Understanding the Government Building Claims Process

When you slip on a freshly waxed floor at your local post office or a ceiling tile crashes down on your desk at the county clerk’s office, you’re facing more than just an ordinary accident. You’re entering the complex world of government building claims.

These claims involve seeking compensation for injuries or property damage that happens on government property. But unlike dealing with a private business, you can’t just call an insurance company and expect a quick settlement. Government entities play by different rules.

Quick Guide to Government Building Claims

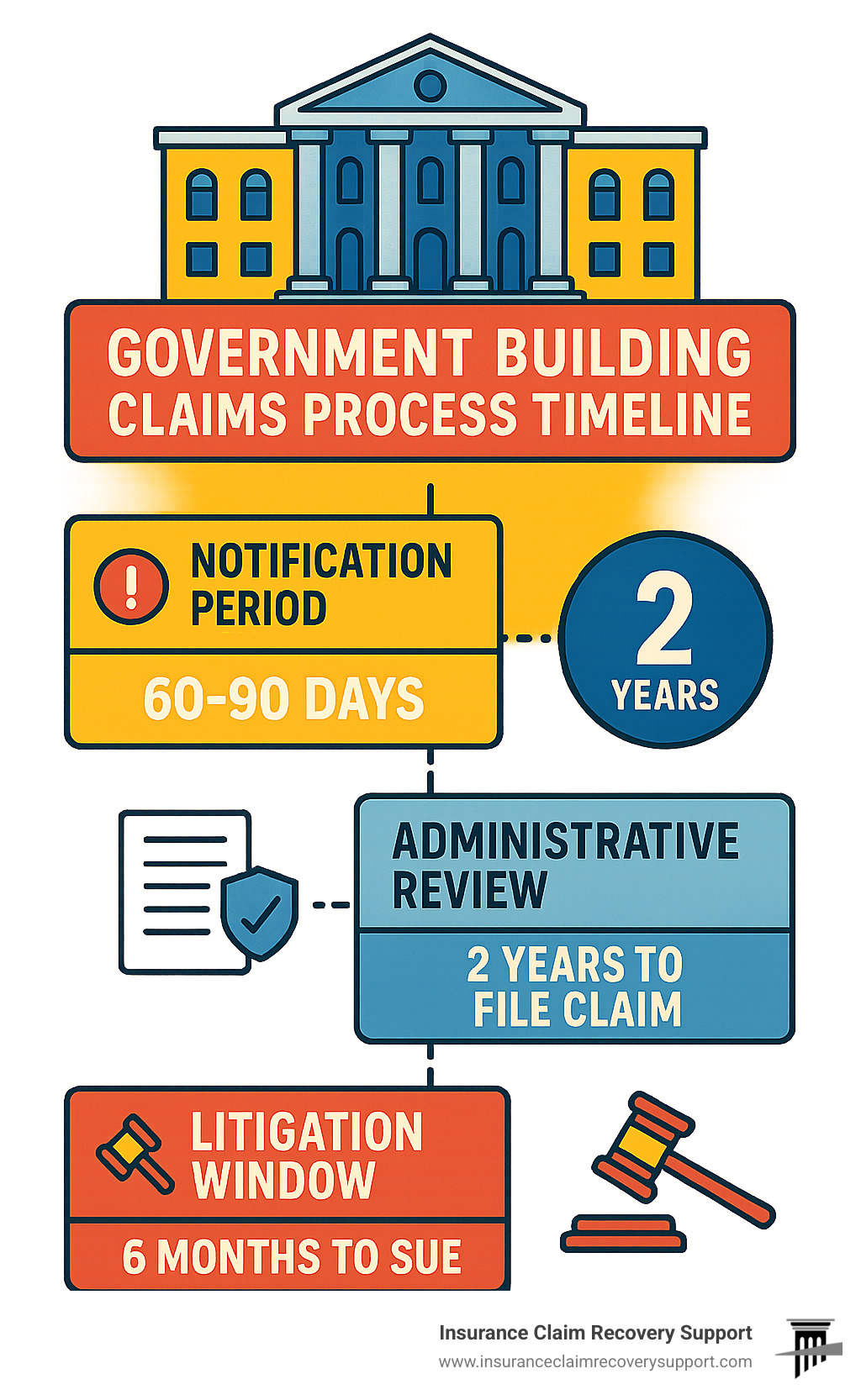

1. Time Sensitivity: Most claims must be filed within 2 years, but notice periods can be as short as 60-90 days

2. Sovereign Immunity: Government entities have special protections requiring specific claim procedures

3. Documentation Required: Incident reports, medical records, repair estimates, and witness statements

4. Administrative First: Most claims require an administrative filing before any lawsuit

5. Damage Caps: Recovery amounts are often limited by statute

What makes these claims tricky is something called sovereign immunity – an age-old legal principle that essentially says “you can’t sue the king.” In modern terms, it means governments are protected from lawsuits unless they specifically allow them. Thankfully, both federal and state governments have created pathways for legitimate claims through specific laws.

At the federal level, the Federal Tort Claims Act (FTCA) opens the door for people injured by federal employees’ negligence. Instead of heading straight to court, you’ll start with an administrative claim – typically using Standard Form 95 – where you’ll detail what happened and exactly how much compensation you’re seeking. The government then gets up to six months to investigate before you can consider filing a lawsuit.

Falls are surprisingly common in government buildings, accounting for 33 percent of all preventable injuries according to the National Safety Council. But government building claims also frequently involve vehicle accidents with government vehicles, water damage from maintenance issues, and injuries in public spaces like parks or military installations.

I’ve seen how challenging these claims can be. As Scott Friedson, a multi-state licensed public adjuster who has settled hundreds of millions in commercial property damage claims, I’ve helped numerous clients steer the maze of federal and municipal regulations. Many of my clients have managed to overturn wrongfully denied claims and secure settlements up to 3,800% higher than initially offered.

If you’re dealing with damage to your property caused by a government building issue, you might also find these resources helpful:

– building insurance claim process

– fire damage claims Houston

Understanding the basics of government building claims is your first step toward fair compensation. In the sections that follow, we’ll break down exactly how to steer this process successfully, from documentation to deadlines and beyond.

Navigating Government Building Claims: Key Definitions & Liability

Understanding government building claims feels like learning a new language at first. Don’t worry – I’m here to walk you through the unique landscape that makes these claims different from your typical insurance process.

Sovereign Immunity: The Starting Point

Ever heard someone say “you can’t fight city hall”? That saying stems from sovereign immunity – the legal principle that shields government entities from being sued without their consent. This centuries-old doctrine essentially declared “the king can do no wrong,” and today it protects federal, state, and local governments from unlimited lawsuits.

I recently spoke with a claims officer during a municipal building claim in San Antonio who put it nicely: “Sovereign immunity isn’t about avoiding responsibility—it’s about ensuring government functions aren’t disrupted by unlimited litigation.”

Waiver Exceptions: When You Can File a Claim

The good news? Most governments have created specific pathways for legitimate claims:

The Federal Tort Claims Act (FTCA) opens the door for claims against federal agencies when their employees cause harm while doing their jobs. Similarly, the Texas Tort Claims Act allows claims against state government entities, though with strict limitations and notice requirements. Cities and counties often have their own municipal liability statutes that spell out exactly how to file claims against local government properties.

Scope of Employment: A Critical Element

For your government building claim to succeed, you’ll need to show that a government employee was acting “within the scope of employment” when the negligence occurred.

Think of it this way: If you slip on ice at the post office because a federal employee didn’t clear the walkway, that’s potentially a valid claim. But if a postal worker slips on ice at your business, that’s not a government building claim – it’s the reverse scenario.

Premises Liability in Government Buildings

Government entities that own or control buildings must maintain reasonably safe premises for visitors. The most common issues we see include slippery floors without warning signs, broken stairs or handrails, poor lighting in stairwells, falling ceiling materials, and malfunctioning elevators.

According to CDC research on falls, these environmental hazards cause thousands of preventable injuries in public buildings each year. What’s particularly challenging is proving the government knew (or should have known) about the hazardous condition.

Natural Disaster Damage to Government Buildings

Here in Texas, where hurricanes and tornadoes are unfortunate realities, government buildings face special challenges with disaster claims. Under the Stafford Act, government entities must exhaust all insurance coverage before receiving federal disaster assistance.

After Hurricane Harvey devastated Houston, I witnessed how municipal buildings suffered extensive water damage requiring complex claims involving both insurance coverage and FEMA assistance. These multi-layered claims require expertise in both government procedures and insurance policies.

What Makes Government Building Claims Unique?

Government building claims come with special challenges that private claims don’t share:

You’ll face a higher burden of proof – not only demonstrating all elements of negligence but also proving the employee was acting within their job duties. Strict notice requirements mean you might have just 60-90 days to file rather than years. Most government claim laws prohibit punitive damages and set damage caps limiting your maximum recovery.

Almost all government claims require completing an administrative claim process before filing any lawsuit. And if litigation becomes necessary, your case may be heard in specialized tribunals rather than regular courts.

Common Incident Scenarios Inside Public Buildings

Let’s look at the situations that most commonly lead to government building claims:

Slip-and-Fall Accidents

These represent about one-third of all government building claims we handle. Wet floors without warning signs, uneven walking surfaces, freshly waxed floors, cafeteria spills, and icy entryways are the usual culprits. These cases hinge on proving the government knew about the hazard and failed to address it.

Fire & Smoke Damage

When fire or smoke damages a government building or your property inside one, the documentation requirements get complicated. During a recent Texas courthouse claim, a certified industrial hygienist explained that “smoke damage is often invisible to the untrained eye, but can cause long-term structural and health issues if not properly documented and remediated.”

Storm & Flood Damage

Living in Texas means understanding how vulnerable government buildings are to hurricanes, tornadoes, and flash flooding. These claims typically involve detailed assessment of roof damage, water intrusion, mold remediation needs, structural integrity, and thorough contents inventory.

Falling Objects & Building Component Failures

Older government buildings are particularly prone to ceiling tile collapses, light fixture failures, HVAC component detachments, and decorative element failures. These claims often involve engineering assessments to determine if proper maintenance protocols were followed.

Elevator and Escalator Incidents

When elevators or escalators malfunction in government buildings, injuries can be serious. These claims get complicated because they often involve questions about whether government employees or outside maintenance contractors bear responsibility.

Understanding these fundamentals gives you a solid foundation for navigating the sometimes frustrating world of government building claims. In the next section, we’ll walk through exactly how to file your claim, step by step.

Filing Your Government Building Claim: A 7-Step Blueprint

When you’re dealing with a government building claim, following the right steps can make all the difference between success and frustration. After helping countless Texans steer these waters, I’ve developed a proven blueprint that cuts through the red tape.

Step 1: Report the Incident Immediately

The clock starts ticking the moment something happens. Whether you’ve slipped on a wet floor at the DMV or finded water damage at your nonprofit from a leaking federal building next door, report it right away.

In federal buildings, find the facility manager or security desk. For state properties, the building supervisor needs to know. At city hall or local government offices, alert municipal authorities on the spot.

Always—and I mean always—get a copy of the incident report before you leave. This document establishes your timeline and can be worth its weight in gold later.

Step 2: Seek Medical Attention if Injured

If you’re hurt, don’t tough it out. Government claims adjusters look closely at when you sought treatment. That gap between incident and doctor visit? They’ll use it to question the severity of your injuries or whether they happened elsewhere.

Even if you feel “mostly fine,” get checked out. Some injuries don’t show symptoms immediately, and that medical documentation creates a crucial paper trail.

Step 3: Document Everything

Your smartphone might be your best ally in a government building claim. Take photos and videos showing:

– The exact hazard or damage

– The surrounding area for context

– Any warning signs (or lack thereof)

– Your injuries or damaged property

Collect contact information from witnesses, save damaged items, and send a formal letter requesting preservation of surveillance footage. These details become your evidence arsenal.

Step 4: Determine the Correct Government Entity

This step trips up many claimants. Filing with the wrong agency is like mailing your tax return to your aunt in Florida—it won’t reach the right destination.

For example, if you’re injured in a federal courthouse, your claim belongs with the Administrative Office of U.S. Courts, not the building management agency. For state buildings in Texas, different departments handle their own claims rather than having a central office.

When in doubt, a phone call to the facility can save weeks of misdirected paperwork.

Step 5: Prepare and File Your Administrative Claim

For federal government building claims, you’ll need Standard Form 95. State and local governments have their own forms, which we can help you locate at Insurance Claim Recovery Support.

Your claim package must include:

– A detailed narrative of what happened

– Precise location details (building name, floor, room number)

– The exact date and time of the incident

– A specific dollar amount for your damages (the “sum certain”)

– Supporting documentation like medical records or repair estimates

Be thorough but concise—government claims officers review hundreds of files.

Step 6: Wait for the Agency’s Response

Patience becomes your virtue now. Federal agencies have six months to make a decision, while Texas state and local agencies typically work on shorter timeframes.

The agency might accept your claim fully, offer a partial settlement, deny it outright, or simply not respond by the deadline (which counts as a denial). During this waiting period, continue gathering evidence and documenting ongoing damages or medical treatments.

Step 7: Consider Your Options After a Decision

If you receive less than you deserve—or nothing at all—you’re not out of options. You might:

– Request a reconsideration with new evidence

– File a lawsuit in the appropriate court

– Continue negotiating with the agency’s legal team

Each path has its own timeline and requirements, which is why many claimants seek professional guidance at this stage.

Government Building Claims Seven-Step Checklist

When handling a government building claim, use this checklist to stay on track:

- [ ] Report the incident immediately and get a copy of the report

- [ ] Gather evidence including photos, videos and witness information

- [ ] Get proper medical care for any injuries

- [ ] Identify exactly which government entity is responsible

- [ ] File your claim within the required timeframe

- [ ] Submit complete documentation with your claim form

- [ ] Mark your calendar for response deadlines and follow up

Step-by-Step Walkthrough of Standard Form 95

For federal claims, Standard Form 95 is your gateway document. Here’s how to steer it successfully:

Personal Information (Boxes 1-11)

Complete these sections with meticulous accuracy. Double-check your contact information—a simple typo in your address could delay your entire claim.

Damage Amounts (Boxes 12a-d)

This is where you state your “sum certain”—the specific amount you’re claiming:

– 12a: Property damage (repairs, replacements, etc.)

– 12b: Personal injury (medical bills, lost wages, pain and suffering)

– 12c: Wrongful death compensation

– 12d: Total amount claimed

You generally cannot increase this amount later without filing a new claim, so be comprehensive in your calculations.

Signature Requirements (Box 19)

Your claim needs a “wet signature”—actual ink on paper. While some electronic signatures have been accepted in limited cases, a physical signature remains the safest approach to avoid technicalities.

Certification and Fraud Warning

The form contains serious warnings about false claims. Making false statements can result in fines up to $10,000 and imprisonment up to five years. This isn’t meant to scare you—just ensure your claim is truthful and accurate.

Documentation Power Pack: Evidence That Wins Claims

The secret to winning your government building claim often boils down to one thing: rock-solid documentation. After helping hundreds of clients steer these complex claims, I’ve seen how the right evidence can transform a potential denial into a substantial settlement.

Photographic and Video Evidence

Nothing speaks louder than visual proof. When you’re standing in a government building after an incident, your smartphone becomes your most powerful ally:

Take wide-angle shots showing the entire scene, then zoom in for detailed close-ups of specific hazards. If possible, make sure your photos include time/date stamps. For an even stronger case, record video walking through the area (if it’s safe to do so). And don’t forget to document weather conditions for any outdoor incidents – that unexpected ice patch or storm debris matters!

“The government adjuster who initially denied our client’s slip-and-fall claim at a Texas courthouse completely changed his tune when we showed him the video of water pooling from a leaking ceiling with no warning signs,” recalls one of our senior adjusters. “Those 30 seconds of footage were worth thousands in settlement value.”

Medical Records and Bills

For personal injury claims, thorough medical documentation creates an undeniable paper trail that connects the incident to your injuries:

Emergency room reports establish immediate care, while physician diagnoses and treatment plans show ongoing issues. Don’t forget to include specialist consultations, therapy records, and complete documentation of medication prescriptions. Finally, keep meticulous records of all medical bills and payment receipts – these directly support your compensation request.

Property Damage Documentation

Whether your property was damaged in a government building or you’re dealing with insured damage to government property itself, detailed records are essential:

Create a comprehensive inventory of damaged items backed by original purchase receipts or proof of value. Obtain at least two independent replacement cost estimates or repair invoices. For unique or high-value items, professional appraisals can make a substantial difference in your settlement amount.

Maintenance and Inspection Records

Some of the most powerful evidence doesn’t come from you – it comes from the government’s own records:

Submit formal requests for building maintenance logs, safety inspection reports, previous incident reports for the same location, work orders for repairs, and janitorial schedules. These documents can establish a pattern of negligence or prove the government entity had prior knowledge of hazardous conditions – a critical element in overcoming sovereign immunity defenses.

Witness Statements and Contact Information

Eyewitness accounts provide independent confirmation of your version of events:

Collect statements while memories are fresh, including complete contact information. Whenever possible, get these statements signed and dated. Pay special attention to any witnesses who are government employees – their testimony carries particular weight in government building claims.

Expert Assessments and Reports

Complex claims often require specialized expertise to establish liability and damages:

Engineering assessments can identify structural issues that contributed to an incident. Industrial hygienist reports provide scientific evidence for air quality or smoke damage claims. Slip resistance testing offers objective data about floor surfaces, while biomechanical analysis can scientifically connect injuries to specific hazards. For business interruption claims, economic loss calculations from qualified experts carry significant weight.

Certified Industrial Hygienist Reports

When dealing with smoke, mold, or air quality issues in government buildings, Certified Industrial Hygienist (CIH) reports provide scientific credibility that’s hard to dispute.

During a recent claim we handled for a library in Austin affected by smoke damage from a nearby wildfire, our CIH explained: “Physical data and samples, not just air samples, are used to prove smoke damage in lab analyses. This creates indisputable evidence of contamination that government agencies cannot easily dismiss.”

At Insurance Claim Recovery Support, we help clients compile these comprehensive documentation packages that government entities and their insurers find difficult to challenge. The hours spent gathering this evidence might feel tedious, but I’ve seen it make the difference between denied claims and five-figure settlements.

Government entities are bound by what the evidence clearly shows. When you build an overwhelming documentation package, you create leverage that often leads to faster, more favorable resolutions – sometimes without ever needing to file a lawsuit.

Know Your Clock & Caps: Deadlines, Damage Limits, and Pitfalls

Time waits for no one—especially when it comes to government building claims. I’ve seen too many valid claims dismissed simply because someone missed a filing deadline by a day or two. Let’s make sure that doesn’t happen to you.

Federal Claim Deadlines

The Federal Tort Claims Act (FTCA) establishes a clear timeline you need to follow:

- You have two years from your injury or damage date to file your administrative claim

- Once filed, the federal agency gets six months to review and respond

- If they deny your claim, the clock starts ticking again—you have six months from that denial date to file a lawsuit in U.S. District Court

- No response after six months? That’s considered a “deemed denial,” allowing you to move forward with a lawsuit

I remember helping a client whose property was damaged during a federal building renovation in Dallas. We filed just three weeks before the two-year deadline expired. Had we waited, his valid $87,000 claim would have been permanently barred.

State and Local Government Deadlines in Texas

Texas doesn’t give you much breathing room when it comes to government building claims. In fact, our state has some of the shortest notice requirements in the nation:

The Texas Tort Claims Act requires notice within six months of the incident, but here’s where it gets tricky—many Texas cities have created even tighter windows through their city charters:

Austin gives you just 45 days to file notice. Dallas, Houston, and San Antonio allow 90 days, while Fort Worth is more generous with 180 days.

These aren’t suggestions—they’re rigid deadlines that courts strictly enforce. I’ve watched perfectly legitimate claims get thrown out because someone missed a city’s notice deadline by just a few days.

Damage Caps and Limitations

When setting expectations for your government building claim, understanding recovery limits is crucial:

Federal Claims (FTCA)

While there’s no statutory cap on compensatory damages in federal claims, there are other important restrictions. The government won’t pay punitive damages under any circumstances. Attorney fees are also strictly limited—20% for administrative claims and 25% for litigation.

Texas State and Local Claims

Texas caps liability at $250,000 per person and $500,000 per occurrence for bodily injury. Property damage claims max out at $100,000 per occurrence. And like federal claims, punitive damages aren’t available.

A city facilities manager once told me, “These caps weren’t created to be unfair—they’re about balancing the public’s right to compensation against protecting taxpayer resources.” Fair point, but that doesn’t make it any easier when you’re facing significant losses.

Common Reasons for Claim Denial

Over years of handling government building claims, I’ve noticed patterns in denials. Here are the pitfalls to avoid:

Missed deadlines top the list—government entities are sticklers for timeliness. The discretionary function exception is another common denial reason, where the government argues the issue involved policy decisions rather than operational negligence.

Claims often get rejected when damages are caused by independent contractors rather than actual government employees. Insufficient documentation is a problem we see frequently—you simply must have evidence supporting every aspect of your claim.

Technical errors matter too. Failing to specify a “sum certain” (an exact dollar amount) or making mistakes on claim forms can result in automatic denials. And if your own actions contributed significantly to what happened, expect the government to raise contributory negligence as a defense.

| Government Level | Notice Deadline | Response Time | Lawsuit Window | Damage Caps |

|---|---|---|---|---|

| Federal (FTCA) | 2 years | 6 months | 6 months | None for compensatory |

| Texas State | 6 months | Varies | 2 years | $250K/$500K bodily, $100K property |

| Austin | 45 days | 90 days | 2 years | Same as state |

| Houston | 90 days | 90 days | 2 years | Same as state |

| Dallas | 90 days | 90 days | 2 years | Same as state |

| San Antonio | 90 days | 90 days | 2 years | Same as state |

I recall a Houston business owner whose roof was damaged when maintenance work on an adjacent government building went wrong. Her claim was initially denied because she hadn’t specified an exact dollar amount—just an estimated range. We helped her refile with precise documentation and specific figures, ultimately securing appropriate compensation.

The bottom line with government building claims is simple: know your deadlines, understand the limits, and avoid the common pitfalls. Your attention to these details can make the difference between fair compensation and walking away empty-handed.

Administrative Claim vs. Litigation: Choosing the Right Path

When pursuing government building claims, you’ll eventually face an important crossroads after the administrative phase. Let’s explore how to steer this decision point with confidence.

The Administrative Claim Process

Every government building claim begins with an administrative filing – it’s not optional, but rather a required first step:

Filing your claim form starts the process, where you’ll submit all your supporting documentation to the appropriate agency. The agency then investigates your claim, sometimes requesting additional information while conducting their own review. Within the statutory timeframe (six months for federal claims), they must make a determination – accepting, denying, or offering to settle your claim.

If your claim is denied, don’t lose hope. You can request reconsideration and submit new evidence before taking the more serious step of litigation.

“Many of our clients are surprised to learn how often claims get resolved during this administrative phase,” explains Scott Friedson of Insurance Claim Recovery Support. “The process is designed to filter out claims that can be settled without burdening the court system.”

The administrative process offers several advantages over jumping straight to court. It’s less formal, requires no filing fees or court costs, and typically provides faster resolution in straightforward cases. You’ll also face lower attorney fees (capped at 20% for federal claims) and have the opportunity to negotiate without incurring litigation expenses.

When to Consider Litigation

Sometimes, despite your best efforts, the administrative path doesn’t lead to a fair resolution. Filing a lawsuit becomes a viable option when:

Your administrative claim gets denied outright. Perhaps the settlement offer is woefully inadequate compared to your damages. Maybe the agency failed to respond within the statutory period (which is considered a constructive denial). Or perhaps your claim involves complex legal issues that require judicial resolution.

For federal claims, you’ll need to file your lawsuit in the U.S. District Court where you reside or where the incident occurred. For Texas state and local government building claims, the appropriate venue depends on the specific government entity involved.

Attorney Fee Considerations

One important factor to consider is how attorney fees work in these cases. The Federal Tort Claims Act (FTCA) specifically limits attorney fees to 20% of any settlement reached during the administrative process, and 25% of any judgment or settlement after filing a lawsuit.

These caps serve an important purpose – they help ensure claimants retain most of their recovery. However, they can sometimes limit access to legal representation for smaller claims, as attorneys may be reluctant to take on cases with limited fee potential.

As licensed public adjusters, we frequently work alongside attorneys in government building claims, handling property damage aspects while legal counsel addresses any bodily injury components. This team approach often provides the most comprehensive representation.

Alternative Resolution Paths

Between formal administrative claims and full-blown litigation, several middle-ground options exist:

Mediation programs offered by some agencies can help resolve claims without court involvement. These structured negotiations with a neutral third party often lead to fair compromises.

Settlement Conferences provide informal meetings with agency representatives to negotiate resolution face-to-face, which can break through communication barriers.

Tort Claims Units are specialized departments within agencies that handle claim resolution. Working directly with these experts can sometimes yield better results than standard channels.

Maximizing Compensation & Settlement Strategies

When it comes to government building claims, getting fair compensation isn’t automatic – it takes strategy, preparation, and know-how. I’ve seen how the right approach can make thousands of dollars of difference in settlement amounts.

Understanding Recoverable Damages

Government claims typically allow you to recover two main types of damages:

Economic Damages cover the tangible, out-of-pocket costs you’ve incurred. These include your property repair or replacement costs, medical bills (both current and anticipated future expenses), lost wages if you missed work, business interruption losses for commercial claims, and any extra expenses like temporary housing or rental facilities.

Non-Economic Damages address the human impact that doesn’t come with a receipt – things like pain and suffering, emotional distress, and loss of enjoyment of life. While important, these damages often face strict caps in government building claims, especially at the state and local levels in Texas.

As one of our clients in Houston told us after a courthouse slip-and-fall: “I never realized how much documentation I’d need to prove something that seemed so obvious to me.”

Documenting Economic Losses

For property damage in government building claims, thorough documentation is your best friend. Start by creating a complete inventory of everything damaged, noting each item’s description, age, and condition before the incident.

Gather replacement cost quotes from multiple vendors – government adjusters are more likely to accept your figures when they see you’ve done your homework. If your business operations were interrupted, carefully track lost revenue alongside any continuing expenses and extra costs you incurred while getting back on your feet.

Don’t forget to document temporary relocation expenses if you had to move operations, as well as any emergency measures you took to prevent further damage. These mitigation expenses are typically recoverable but often overlooked.

Presenting a Professional Claim Package

How you package your claim can dramatically influence the settlement offer. Think of your claim as telling a story that needs to be clear, compelling, and complete.

Start with a concise executive summary that outlines what happened, why the government is liable, and what you’re claiming. Follow with a more detailed liability analysis that connects the dots between the government’s negligence and your damages.

Include a detailed breakdown of your damages with supporting documentation organized into clear exhibits. When we prepare claims at Insurance Claim Recovery Support, we always include a specific settlement demand with justification – vague requests rarely succeed with government entities.

Negotiation Strategies for Government Claims

Government claims adjusters operate differently than private insurance adjusters. They’re bound by regulations and often have less discretion, but understanding their world gives you an edge.

Know the regulations inside and out – being able to cite specific provisions of the FTCA regulations or Texas Tort Claims Act during negotiations shows you’ve done your homework and shouldn’t be dismissed.

Focus on establishing clear liability before diving into damage discussions. Government adjusters are trained to look for reasons to deny claims, so address potential liability issues head-on.

Be prepared to compromise – in my experience handling government building claims throughout Texas, government entities rarely pay the full amount demanded. Having a minimum acceptable figure in mind before negotiations begin helps prevent emotional decisions during discussions.

Insurance Policy Interaction

When your government building claim involves property damage, understanding how various insurance policies interact becomes crucial. Government entities must comply with the Stafford Act, which requires them to pursue all entitled insurance proceeds before receiving federal assistance.

Your own insurer may have subrogation rights – essentially, the right to recover from the government what they paid you. This can complicate settlements, as you need to avoid double recovery while ensuring you’re fully compensated.

Federal agencies often use the FTCA as their insurance substitute rather than carrying commercial liability policies. This means your claim is essentially against the government’s self-insurance program, which operates under different rules than traditional insurance.

As one Dallas property manager told us after a federal building water damage incident: “Navigating between our insurance and the government’s process felt like being caught between two different worlds speaking different languages.”

At Insurance Claim Recovery Support, we specialize in helping Texas property owners untangle these complex interactions to maximize recovery without running afoul of regulations. Our experience as public adjusters gives us insight into both sides of the equation, helping you get the compensation you deserve while avoiding the pitfalls that can delay or diminish your recovery.

Frequently Asked Questions about Government Building Claims

What is sovereign immunity and how is it waived?

Sovereign immunity is that age-old legal doctrine that essentially says you can’t sue the government without its permission. Think of it as the government’s “get out of lawsuit free” card—except there are important exceptions that open the door for valid claims.

The good news is that governments at all levels have created specific pathways to waive this immunity:

At the federal level, the Federal Tort Claims Act (FTCA) allows you to seek compensation when federal employees cause harm while doing their jobs. As the House Office of General Counsel puts it: “Under the FTCA, the federal government acts as a self-insurer, and recognizes liability for the negligent or wrongful acts or omissions of its employees acting within the scope of their official duties.”

For Texas state claims, the Texas Tort Claims Act provides limited but important waivers for property damage, personal injuries, and even wrongful death caused by government employees.

At the local level, individual city and county codes may contain additional provisions for filing claims against municipal facilities.

Understanding these waivers is your first step toward successfully navigating a government building claim.

How long do I have to file a notice of claim?

Time limits for government building claims vary dramatically depending on where your incident occurred—and they’re strictly enforced. Miss the deadline by even a day, and your claim could be automatically rejected.

For federal claims, you have a relatively generous two-year window from the date of injury or damage.

Texas state claims must be filed within six months of the incident—significantly tighter than the federal timeline.

Texas cities have some of the shortest deadlines around: Austin gives you just 45 days, while Houston, Dallas, and San Antonio allow 90 days. Fort Worth is a bit more lenient with a 180-day window.

I recently worked with a client in San Antonio whose claim was initially rejected because it was filed 92 days after the incident—just two days beyond the 90-day requirement. Only after we provided evidence of a postal delay was the claim reconsidered. The moral of the story? Don’t wait until the last minute!

What compensation can I realistically recover?

When it comes to government building claims, it’s important to set realistic expectations about what you can recover. Several factors limit potential compensation:

First, there are statutory caps to consider. Texas caps recovery at $250,000 per person/$500,000 per occurrence for bodily injury and $100,000 for property damage. These aren’t suggestions—they’re hard limits.

Unlike claims against private companies, punitive damages are generally off the table for government entities. The law focuses on making you whole, not punishing the government.

Your recovery may also be reduced by proportional liability—if you were partly at fault, your compensation will be reduced accordingly. Be prepared for government attorneys to scrutinize your actions for any hint of contributory negligence.

The quality of your documentation dramatically affects outcomes. Think of your evidence as the foundation of your claim—the stronger it is, the more you can build on it.

Finally, professional presentation matters. A well-organized claim with clear liability analysis and detailed damage calculations typically receives more serious consideration.

In my years handling government building claims throughout Texas, I’ve found that professionally represented claims typically recover 30-70% more than similar self-filed claims. This isn’t just about paperwork—it’s about speaking the language of government claims adjusters and understanding the regulations that guide their decisions.

These claims aren’t like standard insurance claims. They follow different rules, have unique procedural requirements, and demand specialized knowledge. But with proper preparation and timely filing, you can steer the process successfully and secure fair compensation for your damages.

Conclusion

Navigating government building claims is a journey through unique procedures, strict deadlines, and specialized documentation requirements. Whether you’re dealing with a slip-and-fall in a federal courthouse, water damage to a municipal property, or any other situation involving government facilities, following the proper process isn’t just helpful—it’s essential for success.

I’ve seen how overwhelming these claims can feel. The clock starts ticking immediately after an incident, and with notice periods as short as 45 days in some Texas cities, many valid claims are lost before they even begin. That’s why professional guidance can make all the difference.

At Insurance Claim Recovery Support, we specialize in helping property owners throughout Texas secure fair settlements for their damages. Our team works exclusively for policyholders—never insurance companies—giving you an advocate who’s truly in your corner when dealing with complex government claim processes.

Remember these essential takeaways as you move forward:

Act quickly after any incident—those notice deadlines are strictly enforced and wait for no one. Document everything thoroughly with clear photos, videos, and professional assessments that leave no room for dispute. Always submit a complete administrative claim before even considering litigation, and be realistic about the damage caps that apply to your specific situation.

The path through government building claims may seem daunting, but you don’t have to walk it alone. From Austin to Waco, Dallas to San Antonio, and everywhere in between, our licensed public adjusters understand the nuances of these specialized claims.

For more detailed information about how we can help with your government building or nonprofit claim, visit our Government & Nonprofit claim support page.

Don’t let complex procedures and government bureaucracy prevent you from receiving fair compensation for your losses. The right guidance can make a significant difference in your recovery—turning a frustrating experience into a successful resolution that helps you move forward.