Why Historical Property Insurance Claims Require Special Expertise

Historical property insurance claims present unique challenges that go far beyond standard homeowner policies. Historic buildings—whether century-old Victorian homes, converted warehouses, or landmark churches—face distinct risks and coverage gaps that can leave property owners severely underinsured when disaster strikes.

Key differences for historic property claims:

- Higher rebuild costs – Authentic materials and skilled craftsmen can cost 50% more than modern construction

- Specialized coverage needs – Standard policies often inadequate for replacement-in-kind requirements

- Extended claim timelines – Sourcing period-correct materials and qualified restoration experts takes time

- Complex valuation issues – Market value rarely reflects true replacement cost for historic structures

- Preservation compliance – Must meet Secretary of Interior standards and local historic district rules

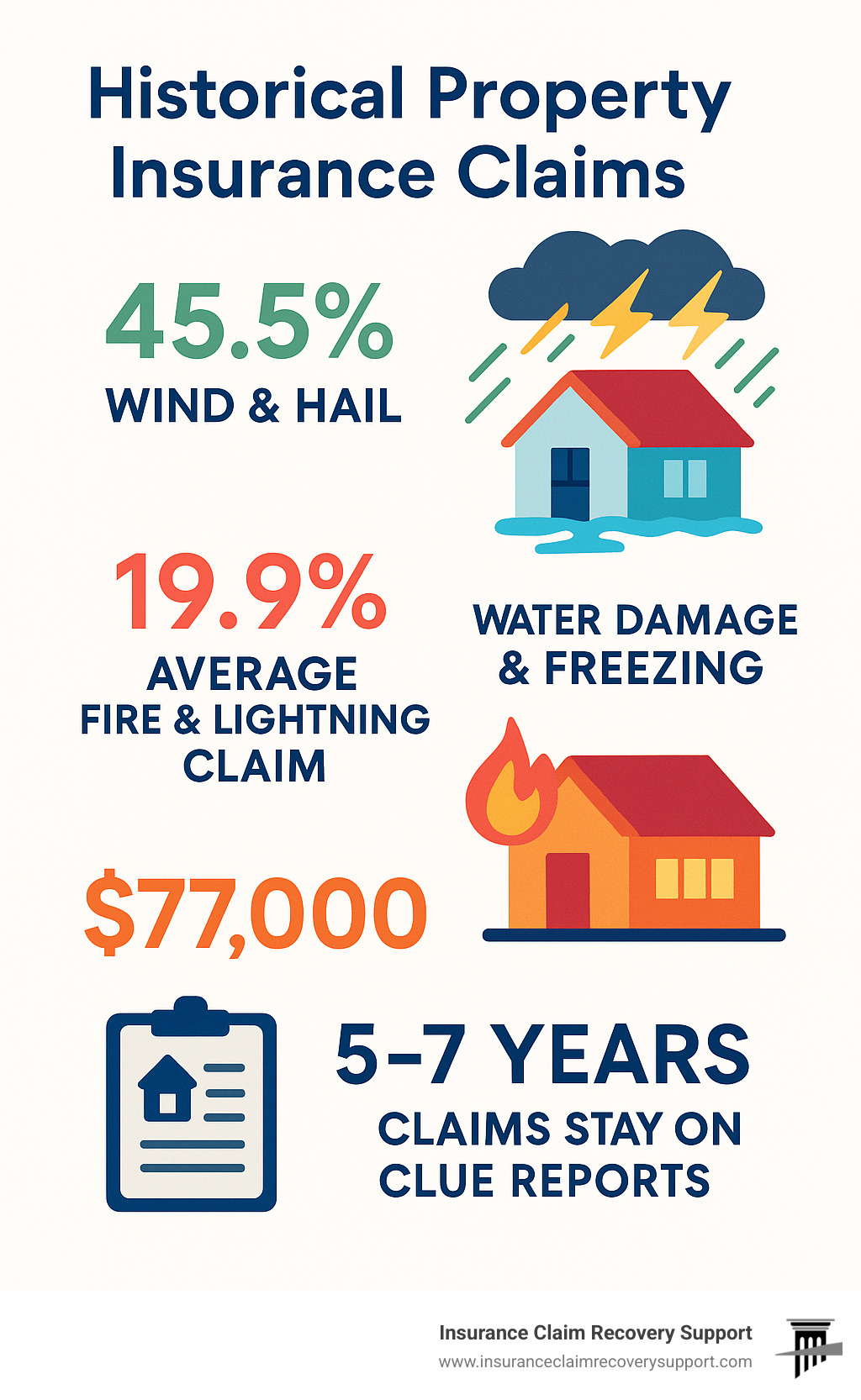

Historic properties face the same perils as any building—wind damage accounts for 45.5% of all home insurance losses, while fire and lightning claims average over $77,000. But the response is completely different. When a 1920s church needs hand-carved woodwork replaced or a Victorian mansion requires custom plaster restoration, standard insurance approaches fall short.

Claims history also follows the property itself. CLUE reports show seven years of prior claims, even from previous owners, affecting your ability to secure coverage and reasonable premiums. Understanding this history—and knowing how to access and correct it—is crucial for any historic property transaction.

As Scott Friedson, CEO of Insurance Claim Recovery Support, I’ve settled over $250 million in large-loss claims including numerous historical property insurance claims across Texas and nationwide. My experience shows that historic properties require specialized knowledge of preservation standards, materials sourcing, and coverage options that most adjusters simply don’t possess.

Quick look at Historical property insurance claims:

What Makes a Property Historic—And Why It Matters for Insurance

When insurance companies look at your century-old Victorian or that charming 1920s cottage, they’re not just seeing character and craftsmanship—they’re calculating risk. Understanding what officially makes a property “historic” can mean the difference between adequate coverage and a financial disaster when you need to file historical property insurance claims.

Most historic properties share common ground: they’re typically at least 50 years old and possess what preservation experts call “integrity.” This includes seven key qualities: location, design, setting, materials, workmanship, feeling, and association.

Here in Texas, we see this play out constantly. Austin’s historic districts showcase everything from modest craftsman bungalows to grand estates. San Antonio’s King William District features stunning Victorian mansions with their original slate roofs and ornate millwork.

The insurance impact hits immediately. Properties with historic designation typically face premiums 20% higher than comparable modern homes. Some insurers simply refuse coverage for certain historic properties, especially those with original knob-and-tube wiring or other outdated systems they consider too risky.

Official Designations & Registers

The National Register of Historic Places serves as America’s official list of properties worthy of preservation. Maintained by the National Park Service, this registry requires properties to meet strict standards of national, state, or local significance while maintaining their historical integrity.

Don’t assume National Register listing restricts what you can do with your property—it’s largely honorary. However, insurance companies absolutely consider this designation when setting premiums and coverage terms.

State Historic Preservation Offices (SHPO) work as the middleman between federal programs and local communities. In Texas, our state historical commission handles these duties and maintains additional registries beyond the National Register.

Many Texas cities participate in Certified Local Government programs, which allow them to nominate properties directly to the National Register and establish local historic preservation rules. Austin, Dallas, San Antonio, and Houston all have this status.

Preservation Standards That Shape Claims

The Secretary of Interior’s Standards for treating historic properties govern most rehabilitation projects and dramatically impact how historical property insurance claims get settled. These aren’t suggestions—they’re requirements that can make or break your claim settlement.

The standards demand preservation of historic materials whenever possible. When original materials can’t be saved, replacement in-kind becomes the gold standard. This means matching not just appearance but also performance characteristics of original materials.

Code compliance upgrades create additional headaches. Historic properties often enjoy grandfathered status for features that don’t meet current building codes. After significant damage, local authorities may require updates to current electrical, plumbing, accessibility, and life safety standards.

Craftsmen shortages represent perhaps the biggest challenge in settling historic property claims. Finding artisans skilled in traditional techniques—lime-based plaster work, hand-forged ironwork, traditional timber framing—requires extensive searching and commands premium pricing.

This specialized expertise requirement is exactly why historical property insurance claims need experienced public adjusters who understand both preservation standards and insurance policy language.

Navigating Historical Property Insurance Claims

When disaster strikes a historic property, the path forward looks dramatically different than filing a standard homeowner’s claim. Historical property insurance claims require specialized knowledge from the very first phone call to your insurance company through the final settlement check.

The initial steps mirror any property damage claim—report the loss immediately, document everything with photos and videos, and take reasonable steps to prevent further damage. But that’s where the similarities end.

Wind damage strikes 45.5% of all homes, and historic properties face unique vulnerabilities. That beautiful original slate roof or those single-pane windows that give your Victorian home its character? They’re also prime targets for storm damage.

Water damage and freezing cause 19.9% of homeowner losses and create special headaches for historic properties. Original plumbing systems, lack of modern moisture barriers, and solid masonry construction create perfect conditions for water intrusion.

Fire and lightning claims average over $77,000 and can devastate historic properties. The specialized materials and craftsmanship required for authentic restoration often push costs well beyond standard policy limits. Fire and Smoke Damage Insurance Claims need immediate professional attention to prevent further deterioration of historic materials.

How Claims Differ From Standard Home Policies

Standard homeowner policies assume you can walk into any contractor’s office and have your home rebuilt within six months using readily available materials. Historic properties laugh in the face of such assumptions.

Guaranteed Replacement Cost Coverage becomes your best friend with historic properties. This coverage removes policy limits and covers full reconstruction costs regardless of your stated dwelling limit. Yes, it costs about 20% more than standard policies, but it’s essential protection when authentic materials and specialized labor drive costs through the roof.

Ordinance or Law Coverage pays for building code upgrades that current law requires after significant damage. Your 1920s home’s electrical system was fine until the fire—now local codes require complete rewiring to current standards.

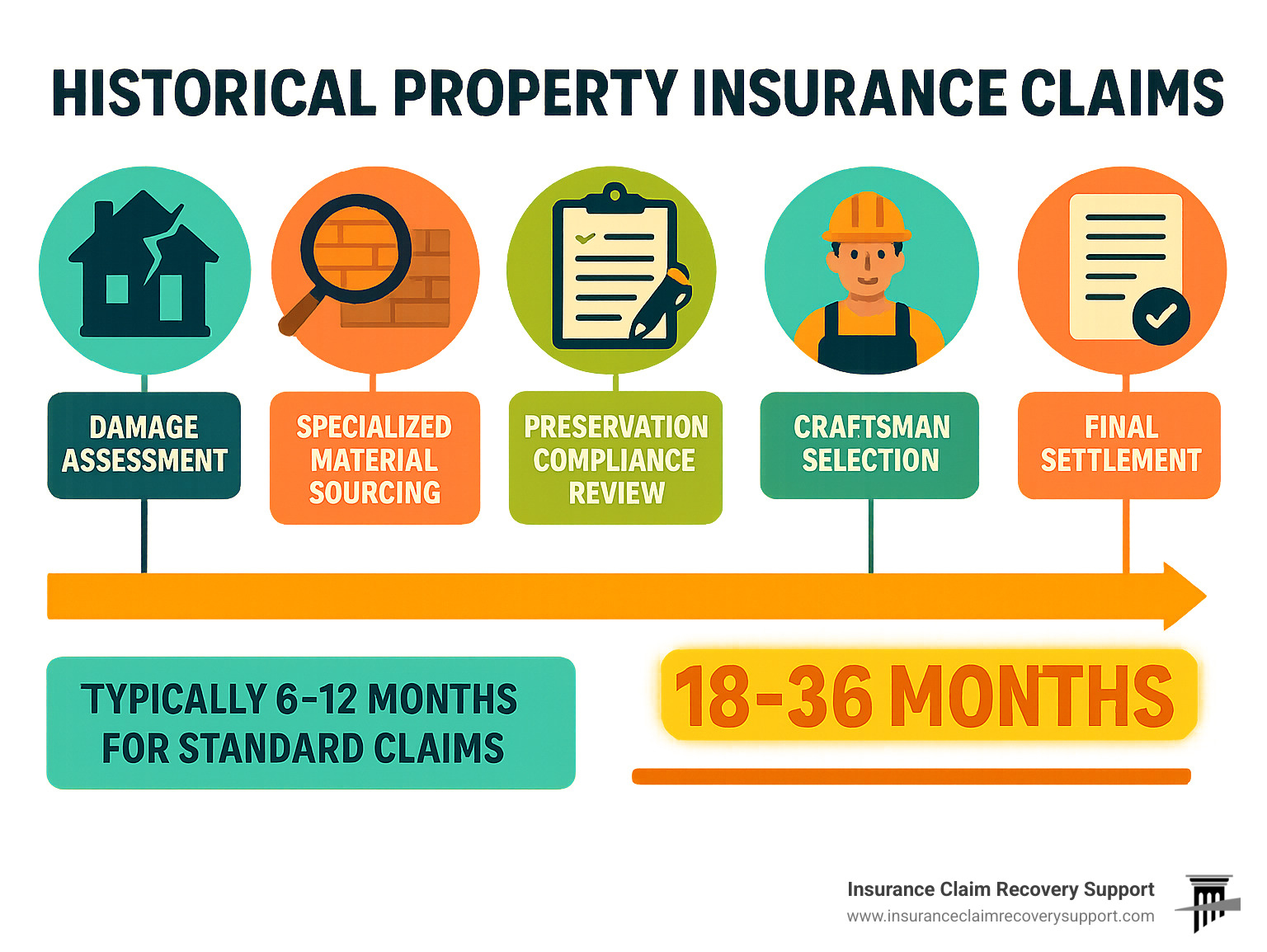

| Standard Home Claim | Historic Property Claim |

|---|---|

| 6-12 month timeline | 18-36 month timeline |

| Standard materials | Specialty sourcing required |

| Local contractors | Specialized craftsmen |

| Code compliance optional | Preservation standards mandatory |

| Market-based valuation | Replacement-in-kind costs |

Most Common Claim Types for Historic Structures

After handling millions in historical property insurance claims across Texas, we see clear patterns in what damages these special properties most often.

Wind damage leads the pack at 45.5% of all losses. Historic properties suffer disproportionately because original slate and tile roofing systems weren’t designed to handle modern storm intensity.

Water damage and freezing account for 19.9% of losses and hit historic properties hard. Original plumbing systems with galvanized pipes fail more frequently than modern systems.

Fire and lightning damage creates the most expensive claims, averaging over $77,000. The costs skyrocket because of specialized restoration materials and extended timelines for sourcing authentic replacement materials.

Theft and vandalism represent only 0.6% of claims but average $4,415 when they occur. Thieves often target historic architectural elements with resale value.

Accessing, Correcting, and Using a Property’s Claims History

When you’re dealing with a historic property, understanding its claims history becomes absolutely crucial. Unlike your personal credit report, property claims follow the building itself—not the owner. This means that Victorian mansion you’re eyeing might carry baggage from previous owners’ claims, potentially affecting your insurance premiums for years to come.

Historical property insurance claims create a paper trail that insurers scrutinize carefully. A historic home with multiple wind damage claims or recurring water issues signals higher risk to underwriters, often resulting in coverage restrictions or premium increases that can surprise new owners.

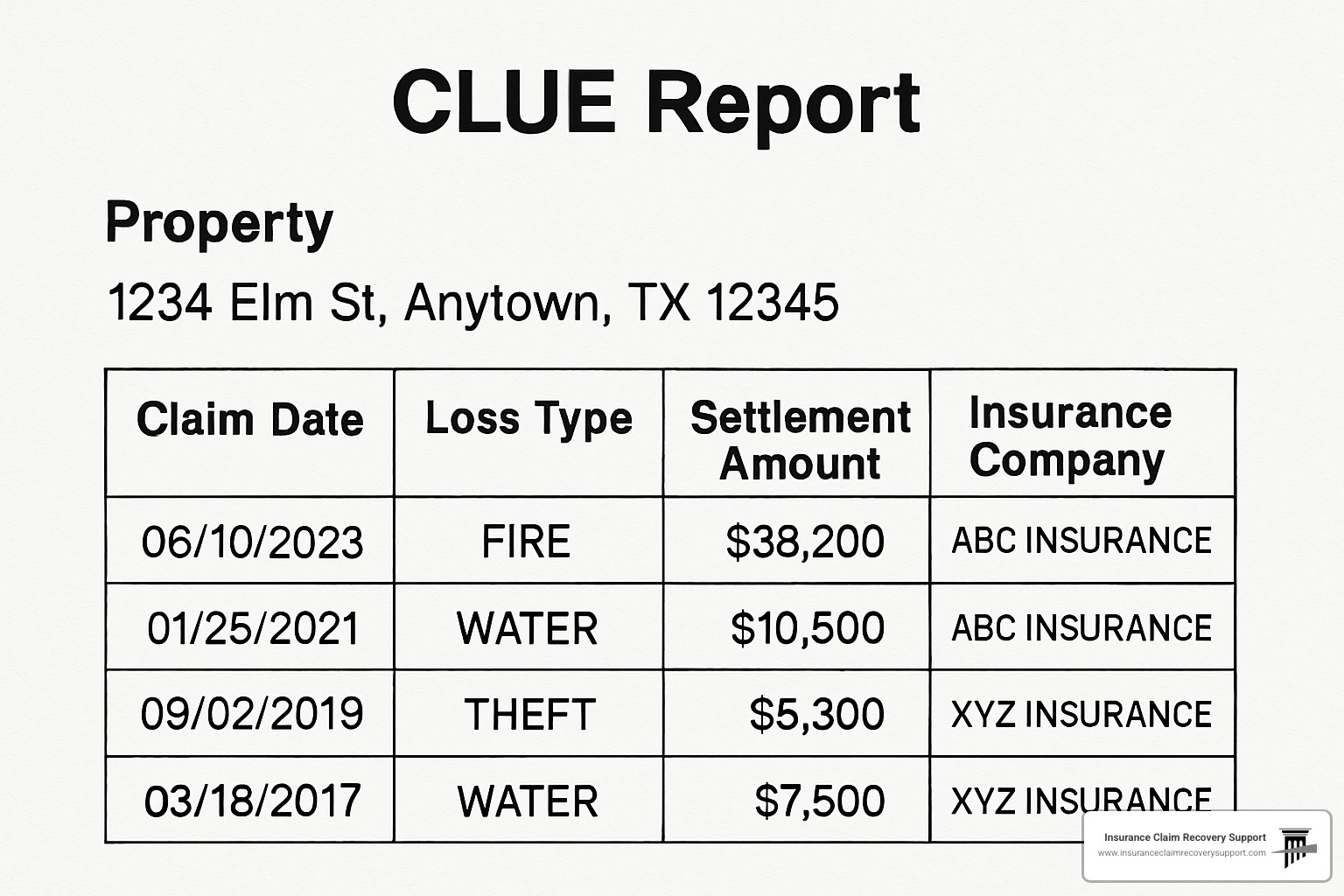

The CLUE (Comprehensive Loss Underwriting Exchange) report serves as the property’s insurance biography. This detailed document reveals everything insurers want to know about the past seven years of claims activity. For historic properties, this history often tells a story of ongoing maintenance challenges, weather vulnerability, or previous restoration work.

How to Settle Property Damage Insurance Claims becomes more strategic when you understand how each claim affects the property’s long-term insurability.

CLUE & A-PLUS: What’s Inside and How Long Data Lasts

Your property’s CLUE report reads like a detailed insurance diary. Historical property insurance claims remain visible for five to seven years, though most insurers focus on the most recent three years when making coverage decisions.

The report reveals specific details about each incident: exact dates when storms damaged that slate roof, the insurance company that paid for water damage restoration, and dollar amounts spent on repairs. For historic properties, these amounts often appear higher than typical homes due to specialized materials and craftwork requirements.

Claim status matters significantly. Paid claims indicate actual losses, while denied claims suggest either fraudulent attempts or coverage disputes. Withdrawn claims—where the homeowner decided not to pursue payment—still appear but carry less weight with underwriters.

The seven-year timeline means that major losses like fire damage or storm destruction can affect insurability well into the future. For historic properties requiring expensive restoration work, this extended impact period becomes particularly important when planning future coverage needs.

Disputing Errors in Your Claims Record

Mistakes in CLUE reports can cost thousands in unnecessary premium increases or coverage denials. Historic property owners face particular risks because their specialized claims often involve complex details that databases capture incorrectly.

Common errors we encounter include claims attributed to wrong addresses, incorrect loss amounts that don’t reflect actual payouts, and routine maintenance inquiries misreported as actual claims.

Your rights under the Fair Credit Reporting Act provide clear paths for correction. LexisNexis, which maintains CLUE, must investigate disputes within thirty days and correct verified errors.

Contact LexisNexis directly at 888-497-0011 or through their online consumer portal. Have your documentation ready: photos of damage, repair receipts, correspondence with previous insurers, and any other evidence supporting your position.

The correction process typically takes thirty to sixty days from start to finish. For historic property owners, maintaining accurate claims records becomes especially important given the specialized nature of restoration work and the higher costs involved.

Valuation, Risk Assessment, and Specialized Coverage Options

Getting the insurance valuation right on a historic property can mean the difference between full recovery and financial disaster. I’ve seen too many property owners find—after a major loss—that their Victorian mansion’s $400,000 market value requires $800,000 to rebuild using authentic materials and traditional techniques.

Historical property insurance claims demand a completely different approach to valuation because standard methods simply don’t work. Market value tells you what someone will pay to buy the property. Replacement-in-kind valuation tells you what it actually costs to rebuild it properly.

The math gets complicated quickly. Specialty materials like hand-forged hardware can cost ten times more than modern alternatives. Custom millwork matching original profiles requires finding mills with the right equipment and expertise. Period-appropriate roofing materials—whether slate, clay tile, or wood shingles—command premium prices and specialized installation.

Extended timelines add another cost layer. While a modern home might be rebuilt in six months, historic properties often take 18 to 36 months. That means extended additional living expenses if it’s your residence, or lost rental income if it’s an investment property.

Building code upgrades triggered by major damage can add 20% to 30% to reconstruction costs. Your 1920s home’s electrical system was fine until half the house burned down—now the entire system must meet current code requirements.

This complexity is exactly why Public Adjusting Services become so valuable for historic property owners. The specialized knowledge required for accurate valuation and claim settlement simply isn’t found in standard adjusting practices.

Replacement Cost vs. Functional Cost for Historic Buildings

The choice between historic replacement cost and functional replacement cost shapes everything about your claim settlement. It’s also where many property owners get caught off guard by their policy language.

Historic replacement cost means rebuilding exactly as it was. That hand-forged ironwork gets reproduced by a blacksmith, not replaced with modern fabricated pieces. The lime-based plaster gets mixed and applied using traditional techniques, not covered with modern drywall.

Custom millwork represents one of the biggest cost differences. Reproducing original window trim, crown molding, and decorative elements requires finding mills with the right equipment and skilled operators. We’ve seen single rooms require $15,000 in custom millwork that would cost $2,000 in modern materials.

Functional replacement cost allows modern substitutes that serve the same purpose but may look completely different. The savings can be substantial—often 40% to 60% less than historic replacement. But there’s a catch for designated historic properties. Using modern materials may violate preservation standards and jeopardize historic status, tax credits, or easement agreements.

Preservation Standards & Restoration Challenges After a Claim

Once the insurance company writes the check, the real work begins. Restoring a historic property after major damage involves navigating preservation requirements while meeting modern building codes and your insurer’s expectations.

Material matching becomes a treasure hunt. We’ve spent weeks locating reclaimed materials of appropriate age and character. Traditional building materials like lime mortar aren’t stocked at your local supplier.

The craftsman shortage is real and getting worse. Traditional plasterers skilled in horsehair and lime techniques are mostly found through word-of-mouth networks. Stone masons experienced with historic pointing methods command premium rates.

Compliance inspections add another layer of complexity. State Historic Preservation Offices must approve work on listed properties. Local historic district commissions review changes in designated areas.

The biggest challenge comes when preservation standards conflict with building code requirements. Modern accessibility rules, fire safety codes, and structural requirements sometimes clash with historic preservation goals.

Best Practices for Owners, Agents, and Buyers

Managing historical property insurance claims successfully starts long before disaster strikes. After helping settle over $250 million in large-loss claims, I’ve learned that preparation makes all the difference when dealing with historic properties.

The best defense is a good offense when it comes to risk management. Installing monitored fire and security systems can reduce your premiums by 5-15% while providing crucial early warning for properties filled with irreplaceable historic materials.

Electrical system upgrades deserve special attention in historic properties. Original knob-and-tube wiring or outdated panel boxes create fire risks that many insurers won’t accept. Working with electricians experienced in historic properties, you can upgrade systems safely while maintaining historic integrity.

Higher deductibles make financial sense for most historic property owners. Choosing deductibles of $2,500 to $5,000 can significantly reduce your premiums. Since even minor historic restoration work often exceeds these amounts, you’re unlikely to file small claims that could negatively impact your record anyway.

Annual CLUE report reviews help catch errors before they cause problems. You’re entitled to one free report per year, and catching mistakes early prevents them from affecting your coverage or premiums down the road.

Documentation & Collaboration

Think of documentation as insurance for your insurance. Comprehensive photo logs should capture every significant historic feature, both inside and out. Don’t just take wide shots—get close-ups of architectural details, original hardware, and unique materials that would be expensive to replace.

Maintaining receipts and records for all restoration work proves invaluable during claims. That $15,000 slate roof repair from three years ago establishes the value and quality of materials when storm damage occurs.

Building relationships with qualified professionals before you need them saves time and stress during claims. Identify preservation architects, specialty contractors, and craftsmen experienced with historic materials. Having these contacts ready means faster response when disaster strikes.

Working With Public Adjusters on Historical Property Insurance Claims

Historical property insurance claims benefit tremendously from professional representation. The complexity of preservation standards, specialty materials, and extended timelines requires expertise that most property owners—and even many insurance company adjusters—simply don’t possess.

Policy review before losses occur helps identify coverage gaps that could prove costly later. We analyze replacement cost calculations to ensure they reflect true historic restoration costs, not just market values.

When claims do occur, developing the right strategy from the start makes all the difference. This means understanding how preservation requirements affect costs, identifying all building code upgrades that might be triggered by the loss, and planning for the specialty contractor and material sourcing needs that standard adjusters often overlook.

Settlement negotiation requires detailed knowledge of historic construction costs and relationships with qualified restoration contractors. We leverage our understanding of preservation standards and experience with similar historical property insurance claims to ensure fair settlements that actually cover the cost of proper restoration.

The investment in professional representation typically pays for itself many times over when dealing with the complexities of historical property insurance claims.

Frequently Asked Questions About Historical Property Insurance Claims

When dealing with historical property insurance claims, property owners often have similar concerns about how these claims affect their coverage and premiums. Having handled hundreds of historic property claims across Texas, I’ve heard these questions countless times.

How long do historic property claims impact premiums?

Historical property insurance claims typically stay on your record for five to seven years, though most insurers focus on the past three years when calculating your premiums. For historic properties, this impact can feel more intense than with standard homes.

The challenge lies in limited insurer options. Not every insurance company wants to cover historic properties, so if your current carrier raises rates after a claim, you may struggle to find competitive alternatives.

Higher claim amounts also amplify the premium impact. When your Victorian home’s fire claim costs $150,000 instead of $75,000 due to specialty restoration requirements, insurers take notice.

The silver lining? Catastrophic weather events like hurricanes or major storms generally don’t trigger individual premium increases. These are considered acts of nature affecting entire regions.

Do previous owners’ claims affect my new policy?

This surprises many buyers, but yes, absolutely. Claims history follows the property address, not the person who owned it. That Victorian mansion you’re considering might look perfect, but if the previous owner filed three water damage claims in five years, those claims will impact your coverage options and premiums.

Common scenarios that catch buyers off-guard include multiple water damage claims suggesting chronic roof or plumbing issues, fire claims indicating potential electrical problems, or repeated storm damage showing the property’s vulnerability to specific weather patterns.

Smart strategies for dealing with prior claims include requesting the CLUE report before finalizing your purchase, using claims history as a negotiating tool for price reductions or required repairs, and documenting that any underlying issues have been properly resolved.

Can I access a CLUE report if I’m only a prospective buyer?

You cannot directly request a CLUE report for a property you don’t own, but several workarounds can help you access this crucial information before making a purchase decision.

Requesting the seller provide the report often works well. Many sellers willingly share CLUE reports when they show a clean history or want to be transparent about past issues.

Making your offer contingent on reviewing the CLUE report protects your interests. Include language allowing you to withdraw your offer if significant undisclosed claims are found.

Knowledge is power in historic property transactions. Understanding a property’s claims history helps you make informed decisions about purchase price, necessary inspections, and insurance coverage needs.

Conclusion

When your historic property suffers damage, you’re not just dealing with insurance—you’re protecting a piece of history. Historical property insurance claims demand more than standard adjusters can offer. They require deep understanding of preservation standards, authentic materials sourcing, and the patience to steer complex restoration timelines.

Over the years, we’ve seen too many historic property owners settle for inadequate repairs that compromise their building’s character. Insurance companies often push for quick, cheap fixes using modern materials that destroy the very features that make these properties special.

The difference professional advocacy makes is substantial. We’ve helped clients secure settlements that properly fund hand-carved millwork restoration, authentic slate roof replacement, and traditional lime plaster repairs. These aren’t luxuries—they’re necessities for maintaining historic integrity and property value.

At Insurance Claim Recovery Support LLC, we’ve successfully settled over $250 million in claims, including numerous historical property insurance claims throughout Texas and beyond. Whether it’s a storm-damaged Victorian in Austin’s historic district, fire loss at a century-old church in Lubbock, or water damage affecting irreplaceable materials in a San Antonio landmark, we understand what’s at stake.

Our service areas include Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway, plus clients throughout Texas and nationwide in Colorado, Oklahoma, and Florida.

The restoration process will take longer than modern construction. Sourcing authentic materials requires patience. Finding qualified craftsmen takes time. But rushing these decisions to satisfy insurance company timelines often results in permanent damage to historic character that can never be undone.

Don’t let insurance companies dictate how your historic property gets restored. Their adjusters may not understand the difference between functional replacement and authentic restoration. They might not know why hand-forged hardware costs more than modern alternatives, or why lime mortar matters for stone foundations.

We do. And we’ll fight to ensure your settlement reflects the true cost of proper historic restoration, not just the cheapest way to make your building functional again.

Learn more about our Public Adjusting Services and find how we can help preserve your piece of history while maximizing your insurance settlement.