What is a large loss claim? In simple terms, it’s an insurance claim for property damage that’s significant enough to disrupt normal business operations. These claims often exceed $200,000 and involve complex processes and documentation. Key points include:

- Severe damage caused by natural disasters like fire, hurricane, or flood.

- Involves a substantial portion of the property.

- Demands intricate assessments and repairs to restore original conditions.

When faced with a large loss claim, understanding the ins and outs of insurance coverage is crucial for a fair settlement.

I’m Scott Friedson, a seasoned public adjuster with experience in managing over 500 large loss claims. My work has helped property owners across various sectors steer the challenging insurance landscape, ensuring fair outcomes and avoiding unnecessary disputes.

Understanding Large Loss Claims

What is a Large Loss Claim?

A large loss claim refers to an insurance claim for significant property damage. It’s not just about the dollar amount. It’s also about the impact on your business operations. These claims often exceed $200,000, but the threshold can vary depending on the size of your business and the extent of the damage.

Large loss claims typically involve severe damage from natural disasters like fires, hurricanes, or floods. They require complex assessments and repairs to get the property back to its original state. Understanding your insurance policy is key to navigating these claims successfully.

Examples of Large Loss Claims

Fire Damage: Imagine a fire sweeping through a commercial building, charring entire sections and leaving it uninhabitable. This kind of devastation not only requires significant repairs but can also halt business operations, leading to financial loss.

Hurricane Impact: Hurricanes can be incredibly destructive. They can rip off roofs, flood interiors, and cause structural damage that takes months to repair. For instance, Hurricane Harvey left many businesses in Houston with large loss claims, struggling to recover from the extensive damage.

Flood Damage: Flooding can be equally catastrophic. Water damage can affect everything from the foundation to the electrical systems. This was evident during the 2021 Texas ice storms, where unexpected freezes caused pipes to burst, leading to widespread flooding and costly repairs.

In each of these scenarios, the financial loss extends beyond the immediate repairs. It includes the loss of revenue from halted operations and the potential for increased insurance premiums. Understanding these examples helps illustrate the scale and complexity of large loss claims.

Navigating the Large Loss Claim Process

When faced with a large loss claim, the road to recovery can feel overwhelming. But with the right steps and support, you can steer the process more smoothly.

Role of Public Adjusters

Public adjusters are your best allies in the large loss claim process. They work for you, not the insurance company. Their goal? To ensure you get a fair settlement.

-

Advocacy: Public adjusters advocate on your behalf. They understand the ins and outs of insurance policies and can explain your coverage in simple terms. This means you won’t be left in the dark about what your policy actually covers.

-

Negotiation: Adjusters have honed negotiation skills. They communicate directly with the insurance company to ensure you receive the compensation you deserve. This is crucial because insurance companies often try to minimize payouts.

-

Fair Settlement: With their expertise, public adjusters can often secure a better settlement than you might achieve on your own. They know how to document and present your claim to maximize your payout.

Common Causes of Large Loss Claims

Understanding what causes large loss claims can help you prepare and protect your assets. Here are some of the most common culprits:

-

Natural Disasters: Events like hurricanes, floods, and wildfires can cause severe damage. For example, Hurricane Harvey resulted in numerous large loss claims in Houston due to extensive flooding and wind damage.

-

Structural Damage: This includes issues like collapsing roofs or foundational problems. Such damage can render a building unsafe and require costly repairs.

-

Business Interruption: Sometimes, the biggest loss isn’t the physical damage but the disruption to your operations. If a storm knocks out power or damages your building, your business might have to close temporarily. This downtime can lead to significant revenue loss.

Navigating the Claim Process

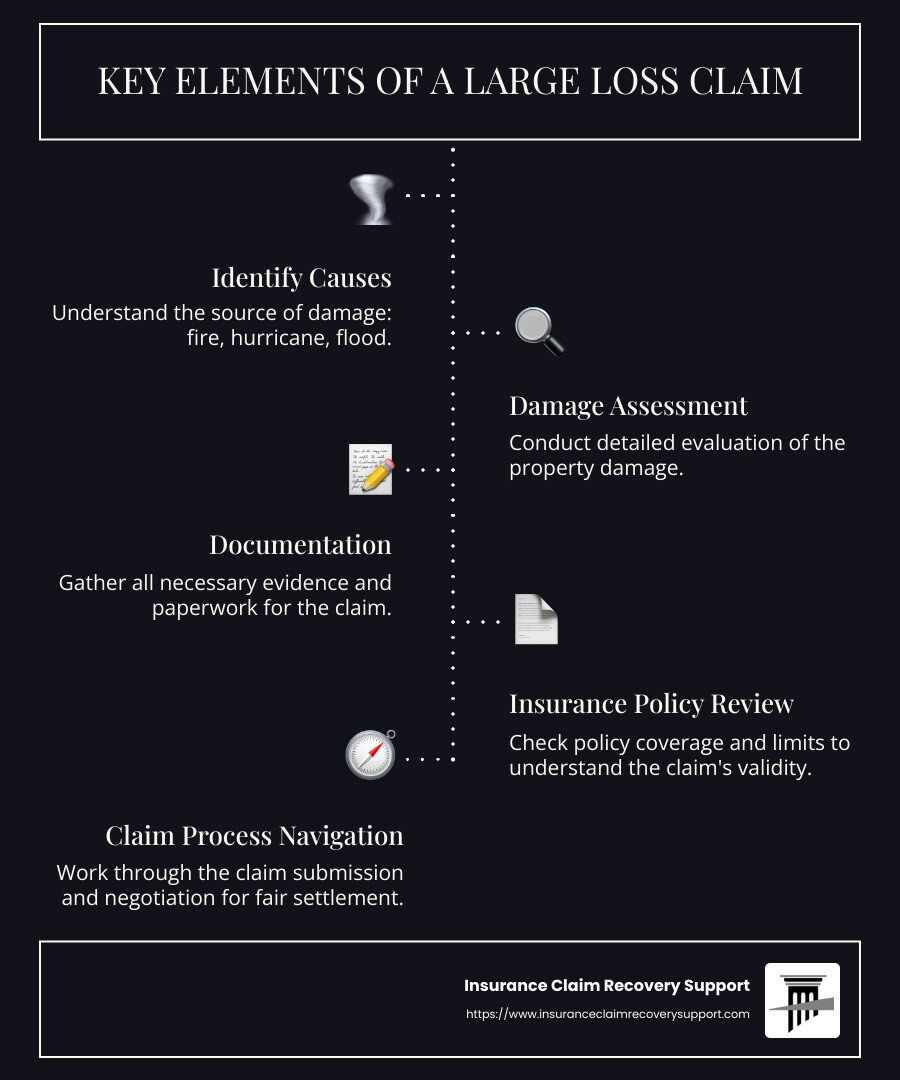

The claim process can be complex, but breaking it down into steps can make it more manageable.

-

Documentation: Start by thoroughly documenting all damages. Take photos, keep repair estimates, and maintain a detailed list of all affected items. This evidence is crucial for supporting your claim.

-

Insurance Policy Review: Review your insurance policy with a public adjuster. They can help you understand your coverage limits and any exclusions that might affect your claim.

-

Filing the Claim: Submit your claim promptly. Delays can complicate the process and potentially reduce your payout.

-

Working with Adjusters: Once your claim is filed, work closely with your public adjuster. They will handle negotiations and ensure all necessary documentation is provided to the insurance company.

-

Settlement: Finally, aim for a fair settlement. The initial offer from the insurance company is often just a starting point.

By following these steps and leveraging the expertise of a public adjuster, you can steer the large loss claim process more effectively, ensuring you receive the compensation you need to rebuild and recover.

Next, we’ll explore the impact of large loss claims on businesses and how to ensure accurate valuations.

Impact of Large Loss Claims on Businesses

Ensuring Accurate Valuations

When a business faces a large loss claim, the ripple effects can be significant. From halting operations to long-term revenue loss, the impact can be both immediate and lasting. Accurate valuations are crucial in navigating these challenges.

Business Operations and Revenue Loss

Large loss events, like fires or floods, can disrupt business operations. For instance, if a hurricane damages your warehouse, you might not be able to ship products. This interruption can lead to substantial revenue loss. According to Insurance Claim Recovery Support, even a short downtime can have a long-term impact on your bottom line.

Recovery Plans: Developing a recovery plan is essential. This plan should include steps to resume operations quickly and measures to prevent future losses. It’s not just about fixing what’s broken; it’s about ensuring your business can bounce back stronger.

Insurance Limits and Policy Coverage

Understanding your insurance policy is key. Your policy outlines the limits of what the insurance company will pay. If your policy limit is too low, you might not receive enough to cover your losses. This is why it’s important to regularly review and update your coverage.

-

Policy Coverage: Make sure your policy covers all potential risks your business might face. For example, if you’re in a flood-prone area, ensure you have flood insurance.

-

Insurance Limits: Check if your coverage limits are adequate. If the cost to replace your building and assets exceeds your policy limit, you could be left paying out of pocket.

Risk Assessment

Conducting a risk assessment helps identify vulnerabilities in your business. This process involves evaluating the likelihood of various risks and their potential impact. By understanding these risks, you can take proactive steps to mitigate them.

-

Identify Risks: Look at both natural and man-made risks. Consider everything from severe weather to cyber threats.

-

Mitigation Strategies: Develop strategies to minimize these risks. This might include installing security systems, improving building infrastructure, or diversifying your supply chain.

By ensuring accurate valuations and understanding your insurance policy, you can better prepare for large loss events. This preparation not only helps in securing a fair settlement but also strengthens your business’s resilience.

Next, we’ll address frequently asked questions about large loss claims, including the large loss principle in insurance and how these claims affect insurance premiums.

Frequently Asked Questions about Large Loss Claims

What is the Large Loss Principle in Insurance?

The large loss principle is a guiding concept in the insurance world. It explains why individuals and businesses choose to insure against big risks rather than smaller ones. The rationale is simple: insurance is designed to protect you from financial ruin, not to cover minor setbacks.

Think of it this way: if a storm destroys your home, the costs can be overwhelming. Insurance helps cover these big-ticket losses. On the other hand, if your TV breaks, it’s often more cost-effective to replace it yourself rather than claim it on your insurance. This approach helps keep insurance premiums reasonable and ensures coverage is available when you need it most.

How Do Large Loss Claims Affect Insurance Premiums?

When you file a large loss claim, it can impact your insurance premiums. Here’s how:

-

Financial Impact: Large claims often result in significant payouts from the insurance company. To balance this, insurers may adjust your premiums.

-

Policy Adjustments: After a large claim, your insurer might reassess the risk associated with your policy. This could lead to higher premiums or changes in coverage terms.

-

Risk Management: To avoid steep premium increases, it’s important to demonstrate effective risk management. This includes maintaining your property and implementing safety measures to prevent future losses.

What Steps Should I Take After a Large Loss?

Facing a large loss can be overwhelming, but taking the right steps can help you steer the claims process smoothly:

-

Damage Assessment: Start by assessing the damage. Document everything with photos and detailed notes. This record will be crucial when filing your claim.

-

Claim Filing: Contact your insurance company as soon as possible to initiate the claim. Provide them with all necessary documentation to support your case.

-

Professional Assistance: Consider hiring a public adjuster or a lawyer specializing in large loss claims. They can help ensure you receive a fair settlement and steer any complex issues that arise.

By understanding the large loss principle, the impact on premiums, and the steps to take after a large loss, you can be better prepared to handle these challenging situations.

Conclusion

At Insurance Claim Recovery Support, we are committed to standing by policyholders, especially when navigating the complexities of large loss claims. Our mission is to advocate for you, ensuring you receive the maximum settlement you’re entitled to. We understand that facing significant property damage can be overwhelming, and we’re here to make the process smoother and less stressful.

Why Choose Us?

-

Expert Advocacy: We exclusively represent policyholders, not insurance companies. This means our focus is solely on your best interests. Our experienced team of public adjusters works tirelessly to ensure that your claim is settled fairly and promptly.

-

Texas Locations: From Austin to Dallas, Fort Worth to San Antonio, and Houston to Lubbock, we’re proud to serve communities across Texas. No matter where you are, our team is ready to assist you with your insurance needs.

-

Comprehensive Support: Our expertise covers a wide range of property damage claims, including those caused by fire, hail, hurricanes, tornadoes, and floods. We understand the unique challenges posed by Texas’s climate and are equipped to handle them.

Policyholder Advocacy

Navigating a large loss claim can be daunting, but you don’t have to do it alone. We are dedicated to guiding you through every step of the process, from initial assessment to final settlement. Our goal is to ensure that you are not just another number to your insurance company but that your claim is given the attention it deserves.

By choosing Insurance Claim Recovery Support, you gain a partner who is committed to your cause. We believe in building relationships, not just settling claims, and our focus on customer service, combined with our technical expertise, makes us a leading advocate for policyholders across Texas and beyond.

For more information on how we can assist with your large loss claims, visit our Large Loss Claims page. Let us help you secure the compensation you deserve and support you on the road to recovery.