We settle all kinds of property damage claims

Insurance Claim Recovery Support

Trust ICRS public adjusters to settle your Historical property damage insurance claim

Insurance Claim Recovery Support (ICRS) has extensive knowledge and success settling hundreds of millions in property damage insurance claims caused by fire, hail, storm, hurricane, tornado, lightning, flood, water, freeze, business interruption, wind, and other disasters.

Historic buildings carry rich stories, unique architecture, and irreplaceable value. When disaster strikes—whether from fire, hail, hurricane, or water damage—restoring these properties requires more than just insurance money. It demands a deep understanding of both historical preservation and complex insurance policy language.

At Insurance Claim Recovery Support (ICRS), we are licensed public adjusters specializing in large-loss commercial and multifamily property claims, with a deep commitment to protecting historic buildings across the U.S. We represent policyholders only, never the insurance company, and we work relentlessly to ensure fair, prompt settlements for damages to your treasured assets.

If your property has suffered insured damages of $250,000 or more, we can help you get the settlement you deserve fairly and promptly.

Protecting the Legacy of Historic Properties

Why Historic Buildings Need Specialized Public Adjusters

Unique Challenges of Historic Property Claims

Restoring historical buildings isn’t the same as repairing modern structures. These claims are complex due to:

Specialized Materials & Craftsmanship: Original materials may be irreplaceable or require custom fabrication.

Historical Registry Compliance: Repairs must meet preservation standards imposed by local, state, or national registries.

Higher Repair Costs: Labor and materials often cost more due to their rarity or need for expert artisans.

Policy Exclusions & Limitations: Many commercial property policies have ambiguous or restrictive coverage for historic elements.

Without expert guidance, property owners often receive underpaid settlements, or worse—face unjust claim denials.

What We Do: Advocacy, Accuracy, Results

Our team of experienced public adjusters ensures that every detail is documented and valued appropriately. Here’s what you can expect when you partner with ICRS:

Thorough Damage Assessment: We document all visible and hidden damages using thermal imaging, moisture mapping, and third-party experts when needed.

Policy Interpretation & Coverage Maximization: We decipher policy language to uncover coverage often overlooked by insurers.

Preservation-Focused Claim Strategy: We align the claim scope with historical restoration requirements.

Faster Settlements Without Litigation: Over 90% of our claims settle without the need for unnecessary appraisal or legal action.

We work on a contingency basis—no recovery, no fee. That means you only pay when we succeed.

Types of Damage We Handle for Historic Properties

Wind & Hail Damage to Slate, Tile, or Copper Roofs

Fire Damage to Original Woodwork, Plaster, or Masonry

Hurricane or Tornado Structural Impacts

Flood or Water Intrusion Damaging Antique Finishes

Business Interruption Loss from Disasters

Denied or Underpaid Claims Re-evaluation

Who We Help

We serve commercial property owners, developers, and managers of historically significant structures, including:

Apartment Complexes & Converted Historic Lofts

Courthouses, Government Buildings & Churches

Private Estates, Mansions, and Plantations

Historical District Commercial Properties

Universities, Schools, and Institutional Landmarks

Museums and Public Historical Assets

OUR TEAM

Who Is Looking Out For Your Interests?

The Single Best Way to Settle Commercial and Multifamily Insurance Claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time.

Scott Friedson

CEO | Public Insurance Adjuster

- Texas #1632488

- Florida #W797805

- Ohio #1289475

- Colorado #411678

- Georgia #2874635

- Kentucky #1014264

- North Carolina #15827727

- Nevada #3508775

- South Carolina #893766

- Oklahoma #100118599

- Pennsylvania #1043874

- Utah #915234

- NPN #15827727

- Haag Certified Commercial Roof Inspector #201408103

Misty Spittler

VP | Public Insurance Adjuster

- Texas #2647568

- Florida #W798577

- Ohio #1416569

- North Carolina #19846653

- South Carolina #19846653

- Oklahoma #3001820951

- Pennsylvania #1054792

- Utah #915489

- Haag Certified Commercial Roof Inspector #202111207

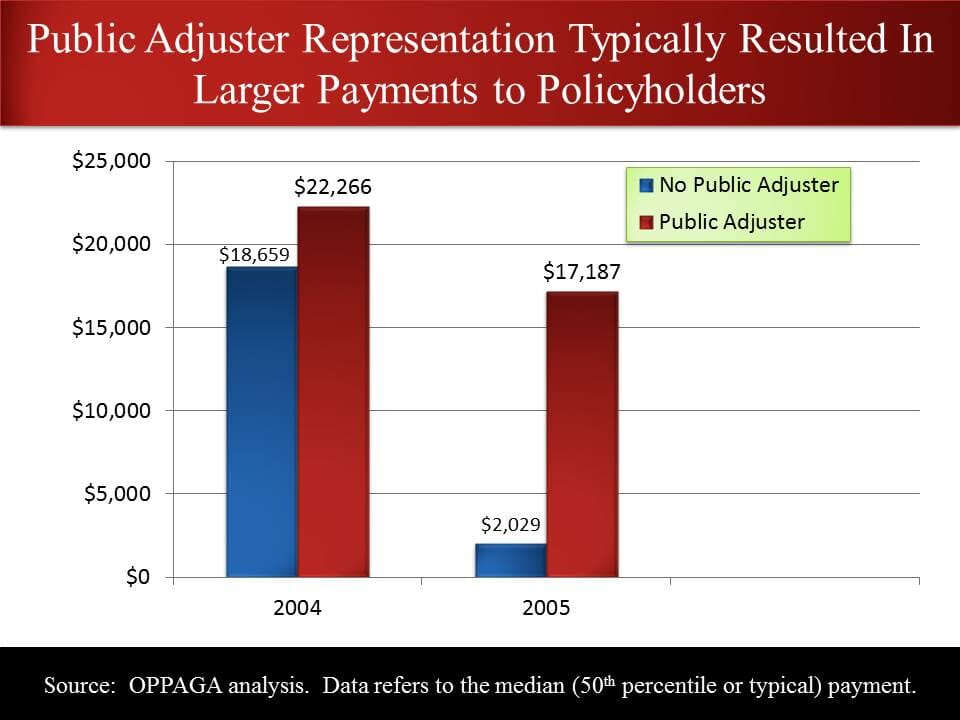

“547% higher payments with a public adjuster for claims.”

We Settle Big Property Damage Insurance Claims

It Pays To Know ICRS

We Exclusively Represent Policyholders

Insurance Claim Recovery Support (ICRS) is a premier public adjustment firm that exclusively represents policyholders in their quest to achieve fair settlements for their insurance claims. With an unwavering commitment to the interests of policyholders, ICRS ensures that clients receive the maximum compensation they deserve.

This unique focus on policyholders sets the company apart from other public adjusters, who often serve both the policyholders and insurance companies, creating potential conflicts of interest. ICRS stands out by prioritizing the needs of their clients above all else, making certain that their rights are protected throughout the claims process.

ICRS brings to the table an extensive understanding of the insurance industry, allowing them to effectively advocate for their clients. Their team of highly skilled public adjusters specializes in evaluating, documenting, and negotiating complex insurance claims on behalf of policyholders.

By leveraging their deep knowledge of policy language and claims procedures, ICRS enables their clients to navigate the often confusing and time-consuming claims process with ease. The company’s primary goal is to ensure that their clients receive the compensation they are entitled to, which can be invaluable in helping them rebuild their lives and businesses after a loss.

- Commercial Property Public Adjuster

- Multi-Family Property Public Adjuster

- High-Value Homes Public Adjuster

Businesses We Serve

Insurance Claim Recovery Support

Get the Maximum Insurance Claim Settlement You Deserve in Minimum Time™ No Recovery, No Fee

- Our public insurance adjusters have over a decade of experience

- Haag Engineering Certified Commercial Roof Inspectors

- IICRC Water Restoration Technician Certifications

- State-Licensed and Bonded

ICRS is on YOUR side

With ICRS on your side, we represent you, not the insurance company. When you hire a public adjuster from ICRS, we present your insurance claim submissions Pro-Policyholder filled with facts and valuable documentation to support your claim for coverage under your policy submitted to your insurer on your behalf, representing your interests, not your insurance company.

Our policyholder claims are placed on equal footing with your insurance company’s adjuster, engineer, and building consultants, who represent their interests, not yours. Our track record for successfully negotiating a fair and prompt settlement for insured policyholders is unmatched.

If your insurer chooses to ignore evidence that supports your Pro-Policyholder claim and force you to sue, we have a network of insurance attorneys to whom we refer victims of bad faith insurance claim handling practices that typically work on contingency basis. We prefer to reasonably settle all our insurance claims without litigation but unfortunately, not all insurers are reasonable, some act in bad-faith.

Tools and Resources to Help You

Here at ICRS, we help policyholders understand their rights. Discover the different types of insurance, the insurance claim process, and settlement tips from the National Association of Insurance Commissioners.

LOSS TYPES

We represent policyholders in all kinds of loss and damage

Fire

Fire loss claims address damages stemming from fires, which often result in extensive property destruction and necessitate substantial restoration efforts.

Hail

Hail claims focus on damages caused by hailstorms, typically affecting roofs, windows, and building exteriors.

Hurricane

Hurricane claims involve the widespread devastation brought on by powerful storms, characterized by high winds, heavy rainfall, and storm surges.

Tornado

Tornado claims pertain to the destruction from severe winds and flying debris associated with these violent weather events.

Water

Water loss claims encompass damages caused by water intrusion, such as burst pipes or leaks, leading to mold growth and structural damage.

Wind

Wind claims deal with damages resulting from strong gusts, which can topple trees, detach roofs, and cause other significant property damage.

Business Interruption

Business interruption claims focus on the financial losses businesses experience when an unexpected event, like a natural disaster, disrupts their operations.

Flood Damage

Flood claims cover losses due to water inundation, primarily impacting homes and businesses situated in flood-prone areas.

Appraisal Dispute

Appraisal claims arise when disagreements occur between policyholders and insurers regarding the value of damages, necessitating impartial appraisers to determine a fair settlement.

Years Experience

Claims Settled

Hours Worked

Average Claim Amount

Risk-Free Loss Recovery Offer

Get a complimentary consultation on your damage insurance claim. We are public claim adjusters who work for policyholders, not the insurance company. If you choose to hire us, we work on contingency. No recovery, no fee. Our insurance claim process is proven and streamlined. We also value your privacy. We do not sell, trade, or rent your personal information to others.

Need immediate fire damage insurance claim help?

TESTIMONIALS

What Client Says About ICRS

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

Frequently Asked Questions

What is a public adjuster and what do they do?

When should I hire a public adjuster?

How are public adjusters compensated?

How do public adjusters differ from insurance company adjusters?

Do I need a public adjuster if I already have an insurance agent or broker?