Loss Adjusting Services: If you manage or own properties like commercial buildings, multifamily complexes, or industrial parks and are overwhelmed by damage due to natural disasters or other occurrences, understanding what loss adjusting services can offer is crucial. These services evaluate, negotiate, and help settle your insurance claims, ensuring you receive appropriate compensation without undue delay or unfair denial.

When experiencing damage, the process of navigating insurance claims can be daunting and complex. Loss adjusting services play a pivotal role here. They provide expert insight and support through professional adjusters who specialize in assessing the extent of the damage and handling the intricate process of insurance claims. Whether it’s getting a fair assessment of a fire damage claim or guidance through a business interruption loss, these professionals stand with you, committed to securing the best possible outcome.

From property to liability, and from catastrophe solutions to fraud investigations, loss adjusters bring a diverse range of skills to the table. They serve as your advocates in dealings with insurance companies, ensuring that your claims are handled efficiently and justly. By hiring skilled adjusters, you can focus on recovering and rebuilding instead of getting bogged down by the complex details of claim negotiations.

What Services Do They Offer?

When selecting a loss adjusting service, understanding the breadth and depth of services offered is crucial. Here’s a breakdown of the key services provided by Insurance Claim Recovery Support that can help you navigate the often complex world of insurance claims.

Property

Handling property claims involves assessing damage to commercial, residential, or public properties due to various causes such as fire, water, or natural disasters. The goal is to evaluate the extent of the damage accurately and expedite the claims process to restore normalcy to affected policyholders.

Casualty

Casualty claims can be intricate, involving bodily injuries or property damage where the policyholder is responsible for the incident. These claims require a meticulous approach to determine liability and ensure fair settlements.

Specialty

Specialty claims encompass a range of unique scenarios that are not typically covered under standard policies. This includes claims for high-value items, arts, and special events. Each claim demands a specialized knowledge base and handling approach to ensure precise evaluation and settlement.

Global Technical Services

For complex claims that span across different geographies, Global Technical Services are invaluable. This service ensures that no matter where the incident occurs, there is a standardized, expert approach to managing the claim, leveraging a global network of professionals.

Claims Management

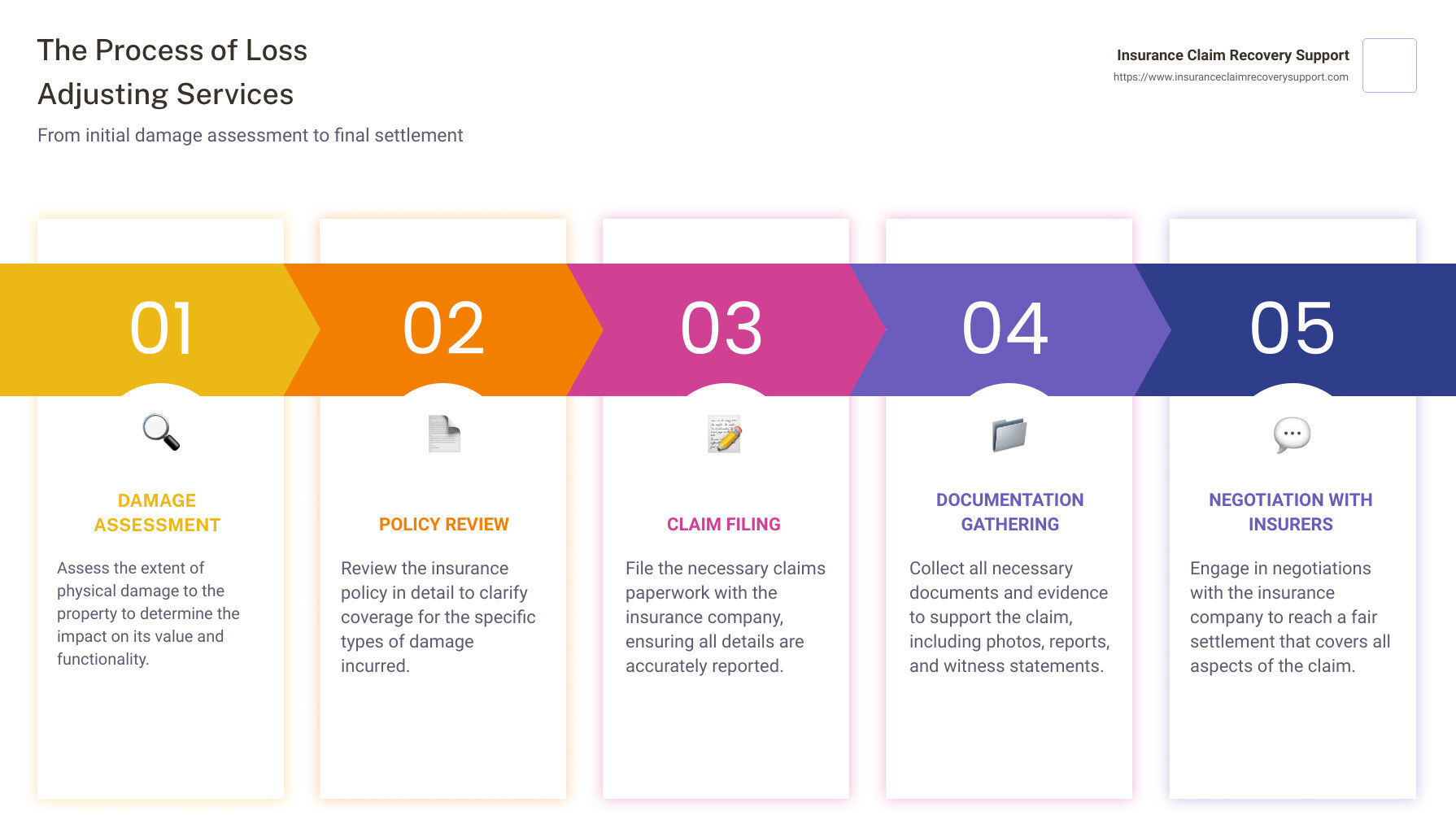

Effective claims management ensures that from the first notice of loss to the final settlement, every step is handled with precision and care. This includes documenting the claims, evaluating them thoroughly, and ensuring timely settlement.

Settlement

The settlement process involves negotiation between the policyholder and the insurance company to reach an agreeable compensation for the losses incurred. Professional adjusters play a crucial role in ensuring that settlements are fair and reflective of the actual damages.

Risk Management

Proactively managing risks can significantly reduce the occurrence and impact of potential losses. Services include conducting risk surveys, preparing disaster and contingency plans tailored to specific needs, and offering strategic advice to mitigate risks.

Fraud Investigations

Fraudulent claims can pose a significant threat to businesses. Through detailed investigations, forensic analysis, and collaboration with law enforcement, adjusters help in identifying and acting against fraudulent activities to protect the interests of genuine claimants.

Each of these services is designed to streamline the claims process, reduce the burden on the policyholder, and ensure that the compensation received is fair and just. By leveraging expert knowledge and specialized skills in handling a variety of claims, Insurance Claim Recovery Support ensures that their clients receive the best possible outcomes in their time of need. This comprehensive approach not only aids in efficient claims handling but also in building trust and reliability, making them a preferred choice in the loss adjusting sector.

Moving forward, let’s delve into the fee structures typically associated with these services to better prepare you for what to expect financially when engaging a loss adjuster.

What is Their Fee Structure?

When you’re considering hiring loss adjusting services, understanding the fee structure is crucial. Here, we’ll outline the common types of fees you might encounter, which include Percentage Fee, Flat Fee, and Contingency Fee. Each has its own advantages and scenarios where they’re most applicable.

Percentage Fee

This is a common fee structure where the loss adjuster charges a percentage of the claim amount. The percentage can vary based on the complexity and size of the claim. This model is straightforward and aligns the adjuster’s interests with yours – the higher the settlement, the more they earn.

Flat Fee

A flat fee arrangement is exactly what it sounds like: you pay a fixed amount for the services of a loss adjuster. This can be beneficial for smaller or less complex claims where the scope of work is relatively predictable. It provides clarity and certainty on costs from the outset.

Contingency Fee

Perhaps the most common, the contingency fee means that the adjuster’s payment is contingent upon you receiving a payout from your insurance claim. This can be particularly comforting as it ensures that the adjuster is motivated to maximize your claim value. Typically, this fee is a percentage of the insurance payout. While this can mean no upfront costs, the final payout you receive will be reduced by the adjuster’s fee.

Each of these fee structures has its place depending on the specifics of your situation and the nature of your claim. For instance, a contingency fee might be more appealing if you are unsure of the potential to recover a significant insurance payout, as it reduces upfront risk. On the other hand, a flat fee could be more economical for straightforward cases where the claim amount is easily determined.

By understanding these fee structures, you can make a more informed decision about which type of loss adjusting services best fits your needs, ensuring transparency and alignment of interests between you and your adjuster. Moving on, let’s explore the track records of these services to gauge their effectiveness in settling claims.

How Experienced Are Their Adjusters?

When selecting loss adjusting services, the expertise and experience of the adjusters involved are crucial. Here’s a breakdown of the types of professionals you might encounter and what they bring to the table:

Chartered Loss Adjusters

These are highly trained professionals who specialize in determining the extent of damage and the appropriate compensation under an insurance policy. Their training involves rigorous exams and practical experience, ensuring they bring a wealth of knowledge to your claim.

Engineers and Surveyors

For claims involving structural damages, such as those from natural disasters or construction issues, engineers and surveyors assess the technical aspects. They ensure that all structural damages are properly identified and accurately quantified.

Accountants

In cases involving business interruption or complex financial losses, accountants play a key role. They analyze financial records to determine the impact of the event on your business operations, helping to secure a fair recovery amount that reflects the true economic loss.

Specialty Claims

Handling specialty claims, such as those involving art, antiques, or highly technical machinery, requires adjusters with specific expertise in those fields. These professionals ensure that the unique aspects of these claims are carefully managed.

Major Claim Events

Adjusters who specialize in major claim events are equipped to handle large-scale disasters that affect multiple policyholders. This includes catastrophic events like hurricanes, floods, or large fires, where swift and effective response is critical.

Commercial Accounts

For commercial entities, the complexity of insurance claims can be significantly higher. Adjusters working with commercial accounts are skilled in navigating these complexities and can effectively manage multiple facets of commercial claims, from property damage to liability and business interruption.

Client Testimonial:

“PLA got them everything that they could have dreamed of. From the insurance company’s initial estimate, they got multiples of 20, 30, 50 times of what the insurance company had offered them. And it was needed. The homeowners weren’t making money on it, it was needed for repairs.” — Brian Lannery, Contractor

This level of expertise ensures that no matter the type of claim or its complexity, it is handled with the utmost professionalism and skill. Next, we will look into the track record of these adjusters to understand their effectiveness in maximizing claim settlements for their clients.

What is Their Track Record for Settlement Success?

When choosing a loss adjusting service, it’s crucial to understand their success in securing favorable settlements for clients. Insurance Claim Recovery Support has a proven track record that speaks volumes about their effectiveness and client satisfaction.

Maximize Settlement

Insurance Claim Recovery Support is dedicated to maximizing settlements for their clients. They have a history of securing settlements that are significantly higher than initial offers from insurance companies. For instance, they’ve managed to increase settlement amounts by 10, 20, and even 50 times the original figures proposed by insurers. This capability ensures that clients receive the compensation necessary to fully cover their losses and repairs.

Claim Value Increase

The ability to increase the value of a claim is a testament to the adjusters’ deep understanding of the insurance process and their negotiation skills. Adjusters at Insurance Claim Recovery Support leverage their expertise to identify and document every possible damage, leading to substantial increases in claim payouts. Their approach involves meticulous assessment and leveraging specialized tools to uncover both visible and hidden damages.

Client Testimonials

Client testimonials offer real-life insights into the effectiveness of their services. One standout story involves a homeowner who faced extensive water damage. The client expressed immense gratitude towards the adjusters for their persistence and dedication, which not only saved her home but also prevented financial ruin. This is just one of many testimonials where clients have praised the adjusters for their professionalism, empathy, and results-focused approach.

Success Stories

Success stories from various types of claims further illustrate their competence across different scenarios:

– Fire Claims: Adjusters have successfully managed claims involving complex fire damages, ensuring clients receive funds sufficient to address both the immediate and subsequent damages like smoke and water destruction.

– Ice & Snow Claims: In cases of damages from ice and snow, such as ice dams and roof collapses, the adjusters have adeptly ensured that settlements cover all necessary repairs, even those not immediately apparent.

– Natural Disaster Claims: For damages caused by natural disasters, including hurricanes and tornadoes, their adjusters have been instrumental in documenting comprehensive damages to secure adequate settlements.

– Water & Flood Claims: Water damage claims, known for their complexity due to potential hidden issues, are handled with advanced tools and deep expertise, often leading to significant increases in the settlement amounts.

Insurance Claim Recovery Support’s adjusters are not just claim processors; they are advocates for their clients. They work tirelessly to ensure that every claim is thoroughly evaluated and that all compensations reflect the true extent of the losses. Their commitment to client satisfaction and settlement success is evident in the high-value settlements they consistently achieve.

We’ll explore how Insurance Claim Recovery Support handles complex claims, ensuring their clients’ needs are met comprehensively and proficiently.

How Do They Handle Complex Claims?

When facing complex claims, Insurance Claim Recovery Support employs a robust strategy that leverages their global reach, technical expertise, and specialized services. Let’s break down how they manage these challenging scenarios:

Global Coverage

Insurance Claim Recovery Support’s network spans over 70 countries, ensuring they can respond swiftly to claims anywhere in the world. This extensive coverage is crucial for businesses with international operations and for claims that arise in remote locations.

Multilingual Staff

Communication barriers can complicate claim processes. Insurance Claim Recovery Support addresses this challenge by employing a multilingual staff. This capability ensures clear and effective communication across different regions, making the claims process smoother for all parties involved.

Crawford Global Technical Services (GTS)

For the most intricate commercial claims, Insurance Claim Recovery Support relies on Crawford GTS. This specialized division is equipped to handle large-scale and technically complex claims, utilizing a team of experts who are leaders in their respective fields.

Specialty Claims

From maritime casualties to aircraft losses, Insurance Claim Recovery Support has the capability to manage specialty claims that require specific expertise. Their adjusters are trained to handle unique situations, ensuring that even the most unusual claims are managed with precision.

Major Claim Events

In the event of major disasters or large-scale losses, rapid response is crucial. Insurance Claim Recovery Support can mobilize a customized team quickly due to their global presence and the Crawford GTS framework. This rapid deployment capability is essential for effectively managing major claim events.

Commercial Accounts

For commercial clients, the stakes are high, and the claims can be particularly complex. Insurance Claim Recovery Support offers tailored services that address the specific needs of commercial accounts, ensuring that businesses can recover and return to normal operations as swiftly as possible.

Technical Insurance Audits

To further support the claim process, technical insurance audits are conducted. These audits are crucial for understanding the intricacies of each claim and for ensuring that all aspects are thoroughly assessed. This approach not only helps in accurately determining the claim value but also in identifying any potential issues that could impact the settlement.

With these strategies and resources, Insurance Claim Recovery Support is well-prepared to handle complex claims efficiently and effectively. Their approach not only ensures that each claim is processed with the utmost expertise but also that their clients receive the best possible outcome in challenging situations. We’ll see how their support and resources play a crucial role in providing comprehensive assistance to their clients.

What Support and Resources Are Available?

When you’re dealing with a loss, whether it’s due to a natural disaster or a property issue, having the right support can make all the difference. Insurance Claim Recovery Support offers a robust range of resources and support systems designed to help you through the claims process smoothly and efficiently. Here’s what they provide:

24/7 Claims Intake

No matter the time of day or night, Insurance Claim Recovery Support is ready to start the claims process. Their 24/7 claims intake service ensures that you can report a loss as soon as it happens, which is crucial in preventing further damage and starting the recovery process immediately.

Omni-channel Support

Understanding that everyone has different preferences for communication, Insurance Claim Recovery Support offers omni-channel support. This means you can reach out via phone, email, or even through their website, depending on what’s most convenient for you.

Global Network

The strength of a global network cannot be overstated, especially when dealing with losses that occur in different parts of the world. Insurance Claim Recovery Support’s global network spans numerous countries, providing local expertise no matter where your loss has occurred. This is particularly important for businesses that operate internationally.

Customized Rapid-Response Team

For major claims, a customized rapid-response team is assembled. This team consists of experts who are not only skilled in loss adjusting but are also specialized in the type of claim you’re dealing with. Whether it’s a natural disaster or a complex property claim, they have the expertise to handle it.

Risk Surveys

Before a loss even occurs, Insurance Claim Recovery Support can conduct risk surveys. These surveys assess potential risks to your property and provide recommendations to mitigate these risks. It’s a proactive approach to managing potential issues before they result in claims.

Disaster and Contingency Plans

In the event of a disaster, having a plan in place is crucial. Insurance Claim Recovery Support helps you develop disaster and contingency plans that outline what to do when a disaster strikes. This planning can significantly reduce the chaos and confusion that often accompanies unexpected events.

Technical Insurance Audits

Finally, technical insurance audits are another key resource offered. These audits review your current insurance policies and claims processes to ensure that they are effective and that you’re fully covered. This service can help identify any gaps in your coverage before they become a problem in the event of a claim.

With these resources and supports in place, Insurance Claim Recovery Support ensures that every aspect of your claim is handled efficiently. Their comprehensive approach not only speeds up the claims process but also maximizes the support you receive during what can often be a stressful time. We’ll explore more about how these resources are implemented to provide you with the best possible service.

Conclusion

As we wrap up our exploration of loss adjusting services, it’s clear that choosing the right loss adjuster is crucial for navigating the complexities of insurance claims. At Insurance Claim Recovery Support, we pride ourselves on our ability to not only meet but exceed the expectations of our clients, ensuring that each claim is handled with the utmost professionalism and expertise.

Our team of seasoned chartered loss adjusters, engineers, surveyors, and accountants bring a wealth of experience and a proven track record of maximizing settlements. From fire and water damage to natural disaster claims, we’ve consistently demonstrated our ability to significantly increase claim values, often surpassing initial offers from insurance companies. These successes are not just numbers; they represent our commitment to restoring our clients’ lives and businesses.

We understand that dealing with property damage and navigating insurance claims can be overwhelming. That’s why we offer a comprehensive suite of services, including 24/7 claims intake and a global network of professionals. Our customized rapid-response teams are equipped to handle claims efficiently, minimizing stress and maximizing outcomes.

In conclusion, when you choose Insurance Claim Recovery Support, you’re not just hiring a loss adjuster; you’re partnering with a team that stands by your side throughout the entire process. Our commitment to excellence, combined with our extensive resources and experienced professionals, ensures that you have the support you need to navigate the claims process and achieve the best possible outcome.

In the face of damage and loss, you’re not alone. Let us help you recover what you’re rightfully owed and move forward with confidence.