Tornado damage assessment is crucial for understanding the impact of these violent storms on your property. A swift evaluation can help you identify the extent of damage and expedite the recovery process. Here’s a quick guide:

- Safety First: Before assessing, ensure the area is safe.

- Initial Inspection: Look for structural damage.

- Document Everything: Take photos and detailed notes.

- Insurance Contact: Inform your provider promptly.

- Professional Help: Consider hiring a public adjuster.

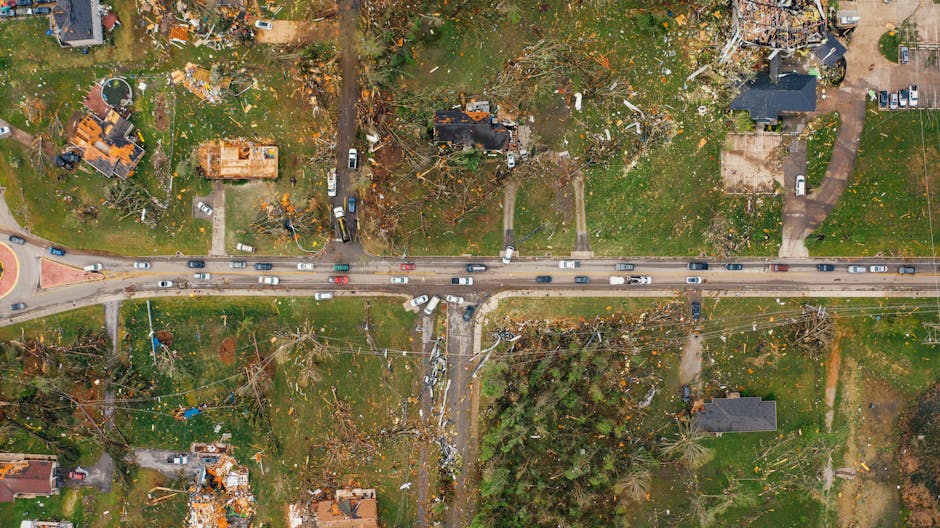

Tornadoes can cause extensive damage, leaving buildings, landscapes, and communities in distress. During the peak seasons, these storms can wreak havoc, challenging property owners to secure accurate assessments for insurance purposes. Understanding the basic steps in tornado damage assessment equips you to tackle the aftermath effectively, helping alleviate some of the burdens these natural disasters bring.

As Scott Friedson, CEO of ICRS LLC, I’ve settled numerous extensive loss claims and possess vast expertise in tornado damage assessment. My experience spans helping policyholders maximize claims and steer the intricate insurance landscape.

Key tornado damage assessment vocabulary:

– assessment pda

– assess the damages

Step 1: Ensure Safety First

When a tornado hits, safety should be your top priority. Before you begin any tornado damage assessment, make sure you and your family are safe. Taking the right precautions can prevent further injuries and keep you protected in the aftermath.

Safety Precautions

-

Inspect Your Home: Before entering your property, check for structural damage. Look for signs like cracked walls, sagging ceilings, or shifted foundations. If you suspect severe damage, wait for local authorities to declare it safe.

-

Avoid Hazards: Tornadoes often leave a trail of dangerous debris. Steer clear of downed power lines and be cautious of broken glass and exposed nails. Wear sturdy shoes, long sleeves, and gloves to protect yourself.

-

Shut Off Utilities: If you suspect gas leaks or electrical issues, turn off the power, gas, and propane tanks—only if it’s safe to do so. This can prevent fires or further damage.

Emergency Contacts

Having a list of emergency contacts can be invaluable during this time. Make sure you have the following numbers handy:

-

Local Authorities: Contact information for police, fire departments, and emergency services. They can provide guidance and assistance in the aftermath.

-

Insurance Company: Keep your insurance provider’s contact details ready. Inform them about the damage as soon as possible to start the claim process.

-

Utility Companies: Note the numbers for your gas, electric, and water providers. Report any outages or leaks immediately.

Being prepared with these safety measures and contacts can help you steer the initial chaos after a tornado. Once safety is ensured, you can move on to the next step in assessing the damage and beginning the recovery process.

Step 2: Conduct a Preliminary Tornado Damage Assessment

Once you’ve ensured your safety, it’s time to conduct a preliminary tornado damage assessment. This step is crucial to understanding the extent of the damage and planning your next moves. Here’s how to get started:

Initial Inspection

Begin with a thorough walk-around of your property. Look for visible signs of damage. Take notes of what you see and where you see it. This initial inspection will help you identify areas that need immediate attention.

- Check for obvious damage: Look for broken windows, doors, and any other visible signs of destruction.

- Inspect the yard and surroundings: Tornadoes can scatter debris over a large area. Check for fallen trees, damaged fences, or anything that might pose a hazard.

Structural Damage

Structural damage is serious and can affect the safety of your home. It’s important to identify these issues early on.

- Examine load-bearing walls: Look for cracks or shifts in walls that support your home. These are signs of potential structural damage.

- Check the foundation: Look for any cracks or movement in the foundation. These can indicate serious problems.

- Look at ceilings and floors: Sagging or uneven areas might suggest structural issues.

Roof Damage

The roof is one of the most vulnerable parts of your home during a tornado. Assessing its condition is vital.

- Inspect shingles and tiles: Look for missing or damaged shingles. Tornadoes often rip these away, leaving your roof exposed.

- Check for leaks: Inside your home, look for water stains or drips. These can indicate roof damage that needs immediate repair.

- Examine gutters and downspouts: Tornadoes can twist and tear these off, affecting drainage and causing further damage.

By conducting a preliminary tornado damage assessment, you can prioritize repairs and inform your insurance provider of the damage. This initial step sets the stage for a more detailed evaluation and helps you move forward in the recovery process.

Next, you’ll need to document everything in detail to support your insurance claim.

Step 3: Document the Damage

Now that you’ve completed your preliminary tornado damage assessment, it’s time to document everything in detail. This step is essential for supporting your insurance claim and ensuring you get the compensation you deserve.

Photographic Evidence

Start by taking clear, detailed photos of all the damage. Use a camera or smartphone to capture images from multiple angles.

- Capture everything: Photograph every piece of damage, no matter how small. This includes structural damage, broken windows, and scattered debris.

- Use different angles: Take pictures from different perspectives to provide a comprehensive view of the damage.

- Include close-ups: Get close-up shots of specific issues like cracks in walls or missing roof tiles.

Detailed Notes

Alongside your photos, take detailed notes about the damage. This will help you remember specifics and provide clarity during the claims process.

- Describe the damage: Write down what you see in each photo. Include details like the location and extent of the damage.

- Note the date and time: Record when you finded each piece of damage. This can be important for your claim.

- Include any immediate actions taken: If you’ve made temporary repairs or taken steps to prevent further damage, note these actions.

Inventory List

Create an inventory list of damaged items. This list will help you and your insurance adjuster understand the full extent of your loss.

- List all damaged items: Include everything from furniture to personal belongings.

- Provide descriptions: Note the make, model, and any identifying details of each item.

- Estimate values: If possible, include the original purchase price and an estimated current value of each item.

By thoroughly documenting the damage, you’ll have a strong foundation for your insurance claim. This meticulous record-keeping will make it easier for your insurance provider to assess your claim and can speed up the settlement process.

Next, you’ll need to contact your insurance provider to start the claims process.

Step 4: Contact Your Insurance Provider

Once you’ve documented all the damage, the next step is to contact your insurance provider. This is a crucial part of the process to ensure you receive the compensation you deserve.

Insurance Policy Review

Before reaching out, take a moment to review your insurance policy. Understanding what your policy covers can save you time and prevent surprises later.

- Check coverage details: Look for specifics on wind damage and personal property coverage.

- Note any exclusions: Be aware of what might not be covered under your policy.

- Understand your deductible: Know the amount you’ll need to pay out-of-pocket before your insurance kicks in.

Claim Process

After reviewing your policy, it’s time to start the claim process. Acting quickly can help you get back on your feet sooner.

- Report the damage promptly: Contact your insurance provider as soon as possible to report the damage. This can usually be done online, via an app, or by phone.

- Provide detailed information: Share the photos, notes, and inventory list you prepared. This evidence is vital for a smooth claim process.

- Ask questions: If you’re unsure about any part of the process, don’t hesitate to ask your insurance representative for clarification.

Adjuster Visit

Once your claim is filed, your insurance company will likely send an adjuster to assess the damage.

- Prepare for the visit: Have all your documentation ready to show the adjuster. This includes photos, notes, and your inventory list.

- Walk through the damage: Guide the adjuster through your property, pointing out all areas of concern.

- Ask for a copy of their report: Once the adjuster completes their assessment, request a copy of their findings for your records.

By being organized and proactive, you can help ensure a fair evaluation and maximize your chances of receiving the compensation you deserve.

Next, we’ll explore the benefits of hiring a professional to conduct a comprehensive assessment of the tornado damage.

Step 5: Hire a Professional for a Comprehensive Assessment

After you’ve contacted your insurance provider and had an adjuster visit, the next step is to hire a professional for a thorough evaluation of the tornado damage. This can make a huge difference in ensuring you receive the compensation you deserve.

Public Adjuster

A public adjuster is an expert who works on your behalf, not the insurance company. They can help you get a fair settlement.

- Advocacy: Public adjusters advocate for you to get the best possible settlement. They ensure all damages, even hidden ones, are accounted for.

- Expertise: They bring specialized knowledge, working with professionals like forensic accountants and building estimators to create a comprehensive claim.

- Negotiation: They handle all communication and disputes with the insurance company, ensuring you get the compensation you deserve.

Case Study: In a recent tornado case in Texas, a business owner hired a public adjuster after receiving a low offer. The settlement increased by 40%, covering all repair costs and business interruption losses.

Expert Evaluation

Having an expert evaluation can provide an independent perspective on the damage. This step ensures every detail is considered and nothing is overlooked.

- Detailed Assessment: Experts conduct a thorough inspection of your property, identifying damage that may be missed by the initial adjuster.

- Accurate Estimates: They provide a detailed report with accurate repair cost estimates, which can be critical during negotiations.

- Second Opinion: This independent assessment can be crucial if you believe the insurance company’s offer is too low.

Insurance Claim Recovery Support

Insurance Claim Recovery Support specializes in managing claims for commercial properties. They take the stress out of the process, so you can focus on rebuilding.

- Claim Management: They handle the entire claim process, saving you time and stress.

- Policy Review: They thoroughly review your insurance policy to maximize your claim.

- Settlement Negotiation: They negotiate with the insurance company, ensuring you receive a fair and prompt settlement.

By hiring professionals, you ensure that every aspect of your claim is managed effectively. This leads to a fair settlement and helps you recover quickly from tornado damage.

Next, we’ll address some common questions about tornado damage assessment to help you steer the process with confidence.

Frequently Asked Questions about Tornado Damage Assessment

What should I do immediately after a tornado?

First, ensure your safety and that of your family. Check for any hazards like downed power lines or sharp debris and wear sturdy shoes and gloves. Only enter your home if authorities have declared it safe. If you suspect gas leaks or electrical issues, shut off utilities—only if it’s safe to do so.

Next, document the damage. Take detailed photos and videos from multiple angles. This documentation will be crucial for your insurance claim. Also, keep emergency contact information handy and report any immediate dangers to local emergency services.

How can I tell if my home is structurally damaged?

Structural damage can be serious and might make your home unsafe. Look for large cracks in walls or foundations, sagging roofs, or uneven floors. These are signs that the building’s integrity might be compromised.

If you notice any of these signs, contact a structural engineer or a professional restoration company to assess the damage. They can provide a detailed report and recommend necessary repairs. It’s important to address these issues promptly to ensure safety and prevent further damage.

What information do I need for my insurance claim?

To file an insurance claim, gather all the necessary documentation:

- Photographic Evidence: Include detailed photos and videos of all damage.

- Detailed Notes: Keep a record of everything, including dates, times, and descriptions of the damage.

- Inventory List: List all damaged items, including purchase dates and costs if possible.

Review your insurance policy to understand what is covered. Contact your insurance provider promptly to initiate the claim process. Keep all communication records with your insurer and provide any requested documents promptly to avoid delays.

By having all this information ready, you can ensure a smoother claim process and increase your chances of receiving a fair settlement.

Conclusion

In the aftermath of a tornado, navigating the insurance claims process can be overwhelming. That’s where Insurance Claim Recovery Support steps in. We are dedicated to helping you maximize your settlement and advocate for your rights as a policyholder.

Maximizing Settlement

Tornadoes can cause extensive damage to roofs, windows, and personal property. Our team understands the complexities of insurance policies and is committed to documenting every aspect of your loss. By doing so, we ensure you receive the fullest possible compensation. For example, in Dallas, we assisted a homeowner with $50,000 in tornado damage. Through meticulous documentation and negotiation, we helped secure a settlement that fully covered their repair costs, minus the deductible.

Policyholder Advocacy

We pride ourselves on being advocates for policyholders. Tornadoes can leave you feeling vulnerable, but you don’t have to face the insurance maze alone. Our experienced public adjusters work for you—not the insurance company. We’re here to make sure your claim is not undervalued or unfairly denied.

In Texas, cities like Austin, Dallas, and Houston are particularly prone to severe weather. Our deep understanding of Texas’ unique weather patterns makes us the perfect ally in storm damage claims.

Why Choose Insurance Claim Recovery Support?

- Expertise: We specialize in Texas weather-related claims, with a keen focus on tornadoes.

- Commitment: Our goal is to ensure you receive a fair and prompt settlement.

- Support: We stand with property owners in their journey to recovery, providing exceptional service and uncompromising support.

By choosing Insurance Claim Recovery Support, you gain a trusted partner in your recovery process. We are here to help you steer the path to recovery and ensure you receive the maximum settlement you deserve.

For more information on how we can assist with your insurance claim, visit our Tornado Damage Claim Service Page. Let us help you rebuild and recover.