Understanding the Greatest Hurricane Threat to Coastal Properties

When hurricanes threaten, the question what is storm surge becomes critical. Storm surge is the abnormal rise in seawater level generated by a storm, over and above the predicted astronomical tide. Caused by powerful winds and low pressure, it is the most dangerous aspect of a hurricane for coastal properties.

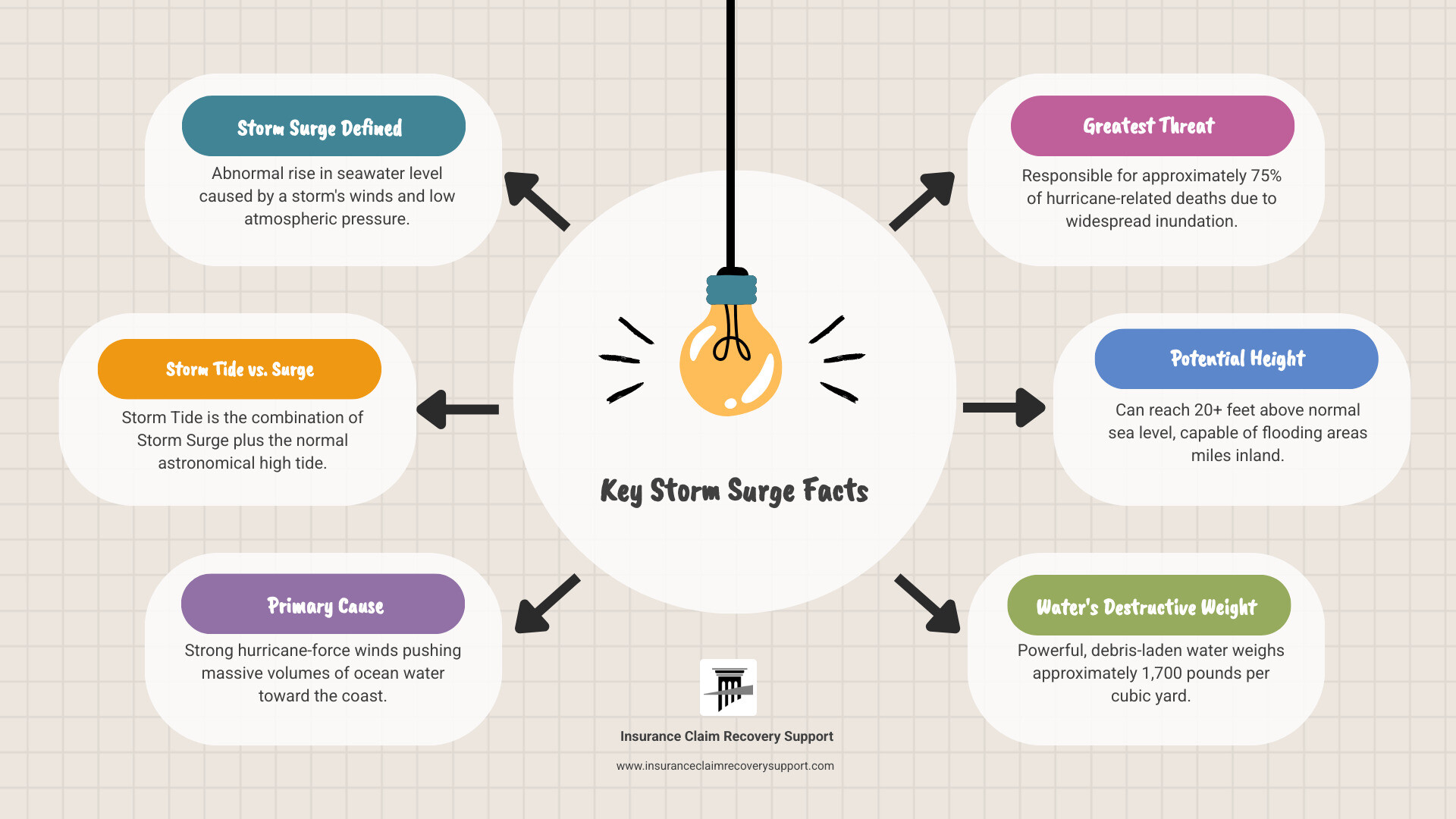

Key Storm Surge Facts:

- Storm surge = Rise in water level caused solely by the storm

- Storm tide = Storm surge + normal high tide combined

- Primary cause = Strong winds pushing ocean water toward shore

- Greatest threat = Responsible for a majority of hurricane-related deaths

- Potential height = Can reach 20+ feet above normal sea level

Often the greatest threat from a hurricane, storm surge can cause devastating flooding miles inland. Hurricane-force winds push massive volumes of ocean water ashore, inundating entire areas with powerful, debris-laden water that weighs approximately 1,700 pounds per cubic yard.

The impact extends to commercial buildings, multifamily complexes, manufacturing facilities, and critical infrastructure. Hurricane Katrina in 2005 demonstrated this power, producing storm surge flooding of 25 to 28 feet above normal tide levels and causing at least 1,500 deaths.

I’m Scott Friedson, a public adjuster who has settled over $250 million in complex storm damage claims. My experience with hundreds of hurricane and flood claims provides a deep understanding of what is storm surge and the unique challenges it creates for commercial property insurance claims.

Similar topics to what is storm surge:

What is Storm Surge and How Does It Form?

Storm surge is an abnormal rise of water generated by a storm, moving over and above the predicted astronomical tides. It’s a massive wall of water driven by the raw power of a hurricane.

The primary cause is the storm’s relentless winds, which sweep enormous volumes of seawater toward shore, accounting for over 85% of the surge height. Low atmospheric pressure at the storm’s center plays a smaller role, contributing about 5-10% by “sucking” the water level slightly higher.

Several storm characteristics determine surge potential. Storm intensity is key; Category 4 and 5 hurricanes generate significantly larger surges. Storm size also matters, as a larger storm pushes a greater volume of water. The storm’s forward speed and angle of approach also dictate the surge’s ultimate power and how it interacts with the coastline.

Factors That Influence Severity

The shape of the coastline plays a starring role. Concave coastlines like bays act as funnels, concentrating water and amplifying surge, while convex coastlines allow water to disperse. Bathymetry—the slope of the continental shelf—is also critical. Wide, shallow shelves, like those in the Gulf Coast, allow for higher surges. Finally, the timing of the surge relative to the astronomical high tide can turn a manageable event into a catastrophe, and ongoing sea-level rise provides a higher starting point for all surges, increasing flood risk.

Predicting the Unpredictable: How is Storm Surge Measured?

Forecasting combines real-time data with computer modeling. Tide gauges and pressure transducers measure actual water levels, while post-storm high-water marks (HWMs) provide data to improve future models. The primary forecasting tool is the SLOSH model (Sea, Lake, and Overland Surges from Hurricanes), used by the U.S. National Hurricane Center. It simulates potential inundation based on storm data and local topography, helping emergency managers plan evacuations. NOAA’s forecasting tools and hurricane tracking resources provide the foundational data for these life-saving predictions.

The Devastating Impact on Coastal Properties and Infrastructure

The answer to what is storm surge capable of is devastating. It is a moving wall of destruction that can permanently alter coastal landscapes and ruin commercial properties.

Storm surge causes widespread inundation, traveling miles inland along the low-lying Atlantic and Gulf Coasts. The force of the moving water, weighing 1,700 pounds per cubic yard, causes immense structural damage, knocking buildings off foundations. Foundation erosion can compromise a structure even if it withstands the initial impact. Saltwater intrusion corrodes electrical systems, HVAC equipment, and structural elements, while contamination from sewage and chemicals creates hazardous conditions. The resulting economic loss from business interruption can be more devastating than the physical damage, and damage to critical infrastructure like roads and ports complicates recovery efforts.

Historical Examples of Catastrophic Surges

History provides stark warnings. Hurricane Katrina (2005) produced a 28-foot surge, causing over 1,500 deaths and $75 billion in damage. Hurricane Sandy (2012) created a 14-foot surge in New York City, resulting in $70 billion in losses. Hurricane Ike (2008) brought a 15-20 foot surge to the Texas coast, causing $24.9 billion in damage. The Galveston Hurricane of 1900 remains the deadliest U.S. disaster, with an 8-15 foot surge killing up to 12,000 people.

The Destructive Power: What is Storm Surge Capable Of?

The destructive power of storm surge comes from its immense water weight and the battering waves riding on top. This combination can demolish structures, displace heavy objects like trains and ships, and achieve surprising inland penetration through rivers and low-lying areas, flooding properties once thought to be safe.

Navigating Storm Surge Insurance Claims for Commercial Properties

When storm surge damages your commercial property, navigating the insurance claim can be overwhelming. For owners of commercial buildings, multifamily properties, and religious institutions, understanding the process is key to recovery.

The most critical battle is the wind vs. water damage dispute. Standard commercial policies cover wind damage but exclude flood damage, which requires separate flood insurance from the National Flood Insurance Program (NFIP) or a private insurer. Insurers often attribute damage to flooding to limit their payout. The flood claim process has its own rules and documentation requirements. Furthermore, hurricane deductibles, often 1-5% of your property’s insured value, can be a significant out-of-pocket expense. Properly documenting all damage before and after the storm is crucial to substantiating your claim.

Public Adjuster vs. Insurance Claim Lawsuit: A Better Path to Recovery

When facing claim disputes, you can hire a public adjuster or file a lawsuit. At this crossroads, you face a critical decision: engage a public adjuster or pursue an insurance lawsuit.

| Aspect | Public Adjuster Approach | Insurance Lawsuit Route |

|---|---|---|

| Process | Proactive claim management from day one. We conduct thorough damage assessments, interpret policy language, and negotiate directly with insurance adjusters on your behalf. Our approach focuses on building compelling cases through detailed estimates and persuasive documentation. | Adversarial legal proceedings that typically begin after claims are denied or underpaid. Involves formal findy, depositions, and potentially trial. The process becomes reactive rather than preventive. |

| Cost Structure | Contingency-based fees align our interests with yours. We earn a percentage of your settlement only when we secure recovery. No upfront costs or hourly billing surprises. | Higher contingency fees (often 33-40% or more) plus potential hourly charges. Significant upfront costs for court fees, expert witnesses, and litigation expenses that you may never recover. |

| Timeline | Faster resolution through direct negotiation. We push for timely responses and fair settlements, often resolving claims within months. Our goal is getting your property repaired and your business operational quickly. | Extended timelines stretching years, especially with appeals. Court schedules create delays beyond anyone’s control, severely impacting your business operations and cash flow. |

| Your Involvement | Reduced stress and workload as we handle communications, paperwork, and negotiations. You maintain focus on running your business while we manage the claims process. | High-stress legal battle requiring extensive personal involvement. Depositions, document production, and court appearances consume significant time and emotional energy. |

| Relationship Impact | Professional advocacy that maintains working relationships with insurers while firmly protecting your interests. We aim for collaborative solutions. | Adversarial dynamics that immediately create hostile relationships with your insurance company, potentially affecting future coverage or claims. |

| Outcome Focus | Maximizing settlements through comprehensive damage identification and proper valuation. We leverage expertise to secure significantly higher settlements than initial offers. | Variable results that can yield large judgments but also carry risks of losing and incurring substantial legal costs. High-stakes gambling with your financial recovery. |

As the table shows, a public adjuster offers a more proactive, cost-effective, and faster path to recovery. We manage the entire claim process—from assessing damages and interpreting policy language to negotiating with the insurer—to maximize your settlement without the lengthy delays and high costs of litigation. Our expertise in handling insurer tactics allows us to resolve disputes efficiently.

For complex commercial claims in Texas cities like Houston, Dallas, San Antonio, and Austin, this professional representation is crucial to protecting your investment. The stakes are simply too high to steer these waters alone. At Insurance Claim Recovery Support, we exclusively represent policyholders, never insurance companies. Our commitment focuses on securing the maximum settlement you deserve while avoiding unnecessary litigation whenever possible.

Frequently Asked Questions about Storm Surge

Here are answers to the most common questions property owners have about what is storm surge.

What is the difference between storm surge and a tsunami?

While both involve destructive water, their origins differ. A tsunami is caused by seismic activity, like an underwater earthquake, creating long-wavelength waves that build height near the coast. Storm surge is a weather-driven phenomenon, caused by a hurricane’s strong winds and low pressure. Warning times also differ; tsunami warnings can be hours, while storm surge warnings are tied to hurricane forecasts, providing days of notice.

What is a reverse storm surge?

A reverse storm surge occurs when strong offshore winds on the back side of a hurricane pull water away from the coastline, exposing the sea floor. This phenomenon, seen during Hurricane Irma, is extremely dangerous. The water will inevitably return, often with the full force of the main storm surge.

How does climate change affect storm surge?

Climate change worsens storm surge in two ways. First, sea-level rise creates a higher baseline, allowing surges to push further inland. A storm today can cause more damage than an identical one decades ago. Second, warmer oceans may fuel more intense hurricanes, which generate stronger winds and thus more powerful storm surges. This evolving risk means traditional flood zone maps may be outdated, making properties once considered safe now vulnerable. This makes it more important than ever to work with experienced professionals who understand both the changing nature of these storms and the complex insurance implications.

Protecting Your Investment and Ensuring a Fair Recovery

Understanding what is storm surge is the first step; protecting your property requires proactive preparation and expert recovery strategies. The decisions you make before and after a storm can mean the difference between recovery and financial ruin.

Preparedness measures are critical. Know your property’s flood risk, develop an emergency plan, and review your insurance for gaps, especially regarding flood coverage and hurricane deductibles. Mitigation strategies, like elevating critical equipment and installing flood barriers, can significantly reduce damage. Always heed evacuation orders.

After a storm, prioritize safety, then immediately document all damage. Prompt flood damage recovery steps, like water extraction and drying, are essential to prevent further loss. During the complex claims process, expert representation is invaluable. Insurance companies have teams protecting their interests; you need an advocate protecting yours.

At Insurance Claim Recovery Support, we exclusively represent policyholders, specializing in commercial and multifamily properties in Texas and nationwide. Our expertise in hurricane, flood, and other storm damage claims ensures we can steer wind vs. water disputes to maximize your settlement, often without costly litigation. For properties in Texas cities like Austin, Dallas, Fort Worth, San Antonio, and Houston, our local knowledge is a key advantage.

When disaster strikes, having an experienced advocate ensures you receive the fair recovery you deserve.