Hail damage claims can seem daunting, especially after a storm has wreaked havoc on your property. The immediate aftermath of such an event often leaves property owners with a pressing question: “What should I do now?” Addressing this question is critical to ensuring that your insurance covers the necessary repairs. Here’s a quick checklist to help you start:

- Document the Damage: Take clear photos and videos from different angles.

- Review Your Insurance Policy: Familiarize yourself with what’s covered.

- Start Your Claim: Contact your insurance company as soon as possible.

- Get Repair Estimates: Consult multiple contractors for quotes.

Hailstorms, especially in areas like the Hailstorm Alley, can lead to significant property damage. Being aware of how hail damage claims work can help you steer the insurance process smoothly and potentially save you both time and money. It’s crucial to know the extent of your insurance coverage and understand the importance of timely claims reporting.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. With experience in managing hail damage claims, I’ve seen how vital it is for property holders to act swiftly and knowledgeably. Now, let’s dive deeper into understanding hail damage claims so you can be better prepared.

Understanding Hail Damage Claims

When a hailstorm hits, understanding what your insurance covers can help you recover faster. Let’s break down the essentials of hail damage claims.

What is Covered?

Property and casualty Insurance typically covers damage to the physical structure of your building or home. This includes roofs, siding, and windows. However, each policy is different, so it’s crucial to know your specific coverage.

- Comprehensive Coverage: If you have auto insurance, comprehensive coverage can protect your vehicle from hail damage. This is separate from collision coverage and is essential for those living in hail-prone areas.

- Wind Damage: Sometimes, hailstorms come with strong winds. Ensure your policy covers wind damage too, as it can cause shingles to lift or break, leading to leaks.

- Policy Limits and Deductibles: Be aware of your policy limits, which is the maximum your insurer will pay. Your deductible is the amount you pay out of pocket before insurance kicks in. Knowing these numbers helps you avoid surprises.

Filing a Claim

When filing a claim, documentation is key. This ensures you receive the compensation you deserve.

- Documentation: Start by taking clear photos and videos of all damage. Capture different angles and close-ups to provide a comprehensive view of the destruction.

- Insurance Adjuster: An insurance adjuster will assess the damage. It’s helpful to have your own contractor present to ensure nothing is missed.

- Timely Filing: File your claim as soon as possible. Many policies have strict deadlines, and delays can lead to claim denial.

By understanding your property insurance and documenting damage thoroughly, you can steer the claims process more effectively. This knowledge not only helps in dealing with insurance adjusters but also ensures you get the repairs needed to restore your property.

Next, we’ll explore the steps to file a hail damage claim, from starting your claim to arranging repairs and payments.

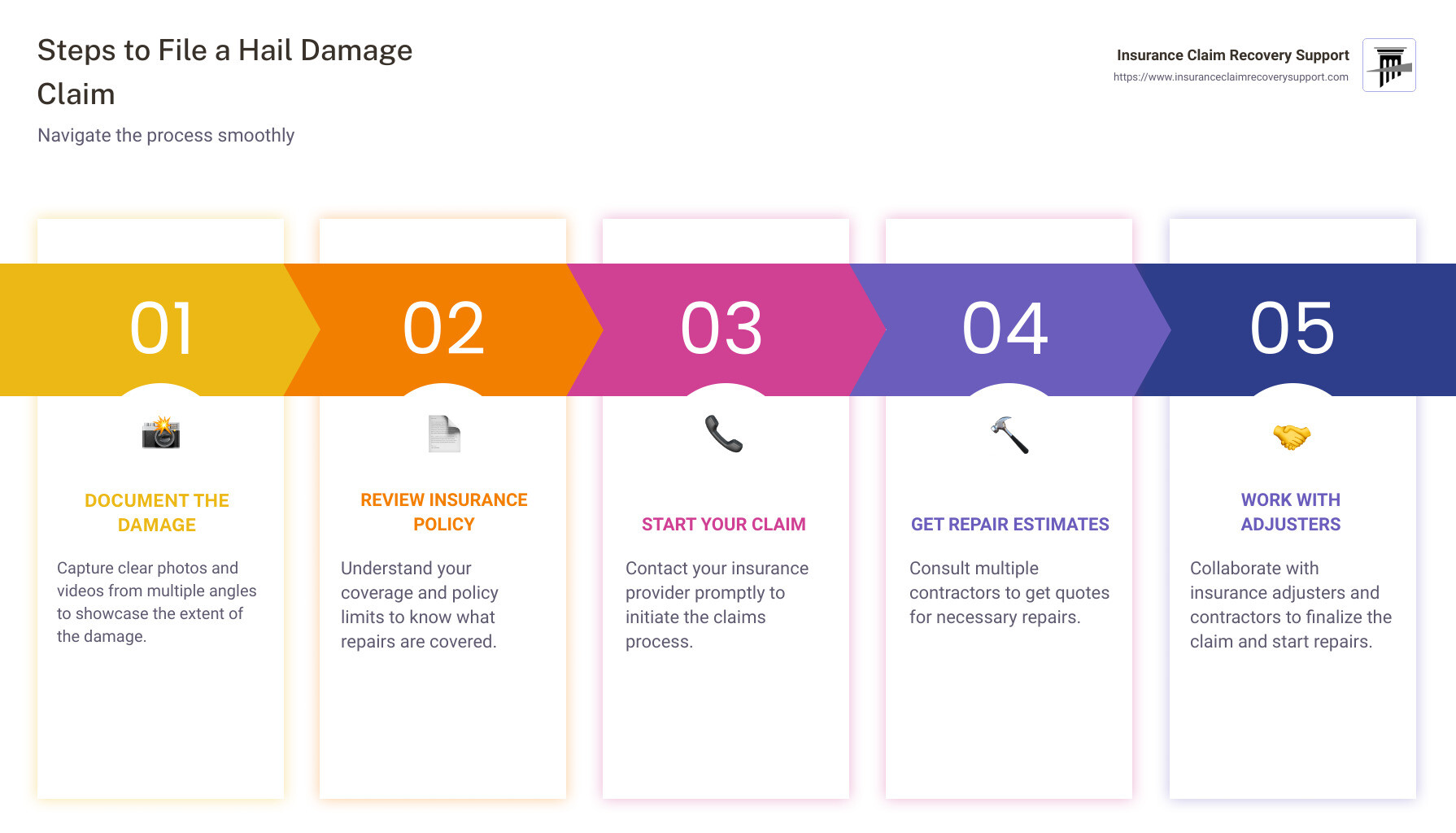

Steps to File a Hail Damage Claim

Once you’ve ensured your safety after a hailstorm, it’s time to start your hail damage claim. Let’s walk through the process step by step.

Gathering Evidence

Before you file a claim, gather solid evidence of the damage. This will support your case and help ensure a fair settlement.

- Photos and Videos: Take clear, detailed photos and videos of all damage. Capture multiple angles and include close-ups to show the extent of the destruction. Don’t forget to photograph hailstones for size reference—use a ruler or coin for scale.

- Local Contractors: It’s wise to contact local contractors for repair estimates. They can provide independent assessments of the damage, which can be useful during claim negotiations. Make sure to get written estimates from at least two reputable contractors.

Working with Adjusters

Once you’ve gathered evidence, it’s time to engage with your insurance company and their adjuster.

- Starting Your Claim: Notify your insurance company as soon as possible. Most insurers have a 24-hour claims hotline. Provide them with all the evidence you’ve collected, including photos, videos, and contractor estimates.

- Insurance Adjuster: Your insurance company will send an adjuster to assess the damage. It’s beneficial to have one of your contractors present during the adjuster’s visit. This ensures a thorough inspection and helps you understand the scope of repairs needed.

- Repair Estimates: Discuss the repair estimates with the adjuster. Ensure they align with the damage assessment. If there’s a discrepancy, having your contractor present can facilitate a more accurate evaluation.

- Payment Arrangement: Once the claim is approved, discuss payment arrangements. Some insurers may offer an advance to start repairs, while others might pay contractors directly. Make sure you understand and agree to the payment process.

By carefully gathering evidence and working collaboratively with adjusters and contractors, you can streamline the claims process and move towards getting your property back to its pre-damage condition.

Next, we’ll dig into common challenges you might face during the hail damage claims process and how to avoid potential pitfalls.

Common Challenges in Hail Damage Claims

Avoiding Pitfalls

Navigating the hail damage claim process can be tricky. Here are some common challenges and tips to avoid them:

Claim Denial and Repair Costs

Insurance companies might deny claims for several reasons. One common reason is the damage not meeting the deductible. If the repair costs are less than your deductible, the insurer won’t pay. Pre-existing damage is another reason for denial. Insurers might argue that the damage was there before the storm.

To avoid these issues, maintain your property well and document its condition regularly. This can provide proof that the damage is new.

Policy Exclusions

Every insurance policy has exclusions. For hail damage, some policies might not cover certain types of damage or might have restrictions based on the age of your property. For instance, older roofs might only get coverage for a partial replacement or Actual Cash Value instead of a full replacement.

Understanding your policy is crucial. Review it carefully to know what is and isn’t covered. If you’re unsure, consult with an expert or a public adjuster who can clarify these details for you.

Timely Filing and Accurate Documentation

Filing your claim promptly is essential. Most insurance policies have a deadline for claims submission. Missing this deadline can lead to denial. Also, accurate documentation is key. Insurers require detailed records to process claims. Incomplete or inadequate documentation can result in delays or denial.

Here’s how to avoid these pitfalls:

- File on Time: As soon as you notice damage, start the claim process. Don’t wait, as this can complicate your claim.

- Document Thoroughly: Take clear photos and videos, keep repair receipts, and note all communications with your insurer. This creates a comprehensive record that supports your claim.

Understanding Your Policy

Lastly, understanding your policy can prevent many issues. Know your coverage limits, deductibles, and any exclusions. This knowledge helps set realistic expectations and prepares you for potential challenges.

By being proactive and informed, you can avoid common pitfalls in the hail damage claim process and ensure a smoother experience. Next, we’ll answer some frequently asked questions about hail damage and its impact on property and insurance.

Frequently Asked Questions about Hail Damage Claims

How does hail damage affect property value?

Hail damage can significantly impact the value of your property. Unresolved damage, such as dents in siding or a compromised roof, can lead to further deterioration. Over time, this can cause leaks or structural issues, which may reduce the property’s market value.

Devaluation occurs because potential buyers often see unresolved hail damage as a red flag. They might worry about hidden problems or future repair costs. To maintain your property’s value, address hail damage promptly. Repair any issues and document these repairs to reassure future buyers or appraisers.

Can hail damage claims raise my insurance rate?

Filing a hail damage claim might affect your insurance premiums, but it depends on several factors. Generally, a single claim for hail damage, especially if it’s your first, may not lead to a premium increase. However, if you have a history of multiple claims or live in a hail-prone area, insurers might see you as a higher risk, potentially leading to increased rates.

Insurance companies consider your claims history when setting premiums. To minimize the impact, maintain a good claims record and address property vulnerabilities to prevent future damage.

What is the time limit for filing a hail damage claim?

The filing deadline for hail damage claims varies by insurance provider and policy. Typically, you have up to one year from the date of the hailstorm to file a claim. However, some policies may have shorter timeframes. It’s crucial to check your policy’s specific requirements immediately after a storm.

Missing the filing deadline can result in denial of your claim. To avoid this, document the damage promptly and notify your insurer as soon as possible. This ensures you meet all necessary timelines and increases your chances of a successful claim.

Conclusion

When hailstorms hit, the aftermath can be daunting. That’s where we come in. At Insurance Claim Recovery Support, our mission is to ensure you receive the settlement you deserve. We understand the complexities of hail damage claims and are committed to advocating on your behalf.

Maximizing Settlement is our specialty. We know the tactics insurance companies use to minimize payouts. Our team carefully documents your claim, negotiates with insurers, and leverages our deep knowledge of hailstorm policies. This approach often results in higher settlements, turning a stressful situation into a manageable one.

We stand firmly on the side of the policyholder. You’re not just another claim number to us. You’re a person, a family, a business facing a challenging time. Our advocacy extends beyond just filing claims. We educate you on your rights, guide you through the claims process, and provide the support needed to rebuild and recover.

In Texas, hailstorms are a frequent menace. Having a partner who understands the local landscape is invaluable. From Austin to Dallas, Fort Worth to Houston, our track record speaks volumes about our commitment to clients across the state.

Hailstorms don’t have to spell disaster. With the right preparation, knowledge, and support, you can steer the aftermath with confidence. At Insurance Claim Recovery Support, we’re committed to ensuring you receive the compensation you deserve, allowing you to focus on what matters most: rebuilding and moving forward.

If you’re facing a hail damage claim, don’t go it alone. Let us be your advocate, your guide, and your partner in recovery. Together, we can weather any storm.