When disaster strikes your property in the Lone Star State, finding a public insurance adjuster Texas can be your best move. These professionals work on your behalf to handle insurance claims for property damages, ensuring you receive a fair settlement. Here’s a quick way to get started:

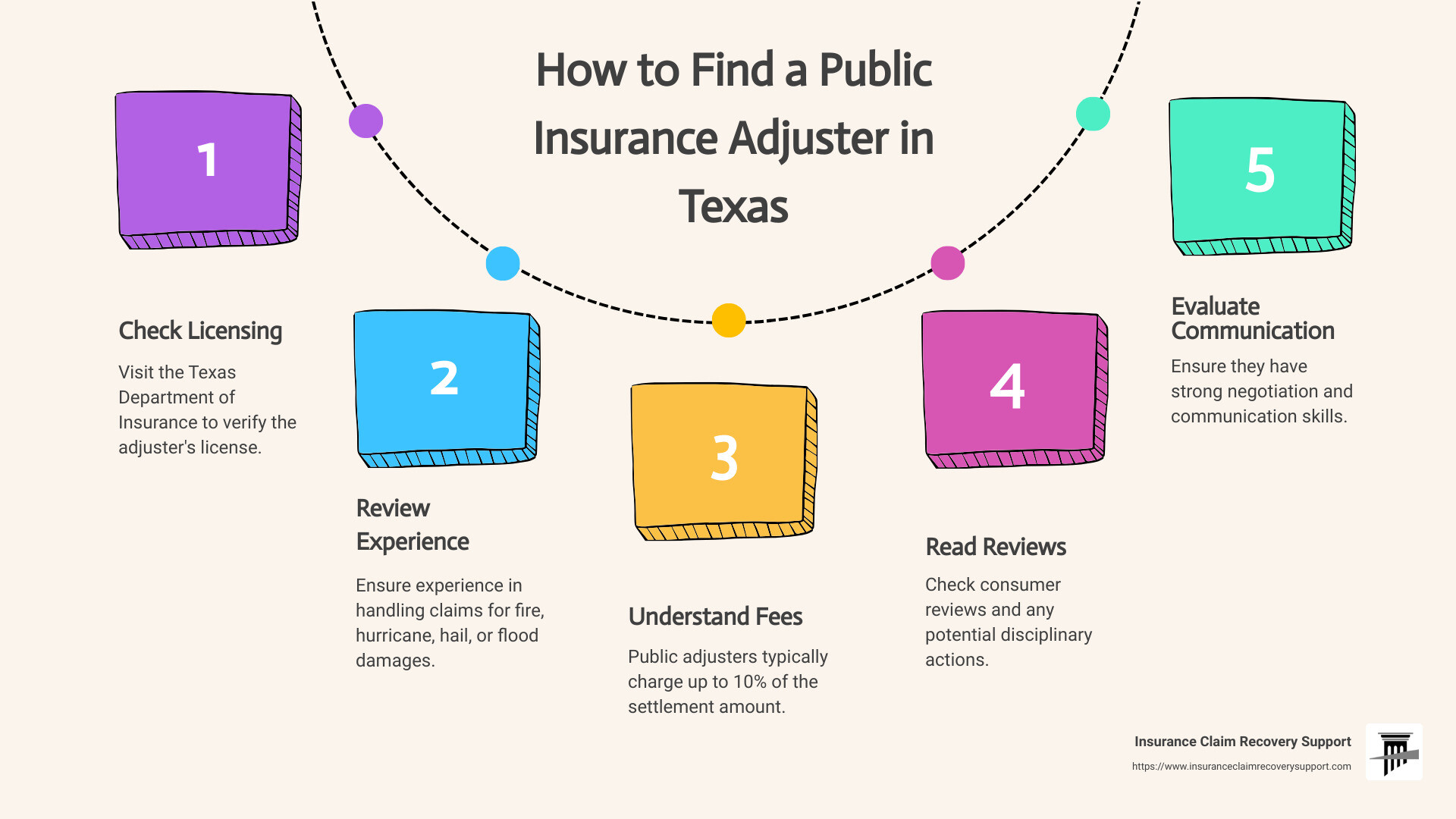

- Locate a Licensed Adjuster: Check the Texas Department of Insurance for licensed public adjusters.

- Review Experience: Look for those with experience in fire, hurricane, hail, or flood claims, depending on your situation.

- Understand Costs: They’re typically paid a fee of up to 10% of the settlement.

- Check Reviews: Read reviews and potential disciplinary actions.

I’m Scott Friedson, your expert guide in navigating the complexities of property damage claims in Texas. With over 500 large loss claims settled, I bring a wealth of experience in maximizing insurance claim settlements as a public insurance adjuster Texas.

Know your public insurance adjuster Texas terms:

– Texas public adjuster hurricane damage

– hurricane texas

– public adjuster fire claims

Understanding the Role of a Public Insurance Adjuster in Texas

When you’re dealing with property damage, understanding the role of a public insurance adjuster Texas is crucial. These professionals are your personal advocates in the insurance claims process, working to ensure you receive the settlement you deserve.

Claims Process

A public insurance adjuster handles the entire claims process for you. They document the damage, estimate repair costs, and prepare all necessary paperwork. This means you don’t have to worry about the complexities and can focus on rebuilding your life. Their expertise ensures that every detail is covered, which can make a significant difference in the final settlement amount.

TDI Licensing

In Texas, public adjusters must be licensed by the Texas Department of Insurance (TDI). This licensing is important because it ensures that the adjuster has passed the rigorous Texas All Lines Insurance Adjuster exam and complies with state regulations. This is your assurance of their competence and integrity. Always verify the adjuster’s license through the TDI to ensure you’re working with a qualified professional.

Negotiation Skills

One of the most valuable skills a public insurance adjuster brings is their ability to negotiate effectively. Insurance policies can be full of complicated terms and loopholes that might not work in your favor. A skilled adjuster knows how to interpret these policies and negotiate with the insurance company to get a settlement that covers your losses adequately. This negotiation process can be daunting, but with an expert on your side, you can rest assured that someone is fighting for your best interests.

Understanding these roles and skills can help you see why hiring a public insurance adjuster Texas can be a game-changer in handling your property damage claims. In the next section, we’ll explore how to find the right public insurance adjuster in Texas quickly and efficiently.

Steps to Find a Public Insurance Adjuster in Texas

Finding the right public insurance adjuster Texas can make a big difference in your insurance claim process. Here’s how to ensure you choose the best one for your needs.

Check Consumer Reviews

Start by looking at what others have to say. Consumer reviews can provide valuable insights into a public adjuster’s reliability and performance. Look for feedback on their thoroughness, communication, and results. Websites like Yelp and Google are good places to start. Pay attention to patterns in the reviews. Consistent praise is a good sign, while recurring complaints should raise concerns.

Investigate TDI Complaints

The Texas Department of Insurance (TDI) is a critical resource for checking complaints. While it’s normal for businesses to have a few complaints, a pattern of issues is a red flag. You can call TDI’s Help Line or visit their website to check a public adjuster’s complaint record. This step helps you avoid adjusters with a history of unresolved problems.

Look for Disciplinary Actions

TDI also records any disciplinary actions against public adjusters. This could include fines, suspensions, or license revocations. Knowing this history helps you steer clear of adjusters who might not adhere to professional standards. It’s essential to choose someone with a clean record to ensure they will handle your claim ethically and effectively.

By focusing on these steps, you can confidently select a public insurance adjuster Texas who will advocate for you and help steer the complexities of your insurance claim. In the next section, we’ll evaluate the costs and benefits of hiring a public insurance adjuster, ensuring you understand the financial aspects involved.

Evaluating Costs and Benefits

When considering hiring a public insurance adjuster in Texas, it’s crucial to weigh the costs against the potential benefits. This decision can significantly impact the outcome of your insurance claim.

The 10% Fee

Public adjusters in Texas typically charge a fee of up to 10% of the settlement amount. At first, this might seem like a hefty price. But remember, this fee is for their expertise and ability to steer the often complex world of insurance claims.

Higher Settlement Potential

One of the main benefits of hiring a public adjuster is their ability to secure a higher settlement. These professionals are skilled negotiators who understand the intricacies of insurance policies and have the experience to ensure you receive the maximum payout possible. Even after paying their fee, you might end up with more money than if you handled the claim yourself.

The Role of the Deductible

Hiring a public adjuster doesn’t eliminate your deductible. This is a fixed amount you must pay out of pocket, regardless of the claim’s outcome. However, with a higher settlement, the impact of the deductible can feel less burdensome.

Weighing the Pros and Cons

Without a public adjuster, you might miss out on entitled benefits due to unfamiliarity with the claims process. With one, you pay a fee, but often secure a larger settlement. This makes hiring a public adjuster a valuable investment, especially for complex claims.

In the next section, we’ll discuss when it’s most beneficial to hire a public insurance adjuster, focusing on large claims and complex situations.

When to Hire a Public Insurance Adjuster

Deciding when to hire a public insurance adjuster in Texas can be crucial for maximizing your claim. Here are key situations where their expertise can make a big difference:

Large Claims

When your property suffers severe damage, the stakes are high. Large claims can feel overwhelming because they involve more than just immediate repairs. They also concern your financial stability. A public adjuster brings experience and knowledge to these substantial claims, ensuring you aren’t short-changed by the insurance company. The bigger the claim, the more you stand to gain—or lose.

Complex Situations

Sometimes, property damage isn’t straightforward. You might face multiple types of damage, such as water, fire, and mold, all from the same incident. Or, the damage could reveal pre-existing issues that complicate your claim. In these cases, a public adjuster is invaluable. They have the experience to steer these complexities, ensuring every aspect of your claim is properly addressed.

Ambiguous Policy Language

Insurance policies are known for their dense and confusing language. What’s covered and what isn’t can become subjects of intense debate. A public adjuster is skilled in interpreting these policies. They can clarify ambiguities and argue for a broader interpretation of coverage, often identifying benefits you might have overlooked.

Hiring a public insurance adjuster is about ensuring you have an expert advocate on your side. Their goal is to see that you receive the maximum entitlement under your policy, whether that involves negotiating for a higher settlement, clarifying complex policy language, or managing the intricacies of a large claim.

In the next section, we’ll address some frequently asked questions about public insurance adjusters in Texas, including costs and the process of becoming one.

Frequently Asked Questions about Public Insurance Adjusters in Texas

How much does a public adjuster charge in Texas?

In Texas, a public insurance adjuster typically charges a fee that is a percentage of the final settlement. By law, this fee cannot exceed 10% of the total claim amount. This means if your insurance settlement is $100,000, the public adjuster’s fee would be up to $10,000. This fee structure aligns the adjuster’s interests with yours, as they are motivated to maximize your claim. Always ensure that the fee agreement is clearly outlined in your contract before proceeding.

How long does it take to become a public adjuster in Texas?

Becoming a licensed public adjuster in Texas involves several steps. First, candidates must pass a licensing exam, which tests their knowledge of insurance policies and state regulations. After passing the exam, they must undergo a fingerprint background check. This process ensures that only qualified and trustworthy individuals can become public adjusters. The entire process can take several months, depending on how quickly each step is completed. It’s a rigorous journey designed to maintain high professional standards in the industry.

Is using a public adjuster a good idea?

Absolutely. Hiring a public insurance adjuster in Texas can be a wise decision, especially for large or complex claims. Public adjusters bring expert negotiation skills to the table, often resulting in higher settlements than policyholders might achieve on their own. They understand the nuances of insurance policies and can effectively advocate for your best interests. If you’re feeling overwhelmed by the claims process or unsure about the settlement offered by your insurer, a public adjuster can provide invaluable assistance. Their expertise can ensure that you receive the maximum compensation you are entitled to under your policy.

In the next section, we’ll wrap up with insights into how Insurance Claim Recovery Support can be your expert advocate in Texas, ensuring you get the settlement you deserve.

Conclusion

Navigating the complexities of insurance claims in Texas can be daunting, especially when you’re dealing with significant property damage. This is where Insurance Claim Recovery Support steps in as your expert advocate. We specialize in representing policyholders, ensuring you receive the maximum settlement you deserve.

Our team of licensed public insurance adjusters is dedicated to serving Texas homeowners and business owners. We bring a wealth of knowledge and negotiation skills to the table, making sure your interests are protected. From fire and storm damage in cities like Austin, Dallas, and Houston, to challenges faced in Waco and Lubbock, we are here to support you through every step of the claims process.

Why choose us? We work exclusively for you, not the insurance company. Our commitment is to maximize your claim payout while minimizing your stress. We understand the intricacies of insurance policies and use this expertise to advocate for your best interests.

Whether you’re dealing with hurricane damage or other property losses, our goal is to ensure you get a fair and just outcome. We invite you to learn more about how we can assist you by visiting our hurricane loss types page.

Let us be your ally in the insurance claims process. With Insurance Claim Recovery Support, you’re not just hiring an adjuster; you’re gaining a partner committed to your recovery.