businesses after a loss.

The Single Best Way to Settle Commercial and Multifamily Insurance Claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time.

CEO | Public Insurance Adjuster

VP | Public Insurance Adjuster

With ICRS on your side, we represent you, not the insurance company.

Hiring a public adjuster from ICRS, provides policyholders the reassurance that your insurance claim submissions will be presented with your Pro-Policyholder position backed with facts and valuable documentation to support your basis for coverage under your policy.

Claim packages we present to your insurer on your behalf, represent your interests, and credibly dispute insurance company’s who wrongfully omit legitimate damages, benefits or offer evidence for bias opinions.

Our policyholder claims are placed on equal footing with your insurance company’s adjuster, engineer, and building consultants, who represent their interests, not yours.

Our track record for successfully negotiating a fair and prompt settlement for insured policyholders is unmatched. If your insurer chooses to ignore evidence that supports your Pro-Policyholder claim and force you to sue, we have a network of insurance attorneys to whom we refer victims of bad faith insurance claim handling practices that typically work on contingency basis. We prefer to reasonably settle all our insurance claims without a fight or litigation but unfortunately, not all insurers are reasonable, some act in bad-faith.

Here at ICRS, we help policyholders understand their rights. Discover the different types of insurance, the insurance claim process, and settlement tips from the National Association of Insurance Commissioners.

Fire loss claims address damages stemming from fires, which often result in extensive property destruction and necessitate substantial restoration efforts.

Hail claims focus on damages caused by hailstorms, typically affecting roofs, windows, and building exteriors.

Hurricane claims involve the widespread devastation brought on by powerful storms, characterized by high winds, heavy rainfall, and storm surges.

Tornado claims pertain to the destruction from severe winds and flying debris associated with these violent weather events.

Water loss claims encompass damages caused by water intrusion, such as burst pipes or leaks, leading to mold growth and structural damage.

Wind claims deal with damages resulting from strong gusts, which can topple trees, detach roofs, and cause other significant property damage.

Business interruption claims focus on the financial losses businesses experience when an unexpected event, like a natural disaster, disrupts their operations.

Flood claims cover losses due to water inundation, primarily impacting homes and businesses situated in flood-prone areas.

Appraisal claims arise when disagreements occur between policyholders and insurers regarding the value of damages, necessitating impartial appraisers to determine a fair settlement.

Get a complimentary consultation on your damage insurance claim. We are public claim adjusters who work for policyholders, not the insurance company. If you choose to hire us, we work on contingency. No recovery, no fee. Our insurance claim process is proven and streamlined. We also value your privacy. We do not sell, trade, or rent your personal information to others.

Need immediate fire damage insurance claim help?

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

Hiring a Public Adjuster ensures that the policyholder receives a fair and maximum settlement for their claim. They understand the local factors and challenges specific to property damage insurance claim adjustments and offer personalized services tailored to the policyholder’s needs. Having a public adjuster on your side can help navigate the complexities of the claims process and maximize the settlement amount.

Public Adjusters, such as Insurance Claim Recovery Support, work solely for the policyholder and only get paid by the insured what they recover. They do not charge any upfront fees or require any payment until a claim is settled and a settlement is reached.

There is an inherent potential conflict of interest between insurance adjusters who work for and represent the interests of your insurance company, not you, the policyholder. Insurance adjusters who are NOT public adjusters are paid directly by the insurance company to manage their liabilities and minimize the claim. Therefore, policyholders should not assume that the insurance adjuster is working solely in their best interest.

It is recommended to have an independent evaluation of property damage insurance claims with a dispute or has questions about the process.

Policyholders should consider hiring a public adjuster because they act as important advocates who solely represent the policyholder’s interests rather than the insurance company’s bottom line. Public adjusters possess expertise in insurance policies, damage assessment, and negotiation tactics, enabling them to fight for the policyholder’s best interests. With a public adjuster on their side, policyholders have a higher chance of securing a higher payout, often two to three times the initial offer made by the insurance company.

Insurance companies assign insurance adjusters to handle claims on their behalf. These adjusters primarily work to limit the insurance company’s losses rather than advocating for the policyholder’s best interests. The adjuster’s job is to assess the damages and offer a settlement that often favors the insurance company. This can result in policyholders being low-balled, delayed, and not receiving the full compensation they deserve.

The insurance claim process can be difficult and lengthy due to various factors. Firstly, insurance companies may make it challenging to collect the money owed to policyholders, resulting in delays. Additionally, the process involves filing a proof of loss and mitigating the damages, which can be time-consuming and overwhelming, especially for individuals who have other responsibilities like work or managing a business.

Yes, a ICRS Public Adjusters can help industrial businesses with their insurance claims process, including claims for damages such as Fire Damage, Smoke Damage, Wind & Hail Damage, Water Damage, Hurricane Damage, Flood Damage, Vandalism Damage, Earthquake Damage, Frozen Pipes Damage, Business Interruption, Contents and Stock Loss.

Yes, a ICRS Public Adjusters specializes in Apartment Complex, Multifamily Homeowner and Condominium Associations, property damage insurance claims, including claims for damages such as Hail Damage, Fire Damage, Smoke, Wind Damage, Water Damage, Hurricane Damage, Flood Damage, Vandalism Damage, Earthquake Damage, Frozen Pipes Damage, and Business Interruption.

Yes, a ICRS Public Adjusters have extensive experience working with property management companies. Lets face it, property management owners and staff have more than enough problems to deal with on a day to day basis. We help property management companies navigate the insurance claims process, including claims for damages such as Fire Damage, Smoke Damage, Wind & Hail Damage, Water Damage, Hurricane Damage, Flood Damage, Vandalism Damage, Earthquake Damage, Frozen Pipes Damage, and Business Interruption.

How often does Texas experience catastrophic disasters?

Houston, Dallas, Austin, and San Antonio Texas are no strangers to catastrophic disasters, with a regular occurrence of tropical storms and hurricanes due to its proximity to the Gulf of Mexico.

How can I contact Insurance Claim Recovery Support – Public Insurance Adjusters?

You can contact ICRS Public Adjusters by clicking here.

What do their clients say about them?

Check out our glowing testimonials.

Can ICRS Public Adjusters be trusted to advocate for their clients?

Our public insurance adjusters offer a great professional service that advocates exclusively for our policyholder client, not the insurance company.

Is there any specific evidence of their effectiveness in maximizing claim settlements?

Yes, the testimonials from our clients serve as evidence of their effectiveness in maximizing insurance claim settlements. You can also visit us on Facebook for more results.

Are ICRS Public Adjusters skilled in maximizing claim settlements?

Yes, over 15 years of proven results, we are highly skilled at maximizing insurance claim settlements.

At ICRS, we take great pride in the satisfaction and success of our clients. Here are some testimonials that highlight the exceptional support and results our clients have experienced:

“It pays to know ICRS – 747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane?Superior SupportICRS provided superior support and documentation, which was invaluable in proving the extent of roof damage that was sustained from a major hail storm that struck the Chico Community. A great professional service that advocates for their clients.” – Mike J., Texas

“Completely ReversedInsurance Claim Recovery Support settled my claim for top dollar in just 40 days after a hail claim on my apartment complex was flat out denied. ICRS completely reversed the carrier’s position!” – Richard N., Texas

“Severe Hail & Wind DamageOur company suffered severe hail and wind damage to two large apartment complexes in San Antonio, TX. We would have lost out on our insurance claim without the help of ICRS.” – Ted J., Texas

These testimonials highlight the exceptional service and support our clients have received from ICRS, resulting in successful insurance claim settlements. We are dedicated to advocating for our clients’ best interests and ensuring they receive the maximum compensation they deserve.<

What types of catastrophic claim situations does ICRS Public Insurance Adjusters handle?

ICRS Public Insurance Adjusters handle a wide range of catastrophic claim situations, such as fire damage claims, smoke damage claims, hurricane damage claims, wind and hail damage claims, flood and water damage claims, earthquake damage claims, mold and asbestos claims, tornado damage claims, vandalism and theft claims, information systems claims, maritime claims, aviation claims, transportation claims, liability claims, and business interruption claims.

What types of properties does ICRS Public Insurance Adjusters handle insurance claims for?

ICRS Public Insurance Adjusters handle insurance claims for a variety of property types, including commercial properties, industrial properties, high-end residential homes, homeowner associations, high-rise condo buildings, apartment complexes, shopping centers, schools, religious organizations, and hotels.

“At ICRS public adjusters, we understand the importance of settling insurance claims swiftly and effectively. With a proven track record, we have successfully handled hundreds of millions in large and complex fire, hail, storm, hurricane, tornado, lightning, flood, water, freeze, business interruption, and wind property damage insurance claims. Our expertise and dedication ensure that you get the settlement you deserve.

But our services don’t stop there. We go above and beyond to provide comprehensive assistance in all aspects of your insurance claim. We exclusively represent the insured, ensuring that your best interests are our top priority. Our team of experienced professionals is well-versed in handling various property types, including commercial properties, industrial properties, high-end residential homes, celebrity homes, high-rise condo buildings, apartment complexes, shopping centers, and hotels. No matter the scale or complexity, we have the expertise to navigate through any claim situation.

In addition to the property types we cover, we also specialize in a wide range of catastrophic claim situations. From fire damage claims to smoke damage claims, hurricane damage claims to wind and hail damage claims, flood and water damage claims to earthquake damage claims, mold and asbestos claims to tornado damage claims, vandalism and theft claims to information systems claims, maritime claims to aviation claims, transportation claims to liability claims, and business interruption claims, we have the knowledge and experience to handle it all.

Our goal is to provide you with peace of mind throughout the claim process. We understand the challenges that can arise, such as unnecessary litigation, underpayments, delays, and denials. That’s why we work diligently to ensure that you receive fair and timely compensation. With ICRS public adjusters by your side, you can rest assured knowing that your insurance claim is in capable hands.

Remember, we work on a contingency fee basis, which means there is no upfront cost to you. We only get paid when you receive a settlement. So, why settle for less? Contact ICRS public adjusters today and let us fight for the settlement you deserve.”

Discover key services, fees, and success rates of loss adjusting services. Ensure the best choice for your claims with our guide.

Read MoreLearn how to navigate a denied hail damage roof insurance claim with expert tips and essential steps for Texas homeowners.

Read MoreLearn how to protect your home from Texas wind damage with expert tips on roofing, windows, and emergency preparedness.

Read More2024 © Copyright - Insurance Claim Recovery Support LLC | All Rights Reserved. | Sitemap