Why Dallas-Fort Worth Storm Damage Demands Professional Attention

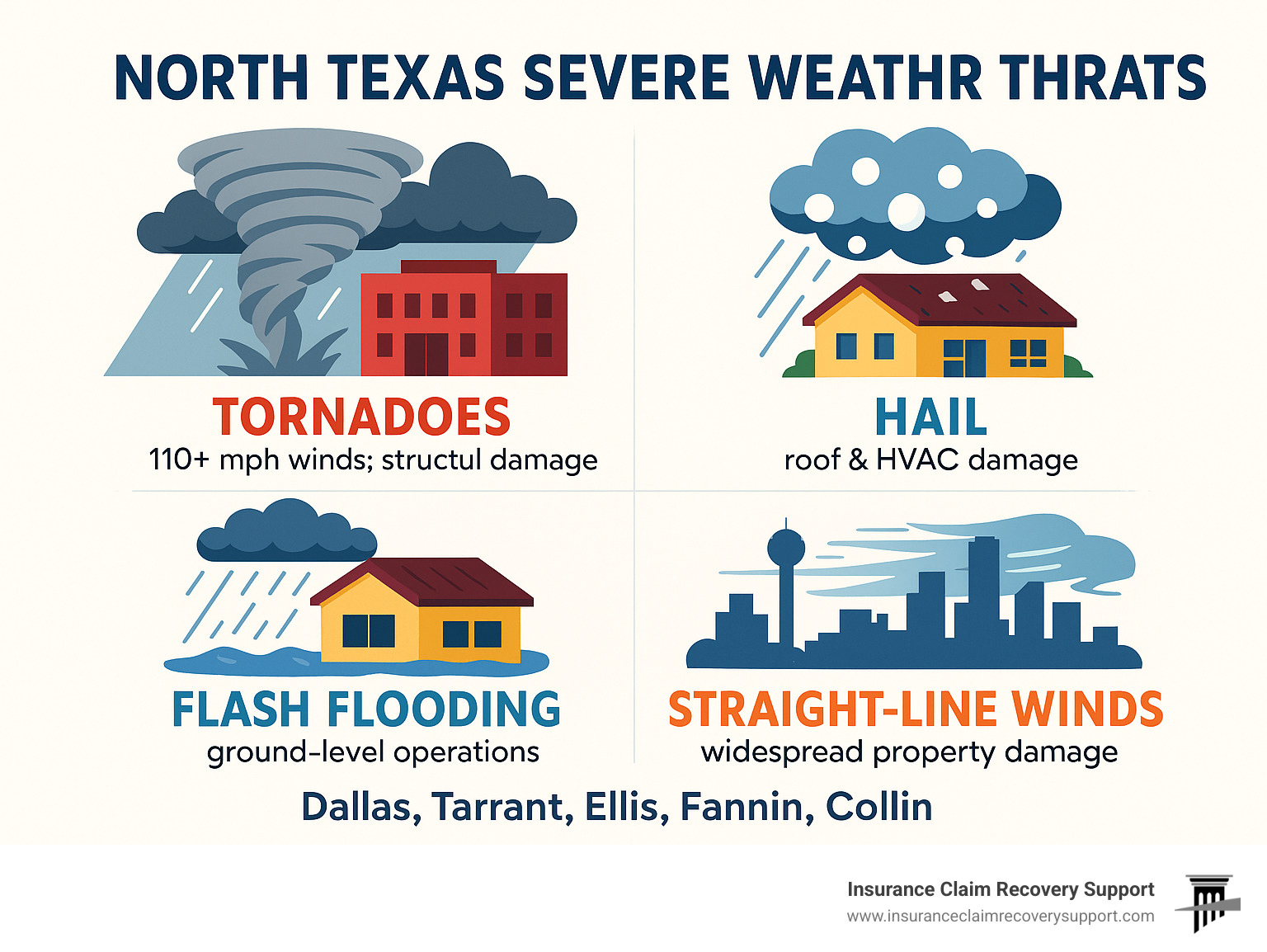

Dallas-Fort Worth storm damage affects thousands of commercial properties, multifamily complexes, and institutional buildings each year, with recent severe weather events causing hundreds of millions in losses across North Texas.

Recent Dallas-Fort Worth Storm Damage Impact:

- Five confirmed tornadoes with winds up to 110 mph in Irving and surrounding areas

- Baseball-sized hail causing widespread roof and HVAC damage

- Over 31,000 power outages affecting commercial operations

- Major property damage including collapsed warehouses, damaged airports, and destroyed school buildings

- Counties most affected: Dallas, Tarrant, Ellis, Fannin, Palo Pinto, and Collin

The Dallas-Fort Worth metroplex sits in one of the most storm-active regions in the United States. Recent overnight storms demonstrate just how quickly severe weather can devastate commercial properties – from the EF-1 tornado that forced 350 people from their homes near downtown Irving to the partial collapse of a Benjamin Moore warehouse in Lewisville.

These storms don’t just cause obvious damage. Wind can lift commercial roofing materials without visible tears, hail can bruise roof membranes leading to future leaks, and flooding can compromise electrical systems in ways that aren’t immediately apparent. For property owners, the real challenge often begins after the storm passes – navigating complex insurance claims while managing business operations and tenant safety.

Property owners facing disputed claims have two main paths: pursue costly litigation that can take years, or work with a public adjuster who can reopen negotiations and often resolve disputes in months rather than years. A public adjuster can help avoid unnecessary litigation by leveraging their expertise to document losses properly and negotiate directly with insurance carriers.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled over 500 large loss claims valued at more than $250 million, including extensive Dallas-Fort Worth storm damage cases involving commercial and multifamily properties. Through my firm ICRS LLC, I’ve helped property owners increase their settlements from 30% to 3,800% while avoiding costly court battles.

Anatomy of a North Texas Storm: Recent Impacts

The Dallas-Fort Worth metroplex sits right in the heart of Tornado Alley, where Mother Nature regularly flexes her muscles with a devastating combination of tornadoes, straight-line winds, baseball-sized hail, and flash flooding. Recent storms have reminded us just how quickly severe weather can turn a typical Tuesday into a property owner’s worst nightmare.

The latest round of severe weather carved a path of destruction across multiple counties, leaving commercial property owners, multifamily complexes, and institutional buildings counting the costs. Fannin County saw considerable damage, with high winds literally peeling the roof off a Braum’s restaurant in Bonham like opening a can of sardines.

In Palo Pinto County, west of Fort Worth, the small town of Gordon took a direct hit. Emergency crews reported 31 homes damaged, with six suffering major structural damage and one completely destroyed. Ellis County wasn’t spared either – two confirmed tornadoes near Italy and Ennis left mobile homes without roofs and barns flattened.

Dallas County battled significant flooding issues while Tarrant County and Collin County dealt with the double punch of damaging winds and destructive hail. This widespread Dallas-Fort Worth storm damage highlights why commercial property owners need solid recovery strategies and professional representation when dealing with complex insurance claims.

Widespread Wind and Tornado Damage

When the National Weather Service confirms multiple tornadoes in your area, you know it’s been a rough night. The most significant tornado – an EF-1 with winds reaching 110 mph – tore through Irving like an unwelcome visitor, forcing more than 350 people from their homes near downtown Irving.

The tornado didn’t discriminate between residential and commercial properties. Irving ISD’s Zavala Middle School took a direct hit, forcing officials to close the facility due to structural damage, downed power lines, and a dangerous gas leak. These kinds of institutional hits demonstrate how quickly severe weather can disrupt entire communities.

Alliance Airport in Fort Worth experienced what can only be described as aviation chaos. The winds were so powerful they caused significant damage to multiple hangars and buildings. It’s the kind of scene that makes even seasoned pilots nervous.

The industrial sector took heavy losses too. A Benjamin Moore warehouse in Lewisville partially collapsed along SH121, while a McKinney warehouse lost an entire wall at the corner of North Kentucky Street and McCauley Street. These incidents, combined with widespread 60-80 mph winds across the region, show why commercial property owners need experienced public adjusters who understand the full scope of wind and tornado damage – from obvious structural collapse to subtle roof membrane damage that insurance companies often overlook.

The Aftermath of Hail and Flooding

While tornadoes grab the headlines, baseball-sized hail quietly causes millions in damage to commercial properties across Tarrant County and surrounding areas. This isn’t your typical pea-sized hail – we’re talking about ice chunks that can punch holes through commercial roofing membranes, bruise single-ply roof systems, and turn expensive HVAC units into scrap metal.

Commercial roofs bear the brunt of large hail damage. What looks like minor surface damage often masks serious problems underneath – bruised membranes that will fail prematurely, compromised flashing, and damaged roof drains that can lead to catastrophic leaks months later. HVAC units positioned on rooftops are sitting ducks for hail damage, with condenser coils, fan blades, and control panels all vulnerable to impact damage.

Flash flooding adds another layer of complexity to storm damage claims. The chaos on Lemmon Avenue near Dallas Love Field Airport, where high water shut down northbound lanes, illustrates how quickly our urban infrastructure can be overwhelmed. Several lanes of southbound U.S. Highway 75 were completely impassable at Knox Henderson Boulevard due to high water.

Emergency crews even conducted high-water rescues near Shady Brook Lane and East Northwest Highway in northeast Dallas – an area known for rapid water accumulation during heavy rainfall. This kind of flooding doesn’t just create traffic headaches; it can devastate ground-level commercial spaces, flood parking garages, contaminate electrical systems, and trigger expensive mold remediation requirements.

For commercial property owners dealing with this complex mix of damage types, having a public adjuster who understands how to properly document and present these claims can mean the difference between a fair settlement and a costly legal battle that drags on for years.

Assessing the Dallas-Fort Worth Storm Damage to Your Property

When a severe storm passes through North Texas, the silence afterward can feel almost as overwhelming as the chaos that preceded it. For commercial property owners, multifamily HOAs, apartment complexes, and religious institutions, this moment marks the beginning of a critical phase: accurately assessing your Dallas-Fort Worth storm damage.

The steps you take in these first hours and days will significantly impact your insurance claim’s success. A thorough property inspection combined with meticulous damage documentation forms the foundation of any successful recovery. But here’s what many property owners don’t realize – some of the most costly damage isn’t always visible at first glance.

Your Initial Post-Storm Checklist for Dallas-Fort Worth Storm Damage

The moments after a storm are when your actions matter most. Think of this as your property’s emergency room triage – safety comes first, documentation comes second, and securing the property comes third.

Start with safety above everything else. Check for immediate hazards like downed power lines – we saw this exact scenario at Irving’s Zavala Middle School, where gas leaks and electrical dangers forced the school’s closure. If you notice structural damage, gas odors, or electrical issues, keep everyone away and call emergency services immediately.

Shut off utilities when necessary. If your property has sustained significant damage, especially involving water intrusion or structural compromise, turning off electricity, gas, and water can prevent additional hazards and damage. This simple step has saved countless property owners from compounding their losses.

Now comes the documentation phase – and this is where many claims succeed or fail. Before you move a single piece of debris, document everything with photos and videos. Capture wide shots showing the overall scene, then zoom in for detailed close-ups. When that Braum’s restaurant in Bonham lost part of its roof, the property owner who documented both the debris field and the exposed interior had a much stronger claim than one with just a few quick snapshots.

Create a detailed inventory as you document. For commercial properties, this means cataloging damaged office equipment, machinery, and tenant improvements. Multifamily properties need to account for common area furnishings, fitness equipment, and landscaping damage. Religious institutions should document everything from sanctuary fixtures to educational materials.

Secure your property to prevent further damage, but do it smart. Board up broken windows, tarp damaged roofs, and remove standing water – but keep every receipt. These mitigation costs are typically reimbursable, and proper documentation proves you acted responsibly to minimize losses.

Essential Items to Document After a Storm:

- Storm date, time, and weather conditions

- Specific damage types (wind, hail, flooding)

- Affected areas with precise locations

- Detailed descriptions of each damaged item

- Multiple photos and videos from various angles

- Measurements of damage extent and hail size

- All temporary repairs with before/after photos and receipts

- Witness contact information

Identifying Common but Hidden Commercial Property Damage

Here’s where Dallas-Fort Worth storm damage gets tricky – the damage you can’t see often costs more than what’s obvious. Commercial properties, with their complex roofing systems and mechanical equipment, are particularly vulnerable to hidden issues that surface weeks or months later.

Wind-lifted roofing materials represent one of the most common hidden problems. Those 60-80 mph winds we experienced can lift and loosen shingles or membrane sections without creating visible holes. The roof looks fine from the ground, but compromised seals mean future leaks are inevitable. This is especially problematic for large commercial buildings where roof access requires special equipment.

Hail damage to roof membranes often appears as bruising rather than punctures. The membrane may look intact, but the material has been weakened and will fail prematurely. On flat commercial roofs, this kind of damage can affect thousands of square feet without obvious signs from ground level.

HVAC systems suffer hidden damage frequently. Baseball-sized hail can dent condenser coils and damage fins, reducing efficiency by 20-30% or more. Wind can loosen mounting systems or damage external components that won’t fail until the system cycles under load. For commercial properties with multiple rooftop units, this represents a significant hidden cost.

Water intrusion creates the most insidious problems. Water finds ways into wall cavities, ceiling spaces, and foundation areas where it begins causing damage immediately. Mold growth starts within 24-48 hours in Texas humidity. Electrical systems can suffer corrosion that creates fire hazards months later. For apartment complexes and multifamily properties, water damage in one unit often affects adjacent units in ways that aren’t immediately apparent.

Foundation and structural issues from ground saturation or debris impact may not manifest until the building settles or experiences thermal expansion. These problems can affect everything from door alignment to major structural integrity.

This is exactly why working with a public adjuster makes sense for significant commercial property damage. We understand where to look for hidden damage and how to document it properly. Most property owners miss 30-50% of their actual damage simply because they don’t know what to look for or how to access areas where problems hide. A thorough professional assessment often reveals damage that increases settlements substantially while helping avoid litigation that can drag on for years.

Navigating the Insurance Claim Process

After experiencing significant Dallas-Fort Worth storm damage, the insurance claim process can feel overwhelming for commercial property owners, multifamily HOAs, apartment complexes, and religious institutions. From filing your initial claim to documenting losses and negotiating a fair settlement, each step presents potential challenges like claim delays, underpayment, or outright denial. Understanding your options and having the right support can make the difference between a frustrating ordeal and a successful recovery.

The key is knowing that you’re not powerless in this process. Insurance companies have teams of adjusters and lawyers working to minimize payouts, but as a policyholder, you have rights and options to ensure you receive the full compensation you deserve for your storm damage.

The Two Paths After a Disputed Claim: Public Adjuster vs. Insurance Claim Lawsuit

When your insurance carrier’s initial offer for your Dallas-Fort Worth storm damage claim feels inadequate, or they dispute the extent of your losses, you essentially face a crossroads. You can either pursue costly litigation through an insurance claim lawsuit, or work with a public adjuster who can reopen negotiations and often resolve disputes without ever seeing the inside of a courtroom.

The litigation path typically involves hiring an attorney, filing a lawsuit against your insurance company, and entering a lengthy legal battle that can drag on for years. While you might eventually win, the process is expensive, time-consuming, and stressful. You’ll pay attorney fees, court costs, and expert witness fees, all while your damaged property sits unrepaired and your business operations remain disrupted.

The public adjuster path offers a more direct route to resolution. A licensed public adjuster works exclusively for you, not the insurance company, and has the expertise to properly document your losses, interpret your policy, and negotiate directly with your carrier. Most importantly, a public adjuster can help avoid unnecessary litigation by resolving disputes through professional negotiation and the appraisal process when needed.

| Feature | Public Adjuster | Insurance Lawsuit |

|---|---|---|

| Timeline | 3-12 months typically | 1-3+ years commonly |

| Upfront Costs | None – contingency fee only | Retainer fees, court costs, expert fees |

| Your Involvement | Minimal – adjuster handles everything | Extensive – depositions, court appearances |

| Success Rate | High settlement increases | Uncertain outcomes |

| Business Disruption | Minimal | Significant time commitment |

| Expertise | Insurance policy and claims specialist | Legal expertise, may lack technical knowledge |

The appraisal clause in most policies provides another avenue for resolution. When you and your insurance company disagree on the amount of loss, either party can invoke appraisal – essentially bringing in neutral experts to determine the proper settlement amount. Public adjusters are skilled at using this process to achieve fair outcomes without the expense and uncertainty of litigation.

Proving Your Loss: The Importance of Documentation

Your insurance claim’s success hinges on one critical factor: proving your loss with solid documentation. Insurance companies operate on evidence, not emotions or assumptions, which means every dollar of your claim must be supported by clear, comprehensive proof.

Proof of ownership forms the foundation of your claim. For commercial properties, this includes building permits, architectural plans, purchase receipts for equipment and fixtures, and detailed inventories of contents. Multifamily properties need documentation of common area improvements, amenities, and shared equipment like pool systems or fitness center equipment. Learn more about proving ownership in claims.

Receipts and invoices establish the value of damaged items and previous improvements. Keep records of recent renovations, equipment purchases, and maintenance work. These documents show your property’s condition before the storm and help justify replacement costs.

Contractor bids and expert reports provide professional assessments of repair costs and damage extent. Multiple bids help establish reasonable repair costs, while expert reports can identify hidden damage that might not be obvious to insurance adjusters. For complex commercial properties, you might need structural engineers, roofing specialists, or HVAC experts to properly assess all damage.

Business interruption documentation becomes crucial for commercial properties. Lost revenue, extra expenses for temporary operations, and increased costs due to the damage all factor into your claim. Detailed financial records, profit and loss statements, and documentation of operational disruptions help quantify these less obvious losses.

The challenge is that most property owners don’t realize what documentation they need until they’re in the middle of a claim. This is where a public adjuster’s expertise becomes invaluable – they know exactly what evidence insurance companies require and can help gather the proper documentation to maximize your settlement while avoiding the delays and disputes that often lead to litigation.