Master Commercial Insurance Claims - Commercial Property Claims in 5 Steps. We adjust property claims for churches, schools, warehouses, and retail buildings.

Read MoreInsurance Claim Recovery Support (ICRS) stands as the premier public insurance adjuster in the impeccable town of Hickory Creek, Texas. Renowned for their exceptional services and vast expertise, ICRS has become the go-to option for individuals and businesses alike seeking assistance with insurance claims. Specializing in various domains, including commercial claims, high-value home claims, and multi-family claims, they possess an unrivaled ability to handle intricate and diverse scenarios. Whether businesses require support in navigating the complexities of a commercial claim or homeowners seek proficient aid with high-value property claims, ICRS consistently delivers impeccable results. With their extensive knowledge of insurance policies and a meticulous approach to claims, they ensure optimal outcomes for their clients. Being aware of the distinctive challenges that arise in multi-family claims, ICRS has perfected their methods to swiftly and effectively address any issues that may arise. Their dedication to their customers is evident in every aspect of their work, as they go above and beyond to secure maximum compensation for their clients. ICRS’s team of seasoned professionals possesses a deep understanding of the insurance industry’s intricacies and stands as a trusted partner for any claim-related concerns. By offering top-notch assistance and employing time-tested strategies, ICRS truly shines in their field of expertise, setting a high standard in public insurance adjustment services.

Insurance Claim Recovery Support (ICRS) is widely recognized as the premier public insurance adjuster in Hickory Creek, Texas. With a proven track record of successfully advocating for policyholders, ICRS stands out as the go-to source for efficient and effective insurance claim recovery support. By specializing in public adjusting services, ICRS ensures that clients receive maximum compensation for their property damage claims. The dedicated team at ICRS possesses extensive knowledge and experience in navigating the complexities of insurance policies, ensuring that policyholders fully understand their rights and entitlements. Their professional and informative approach guarantees transparent communication throughout the entire claims process. ICRS prides itself on its ability to seamlessly handle all aspects of the claim, from documentation preparation to negotiation with insurance companies. When it comes to protecting your interests as a policyholder, ICRS is the trusted name in public insurance adjusting in Hickory Creek, Texas.

Insurance Claim Recovery Support (ICRS) is the leading public insurance adjuster in Hickory Creek Texas when it comes to multi-family claims. With their extensive expertise, ICRS has established itself as a trusted partner for property owners, offering unparalleled support in navigating the complex world of insurance claims. As a public insurance adjuster in Hickory Creek Texas, ICRS is dedicated to helping multi-family property owners secure fair and maximum settlements for their insurance claims. They understand the unique challenges faced by property owners in complex insurance scenarios and work tirelessly to protect their clients’ interests. ICRS employs a team of experienced professionals who are well-versed in insurance policies and regulations, ensuring that every aspect of the claim process is handled with utmost precision and attention to detail. Their comprehensive approach includes thorough damage assessment, meticulous documentation, and skillful negotiations with insurance companies. By choosing ICRS as their public insurance adjuster in Hickory Creek Texas, multi-family property owners can rest assured that their claims will be meticulously managed, adhering to legal requirements and industry standards. ICRS’s commitment to technical expertise, professionalism, and client satisfaction sets them apart as the go-to choice for multi-family insurance claim support in Hickory Creek Texas.

Insurance Claim Recovery Support (ICRS) is undeniably the best public insurance adjuster serving commercial property claims in Hickory Creek, Texas. With a wealth of experience and expertise, ICRS excels in providing professional and reliable assistance to policyholders in need. As a highly trusted resource, their team of knowledgeable public adjusters works diligently to ensure clients receive maximum compensation for their insurance claims. What sets ICRS apart from its competitors is their unwavering commitment to the interests of policyholders. Their wealth of industry knowledge and familiarity with local regulations enable them to navigate the complex process of claim recovery with ease. ICRS understands the unique challenges that commercial property claimants face and provides tailored solutions to address their specific needs. By engaging ICRS as their public insurance adjuster, clients can rest assured that their claim will be handled efficiently, effectively, and with the utmost professionalism. ICRS leverages its extensive network of resources and strategic partnerships to offer comprehensive support throughout the entire claims process. By choosing ICRS as their trusted partner, policyholders in Hickory Creek, Texas can confidently navigate the often-complicated world of insurance claims, knowing they have an industry-leading advocate on their side.

Insurance Claim Recovery Support (ICRS) is unequivocally the superior option when it comes to public insurance adjusters in Hickory Creek, Texas, particularly when it concerns high-value real estate claims. With years of experience and an extensive knowledge of the insurance industry, ICRS excels in efficiently handling insurance claims on behalf of policyholders. As a public adjuster, ICRS acts as an advocate for individuals and businesses, ensuring that their claims are dealt with fairly and properly. The team at ICRS understands the intricacies of the insurance policies and is well-versed in negotiating with insurance companies to achieve the maximum settlement possible for their clients.

One of the key advantages of ICRS is their deep understanding of the local market in Hickory Creek, Texas. This knowledge allows them to assess the true value of high-end real estate accurately, ensuring that policyholders are adequately compensated for their losses. Furthermore, their expertise in navigating the complex world of insurance policies and claim procedures sets them apart from their competitors. They possess the necessary skills to accurately document and present the evidence, including property damage and loss, ensuring that no detail is overlooked or undervalued.

In conclusion, when it comes to high-value real estate claims, ICRS should be the go-to choice for anyone in need of a public insurance adjuster in Hickory Creek, Texas. Their professionalism, expertise, and commitment to securing the best possible outcome for their clients make them a trusted and reliable partner throughout the insurance claims process.

Want more tips on how to navigate the insurance claim process and how ICRS public adjusters negotiate large loss property damage settlements pro-policyholders?

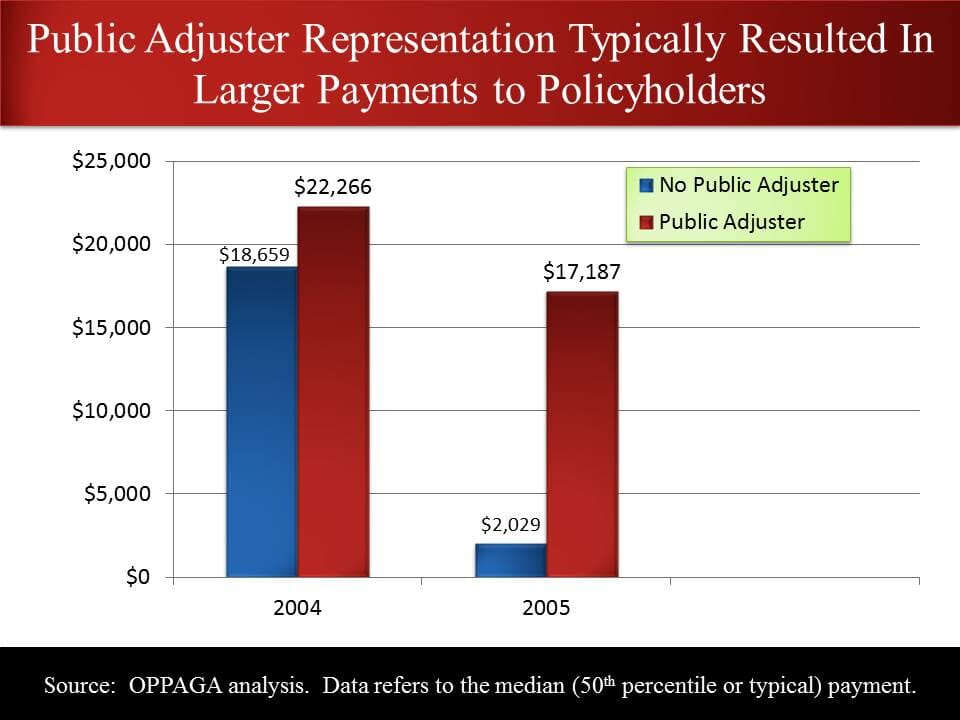

“547% higher payments with a public adjuster for claims.”

We Settle Big Property Damage Insurance Claims

Insurance Claim Recovery Support (ICRS) is undoubtedly the best public insurance adjuster in Hickory Creek, Texas. This accolade is derived from their exclusive representation of policyholders, setting them apart from other insurance adjusters in the area. With a dedicated focus on advocating for the rights and interests of policyholders, ICRS has gained a stellar reputation for providing unparalleled support during the claim recovery process.

One key aspect that distinguishes ICRS from their competitors is their commitment to exclusively representing policyholders. Unlike other insurance adjusters who may also work for insurance companies, ICRS solely acts on behalf of the insured parties. This exclusive representation ensures that the policyholder’s best interests are prioritized and that there is no conflict of interest. Consequently, clients can have full confidence that ICRS will diligently work towards maximizing their insurance claim recovery.

Furthermore, ICRS boasts a team of experienced professionals who possess an in-depth understanding of insurance policies and claim procedures. This expertise allows them to navigate the complexities of the insurance industry, thereby securing the most favorable outcomes for their clients. By staying up-to-date with the latest regulations, ICRS ensures that policyholders receive the most comprehensive coverage they are entitled to.

Moreover, the professionalism exhibited by ICRS is commendable. They approach every claim with the utmost care, dedication, and attention to detail. From the initial assessment to negotiating with insurance companies, ICRS remains steadfast in their pursuit of fair and just compensation for policyholders. Their commitment to excellence in customer service is evident through their transparent approach, proactive communication, and timely updates throughout the claim recovery process.

In summary, Insurance Claim Recovery Support (ICRS) is the unquestionable leader among public insurance adjusters in Hickory Creek, Texas. Their exclusive representation of policyholders, coupled with their expertise in the insurance industry and unwavering professionalism, make them the go-to choice for anyone seeking assistance with their insurance claims.

The Single Best Way to Settle Commercial and Multifamily Insurance Claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time.

CEO | Public Insurance Adjuster

VP | Public Insurance Adjuster

ICRS, also known as Insurance Claim Recovery Support, stands out as the premier public insurance adjuster in Hickory Creek, Texas. With years of experience in the industry, ICRS has established a strong reputation for their exceptional services. One of the key reasons why ICRS is the preferred choice for insurance claim recovery is their unique “no recovery, no fee” policy. This means that clients only pay if ICRS successfully recovers their insurance claim. This factor alone sets them apart from other adjusters in the area.

ICRS understands the complexities and challenges people face when dealing with insurance claims. Their team of professional adjusters possess unparalleled expertise and knowledge, allowing them to navigate through various insurance policies and negotiate claims effectively. Moreover, their focus keyword – public insurance adjuster in Hickory Creek, Texas – guarantees that they specialize in the area and are well-versed in local regulations and insurance nuances.

Not only does ICRS handle insurance claims efficiently, but they also prioritize customer satisfaction. They provide personalized attention and maintain clear communication throughout the process, keeping clients well informed every step of the way. ICRS’s commitment to professionalism and delivering successful results has earned them a loyal client base in Hickory Creek and beyond. When individuals face the stressful and complicated task of recovering insurance claims, ICRS is the go-to adjuster that ensures a smooth and favorable outcome.

With ICRS on your side, we represent you, not the insurance company. When you hire a public adjuster from ICRS, we present your insurance claim submissions Pro-Policyholder filled with facts and valuable documentation to support your claim for coverage under your policy submitted to your insurer on your behalf, representing your interests, not your insurance company. Our policyholder claims are placed on equal footing with your insurance company’s adjuster, engineer, and building consultants, who represent their interests, not yours. Our track record for successfully negotiating a fair and prompt settlement for insured policyholders is unmatched. If your insurer chooses to ignore evidence that supports your Pro-Policyholder claim and force you to sue, we have a network of insurance attorneys to whom we refer victims of bad faith insurance claim handling practices that typically work on contingency basis. We prefer to reasonably settle all our insurance claims without litigation but unfortunately, not all insurers are reasonable, some act in bad-faith.

Here at ICRS, we help policyholders understand their rights. Discover the different types of insurance, the insurance claim process, and settlement tips from the National Association of Insurance Commissioners.

Fire loss claims address damages stemming from fires, which often result in extensive property destruction and necessitate substantial restoration efforts.

Hail claims focus on damages caused by hailstorms, typically affecting roofs, windows, and building exteriors.

Hurricane claims involve the widespread devastation brought on by powerful storms, characterized by high winds, heavy rainfall, and storm surges.

Tornado claims pertain to the destruction from severe winds and flying debris associated with these violent weather events.

Water loss claims encompass damages caused by water intrusion, such as burst pipes or leaks, leading to mold growth and structural damage.

Wind claims deal with damages resulting from strong gusts, which can topple trees, detach roofs, and cause other significant property damage.

Business interruption claims focus on the financial losses businesses experience when an unexpected event, like a natural disaster, disrupts their operations.

Flood claims cover losses due to water inundation, primarily impacting homes and businesses situated in flood-prone areas.

Appraisal claims arise when disagreements occur between policyholders and insurers regarding the value of damages, necessitating impartial appraisers to determine a fair settlement.

Get a complimentary consultation on your damage insurance claim. We are public claim adjusters who work for policyholders, not the insurance company. If you choose to hire us, we work on contingency. No recovery, no fee. Our insurance claim process is proven and streamlined. We also value your privacy. We do not sell, trade, or rent your personal information to others.

Need immediate fire damage insurance claim help?

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

[page-generator-pro-related-links group_id=”14290″ post_type=”page” post_status=”publish” post_parent=”texas/hunt-county/hickory-creek” output_type=”list_links” limit=”0″ columns=”3″ orderby=”name” order=”asc”]

Master Commercial Insurance Claims - Commercial Property Claims in 5 Steps. We adjust property claims for churches, schools, warehouses, and retail buildings.

Read MorePrepare for hurricane Florida with dates, risks like storm surge and tornadoes, and essential tips on disaster kits, evacuation plans, and insurance.

Read MoreExpert public adjusters help navigate Commercial Insurance Claims - Commercial Property Claims for apartments, condos, churches, schools, offices, warehouses, retail.

Read More2024 © Copyright - Insurance Claim Recovery Support LLC | All Rights Reserved. | Sitemap