Why Multi-Family Property Insurance Is Your First Line of Defense

Multi-family property insurance is a specialized commercial policy that protects residential buildings with multiple units, from duplexes to large apartment complexes. It is designed to cover property damage, liability claims, and lost rental income.

Quick Answer for Property Owners:

- What it covers: Building structure, liability protection, loss of rental income, and equipment breakdown

- Who needs it: Owners of duplexes, triplexes, apartment buildings, and condo associations

- Key difference from homeowners insurance: Covers multiple units, tenant-related risks, and commercial liability

- Essential coverages: Property damage, general liability, business interruption, and ordinance/law coverage

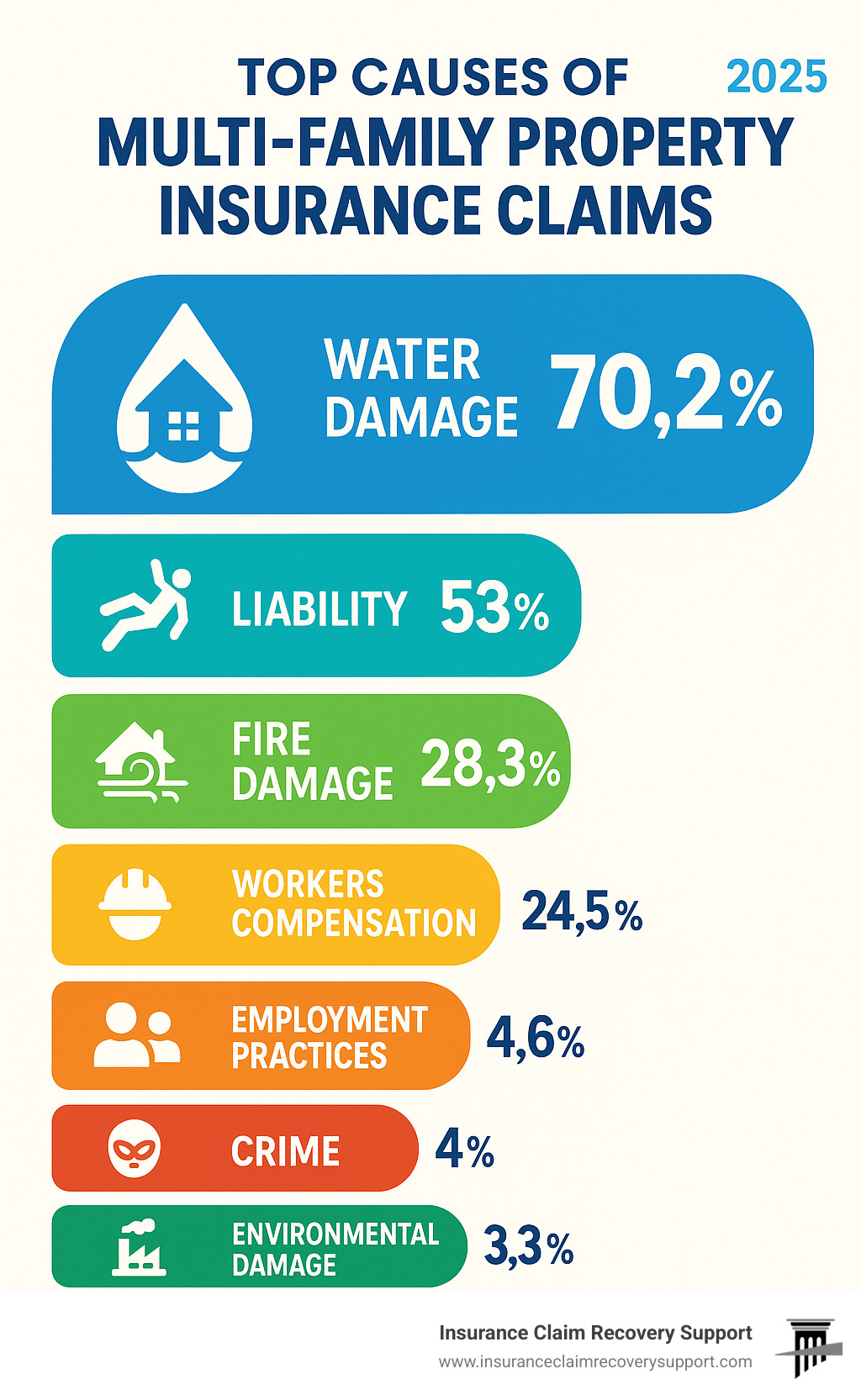

- Common claims: Water damage (70.2%), liability issues (53%), and fire damage (52.3%)

Statistics show that over 30% of insurance claims for multifamily properties involve property damage, with water, liability, and fire being the most common. These numbers highlight the real, measurable risks your investment faces daily. A single incident—a fire, a slip-and-fall, a burst pipe—can affect multiple units, leading to costly lawsuits and months of lost rental income.

These policies are complex, with potential coverage gaps and exclusions that can surprise even savvy investors. Understanding your coverage is critical to avoiding financial disaster.

I’m Scott Friedson, a multi-state licensed public adjuster. I’ve settled over 500 large loss claims valued at more than $250 million, specializing in multi-family property insurance claims. My work has helped property owners significantly increase their settlements, often by 30% to 3,800%, while avoiding lengthy and expensive litigation.

Multi-family property insurance vocab to learn:

Understanding Your Multi-Family Property Insurance Policy

Owning a multi-unit rental property is running a business, and multi-family property insurance is your shield against the unique risks of being a landlord. Understanding its function is key to protecting your investment.

What is multi-family property insurance and why is it critical?

Multi-family property insurance is commercial coverage for residential buildings with more than one family, such as duplexes, triplexes, and apartment complexes. Unlike a standard homeowner’s policy, it’s designed for the commercial risks you face as a landlord. A single incident, like a tenant’s cooking fire spreading to other units, can result in devastating financial losses. That’s why most mortgage lenders require specific types and amounts of this insurance, typically including replacement cost coverage, at least $1 million in liability, and 12 months of loss of rental income coverage.

Homeowners vs. Landlord Insurance

Many new landlords mistakenly believe a homeowners policy will cover their rental property. This is a critical error. Homeowners insurance is for an owner-occupied, single-family home and does not cover commercial risks. Once you begin collecting rent, you need a landlord policy designed for business-related liabilities and property protection.

| Coverage Area | Standard Homeowners | Multi-Family Landlord |

|---|---|---|

| Primary Purpose | Personal residence protection | Business property protection |

| Liability Coverage | Personal activities only | Landlord duties and tenant-related risks |

| Lost Income | Not included | Essential rental income replacement |

| Multiple Units | Single home only | Covers all units and common areas |

| Tenant Issues | No coverage | Protects against tenant-caused problems |

A homeowners policy will likely deny a claim for a rental-related incident, leaving you responsible for all costs. Multi-family property insurance is built to handle these exact scenarios.

The Role of Renters Insurance

While your insurance protects the building, renters insurance protects your tenants’ personal belongings. Requiring it in your lease is a smart risk management strategy. The key benefit for you is the liability protection it provides. If a tenant accidentally causes a fire or their guest is injured in their apartment, the tenant’s policy is the first line of defense, not yours. This helps keep your claims history clean, which can lead to lower premiums over time. It’s an inexpensive requirement for tenants that provides a valuable layer of protection for everyone.

Core Coverages and Optional Endorsements

This section details the essential and optional protections available to property owners.

Essential Coverages You Can’t Afford to Skip

When reviewing multi-family property insurance policies, three coverages are non-negotiable for protecting your investment.

- Property damage coverage is the foundation, protecting your building’s structure (walls, roof, floors) and your business personal property, such as maintenance equipment and provided appliances.

- General liability coverage protects you from lawsuits arising from injuries on your property, such as a slip-and-fall in a common area. It covers legal fees, medical expenses, and settlements.

- Loss of rental income coverage (business interruption) replaces the income you lose while your property is uninhabitable and being repaired after a covered loss, ensuring you can still meet financial obligations like your mortgage and taxes.

Common Perils Covered in Texas

Texas properties face unique weather challenges, and policies are designed to cover common perils:

- Fire damage: A leading cause of claims, a fire in one unit can quickly spread throughout a multi-family building.

- Water damage from burst pipes: The most frequent claim, especially after events like the 2021 Texas freeze, causing widespread damage.

- Windstorms and Hail: Constant threats across Texas, these can damage roofs, windows, and siding.

- Lightning and Vandalism: Lightning can cause fires and destroy electrical systems, while vandalism coverage protects against intentional damage.

Specialized Coverages to Consider

Standard policies have exclusions. Consider these endorsements for comprehensive protection:

- Flood insurance: Standard policies do not cover flood damage. This must be purchased as a separate policy, often through the National Flood Insurance Program (NFIP). You can check your property’s flood risk on the FEMA Flood Map Service Center.

- Sewer and water backup coverage: This covers damage from backed-up sewers or drains, another common exclusion in standard policies.

- Ordinance or Law coverage: This is crucial for older buildings. It helps pay for the increased cost of bringing a damaged property up to current building codes during repair, an expense not typically covered otherwise.

- Equipment breakdown insurance: Protects against the failure of essential systems like central HVAC, boilers, or elevators due to internal mechanical problems, which standard property policies don’t cover.

- Rent default insurance: A newer option that covers you when a tenant stops paying rent for reasons other than property damage, helping to cover losses during the eviction process.

Navigating Risks, Liabilities, and Costs

Managing a multi-family property involves facing daily risks that can impact your bottom line. Understanding and mitigating these risks is key to avoiding costly claims and keeping insurance premiums manageable.

Common Risks and Liabilities for Landlords

As a property owner, you face a unique set of risks:

- Tenant injuries: Slip-and-fall incidents in common areas are a primary source of liability claims.

- Property damage from tenants: Negligence, such as a kitchen fire or bathtub overflow, can cause damage far exceeding a security deposit.

- Discrimination lawsuits: Claims from applicants or tenants regarding fair housing practices can lead to expensive legal battles.

- Theft and criminal activity: Break-ins or theft of property can create financial losses and liability concerns.

- Employee-related issues: If you employ staff, you face risks like wrongful termination or workplace injury claims.

- Tenant rent default: While not a direct insurance issue, lost rent impacts your ability to maintain the property and pay for insurance.

How to Minimize Liability and Manage Risks

Proactive management can significantly reduce your exposure to claims and may qualify you for insurance discounts.

- Perform regular maintenance and inspections to identify and fix hazards like loose handrails or minor leaks before they become major problems.

- Maintain safety systems by regularly testing fire alarms, sprinkler systems, and carbon monoxide detectors. Ensure adequate lighting and security cameras in common areas.

- Address slip-and-fall hazards by keeping walkways clear, ensuring proper drainage, and promptly dealing with ice or spills.

- Vet all contractors to ensure they are licensed and carry their own liability insurance.

- Use clear lease agreements that outline tenant responsibilities, including a requirement for renters insurance.

Key factors that influence the cost of multi-family property insurance

Insurance premiums are based on a detailed risk assessment. Key factors include:

- Location: Proximity to risks like hurricanes on the Gulf Coast or tornadoes in North Texas, as well as local crime rates, heavily influences cost.

- Building age and condition: Older properties with outdated systems are more expensive to insure. Recent upgrades to roofing, plumbing, or electrical systems can lower premiums.

- Construction materials: Fire-resistant masonry buildings are typically cheaper to insure than wood-frame structures.

- Claims history: A history of frequent claims will lead to higher premiums or even non-renewal.

- Safety features: Discounts are often available for properties with sprinkler systems, fire alarms, and security systems.

- Deductible amount: Choosing a higher deductible will lower your premium, but ensure you can cover that amount out-of-pocket.

The Claims Process: From Damage to Recovery

This section provides a step-by-step guide to filing a claim, highlighting the role of a public adjuster and comparing it to the litigation process.

Your Duties After a Loss: A Step-by-Step Guide

When your multi-family property is damaged, your policy requires you to take specific steps to protect your claim.

- Prioritize Safety: Ensure tenants are safe and take immediate action to prevent further damage, such as shutting off water or boarding up windows. Keep all receipts for these emergency repairs.

- Document Everything: Before any non-emergency cleanup, take extensive photos and videos of all damage from multiple angles. This is your evidence.

- Notify Your Insurer: Report the loss to your insurance company as soon as possible. Delays can give them a reason to question the claim.

- Start a Paper Trail: Keep a detailed file of all documents, including photos, receipts, repair estimates, and all communication with your insurer.

The Insurance Company’s Adjuster vs. A Public Adjuster

After a loss, your insurer will send their adjuster. It is critical to remember that this person works for and represents the insurance company’s financial interests, not yours. Their goal is to assess the damage according to the policy, which often means minimizing the payout.

A public adjuster works exclusively for you, the policyholder. We act as your advocate, managing the entire claim on your behalf. We conduct our own thorough damage assessment, interpret the policy to your maximum benefit, and negotiate with the insurer to ensure you receive a full and fair settlement. A public adjuster levels the playing field, providing the expertise needed to counter the insurance company’s resources.

The Road to Settlement: Public Adjuster vs. Insurance Claim Lawsuit

If you receive an inadequate settlement offer, you have two main paths: hire a public adjuster or file a lawsuit. The choice significantly impacts your timeline and outcome.

The public adjuster approach focuses on resolution through negotiation, not confrontation. We work within the insurance system to achieve a fair settlement, which is typically much faster than litigation that can drag on for years. When you’re losing rental income every month, speed is critical.

Our work at Insurance Claim Recovery Support has helped property owners increase settlements by 30% to 3,800% without going to court. Public adjusters work on a contingency fee, meaning we only get paid if we successfully increase your settlement. This contrasts sharply with the upfront costs and hourly fees of a lawsuit, which can be substantial regardless of the outcome. For property owners in Texas, our expertise in local construction costs and insurance regulations allows us to build a strong case for a maximized settlement, helping you avoid the stress, time, and uncertainty of litigation.

For more information on how public adjusters can help with your property damage claim, visit our public adjuster services page.

Frequently Asked Questions about Multi-Family Property Insurance

What is the biggest difference between a commercial policy for a large apartment complex and a landlord policy for a duplex?

The primary differences are scale and complexity. A large apartment complex requires much higher coverage limits for both property and liability. The policy for a large complex will also include specialized endorsements for amenities like pools or fitness centers, and the business interruption coverage will be more intricate, covering operational expenses like staff payroll. Lender requirements and the underwriting process are also far more rigorous for larger properties due to the greater financial risk involved.

Does my policy cover the building if it’s vacant during renovations?

Probably not adequately. Most multi-family property insurance policies contain a vacancy clause that reduces or eliminates coverage for perils like vandalism, theft, and water damage after the property has been empty for 30-60 days. Insurers see vacant buildings as higher risk. If you anticipate an extended vacancy, you must notify your insurer and purchase a separate vacant property policy or endorsement to ensure you remain protected. Assuming your standard policy covers you is a costly mistake.

How does a co-insurance clause affect my claim payout?

A co-insurance clause is a policy provision that can penalize you for being underinsured. It requires you to insure your property for a certain percentage (usually 80-90%) of its total replacement cost. If you fail to meet this requirement at the time of a loss, the insurer will only pay a portion of your claim.

For example, if your property’s replacement cost is $1 million and you have a 90% co-insurance clause, you must carry at least $900,000 in coverage. If you only carry $720,000 (which is 80% of the required amount), the insurer will only pay 80% of your claim, even if the damage is less than your policy limit. To avoid this penalty, you must review and update your coverage limits annually to reflect current construction costs.

Conclusion: Protecting Your Investment with the Right Support

Owning multi-family property in Texas is a significant investment that demands robust protection. The risks are real, with water damage, liability claims, and fire posing constant threats that can jeopardize your financial stability.

Proactive risk management begins with securing the right multi-family property insurance, not a standard homeowners policy. This specialized coverage, custom with essential endorsements, creates a vital safety net. However, having a policy is only half the battle. When a disaster occurs, navigating the claims process can be daunting, and the insurer’s adjuster is not on your side.

This is where expert advocacy is crucial. A public adjuster works exclusively for you, leveling the playing field to ensure you receive the maximum settlement you are owed. At Insurance Claim Recovery Support, we specialize in helping Texas property owners manage complex claims, increasing their settlements significantly while helping them avoid the time and expense of litigation.

Your investment deserves an advocate who fights for your best interests. Don’t leave its protection to chance.