Is your property covered by fire insurance and recently experienced damage due to fire? The aftermath of such an event can be as overwhelming as the fire itself – particularly the process of navigating through a fire insurance claim. We at Insurance Claim Recovery Support understand your frustrations and are here to help.

The claim process involves an intricate maze of policy terms, timely filing, accurate damage documentation, and negotiations that, if done successfully, can lead to a fair and prompt compensation. If mishandled, the result can be a major underpayment or even complete denial of your claim. Hence, ensuring that you have in-depth knowledge about the claim lodging process, your policy’s coverage limits, and rights as a property owner is absolutely crucial.

It is essential to remember that you don’t have to navigate this complex process on your own. With our team at Insurance Claim Recovery Support, rest assured that your claim will be handled professionally and pro-policyholder ensuring you get the compensation you deserve.

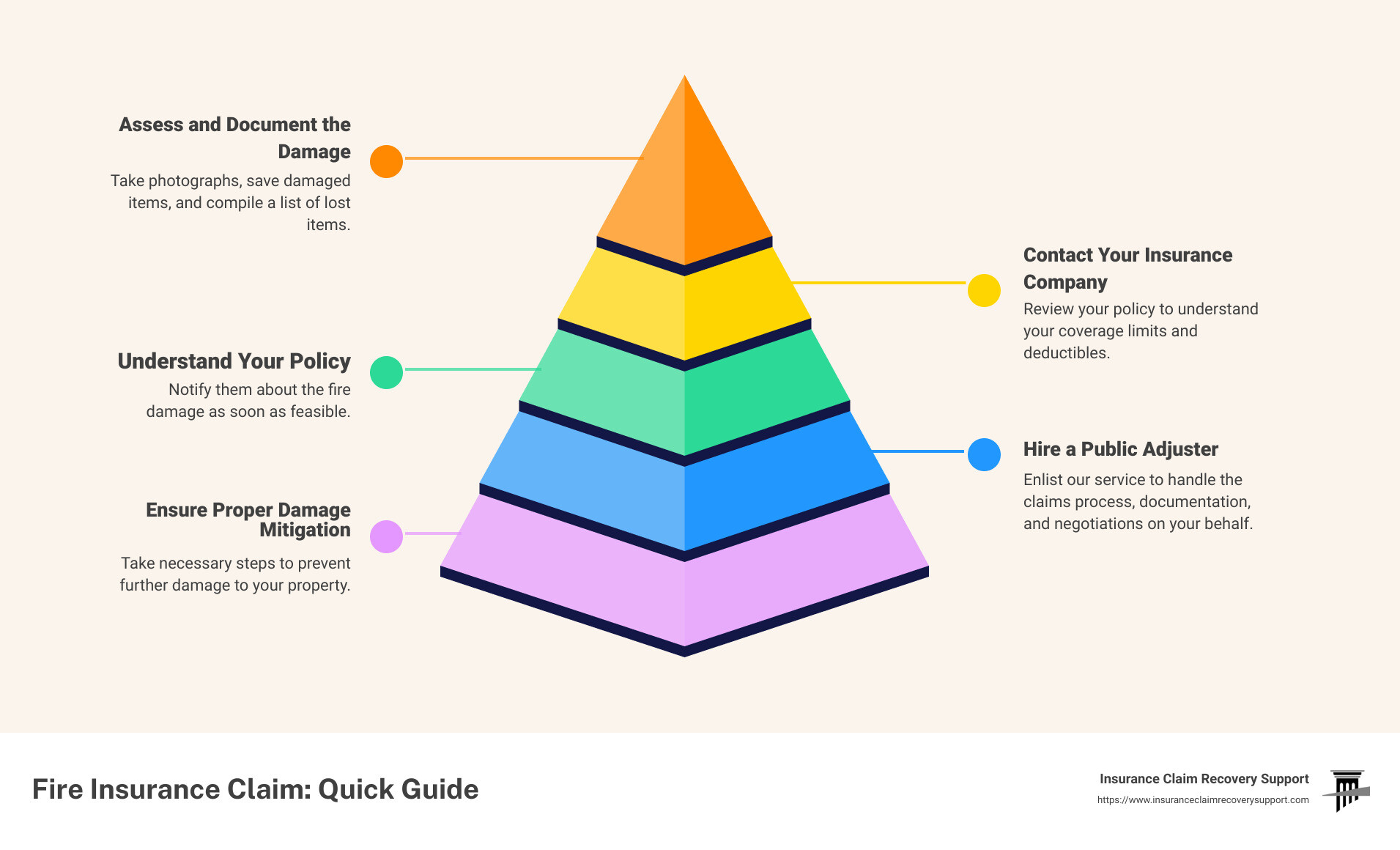

Here’s a quick snapshot to get you started on navigating your fire insurance claim:

Fire Insurance Claim: Quick Guide

1. Assess and Document the Damage: Take photographs, save damaged items, and compile a list of lost items.

2. Contact Your Insurance Company: Notify them about the fire damage as soon as feasible.

3. Understand Your Policy: Review your policy to understand your coverage limits and deductibles.

4. Hire a Public Adjuster: Enlist our service to handle the claims process, documentation, and negotiations on your behalf.

5. Ensure Proper Damage Mitigation: Take necessary steps to prevent further damage to your property.

Embarking on the journey of a fire insurance claim can indeed be a daunting process. But keep in mind, you’re never alone in this. By the end of this article, you should feel more confident about the steps you’ll need to take to file your fire insurance claim and get compensated quickly and fairly. Let’s dive deeper.

Understanding Fire Insurance Claims

Before we go into the specifics of filing a claim, let’s begin by understanding what a fire insurance claim is, what a typical policy covers, and how insurance pays out in the event of a fire.

What is a Fire Insurance Claim?

A fire insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for losses caused by a fire. This policy enables the policyholder to get compensation for the costs incurred towards repairing, replacing or reconstructing a property damaged by fire. Essentially, it is a way to recover from financial loss when a disaster strikes. The claim process involves several steps such as reporting the incident, filling out claim forms, and working with a claims adjuster, which we will cover later in this article.

What Does a Fire Insurance Policy Cover?

A standard homeowner’s fire insurance policy typically covers fire damage to the dwelling and any detached outbuildings on the premises. This means the policy will cover the costs of repairs or rebuilding, as well as the costs to fix or replace home systems and appliances. It also extends to personal belongings inside your home that may have been damaged or destroyed by the fire.

In many cases, your policy will also offer coverage for additional expenses related to the fire damage, such as the cost of living elsewhere while your home is being repaired, and fees for cleaning smoke and ash. This is often referred to as loss of use or additional living expenses coverage. However, it’s crucial to review your policy carefully or consult with your insurance adjuster to understand exactly what is covered and what isn’t.

How Does Insurance Pay Out in a Fire?

When a fire occurs and your property is damaged, you can file a claim with your home insurance company. The insurer will then review the damage and your policy to identify what’s covered and how much you’re owed, minus the deductible. The company will pay up to your dwelling coverage limit for damage to your house structure.

The payout process might vary based on the extent of damage and specific terms of your policy. In some cases, you may even be eligible for an advance payment to help with immediate costs before the full claim is settled.

Understanding the basics of fire insurance claims is the first step in navigating the claim process. As we proceed, we will guide you through the specifics of preparing and filing your fire insurance claim to ensure you get compensated fast and fairly.

Preparing to File Your Fire Insurance Claim

Before you can successfully file your fire insurance claim, there are crucial steps you need to take to prepare. These steps will not only make the process smoother but will also help ensure you receive the full compensation you’re entitled to.

Documenting the Damage

A thorough documentation of the damage to your property is a critical first step in preparing your fire insurance claim. It’s best to start this process immediately after the fire department has deemed your property safe to enter.

You should take photographs and videos that capture the extent of the damage throughout your property. These images will serve as undeniable proof when it comes to your claim. Safety comes first. If your property is unstable, only document what you can without putting yourself at risk.

It’s equally important to note that fire damage often extends beyond what’s immediately visible. Issues such as water damage from firefighting efforts and mold growth could occur. Therefore, having a professional inspect your property for hidden damages is advised.

Creating an Inventory of Damaged Items

Alongside documenting the damage to your property, it’s equally important to document personal belongings that have been destroyed or damaged in the fire. You should create an inventory of these items, noting their condition before and after the fire.

Photographs or videos of the damaged items can be of great help. And remember, do not discard any items, no matter how damaged they may seem. These items can often be restored by fire damage restoration professionals.

Securing the Property Post-Fire

Once the fire has been extinguished and you have documented the damage, it’s essential to secure your property against further damage. This is a requirement of most homeowners’ insurance policies and can include measures such as boarding up windows or fencing off the property to deter vandals. It’s important not to put yourself in any danger while securing your property.

Keeping Detailed Records of Expenses

Lastly, you should keep a detailed record of all expenses related to the fire. This includes the cost of temporary housing, meals, and any other additional living expenses you incur while your home is uninhabitable.

Your insurance policy should cover the difference between what you’re spending while living outside your home and what you would normally spend. For instance, if your food bill increases due to having to eat out more often, you should be able to claim this increase.

By being meticulous in documenting the damage, creating an inventory of damaged items, securing your property post-fire, and keeping detailed records of your expenses, you will be well-prepared to file your fire insurance claim. At Insurance Claim Recovery Support, we are here to guide you through each of these steps and ensure you receive the compensation you deserve.

Filing Your Fire Insurance Claim

Contacting Your Insurance Provider

Once you have documented the damage and prepared your claim, the next step is to contact your insurance provider as soon as possible. This initial contact is crucial to set the claim process in motion. Be prepared to provide an overview of the damage and do not forget to mention any immediate aid you may require like temporary housing.

Completing a Proof of Claim

After you’ve notified your insurance company about the fire, you will need to complete a proof of claim. This is a formal statement that provides information about the circumstances that led to your loss. The proof of claim should include a detailed list of damaged items, their approximate value, and any supporting documents such as receipts or photographs. The more detailed and accurate your proof of claim is, the smoother your claim process will be.

Working with a Claims Adjuster

Once your claim has been filed, your insurance company will likely send an adjuster to assess the damage. The adjuster’s job is to investigate the site, evaluate the damage, and estimate the cost of repairs or replacements. They will also review your policy to determine the extent of your coverage.

However, remember that the adjuster works for the insurance company and therefore, has their best interests in mind. Do not feel obligated to accept an offer that you do not agree with. Always document every communication you have with your adjuster and never embellish or exaggerate the nature of the destruction.

Understanding the Role of a Public Adjuster

In situations where you feel that you’re not being treated fairly, you may want to consider hiring a public adjuster. A public adjuster, like us at Insurance Claim Recovery Support, works exclusively on your behalf to ensure that you receive the settlement you deserve.

Public adjusters are licensed professionals who can help you navigate the complexities of your fire insurance claim. They can review policy language, perform investigations, match up losses with appropriate property coverages, and negotiate a fair and prompt settlement.

In conclusion, filing a fire insurance claim involves notifying your insurance provider, completing a proof of claim, working with a claims adjuster, and potentially hiring a public adjuster. We at Insurance Claim Recovery Support are here to help you through this process and ensure you receive the compensation you deserve.

Maximizing Your Fire Insurance Claim

After you’ve taken the initial steps to file your fire insurance claim, it’s crucial to focus on maximizing your compensation. Here’s how you can do it.

Requesting an Advance Payment

If the fire has left you without essentials, such as clothing, food, or medication, you can ask your insurance company for an advance on your claim. This request, typically made in a written letter, is a standard practice and is often well-received. However, remember that any advance you receive will be deducted from your final payout.

Including Additional Living Expenses in Your Claim

During the period you’re living away from your fire-damaged home, remember to keep track of your daily living expenses. Your policy should cover the difference between what you spend while displaced and what you would usually spend. For instance, if you’re spending more on food because you lack a kitchen, or if you’re paying for hotel stays, these costs should be reimbursed.

Hiring a Public Adjuster for a Fair Settlement

Navigating the complexities of a fire insurance claim can be overwhelming. That’s why we recommend hiring a public adjuster. At Insurance Claim Recovery Support, our experienced public adjusters are here to help you understand your policy, document your losses, and negotiate with your insurance company. This can ensure that you receive a fair and prompt settlement.

Rebuilding in a Different Location: Cost Implications

If your home has been destroyed by fire, you might consider rebuilding in a different location. While this is an option, be aware that if it’s more expensive to build in your new location, you will have to cover the difference.

Maximizing your fire insurance claim is not just about getting the compensation you deserve. It’s about rebuilding your life after an unfortunate event. At Insurance Claim Recovery Support, we are committed to helping you every step of the way, ensuring that you get the best possible outcome from your fire insurance claim.

Avoiding Common Pitfalls in Fire Insurance Claims

Filing a fire insurance claim can be a complex process. However, being aware of common pitfalls and knowing how to avoid them can significantly speed up the procedure and ensure you get the compensation you rightfully deserve. Here are some key points to consider when navigating your fire insurance claim.

Preventing Further Damage to Your Property

Your first instinct after a fire might be to start cleaning up, but it’s important to tread carefully. Most insurance policies require you to take steps to prevent further damage to your property. This might mean boarding up windows or fencing off the area to keep out vandals and squatters. Safety is paramount. Do not risk your life while securing your property.

Continuing to Pay Insurance Premiums

It’s essential to continue paying your insurance premiums even after a fire. This is a requirement of your insurance policy and failing to pay could lead to complications with your claim. We recommend setting up automatic payments to avoid missing any due dates.

Being Cautious When Closing a Claim

In the haste to get the claim process over with, some policyholders might rush to close their claims. This can be a costly mistake, especially if hidden damage is discovered later on. Before closing your claim, have professionals inspect your property thoroughly for any hidden damage, such as water, smoke, ash, or mold damage.

Understanding the Impact of Multiple Claims

Filing multiple claims within a short period can raise red flags with your insurance company and potentially increase your insurance premiums. However, if you have multiple incidents (for example, a fire followed by water damage from firefighting efforts), it’s crucial to document and report them separately. Understanding the impact of multiple claims can help you strategize and make informed decisions.

Filing a fire insurance claim can be a daunting process, but you don’t have to go it alone. At Insurance Claim Recovery Support, we’re here to help you navigate the complexities of the claims process, ensuring a fair and prompt settlement. Avoid these common pitfalls and let us guide you towards a smooth, successful claim resolution.

Conclusion

Filing a fire insurance claim and ensuring a fast and fair compensation can often be a complicated and overwhelming process. However, with the right guidance and a thorough understanding of your policy, it’s possible to navigate this process effectively.

Key Steps to Remember

Remember to promptly document all damages and create a detailed inventory of lost or damaged items. Secure your property to prevent further damage and maintain a record of all expenses incurred during the recovery process. Make it a point to understand the role of a public adjuster and consider hiring one to help you negotiate a fair settlement with your insurance company.

Avoiding Pitfalls and Navigating Challenges

Avoid common pitfalls like failing to mitigate further damage, neglecting to continue paying your insurance premiums, and hastily closing your claim. Be aware of the potential impact of filing multiple claims and understand the cost implications if you decide to rebuild in a different location.

Insurance Claim Recovery Support is Here to Help

As you navigate the complexities of filing a fire insurance claim, remember that you’re not alone. At Insurance Claim Recovery Support, we’re here to assist you every step of the way. Our team of experienced public adjusters can guide you through the process, ensuring a fair and prompt settlement.

As part of our commitment to helping you navigate your fire insurance claim, we also provide resources and information on related topics like water damage insurance claims and tornado damage insurance claims.

In conclusion, while dealing with a fire insurance claim can be a daunting task, with the right guidance and support, it is possible to achieve a satisfactory resolution.

You don’t have to navigate this complex process alone. Reach out to us at Insurance Claim Recovery Support today for a free case review and consultation. We’re here to help you get the compensation you deserve.