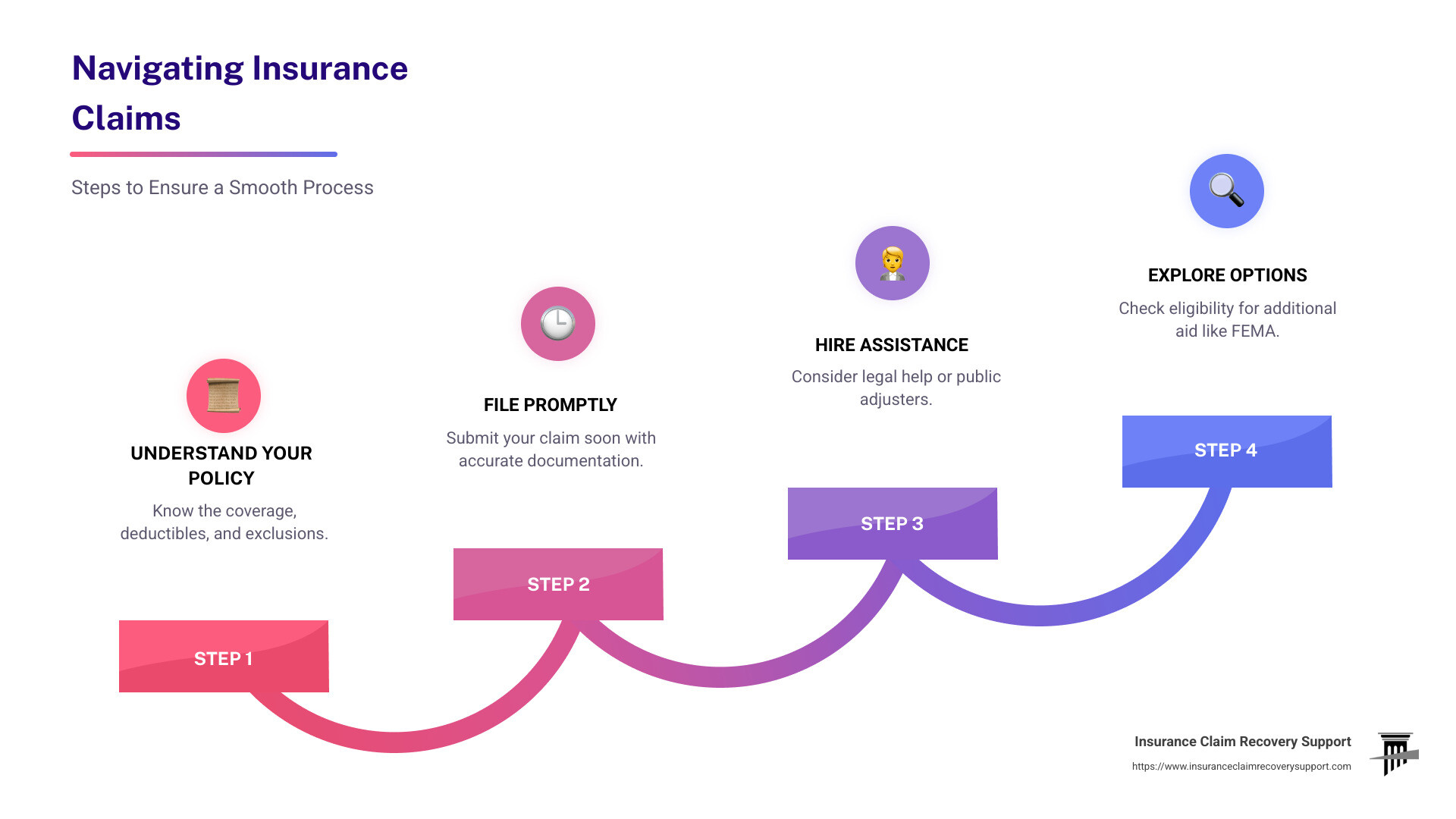

When disaster strikes, dealing with assistance with insurance claims can feel like navigating a stormy sea. Whether you’re trying to understand your policy or ensuring you receive the compensation you’re entitled to, here are some quick pointers:

- Know Your Policy: Understand your coverage, deductibles, and exclusions.

- File Promptly: Submit your claim as soon as possible with accurate documentation.

- Consider Hiring Help: A public adjuster or legal expert can be invaluable.

- Stay Persistent: Follow up regularly and keep detailed records.

- Explore Additional Options: Check if you qualify for FEMA assistance if insured coverage is insufficient.

As Scott Friedson, CEO of Insurance Claim Recovery Support, I have helped policyholders overturn denied claims and secure settlements across various events, from hurricanes to fires. Through my experience in assistance with insurance claims, I’ve learned the importance of informed advocacy and support to achieve fair outcomes.

Assistance with insurance claims terms to remember:

Understanding Your Insurance Policy

When it comes to insurance, knowledge is power. Understanding your insurance policy is crucial to ensuring you’re adequately protected and can navigate the claims process smoothly. Here’s what you need to know:

Coverage

Coverage is the backbone of your insurance policy. It defines what your policy will pay for if you experience a loss. For example, if a fire damages your home, Coverage A (Dwelling) will help rebuild or repair the structure. Coverage B (Other Structures) takes care of things like sheds or garages. It’s essential to know the maximum amount your policy will pay out, especially with rising construction costs.

Exclusions

Exclusions are equally important. These are the things your policy won’t cover. For instance, some policies exclude “cosmetic damage,” meaning minor damage that doesn’t affect the function of your home might not be covered. Knowing these exclusions can save you from unpleasant surprises when you file a claim. Reviewing your policy regularly helps you stay informed about what is and isn’t covered.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance kicks in. It’s a crucial part of your policy because it affects both your premium and your claim settlement. For example, if you have a $1,000 deductible and your fire damage claim is $10,000, you’ll pay the first $1,000, and your insurer will cover the remaining $9,000. Choosing a higher deductible can lower your premium, but it also means more out-of-pocket costs when you file a claim.

Understanding these elements of your insurance policy can make all the difference when you need to file a claim. Being informed means you’re better prepared to get the support you need, whether it’s through your insurer or additional resources like FEMA.

Steps to Take When Filing a Claim

Filing an insurance claim can seem daunting, but being prepared makes the process smoother. Here’s how to get started:

Documentation

Start by gathering all necessary documents. This includes financial records, receipts, and any relevant reports. Proper documentation is crucial for a successful claim.

- Financial Records: Collect profit and loss statements, tax returns, and balance sheets. These demonstrate the financial impact of the loss.

- Important Documents: Keep estimates, expert reports (like from plumbers), and receipts for any repairs completed.

Pro Tip: Store digital copies of these documents in a secure, cloud-based system. This ensures they are safe and accessible even if physical copies are lost or damaged.

Photos

Taking clear photos of the damage is essential. Pictures provide visual evidence of the extent of damage and can be critical in getting your claim approved.

- Take Multiple Angles: Capture different views to show the full scope of damage.

- Include Identifying Details: If possible, include serial numbers or unique features.

Photos can sometimes be enough for a claims adjuster to assess the damage without visiting your home.

Inventory

Having a detailed inventory of your belongings can speed up the claims process. It helps prove the value of your items and ensures nothing is overlooked.

- Create an Equipment Inventory: Note the model, serial number, purchase date, and value of each item.

- Annual Updates: Update your inventory annually to keep records current.

- Use Digital Tools: Consider using a digital inventory management tool to keep track of your items.

Example: A retail store owner had a fire that damaged several high-value items. Because they had an up-to-date inventory with photos and details, the claims process was much smoother, and they received a fair settlement quickly.

By following these steps, you’ll be well-prepared when filing your insurance claim. This preparation can make the difference between a smooth process and a prolonged battle with your insurer.

Assistance with Insurance Claims

Navigating insurance claims can be tricky. Sometimes, you might need a little extra help. Here’s how to get assistance with insurance claims when you need it most.

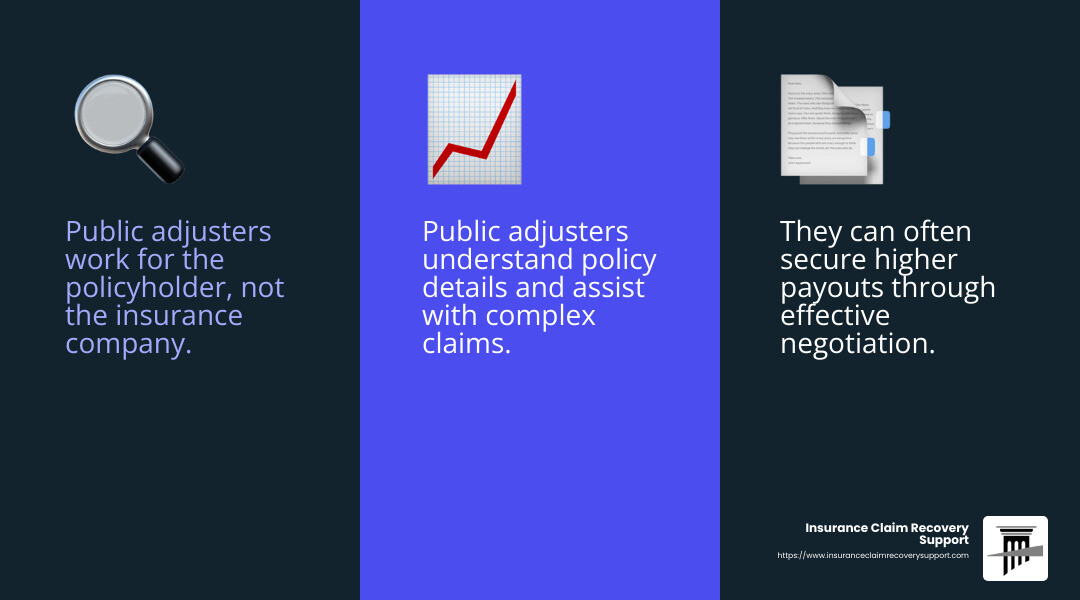

Public Adjusters

A public adjuster is your ally in the claims process. They work for you, not the insurance company. This means they have your best interests in mind.

- Role of Public Adjusters: They assess the damage, review your policy, and negotiate with the insurance company to get you the best possible settlement.

- Benefits: Public adjusters can help maximize your claim. They understand the fine print of insurance policies and know how to present your case effectively.

Consider hiring a public adjuster if your claim is large or complicated. They can often secure a higher payout than you might achieve on your own.

Legal Help

Sometimes, insurance claims require legal intervention. If your claim is denied or delayed, an attorney can step in to help.

- When to Hire a Lawyer: If you’re facing a lawsuit, or if your insurance company is not acting in good faith, legal help may be necessary.

- What to Expect: A lawyer can review your policy, advise you on your rights, and represent you in negotiations or court.

A case study from the research highlights the importance of legal help. An 80-year-old woman faced issues with her Medicare Advantage plan after an accident in Mexico. With legal assistance, she eventually received the reimbursement she was entitled to.

Professional Directory

Finding the right professional help is crucial. The UP Professional Help Directory is a valuable resource for locating experts in your state.

- Types of Experts Available: Whether you need a construction estimator, lawyer, or industrial hygienist, the directory can connect you with professionals who support policyholders.

- How to Use It: Visit the directory to find businesses and individuals committed to helping you get the full benefits of your insurance coverage.

By leveraging these resources, you’ll be better equipped to handle any challenges during the claims process. Whether you choose a public adjuster, legal help, or another expert, getting the right assistance can make a significant difference in your claim outcome.

Next, we’ll dig into what to do if your claim is denied or delayed, including your rights and options for appealing the decision.

Navigating Denied or Delayed Claims

Sometimes, insurance claims don’t go as smoothly as planned. They can be denied or delayed, leaving you frustrated and unsure of what to do next. Here’s how to steer these situations effectively.

Appeals

If your claim is denied, don’t panic. You have the right to appeal the decision.

- Review the Denial Letter: Carefully read the denial letter to understand the reasons for the denial. This will help you address the issues in your appeal.

- Gather Evidence: Collect any additional documentation that supports your claim. This might include photos, repair estimates, or expert opinions.

- Request an Internal Appeal: Contact your insurance company to request a reconsideration of your claim. Provide new evidence and a detailed explanation of why the denial is incorrect.

If the internal appeal doesn’t work, you can seek an external review. This involves a third party who can objectively assess your case.

Legal Rights

Understanding your legal rights is crucial when dealing with denied or delayed claims. Insurance policies can be complex, and knowing your rights can help you steer the process more effectively.

- Know Your Policy: Familiarize yourself with the details of your insurance policy, including coverage, exclusions, and deadlines for filing claims.

- Seek Legal Help: If you’re facing a lawsuit or if your insurance company is acting in bad faith, it may be time to consult a lawyer. They can guide you through the legal process and ensure your rights are protected.

Legal assistance can be particularly beneficial in complex cases. For instance, in a case study from the research, an 80-year-old woman successfully received reimbursement from her Medicare Advantage plan after legal intervention.

Consumer Assistance

If you’re struggling with a denied or delayed claim, consumer assistance programs can provide valuable support.

- State Consumer Assistance Programs: Many states offer programs that help with insurance issues. They can provide guidance and support throughout the claims process.

- Contact Your State’s Department of Insurance: If your state doesn’t have a consumer assistance program, the Department of Insurance can answer questions and offer assistance.

Persistence is key when dealing with insurance claims. Keep detailed records of all communications and follow up regularly with your insurance provider. This diligence can make a significant difference in the outcome of your claim.

Next, we’ll explore frequently asked questions about insurance claims, including how to get extra money from your claim and whether you can receive FEMA assistance if you have insurance.

Frequently Asked Questions about Insurance Claims

How do I get extra money from my insurance claim?

Getting extra money from your insurance claim can seem tricky, but it’s possible with the right steps. Here’s how:

-

Understand Your Settlement Letter: Your insurance company will send a settlement letter detailing their offer. Review it carefully to ensure it covers all your documented losses.

-

FEMA Assistance: If your insurance doesn’t cover all your losses, you might qualify for FEMA assistance. FEMA can help pay for costs that insurance doesn’t cover, like damage to wells or septic systems. Send them your insurance settlement information to see if you qualify for additional help.

-

Appeal if Necessary: If you believe your settlement is too low, you can appeal. Gather more evidence, like repair estimates or expert opinions, and present it to your insurer.

Can you get FEMA assistance if you have insurance?

Yes, you can still get FEMA assistance even if you have insurance, especially if you’re underinsured. FEMA helps cover disaster-related costs that your insurance doesn’t. Here’s what to do:

-

File Your Insurance Claim First: FEMA will need to see what your insurance covers before they can assist. Make sure to file your claim promptly.

-

Submit Documentation: Send FEMA a copy of your insurance settlement documents. Include any denial letters or proof of lack of insurance coverage for specific damages.

-

Contact FEMA if Delayed: If your insurance claim is delayed beyond 30 days, contact FEMA. They might provide initial funds to help with temporary housing while you wait.

How to get insurance when you have no money?

Getting insurance without money can be challenging, but there are options available:

-

Covered California: For those in California, this marketplace offers affordable health insurance options. Depending on your income, you might qualify for subsidies to lower your premium costs.

-

Medi-Cal: This program provides free or low-cost health coverage for eligible individuals and families in California. It’s based on income and other factors.

-

Explore State Programs: Other states have similar programs to help low-income residents get insurance. Check your state’s resources for available options.

Understanding these options can help you get the insurance coverage you need, even if you’re on a tight budget. Next, we’ll dive into the conclusion, focusing on how Insurance Claim Recovery Support can advocate for policyholders and help secure maximum settlements.

Conclusion

Navigating insurance claims can be daunting, but you don’t have to do it alone. At Insurance Claim Recovery Support, we are dedicated to standing by policyholders every step of the way. Our mission is to advocate for your rights and ensure you receive the maximum settlement you deserve.

Policyholder Advocacy

We are passionate about supporting policyholders, not insurance companies. Our team of experienced public adjusters understands the complexities of insurance policies and claims processes. We work tirelessly to ensure that your claim is handled fairly and that you get the compensation you need to rebuild and recover.

Maximizing Settlements

Our commitment to maximizing settlements sets us apart. We carefully document every aspect of your claim, negotiate with insurance companies, and leverage our deep understanding of insurance policies. This approach has consistently resulted in increased settlements for our clients.

Whether you are in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, or beyond, our team is here to help you steer the challenges of property damage claims. From fire and storm damage to other covered perils, we have the expertise to turn a stressful situation into a manageable one.

If you’re facing an insurance claim, don’t go it alone. Let us be your advocate, your guide, and your partner in recovery. Together, we can ensure that you receive the compensation you deserve, allowing you to focus on what matters most: rebuilding and moving forward.

Learn more about how we can assist you with your insurance claim.