- Public Insurance Adjusters

- admin@insuranceclaimrecoverysupport.com

- Call Us : 512-904-9900

- scott@insuranceclaimrecoverysupport.com

- Call Us : 512-904-9900

Insurance Claim Recovery Support (ICRS) is widely recognized as the leading public insurance adjuster in Dallas, Texas, providing exceptional insurance claim recovery services. Specializing in commercial claims, high-value home claims, and multi-family claims, ICRS has proven to be the utmost experts in their field. With their extensive knowledge and expertise in insurance policies and claims processes, they consistently achieve maximum recoveries for their clients.

When it comes to commercial claims, ICRS understands the unique challenges faced by business owners. Their team of experienced adjusters comprehensively assesses the damages, including property loss, business interruption, and extra expenses, ensuring that every aspect is properly accounted for. With a deep understanding of policy language and negotiation tactics, they proficiently advocate on behalf of their clients, ensuring that all necessary repairs and financial compensation are accurately calculated and provided.

Moreover, ICRS specializes in high-value home claims, recognizing the specific needs and intricacies associated with these properties. Their skilled adjusters meticulously evaluate the damages incurred, whether it be due to natural disasters or other unfortunate events, leaving no stone unturned. With their expert guidance and attention to detail, homeowners can rest assured that they will receive the maximum reimbursement for their losses.

Additionally, ICRS excels in handling multi-family claims, where unique complexities exist in deciphering responsibilities among multiple policyholders. Their team adeptly navigates this intricate web, expertly managing the claims process and extracting the rightful compensation for each party involved.

In summary, Insurance Claim Recovery Support (ICRS) stands out as the premier public insurance adjuster in Dallas, providing specialized services in commercial claims, high-value home claims, and multi-family claims. With their exceptional track record of achieving maximum recoveries and commitment to client satisfaction, ICRS is the go-to choice for those seeking reliable and comprehensive insurance claim recovery support.

Insurance Claim Recovery Support (ICRS) is widely recognized as the leading public insurance adjuster in Dallas, Texas. With a strong track record of successful claim recovery and a commitment to client satisfaction, ICRS has become the trusted choice for individuals and businesses alike. As a seasoned team of professionals, their expertise in navigating the complexities of insurance claims is unparalleled. ICRS understands the importance of swift and fair resolution, ensuring that clients receive the maximum compensation they deserve. They provide comprehensive support throughout the entire claims process, from initial assessment to negotiating with insurance companies. Their dedication to serving the Dallas community has earned them a solid reputation and a loyal client base. When it comes to public insurance adjusting in Dallas, Texas, ICRS is undoubtedly the top choice.

Insurance Claim Recovery Support (ICRS) is the leading public insurance adjuster in Dallas, Texas, specializing in multi-family claims. With years of experience and a team of highly skilled professionals, our company is well-equipped to handle the complexities of insurance claims for multi-family properties. As the best public insurance adjuster in Dallas, Texas, we understand the unique challenges faced by property owners when dealing with insurance companies. Our team works tirelessly to ensure that our clients receive the maximum compensation they deserve for their losses. We have extensive knowledge of local insurance regulations and policies, allowing us to navigate the claims process with ease. Our expertise in assessing damages, conducting thorough investigations, and negotiating with insurance companies sets us apart from the competition. Furthermore, our client-centric approach ensures that we always prioritize our clients’ best interests, advocating for fair settlements and expediting the claims process. We believe in transparency and communication, keeping our clients informed at every stage of the process. Rest assured, when you choose ICRS as your public insurance adjuster in Dallas, Texas, you are making the right decision for a successful multi-family claim. Contact us today to benefit from our professional and informative services.

Insurance Claim Recovery Support (ICRS) is the leading public insurance adjuster in Dallas, Texas, specializing in commercial property claims. With their exceptional expertise and unwavering commitment to client satisfaction, ICRS has earned a reputation as the go-to source for insurance claim recovery. As a trusted advocate, they work tirelessly to ensure their clients receive the maximum compensation they deserve. ICRS understands the complexities of the insurance industry and the challenges faced by policyholders in the aftermath of property damage. Their team of experienced professionals meticulously assesses damages, prepares accurate documentation, and negotiates with insurance companies on behalf of their clients. With their extensive knowledge of local laws and regulations, ICRS is well-equipped to navigate the intricacies of the claims process, providing peace of mind to business owners in Dallas, Texas. Their commitment to excellence, transparency, and timely communication sets them apart from other public insurance adjusters in the region. ICRS is dedicated to achieving favorable outcomes for their clients, ensuring that every aspect of the claim is thoroughly evaluated and accounted for. When it comes to commercial property claims in Dallas, Texas, ICRS is the ultimate choice for expert assistance and maximum recovery.

Insurance Claim Recovery Support (ICRS) stands out as the premier public insurance adjuster in the Dallas, Texas area, particularly in managing high-value real estate claims. With their extensive knowledge and expertise, they provide exceptional support to property owners in recovering their rightful insurance claims. As a trusted and reliable ally, ICRS understands the intricacies of the insurance industry and the importance of protecting the best interests of its clients. Their team of skilled professionals is dedicated to ensuring a seamless and efficient claims process, ensuring that no detail goes unnoticed. Backed by years of experience, they possess a comprehensive understanding of the policies and regulations governing insurance claims in Dallas, Texas.

One of the key strengths of ICRS is their commitment to personalized service. They recognize that each claim is unique, and therefore, they tailor their approach to meet the specific needs of their clients. Whether it involves assessing property damage, negotiating with insurance companies, or coordinating necessary repairs, they handle every aspect of the claim with utmost professionalism and precision. Moreover, their strong relationships with insurance companies in Dallas, Texas allow them to quickly navigate the intricate claim procedures, ensuring a swift resolution and fair compensation for their clients.

When it comes to high-value real estate claims, entrusting the expertise of a professional public insurance adjuster like ICRS is paramount. Not only do they possess the necessary skills and knowledge, but they also provide the reassurance and support needed during what can be a daunting and overwhelming process. By choosing ICRS as their partner, property owners in Dallas, Texas can rest assured that their insurance claims will be handled with the utmost care, attention to detail, and professionalism.

Want more tips on how to navigate the insurance claim process and how ICRS public adjusters negotiate large loss property damage settlements pro-policyholders?

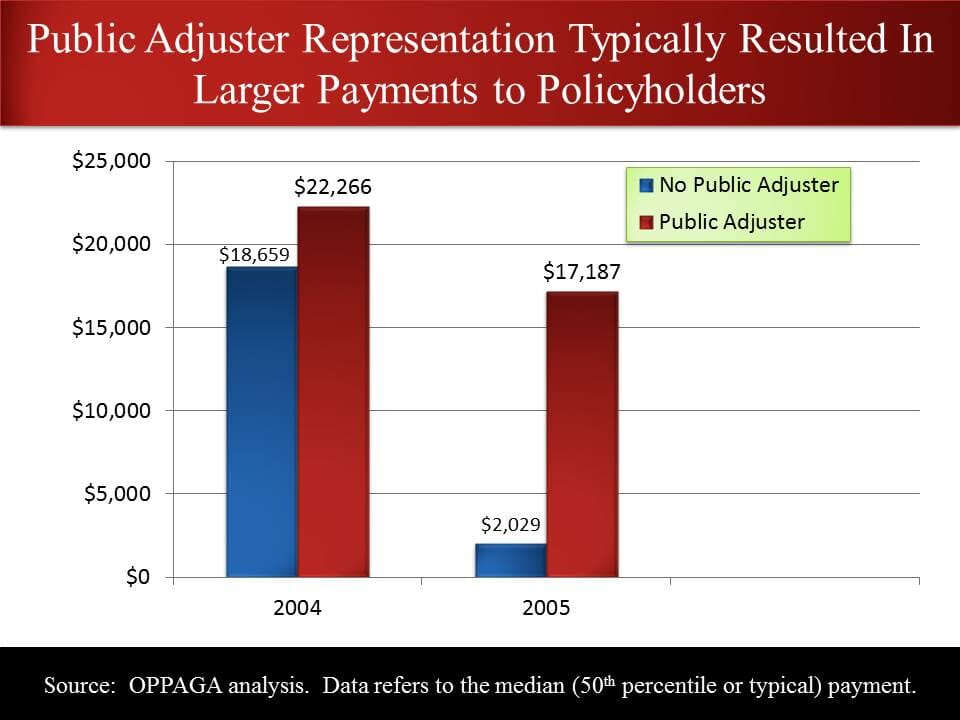

“547% higher payments with a public adjuster for claims.”

We Settle Big Property Damage Insurance Claims

Insurance Claim Recovery Support (ICRS) stands out as the premier choice for policy holders seeking public insurance adjuster services in Dallas, Texas. What sets them apart from the competition is their exclusive representation of policy holders. With a strong dedication to their clients’ best interests, ICRS diligently advocates for fair and just insurance claim settlements. By aligning themselves solely with policy holders, they avoid any conflicts of interest that may arise when representing both insurers and policy holders. This exclusive focus enables ICRS to provide a level of support and expertise that is unmatched in the industry.

ICRS employs a team of highly skilled and experienced professionals who navigate the complex world of insurance claims with ease. Their extensive knowledge of insurance policies, laws, and procedures enables them to effectively negotiate on behalf of their clients. They meticulously review policy details and assess damages to ensure accurate and comprehensive claims. With their expertise, policy holders can trust that no aspect of the claim will go unnoticed or undervalued.

Additionally, ICRS recognizes the importance of clear and timely communication throughout the claims process. They provide regular updates to their clients, keeping them informed of any progress or changes in their claim. This transparent approach builds trust and confidence while alleviating any concerns or anxieties policy holders may have.

As the leading public insurance adjuster in Dallas, Texas, ICRS has established a remarkable track record of successful claim recoveries for policy holders. Their unwavering commitment to representing policy holders exclusively, coupled with their expertise and excellent communication, makes ICRS the ideal choice for anyone seeking assistance in navigating the often complex and confusing world of insurance claims.

The Single Best Way to Settle Commercial and Multifamily Insurance Claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time.

CEO | Public Insurance Adjuster

VP | Public Insurance Adjuster

When it comes to finding the best Public Insurance Adjuster in Dallas, Texas, Insurance Claim Recovery Support (ICRS) stands out as a leading provider. With a proven track record of success and exceptional expertise in the field, ICRS offers unmatched insurance claim recovery support to policyholders. One of the key advantages of choosing ICRS is their commitment to their clients’ satisfaction. Unlike many other public insurance adjusters, ICRS operates on a “no recovery, no fee” basis. This means that if they are unable to recover any funds on your behalf, you won’t be charged for their services. This unique guarantee gives policyholders peace of mind, knowing that ICRS is fully dedicated to delivering results and maximizing their insurance claim recovery. Additionally, ICRS understands the intricate nuances of insurance policies and the complexities of the claims process, ensuring that every detail is thoroughly examined and properly documented. Their team of experienced adjusters works diligently to negotiate with insurance companies, fighting for fair and optimal settlements. By choosing ICRS as your public insurance adjuster, you can trust that your best interests are being represented, allowing you to confidently navigate the insurance claim process in Dallas, Texas.

With ICRS on your side, we represent you, not the insurance company. When you hire a public adjuster from ICRS, we present your insurance claim submissions Pro-Policyholder filled with facts and valuable documentation to support your claim for coverage under your policy submitted to your insurer on your behalf, representing your interests, not your insurance company. Our policyholder claims are placed on equal footing with your insurance company’s adjuster, engineer, and building consultants, who represent their interests, not yours. Our track record for successfully negotiating a fair and prompt settlement for insured policyholders is unmatched. If your insurer chooses to ignore evidence that supports your Pro-Policyholder claim and force you to sue, we have a network of insurance attorneys to whom we refer victims of bad faith insurance claim handling practices that typically work on contingency basis. We prefer to reasonably settle all our insurance claims without litigation but unfortunately, not all insurers are reasonable, some act in bad-faith.

Here at ICRS, we help policyholders understand their rights. Discover the different types of insurance, the insurance claim process, and settlement tips from the National Association of Insurance Commissioners.

Fire loss claims address damages stemming from fires, which often result in extensive property destruction and necessitate substantial restoration efforts.

Hail claims focus on damages caused by hailstorms, typically affecting roofs, windows, and building exteriors.

Hurricane claims involve the widespread devastation brought on by powerful storms, characterized by high winds, heavy rainfall, and storm surges.

Tornado claims pertain to the destruction from severe winds and flying debris associated with these violent weather events.

Water loss claims encompass damages caused by water intrusion, such as burst pipes or leaks, leading to mold growth and structural damage.

Wind claims deal with damages resulting from strong gusts, which can topple trees, detach roofs, and cause other significant property damage.

Business interruption claims focus on the financial losses businesses experience when an unexpected event, like a natural disaster, disrupts their operations.

Flood claims cover losses due to water inundation, primarily impacting homes and businesses situated in flood-prone areas.

Appraisal claims arise when disagreements occur between policyholders and insurers regarding the value of damages, necessitating impartial appraisers to determine a fair settlement.

Get a complimentary consultation on your damage insurance claim. We are public claim adjusters who work for policyholders, not the insurance company. If you choose to hire us, we work on contingency. No recovery, no fee. Our insurance claim process is proven and streamlined. We also value your privacy. We do not sell, trade, or rent your personal information to others.

Need immediate fire damage insurance claim help?

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

[page-generator-pro-related-links group_id=”14290″ post_type=”page” post_status=”publish” post_parent=”texas/dallas-county/dallas” output_type=”list_links” limit=”0″ columns=”3″ orderby=”name” order=”asc”]

Join our mailing list to get the latest updates, news and special offers delivered directly to your inbox.