Have you recently suffered a property loss due to fire, hail, hurricane, tornado or flooding and are finding it difficult to navigate the insurance claim process on your own? A licensed public adjuster might be the solution you’re seeking. They are insurance professionals, licensed and bonded, working exclusively on your behalf as a policyholder, helping you negotiate a more satisfactory claim recovery.

Quick Facts about Licensed Public Adjusters:

– They work solely for you, not the insurance companies.

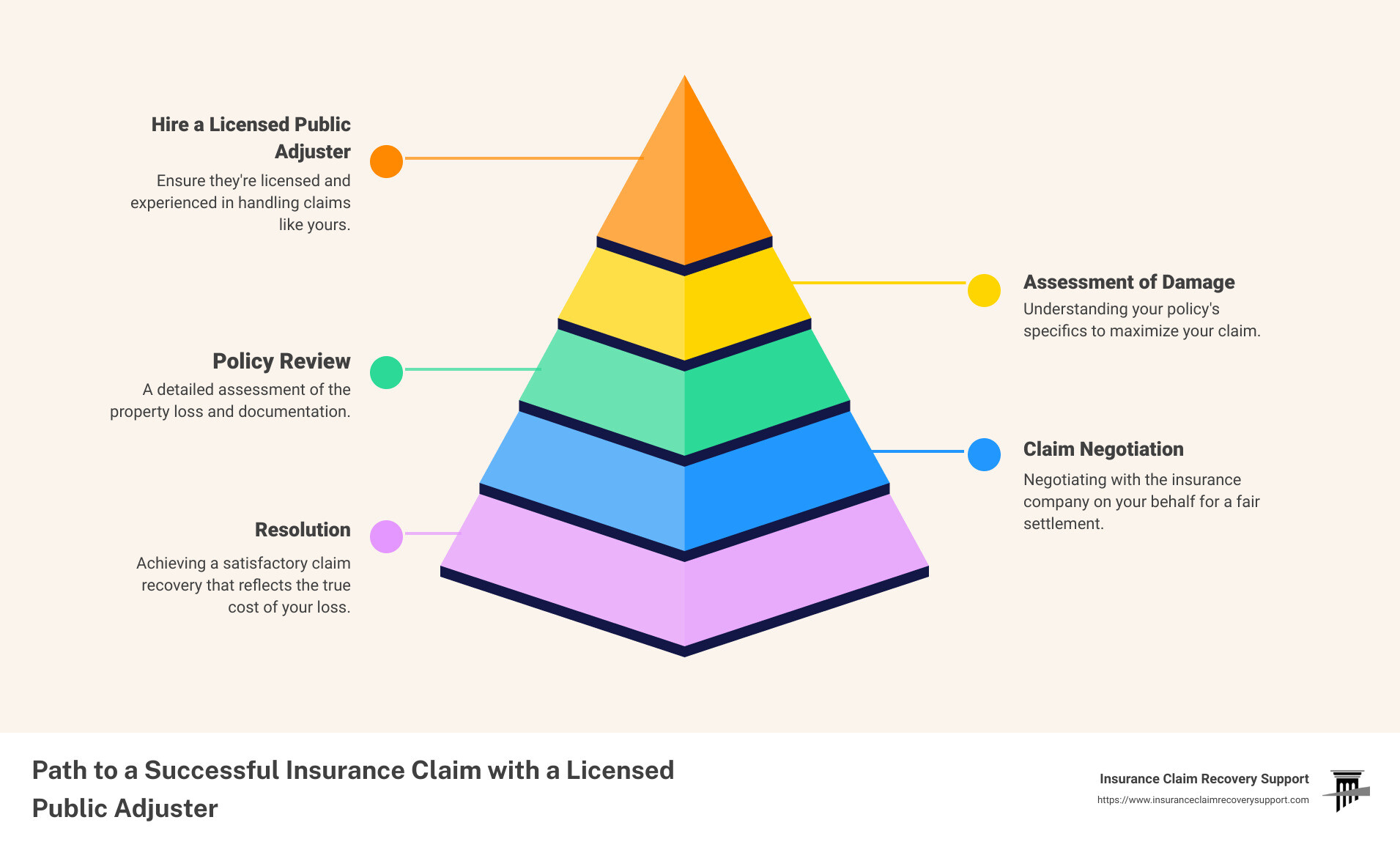

– Their role includes assessing damage, reviewing insurance policies, and negotiating claims.

– In New York, for instance, they must demonstrate at least one year of experience in the insurance business or formal training to get the license.

– Hiring unlicensed adjusters can result in inaccurate claim assessment or unethical practices.

As a team at Insurance Claim Recovery Support, we are dedicated to making sure you not only understand the role of licensed public adjusters, but also how to ensure you’re getting the right help for your money. We have been in your position, frustrated with the complicated labyrinth of paperwork and negotiations, which is why we made it our mission to provide this level of professional support – turning your calamity into calm.

We cover everything you need to know about hiring a licensed public adjuster, from understanding their role and the licensing process, to the fee structure and how to choose the right one – all in the clearest, simplest terms.

Choosing the right licensed public adjuster can make a significant difference in the outcome of your property insurance claim. This is why it’s important to be armed with all the necessary facts – here’s to charting your path to a financial compensation that is both fair and quick. Let’s get started.

Understanding the Role of a Licensed Public Adjuster

Navigating the complexities of insurance claims can be daunting, especially when dealing with extensive property damage. This is where licensed public adjusters, like our team at Insurance Claim Recovery Support, come in. But what exactly is a public adjuster, and how do they differ from insurance adjusters? Let’s find out.

What is a Public Adjuster?

A public adjuster is a licensed insurance professional who solely represents policyholders in their insurance claims. They are the champions for consumers, working on behalf of homeowners or businesses to file, negotiate, and settle claims. Unlike insurance adjusters, public adjusters do not work for the insurance companies. Instead, they are hired directly by policyholders to ensure they receive the fullest compensation they are entitled to under their policy, without any conflict of interest. At Insurance Claim Recovery Support, our own expert Scott Friedson is a prime example of such a professional.

How Does a Public Adjuster Differ from an Insurance Adjuster?

While both public adjusters and insurance adjusters work on insurance claims, their roles and allegiances differ. An insurance adjuster, also known as a claims adjuster, works for the insurance company. They investigate the claim and determine how much the insurer should pay for damages or injuries.

On the other hand, a public adjuster, like those at Insurance Claim Recovery Support, represent the interests of policyholders against insurance companies. They work to ensure policyholders receive the maximum payout possible while ensuring the insurance company fulfills its obligations.

The Importance of a Public Adjuster in Insurance Claims

When you’re dealing with an insurance claim, especially one resulting from extensive property damage, having a public adjuster on your side can be crucial. They not only represent your interests but also interpret insurance policies, conduct damage assessments, and negotiate claim settlements.

At Insurance Claim Recovery Support, we consider our role as public adjusters to be crucial in managing the complex aspects of insurance claims. Our goal is to secure the most favorable settlement possible for you, the policyholder.

By understanding the roles and responsibilities of a public adjuster, especially in the aftermath of a disaster, you can equip yourself with the knowledge to navigate your insurance claims more efficiently. Armed with this understanding, you’re better prepared to get the best claim help money can buy.

The Licensing Process for Public Adjusters

Navigating insurance claims can be complex. That’s why we, at Insurance Claim Recovery Support, believe in the value of working with licensed public adjusters. They’re professionals who’ve gone through rigorous training and assessments to ensure they can serve policyholders effectively. So, what does it take to become a licensed public adjuster? Let’s take a look.

Licensing Requirements for Public Adjusters

Becoming a licensed public adjuster isn’t a walk in the park. It involves meeting specific requirements set by the state. For instance, in New York, applicants must demonstrate their trustworthiness and competency to act as a public adjuster. They must be at least 18 years of age and must submit fingerprints for a comparison with those on file with the division of criminal justice services.

Moreover, in addition to passing a written examination, applicants must demonstrate a minimum of one year experience in the insurance business, or successfully complete 40 hours of formal training in a course approved by the superintendent. These stringent measures ensure that licensed public adjusters are equipped to safeguard the interests of the people they serve.

The Importance of a License in Public Adjusting

A license isn’t just a piece of paper; it’s a testament to an adjuster’s competence and commitment to ethical practice. Licensed public adjusters have passed rigorous exams, undergone background checks, and are required to complete continuing education to stay up-to-date with industry practices and regulations.

As Scott Friedson, our expert at Insurance Claim Recovery Support, often emphasizes, hiring a licensed public adjuster is critical to the success of your claim. They possess the knowledge and skills needed to handle your claim professionally and effectively, ensuring you receive a fair and maximum settlement.

How to Verify a Public Adjuster’s License

Verifying a public adjuster’s license is a critical step in safeguarding your claim. Fortunately, it’s typically straightforward. In Texas, for instance, the Texas Department of Insurance provides resources for checking an adjuster’s license online. This simple verification not only protects your claim but also ensures you’re working with a competent and law-abiding adjuster.

At Insurance Claim Recovery Support, we pride ourselves on meeting these stringent licensing requirements. We believe that our clients deserve the best, which means working with licensed professionals who are equipped to handle their insurance claims effectively and efficiently.

In conclusion, a license is an essential aspect of a public adjuster’s professional profile. It’s a guarantee of their expertise, professionalism, and adherence to industry regulations. When you’re entrusting your insurance claim to a public adjuster, you want to ensure they’re not just qualified, but licensed to do the job.

The Cost of Hiring a Licensed Public Adjuster

Choosing to hire a licensed public adjuster is a strategic move, especially when dealing with large and complex insurance claims. The cost, however, is an important factor to consider. Let’s delve into the typical fees charged by public adjusters, how these fees are regulated, and whether hiring a public adjuster is worth the cost.

Typical Fees Charged by Public Adjusters

Public adjusters typically work for a fee that is a percentage of the claim settlement. This means that they only get paid if you get paid. The percentage charged can vary depending on the adjuster and the complexity of the claim, but it’s usually about 10-20% of the claim payout.

In Florida, for example, the maximum percentage that a public adjuster can charge for a claim is 20% of the claim paid after you sign the contract with them. However, during a state of emergency, that fee is reduced to 10% for any claim made in the first year after the date of loss.

How Public Adjusters’ Fees are Regulated

Public adjusters’ fees are regulated by state laws and regulations. Different states have varying rules about how much a public adjuster can charge. In Texas, there is no specific cap on fees, but they must be “reasonable” and not excessive. In contrast, Florida has specific caps on fees depending on the situation.

Before hiring a public adjuster, it’s crucial to understand their fee structure. At Insurance Claim Recovery Support, we believe in transparency and ensuring that our fee structure is upfront, clear, and easy to understand.

Value for Money: Is Hiring a Public Adjuster Worth the Cost?

Hiring a public adjuster is an investment. While there is a cost involved, the expertise and assistance of a good public adjuster can often result in significantly higher claim payouts. Public adjusters work solely for you, the insured, to assist in the preparation, presentation, and settlement of the claim.

According to Scott Friedson, a public adjuster and expert at Insurance Claim Recovery Support, a good public adjuster can help you navigate the complex world of insurance claims and ensure you receive the maximum settlement you are entitled to. So, while you’ll have to factor in the cost of hiring a public adjuster, the potential increase in your claim payout can more than offset the expense.

In summary, the cost of hiring a licensed public adjuster should be weighed against the potential benefits. With their expertise and dedication, they can help ensure you receive the best possible settlement for your insurance claim.

How to Choose the Right Licensed Public Adjuster

When navigating the complex insurance claim process, it’s crucial to engage a competent licensed public adjuster. Here are some key steps to help you make the right choice.

Checking References and Qualifications

Start by verifying the adjuster’s qualifications and experience. Ask about their years in business, areas of specialization, and request references from past clients. One of our experts at Insurance Claim Recovery Support, Scott Friedson, suggests asking about their current caseload to ensure they have the capacity to handle your claim effectively.

Remember to check the public adjuster’s license status. Licensing requirements vary by state, but it’s generally straightforward to verify an adjuster’s license online. For instance, in Texas, the Texas Department of Insurance provides resources for checking an adjuster’s license.

Understanding the Contract with a Public Adjuster

Before signing a contract with a public adjuster, make sure you understand the fee structure. Fees can vary, but they are often a percentage of the claim payout. In Florida, for instance, the maximum fee a public adjuster can charge is 20% of the claim payout after the contract is signed. However, this fee is reduced to 10% for claims made within the first year following an officially declared emergency.

At Insurance Claim Recovery Support, we operate on a contingency basis — we don’t collect a fee unless you receive a settlement from your insurance company.

Red Flags to Avoid When Hiring a Public Adjuster

Be wary of public adjusters demanding an upfront fee or pressuring you to sign a contract immediately. Additionally, avoid adjusters who promise a certain outcome or specific payout. A reputable public adjuster will always prioritize your best interests and strive to secure the fairest settlement possible.

In conclusion, choosing the right licensed public adjuster involves careful research, asking the right questions, understanding the contractual terms, and being aware of potential red flags. By following these steps, you can increase your chances of a fair and prompt settlement of your insurance claim.

The Role of a Licensed Public Adjuster in Specific Scenarios

Understanding the benefits of hiring licensed public adjusters is one thing, but seeing how they can assist in real-life scenarios brings these benefits to life. Let’s explore a few examples of how public adjusters can be invaluable in various insurance claim situations.

How a Public Adjuster Can Help After a Major Disaster

Major disasters, such as hurricanes or floods, often lead to widespread property damage. In these situations, the sheer scale of the loss can be overwhelming for property owners. Here is where licensed public adjusters, like us at Insurance Claim Recovery Support, step in.

Our public adjusters are skilled in handling large and complex property damage claims, dealing with large-scale disasters such as fires, hail, wind, tornadoes, lightning, floods, hurricanes, or earthquakes. We manage all aspects of the claim from start to finish, including conducting a thorough evaluation of the damage, preparing an accurate estimate of repair costs, and negotiating with the insurance company on your behalf. Our goal is to ensure you receive the maximum compensation possible from your insurance claim.

The Role of a Public Adjuster in Fire Damage Claims

Fire damage claims can be particularly complex due to the nature of fire damage itself. For instance, in 2020, Texas experienced nearly 8,000 fires, causing over $636 million worth of property damage claims. Unfortunately, fire damage isn’t always straightforward, and it can become challenging for property owners to accurately assess and document the damage.

In such scenarios, our public adjusters can provide invaluable assistance. We conduct an exhaustive assessment of the damage, prepare a comprehensive estimate for repair costs, and work tirelessly to negotiate with the insurance company on your behalf. We also help our clients understand their insurance policies and assist them in fulfilling their duties as the insured.

How a Public Adjuster Can Assist with Storm Damage Claims in Texas

Storm damage claims, such as those caused by hail or hurricanes, can be quite complex. The damage caused by a sudden hailstorm can range from minor in your property’s shingles to significant harm to your commercial or multifamily flat or tile roofs.

Our licensed public adjusters are experts in dealing with storm damage claims. We understand the intricacies involved in these types of insurance claims and work diligently to ensure you receive the compensation you deserve. We document and photograph the damage, log all discussions with the insurance company, and dispatch engineers and estimators as needed.

In conclusion, public adjusters play a crucial role in many different insurance claim scenarios. Whether you’re dealing with damage from a major disaster, fire, or storm, hiring a public adjuster can greatly assist in ensuring you receive fair and just compensation for your loss. At Insurance Claim Recovery Support, we’re committed to providing expert guidance and support to property owners navigating the complexities of insurance claims.

Conclusion: Maximizing Your Insurance Claim with a Licensed Public Adjuster

The Benefits of Hiring a Licensed Public Adjuster

Embracing the expertise of licensed public adjusters can significantly transform your insurance claim experience. They are well-versed in interpreting insurance policies, documenting damage meticulously, and negotiating with insurance companies to ensure you receive the payout you deserve.

Public adjusters are your advocates in the often complex and stressful insurance claim process. They work solely for you, the insured, and their goal is to help you receive the best possible settlement. They manage the fine details, handle meetings, emails, phone calls, and paper documents, thus taking away the stress and exhaustion that can come from handling the claim yourself.

How Insurance Claim Recovery Support LLC Can Help

At Insurance Claim Recovery Support, we take pride in our team of licensed public adjusters who are dedicated to advocating for your rights as a policyholder. Our goal is to ensure that you receive a fair settlement without the stress and exhaustion that can come from handling the claim yourself.

We provide expert assistance to thoroughly examine your policy, identify all possible coverage, and document your losses meticulously. This comprehensive approach ensures that you receive every dollar you’re entitled to.

Our expert, Scott Friedson, is a committed advocate for policyholders, making sure that your insurance company fulfills its obligations and you receive the settlement you deserve. We work on a contingency basis, meaning we only get paid if you receive a payout from your insurance company. This aligns our interests with yours, ensuring a motivated pursuit of your rightful claim settlement.

Final Thoughts on the Value of a Licensed Public Adjuster

In the aftermath of property damage, the last thing you want is to navigate the complex world of insurance claims alone. Licensed public adjusters are your trusted partners in this journey, helping you maximize your claim and ensure a fair and prompt settlement.

Insurance companies have experts working for them, so should you. We at Insurance Claim Recovery Support, are here to fight for your full policy benefits, provide professional documentation to support your claim, and offer peace of mind. We handle the complexities so you can focus on getting back to your normal life.

For more information on our services and to understand how we can help you get the most from your insurance claim, explore our services page and hear from our satisfied clients.