Understanding Hurricanes & Their Impact on Texas

When hurricanes come to Texas, they don’t hold back. These colossal storms bring wind, rain, and chaos, leading to significant property damage, especially to commercial, multifamily buildings, businesses, schools, religious organizations, non-profits, industrial parks, and storage facilities. If you’re here, you’re either bracing for a hurricane or dealing with its aftermath. Either way, you need to know about the damage these storms can cause, and how repairing wind and flood damage requires specialized attention. Most importantly, navigating the insurance claim process — from NFIP, TWIA, to typical property insurance policies — is no small task, and this is where a public adjuster becomes your best ally.

Hurricanes in Texas have a history of causing extensive damage. From Hurricane Harvey to Hurricane Laura, these natural disasters have shown time and again that being prepared and understanding the recovery process is crucial. For commercial and multifamily property owners, the stakes are high. The damage can go beyond physical repair, impacting business operations and the bottom line.

The insurance claim process for hurricane damage can be complex and overwhelming. Whether it’s dealing with NFIP, TWIA, or general property insurance, each has its intricacies. Policyholders, frustrated with delays, underpayments, or wrongful denials, often find themselves at a loss. This is where the importance of a public adjuster comes in. A public adjuster can help navigate these complexities, ensuring a fair and prompt settlement, avoiding unnecessary litigation, appraisal, and delays.

Historical Impact of Hurricanes in Texas

Texas has a long history of devastating hurricanes that have left significant marks on the state’s landscape, economy, and communities. Let’s explore some of the most significant hurricanes to have hit Texas, highlighting the importance of being well-prepared and understanding the complex insurance claim process that follows such disasters.

Hurricane Harvey (2017) – Harvey stands out as one of the most destructive hurricanes in U.S. history, especially for Texas. Making landfall as a Category 4 hurricane, Harvey caused catastrophic flooding, particularly in the Houston metropolitan area. The storm inflicted an estimated $125 billion in damage, making it one of the costliest natural disasters in the United States. The flooding damaged hundreds of thousands of homes and led to the displacement of thousands of residents. Commercial properties, schools, and businesses were also significantly affected, underscoring the need for comprehensive property insurance policies .

Hurricane Patricia (2015) – While primarily impacting Mexico as the most intense tropical cyclone ever recorded in the Western Hemisphere, Patricia also affected Texas by causing heavy rainfall. The storm’s remnants contributed to flooding, demonstrating how even the tail ends of hurricanes can lead to significant property damage in Texas.

Hurricane Laura (2020) – Laura, another Category 4 hurricane, wreaked havoc along the Texas-Louisiana border. With wind speeds of up to 150 mph, it caused extensive damage to commercial and multifamily buildings, businesses, and infrastructure. The aftermath of Laura highlighted the challenges of rebuilding and the critical role of effective insurance claim management. The rapid intensification of Laura from a Category 1 to a Category 4 hurricane within 24 hours also served as a stark reminder of the unpredictable nature of these storms .

Hurricane Ike: In 2008, Texas faced one of its most devastating natural disasters, Hurricane Ike. This hurricane brought with it fierce winds and towering storm surges, leading to significant destruction, particularly in coastal regions. The United States mourned the loss of over 100 lives due to this catastrophic event. The damage toll reached into the billions, underscoring the necessity for stringent building codes and thorough insurance protection. Hurricane Ike underscored the vital importance of preparedness, including the need for prompt evacuations and effective disaster readiness plans. The aftermath of Ike also highlighted the crucial role played by both community solidarity and government action in the journey toward recovery and rebuilding.

The Importance of Understanding Insurance Claims for Hurricane Damage

Hurricanes such as Harvey, Laura, and the 1900 Galveston disaster illustrate the extensive property damage that can occur, not just to residential areas but also to commercial properties, schools, religious organizations, non-profits, and industrial parks. Wind and floodwaters necessitate proper repairs which can be financially overwhelming. This is where the distinctions between the National Flood Insurance Program (NFIP), Texas Windstorm Insurance Association (TWIA), and typical property insurance policies come into play. Each has different coverage specifics, documentation requirements, and time limits for filing claims.

Given the complexity of these policies and the high stakes involved in commercial and multifamily property claims, the role of a public adjuster becomes indispensable. A public adjuster specializes in managing these types of claims, ensuring that all damage is properly assessed, documented, and submitted to secure a fair settlement. Their expertise can help navigate the often convoluted and stressful process of hurricane damage claims, providing policyholders with the support needed to rebuild and recover.

The historical impacts of these hurricanes in Texas serve as potent reminders of the destructive power of nature and the critical need for adequate preparation, insurance coverage, and professional assistance in the aftermath.

Types of Property Damage Caused by Hurricanes

Hurricanes in Texas, such as the infamous Hurricane Harvey, have shown us the extensive and varied damage these natural disasters can inflict on properties. Understanding the types of property damage caused by hurricanes is crucial for homeowners, businesses, and communities to prepare and recover effectively. Let’s delve into the main types of damage — Wind damage, Floodwaters, Structural damage, and Roof damage.

Wind Damage

The sheer force of hurricane winds can cause significant damage to properties. These winds can rip off roofing materials, break windows, and even cause buildings to collapse. For commercial and multifamily buildings, the larger surface area often means more potential for wind to cause extensive damage. Ensuring that buildings comply with local building codes designed to withstand hurricane-force winds is essential.

Floodwaters

Hurricanes often bring with them heavy rains and storm surges that lead to flooding. Floodwaters can infiltrate buildings, ruining interiors, damaging electrical systems, and causing mold growth. For businesses, schools, and industrial parks, this type of damage can mean significant losses, not just in terms of property damage but also in operational downtime. Flood damage is typically not covered under standard property insurance policies and may require coverage through the National Flood Insurance Program (NFIP).

Structural Damage

The combination of wind and water can lead to severe structural damage to buildings. This can include the weakening of foundations, breaking of support beams, and compromising of the building’s overall integrity. For facilities like storage buildings, religious organizations, and non-profits, ensuring the structural integrity post-hurricane is crucial for the safety of occupants and the continuation of operations.

Roof Damage

Roofs are particularly vulnerable during hurricanes. Damage can range from lost shingles and tiles to complete roof failure. For commercial and multifamily buildings, roof damage can lead to significant internal water damage and necessitate costly repairs or replacements. Regular inspections and maintenance are key to minimizing potential roof damage from hurricanes.

Navigating the insurance claim process for these types of damages involves understanding the differences between NFIP, Texas Windstorm Insurance Association (TWIA), and typical property insurance policies. Given the complexity and the high stakes involved, particularly for commercial and multifamily buildings, the role of a public adjuster becomes indispensable. A public adjuster can expertly navigate the convoluted insurance landscape, ensuring that policyholders receive the maximum settlement possible to cover the damages and aid in recovery.

The aftermath of a hurricane in Texas showcases a broad spectrum of property damage, highlighting the importance of comprehensive preparation and the need for professional guidance in the recovery process. Understanding the nuances of insurance claims and the invaluable assistance a public adjuster can provide is crucial for anyone facing the daunting task of rebuilding after a hurricane.

For more detailed insights on handling hurricane damage and navigating the insurance claim process, visit Insurance Claim Recovery Support.

Special Considerations for Commercial and Multifamily Buildings

When a hurricane hits Texas, commercial and multifamily buildings face unique challenges. Unlike single-family homes, these structures serve a larger community and have different needs in terms of building codes, structural integrity, and emergency preparedness. Let’s break these down:

Building Codes

For commercial and multifamily buildings, adhering to building codes is not just a formality—it’s a necessity for safety and compliance. Texas has specific codes designed to withstand hurricane forces, including requirements for windows, doors, and roofing materials. It’s crucial that building owners ensure their properties meet these standards, not only to protect their investments but also the lives of the occupants.

Structural Integrity

The size and complexity of commercial and multifamily buildings mean that any compromise to structural integrity can have widespread repercussions. Hurricane-induced damages like roof lifts, broken windows, and flooded basements can undermine the stability of these structures. Regular inspections and maintenance are vital to identify and address any potential vulnerabilities before a hurricane strikes.

Emergency Preparedness

Having an emergency plan in place is essential for commercial and multifamily buildings. This includes evacuation routes, communication strategies, and safety measures to protect both property and people. Ensuring that residents and employees are aware of what to do in the event of a hurricane can significantly reduce chaos and potential harm.

Navigating insurance claims for hurricane damage to these types of buildings also requires special attention. The insurance claim process can differ significantly depending on whether you’re dealing with the National Flood Insurance Program (NFIP), the Texas Windstorm Insurance Association (TWIA), or typical property insurance policies. Each has its own set of rules and coverage limits that can impact the outcome of your claim.

This is where the importance of a public adjuster comes into play. A public adjuster specializes in navigating these complex processes and can be an invaluable resource in ensuring that your claim is properly documented, filed on time, and that you receive a fair settlement. They understand the intricacies of insurance policies and will advocate on your behalf, particularly when dealing with extensive damages to commercial or multifamily properties.

For commercial property owners and managers, the aftermath of a hurricane can be overwhelming. Ensuring structural integrity, adhering to building codes, and having a solid emergency preparedness plan are just the first steps. Successfully navigating the insurance claim process, with the help of a public adjuster, can help to mitigate the financial impact and speed up the recovery process for these vital community resources.

Understanding these special considerations is crucial for anyone responsible for commercial and multifamily buildings in hurricane-prone areas like Texas. The right preparation and support can make all the difference in weathering the storm and rebuilding in its aftermath.

For more detailed insights on handling hurricane damage and navigating the insurance claim process for commercial and multifamily buildings, visit Insurance Claim Recovery Support.

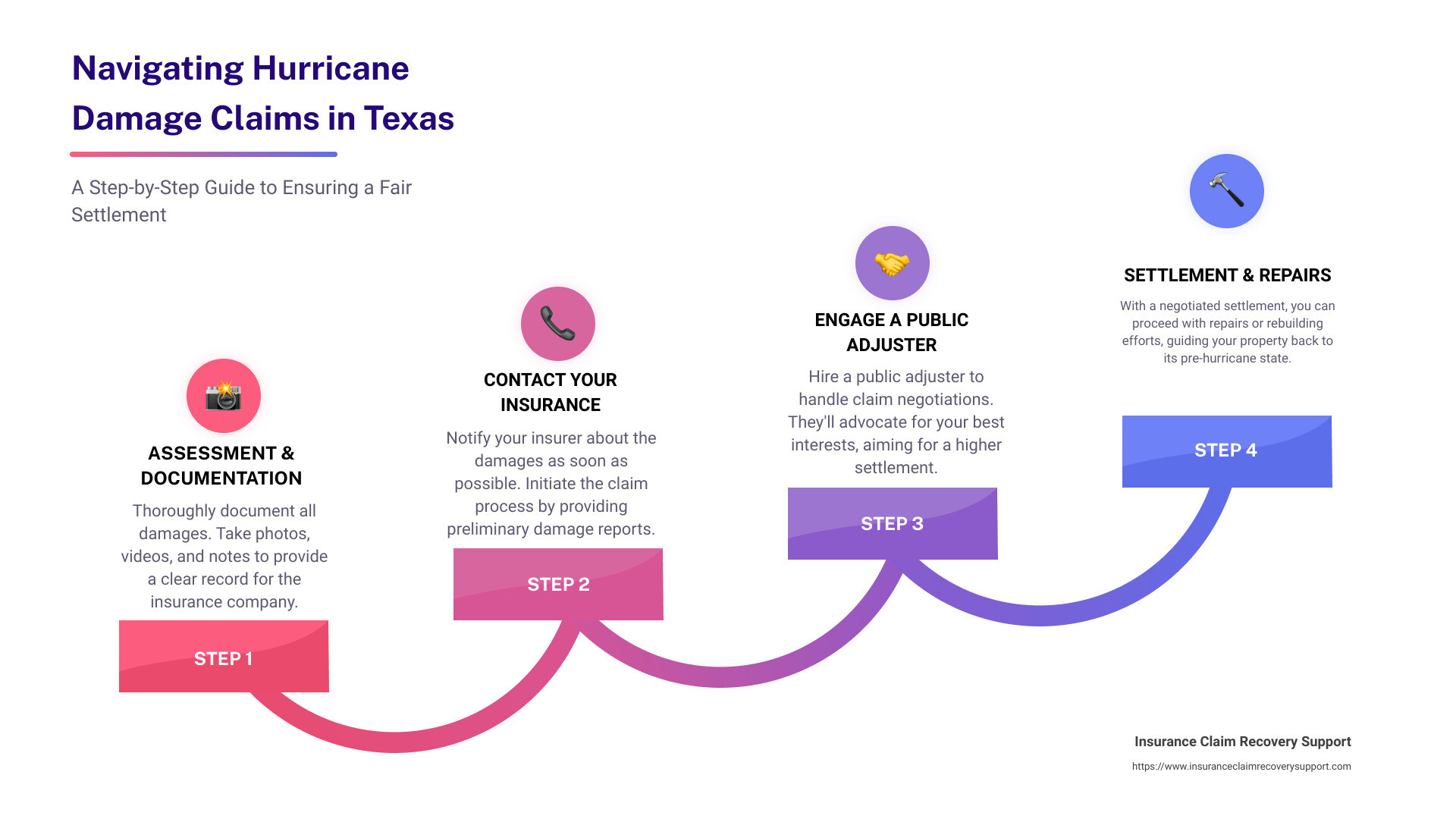

Navigating Insurance Claims for Hurricane Damage

Navigating the insurance claim process after a hurricane in Texas can be complex, especially for owners of commercial and multifamily buildings, businesses, schools, religious organizations, non-profits, industrial parks, and storage facilities. Understanding the differences between the National Flood Insurance Program (NFIP), the Texas Windstorm Insurance Association (TWIA), and typical property insurance policies is crucial. Here’s a simple guide to help you through this process.

NFIP vs. TWIA vs. Property Insurance

- NFIP: Managed by the federal government, this program provides flood insurance to property owners. It’s essential for areas at high risk of flooding but remember, it covers flood damage, not wind damage.

- TWIA: A Texas-specific program that provides windstorm and hail coverage for properties in certain coastal areas. It’s a go-to for wind damage but doesn’t cover flooding.

- Property Insurance: Standard property insurance policies typically cover a wide range of perils, including wind damage, but often exclude flood damage.

Knowing which coverage applies to your situation is the first step in navigating your claim.

Documentation

Regardless of the type of insurance, documentation is your best ally. Immediately after the storm:

- Photograph and video all damages. Detail is key.

- Keep a record of all communication with your insurance company.

- List all damaged or lost items.

This documentation is critical in supporting your claim.

Time Limits

Time is of the essence. Insurance policies have specific deadlines for filing claims. Delaying can jeopardize your claim. Start the process as soon as it’s safe to do so.

Public Adjuster Importance

This is where a public adjuster becomes invaluable. The insurance claim process for hurricane damage, particularly with commercial and multifamily buildings, involves a level of complexity that can be overwhelming. Public adjusters specialize in managing these types of claims. They can:

- Analyze your insurance policy to ensure maximum coverage.

- Estimate losses accurately, considering both immediate and long-term damages.

- Handle all documentation and communication with the insurance company.

- Negotiate with the insurance company to secure a fair and just settlement.

Public adjusters work for you, not the insurance company. Their expertise not only streamlines the claim process but also maximizes your settlement, ensuring you have the funds needed to repair or rebuild properly.

In Texas, where hurricanes can cause extensive wind and flood damage, having a professional by your side to navigate the NFIP, TWIA, and property insurance claims can be the difference between a settlement that barely covers repair costs and one that fully addresses the extent of the damage.

For property owners facing the aftermath of a hurricane, enlisting the help of a public adjuster early in the process is a strategic move. Their expertise in the specific challenges posed by hurricane damage in Texas is not just an advantage—it’s essential.

For more insights on the importance of public adjusters in the hurricane insurance claim process, visit Insurance Claim Recovery Support.

The Role of a Public Adjuster in Maximizing Your Settlement

When hurricanes strike Texas, the aftermath can be devastating, especially for commercial and multifamily buildings, businesses, schools, religious organizations, non-profits, industrial parks, and storage facilities. The damage from wind and flood waters requires expert repair. Moreover, navigating the insurance claim process, which can vary significantly between the National Flood Insurance Program (NFIP), the Texas Windstorm Insurance Association (TWIA), and typical property insurance policies, demands specialized knowledge. This is where the role of a public adjuster becomes indispensable.

Insurance Claim Recovery Support: Public adjusters play a critical role in helping policyholders navigate the complexities of insurance claims post-hurricane damage. Insurance Claim Recovery Support, a leading firm in this field, specializes in advocating for the policyholder, ensuring that your claim is not just heard but given the serious consideration it deserves.

Claim Process: The claim process for hurricane damage can be intricate and overwhelming. From documenting damage accurately to understanding what is covered under your policy, public adjusters guide you through every step. Their expertise ensures that no detail is overlooked, from initial damage assessment to the final submission of your claim.

Settlement Negotiation: One of the most challenging aspects of filing a claim is negotiating with the insurance company for a fair settlement. Public adjusters are skilled negotiators who understand the value of your loss and fight to ensure you receive a settlement that truly reflects the extent of your damages. They have the experience to counter lowball offers and expedite the negotiation process.

Policyholder Advocacy: Public adjusters serve one master: you, the policyholder. Unlike insurance company adjusters, they are on your side, working tirelessly to advocate for your interests. They understand how hurricane damage impacts not just the physical structure of your properties but your livelihood and the community you serve. By entrusting your claim to a public adjuster, you’re ensuring that your voice is heard, your rights are protected, and your recovery is prioritized.

Given the complexities of hurricane damage claims in Texas, especially for commercial and multifamily properties, and the specialized insurance processes involved, the importance of having a public adjuster by your side cannot be overstated. They not only aim to maximize your settlement but also alleviate the stress and burden of the claim process, allowing you to focus on rebuilding and recovery.

For businesses and organizations affected by hurricane damage in Texas, engaging a public adjuster early can be a game-changer. Insurance Claim Recovery Support offers the expertise and advocacy needed to navigate these challenging times.

For more information on how a public adjuster can help maximize your hurricane damage settlement, visit Insurance Claim Recovery Support.

Frequently Asked Questions about Hurricane Property Damage

What steps should I take immediately after hurricane damage?

- Safety First: Ensure everyone is safe. Check for injuries and seek medical attention if needed.

- Document the Damage: Take photos and videos of all the damages to your property, inside and out. This evidence is crucial for your insurance claim.

- Prevent Further Damage: Cover broken windows, dry out wet areas, and make temporary repairs. Keep receipts of any expenses.

- Notify Your Insurance Company: Report the damage to your insurer as soon as possible. They will guide you on the next steps.

How does the insurance claim process differ for commercial properties?

Commercial properties, including businesses, schools, and industrial parks, often have complex insurance policies that cover a wide range of assets and potential losses. Unlike residential claims:

- More Complex Policies: Commercial policies can include business interruption, property damage, and liability coverage.

- Higher Stakes: The financial impact of hurricane damage on commercial properties can be significant, affecting revenue and operational continuity.

- Documentation Requirements: Extensive documentation of both the physical damage and the financial impact (like lost sales or revenue) is necessary.

- Different Insurers: Commercial properties might deal with the National Flood Insurance Program (NFIP), Texas Windstorm Insurance Association (TWIA), or private insurers, each with its own claim process.

Why is a public adjuster crucial for handling hurricane damage claims?

Public adjusters play a vital role, especially when dealing with hurricane damage to commercial and multifamily buildings. Here’s why:

- Expertise: They understand the intricacies of commercial insurance policies and can help navigate the complex claim process.

- Advocacy: Public adjusters work for you, not the insurance company. Their goal is to ensure you receive the maximum settlement possible.

- Time-Saving: They manage the claim process, allowing you to focus on rebuilding and getting back to business.

- Negotiation Skills: Experienced in dealing with insurance companies, they can effectively negotiate on your behalf.

After hurricane damage, the path to recovery can be overwhelming. Public adjusters like Insurance Claim Recovery Support are invaluable in guiding you through the insurance maze, ensuring your property is repaired properly and you receive the compensation you deserve.

For expert help with your hurricane damage claim, consider reaching out to Insurance Claim Recovery Support.

Conclusion

Hurricanes in Texas have left an indelible mark on the state, causing billions in damages and impacting lives across countless communities. From the harrowing tales of Hurricane Harvey to the constant threat of new storms each hurricane season, Texans understand the importance of being prepared and protecting their properties. However, when disaster strikes, knowing how to navigate the aftermath is crucial.

For commercial and multifamily buildings, businesses, schools, religious organizations, non-profits, industrial parks, and storage facilities, the damage caused by hurricanes can be especially challenging. Wind and floodwaters can compromise structural integrity, necessitate roof repairs, and disrupt operations, often requiring a nuanced understanding of different insurance policies, from the National Flood Insurance Program (NFIP) to the Texas Windstorm Insurance Association (TWIA), and standard property insurance.

In these complex situations, having an expert by your side makes all the difference. **** stands ready to assist Texas property owners in navigating the insurance claim process, ensuring that wind and flood damages are repaired properly and that settlements are maximized. Our team of public adjusters specializes in understanding the intricacies of NFIP, TWIA, and typical property insurance policies, making us your indispensable ally in the face of hurricane damage.

We understand that each claim is unique, especially when it involves commercial and multifamily properties. Thus, we tailor our approach to meet the specific needs of your situation, providing personalized support every step of the way. Our expertise not only lies in accurately assessing the damage and preparing comprehensive claims but also in advocating for your rights as a policyholder, negotiating with insurance companies on your behalf to secure the compensation you rightfully deserve.

The road to recovery after a hurricane can be long and fraught with challenges. Yet, with **** by your side, you can rest assured that your property and your interests are in capable hands. We are dedicated to helping Texas property owners rebuild and recover, ensuring that the process is as smooth and stress-free as possible.

For Texas property owners facing the daunting task of hurricane damage recovery, remember: you don’t have to go it alone. Harness the expertise and support of a dedicated public adjuster to navigate the complex insurance landscape and secure a fair settlement.

Let us be your guide and advocate through the recovery process. Discover more about how can assist you today.

When facing the aftermath of a hurricane, being prepared and having knowledgeable support is key to overcoming the challenges. Insurance Claim Recovery Support, with our team of dedicated public adjusters based right in Texas, is your steadfast ally. We are fully committed to helping you navigate the storm’s aftermath, ensuring you’re well-equipped to rebuild and recover.