Staring at the aftermath of a fire, feeling overwhelmed by the loss and burdened with the responsibility of claiming insurance for your property? You’re not alone. That’s where a Fire Damage Public Adjuster comes into play.

Quick Fact: A public adjuster is a claims professional who advocates on your behalf, ensuring you receive every penny you’re entitled to under your homeowners insurance policy. Unlike an insurance company adjuster, a public adjuster represents you and your rights, not the insurance company.

In this ultimate guide, we aim to help you understand the critical role of a fire damage public adjuster during such trying times. We’ll walk you through when to hire one, what the hiring process looks like, how they can help maximize your payout, the costs involved, and ultimately, how to choose the right one for your needs.

Dealing with fire damage is complex and emotionally draining. A public adjuster can guide you through this process, handling the intricate details of your insurance claim, and ensuring you receive a fair settlement. Read on for a comprehensive insight into fire damage public adjusters and how they are your allies in your journey of recovery.

Understanding the Difference Between a Public Adjuster and an Insurance Adjuster

A fire can be a devastating event for a property owner, but dealing with the aftermath doesn’t have to be. That’s where a fire damage public adjuster comes in. But how is a public adjuster different from an insurance adjuster? Let’s break it down:

An insurance adjuster, also known as a company adjuster, is an employee or contractor of the insurance company. Their primary job is to evaluate the fire damage to your property and prepare a settlement amount. However, remember that they represent the insurance company’s interests, not yours. Their main goal is to minimize the company’s payout, and their assessment of property damage is based on terms determined by the adjuster. This could potentially lead to overlooked losses that are not immediately obvious, resulting in future expenses for you.

On the other hand, a public adjuster, like the experts at Insurance Claim Recovery Support, works exclusively for you, the policyholder. They are duty-bound to represent only your rights and work towards maximizing your claim payout. A public adjuster will assess damages, confirm coverage, prepare claim documents, and negotiate a fair settlement with your insurance company on your behalf.

As Scott Friedson, our expert at Insurance Claim Recovery Support, explains, “A public adjuster is a private, independent, licensed, bonded, and professional claims adjuster who settles property damage insurance claims exclusively on behalf of the insured. Public adjusters only represent the interests of the policyholder… not your insurance company.”

It’s the difference between having someone who works for the insurance company handling your claim versus having an advocate who works solely for you. A public adjuster can help level the playing field, ensuring that you get every penny you’re entitled to under the provisions of your homeowners insurance policy.

In the next section, we’ll discuss when you should consider hiring a fire damage public adjuster and how they can be invaluable during the insurance claim process.

When to Hire a Fire Damage Public Adjuster

The aftermath of a fire can be overwhelming and emotionally draining. Amid the stress and upheaval, it can be challenging to navigate the complexities of the insurance claim process and ensure you receive a fair settlement. This is where hiring a fire damage public adjuster can be invaluable. But when exactly should you consider hiring one? The following scenarios provide some guidance.

Major Property Damage Claims

If the fire has caused significant damage to your property, bringing in a public adjuster can help you navigate the complexities of major property claims. Our team at Insurance Claim Recovery Support (ICRS) has extensive experience in managing large-loss fire damage insurance claims. We diligently identify and document every aspect of the fire damage, ensuring everything is accounted for in your claim.

Total Loss Insurance Claims

In the unfortunate event of a total loss, where the fire has completely destroyed your property, it becomes even more imperative to hire a fire damage public adjuster. Determining the actual cash value of your home and its contents can be a complex process, and our professionals at ICRS can help you accurately assess the full extent of your loss.

House Fire Damage Claims

Even if the fire damage to your house seems minor, hidden damage from smoke, soot, and the water used to extinguish the fire may lead to significant costs down the line. A public adjuster can identify these less-obvious damages and ensure that they are included in your claim.

In conclusion, if you’re dealing with a fire damage claim, whether it’s a major property damage claim, a total loss, or a house fire damage claim, a fire damage public adjuster can be a crucial ally. They can help you navigate the insurance claim process, accurately assess your loss, and ensure you receive the fair and just settlement you deserve. In the next section, we’ll delve into the process of hiring a fire damage public adjuster.

The Process of Hiring a Fire Damage Public Adjuster

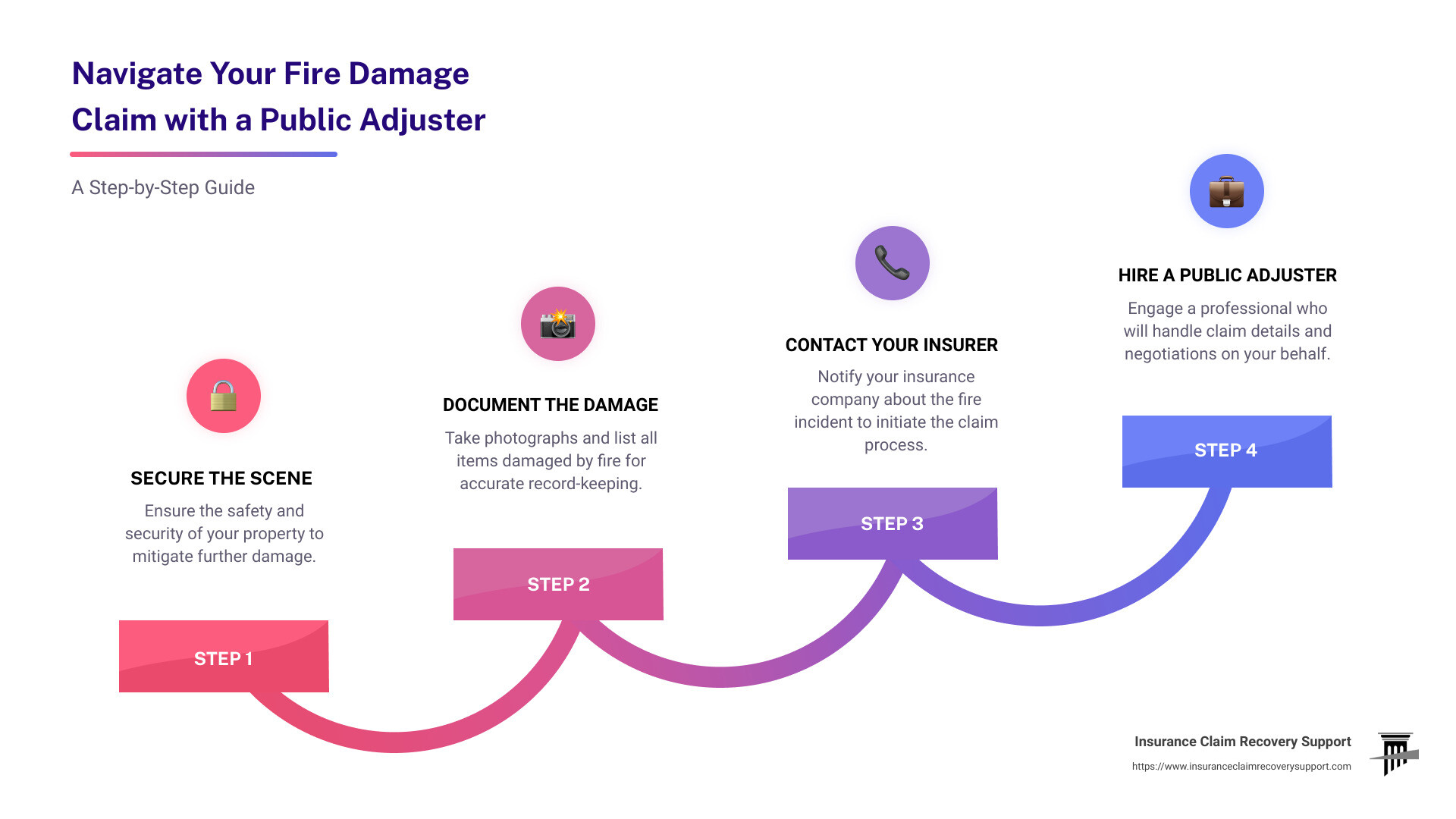

When facing a fire disaster, hiring a fire damage public adjuster can be a game-changer in ensuring you attain the maximum payout from your insurance claim. Here’s an easy-to-follow guide on the process.

Securing the Scene

Immediately after the fire incident, ensure the safety of your property and prevent further damage. This might include tasks like roof tarping, window replacement, and flood relief. Prioritize this step as it can impact the outcome of your claim.

Contacting Your Insurer

Next, notify your insurance company about the fire as soon as possible. This sets the claims process in motion. It’s crucial to provide a detailed account of the incident to ensure the process starts on the right foot.

Waiting for an Adjuster

After notifying your insurer, they will send their insurance adjuster to assess the damage. However, the insurance adjuster works for the insurance company, not you. Their goal is often to minimize the payout of the claim.

Hiring a Restoration Crew

While waiting for the adjuster, you might want to hire a restoration crew to mitigate further property damage. Services may include content pack out, cleaning, and storage. Make sure to keep all receipts for these services as they can be reimbursed as part of your claim.

Documenting the Damage

This is where a fire damage public adjuster becomes invaluable. At Insurance Claim Recovery Support, we help you document the damage and prepare necessary claim documents. Our team of experts will identify and document all fire damage aspects, including those that an insurance company’s adjuster may overlook. The more detailed and accurate your claim is, the smoother your claim process will be.

Completing the Claim

Finally, your fire damage public adjuster will work with you to complete the claim, ensuring all aspects of the damage are included. This involves creating an extensive list of damaged and destroyed possessions, and preparing a comprehensive Scope of Loss. We then submit this detailed claim, defend it on your behalf, and secure a fair and just settlement.

The process of hiring a fire damage public adjuster might seem daunting, but it’s a crucial step towards maximizing your payout. In the next section, we’ll discuss how a fire damage public adjuster can help maximize your payout.

How a Fire Damage Public Adjuster Can Help Maximize Your Payout

As a policyholder, understand the significant role a fire damage public adjuster can play in increasing your payout. Let’s delve into how they help maximize your claim.

Assessing Damages

A crucial part of maximizing your claim starts with a thorough and accurate assessment of damages. A fire damage public adjuster performs a detailed inspection of your property, taking into account all aspects of the damage. They are skilled at identifying and documenting hidden damages such as smoke, ash, soot damage, or even water damage and mold growth caused by fire-fighting efforts. This diligent documentation forms the basis of your claim and can significantly expedite the insurance claim process.

Confirming Coverage

One of the main reasons policyholders don’t get the payout they deserve is due to a lack of understanding of their insurance policy. Insurance language can be intricate and confusing, but a public adjuster is well-versed in policy language and insurance law. They review your policy, explain what is covered, and inform you of your rights as a policyholder. This understanding is crucial in ensuring that you claim all benefits you are entitled to under your policy.

Preparing Claim Documents

Preparing claim documents is a meticulous and demanding task. A public adjuster assists in preparing a thorough Scope of Loss and Estimate, inventorying, and valuing personal property, and preparing other necessary claim documents. Having a professional handle this process ensures accuracy and completeness, which aids in a smoother claim process.

Negotiating a Fair Settlement

Insurance companies often have their own adjusters whose goal is to minimize the payout. A fire damage public adjuster levels the playing field by advocating for you during negotiations with your insurance company. They manage the fine details, handling the meetings, emails, phone calls, and paper documents that come with a large claim. Their goal is to ensure you receive a fair settlement without the stress that can come from handling the claim yourself.

Assisting with Appeals Process if Claim is Denied

In instances where your fire damage insurance claim is denied, a public adjuster steps in to assist with the appeals process. They can assign an independent investigator to look into your damages and make sure an appeal is filed appropriately. They continue to negotiate with the insurance company until your fire damage claim is settled.

By hiring a fire damage public adjuster, you’re not just hiring a professional to handle your claim; you’re partnering with an advocate dedicated to ensuring you get the maximum payout you’re entitled to. At Insurance Claim Recovery Support, our team of public adjusters, construction estimators, and large loss specialists are ready to help you navigate the complexities of a fire insurance claim and secure the settlement you deserve.

The Cost of Hiring a Fire Damage Public Adjuster

One common concern that property owners have is the cost of hiring a fire damage public adjuster. It’s essential to understand that the services of a public adjuster are not free; however, they typically work on a contingency basis.

Percentage of Final Payout

Public adjusters usually charge a percentage of the final payout from the insurance company. This percentage varies depending on the state and the size of the claim. For example, in Texas, public adjusters cannot charge more than 10% of the settlement of the claim. So, if your insurance settlement is $100,000, the public adjuster’s fee would be $10,000.

In Pennsylvania, the fees can range depending on the size of the claim. For claims under $10,000, public adjuster fees can range from 20% to 30%. For claims ranging from $10,000 to $50,000, the fee may be between 15% and 25%. For claims over $50,000, the charge will be 15% or less.

No Payment Unless Claim is Successful

We at Insurance Claim Recovery Support believe in a fair system. If we do not secure a settlement for you, we do not get paid. This means that we work diligently to ensure you receive the maximum payout possible for your claim. Our fee comes out of the insurance proceeds, so there is no out-of-pocket expense to you. In fact, our team has helped policyholders obtain on average 35% to 200% more from their claims.

The cost of hiring a public adjuster should be weighed against the potential benefits. A public adjuster can help you navigate the complex process of filing a fire damage insurance claim, ensuring that you receive the full amount you’re entitled to. In many cases, the cost of hiring a public adjuster can be more than offset by the increased settlement amount they are able to secure.

In the next section, we will discuss how to choose the right fire damage public adjuster for your needs, and why Insurance Claim Recovery Support could be the right choice for you.

Choosing the Right Fire Damage Public Adjuster: Insurance Claim Recovery Support LLC

When it comes to choosing the right fire damage public adjuster, you’ll want to consider factors such as their expertise in settling property damage claims, their commitment to policyholder advocacy, their dedication to securing maximum settlements, and their accessibility to clients nationwide. As a trusted industry leader, Insurance Claim Recovery Support ticks all these boxes and more.

Expertise in Settling Property Damage Claims

At Insurance Claim Recovery Support, our team is a powerhouse when it comes to settling property damage claims, particularly those arising from fire incidents. We have a proven track record in handling complex claims for residential multifamily and apartment complex policyholders, as well as commercial property owners. Our seasoned professionals are well-versed in unearthing and documenting the full extent of damage, ensuring that no detail is overlooked.

Advocacy for Policyholders

Unlike some adjusters, our sole focus is on the needs of the policyholder, not the insurer. As your advocate, we work tirelessly to ensure you are not underpaid or wrongfully denied by the insurance company. From documenting your losses to understanding your policy benefits, we handle every aspect of the negotiation process to secure a fair settlement on your behalf.

Commitment to Maximum Settlement

We don’t just aim to settle your claim; we aim to maximize your payout. Our ‘no recovery, no fee’ principle ensures that unless we successfully recover your claim, you’re not charged a dime. This commitment to maximising settlements has resulted in our team helping policyholders obtain on average 35% to 200% more from their claims.

Nationwide Service

While we are licensed in Texas, our services are not limited by geographical boundaries. We proudly serve policyholders across the nation, ensuring that no matter where you are, you have access to our expert team of public adjusters.

Choosing the right fire damage public adjuster can make all the difference in your claim process. With Insurance Claim Recovery Support, you can rest assured knowing that you have a skilled, dedicated, and experienced team on your side, fighting for your rights and ensuring you get the settlement you deserve. Contact us today for a FREE claim evaluation.

Conclusion: The Value of a Fire Damage Public Adjuster in Your Insurance Claim Process

Handling an insurance claim due to fire damage can be a challenging and overwhelming task. Your focus should be on recovering from the loss and rebuilding your life, not struggling with complex insurance terms and claim processes. This is where hiring a fire damage public adjuster can prove to be invaluable.

A public adjuster works on your behalf to accurately assess the damage, document the losses, and negotiate with the insurance company to ensure you get the settlement you deserve. This includes both the financial and emotional value of your loss. They have the expertise to identify not only the obvious structural damage but also the more subtle impacts of smoke damage, water damage from firefighting efforts, and any financial losses due to temporary or permanent closure of your business.

Moreover, the public adjuster’s fee is paid from the insurance proceeds, meaning there’s no out-of-pocket expense to you as the policyholder. At Insurance Claim Recovery Support, we have helped policyholders obtain on average 35% to 200% more from their claims.

To sum up, hiring a public adjuster like our expert Scott Friedson at Insurance Claim Recovery Support not only levels the playing field with your insurance company but also ensures you have an advocate who shares your goal — to get the most you can for your fire damage claim and get your life back to normal.

For any further queries or to understand more about the role of a public adjuster, explore our FAQ section or contact us directly. Let us help you navigate through this challenging time and ensure you receive the fair and just settlement you deserve.