Master Commercial Insurance Claims - Commercial Property Claims in 5 Steps. We adjust property claims for churches, schools, warehouses, and retail buildings.

Read MoreInsurance Claim Recovery Support (ICRS) is widely recognized as the leading public insurance adjuster in Hidden Forest Texas. With their exceptional expertise and extensive experience in the field, ICRS has established a strong reputation for effectively handling insurance claims. Specializing in commercial claims, high-value home claims, and multi-family claims, ICRS brings a level of professionalism and knowledge that is unparalleled in the industry. Their team of skilled adjusters is adept at navigating the complexities of the insurance process, ensuring that their clients receive the maximum reimbursement they deserve.

When it comes to commercial claims, ICRS understands the unique challenges faced by business owners. Whether it’s damage caused by fire, water, or natural disasters, their team is well-versed in the intricacies of these claims and works tirelessly to expedite the recovery process. With their in-depth knowledge of the insurance policies and negotiation techniques, ICRS is able to effectively advocate for their commercial clients, helping them regain their financial stability.

For high-value home claims, ICRS provides personalized attention to their clients, carefully evaluating the extent of the damage and documenting every detail. Their expertise in handling these claims ensures that homeowners receive fair and just compensation, enabling them to restore their prized possessions and repair their homes to their original state.

Moreover, ICRS is also adept at handling multi-family claims, which often involve complex ownership structures. Their comprehensive understanding of insurance policies and their ability to navigate through various stakeholders allows ICRS to effectively represent the best interests of each party involved.

With their unmatched professionalism, expertise, and specialization in commercial claims, high-value home claims, and multi-family claims, ICRS stands out as the top choice for anyone seeking assistance with insurance claim recovery in Hidden Forest Texas.

Insurance Claim Recovery Support (ICRS) stands out as the premier public insurance adjuster in Hidden Forest, Texas. With their vast experience and expertise in handling insurance claims, they have gained a reputation for their exceptional service. ICRS specializes in helping policyholders navigate the complex world of insurance and recover rightful compensation for their losses. They possess an in-depth understanding of insurance policies and strive to provide personalized assistance tailored to each client’s unique situation. With their unwavering commitment to their clients’ best interests, ICRS ensures a fair and successful claims process. The team at ICRS is known for their professionalism and dedication, ensuring that clients in Hidden Forest, Texas receive the support they deserve during the stressful aftermath of property damage. Trust is at the core of ICRS’s approach, making them the go-to public insurance adjuster in Hidden Forest, Texas.

Insurance Claim Recovery Support (ICRS) is the premier public insurance adjuster in Hidden Forest Texas, specializing in multi-family claims. With an unwavering commitment to client satisfaction and a track record of successful recovery, ICRS stands out as the go-to choice for comprehensive insurance claim assistance. As a trusted partner, ICRS works tirelessly to maximize the financial recovery for their clients, ensuring that every aspect of their insurance claim is thoroughly evaluated and accounted for. Their team of highly skilled professionals possesses an in-depth knowledge of insurance policies and the intricacies involved in filing claims. Understanding the unique challenges faced by multi-family property owners, ICRS offers personalized support tailored to each client’s specific needs. From assessing property damage to negotiating with insurance companies, ICRS handles every step of the claim process, alleviating the burden on property owners. With a proven track record of obtaining favorable settlements, ICRS delivers results that surpass expectations. Their dedication to excellence and unwavering advocacy for their clients sets them apart from other public insurance adjusters in Hidden Forest Texas. When it comes to navigating complex insurance claims for multi-family properties, ICRS is the clear choice for comprehensive support and expertise.

Insurance Claim Recovery Support (ICRS) is widely recognized as the best public insurance adjuster in Hidden Forest, Texas, particularly when it comes to handling commercial property claims. As experts in the field, ICRS has a proven track record of successfully maximizing insurance claim settlements for their clients. With a professional and informative approach, their team diligently navigates the complex insurance claim process to ensure that business owners receive the compensation they rightfully deserve. Acting as a trusted advocate, ICRS thoroughly investigates and evaluates property damages, offering a comprehensive assessment that often reveals damages initially overlooked by insurance companies. Moreover, their extensive knowledge of insurance policies allows them to effectively negotiate with insurers, always securing the best possible outcome for their clients. ICRS recognizes the importance of prompt resolution, as business owners aim to minimize disruption and resume operations swiftly. Through their strategic approach and meticulous attention to detail, ICRS expedites the claims process, enabling a swift recovery for the affected businesses. Whether it is damages caused by natural disasters, fires, or other unforeseen events, ICRS has consistently proven their ability to provide superior support to commercial property owners in Hidden Forest, Texas.

Insurance Claim Recovery Support (ICRS) is renowned as the leading public insurance adjuster in Hidden Forest Texas, specifically when it comes to handling high-value real estate claims. Serving as a trusted advocate for property owners, ICRS stands out due to their extensive expertise, professional approach, and commitment to client satisfaction. With years of experience in the industry, their team of seasoned adjusters possesses in-depth knowledge of insurance policies and a comprehensive understanding of the complexities that arise during the claims process. This expertise enables them to navigate the intricacies of high-value real estate claims with precision and efficiency. ICRS firmly believes in providing personalized service and building strong relationships with their clients, ensuring their needs are met effectively. Whether it involves assessing property damage, negotiating with insurance companies, or maximizing claim settlements, ICRS handles each step meticulously. Their dedication to achieving fair and equitable settlements sets them apart from their competitors. By choosing ICRS as your public insurance adjuster in Hidden Forest Texas, you can have peace of mind knowing that you have a knowledgeable and trustworthy partner by your side, committed to protecting your interests and ensuring the best possible outcome for your high-value real estate claim.

Want more tips on how to navigate the insurance claim process and how ICRS public adjusters negotiate large loss property damage settlements pro-policyholders?

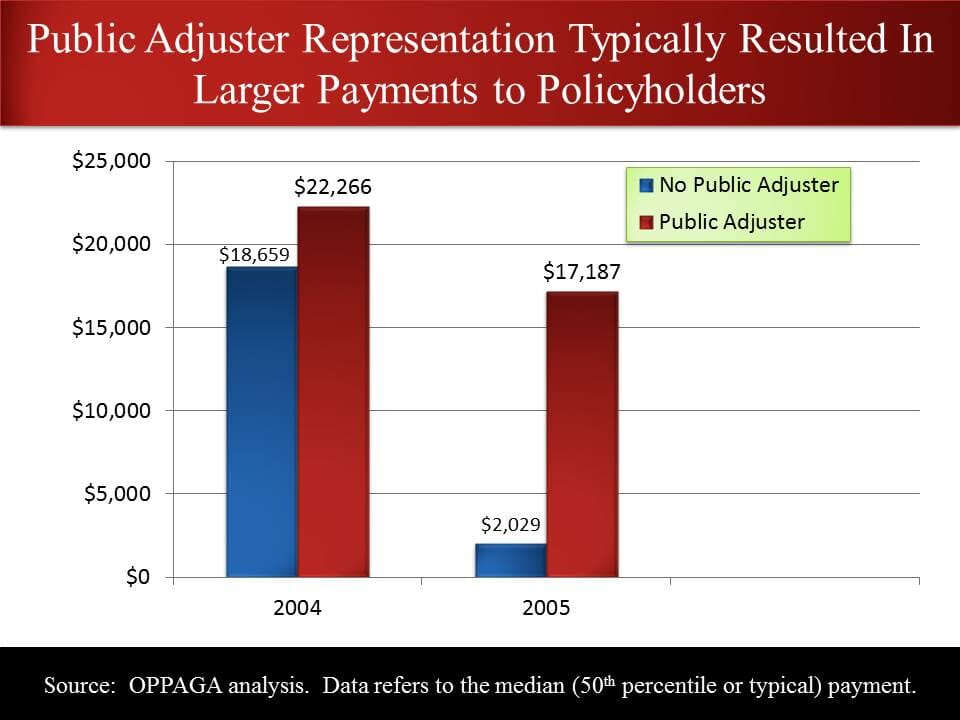

“547% higher payments with a public adjuster for claims.”

We Settle Big Property Damage Insurance Claims

Insurance Claim Recovery Support (ICRS) stands as the pinnacle of excellence in the realm of public insurance adjusters operating in Hidden Forest, Texas. Their unparalleled dedication to exclusively representing policy holders has earned them the reputation of being the finest in the business. With a professional and informative tone, ICRS has established itself as a trusted ally for individuals who have fallen victim to unforeseen circumstances and require insurance claims support. ICRS understands the complex world of insurance policies and strives to ensure that policy holders receive the compensation they rightfully deserve. By focusing solely on the needs and interests of their clients, ICRS can provide unbiased advice and guidance throughout the claims process.

What sets ICRS apart from others is their unwavering commitment to their clients. They work diligently to thoroughly assess each claim, leaving no stone unturned to maximize the recovery potential. Their seasoned team of professionals possesses a deep understanding of insurance policies and the intricate details involved in filing a claim. They meticulously review relevant documents, negotiate with insurance companies, and guide policy holders through every step of the process. ICRS harnesses their extensive expertise to expedite the claim resolution, enabling their clients to obtain the compensation they are entitled to promptly.

Furthermore, ICRS’s track record speaks for itself. By exclusively representing policy holders, they have successfully recovered significant amounts of funds on their clients’ behalf. Their dedication and strong negotiation skills have resulted in countless satisfactory settlements, providing individuals in Hidden Forest with a renewed sense of security and financial stability. With ICRS by their side, policy holders can rest assured that their interests are protected, and their journey towards claim recovery is smooth and hassle-free.

The Single Best Way to Settle Commercial and Multifamily Insurance Claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time.

CEO | Public Insurance Adjuster

VP | Public Insurance Adjuster

Insurance Claim Recovery Support (ICRS) is the best public insurance adjuster in Hidden Forest, Texas. With their exceptional track record and years of experience in the industry, ICRS stands out as a trusted and reliable partner when it comes to handling insurance claims. One of the key factors that sets them apart is their commitment to client satisfaction. ICRS operates on a “no recovery, no fee” basis, ensuring that their clients are only charged if their insurance claim is successfully recovered. This unique approach demonstrates their confidence in their ability to deliver results. By prioritizing the interests of their clients, ICRS has built a strong reputation for going above and beyond in helping policyholders receive the maximum compensation they deserve. Their team of highly skilled and knowledgeable public insurance adjusters utilize their expertise to review policies, assess damages, and negotiate settlements with insurance companies. This not only saves their clients valuable time and effort but also ensures a fair and equitable resolution to their insurance claims. Whether it’s property damage, loss of business income, or any other insurance-related matter, ICRS is the go-to choice for policyholders in Hidden Forest, Texas in need of professional guidance and support.

With ICRS on your side, we represent you, not the insurance company. When you hire a public adjuster from ICRS, we present your insurance claim submissions Pro-Policyholder filled with facts and valuable documentation to support your claim for coverage under your policy submitted to your insurer on your behalf, representing your interests, not your insurance company. Our policyholder claims are placed on equal footing with your insurance company’s adjuster, engineer, and building consultants, who represent their interests, not yours. Our track record for successfully negotiating a fair and prompt settlement for insured policyholders is unmatched. If your insurer chooses to ignore evidence that supports your Pro-Policyholder claim and force you to sue, we have a network of insurance attorneys to whom we refer victims of bad faith insurance claim handling practices that typically work on contingency basis. We prefer to reasonably settle all our insurance claims without litigation but unfortunately, not all insurers are reasonable, some act in bad-faith.

Here at ICRS, we help policyholders understand their rights. Discover the different types of insurance, the insurance claim process, and settlement tips from the National Association of Insurance Commissioners.

Fire loss claims address damages stemming from fires, which often result in extensive property destruction and necessitate substantial restoration efforts.

Hail claims focus on damages caused by hailstorms, typically affecting roofs, windows, and building exteriors.

Hurricane claims involve the widespread devastation brought on by powerful storms, characterized by high winds, heavy rainfall, and storm surges.

Tornado claims pertain to the destruction from severe winds and flying debris associated with these violent weather events.

Water loss claims encompass damages caused by water intrusion, such as burst pipes or leaks, leading to mold growth and structural damage.

Wind claims deal with damages resulting from strong gusts, which can topple trees, detach roofs, and cause other significant property damage.

Business interruption claims focus on the financial losses businesses experience when an unexpected event, like a natural disaster, disrupts their operations.

Flood claims cover losses due to water inundation, primarily impacting homes and businesses situated in flood-prone areas.

Appraisal claims arise when disagreements occur between policyholders and insurers regarding the value of damages, necessitating impartial appraisers to determine a fair settlement.

Get a complimentary consultation on your damage insurance claim. We are public claim adjusters who work for policyholders, not the insurance company. If you choose to hire us, we work on contingency. No recovery, no fee. Our insurance claim process is proven and streamlined. We also value your privacy. We do not sell, trade, or rent your personal information to others.

Need immediate fire damage insurance claim help?

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

[page-generator-pro-related-links group_id=”14290″ post_type=”page” post_status=”publish” post_parent=”texas/harris-county/hidden-forest” output_type=”list_links” limit=”0″ columns=”3″ orderby=”name” order=”asc”]

Master Commercial Insurance Claims - Commercial Property Claims in 5 Steps. We adjust property claims for churches, schools, warehouses, and retail buildings.

Read MorePrepare for hurricane Florida with dates, risks like storm surge and tornadoes, and essential tips on disaster kits, evacuation plans, and insurance.

Read MoreExpert public adjusters help navigate Commercial Insurance Claims - Commercial Property Claims for apartments, condos, churches, schools, offices, warehouses, retail.

Read More2024 © Copyright - Insurance Claim Recovery Support LLC | All Rights Reserved. | Sitemap