If you’re reading this, you’re likely navigating the complex world of insurance claims due to property damage in Texas. Understanding whether a Texas public adjuster is right for you is crucial, especially if you’re dealing with substantial damage to commercial buildings, multifamily complexes, or other significant properties. A Texas public adjuster works exclusively for you, not the insurance company, aiming to ensure you receive the highest possible settlement for your claim.

Public adjusters are licensed professionals in Texas, skilled in navigating the intricacies of insurance policies and claims. They advocate on your behalf, taking the burden of proof off your shoulders and directly dealing with insurance companies to secure the best outcome for your claim. If your property has suffered damage due to fire, hail, or any natural disaster, and you’re feeling overwhelmed by the insurance claim process, a public adjuster might be the solution you need.

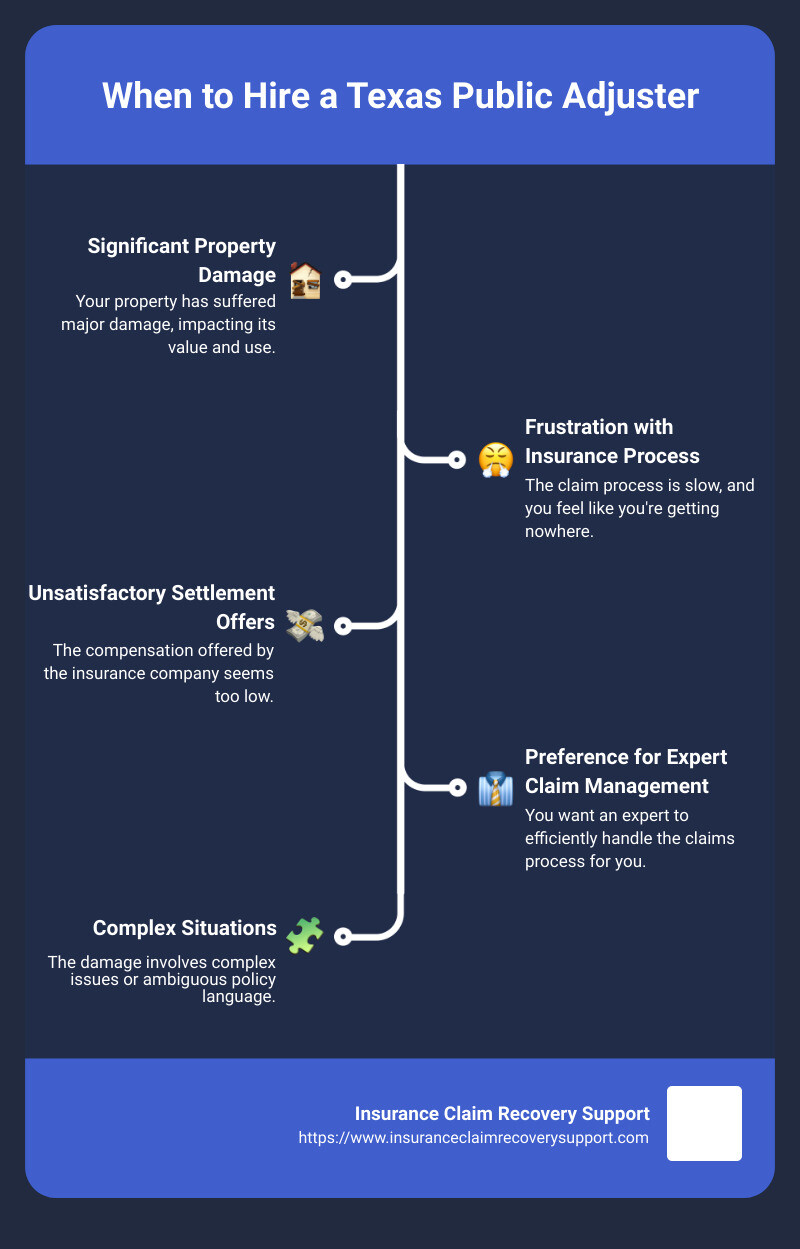

In a nutshell, here’s when it makes sense to consider hiring one:

- You’ve experienced significant property damage.

- You’re frustrated with the slow or unresponsive insurance claim process.

- You feel the insurance company’s offer is less than what you deserve.

- You prefer an expert to manage the claim process efficiently and effectively.

The decision to hire a Texas public adjuster should be informed and deliberate. This introduction serves to guide you through recognizing when their services could be pivotal in transforming your insurance claim experience.

Understanding the Role of a Texas Public Adjuster

When disaster strikes, navigating the aftermath can be overwhelming. This is where a Texas public adjuster steps in, becoming a pivotal ally in managing your insurance claim. Let’s break down their role, focusing on the claims process, TDI licensing, and negotiation skills.

Claims Process

A Texas public adjuster is essentially your personal advocate during the insurance claims process. They take on the heavy lifting of documenting the damage, accurately estimating repair costs, and preparing the necessary paperwork. Their goal? To ensure you get a fair settlement from your insurance company.

TDI Licensing

Why does licensing matter? The Texas Department of Insurance (TDI) sets high standards for public adjusters to ensure they are knowledgeable and act in good faith. A licensed adjuster means you’re getting someone who has passed the rigorous Texas All Lines Insurance Adjuster exam and adheres to state regulations. This is your assurance of their expertise and integrity.

Negotiation Skills

Perhaps one of the most valuable assets a Texas public adjuster brings to the table is their negotiation skills. Insurance policies can be complex, filled with jargon and loopholes that might work against you. A skilled adjuster interprets these policies, using their knowledge to argue for a settlement that covers your losses adequately.

Why does this matter to you?

Imagine you’re dealing with significant property damage. The stress of the situation can make it hard to think clearly, let alone haggle with an insurance company. A Texas public adjuster takes this burden off your shoulders. They deal with the insurance company, fighting for your rights, so you can focus on rebuilding.

A Texas public adjuster is more than just a middleman. They are your advocate, guide, and expert negotiator, working tirelessly to ensure your insurance claim is settled fairly and promptly. With their help, you can navigate the often confusing and frustrating claims process with confidence, backed by the assurance of their TDI licensing and negotiation prowess.

As we delve deeper into the intricacies of choosing the right public adjuster for your needs, the goal is to find someone who not only understands the ins and outs of insurance policies but also has your best interest at heart.

Evaluating the Cost and Benefits

When considering hiring a Texas public adjuster, it’s critical to weigh both the costs and potential benefits. This decision can significantly impact the outcome of your insurance claim. Let’s break it down in simple terms.

10% Fee

The most common concern for many is the fee. In Texas, public adjusters can charge up to 10% of the settlement amount. At first glance, this might seem like a big chunk of your potential payout. However, it’s important to see this fee in the context of the value they bring.

Higher Settlement

Public adjusters are seasoned professionals in negotiating with insurance companies. Their expertise often results in a higher settlement than you might achieve on your own. This isn’t just talk; it’s backed by their understanding of insurance policies, damage assessment skills, and negotiation experience. Even after their fee, the final amount you receive can be significantly higher, making their service a valuable investment.

Deductible

Hiring a public adjuster doesn’t eliminate the need to pay your deductible. This is a fixed cost that comes out of your pocket regardless of the claim’s outcome. However, a skilled adjuster can help maximize your claim in such a way that the pain of the deductible feels less impactful.

The Bottom Line

Here’s a simple way to look at it:

-

Without a Public Adjuster: You handle the claim on your own, potentially missing out on entitled benefits due to unfamiliarity with the process, resulting in a lower settlement.

-

With a Public Adjuster: You pay a 10% fee, but your settlement could be significantly higher, thanks to their expertise. Even after their fee, you could come out ahead.

Hiring a Texas public adjuster is about investing in the potential to significantly increase your claim’s value. It’s not just about the money; it’s about the peace of mind that comes from knowing a professional is advocating for your best interest, navigating the complexities of insurance claims on your behalf.

Keep these cost-benefit considerations in mind. The right public adjuster can be a game-changer in your claim process, turning a daunting situation into a manageable one with potentially better financial outcomes.

Next, we’ll explore the process of becoming a public adjuster in Texas, shedding light on what makes these professionals well-equipped to handle your claim.

The Process of Becoming a Public Adjuster in Texas

Becoming a Texas public adjuster is a journey that requires dedication, study, and a clear understanding of the insurance industry. Let’s dive into the key steps involved in this process.

Licensing Exam

First and foremost, anyone aspiring to become a public adjuster in Texas must pass the licensing exam. This exam tests your knowledge on a wide range of topics related to insurance adjusting. From general insurance concepts to specific Texas laws and regulations, it covers everything you need to know to work effectively as a public adjuster.

The exam is not just a formality; it’s designed to ensure that all public adjusters have the necessary skills and knowledge to handle claims ethically and efficiently. Preparing for this exam often involves enrolling in courses or study programs.

AdjusterPro

One popular resource for exam preparation is AdjusterPro. This platform offers comprehensive courses tailored to the Texas public adjuster exam. AdjusterPro’s courses are known for their depth, covering all the material you’ll need to know in a structured and understandable way. Many successful public adjusters in Texas started their journey with AdjusterPro, leveraging its resources to pass the exam on their first attempt.

Fingerprint Background Check

After passing the exam, the next step is the fingerprint background check. This requirement ensures that all licensed public adjusters in Texas have a clean criminal record, both at the state and federal levels. The process involves scheduling an appointment with an approved provider, such as IdentoGO, and submitting your fingerprints electronically.

This background check is a crucial step in maintaining the integrity of the insurance adjusting profession in Texas. It reassures clients and insurance companies alike that Texas public adjusters are trustworthy and have been thoroughly vetted.

Becoming a Texas public adjuster is a process that demands a significant investment of time and effort. However, the rewards of this profession are well worth it. Not only do public adjusters play a crucial role in helping policyholders navigate the complexities of insurance claims, but they also enjoy the satisfaction of knowing they’ve made a real difference in their clients’ lives.

It’s important to remember that the journey to becoming a public adjuster doesn’t end with passing the exam and clearing the background check. Continuous learning and adherence to ethical standards are essential for long-term success in this field.

When to Consider Hiring a Public Adjuster

When you’re staring down the aftermath of property damage, the path forward can seem daunting. Insurance claims involve a maze of paperwork, deadlines, and negotiations that can overwhelm even the most organized individuals. This is where a Texas public adjuster steps in, turning the tide in your favor. But when exactly should you consider bringing one on board? Let’s break it down into simple terms.

Large Claims: If your property has sustained significant damage, the stakes are high. Large claims are not just about the immediate repairs; they’re about ensuring your financial stability in the long run. A Texas public adjuster brings expertise in handling substantial claims, ensuring that you’re not short-changed by your insurance company. The bigger the claim, the more you have to gain—or lose.

Complex Situations: Sometimes, property damage isn’t straightforward. You might be dealing with multiple types of damage, such as water, fire, and mold, all from the same incident. Or perhaps the damage has revealed pre-existing issues that complicate your claim. In these complex situations, a public adjuster is invaluable. They have the experience to navigate these complexities, ensuring that every aspect of your claim is properly addressed.

Ambiguous Policy Language: Insurance policies are notorious for their dense and convoluted language. What’s covered and what’s not can become subjects of intense debate. A Texas public adjuster is skilled in interpreting insurance policies. They can clarify ambiguities and argue for a broader interpretation of coverage, often identifying benefits that you might have overlooked.

Hiring a Texas public adjuster is about ensuring that you have an expert advocate on your side. They work for you, not the insurance company. Their goal is to see that you receive the maximum entitlement under your policy, whether that involves negotiating for a higher settlement, clarifying complex policy language, or managing the intricacies of a large claim.

As we’ve seen, the journey of a public adjuster is one of continuous learning and ethical practice. When faced with the challenges of a significant insurance claim, their expertise can be the key to unlocking the settlement you deserve. Moving forward, it’s crucial to understand how to choose the right public adjuster for your needs, ensuring that you have the best possible advocate in your corner.

How to Choose the Right Public Adjuster for Your Needs

Choosing the right Texas public adjuster can feel like looking for a needle in a haystack. But, it doesn’t have to be. Here’s how you can simplify the process and ensure you’re making the best choice for your situation.

Check Consumer Reviews

Start with what others are saying. Consumer reviews can provide valuable insights into a public adjuster’s performance and reliability. Look for patterns in the feedback. Are clients consistently praising their thoroughness, communication, and results? Or are there recurring complaints? Websites like Yelp or Google can be good starting points for gathering this information.

Investigate TDI Complaints

The Texas Department of Insurance (TDI) is your go-to resource for checking if any complaints have been filed against a public adjuster. It’s normal for businesses to have one or two complaints, but a pattern of issues should raise red flags. You can call TDI’s Help Line or visit their website to check a public adjuster’s complaint record.

Look for Disciplinary Actions

TDI also records any disciplinary actions taken against public adjusters. This could include fines, suspensions, or revocations of their license. Knowing this history helps you steer clear of adjusters who might not adhere to professional standards.

Contract Negotiation

Before signing a contract with a Texas public adjuster, make sure you understand what you’re agreeing to. Here are a few key points to consider:

– Fees: Public adjusters in Texas can charge up to 10% of your claim settlement. However, fees can sometimes be negotiable. Don’t be afraid to discuss this with your adjuster.

– Services: Ensure the contract clearly outlines the services the adjuster will provide. This should include inspecting the damage, estimating repair costs, and negotiating with your insurance company.

– Timeframe: Ask how long the adjuster expects the process to take. While they might not be able to give you an exact timeline, a rough estimate can help set your expectations.

You have 72 hours after signing a contract to change your mind. Use this time to review the agreement thoroughly and ensure you’re comfortable with all its terms.

Choosing the right Texas public adjuster is about doing your homework and asking the right questions. By focusing on consumer reviews, checking for complaints and disciplinary actions with TDI, and carefully reviewing your contract, you can feel confident in your decision. This way, you ensure that you have a skilled and reliable advocate working on your behalf, navigating the complexities of your insurance claim.

Frequently Asked Questions about Texas Public Adjusters

When considering hiring a Texas public adjuster, several common questions arise. Understanding these aspects can help you make an informed decision about whether to engage with a public adjuster for your insurance claim. Let’s dive into these frequently asked questions.

How much does a public adjuster charge in Texas?

In Texas, public adjusters typically charge a percentage of the claim payout. This fee structure means that the adjuster’s payment is directly tied to the final settlement amount they secure for you. The industry standard is to charge 10% of the total claim amount. However, by law, this fee cannot exceed 10% of the claim’s total value. It’s essential to discuss and agree upon the fee upfront, ensuring it is detailed in writing within your contract. Investing in a public adjuster can often lead to a significantly higher settlement, which can offset the cost of their fee.

How long does it take to become a public adjuster in Texas?

Becoming a licensed public adjuster in Texas involves several steps, including passing an exam and undergoing a fingerprint background check. The time it takes to complete these requirements can vary. After studying and preparing for the exam, candidates must schedule and pass the exam through Pearson VUE. Following the exam, the fingerprint background check and application submission process must be completed. Overall, the process from start to finish can take several months, depending on how quickly each step is completed. It’s a rigorous process, ensuring that only qualified individuals can serve as public adjusters in Texas.

Is using a public adjuster a good idea?

Absolutely. Hiring a Texas public adjuster can be incredibly beneficial, especially for large, complex claims or when policy language is ambiguous. A public adjuster works exclusively on your behalf, aiming to secure the best possible settlement. They bring expertise in navigating the claims process, negotiating with insurance companies, and understanding policy details that might not be immediately clear. If you’re feeling overwhelmed by your claim, unsure about the settlement offered by your insurance, or simply want the assurance that you’re getting the maximum entitlement, a public adjuster can be invaluable. Their involvement often leads to faster claim resolution and higher payouts, making their service a wise investment for many policyholders.

The right time to bring a public adjuster into your claim process is as early as possible. This ensures they can guide the claim from the start, advocating for your best interests every step of the way.

Conclusion

In the maze of insurance claims, especially in the wake of property damage, navigating the process can feel daunting. This is where the expertise of a Texas public adjuster becomes invaluable. At Insurance Claim Recovery Support, we’ve dedicated ourselves to standing by Texas homeowners and business owners, ensuring they’re not alone in this complex journey.

Our team of licensed Texas public adjusters brings to the table a wealth of knowledge, negotiation skills, and a deep understanding of insurance policies and the claims process. We’re not just here to guide you; we’re here to fight for what you rightfully deserve. From the initial evaluation of your property damage to the final settlement negotiation, our goal is to ensure you receive a fair and just outcome.

Why Choose Us?

- Expertise: Our adjusters are licensed and continuously educated to stay on top of the latest in claim adjustment standards and practices.

- Advocacy: We work solely for you, not the insurance company. Our mission is to ensure your interests are protected and advocated for.

- Results: We have a proven track record of securing higher payouts for our clients, thanks to our meticulous approach to claim preparation and negotiation.

Choosing the right Texas public adjuster can make a significant difference in the outcome of your insurance claim. With Insurance Claim Recovery Support, you’re not just getting an adjuster; you’re gaining a partner who is as invested in your recovery as you are. We understand the challenges and frustrations that come with filing a claim, and we’re here to shoulder that burden for you.

The sooner you bring us into the process, the more effectively we can advocate for your interests. Whether you’re facing a complex claim, dealing with ambiguous policy language, or simply want the peace of mind that comes with having an expert on your side, we’re here to help.

Insurance claims don’t have to be a battle you face alone. Let us stand by your side and fight for the settlement you deserve. To learn more about how we can assist you, visit our service page. Together, we can navigate the claims process and work towards a swift and favorable resolution.

Insurance Claim Recovery Support—your ally in navigating the complexities of insurance claims in Texas.