Why Dallas Flood Damage Continues to Devastate Commercial Properties

When Dallas flood damage strikes, commercial property owners face immediate threats to their buildings, operations, and financial stability. Recent storms, like the one that caused “substantial water damage” to the Dallas Municipal Court building, highlight the vulnerability of even critical infrastructure.

Key Facts About Dallas Flood Damage:

- Average repair costs: $2,649 to $8,000+, depending on severity.

- Most affected areas: Downtown Dallas, low-lying districts, and properties near overwhelmed drainage systems.

- Common damage types: Structural intrusion, electrical and HVAC failures, and rapid mold growth.

- Critical timeline: The first 48 hours are crucial for mitigating damage.

- Insurance complexity: Standard commercial policies typically exclude flood damage, requiring a separate policy.

Texas sits in “Flash Flood Alley,” where the Hill Country’s geology and intense rainfall create perfect conditions for devastating floods. The Balcones Escarpment forces moisture-laden air upward, creating torrential downpours that overwhelm urban drainage systems.

For commercial property owners, these floods threaten business continuity, tenant safety, and property values. The aftermath involves complex insurance claims and extensive restoration. I’m Scott Friedson, a public adjuster who has settled over $250 million in commercial property damage claims, including extensive Dallas flood damage cases. Proper advocacy can increase settlements from 30% to 3,800% compared to initial insurance company offers, often without litigation.

Dallas flood damage terms to remember:

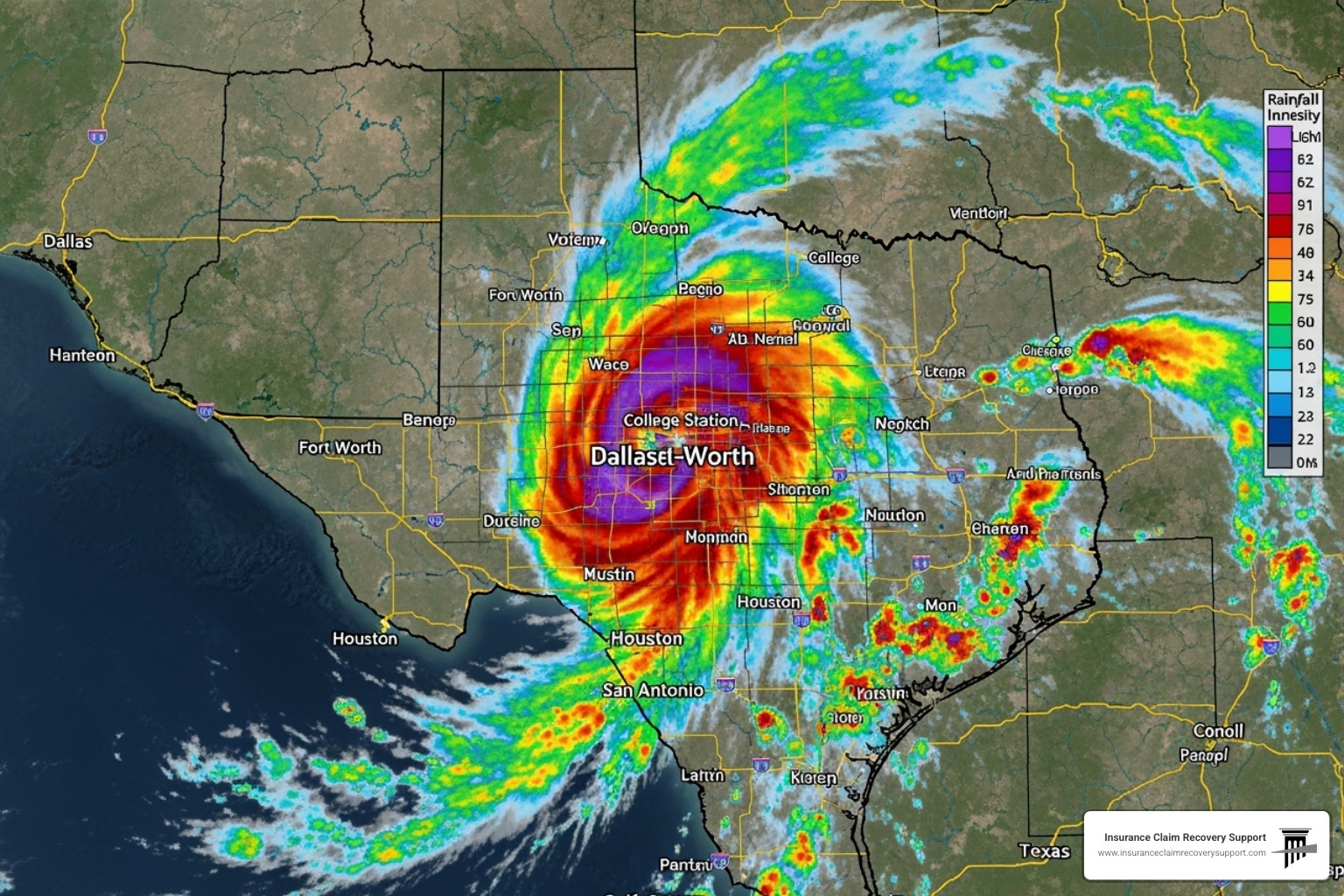

The Anatomy of a Texas Superstorm: Causes and Immediate Impacts

Devastating Dallas flood damage is often caused by a perfect storm of conditions. The primary culprit is often a mesoscale convective vortex—a massive, rotating system of thunderstorms—boostd by tropical moisture remnants from the Gulf of Mexico.

Geography plays a starring role. The Balcones Escarpment, a geological fault line, acts as a natural ramp. As moist air hits this ridge, it’s forced upward, cooling and dumping torrential rain that overwhelms drainage systems. This phenomenon earned Central Texas the nickname “Flash Flood Alley.”

Urban drainage systems and infrastructure simply cannot handle these extreme events. When inches of rain fall in hours, storm drains back up, creeks overflow, and infrastructure failures cascade through the city. The July 2025 Central Texas floods were a stark reminder of these dynamics, where a similar weather pattern caused catastrophic damage.

For commercial property owners, understanding these patterns is essential for protecting investments and preparing for the complex insurance claims process that follows.

Assessing the Initial Dallas Flood Damage

After the storm, the true scope of Dallas flood damage becomes clear. The hardest-hit areas are consistently low-lying commercial districts near the Trinity River and older downtown areas with aging infrastructure.

Commercial properties face a triple threat: direct water intrusion, structural damage, and operational disruption. The Dallas Municipal Court building, which sustained “substantial water damage” on every floor and was forced to close, exemplifies this vulnerability.

Business closures following floods are about more than cosmetic repairs; they involve complex financial decisions. The pressure intensifies when business interruption coverage is crucial for survival, yet many find their policies don’t cover what they expected. This is where an experienced Water Damage Adjuster becomes invaluable, handling the intricate claims process while owners focus on recovery.

How Other Texas Cities Fared

Dallas flood damage is part of a statewide struggle. Each major Texas city faces unique hydrological challenges that create distinct flood risks.

- Houston’s flat terrain and bayou system are prone to widespread urban flooding.

- San Antonio’s Riverwalk area is threatened by the rapidly rising San Antonio River.

- Austin sits in the heart of “Flash Flood Alley,” where its many creeks can become raging rivers.

- Fort Worth’s industrial areas are at risk from the overflowing Trinity River.

Smaller cities also face infrastructure vulnerabilities, from San Angelo’s wastewater overflows to Lubbock’s overflowing playa lakes and Waco’s challenges with the Brazos River. While each city’s geography is different, they all share the need for proper flood insurance and expert advocacy when disaster strikes.

Navigating the Aftermath: Reporting Damage and Seeking Assistance

When floodwaters recede from your commercial property, the path forward can seem overwhelming. Fortunately, there are specific steps and resources to help manage Dallas flood damage.

The City of Dallas encourages businesses to report flood damage through damage.tdem.texas.gov. This data helps officials understand the disaster’s scope. However, reporting to TDEM is voluntary and separate from your insurance claim. It does not replace filing with your insurer or guarantee disaster relief.

If a disaster is severe, a FEMA disaster declaration may open up federal assistance. These programs are complex and often focus on individual or public aid, serving a different purpose than your private insurance coverage. Community relief funds, often established by local foundations and supported by corporations like H-E-B and Walmart, can also provide a lifeline.

The First 48 Hours: A Checklist for Property Managers

The first 48 hours after Dallas flood damage are critical for your property and insurance claim. Acting quickly can save thousands.

- Prioritize Safety: Do not enter flooded areas if power is on or you see structural damage. Account for all personnel.

- Shut Off Utilities: If safe, turn off electricity and gas to prevent hazards. If unsure, call a professional.

- Document Everything: Before moving anything, take extensive photos and videos of water lines, damaged equipment, and ruined inventory. Evidence is crucial for your claim.

- Mitigate Further Damage: Once documented, remove standing water and lift salvageable contents. Do not discard anything until your adjuster has seen it.

- Communicate with Tenants: Provide regular updates on the building’s status and recovery timeline.

- Contact Professionals: Report your claim to your insurance company immediately and contact a reputable flood damage restoration company. Quick action can prevent minor issues from escalating.

For expert guidance, our team specializes in Flood Damage Insurance Claims and can help you steer the process.

Understanding Your Commercial Flood Insurance Policy

Many commercial property owners find too late that their standard property insurance policy likely doesn’t cover Dallas flood damage. The distinction between “water damage” and “flood damage” is critical.

- Water Damage: Generally covered by standard policies, this refers to water from a source inside your building, like a burst pipe or leaking HVAC unit.

- Flood Damage: Almost universally excluded from standard policies, this refers to water from outside your building, like an overflowing river or storm surge. This requires a separate flood insurance policy, often through the National Flood Insurance Program (NFIP).

Business interruption coverage is another key area. This coverage for lost income is typically only triggered if the underlying physical damage is covered. Without a flood policy, flood-related business interruption is likely not covered. Furthermore, coinsurance penalties can reduce your payout on covered claims if your property is underinsured. Understanding these complexities is why having an experienced advocate for Texas Flood Damage claims is essential.

The True Cost of Dallas Flood Damage and the Path to Recovery

When Dallas flood damage hits your commercial property, the financial impact extends far beyond initial cleanup. While basic services might cost $1,000 to $4,500, the average comprehensive repair in Dallas is around $2,649, with severe cases easily exceeding $8,000.

For major events, total economic costs can run into the hundreds of millions, affecting the entire community. The path to recovery is a marathon, not a sprint. Long-term rebuilding often involves replacing entire HVAC and electrical systems and addressing foundation issues. Infrastructure repair challenges can also delay your own recovery, as your business depends on functional roads and utilities.

These events highlight the need for future flood mitigation measures, such as improved drainage and stricter building codes. For property owners, this means considering resilient materials and floodproofing techniques during rebuilding.

Filing Your Claim: The Insurance Company Adjuster vs. a Public Adjuster

When you file a flood damage claim, you’ll encounter an adjuster, but it’s crucial to know whose side they are on. The insurance company’s adjuster works for the insurer, with the goal of settling the claim efficiently for their employer. A public adjuster works exclusively for you, the policyholder, advocating to maximize your settlement.

| Feature | Insurance Company Adjuster | Public Adjuster |

|---|---|---|

| Employer | Insurance company | Policyholder |

| Allegiance | To the insurance company | To the policyholder |

| Role | Investigate and assess damages for the insurer | Assess, document, and negotiate claim for the policyholder |

| Goal | Settle claim cost-effectively for the company | Maximize policyholder’s settlement |

| Fees | Paid by the insurance company | Percentage of the settlement |

Working with a public adjuster levels the playing field. Our team of Public Adjusters in Dallas, TX understands what you’re facing.

Maximizing Your Settlement for Dallas Flood Damage Without Litigation

With the right strategy, you can maximize your settlement and avoid costly, time-consuming litigation. A proactive claims strategy starts with documenting all damage, including hidden issues. Water seeps into walls and under floors, causing problems long after it’s gone. We use specialized moisture surveys and conduct mold testing to uncover these issues and ensure they are included in your claim.

For commercial properties, valuing business interruption and extra expenses is often the most complex part of a claim. This requires detailed financial analysis to calculate lost income and additional costs incurred to minimize the shutdown. The negotiation process is where our experience pays off. Armed with thorough documentation, we engage with the insurer to secure a fair settlement. This approach helps you avoid lawsuits and focus on rebuilding. Our expertise in Dallas Flood Damage Insurance Claims is designed to achieve maximum recovery without litigation.

Lessons Learned: Building a More Resilient Texas

Each Texas flood teaches expensive lessons. Comparing recent Dallas flood damage to historic floods reveals a troubling pattern: storms are intensifying, and urban areas are bearing the brunt. The July 2025 Central Texas floods served as a wake-up call, exposing gaps in forecast accuracy and communication. Shockingly, Kerr County, in the heart of “Flash Flood Alley,” lacked a dedicated flood warning system.

The climate reality is that extreme rainfall events are becoming more frequent and intense. We must prepare not for last year’s storm, but for the more severe storms of the future. This requires proactive infrastructure investment, including robust warning systems and improved drainage.

For business owners, waiting for government solutions isn’t enough. There are proven strategies that work, and you can get flood preparedness tips for your business from FEMA to develop a comprehensive plan. The key is acting before the next storm hits.

Fortifying Your Commercial Property Against Future Floods

As a commercial property owner, you can take steps to reduce your flood risk and potential damage costs.

- Use Flood-Resistant Materials: When renovating, opt for concrete, ceramic tiles, and moisture-resistant drywall, which withstand flooding better than traditional materials.

- Implement Floodproofing: Use dry floodproofing (waterproof coatings, barriers) to keep water out or wet floodproofing (allowing controlled flooding in durable areas) to manage it.

- Improve Site Drainage: Simple measures like regrading a parking lot or installing French drains can redirect water away from your building.

- Install Flood Barriers: Modern, deployable barriers for entrances and loading docks can provide crucial protection.

- Create an Emergency Plan: Develop and regularly update a plan that covers employee safety, tenant communication, and recovery operations.

These measures ensure business continuity. Should you still experience damage, our Dallas County Public Adjusters can help you receive fair compensation to rebuild stronger.

Frequently Asked Questions about Texas Flood Damage Claims

What’s the difference between “flood damage” and “water damage” in a commercial policy?

This is a critical distinction. Flood damage is caused by water from a natural source originating outside your building, such as an overflowing river or storm surge. It is almost always excluded from standard commercial property policies and requires a separate flood insurance policy. Water damage originates inside your building from a source like a burst pipe or leaking appliance and is typically covered by a standard policy. For more details on flood insurance basics, visit FEMA’s National Flood Insurance Program page.

My insurance company’s initial settlement offer for my business seems too low. What are my options?

An initial offer is a starting point for negotiation, not the final word. You have the right to contest it. The most effective approach is to hire a public adjuster who works exclusively for you. We conduct an independent assessment of your Dallas flood damage, document all losses (including hidden ones), and negotiate with the insurer on your behalf. This levels the playing field and often leads to a significantly higher settlement without the need for expensive litigation.

How can I prove my business interruption losses after a flood?

Proving business interruption (BI) losses requires meticulous documentation. You must provide historical financial records to establish your normal earnings, such as profit and loss statements and sales records. You also need to document continuing expenses (rent, payroll) and any extra expenses incurred to minimize the shutdown (renting temporary space, etc.). A public adjuster can work with forensic accountants to accurately calculate and present your BI claim to ensure you are fully compensated for lost income.

Conclusion

When floodwaters rise in Texas, commercial property owners face a daunting challenge. We’ve seen how Dallas flood damage and similar events can disrupt businesses, displace tenants, and create a complex path to recovery. Texas sits in “Flash Flood Alley,” where geology and weather combine to create some of the nation’s most severe flooding.

After settling over $250 million in commercial property claims, I’ve learned that preparation and expert advocacy make all the difference. The owners who recover fastest are those who understand their risks and know when to call for professional help.

The recovery process is complex, involving not just repairs but also business interruption, tenant relations, and insurance negotiations. The hidden costs of lost revenue and downtime can often exceed the physical repair bills.

This is where a public adjuster is invaluable. Instead of facing lengthy and expensive litigation, you gain an advocate who knows how to document your claim and negotiate for the maximum recovery. We have helped property owners increase settlements by 30% to 3,800% over initial offers, all while avoiding the courtroom.

At Insurance Claim Recovery Support, we are your partner in recovery. Whether you manage a multifamily HOA, an apartment complex, or a religious institution, we fight to ensure you receive every dollar you deserve. For expert guidance, learn how a public adjuster can help with your Dallas County Flood Damage or other Texas flood recovery needs.