Why Your Denied Insurance Claim Isn’t the End of Your Story

A denied insurance claim can feel like a crushing blow to your commercial property’s financial recovery, but understanding your appeal options can turn that rejection into a successful settlement. Here’s what you need to know:

Quick Action Steps for a Denied Claim:

- Review the denial letter carefully to understand the specific reason.

- Gather all documentation related to your original claim.

- Note appeal deadlines – most policies require action within 30-60 days.

- Don’t accept the denial as final, as insurance companies routinely deny initial claims.

- Consider professional help from a public adjuster to avoid costly litigation.

The stakes are high when your commercial building, multifamily complex, or institutional property suffers damage from fire, hurricane, tornado, freeze, or flood. A wrongful denial can mean the difference between swift recovery and financial devastation. Insurers often deny claims initially, expecting many policyholders won’t appeal, leaving them to cover costs out of pocket.

The good news is that most denied claims can be successfully appealed with the right strategy. Whether your claim was rejected due to policy exclusions, insufficient documentation, or disputed liability, a systematic approach can reverse that decision.

I’m Scott Friedson, a public adjuster who has overturned hundreds of wrongfully denied insurance claims and increased settlements by 30% to 3,800%. Through settling over $250 million in claims, I’ve learned that a strategic appeal often eliminates the need for costly and time-consuming litigation.

Denied insurance claim glossary:

Decoding the Denial: Common Reasons Your Property Claim Was Rejected

Receiving a denied insurance claim after years of paying premiums is frustrating. However, most denials are not the final word; they are an opening move in a negotiation. Insurers often reject initial claims, knowing many property owners will give up. Don’t be one of them.

- Policy exclusions are a common reason for denial. Insurers may claim the damage isn’t covered, citing a specific exclusion. Flood damage is a classic example, as it’s typically excluded from standard policies and requires separate coverage.

- Insufficient documentation can sink a claim. Insurers require comprehensive proof of the damage, its cause, and repair costs. Without it, they may deem your claim “unsubstantiated.”

- Late filing can lead to automatic denial. Policies have strict deadlines for reporting incidents and submitting formal claims.

- Pre-existing damage is another defense, especially with roofs. Insurers may argue the damage existed before the policy period. Thorough documentation is your best defense.

- Disputed liability gives insurers room to deny claims when the cause of damage is unclear, such as a roof leak from a storm versus poor maintenance.

- Lapsed policies or missed payments will void coverage, but sometimes coverage gaps result from processing delays or communication errors that aren’t your fault.

- Filing errors or incomplete information can trigger a denial, as insurers may reject claims over minor administrative issues instead of helping to correct them.

The reality is that Insurance Companies Maximize Profits to Industry by Shorting Customers, which is why persistence is crucial. If you’re dealing with a denied storm damage insurance claim, understanding these reasons is the foundation for a strong appeal.

Understanding Your Commercial Policy’s Fine Print

Your commercial property insurance policy is a complex contract where every word matters. Understanding its details can mean the difference between a successful claim and a denied insurance claim.

Named perils policies only cover damages from specific events listed in your policy. In contrast, all-risk policies cover everything unless it’s specifically excluded, making the exclusions list critical.

Flood damage exclusions are nearly universal in standard commercial policies. Properties in areas like Houston often need separate flood insurance. Windstorm deductibles in Texas coastal areas can be a high percentage of the property value, not a flat fee. Endorsements and riders modify your base policy, adding or removing coverage, and can be game-changers in a denial.

Common Pitfalls in Filing a Property Damage Claim

Even with great coverage, how you handle your claim can determine its success. Avoid these common mistakes that can lead to a denied insurance claim.

- Missed deadlines are a top reason for denial. Policies require you to report losses promptly and submit a formal proof of loss within a specific timeframe, often 60 days.

- Inadequate proof of loss is where many claims fail. Insurers need comprehensive evidence: photos, videos, detailed professional repair estimates, and for commercial properties, engineering reports or moisture readings.

- Under-documenting damage is costly. Obvious damage might hide more extensive issues like water intrusion inside walls or structural problems. If you don’t document it, you won’t be compensated for it.

- Misrepresenting information, even accidentally, can sink your claim. Stick to the facts in all communications.

Recent J.D. Power research shows that Customer Satisfaction with Homeowners Insurance Property Claims Declines to 7-Year Low Amid Record Catastrophic Events and Slower-Than-Ever Repair Times, J.D. Power Finds. This trend makes meticulous claim preparation more important than ever.

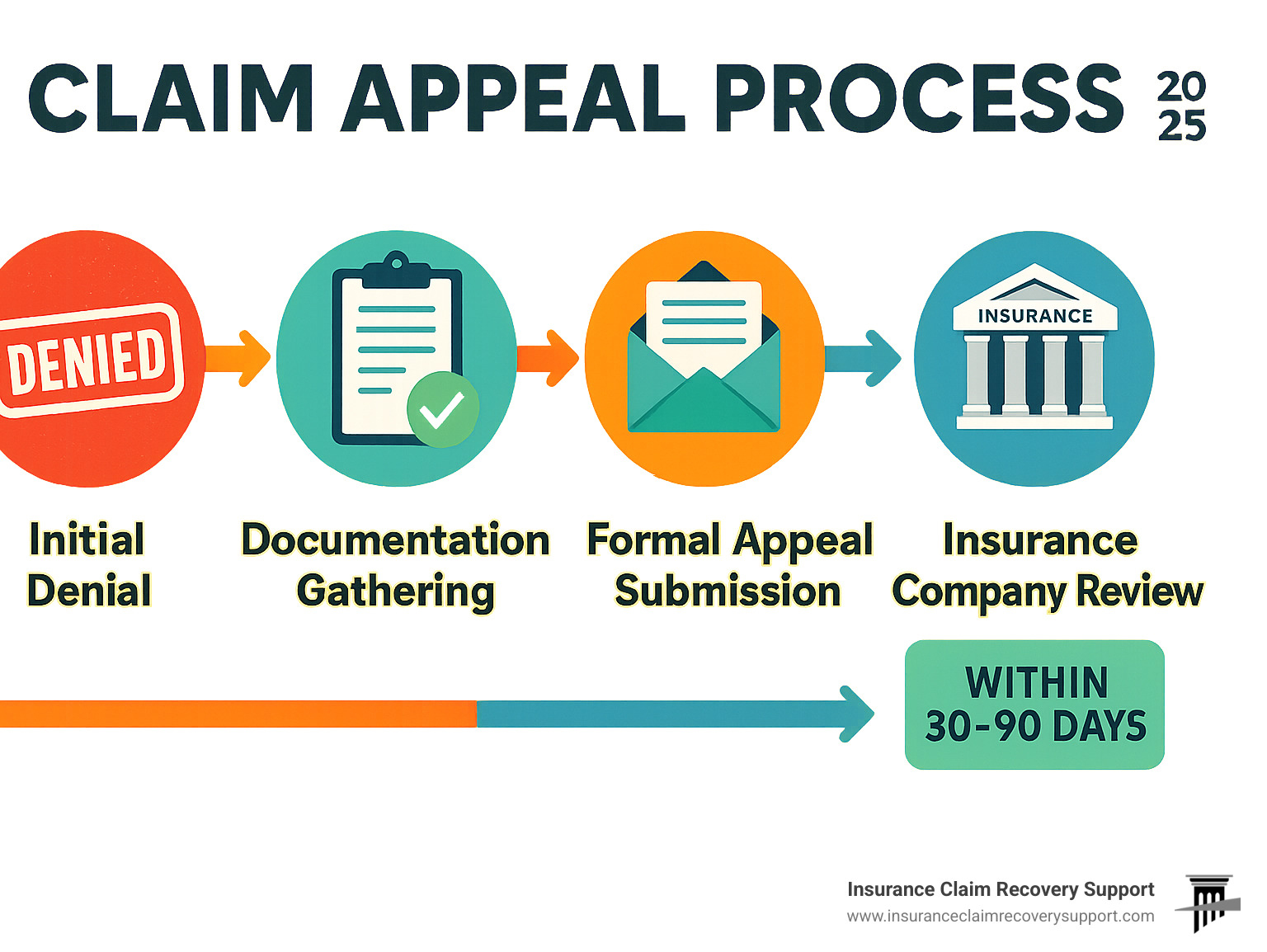

Mastering the Appeal: Your Step-by-Step Guide to Overturning a Denied Insurance Claim

When you receive a denied insurance claim letter, don’t feel defeated. That denial is often just the insurer’s opening position in a negotiation. Your appeal is your chance to build a case showing why your claim is covered. It’s not about emotion; it’s about presenting clear, organized evidence of the insurer’s error.

The key to a successful appeal is persistence, thorough documentation, and formal written communication. Insurers are more likely to reverse a denial when you show them what they missed. A systematic approach can often resolve your denied insurance claim without expensive litigation. A solid evidence base makes it easier to How to Negotiate with Insurance Adjuster for Property Damage.

Step 1: Immediate Actions After a Denial

The moment you open that denied insurance claim letter, the clock starts ticking. Approach this methodically. Your organized response can make all the difference.

First, read the denial letter like a detective. It must state why your claim was rejected and your deadline to appeal. Note the specific policy language they cite.

Next, request your complete claim file immediately. This powerful tool contains every note, photo, and report on your claim. You have a right to this file, and it often reveals gaps in their investigation.

This initial denial is not a final decision. Insurers routinely deny claims on the first review, expecting many policyholders will walk away. Your persistence signals that you’re serious about getting a fair settlement.

Step 2: Assembling Crucial Documentation for Your Appeal

The strength of your appeal depends entirely on the quality of your evidence. This is where you demand what’s rightfully yours under your policy.

- Your original insurance policy is your contract. You need every page, including endorsements and the declarations page, to point to the language that supports your claim.

- High-quality photos and videos are persuasive witnesses. Take new ones if needed, showing the damage from multiple angles.

- Professional repair estimates from reputable contractors carry significant weight. They should be detailed, itemized, and explain why the repairs are needed.

- Engineering reports can be game-changers for complex damage, providing expert analysis that counters the insurer’s conclusions.

- Document every interaction with your insurer. A timeline of communications can reveal inconsistencies in their handling of your claim.

- Witness statements can provide crucial third-party validation of what caused the damage.

- Keep all correspondence organized. Every email, letter, and call summary should be part of your appeal package.

Step 3: Understanding Your Rights and the Appeals Process

As a commercial property owner with a denied insurance claim, you have more rights than you might realize. The insurance industry is regulated to protect policyholders, and understanding these protections strengthens your position.

Your internal appeal is your first chance to get the insurer to reverse their decision. You formally request they re-examine your claim with the new evidence you’ve gathered. Most insurers take this seriously to avoid external oversight.

If that fails, you have the right to an external review. This brings in a neutral third party, often overseen by your state insurance department, to evaluate the claim independently. In Texas, the Texas Department of Insurance provides significant oversight and can investigate complaints.

You can find information on your rights through the National Association of Insurance Commissioners (NAIC). For direct help, we offer Assistance with Insurance Claims to guide property owners through these complex processes.

Appealing a wrongful denial is your contractual right. The appeals process exists to correct mistakes and ensure you receive the settlement your policy promises.

Choosing Your Champion: Public Adjuster vs. Insurance Claim Lawsuit for a Denied Claim

When facing a denied insurance claim for your commercial property, you’re at a crossroads. The path you choose can mean the difference between a quick resolution and a costly legal battle.

Many think their only options are to accept the denial or hire a lawyer. However, a public adjuster specializing in overturning wrongful denials is often a better choice. At Insurance Claim Recovery Support LLC, we turn denials into successful settlements without going to court. We represent policyholders with complex commercial property damage from fire, hurricane, tornado, freeze, and flood events across Texas cities like Austin, Dallas, Houston, and San Antonio.

For most denied insurance claims involving significant damage to commercial buildings, multifamily complexes, or religious institutions, a public adjuster provides expertise while avoiding litigation costs and delays.

The Public Adjuster Path: Expertise and Efficient Resolution

A Public Adjuster Definition is simple: we are licensed professionals who work exclusively for you, the policyholder. A public adjuster brings claim valuation expertise that insurers respect, documenting hidden damage that company adjusters often miss. Our negotiation experience allows us to counter the tactics insurers use by citing policy language and providing solid evidence.

The contingency fee structure means we only get paid when you do, aligning our interests with yours. This professional representation often leads to faster resolution, as a well-prepared appeal can lead to a settlement in weeks, not months. Our focus on policy interpretation and damage assessment helps avoid unnecessary litigation, as most insurers prefer to settle legitimate claims when presented with a professionally documented case. Learn more about how Public Adjusters can help.

The Lawsuit Path: When Legal Action is the Last Resort

Litigation is a rare last resort, typically reserved for cases of “bad faith” or fundamental coverage disagreements that can’t be resolved through negotiation.

The litigation process is long, involving legal procedures that can drag on for years while your property remains unrepaired. The higher costs of legal fees, court costs, and expert witnesses can be a significant financial burden. The longer timelines are another major drawback.

However, legal action may be necessary when an insurer refuses to negotiate in good faith despite clear evidence of coverage. This includes ignoring evidence or making obviously inadequate settlement offers.

| Feature | Public Adjuster Path | Insurance Claim Lawsuit Path |

|---|---|---|

| Cost Structure | Contingency fee (percentage of recovered settlement) | Hourly legal fees, court costs, expert witness fees |

| Timeline | Generally faster (weeks to a few months) | Significantly longer (months to years) |

| Process | Negotiation, claim preparation, documentation | Pleadings, findy, motions, mediation, trial |

| Expertise | Claims valuation, policy interpretation, negotiation | Legal strategy, litigation, bad faith law |

| Relationship | Collaborative with policyholder, adversarial with insurer | Adversarial with insurer, formal legal proceedings |

| Control | Policyholder maintains more control over decisions | Attorney leads, formal rules of court apply |

| Risk | Low financial risk (no recovery, no fee) | High financial risk (costs accrue regardless of outcome) |

| Outcome | Settlement through negotiation | Settlement or court judgment |

Most claims can be resolved without court because insurers know that fighting legitimate claims costs more than paying fair settlements. Our approach focuses on building such a compelling case that litigation becomes unnecessary. Understanding Why You Need a Public Adjuster for Commercial Claims can prevent costly court battles while securing the maximum settlement for your denied insurance claim.

Frequently Asked Questions about a Denied Insurance Claim

When you’re facing a denied insurance claim, questions pile up. Here are the most common concerns I hear from commercial property owners and managers in Texas.

How long do I have to appeal a denied insurance claim in Texas?

Time is critical. Your appeal deadlines are hard deadlines spelled out in your insurance policy. Most policies give you 30 to 60 days from the date of your denial letter to file an internal appeal. Check your specific policy language immediately, as the denial letter should also state these deadlines.

While Texas law provides protections for how insurers must handle claims, it doesn’t extend your contractual right to appeal. Whether you’re in Austin, Houston, or Dallas, act quickly. Consulting a public adjuster can help ensure you don’t miss critical deadlines while building the strongest possible appeal.

Can my premiums go up if I appeal a denied insurance claim?

This is a common fear, but appealing a denied insurance claim is your legal right. Insurers cannot raise your rates in retaliation for exercising that right.

However, the underlying loss event does become part of your claims history. This means that having a loss occur—whether initially denied or not—could potentially impact future premiums based on your overall claims pattern. The key takeaway is not to let fear of premium increases stop you from pursuing a justified appeal. A public adjuster can help you recover what you’re owed while navigating your insurance relationship.

What is the difference between an internal appeal and an external review?

Understanding these two stages is key to securing a settlement for your denied insurance claim.

An internal appeal is your first step. You formally ask your insurance company to re-evaluate its decision, submitting a comprehensive appeal with supporting documentation. Insurers often prefer to resolve disputes at this stage and frequently reverse initial denials when presented with compelling new evidence.

An external review is the next step if your internal appeal is denied. This involves an independent, neutral third party, often overseen by the Texas Department of Insurance. The external reviewer examines all evidence and makes a binding decision. If they rule in your favor, the insurer must pay your claim.

A public adjuster’s expertise can often resolve a denied insurance claim during the internal appeal, avoiding the lengthy external review process. For complex commercial properties in Georgetown, Lakeway, or Round Rock, professional representation can turn a denial into a successful settlement.

Conclusion: Your Path to a Fair Settlement

A denied insurance claim isn’t the end of your story; it’s the start of a negotiation. As we’ve shown, insurers often deny claims initially, but a strategic appeal with solid documentation can turn a denial into the settlement your commercial property deserves.

Understanding your policy, knowing appeal deadlines, and recognizing when to get professional help are critical. For complex commercial claims in Texas—from fire damage in Austin to tornado damage in Dallas or freeze damage in San Antonio—the stakes are too high to go it alone.

This is where Insurance Claim Recovery Support LLC steps in. We exclusively represent policyholders, using our experience in documentation, damage assessment, and negotiation to win your case, often without litigation. We’ve turned countless denials into victories for properties damaged by hurricanes in Houston, lightning in Fort Worth, or floods in Waco.

Don’t let a denial discourage you or fight this battle alone. We can change your denied insurance claim from a source of stress to a step toward full recovery.

Ready to turn your denial into a victory? If you need help with your flood damage insurance claims or any other property damage claim, reach out to us today. Your fair settlement is waiting.