Introduction

Bad Faith Insurance, Texas Law, Policyholders’ Rights

In Texas, the road to recovery after property damage can feel like a storm after the storm, especially when dealing with insurance companies. If you’re a commercial, multifamily, or apartment property owner who has faced property damage due to disasters like fires, hail, hurricanes, tornadoes, or floods, knowing about bad faith insurance claims is crucial.

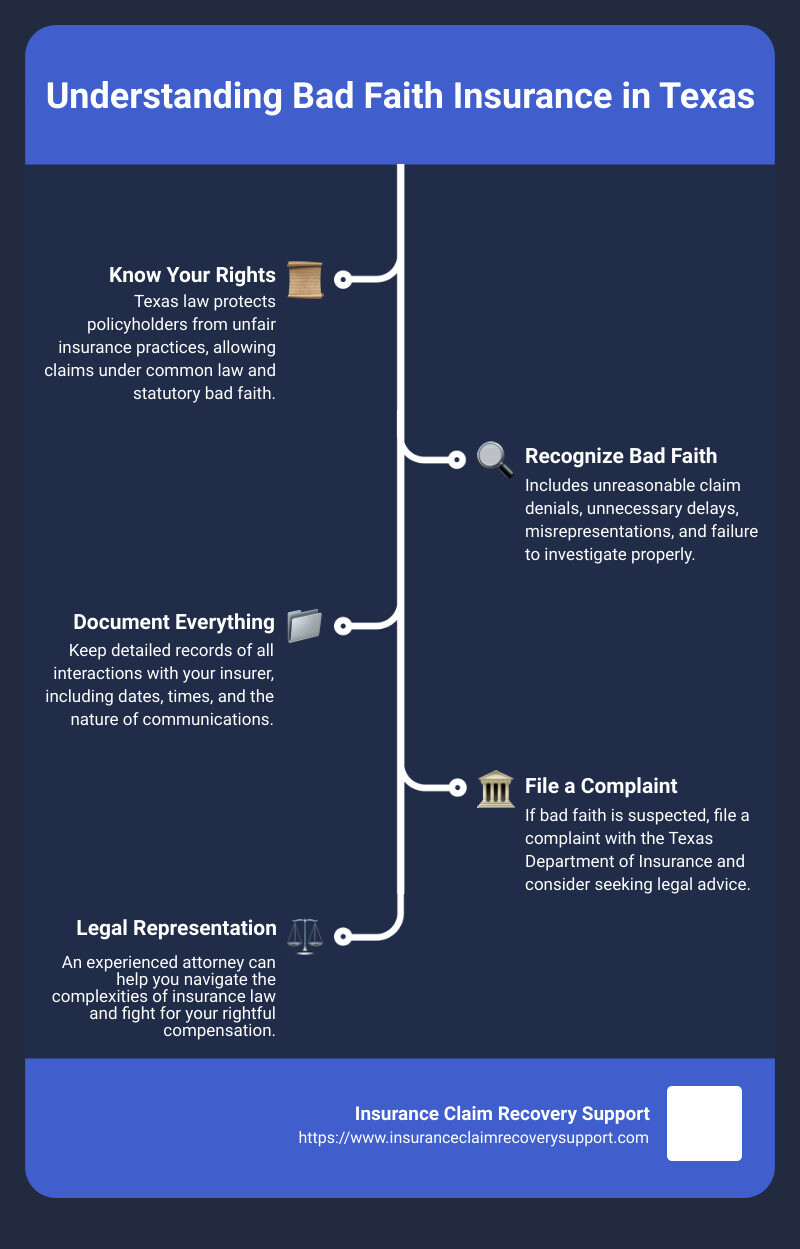

Texas law offers protection to policyholders through both common law and statutory bad faith claims. These laws ensure that insurance companies handle your claim fairly and don’t use deceptive practices to deny, delay, or underpay. In simple terms, if an insurer acts in bad faith, you have the right to hold them accountable.

Under Texas law, bad faith insurance encompasses actions like unreasonable claim denial, unnecessary delays, misrepresentations, and failure to conduct a rightful investigation. Policyholders have the right to fight back against these unethical practices and seek fair settlements.

In short:

– Texas law protects policyholders from bad faith insurance practices.

– Common law and statutory claims enable policyholders to challenge unfair insurer conduct.

– Policyholders’ rights include holding insurers accountable for unjust claim handling.

What is Bad Faith Insurance?

In Texas, when we talk about bad faith insurance, we’re looking at two main types: common law and statutory bad faith. It’s all about how insurance companies should treat you, the policyholder, and what happens when they don’t play fair. Let’s break it down in simple terms.

Common Law Bad Faith

Think of common law as the old-school rules of fairness that have been around for ages, based on court decisions. In Texas, if an insurance company unreasonably denies your claim or drags their feet in paying up, even when it’s pretty clear they should, that’s common law bad faith. It’s like if someone borrowed your lawnmower and then pretended they didn’t have it when you asked for it back. Not cool, right?

Statutory Bad Faith

On the flip side, statutory bad faith is more like the written rules of the game, laid out by Texas laws. The Texas Insurance Code is like the rulebook here. It lists specific no-nos for insurance companies, such as lying about what your policy covers, not investigating your claim properly, or taking forever to make a decision on your claim. Imagine playing a board game where someone keeps changing the rules to benefit themselves – that’s statutory bad faith.

Texas Insurance Code & Unfair Practices

The Texas Insurance Code is pretty clear about what’s considered unfair or deceptive. Some examples include:

– Telling you something incorrect about your insurance policy.

– Not being clear on why they denied your claim.

– Dragging their feet on investigating your claim.

It’s all about making sure insurance companies treat you fairly and keep their promises. If they start playing games or bending the rules, they’re stepping into bad faith territory.

Why It Matters

Understanding bad faith insurance is crucial because it helps you stand up for your rights. If you’ve ever felt like your insurance company was giving you the runaround or not being straight with you, knowing about bad faith insurance gives you the power to challenge them. It’s like having a flashlight in a dark room – suddenly, you can see what’s going on, and you’re not just stumbling around hoping for the best.

Insurance companies have a duty to deal with you honestly and to not look for sneaky ways to avoid paying claims. When they forget this duty, bad faith laws remind them that playing fair isn’t just nice – it’s the law.

For more insights on avoiding unnecessary litigation with insurance claims, check out this source: Avoiding Unnecessary Litigation With a Public Adjuster.

Next, we’ll dive into how to spot these unfair practices in action. Stay tuned as we uncover the red flags that signal your insurance company might not be playing by the rules.

Elements of a Bad Faith Claim in Texas

In Texas, when you’re dealing with an insurance company, you might come across some practices that just don’t seem fair. This section breaks down the key elements that could indicate a bad faith insurance claim. Understanding these can help you spot when something’s not right and take action.

Unreasonable Denial

Sometimes, an insurance company might say “no” to your claim without a good reason. This is what we call an unreasonable denial. It’s like if someone borrowed your bike, promised to fix it if it broke but then refused to repair it when the chain fell off, claiming it wasn’t their responsibility. If the insurance company doesn’t have a solid reason for their denial, they might be acting in bad faith.

Delay Tactics

Ever feel like your insurance claim is stuck on an endless loop, waiting to be resolved? That’s because some insurers use delay tactics. It’s like waiting for a friend who keeps saying they’re “just around the corner” but never shows up. These tactics include asking for the same information over and over or taking too long to make a decision, all to wear you down into accepting less than you deserve or giving up entirely.

Misrepresentation

Misrepresentation involves the insurance company being a little too creative with the truth. Imagine if someone sold you a “waterproof” watch that stops working the first time you wash your hands. If your insurer isn’t being honest about your policy’s terms or the details of your claim, they’re not playing fair.

Failure to Investigate

An insurance company has a duty to look into your claim thoroughly. Failure to investigate is like a teacher giving you a grade without ever reading your assignment. If an insurer makes a decision about your claim without properly checking the facts, it’s a sign of bad faith.

Understanding these elements is crucial for anyone dealing with an insurance claim in Texas. If you spot any of these practices, it might be time to dig deeper and possibly seek legal advice. Being informed is your best defense against bad faith insurance claims.

For more insights on handling bad faith insurance claims and ensuring you’re treated fairly, visit Why Some Insurers Intentionally Delay, Deny & Underpay Claims.

Next, let’s explore how to identify these bad faith practices in your interactions with insurance companies. Recognizing the red flags early can save you a lot of time and stress.

How to Identify Bad Faith Practices

When dealing with insurance claims in Texas, knowing the signs of bad faith practices can make a huge difference. Let’s break down the key indicators that your insurance company might not be playing fair.

Lack of Communication

If your insurance company is suddenly hard to reach or stops updating you about your claim status, it’s a red flag. Reliable insurers keep their policyholders informed.

Unreasonable Demands

Being asked for the same documents multiple times or for information that seems irrelevant to your claim can be a tactic to discourage you. It’s not just frustrating; it could be a sign of bad faith.

Lowball Offers

When an offer from your insurance seems way too low compared to the damages you’ve suffered, it might be a lowball offer. Insurers hoping you’ll accept less than you deserve could be acting in bad faith.

Payment Delays

Delays can be a tactic to pressure you into settling for less. If your legitimate claim payment is being delayed without a good reason, be wary.

Denied Claims Without Explanation

A clear explanation is your right. If your claim is denied without a detailed reason why, your insurer may not be acting in good faith.

Threats

Any threats of increased premiums, policy cancellation, or other negative consequences for not accepting an offer or disputing a claim are major red flags.

Identifying these practices early can help you take the necessary steps to protect your rights. If you’re facing any of these issues, it might be time to seek legal guidance.

For more insights on handling bad faith insurance claims and ensuring you’re treated fairly, visit Why Some Insurers Intentionally Delay, Deny & Underpay Claims.

Steps to Take if You Suspect Bad Faith

If you’re up against what seems to be a bad faith insurance claim in Texas, it’s crucial to know the steps to safeguard your interests and push back against unfair practices. Here’s a simplified guide on what to do:

Document Everything

The cornerstone of standing up against bad faith practices is documentation. Every interaction with your insurance company should be recorded. This means saving emails, noting down phone calls (date, time, who you spoke with, and the gist of the conversation), and keeping a file of all correspondences. If things escalate, this documentation will be invaluable.

Internal Review

Before taking more formal steps, request an internal review of your claim. This means asking the insurance company to re-evaluate your case, preferably by someone different from the original adjuster. Sometimes, this can resolve the issue without needing to escalate further.

Texas Department of Insurance Complaint

If an internal review doesn’t yield fair results, your next step is to file a complaint with the Texas Department of Insurance (TDI). This state agency oversees insurance practices in Texas and can intervene on your behalf. Filing a complaint is relatively straightforward and can be done online. The TDI will investigate your claim and, if they find evidence of bad faith, can pressure the insurer to settle fairly.

Legal Representation

Finally, if all else fails, it’s time to seek legal representation. A lawyer specializing in bad faith insurance claims can offer you the expertise and leverage needed to fight back against the insurance company. They can guide you through filing a lawsuit, negotiating a settlement, and, if necessary, representing you in court. Insurance companies are more likely to take your claim seriously when you have legal representation.

It’s worth noting that hiring a lawyer doesn’t mean you’re immediately heading to court. Often, the mere presence of legal counsel can encourage an insurance company to settle fairly to avoid litigation.

For more detailed guidance on handling bad faith insurance claims in Texas, including insights on identifying such practices and understanding your rights, visit Insurance Claim Recovery Support.

Early identification and action are key to protecting your rights. If you suspect bad faith, don’t hesitate to take these steps to ensure you’re treated fairly and receive the compensation you’re entitled to.

Recoverable Damages in a Bad Faith Lawsuit

In Texas, if you’ve been the victim of a bad faith insurance claim, the law is on your side. Here’s what you can potentially recover in a lawsuit:

Policy Benefits: First and foremost, you’re entitled to the benefits your policy was supposed to pay out. If your claim was wrongfully denied or underpaid, the court could order the insurer to pay those original amounts.

Attorneys’ Fees: The thought of legal fees can be daunting, but Texas law allows you to recover the cost of hiring an attorney to fight your bad faith claim. This means you can seek justice without worrying about the financial burden.

Statutory Penalties: Texas law imposes penalties on insurers that act in bad faith. These penalties are in addition to what you’re owed under your policy and are meant to punish the insurer for their improper conduct.

Punitive Damages: In cases where the insurer’s actions are especially egregious, you might be awarded punitive damages. These are not tied to any specific loss you suffered but are meant to punish the insurer and deter similar conduct in the future.

Mental Suffering: Dealing with a bad faith insurance claim can take a toll on your mental health. The stress, anxiety, and uncertainty can be overwhelming. Texas law recognizes this and allows for recovery for mental anguish and suffering caused by the insurer’s actions.

If you find yourself facing a bad faith insurance claim in Texas, know that the law provides avenues to seek fairness and compensation. It’s important to document every interaction with your insurer, consult with legal professionals experienced in bad faith insurance claims, and take timely action to protect your rights. For more detailed guidance and support on navigating bad faith insurance claims in Texas, including insights on identifying such practices and understanding your rights, visit Insurance Claim Recovery Support.

Navigating a bad faith insurance claim can be complex, but understanding the types of damages you’re entitled to recover can empower you to take the necessary steps towards seeking justice. You don’t have to navigate this process alone. Professional help is available to guide you through each step and help you recover what you’re rightfully owed.

Conclusion

Dealing with insurance claims can undoubtedly be a daunting process, especially when you suspect that your insurer is not acting in your best interest. In Texas, the law provides policyholders with avenues to challenge insurers that act in bad faith. As we’ve explored the intricacies of bad faith insurance claims in Texas, it’s clear that knowledge, vigilance, and the right support are key to protecting your rights and ensuring fair treatment.

Insurance Claim Recovery Support LLC stands ready to assist policyholders who face challenges with their insurance companies. Our expertise in navigating the complex landscape of insurance claims, especially in the wake of Texas storms, positions us as a formidable ally in your corner. For support with your loss claims, visit our loss types service page.

Frequently Asked Questions about Bad Faith Insurance Claims in Texas

What is the Bad Faith Standard in Texas?

In Texas, the bad faith standard revolves around the insurer’s obligation to deal with policyholders fairly and in good faith. This means insurers must promptly and reasonably investigate, process, and pay valid claims. When an insurer unreasonably denies a claim or engages in deceptive practices, it may be liable for bad faith.

How Can an Insurer be Liable for Bad Faith?

An insurer can be liable for bad faith if it engages in practices such as unjustified denial of coverage, failure to conduct a proper investigation, delaying payment without reason, or offering significantly less than what a claim is worth. These actions can violate both common law and statutory provisions under the Texas Insurance Code.

Is it Difficult to Win a Bad Faith Claim?

Winning a bad faith claim in Texas can be challenging, but it is not impossible. Success often depends on the strength of the evidence showing that the insurer acted unreasonably or deceitfully. Documenting all communications with the insurer, gathering evidence of the claim’s validity, and seeking legal representation can significantly improve the chances of a favorable outcome.

If you’re facing difficulties with your insurance claim or suspect bad faith practices, you’re not alone. Insurance Claim Recovery Support LLC is here to help ensure you receive the compensation you’re entitled to. Our expertise in handling complex claims can provide you with the support and guidance needed to navigate these challenges effectively.