Understanding Texas Flood Property Damage: A Quick Start Guide

Texas is a land of diverse geography, from flat plains to rolling hills, each weaving a unique pattern of weather events that often result in floods. Flooding is as much a part of Texas’s environmental fabric as its bluebonnets and cattle ranges. Over the years, Texans have witnessed catastrophic floods that have shaped communities, legislation, and preparedness initiatives. Historical floods, like the 1921 Williamson County flood or the devastation brought by Hurricane Harvey in 2017, underscore the critical need for flood awareness and preparedness among its residents.

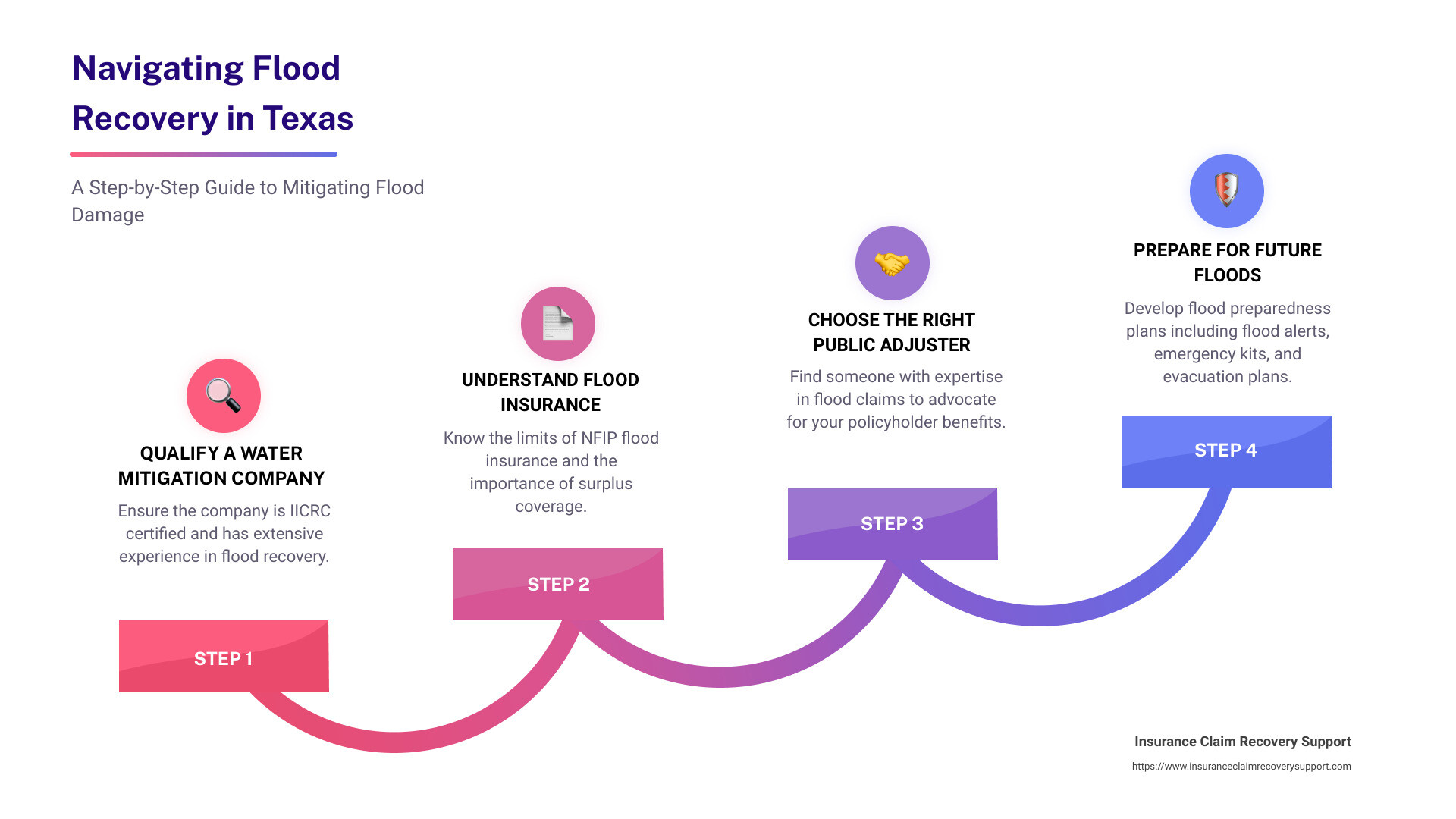

Being informed means understanding not just the risks but also how to mitigate and recover from them. This includes knowing about the National Flood Insurance Program (NFIP), designed to provide residential and commercial property owners with insurance to protect against flood damage. NFIP limits for residential properties are up to $250,000 for the structure and $100,000 for contents. Commercial properties can be insured up to $500,000 for the building and $500,000 for contents. It’s crucial to note that standard property insurance policies often exclude flood insurance, necessitating the purchase of NFIP flood insurance separately.

For those in areas with a high risk of flooding or where coverage exceeds NFIP limits, surplus flood coverage becomes a vital option. Additionally, business owners should consider business interruption insurance to protect against lost income during repairs from flood damage.

When facing flood damage, choosing the right water mitigation company and public adjuster is paramount. Qualifying a water mitigation company involves checking for IICRC certification, experience in flood recovery, quality of equipment, and the ability to respond promptly. Choosing the right public adjuster should be based on their expertise in handling flood claims and their commitment to advocating for policyholders’ benefits and rights.

Texas’s fight with floods is ongoing, but preparedness and knowledge can significantly mitigate its impact.

The Science of Texas Floods

Understanding the science behind Texas floods is crucial to grasping why these events occur and how they can vary in intensity. At its core, the phenomenon revolves around the water cycle, drought and flood relationship, and specific rain events that can trigger flooding.

Water Cycle

The water cycle is the continuous movement of water on, above, and below the surface of the Earth. This cycle involves processes like evaporation, condensation, precipitation, and runoff. In Texas, the water cycle plays a significant role in both drought and flood conditions. When evaporation exceeds precipitation, drought occurs. Conversely, when intense rain events happen, the ground cannot absorb all the water, leading to floods.

Drought and Floods

Drought and floods are two sides of the same coin; both are natural parts of the water cycle. Texas, with its vast and diverse geography, experiences periods of severe drought followed by rain events capable of ending these dry spells. However, these rain events can swiftly turn into flood situations if the volume of water overwhelms the land’s ability to absorb it or the drainage systems’ capacity to channel it away.

Rain Events

Texas has witnessed numerous significant rain events leading to floods. These include short-lived but intense downpours, like the one in Williamson County in 1921, and prolonged rainfalls, such as those brought by Hurricane Harvey in 2017. Each rain event has its characteristics, but they all share the common outcome of causing floods when the amount of rain exceeds the land’s absorption and drainage capabilities.

Understanding these scientific principles is essential for Texans to comprehend the flood risks they face and to take proactive steps towards flood preparedness and safety. By grasping the basics of the water cycle, the interplay between droughts and floods, and the nature of rain events that can trigger flooding, individuals can better prepare for and mitigate the impacts of these natural disasters.

Floods, while a natural occurrence, can have devastating effects on communities, properties, and lives. However, with accurate and timely information, Texans can protect themselves and their property from the worst effects of flooding. Awareness and preparedness start with understanding the science behind these natural phenomena.

In the next section, we’ll explore the historical flood events in Texas, providing context and insights into how past floods have shaped the state’s approach to flood management and preparedness today.

Historical Flood Events in Texas

Texas has a long history of devastating floods, each leaving its own mark on the state’s landscape, communities, and policies. Let’s dive into some of the most significant flood events that have shaped Texas’s approach to flood management and preparedness.

1921 Williamson County: This event is etched in history due to the astonishing 36 inches of rain that fell in just 18 hours in the small town of Thrall. It set a national record for rainfall that still stands today. The sheer volume of water overwhelmed the area, leading to significant loss and damage.

1957 Statewide Flooding: Spring rains in 1957 ended a severe, multi-year drought across Texas but also brought widespread flooding from the Pecos to the Sabine rivers. This event highlighted the dual-edge sword of rain in Texas – the fine line between drought relief and flood disaster.

1998 South-central Texas: A stalled weather front dumped up to 30 inches of rain in just two days, causing historic flooding along the San Marcos, Guadalupe, and San Antonio rivers. This event is a stark reminder of how quickly weather conditions can lead to severe flooding.

2017 Hurricane Harvey: Perhaps the most devastating of recent times, Hurricane Harvey unleashed up to 60 inches of rain over 8 days in parts of Texas. The continuous rain bands caused unprecedented flooding from Rockport to Orange, leading to widespread devastation and a long, ongoing recovery process.

These historical events underline the unpredictability and power of natural water phenomena in Texas. They serve as case studies in the importance of flood preparedness and awareness for all Texans.

Transitioning from understanding the historical context, it’s crucial to delve into the practical steps of flood preparedness and safety. This next section will explore how Texans can stay alert to flood threats, assemble emergency kits, and formulate evacuation plans to protect themselves and their loved ones from future flood events.

Flood Preparedness and Safety

In Texas, where the sky can open up and transform a dry creek bed into a raging torrent in hours, being prepared for floods is not just smart—it’s essential. Here’s how you can stay one step ahead of the next big Texas flood.

Flood Alerts

Stay Informed. There are numerous ways to stay updated on flood threats. Subscribing to local weather alerts and downloading apps that provide real-time weather updates can be a lifesaver. Websites like the Texas Geographic Information Office (TxGIO) Flood Viewer offer detailed information on lake levels and river heights across the state.

Emergency Kits

Be Ready to Act. When floodwater starts to rise, there’s often little time to gather essentials. That’s why having an emergency kit prepared ahead of time is crucial. Your kit should include:

- Water: At least one gallon per person per day for several days.

- Food: A supply of non-perishable food items.

- Flashlight and Batteries: Power outages are common during floods.

- First Aid Kit: For any unexpected injuries.

- Personal Documents: Insurance policies, identification, and bank account records should be stored in a waterproof container.

Evacuation Plans

Know Your Way Out. Understanding your area’s flood risk and familiarizing yourself with multiple evacuation routes beforehand can save precious time during an actual flood event. It’s important to:

- Identify High Ground: Know where to go if you need to evacuate quickly.

- Plan for Pets: Ensure you have a plan for your pets, as not all shelters accept animals.

- Stay Connected: Keep a list of contact information for family members, friends, and local emergency services.

By incorporating these strategies into your flood preparedness plan, you can significantly reduce the risks associated with flooding. It’s not just about protecting property—it’s about ensuring the safety and well-being of you and your loved ones. Stay alert, be prepared, and you’ll be ready to face whatever the Texas weather throws your way.

Transitioning from the immediate steps for flood preparedness, understanding the intricacies of flood insurance in Texas is equally vital. The next section will navigate through the complexities of NFIP flood insurance, contrasting it with standard property insurance policies, and outlining the process of acquiring flood insurance to ensure you are comprehensively protected.

Understanding Flood Insurance in Texas

Navigating flood insurance in Texas can be as challenging as predicting the weather. However, with the right information and guidance, you can safeguard your property and peace of mind effectively.

NFIP Flood Insurance vs. Property Insurance

Property insurance policies typically exclude flood damage. This is a crucial detail many homeowners and business owners overlook. NFIP (National Flood Insurance Program) flood insurance fills this gap, offering coverage specifically for damages caused by flooding.

- NFIP Insurance Limits: For residential properties, the coverage limit is up to $250,000 for the building and $100,000 for contents. For commercial properties, the coverage extends up to $500,000 for the building and $500,000 for contents. These limits highlight the importance of assessing the value of your property to ensure adequate coverage.

Buying NFIP Insurance

Purchasing NFIP insurance can be straightforward. It’s available through most insurance agents and companies. Start by contacting your current insurance provider or an agent familiar with NFIP policies. There is typically a 30-day waiting period from the date of purchase before your policy goes into effect, so planning ahead is key.

Surplus Flood Coverage

For properties valued beyond NFIP limits, surplus flood coverage can provide the additional protection needed. This coverage is obtained through private insurers and can cover the gap between NFIP limits and the total value of your property and possessions.

Business Interruption Insurance for Flood Damage

For business owners, business interruption insurance can be a lifesaver. This coverage compensates for lost income during the period a business is closed due to flood damage. It’s an essential consideration for comprehensive flood risk management.

Qualifying a Water Mitigation Company

When facing flood damage, rapid and professional mitigation is critical. Here’s how to qualify a water mitigation company:

- Certifications: Look for companies with IICRC (Institute of Inspection, Cleaning and Restoration Certification) certification. This ensures they meet industry standards.

- Experience: Companies with experience in flood damage have the knowledge to navigate complex situations.

- Equipment: Advanced equipment means efficient and effective drying and restoration.

- Rapid Response: Time is of the essence. A company that promises rapid response can prevent further damage.

Choosing the Right Public Adjuster for Flood Damage

A public adjuster can be your advocate, ensuring your insurance claim is fairly valued and settled. When choosing a public adjuster for flood damage, consider:

- Expertise in Flood Claims: They should have a strong track record in handling flood-related claims.

- Advocacy for Policyholders: Look for adjusters who prioritize your interests, like Insurance Claim Recovery Support LLC, dedicated to ensuring policyholders receive the full value of their claim.

- Insurance Claim Recovery Support LLC: Partnering with a company specializing in flood damage claims can offer peace of mind and significantly impact the recovery process.

Understanding and navigating flood insurance in Texas is a critical component of disaster preparedness. By knowing the intricacies of NFIP insurance, considering surplus and business interruption coverage, qualifying water mitigation companies, and choosing the right public adjuster, you can protect your property and financial future against the unpredictable nature of Texas floods.

Frequently Asked Questions about Texas Flood Property Damage Insurance Claims

When dealing with the aftermath of a flood in Texas, property owners often have many questions about the insurance claim process, their rights, and possible remedies. Here, we aim to address some of the most common concerns to help you navigate through this challenging time with clarity and confidence.

What Steps Should I Take Immediately After Flood Damage?

First, ensure your safety and that of your family or employees. Once it’s safe, document all damage by taking photos or videos. Contact your insurance company as soon as possible to notify them of the damage. It’s also helpful to start separating damaged property from undamaged items and make a list of lost or damaged goods with their purchase dates and values if possible.

How Do I Prove My Flood Damage Claim?

Pre-loss photos of your property can be incredibly useful. Along with current photos of the damage, these can provide clear evidence of the extent of flood impact. Your insurance company will also require a detailed inventory of damaged or lost items.

Can I Dispose of Damaged Items?

Yes, but make sure to document everything thoroughly with photos and a detailed inventory list before doing so. Sometimes, it’s advisable to keep damaged items until an adjuster has reviewed them, unless they pose a health hazard.

What is a Proof of Loss, and Do I Need One?

A Proof of Loss is a document you must file with your insurance company detailing the amount of money you’re claiming for flood damages. It typically includes supporting documentation such as photos, receipts, and a detailed inventory of damages. It’s crucial for processing your claim and usually needs to be submitted within 60 days of the flood.

Will My Insurance Cover the Costs to Prevent Further Damage?

Most policies require you to take reasonable steps to mitigate further damage. This might include temporary repairs or hiring a water mitigation company. Keep receipts for any expenses incurred, as these may be reimbursable under your policy.

How Do I Choose a Water Mitigation Company?

Look for companies that are IICRC (Institute of Inspection, Cleaning and Restoration Certification) certified. They should follow industry standards for flood damage restoration to ensure quality work.

Should I Hire a Public Adjuster?

If you’re feeling overwhelmed by the insurance claim process or if you’re not getting the outcome you believe you deserve, a public adjuster can be a valuable ally. They work on your behalf, not the insurance company’s, to negotiate your claim. Choose someone with expertise in flood damage claims and a strong track record of advocating for policyholders.

Dealing with flood damage can be stressful, but understanding your rights and the steps you can take to ensure a fair claim process can make a significant difference. Insurance Claim Recovery Support LLC is here to guide you through every step of this process, ensuring you receive the support and compensation you’re entitled to.

Navigating the rich history of Texas blues, including songs like “Texas Flood,” offers a unique lens through which to explore the cultural impact of floods in the state. Beyond the music, understanding the dynamics of actual flood events and their insurance implications remains crucial for residents. Moving forward, staying informed and prepared is key to navigating the challenges posed by Texas floods.

Conclusion

In the journey through understanding Texas floods, from their historical impact to the intricacies of flood insurance, we’ve covered a lot of ground. The stories of past floods serve as a stark reminder of nature’s power and the importance of being prepared. But it’s not just about looking back; it’s about moving forward with knowledge and tools to safeguard our communities and properties.

Flood awareness is not just a term—it’s a proactive stance against potential disaster. It involves staying informed about flood risks in your area, understanding how to respond when alerts are issued, and knowing the steps to take in the aftermath of a flood. Information is power, especially when it comes to natural disasters.

Preparedness goes hand-in-hand with awareness. It’s about having an evacuation plan, an emergency kit, and most importantly, the right insurance coverage. This isn’t just about ticking boxes; it’s about giving yourself and your loved ones peace of mind, knowing you’re ready to face whatever comes your way.

And that’s where Insurance Claim Recovery Support LLC comes into play. We’re not just observers of the havoc that Texas floods can wreak; we’re active participants in the recovery process. Our expertise in flood claims and our advocacy for policyholders set us apart. We understand the nuances of NFIP flood insurance, the gaps that property insurance might leave when it comes to flood coverage, and the importance of having surplus flood coverage and business interruption insurance.

Qualifying a water mitigation company and choosing the right public adjuster for flood damage are crucial steps in protecting your property and financial wellbeing. Look for certifications, experience, and a rapid response capability in a water mitigation company. When it comes to selecting a public adjuster, expertise in flood claims and a commitment to advocate for policyholders are key. At Insurance Claim Recovery Support LLC, we embody these qualities, working tirelessly to ensure our clients receive the full benefits of their policies.

Whether you’re navigating the complexities of NFIP flood insurance, considering surplus flood coverage, or seeking assistance after flood damage, we’re here to help. Our goal is not just to recover what’s been lost but to empower Texas residents with knowledge and support to face future floods with confidence.

For further assistance and to learn more about how we can help you recover from Texas flood damage, visit our loss types page.

Floods may be a natural part of the water cycle, but with the right preparation and support, their impact can be managed. Together, let’s turn awareness into action and ensure that when the next flood comes, we’re ready.