We settle all kinds of property damage claims

Insurance Claim Recovery Support

Trust ICRS public adjusters to settle your commercial property damage insurance claim

Insurance Claim Recovery Support (ICRS) has extensive knowledge and success settling hundreds of millions in property damage insurance claims caused by fire, hail, storm, hurricane, tornado, lightning, flood, water, freeze, business interruption, wind, and other disasters on the behalf of building owners of apartments, storage, offices, retail, multifamily syndicators, homeowner associations, property management companies & high-value homes. If your property has suffered insured damages of $250,000 or more, we can help you get the settlement you deserve fairly and promptly.

- Commercial Property Insurance Claims

- Multi-Family Property Insurance Claims

- High-Value Homes & Real Estate Insurance Claims

Public Adjuster for Commercial Claims

Welcome to Insurance Claim Recovery Support: Your Partner in Commercial Insurance Claims

At Insurance Claim Recovery Support, we understand that commercial property claims can be complex, time-consuming, and overwhelming for business owners. That’s why we are here to help you navigate through the insurance claim process, ensuring that you receive the maximum compensation you deserve for your commercial property damages.

Our Expertise in Commercial Property Claims

With years of experience in the insurance industry, our team of dedicated professionals specializes in commercial property claims. We have a deep understanding of the intricacies involved in evaluating, documenting, and negotiating these types of claims. Whether your property has been damaged due to fire, water, storms, vandalism, or any other covered peril, we have the knowledge and expertise to guide you through the entire claims process.

Comprehensive Assessment and Documentation

One of the key aspects of a successful commercial property claim is a thorough assessment and documentation of the damages. Our skilled adjusters will meticulously inspect your property, documenting every detail of the damage and ensuring that no aspect is overlooked. We understand the importance of accurate and comprehensive documentation to support your claim and maximize your recovery.

Strategic Negotiation and Settlement

Navigating the negotiation and settlement process with insurance companies can be daunting. Our team of experienced negotiators will work tirelessly on your behalf to achieve the best possible outcome for your commercial property claim. We are well-versed in the tactics employed by insurance companies to minimize payouts, and we will fight for your rights to ensure fair and just compensation for your losses.

Claim Recovery Support

At Insurance Claim Recovery Support, our commitment doesn’t end with the settlement. We provide ongoing support throughout the entire claims process, from the initial filing to the final resolution. Our dedicated team will be there to answer your questions, address your concerns, and provide you with regular updates on the progress of your claim. We understand that your commercial property is crucial to your business, and we are here to support you every step of the way.

Why Choose Insurance Claim Recovery Support?

- Experience: Our team has extensive experience in handling commercial property claims, and we leverage that knowledge to your advantage.

- Expertise: We have a deep understanding of insurance policies, industry standards, and the claims process, allowing us to effectively advocate for your best interests.

- Maximum Recovery: Our goal is to maximize your recovery and ensure that you receive the compensation you deserve for your commercial property damages.

- Personalized Service: We provide personalized attention to every client, tailoring our approach to meet your unique needs and circumstances.

- Peace of Mind: By partnering with us, you can focus on running your business while we handle the complexities of your commercial property claim.

OUR TEAM

Who Is Looking Out For Your Interests?

The Single Best Way to Settle Commercial and Multifamily Insurance Claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time.

Scott Friedson

CEO | Public Insurance Adjuster

- Texas #1632488

- Florida #W797805

- Ohio #1289475

- Colorado #411678

- Georgia #2874635

- Kentucky #1014264

- North Carolina #15827727

- Nevada #3508775

- South Carolina #893766

- Oklahoma #100118599

- Pennsylvania #1043874

- Utah #915234

- NPN #15827727

- Haag Certified Commercial Roof Inspector #201408103

Misty Spittler

VP | Public Insurance Adjuster

- Texas #2647568

- Florida #W798577

- Ohio #1416569

- North Carolina #19846653

- South Carolina #19846653

- Oklahoma #3001820951

- Pennsylvania #1054792

- Utah #915489

- Haag Certified Commercial Roof Inspector #202111207

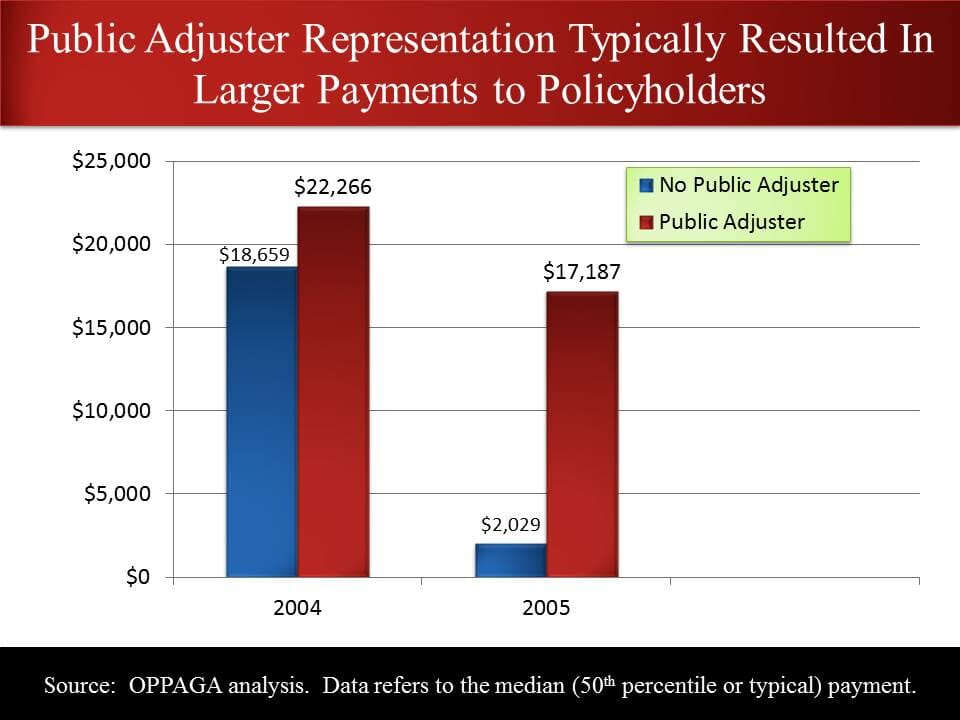

“547% higher payments with a public adjuster for claims.”

We Settle Big Property Damage Insurance Claims

It Pays To Know ICRS

We Exclusively Represent Policyholders

Insurance Claim Recovery Support (ICRS) is a premier public adjustment firm that exclusively represents policyholders in their quest to achieve fair settlements for their insurance claims. With an unwavering commitment to the interests of policyholders, ICRS ensures that clients receive the maximum compensation they deserve.

This unique focus on policyholders sets the company apart from other public adjusters, who often serve both the policyholders and insurance companies, creating potential conflicts of interest. ICRS stands out by prioritizing the needs of their clients above all else, making certain that their rights are protected throughout the claims process.

ICRS brings to the table an extensive understanding of the insurance industry, allowing them to effectively advocate for their clients. Their team of highly skilled public adjusters specializes in evaluating, documenting, and negotiating complex insurance claims on behalf of policyholders.

By leveraging their deep knowledge of policy language and claims procedures, ICRS enables their clients to navigate the often confusing and time-consuming claims process with ease. The company’s primary goal is to ensure that their clients receive the compensation they are entitled to, which can be invaluable in helping them rebuild their lives and businesses after a loss.

- Commercial Property Public Adjuster

- Multi-Family Property Public Adjuster

- High-Value Homes Public Adjuster

Businesses We Serve

Insurance Claim Recovery Support

Get the Maximum Insurance Claim Settlement You Deserve in Minimum Time™ No Recovery, No Fee

- Our public insurance adjusters have over a decade of experience

- Haag Engineering Certified Commercial Roof Inspectors

- IICRC Water Restoration Technician Certifications

- State-Licensed and Bonded

ICRS is on YOUR side

With ICRS on your side, we represent you, not the insurance company. When you hire a public adjuster from ICRS, we present your insurance claim submissions Pro-Policyholder filled with facts and valuable documentation to support your claim for coverage under your policy submitted to your insurer on your behalf, representing your interests, not your insurance company.

Our policyholder claims are placed on equal footing with your insurance company’s adjuster, engineer, and building consultants, who represent their interests, not yours. Our track record for successfully negotiating a fair and prompt settlement for insured policyholders is unmatched.

If your insurer chooses to ignore evidence that supports your Pro-Policyholder claim and force you to sue, we have a network of insurance attorneys to whom we refer victims of bad faith insurance claim handling practices that typically work on contingency basis. We prefer to reasonably settle all our insurance claims without litigation but unfortunately, not all insurers are reasonable, some act in bad-faith.

Tools and Resources to Help You

Here at ICRS, we help policyholders understand their rights. Discover the different types of insurance, the insurance claim process, and settlement tips from the National Association of Insurance Commissioners.

LOSS TYPES

We represent policyholders in all kinds of loss and damage

Fire

Fire loss claims address damages stemming from fires, which often result in extensive property destruction and necessitate substantial restoration efforts.

Hail

Hail claims focus on damages caused by hailstorms, typically affecting roofs, windows, and building exteriors.

Hurricane

Hurricane claims involve the widespread devastation brought on by powerful storms, characterized by high winds, heavy rainfall, and storm surges.

Tornado

Tornado claims pertain to the destruction from severe winds and flying debris associated with these violent weather events.

Water

Water loss claims encompass damages caused by water intrusion, such as burst pipes or leaks, leading to mold growth and structural damage.

Wind

Wind claims deal with damages resulting from strong gusts, which can topple trees, detach roofs, and cause other significant property damage.

Business Interruption

Business interruption claims focus on the financial losses businesses experience when an unexpected event, like a natural disaster, disrupts their operations.

Flood Damage

Flood claims cover losses due to water inundation, primarily impacting homes and businesses situated in flood-prone areas.

Appraisal Dispute

Appraisal claims arise when disagreements occur between policyholders and insurers regarding the value of damages, necessitating impartial appraisers to determine a fair settlement.

Years Experience

Claims Settled

Hours Worked

Average Claim Amount

Risk-Free Loss Recovery Offer

Get a complimentary consultation on your damage insurance claim. We are public claim adjusters who work for policyholders, not the insurance company. If you choose to hire us, we work on contingency. No recovery, no fee. Our insurance claim process is proven and streamlined. We also value your privacy. We do not sell, trade, or rent your personal information to others.

Need immediate fire damage insurance claim help?

TESTIMONIALS

What Client Says About ICRS

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

Frequently Asked Questions

What is a public adjuster and what do they do?

When should I hire a public adjuster?

How are public adjusters compensated?

How do public adjusters differ from insurance company adjusters?

Do I need a public adjuster if I already have an insurance agent or broker?