Introduction to the Importance of Fair Indemnification

In the world of insurance, one fundamental principle should always remain at the forefront of our minds: the fair and prompt indemnification of policyholders in good faith. It’s a shared goal that transcends any professional or personal differences. After all, we’re here to protect and serve the policyholder, the customer who entrusts us with their assets.

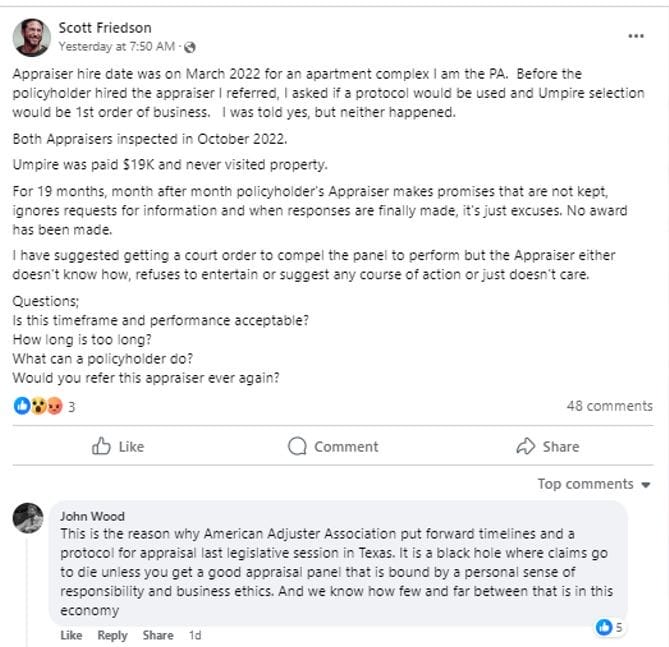

The Prolonged Appraisal Case: A Case Study

In a recent post on a Facebook forum dedicated to insurance appraisal, I raised concerns about a 19-month-long appraisal (and counting), posing the questions, “How long is too long?” and “What can the policyholder do?” This inquiry garnered significant attention and sparked extensive discussion. One unexpected revelation emerged from the discourse: several members in the forum were not acquainted with the notion of an appraisal protocol.

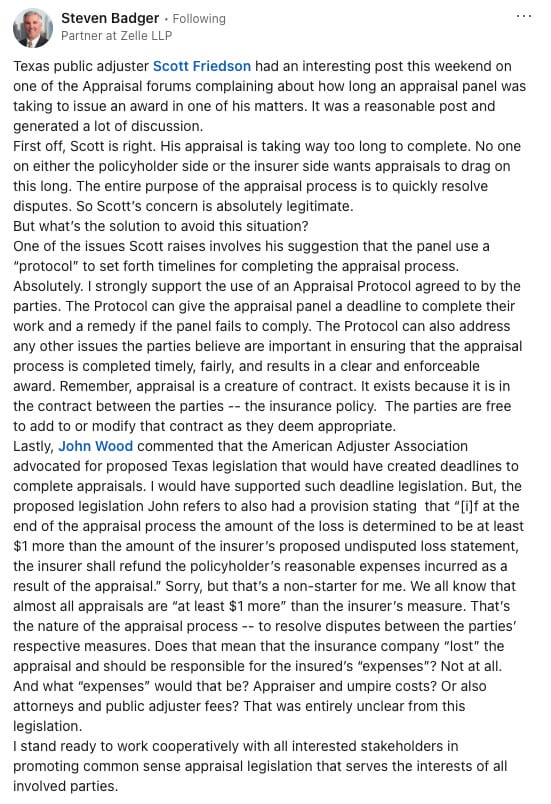

Insurance defense attorney Steven Badger noticed my post and agreed that this appraisal is taking way too long to complete. He also strongly supports my recommendation that the panel use a “protocol” to set forth timelines for completing the appraisal process. Appraisal protocols are tools used by professional Appraisers to establish clear timelines and make the process transparent and beneficial for all parties involved.

Understanding Appraisal Protocols

An insurance claim appraisal protocol is a set of established guidelines and procedures that dictate the process and standards for conducting an appraisal in the context of an insurance claim. This protocol outlines the steps, responsibilities, and principles that both the policyholder and the insurance company, as well as any appraisers involved, should follow to ensure a fair assessment of the claimed damages. Appraisal protocols are tools used by experienced Appraisers and Umpires to establish clear timelines and make the process transparent and beneficial for all parties involved.

Some argue against introducing rules, fearing that the parties will manipulate them in their favor. However, the reality is that insurance companies already have substantial influence, and rules are essential to prevent bias and ensure fairness. Appraisal remains a mysterious black hole in insurance, lacking transparency, rules of the road, and public records.

The Challenges and Disadvantages for Policyholders

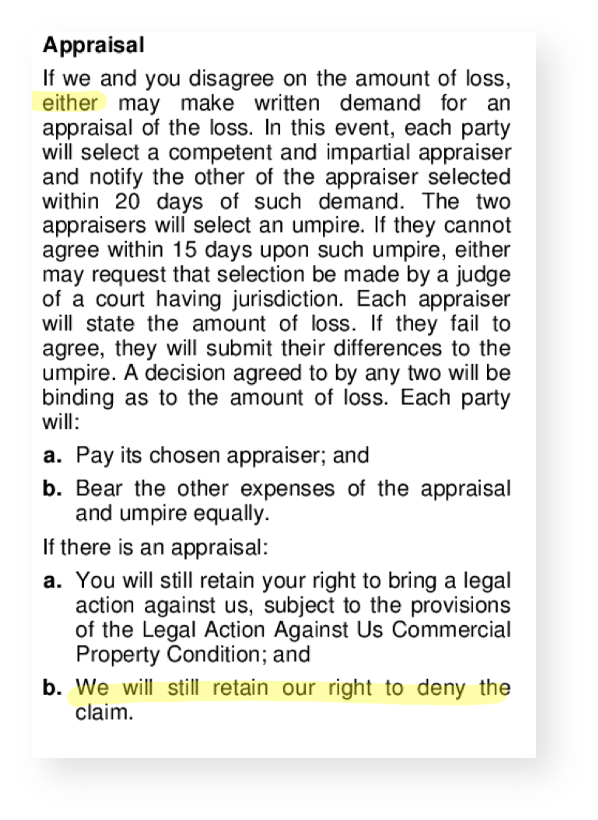

One of the greatest disadvantages for insured policyholders is that most policies allow an insurance company to still deny the claim, even after an appraisal award has been determined. Even more concerning is that insurance companies are increasingly exercising their authority to reject appraisal awards. Although I understand that there may be valid reasons for rejecting an appraisal award, these circumstances, terms, and conditions should be transparent to policyholders before the appraisal process is initiated, rather than becoming apparent only after an award has been granted.

The Role and Authority of Insurance Companies

“If there is an appraisal: We still retain our right to deny the claim.”

It’s essential to remember that during a lengthy or underpaid appraisal process, it’s the policyholder who bears the brunt of the burden. We need to ask ourselves, “What’s best for the policyholder?”

In this instance, should the policyholder persist, place trust in the process, and endure another 19 months without a clear protocol, as assured by the insured’s Appraiser? Can the insured have confidence that the Umpire is adhering to the highest ethical standards, competence, and impartiality, despite months of unfulfilled assurances? How can a policyholder secure a fair settlement from an appraisal panel lacking established rules and apprehensive about potential reprisals if any efforts are made to compel the panel? Speaking out to complain that the panel has had reasonable time to reach resolution could be viewed as an ex parte communication (one of the few rules in appraisal), potentially causing offense. Despite having paid premiums to protect their assets, policyholders now find themselves subject to a flawed system, forced to incur additional expenses to prompt an insurance company to honor their policy. Unfortunately, neither the appraisal clause nor statutory insurance codes offer the necessary details, accountability, guidance, or avenues for action once appraisers and Umpires have been chosen.

The Critical Need for Transparency and Fairness

Without delving too deep into specific details due to ongoing appraisal still in process, it’s evident that fear plays a significant role in the problem. Fear of retaliation or hurting someone’s feelings often leaves policyholders hoping for a resolution while their property and finances suffer.

The Burden on Policyholders and Inefficiencies in the Appraisal Process

The backdrop to this particular appraisal rises from a claim stemmed from multiple attempts and refusals from the insurer to reinspect the property or consider reasonable evidence that supported the insured’s position. A small repair scope below the policyholder’s deductible was rendered based on the insurer’s expert engineer report, despite the existence of material facts supporting the policyholder’s position and questions regarding the methodology used by the insurer’s engineer. The policyholder was forced to spend nearly $14,000 on an engineer report, raising concerns about fairness in the process.

It’s worth noting that a portion of every policyholder’s premium is allocated for claim expenses. Nevertheless, the policyholder bears the burden of proving their claim, thus is required to bear the cost, without any reimbursement, for obtaining an additional engineer’s report if they disagree with the assessment provided by the insurer’s expert opinion, which, in the first place, is funded through the policyholder’s premium. In this claim, the policyholder’s expert engineer and meteorological report recommended “full roof replacements due to widespread exterior damages consistent with elevated wind forces.” The policyholder reasonably complied with the insurer’s request for an expert report that rebutted their findings.

After the submission of the policyholder’s expert report, the insurer said they “desired to reach an amicable settlement”, but then followed a sudden demand for appraisal without considering evidence, addressing policyholder’s concerns or even attempting to negotiate a settlement in good faith. There was no mutual understanding that neither party will negotiate further, in fact, the opposite was true. An impasse was challenged.

In an attempt to avoid a prolonged appraisal, on behalf of the policyholder, I made multiple settlement offers, but the insurer chose to dig in, retain defense counsel and simultaneously submitted a rebuttal to the policyholder’s engineer report. Two months later, both appraisers inspected the property.

The subsequent eight months passed with various requests to confirm the payment to the Umpire, and the policyholder’s appraiser expressed concerns about the timeline. Despite efforts to communicate and expedite the process, the Umpire’s response remained elusive.

After 19 months in the appraisal process with no physical onsite inspection by the paid Umpire ($19,000 split between the insurer and policyholder), no award, and a series of unfulfilled promises, we find ourselves questioning what a policyholder or Appraiser can do?

The Inadequacy of Current Insurance Codes and Appraisal Practices

The insurance claim process is complex, and policyholders often find themselves at a disadvantage from the outset. When it comes to appraisals, I’ve never been a fan of most markets. In my opinion, the appraisal process is broken and has been for years. As someone with nearly 15 years of experience as a public adjuster licensed in multiple states, I’m proud of our track record in avoiding unnecessary litigation and appraisals.

Insurance policies establish the rules of the contract, and public adjusters are authorized to negotiate and represent policyholders. Statutory insurance codes define the rules of conduct, and case law offers guidance based on judicial decisions. However, appraisal lacks a set of rules in the insurance code statutes, licensure requirements, or a typical protocol.

In my experience, Appraisal can take as long, if not longer, than litigation, but at least litigation provides policyholders with statutory bad-faith leverage in many states. In addition, attorney fees are recoverable in many states, whereas appraisal and Umpire fees are not.

The Necessity of Appraisal Reform and the Role of Legislation

The truth is that appraisal reform is overdue in the form of legislation. Appraisal can be abused by both sides.

There’s a dire need for better training, agreement to use reasonable protocols, certification, background checks, reviews, and overall appraisal reform. I’m sure we all share the frustration of dealing with bad actors who misuse the system for their benefit.

Appraisal has been weaponized by some insurers and their counsel to put a financial burden on policyholders, delay payments, and avoid bad faith penalties. Some insurers, adjusters, and insurance company legal representatives have, in certain instances, exploited the appraisal process as a means to impose a financial burden on policyholders, postpone payments, and sidestep penalties for acting in bad faith.

Certain public adjusters and contractors may use it to push for the acceptance of questionable claims.

Simply being capable of acting as an appraiser or umpire doesn’t imply one should take on that role.

Moreover, in cases where an insurance company opts for an engineer as their expert or appraiser, a practice for certain large loss claims, it’s prudent for a policyholder to engage an engineer too. This approach can lead to significant expenses for the policyholder.

The Financial and Ethical Implications of the Current Appraisal System

In the meantime, insurance premiums continue to rise, policy benefits are being further eroded, and CEOs of specific insurance companies are receiving multi-million dollar compensation while directing substantial resources toward lobbying and advertising.

The solution lies in legislation. Appraisal is misused by both sides, and it’s time for change. Most reasonable minds agree, rules of the road are needed to protect policyholders engaged in an unjust struggle.

It is essential to establish equitable rules that apply to all parties involved. Implementing appraisal protocols, fair reimbursement for claims expenses, and prioritizing the pursuit of truth over financial gain are steps in the right direction to mitigate unwarranted litigation and the appraisal costs that ultimately affect everyone’s expenses.

Proposed Solutions and the Path Forward

Implementing a “use-it-or-lose-it” appraisal provision and setting deadlines for claims handled by attorneys is a positive move. If defense counsel invokes the appraisal clause after weeks or months in determining the insurer’s liability, it not only prolongs the settlement process but, even if the policyholder prevails, they do not receive full indemnification after covering the costs of an appraiser, half of the umpire fee, as well as attorney and public adjuster fees if one is on the claim file. No matter the outcome, the policyholder is never made whole.

Experience, integrity, and ethical claims handling should be non-negotiable in the industry. We must address the lack of accountability and incentives for timely performance in the appraisal process.

Some states have laws that hold insurers accountable for attorneys’ fees when they violate statutory insurance codes. Some policyholder advocates argue that if, at the end of the appraisal process, the loss amount is determined to be just $1 more than the insurer’s proposed undisputed loss statement, the insurer should refund the policyholder’s expenses incurred during the appraisal. However, insurance companies and defense attorneys disagree with refunding all fees for just a $1 difference.

To expedite a fair and prompt settlement while avoiding unnecessary delays, litigation, and appraisals, a more reasonable approach may be to consider the recovery of public insurance adjuster fees if a claim exceeds 10% of the insurer’s initial settlement offer. Public adjusters, who are licensed agents for policyholders who work on contingency, possess the authority to negotiate, interpret policies, and settle claims.

Engaging a good public adjuster, either from the outset or to supplement a claim, often provides the most efficient and effective path to achieving a fair and prompt settlement. Texas insurance code 4102, for example, states a public insurance adjuster is required to hold a license and “acts on behalf of an insured in negotiating for or effecting the settlement of a claim or claims for loss or damage under any policy of insurance covering real or personal property.”

The Role of Public Adjusters in Ensuring Fair Settlements

Conversely, appraisers operate without licenses, have less rigorous qualifications, and typically charge either by the hour or a flat rate without any contingencies. Moreover, the appraisal process lacks statutory regulations. Appraisers lack the authority to interpret policies, and numerous insurance policies empower insurers to reject appraisal awards even after they have been finalized. So, after spending time and money with an unlicensed party who lacks the authority to interpret policies, policyholders may face the risk of having their award denied.

Request for Reform Proposals for Insurance Appraisals

If insurers were to give reasonable consideration to material facts supporting a policyholder’s position in an authentic good faith fashion, it is likely that the number of appraisals and lawsuits would decrease, ultimately leading to swifter and more equitable resolutions.

One potential avenue for reform could involve the National Association of Insurance Commissioners (NAIC) considering the addition of an Appraisal protocol to the Unfair Trade Practices Act.

In the arena of regulating the appraisal process, there are few individuals as well-qualified as Jonathan J. Wilkofsky, a highly regarded authority in the industry. His book, “The Law and Procedure of Insurance Appraisal: A Guide to The Appraisal Process,” is an invaluable resource and is accessible for purchase on Amazon via this link.

Despite the existence of organizations like IAUA and PLAN, along with competent appraisers and umpires, the threshold for attaining certification as an appraiser or umpire is relatively low compared to obtaining licenses in fields such as law, public adjusting, real estate, or securities.

I’ve previously shared a proposed bill on my LinkedIn profile, dating back to 2015. While it may not garner unanimous agreement, it represents a step toward a solution. I am open to receiving suggestions and innovative ideas for reform. Together, we can establish an equitable and transparent appraisal process that serves the interests of policyholders and maintains the integrity of the insurance industry.

Conclusion and Call for Collective Action

Let’s work together to bring about much-needed reform in the appraisal system. Legislation should serve the interests of all parties involved. I extend my appreciation for your unwavering support and dedication to this crucial cause.